Why are special condition codes needed?

Codes of special working conditions, which in 2021 may be required to fill out personalized reporting, mean that a particular employee was employed in such working conditions under which it is possible to assign an early insurance pension. Such working conditions can be, for example, difficult or harmful.

Certain categories of workers who work in hard and hazardous work have the right to an early retirement pension. Contributions at additional rates are calculated from their payments. The employer must transmit information about these contributions and the types of work in which employees are employed to the Pension Fund as part of personalized information for each employee.

Special working conditions - what are they?

In order not to violate the law, managers must clearly understand who works in the enterprise under special conditions and who works under normal conditions. After all, higher pay is provided for the former. Operation under normal conditions has the following characteristics:

- working day duration – 8 hours;

- Day shift;

- working week – 40 hours;

- weather conditions are normal;

- work at your place of residence, and not in a remote area;

- full compliance with sanitary standards.

It turns out that failure to comply with these requirements makes working conditions special. True, receiving a higher salary on an ongoing basis is possible if such factors operate regularly. That is, the work week is longer than normal, as is the length of the shift; the employee can work the night shift.

If we rely specifically on labor legislation, we can understand that special conditions are accompanied by the emergence of some unfavorable factors. These may be working conditions at the enterprise or climatic conditions. In fact, such employees work in harmful, dangerous and abnormal conditions.

In Art. 149 of the Labor Code of the Russian Federation also contains a list of conditions that are not considered normal, but are only temporary in nature. These include:

- work on weekends and holidays;

- increasing the length of the working day (for example, work needs to be completed by a certain deadline, which is why the employee has to stay late);

- night shift work;

- internal part-time work.

In this case, we are not talking about increasing the rate. A person usually receives additional payment for additional functionality or hours worked.

SZV-KORR

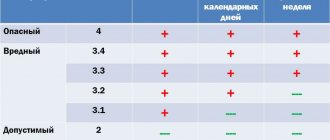

In the SZV-KORR adjustment report in 2021, codes for special working conditions are shown in column 4 of section 6:

SZV-ISH

As for the SZV-ISH report, the codes of special working conditions should be reflected in it according to column 5 of section 8:

What salary supplements are expected?

Labor legislation establishes that work in special or abnormal conditions must be paid in a larger amount than the salary for the same activity in a normal situation . And although the exact amounts have not been established, the legislator has determined the minimum percentages below which the employer cannot set wages.

In this matter it is necessary to distinguish three different situations.

- One-time increased wages for conditions deviating from the norm.

An example of special working conditions was given above. All of them, except for climatic deviations, are one-time in nature. In accordance with Art. 149 of the Labor Code of the Russian Federation, employees working in conditions deviating from the norm are entitled to additional payments:

- for overtime work (Article 152 of the Labor Code of the Russian Federation);

- on non-working days (Article 153 of the Labor Code of the Russian Federation);

- at night (Article 154 of the Labor Code of the Russian Federation, Decree of the Government of the Russian Federation of July 22, 2008 No. 554).

Local acts of the organization may establish a higher size.

- Remuneration for work in special climatic conditions.

The procedure for remuneration in special climatic conditions is regulated in a general sense in Part 2 of Art. 146, art. 148 of the Labor Code of the Russian Federation, which do not contain specific indications of what specific climate criteria are meant. This issue is more specified in other norms - Art. 315 – 317 of the Labor Code of the Russian Federation and in Art. 10-11 of the Law of the Russian Federation of February 19, 1993 No. 4520-1, containing provisions on guarantees, compensation and remuneration for workers working in the Far North.

The percentage of the salary supplement and the conditions for its calculation will depend on the specific region. For example, employees who have worked in Antarctica for six months receive a 10% increase in pay. This increase is made every 6 months.

- Remuneration for work in harmful and (or) dangerous conditions.

In accordance with Art.

147 of the Labor Code of the Russian Federation, the wages of employees who are in conditions that are harmful or dangerous to life and health must be 4% or more more than the salary that they would be paid for similar work under normal conditions. The specific size can be established by separate legislative acts regulating a particular area of labor.

The degree of harmfulness or danger is established by the results of a special certification (Chapter 2 of the Federal Law of December 28, 2013 No. 426).

Transcript and table

Below is a list of codes for special working conditions and their interpretation in a single table that can be used in 2019:

| Codes of special working conditions: table | ||

| Code | Full name | Code expiration date |

| ZP12A | Underground work, work in hazardous working conditions and in hot shops | from 01/01/1996 to 31/12/2001 |

| 42762 | from 01/01/2002 to 31/12/2014 | |

| from 01/01/2015 | ||

| ZP12B | Work with difficult working conditions | from 01/01/1996 to 31/12/2001 |

| 42793 | from 01/01/2002 to 31/12/2014 | |

| from 01/01/2015 | ||

| ZP12V | Work (women) as tractor drivers in agriculture and other sectors of the national economy, as well as drivers of construction, road and loading and unloading machines | from 01/01/1996 to 31/12/2001 |

| 42821 | from 01/01/2002 to 31/12/2014 | |

| from 01/01/2015 | ||

| ZP12G | Labor (women) in the textile industry in work with increased intensity and severity | from 01/01/1996 to 31/12/2001 |

| 42852 | from 01/01/2002 to 31/12/2014 | |

| from 01/01/2015 | ||

| ZP12D | Work as workers of locomotive crews and workers of certain categories who directly organize transportation and ensure traffic safety on railway transport and the subway, as well as truck drivers directly in the technological process in mines, mines, open-pit mines and ore quarries for the removal of coal, shale, ores, rocks | from 01/01/1996 to 31/12/2001 |

| 42882 | from 01/01/2002 to 31/12/2014 | |

| from 01/01/2015 | ||

| ZP12E | Work in expeditions, parties, detachments, on sites and in teams directly on field geological exploration, prospecting, topographic-geodetic, geophysical, hydrographic, hydrological, forest management and survey work | from 01/01/1996 to 31/12/2001 |

| 42913 | from 01/01/2002 to 31/12/2014 | |

| from 01/01/2015 | ||

| ZP12ZH | Work in logging and timber rafting, including maintenance of machinery and equipment | from 01/01/1996 to 31/12/2001 |

| 42943 | from 01/01/2002 to 31/12/2014 | |

| from 01/01/2015 | ||

| 3P123 | Work as machine operators (docker-mechanizers) of complex teams during loading and unloading operations in ports | from 01/01/1996 to 31/12/2001 |

| 42974 | from 01/01/2002 to 31/12/2014 | |

| from 01/01/2015 | ||

| ZP12I | Work as a crew member on ships of the sea, river fleet and fishing industry fleet (with the exception of port ships constantly operating in the port water area, service and auxiliary ships and crew ships, suburban and intracity ships) | from 01/01/1996 to 31/12/2001 |

| 43005 | from 01/01/2002 to 31/12/2014 | |

| from 01/01/2015 | ||

| ZP12K | Work as drivers of buses, trolleybuses, trams on regular city passenger routes | from 01/01/1996 to 31/12/2001 |

| 43035 | from 01/01/2002 to 31/12/2014 | |

| from 01/01/2015 | ||

| ZP12L | Working as a rescuer in professional emergency rescue services, professional emergency rescue teams and participation in emergency response | from 01/01/1996 to 31/12/2001 |

| ZP12M | Working with convicts as workers and employees of institutions executing criminal penalties in the form of imprisonment | from 01/01/1996 to 31/12/2001 |

| 28-OS | from 01/01/2002 to 12/31/2008 | |

| 27-OS | from 01/01/2009 to 31/12/2014 | |

| from 01/01/2015 | ||

| ZP12O | Work in positions of the State Fire Service of the Ministry of Internal Affairs of Russia (fire protection of the Ministry of Internal Affairs of Russia, firefighting and emergency rescue services | from 01/01/1996 to 31/12/2001 |

| 28-PZh | Ministry of Internal Affairs of Russia and emergency rescue services of the Ministry of Emergency Situations of Russia) | from 01/01/2002 to 12/31/2008 |

| 27-PZh | from 01/01/2009 to 31/12/2014 | |

| from 01/01/2015 | ||

| SEV26 | Reindeer herders, fishermen, commercial hunters who live permanently in the Far North and equivalent areas | from 01/01/1996 to 31/12/2001 |

| 28-SEV | from 01/01/2002 to 31/12/2014 | |

| from 01/01/2015 | ||

The code for special working conditions or conditions for the early assignment of a pension is indicated only if, during the period of work in conditions giving the right to an early assignment of a pension, insurance contributions at an additional rate or pension contributions were paid in accordance with pension agreements for early non-state pension provision - clause. 2.3.8 Procedure for filling out SZV-STAZH.

Read also

13.02.2018

Working in areas with special climatic conditions

Remuneration for work in areas with special climate conditions is regulated by Article 148 of the Labor Code of the Russian Federation. According to this article, the employer pays for work in an area with special climate conditions in an amount not lower than what is established by labor legislation and other regulations. The Labor Code provides for increased wages for workers operating in areas with difficult climate conditions.

The payment of increased wages for work is carried out thanks to the introduction of regional coefficients, as well as bonuses in a certain percentage of the salary for persons working in the presented climatic areas.

Legislation recognizes the Far East, Siberia, the Far North and a number of other regions as areas with severe climate conditions. According to the law, a single coefficient for increasing wages has been introduced for workers in all sectors of production, as well as for workers in non-production sectors. This coefficient is set at the federal level.

Currently, regional coefficients are typical for forty regions of the Russian Federation. Labor legislation does not provide for any restrictions on the amount of remuneration when calculating the regional coefficient.

Three groups of regions can be distinguished with different values of regional wage increase coefficients:

- the coefficient represents 10% of the salary at the end of six months of work, with an increase of 10% for each subsequent six months until an increase of 100% is achieved. This includes the islands of the Arctic Ocean, Koryak Autonomous Okrug, Chukotka Autonomous Okrug, Aleutian region of Kamchatka, Severo-Evensky district of the Magadan region.

- The coefficient is 10% at the end of six months of work, with an increase of 10% every six months until an increase of 60% is reached, after which wages are increased by 10% annually. The maximum increase in the coefficient is 80%. These include: Arkhangelsk, Murmansk, Irkutsk, Tyumen, Kamchatka, Magadan, Sakhalin regions, Krasnoyarsk and Khabarovsk territories, the Republics of Komi, Tyva and Sakha (with the exception of some areas).

- The coefficient is 10% at the end of the year of work, with an increase of 10% annually until the bonus reaches 50%. This includes areas whose climate conditions are equivalent to the Far North.

Thus, remuneration in special conditions of work is strictly regulated by Labor legislation.