In what cases does the salary change?

The most common option for changing salary is increasing it. Usually it occurs when the employee’s labor productivity is high, his special services to the company, for the purpose of additional motivation, as well as due to some other general reasons.

- Form and sample

- Free download

- Online viewing

- Expert tested

FILES

Salary reductions also sometimes happen. Most often this is due to the financial problems of the organization or the ineffectiveness of a particular employee. In any case, such an unpopular measure must also be accompanied by writing an order to change the salary, even in cases where the reduction occurs by a not very significant amount.

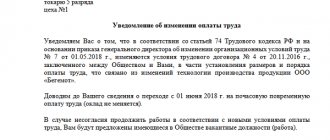

Remember, an important rule to follow is that before reducing an employee's salary, he must be notified in writing at least two months in advance.

During this time, a person can decide for himself whether he will look for another, more financially suitable job or whether he is ready to remain in his previous position, but at a lower salary. It should be noted that the employee has every right to refuse those new financial conditions that are included in the order, without giving up his job.

In this case, by law, the employer is obliged to offer him in writing another position (higher or lower in rank, but corresponding to the level of qualifications and health). If it is not possible to reach an agreement, then you will have to seek a solution to the conflict in court.

Changing employee wages: established procedure and additional registration errors

The wages of employees are a necessary condition of the employment contract. An employer, when changing the amount of remuneration, does not always think about documenting these actions or does not foresee the consequences that may be caused by improper documentation.

In this article, we will look at examples of judicial practice related to changes in employee wages, both in the direction of decreasing and increasing them, pay attention to the procedure for drawing up documents, and analyze possible mistakes of the employer.

Changes in wages

A change in the amount of remuneration refers to changes in the terms of the employment contract determined by the parties. This follows from Article 57 of the Labor Code of the Russian Federation, according to which wage conditions are mandatory for inclusion in an employment contract. The procedure for changing the terms of an employment contract is defined in Art. 72, 74 Labor Code of the Russian Federation. In particular, a reduction in wages at the initiative of the employer is possible only in cases where, for reasons related to changes in organizational or technological working conditions (changes in equipment and production technology, structural reorganization of production, other reasons), the terms of the employment contract determined by the parties cannot be maintained. . The employer is obliged to notify the employee in writing of the upcoming changes, as well as the reasons that necessitated such changes, no later than two months in advance. If the employee does not agree to work under the new conditions, then the employer is obliged to offer him in writing another job available to the employer (both a vacant position or work corresponding to the employee’s qualifications, and a vacant lower position or lower paid job), which the employee can perform taking into account his health status.

The main document fixing the existing level of remuneration for certain positions in an organization is the staffing table, the need for which is indicated in the Labor Code of the Russian Federation, the form approved by Resolution of the State Statistics Committee of the Russian Federation No. 1 No. 01/05/2004.

Often, an employer, believing that the procedure for changing the staffing table is not regulated in detail by law, changes it at its own discretion, including the wages of employees. However, changes in staffing must be made in accordance with Art. 74 Labor Code of the Russian Federation.

In most cases, a reduction in wages will cause dissatisfaction, which may ultimately lead to litigation. In particular, on June 02, 2010, the Sovetsky District Court of Samara made a decision in absentia in case No. 2-1804/10. According to the decision, T. was hired by the LLC on July 16, 2001 as a quality manager. On November 6, 2007, in the same organization, she was hired part-time for the position of logistics manager. According to the staffing table, from 10/01/2009, the tariff rate of the quality manager was 16,000 rubles, the material and technical supply manager was 12,000 rubles. (and 0.5 rates – 6,000 rubles). The plaintiff was fired from her job on May 11, 2010. For December 2009, she was paid a salary of 7,600 rubles, and for the period from January 2010 to the day of her dismissal, she was not paid a salary.

The defendant did not provide evidence of payment of wages, however, the staffing table was changed on January 19, 2010, according to which the tariff rate for the quality manager became 10,000 rubles, and for the logistics manager - 8,000 rubles. (0.5 bets – 4,000 rubles). The plaintiff was not aware of the change in staffing (as required by Article 74 of the Labor Code of the Russian Federation).

Taking into account the above, the court decided that until March 19, 2010 (that is, two months from the date of approval of the new staffing table), the plaintiff has the right to receive a salary in the same amount, and from March 20, 2010 in the amount established by the new staffing table. Thus, the employer’s debt to the plaintiff amounted to:

— for December 2009 11,540 rubles. (16,000 rubles + 6,000 rubles = 22,000 rubles, less income tax of 19,140 rubles, and less paid 7,600 rubles);

— for January and February 2010, wages in the amount of 19,140 rubles are subject to recovery. for every month;

- for the period from 03/01/2010 to 03/19/2010, the debt was calculated based on previous earnings and amounted to 12,180 rubles. (RUB 19,140: 22 working days in a month * 14 working days in the specified period);

— for the period from 03/20/2010 to 03/31/2010, wages were calculated according to the new staffing table and amounted to 4,429 rubles for 8 working days. (14,000 rubles – 1820 rubles income tax = 12,180 rubles. The specified amount is divided by 22 working days in the month and multiplied by 8 working days in the specified period).

In April 2010, the plaintiff was accrued but not paid 13,150 rubles, in May 2010, 19,675 rubles, which is confirmed by a certificate issued by the chief accountant of the LLC.

The court decided to recover 99,255 rubles from the LLC in favor of the plaintiff for the period from December 2009 to May 2010. 01 kopecks, as well as interest for delayed payment of wages in the amount of 2088 rubles. 69 kopecks, moral damage in the amount of 2,500 rubles. 3,226 rubles were recovered from the LLC as local budget revenue. 87 kopecks

Let's consider another court decision, from which it is known that the employee was changed not only the amount of wages established by the employment contract, but also the name of the position. Despite the fact that the staffing table itself had been drawn up, the employer again did not comply with the procedure established by Art. 74 of the Labor Code of the Russian Federation, which led to a decision in favor of the former employee.

According to the decision of the Gus-Khrustalny City Court of the Vladimir Region dated April 23, 2010 in case No. 2-****/2010 , S. worked at LLC “***” as General Director from November 24, 2008, November 23, 2009 . transferred to the position of Director of Technical Affairs. He was dismissed at his own request on 02/03/2010 from the position of director for technical issues, the amount of his salary was provided for in the staffing table and was 19,000 rubles, a 50% bonus was 9,500 rubles, that is, the monthly salary should be 28,500 rubles. In addition, on the basis order dated December 29, 2008, he worked part-time as a driver, and was paid 2,801.25 rubles monthly for the part-time job. For the period from 01/01/2010. to 02/03/2010 wage arrears amounted to 31,583.60 rubles. (salary of the director of technical issues, 50% of the salary - bonuses, additional payment for combinations). He asked to recover the overdue payment for the unlawful use of funds in the amount of 350.76 rubles, as well as 50,000 rubles. for compensation for moral damage.

The representative of the defendant LLC "***" did not agree with the claims, pointing out that on 01/01/2010 changes were made to the organization's staffing table. In particular, the general director of LLC “***” G. changed the name of S.’s position (the new name is “technical engineer”) and the salary, which began to amount to 9,000 rubles from 01/01/2010. without paying bonuses. The court did not accept the changed staffing table as evidence, paying attention to Art. 74 Labor Code of the Russian Federation. In particular, it was noted that no changes were made to the organizational or technological working conditions in the organization, and in addition, S. was not notified in writing two months in advance about the upcoming changes to the terms of the employment contract. In addition, on 02/03/2010 S. was dismissed from the position of technical director, and not from the position of technical engineer as provided for in the staffing schedule dated 01/01/2010.

The court decided to recover 31,583 rubles from LLC “***” in favor of S. 61 kopecks (unpaid wages upon dismissal during the period from 01/01/2010 to 02/03/2010, compensation for unused vacation), 350 rubles. 76 kop. (interest on the amount not paid on time), as well as compensation for moral damage in the amount of 5,000 rubles. A state duty in the amount of 1,158 rubles was collected from LLC “***” for local budget revenue. 00 kop.

It's not just wage cuts that cause legal disputes. In particular, the cassation ruling of the judicial panel for civil cases of the Magadan Regional Court dated June 15, 2010 was made following the consideration of a complaint against the decision of the Magadan City Court dated March 23, 2010 on a claim for the collection of arrears of wages arising in connection with a change in salary towards it increase.

According to the definition, the plaintiff was in an employment relationship with the defendant from 12/05/2007 to 02/01/2010. In accordance with the employment contract, the official salary was 2,860 rubles. By an additional agreement dated 10/01/2008 to the employment contract, the salary was set at 8,000 rubles. The specified salary corresponded to the staffing table put into effect on 10/06/2009.

By order of the General Director dated November 2, 2009, changes were made to the specified staffing table, according to which the plaintiff’s official salary was increased to 18,392 rubles. In this regard, the calculation of wages, as well as compensation for unused vacation, must be made to the plaintiff from the newly established salary. According to the calculation presented by the plaintiff (the correctness of which was not disputed by the defendant), the amount of wages for the period from November 1, 2009 to February 1, 2010 amounted to 240,889.72 rubles. For the specified period, the defendant paid the plaintiff an amount of 89,960.94 rubles. (which is confirmed by payment orders). Thus, the defendant’s debt to the plaintiff for wages and compensation for unused vacation amounted to 150,928.78 rubles. In addition to the specified amount, the court decided to recover from the defendant in favor of the plaintiff compensation for moral damage in the amount of 3,000 rubles, legal costs in the amount of 4,700 rubles, and a total of 158,628 rubles. 78 kop. 4,372 rubles were collected from the budget of the municipal formation "City of Magadan". 57 kopecks

We will pay special attention to documentary evidence of changes in the staffing table. The cassation appeal filed by the defendant indicates that the plaintiff presented only a copy of the order dated November 2, 2009, according to which the salary for her position was increased to 18,392 rubles. However, the original of this order is not available at the enterprise; the copy of the order presented by the plaintiff is not properly certified, since it does not contain an indication of the person who certified this copy; The plaintiff had at her disposal the seal of the company by virtue of her position. In addition, it is indicated that the court ignored the order register presented for review, which had erasures and corrections at the place where the entry about this order was made. The cassation court, having considered the said complaint, found no grounds for canceling the decision, indicating that the defendant did not provide reliable evidence confirming the falsification of the order of the general director dated November 2, 2009, and based on the results of an inspection carried out by the investigative authorities, a decision was made to refuse to initiate a criminal case .

Reducing wages as a reason to terminate an employment contract

In the event of a change in the staffing table and if the employee refuses to work under the new conditions, the employer has the right to terminate the employment contract with the employee under clause 7, part 1, art. 77 Labor Code of the Russian Federation. Employers sometimes take advantage of this provision by reducing wages to employees with whom they want to terminate the employment contract. However, they forget about Art. 74 of the Labor Code of the Russian Federation, according to which changes in the terms of an employment contract determined by the parties can be changed at the initiative of the employer only for reasons related to changes in organizational or technological working conditions. In paragraph 21 of the Resolution of the Plenum of the Supreme Court of the Russian Federation dated March 17, 2004 No. 2 “On the application by the courts of the Russian Federation of the Labor Code of the Russian Federation” (as amended on September 28, 2010), Art. 56 of the Code of Civil Procedure of the Russian Federation, according to which the employer is obliged to provide evidence confirming the cause-and-effect relationship between changes in organizational and technological working conditions and changes in the terms of the employment contract. In the absence of such evidence, termination of the employment contract under clause 7, part 1, art. 77 of the Labor Code of the Russian Federation or a change in the terms of the employment contract determined by the parties cannot be recognized as legal.

To illustrate this situation, consider the Decision of the Nizhnelomovsky District Court of the Penza Region dated 02/05/2010.

Since 06.11.2008 K.N. worked at LLC "G*" as a technician in the customer service department, the salary was set at 6,222 rubles. Orders for the enterprise dated 01/01/2009 and 04/01/2009 approved new staffing schedules, according to which the salary of K.N. was 7,790 rubles from 01/01/2009. On 08/04/2009, a new director was hired at G* LLC, after which new employment contracts were concluded with all employees, according to which wages were reduced to the amounts established at the enterprise before 01/01 .2009. Actions to return to the previous level of wages are due to the fact that changes to the staffing table made at the beginning of the year were made erroneously; the minimum monthly tariff rate for a 1st category worker was changed from 2,550 rubles. per month for 4330 rubles. per month and, as a result, the official salaries and tariff rates of the enterprise’s employees were increased. An error in the staffing table was made due to an incorrect interpretation of the norms of the current labor legislation. Thus, by the Industry Tariff Agreement in the housing and communal services of the Russian Federation for 2008 - 2010, clauses 2, 3 “Payment”, concluded on 06/22/2007, from 01/01/2008 the base monthly tariff rate for a 1st category worker is established in the amount of 2,550 rubles. per month. Setting the tariff rate at 4330 rubles. the previous director did not take into account that this amount of remuneration includes compensation and incentive payments (part 2 of article 129 of the Labor Code of the Russian Federation, part 4 of article 133 of the Labor Code of the Russian Federation). In this regard, both orders were canceled by order dated 08/04/2009, it was indicated that the base monthly tariff rate of a 1st category worker should be 2550 rubles, official salaries and tariff rates of enterprise employees from 08/04/2009 are calculated based on the specified tariff rate of a 1st category worker. th category. Similar changes were made to the collective agreement.

On 10/07/2009, the plaintiff was given a notice of a change in the terms of the employment contract determined by the parties, although before that time she had already worked under the changed terms of the employment contract and there were no organizational or technological changes in working conditions at the enterprise. By order of the enterprise dated December 7, 2009, she was dismissed under clause 7 of Article 77 of the Labor Code of the Russian Federation. She was not offered any vacancies available at the company. The difference in wages was paid to her only upon dismissal.

Having examined the documents presented by the parties, the court indicated that, in accordance with Art. 74 of the Labor Code of the Russian Federation, changes in the terms of the employment contract determined by the parties, introduced in accordance with this article, should not worsen the position of the employee in comparison with the established collective agreement or agreements. However, on August 4, 2009, the enterprise changed, among other things, a clause in the collective agreement - the tariff rate for a 1st category worker was reduced from 4,330 rubles. up to 2550 rub.

Further attention is drawn to the fact that changes in the terms of the employment contract determined by the parties can be made in connection with organizational and technological changes in the organization. However, the reason for the change in the tariff rate and salaries of employees was, according to the director’s explanation, the unprofitability of the enterprise due to the discrepancy between the amount of funds collected and wages, namely the fee for services amounted to 780,000 rubles; salary 630,000 rubles; 320,000 rub. household expenses. Therefore, changes in the staffing table in terms of reducing wages and bringing them in accordance with the standards were, in his opinion, organizational measures that entailed the need to change the terms of employment contracts with employees. These actions of the director, as well as the rationale for changing the staffing table due to the need to correct an error caused by the interpretation of existing regulatory legal acts when approving the staffing schedules of 01/01/2009 and 04/01/2009, were declared illegal by the court.

In addition to the above, the employer violated the procedure for notifying about upcoming changes to the terms of the employment contract determined by the parties. Namely, on 04.08.2009, a general meeting was held with the employees of the enterprise, during which everyone agreed to change the terms of the employment contract determined by the parties precisely from 04.08.2009 (that is, without warning the employees about this two months in advance). Accordingly, the staffing table with new conditions for remuneration of workers could be introduced only two months after the decision was made to carry out measures of an organizational nature (if any took place), that is, no earlier than 10/05/2009, and not 08/04/2009. Despite notification of the plaintiff on 10/07/2009 about changes in the terms of the concluded employment contract and subsequent dismissal on 12/07/2009, the plaintiff actually worked from 08/04/2009 under the new conditions of the employment contract, since before full settlement with her upon dismissal she received a salary in the amount , determined by the staffing table dated 08/04/2009, that is, in the amount of 6,222 rubles. This circumstance is also evidence that the plaintiff did not refuse work and continued to work at G* LLC after the changes were introduced until she was warned about the change terms of the employment contract. According to the court, the employer did not fulfill the obligation to offer K.N. in writing other available work.

Taking into account the above, the dismissal of K.N. produced in violation of labor laws, and therefore cannot be recognized as legal. The court decided to reinstate K.N. in the position of technician in the customer service department since 12/08/2009. To collect from LLC "G*" in favor of K.N. salary for the period of forced absence in the amount of 16,510 rubles. 16 kopecks, compensation for moral damage in the amount of 2,000 rubles, financial assistance in the amount of 3,866 rubles. 89 kopecks (which K.N. asked the employer for, but she was refused due to lack of funds, while in accordance with clause 8.4 of the Collective Agreement of G* LLC, the employer is obliged to provide financial assistance for the next annual main leave in the amount of 30% average monthly earnings), and only 22,377 rubles. 05 kop. To collect from LLC "G*" a state duty in the amount of 2,811 rubles. 31 kopecks

Summarizing the considered court decision, we note that the need to change the employee’s salary and, as a consequence, changes to the staffing table will be recognized as legal if:

1. employees were notified of the upcoming changes at least two months in advance;

2. these actions do not worsen the situation of employees in comparison with the conditions defined in the collective agreement;

3. changes in working conditions are caused by organizational changes. In particular, in a generalized form, these include:

— streamlining of structural connections between divisions, foundation (creation) of new divisions, associations of old ones (for example, through reorganization: creation of new links in the structure, liquidation of old formations, merger of divisions with the transformation of their functional responsibilities, etc.);

— improvement of organizational conditions for managing the production process. These are, first of all, the actions of the employer to organize a systematic change in the structure of the enterprise (institution, organization) as a whole, its restructuring, clarifying the connections and interrelationships of the activities of departments and employees, improving internal clarity and discipline in production and labor relations between services and employees.

To this end, when creating new services and structural divisions, ineffective divisions are eliminated and jobs are cut, changes are introduced in the horizontal interaction of services (other employer structures) and in the vertical subordination and interaction of services to establish a different, more rational system of industrial relations, etc.

Is it always necessary to follow Art. 74 of the Labor Code of the Russian Federation and, in particular, notification of upcoming organizational changes will prevent legal disputes? Judicial practice shows that often employers, while formally complying with the provisions of the law, do not foresee all the possible nuances of terminating an employment contract under clause 7, part 1, art. 77 Labor Code of the Russian Federation.

According to the decision of the Metallurgical District Court of Chelyabinsk in case No. 2-454/2010, B. was hired by LLC in the accounting department of the settlement department for the position of senior accountant. In accordance with the order of the General Director of LLC M., due to the need to optimize the organizational structure, changes were made to the staffing table of the LLC, in accordance with which the position of deputy chief accountant was reduced, the position of senior accountant of the settlement department with a salary of 10,400 rubles. renamed to the position of accountant with a salary of 7,300 rubles. and transferred to the subordination of the deputy chief accountant. Also, a settlement accounting department was introduced into the main accounting department with the positions of department head with a salary of 22,000 rubles. and senior accountant (1 unit) with a salary of 10,400 rubles.

In pursuance of this order and bringing it into line with the amended staffing table, B. was given a notice of changes in the terms of the employment contract. By order, the plaintiff was transferred from the position of senior accountant to the position of accountant with a tariff rate of 7,300 rubles. B. was familiar with the said order, but did not agree with it, which she indicated directly in the order.

On the same day, B. was offered a number of technical vacancies, with which the plaintiff did not agree, about which she made a corresponding note and wrote a statement.

Having restructured the settlements department, a new structural unit was created - the settlements accounting department in which the position of senior accountant was vacant, but there was no information about the offer of the specified vacancy by B.V. was not presented at the court hearing.

After reviewing the proposed vacancies, the plaintiff was familiarized with the order of her dismissal under clause 7 of Art. 77 Labor Code of the Russian Federation. B. also did not agree with this order and refused to sign it, about which a report was drawn up.

B. asked to be reinstated as a senior accountant in the settlement department of the general accounting department of the LLC. The court decided that these requirements must be satisfied on the following grounds:

- in the notice handed to B. there was no indication of the position to which the plaintiff was proposed to be transferred, as well as the job duties that she would have to perform, i.e. there were no mandatory components of the content of the employment contract provided for in Art. 57 Labor Code of the Russian Federation;

- from an analysis of the instructions of the senior accountant of the settlement department and the accountant of the main accounting department, it was concluded that B.’s functions changed when transferred from one position to another, which is unacceptable in case of dismissal under clause 7 of Art. 77 Labor Code of the Russian Federation;

- in violation of the requirements of Art. 74 of the Labor Code of the Russian Federation, all available vacancies were not offered, in particular, the vacancy of a senior accountant in the settlements accounting department was not offered.

The court especially noted that the defendant had not proven that the change in the terms of the employment contract was caused by a change in organizational or technological working conditions. In fact, the position of senior accountant in the settlement department was reduced and a new department and a new position were introduced in the main accounting department - accountant, with a different salary and other functional responsibilities. At the same time, the representative of the defendant explained at the court hearing that there was no reduction in the total number of workers in the organization at the end of 2020, and in this regard it can be concluded that the volume of work in the settlement department has not decreased.

Taking into account the plaintiff’s work experience as an accountant, senior accountant, the specifics of this profession, as well as the presence of a vacancy for a senior accountant in the accounting department, the court came to the conclusion that B.’s dismissal was illegal under clause 7 of Art. 77 Labor Code of the Russian Federation. Consequently, the plaintiff’s demands for her reinstatement as a senior accountant in the settlement department of the LLC must be satisfied, despite the fact that at present the position in which B. worked does not exist.

In addition to the plaintiff’s demand for reinstatement, the demand for the recovery of wages for the period of forced absence in the amount of 41,296 rubles is also subject to satisfaction. 71 kopecks, compensation for moral damage in the amount of 1,500 rubles. The local budget collected a state duty from the LLC in the amount of 1,438.88 rubles.

Who has the right to change the staffing schedule?

Full version of the article in the printed version of the magazine or on the website in 3 months

Grounds for ordering a salary change

Any order, including this one, must have some basis. In this case, such a document may be a presentation or memo from the head of a structural unit, a change in the staffing table, etc. The basis must necessarily indicate

- the circumstances under which it is proposed to change the employee’s salary,

- brief description of the employee,

- and also the size of the current salary and the one that is proposed to be assigned is stated.

In this case, one nuance should be taken into account: if a salary increase in most cases must be accompanied by a written proposal from the head of the department in which the employee works, then for a reduction no documents from the line manager are needed.

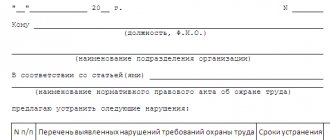

Rules for drawing up an order

There is no standard unified template for drawing up an order to change the salary, so the document can be drawn up in free form. Some organizations have specially developed, mandatory internal order templates (which must be registered in the enterprise's accounting policies). In any case, the document must contain a number of necessary information. These include :

- Company name,

- date of the order,

- text of the order,

- persons responsible for its implementation.

The order may concern either one employee or a number of employees, regardless of their status in the company and their affiliation with a particular structural unit. If several employees are entered into the order at once, then information about each of them must be indicated in a separate paragraph, entering into the document the position, the department in which the person works, as well as the new amount of his salary (in numbers and in words).

Transition from salary to hourly rate

Free consultation by phone Contents The change must be introduced from the moment the relevant document comes into force.

If a new document establishes an increased minimum wage retroactively, then the employer needs to make changes, that is, draw up an additional agreement to the employment contract on the date when the change became known, at the same time extend its effect to earlier periods and recalculate wages, if required. When indexing wages, the procedure for its implementation is additionally specified in the internal local regulations of the organization (Art.

134 Labor Code of the Russian Federation). For example, in the Regulations on Remuneration. In the future, salary indexation is carried out on the basis of an order from the manager with reference to the relevant local regulation. After this, draw up additional agreements to the employment contract with employees and make changes to the organization’s staffing table. Provide the Employee with work stipulated by the Contract.

6.1.3. Provide the Employee with equipment, technical documentation and other means necessary to perform his job duties.

6.1.4. It is important to pay the full amount of wages due to the Employee on time.

6.1.5. Carry out compulsory social insurance for the Employee in the manner established by federal laws. 6.1.7. 6.2.2. Require the Employee to fulfill labor duties specified in the Agreement, to take care of the property of the Employer and other employees, to comply with laws and local regulations.

6.2.3. Attention Immediately notify the Employer of the occurrence of a situation that poses a threat to the life and health of children, or the safety of the Employer’s property.

5.2. The employee has the right to: 5.2.1. Providing him with work stipulated by this employment contract.

5.2.2. Timely and full payment of wages in accordance with your qualifications, complexity of work, quantity and quality of work performed.

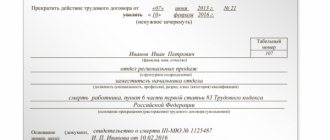

How to place an order

There are also no strict rules for placing an order. It can be printed either by hand or on a computer, both on company letterhead and on a regular A4 sheet.

Mandatory condition: it must be certified by the signature of the head of the company, as well as those employees who are appointed persons responsible for its execution.

There is no need to certify it with a seal, since it relates to the company’s internal documentation; in addition, since 2021, legal entities are exempt from the obligation to affix seals and stamps on their papers.

The order is usually drawn up in a single copy, and after it is executed, it is transferred for storage to the archive of the enterprise. There he should be kept for exactly the amount of time required for such documents.

It should be noted that this order is automatically accompanied by changes to the working conditions specified in the employment contract, so an entry about this should be made in the contract with the employee in the form of an additional agreement certified by both parties.

It is also necessary to reflect the necessary changes in the organization’s staffing table.

What requirements must be taken into account when changing wage conditions?

The list of circumstances under which changes in wage conditions are possible are established by Article 74 of the Labor Code of the Russian Federation and are listed in Resolution of the Supreme Court of the Russian Federation dated March 17, 2004 N 2. Valid circumstances require justification for changes caused, for example, by improvement of equipment, production process, jobs, structure employer.

Objective circumstances include:

- changes in the composition of the management apparatus;

- shifting periods of work and rest;

- application of new or modification of old standards.

Technological changes are expressed in the following events:

- emergence of new technologies;

- commissioning of new equipment;

- bringing innovative products to the market.

The worsening financial condition of the company is not a good reason for changing the terms of remuneration. In any case, if disagreements arise, the responsibility to prove the existence of objective reasons for the changes falls on the employer.

An example of drawing up an order to change the salary of an employee

Filling out the document header

At the beginning, the full name of the company is indicated, below in the center of the line they write the word “order” and its number according to the internal document flow of the enterprise. The next line contains the date the order was drawn up and the locality in which the company is registered.

Filling out the “body” of the document

The basis for issuance is written into the “body” of the order, after which the actual essence of the order is drawn up.

- The first paragraph indicates the position of the employee, his last name, first name, patronymic, as well as the new official salary and the date from which it should be calculated.

- In the second, an order is given to a specific specialist in the accounting department to take the first point into service and ensure the implementation of the order in terms of its practical implementation.

- The third paragraph is similarly entered into by an employee of the personnel department, who must familiarize the interested employee with this order.