Article 131 of the Labor Code of the Russian Federation, like Chapter 20 as a whole, regulates legal relations related to remuneration.

The provisions of Article 131 of the Labor Code cover issues related to the form of remuneration. In this case, the form of payment refers to methods of paying wages in their material, that is, applied, understanding. Labor Code of the Russian Federation

dated December 30, 2001 N 197-FZ

Full text of the article, guides, additional information - in ConsultantPlus

Cash payments

Convention No. 95 of the International Labor Organization, ratified by the USSR in 1961, proclaimed the principle of payment of wages in banknotes that have legal circulation in the country of the employer. The same principle is also established by the Constitution of the Russian Federation (Article 75), the Civil Code of the Russian Federation (Article 140) and the Law of the Russian Federation “On the Bank of Russia”. That is, based on the meaning of the provisions of the law, the currency of wages in the Russian Federation is the Russian ruble.

Naturally, the question arises whether the legal requirement in this case is prescriptive. In fact, the above-mentioned regulations, while establishing the Russian ruble as the currency of wages, do not prohibit or restrict the use of the currencies of other countries, provided that this currency has legal circulation on the territory of the Russian Federation.

Adherents of the “ruble salary” usually use Letter No. 1688-6-1 of the Federal Service for Labor and Employment dated October 10 as an argument. 2006, which expresses an opinion regarding the illegality of paying wages in a currency other than Russian rubles. From our point of view, the Federal Service for Labor and Employment is not a body with the right of normative interpretation. And as an administrative interpretation, the said letter should be considered solely as a recommendation.

Thus, due to the literal interpretation, wages to employees can be paid in the currency agreed upon by the parties to the employment contract.

Salary calculation with example

The amount of wages received by an employee can be calculated by several formulas, depending on the methods of its assignment. Before issuing remuneration, the employer deducts 13% income tax.

The simplest formula is:

(Salary⁄(Number of days worked))/(100%)×13%=Net salary

Such situations almost never occur in practice, since in addition to the salary, the employee is entitled to additional payments in the form of bonuses, social payments or benefits, etc., and the employee may also have the right to receive a tax deduction.

In this case, the calculation formula will look like this:

(Salary+Bonus+Other payments-Tax deduction (if any))/(100%)×13%=Tax

For example, Ivanov I.N. has a salary under an employment contract of 58,000 rubles, while for the current month he was paid a bonus in the amount of 9,540 rubles for a successfully completed project. He has two dependent minor children, who give a tax deduction in the amount of 1,400 for each child (for the third, the deduction is fixed - 3,000 rubles).

Based on this, Ivanov must pay:

(58,000+9,540-(1400×2))/(100%)×13%=8,416.2 rubles of income tax

He will receive:

58,000+9,540-8,416.2=59,123.8 rubles

There are often situations when an employee does not work all days in a month. Then the salary amount is calculated differently:

Salary/(Number of working days)×Number of days worked=Salary (without deduction of personal income tax)

For example, Kravtsova A.B. receives a salary of 48,700 rubles. There are 22 working days in a month, but due to personal circumstances, Kravtsova took 4 days off without saving her salary.

Based on this, Kravtsova will receive:

(48,700 rubles)/(22 working days)×(22 days - 4 days off)=39,845.45 rubles

This amount was obtained without deducting personal income tax, so after all deductions she will receive a “net” salary in the amount of:

39,845.45-(39,845.45/(100%)×13%)=34,665.54 rubles

If she had minor children, she could receive a tax deduction for each child.

Non-monetary salary

Article 131 of the Labor Code of the Russian Federation considers the non-monetary form of wages as a possible alternative to cash payment, but with a number of restrictions on application.

Thus, restrictions on the use of non-monetary forms of remuneration in one form or another are contained in:

- ILO Convention No. 95 contains a direct prohibition on the replacement of wages with promissory notes, as well as coupons or notes declared to be a substitute for national currency;

- The Russian Federation Law “On the Bank of Russia” directly prohibits the introduction of “money surrogates”.

If we exclude the above non-monetary forms of payment, then as an alternative to money, we can consider payment to employees in the form of goods or services produced by the employer.

Speaking about alternative payment, the legislator proceeds from the fact that labor relations, among other things, are also contractual relations. And the free will of the contracting parties cannot be limited otherwise than by law.

Since the law does not limit the possibility of paying for labor in goods or services, Art. 131 of the Labor Code of the Russian Federation allows a non-monetary form of payment to the extent that is not prohibited by law and only if there is an agreement, collective (see Article 40 of the Labor Code of the Russian Federation) or individual, allowing this form of payment with employees.

Thus, a non-monetary form of remuneration stipulated in a collective labor agreement, depending on the procedure for its conclusion, can apply to both all employees and a certain part of them, for example, a branch or division. As for individual employment contracts, the terms of non-monetary remuneration are included in the relevant section of the contract.

In addition to the contractual condition itself, before each payment, you will also need a written statement from the employee containing:

- a request to use a non-monetary form of payment;

- the type of good or service that the employee agrees to accept as payment;

- the price of a good or service received as payment.

Such requirements stem from the Resolution of the Plenum of the Armed Forces of the Russian Federation dated March 17, 2004, which states that the very possibility of non-monetary remuneration depends on a number of circumstances, namely:

- availability of the employee’s consent to such payment;

- availability of a written application from the employee expressing consent to receive payment in non-monetary terms in whole or in part;

- not exceeding the “in-kind payment” mark of 20% of the total amount earned;

- the existence of such a form of remuneration that is desirable or customary for a particular industry;

- the applicability and usefulness of a good or service received as remuneration in the personal life of the employee and his family;

- no restrictions on the circulation of goods or services offered as payment. Items and works prohibited in civil circulation cannot be the subject of payment.

HOW TO APPLY FOR PAYMENT OF SALARY IN PRODUCTS

If your company has never paid wages in products before, then most likely you did not provide for this possibility in your employment contracts with employees. Therefore, the first step is to conclude additional agreements with employees to employment contracts , which will make changes to the “Payment” section. It is enough to add just one point (example 1).

However, the additional agreement is not enough to replace wages with products on a monthly basis. It is necessary for the employee to ask for this, that is, to write a statement . Moreover, in the application he must indicate exactly what he agrees to replace part of his salary with (example 2).

It must be said that the courts consider it acceptable when an employee in his application asks to be given a salary in non-monetary form for a certain period (for example, a quarter). In this case, the employee has the right to refuse this form of remuneration at any time before the end of this period.

Finally, in order for the accounting department to correctly process all write-offs, an order in which the head of the company orders that part of the wages be replaced with products (example 3).

What cannot be the subject of a non-monetary form of remuneration

The following cannot be used as remuneration:

- “cash surrogates” - bonds, promissory notes and coupons;

- alcohol;

- narcotic and psychotropic substances;

- toxic and harmful substances;

- weapons, ammunition;

- other goods partially or completely withdrawn from free circulation;

- precious and rare earth metals and precious stones, with the exception of jewelry made from them;

- other products and production waste included in the list of those withdrawn from free circulation in whole or in part in accordance with Decree No. 179 of the President of the Russian Federation dated February 22, 1992.

Payment of wages

Rakitina M.Yu. expert "RNA" Published: Magazine "Russian Tax Courier" N 17 / 2002

.

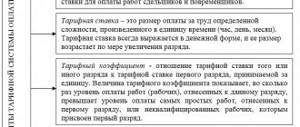

| Procedure for payment of wages In organizations (not financed from the budget), the wage system, tariff rates, salaries, and various types of payments are established by collective agreements, agreements, local regulations of the organization and employment contracts. |