The essence of the problem

The provision of human resources is a problem in all areas of activity. Not only is it difficult to find a decent specialist, but also the main employee may be absent for a long time. For example, in the summer, when the busy holiday season begins, the enterprise begins to have widespread holidays and business becomes difficult. In addition, any employee can get sick. It's good if the cold ends in one or two weeks. But situations are different.

There are many reasons for employees being absent from work. But the company's activities should not suffer. Therefore, it is important for the employer to take care of the duties of absentees. It is not enough to arbitrarily assign responsibilities to a subordinate; you need to pay for the work above the norm.

Categories of substitutions

In the activities of Russian organizations, three methods are most often used:

- A temporary transfer of a specialist to another job is arranged. In this case, the employee will not perform his direct duties. His responsibilities will include working at his new place of work. For example, during the vacation of the head of the quality control department, one of the specialists was transferred to his position. The specialist will be given an additional payment for substituting during the boss's vacation.

- Temporary combination of positions or professions. At the same time, during working hours the employee will perform his previous duties and assigned ones. For example, a payroll accountant will double as a cashier while a key employee is ill.

- Expanding service areas or increasing the scope of work. The employee undertakes to perform during the working day the duties corresponding to his main position, but to a significantly greater extent. For example, the organization has three personnel officers. During the vacation of one personnel employee, his duties can be divided between the two remaining specialists.

At the same time, it is important to properly arrange and pay for each option.

Performing the duties of a temporarily absent employee

There are several ways to replace vacationers:

- Combination. The employee combines his own work and the work of a vacationer (Article 60.2 of the Labor Code of the Russian Federation).

- Temporary transfer. The employee performs only the duties of a vacationer (Article 72.2 of the Labor Code of the Russian Federation).

- Part-time job. The employee spends time free from his main job on vacation work (Article 60.1 of the Labor Code of the Russian Federation).

- Hiring a temporary employee. An employee is hired with the conclusion of a fixed-term contract for a period corresponding to the vacation period of the replaced employee (Article 59 of the Labor Code of the Russian Federation).

Remuneration and registration of temporary transfer

A temporary transfer to another position is issued if the salary for the job being replaced is higher. The method is popular when filling leadership positions. When transferring to a higher-paid position, the salary for the new position is assigned. It is unlawful to indicate in personnel documentation the wording “with additional payment of the difference between salaries” and similar phrases.

For example, a personnel officer receives a salary of 30,000 rubles. And the head of the personnel department - 50,000 rubles. Consequently, when transferred to the position of head of the personnel department, a simple personnel officer will be assigned a salary of 50,000 rubles.

But a subordinate can be transferred to a position paid lower than at the main place of work. Then keep in mind that during a temporary transfer to another position, the level of remuneration cannot be lower than the average salary at the main place (Article 182 of the Labor Code of the Russian Federation).

When making a transfer, prepare the following personnel documents:

- Additional agreement to the employment contract. A transfer is not possible without the employee's consent. The additional agreement must specify the terms of payment. The amount is determined by agreement of the parties, but it cannot be lower than the average salary for the main position.

- Order for temporary transfer in form No. T-5.

- Job descriptions and responsibilities for the new position. It is permissible to specify responsibilities in an additional agreement for temporary transfer.

Sample order

Sample additional agreement

Hiring a temporary employee

Another way to replace an employee who has gone on vacation is to hire a new employee in his place by concluding a fixed-term contract with him (Article 59 of the Labor Code of the Russian Federation).

This replacement method will be preferable for enterprises that have technically complex positions. And if you try to combine them, the entire labor process may suffer. For example, this could be a large manufacturing enterprise. The adjuster of technically complex equipment goes on vacation. The advantages of hiring a temporary employee are obvious: the manager gets a full-time employee, and the work process does not stop.

Payment, conditions and duration of work are negotiated and indicated when concluding a fixed-term employment contract.

Combining professions and increasing the volume of work

If the employer decides to increase the volume of work or assign responsibilities for filling another position to a subordinate, then three mandatory actions must be performed.

1. Offer additional work and obtain the employee’s written consent. Without official consent, an employee cannot be forced to work additionally. But there are exceptions. If the employment contract provides for the possibility of substitution, then special permission is required.

Sample proposal for additional work

2. Agree on the amount of payment. Labor legislation does not provide for restrictions on replacement pay. There is no minimum or maximum pay level. The amount of additional payment is determined by agreement.

3. Prepare personnel and administrative documents. Since the volume of work and remuneration are essential conditions of the labor relationship, it is necessary to consolidate the changes. Prepare an additional agreement to the employment contract. As well as an order to assign duties.

IMPORTANT!

During the period of replacement work, the employee is not relieved of his main duties.

Sample order on combining positions

Sample order to expand service areas

Load registration

Additional work time must be paid.

Article 151 of the Labor Code provides for additional payment for “extra labor.” Here the interests of the worker diverge from the interests of the employer.

The worker wants to receive a decent salary for the excessive stress. The administration's interests boil down to savings.

An employee needs to know how additional types of work are properly documented. This will help him maintain his interests and avoid friction.

The hired worker monitors the registration of additional work and does not begin it until he is convinced of the correctness of this action. Otherwise, it will be very difficult for him to further prove his rights.

It should not be forgotten that all three types of activities described above must be carried out during regular working hours. If the work is done after a shift, then this is a different type of part-time job. It is regulated in Article 60.

An employee should always remember the following important points:

- Combination and substitution are different terms. A vacancy is filled and the activities of a temporarily absent colleague are combined;

- The combined work is done at the same time as the main one. Any work activity carried out after the work specified in the contract is part-time work. These types of overtime work should not be confused. They are paid differently;

- Combined labor operations must be feasible. The employee is not sure that he can cope with new responsibilities? He has the right to refuse. For example, a cleaner is asked to clean 150 meters instead of 100 and do it during her shift. But she is physically unable to handle it. In this case, the person has the right to refuse. The employee must formalize his refusal in writing and submit it to management three days before the start of a new activity;

- If the combination is associated with financial responsibility, then this is discussed additionally. For example, a methodologist who is not financially responsible is offered to temporarily take on the responsibilities of a caretaker. The employer must conclude an agreement on the employee’s new obligations in writing. If there is no such agreement, then the part-time employee does not bear any responsibility;

- Any additional duties are assigned to the employee only with his consent. Consensus is formalized by a written statement from the employee. Another form of consent is a written proposal from the employer, which is signed by the employee.

The requirements for documenting overtime employment of employees do not end there. Additional labor obligations assigned to an employee require the administrator to draw up a new labor contract.

This document clearly describes the types of activities, their volume, the duration of the new employment relationship, and the amount of remuneration. One copy of the document remains with the administration, the second is given to the employee.

Next, the employer is obliged to issue an order listing the points specified in the agreement.

Only after this the employee calmly begins to perform new duties - his interests are legally protected.

About the amount of additional payments for replacement

The amount of additional payment is not limited. The specific amount is established by agreement between the employer and the subordinate performer. It is permissible to establish an additional payment for replacement as a percentage of the official salary. Or fix the premium in absolute value - a fixed amount.

Example No. 1. Additional payment as a percentage.

In a small company, the director can replace personnel; the additional payment for the combination is set by the director himself. The replacement order establishes an additional payment of 10% of the director’s official salary for a fully worked month. Salary - 50,000 rubles. The month has been completely worked out.

Calculation: 50,000 × 10% = 5,000 rubles - the amount of additional payment for replacing the duties of a personnel officer.

Example No. 2. Additional payment in a fixed amount.

The accountant is given a bonus of 10,000 rubles for a fully worked month. For 15 days out of 21 working days, the amount of additional payment for replacement will be:

10,000 / 21 × 15 = 7142.86 rubles.

IMPORTANT!

The additional payment is subject to personal income tax and insurance premiums in the general manner. The amounts can be taken into account in the wage fund when calculating income tax.

Sample order

Sample additional agreement

Sample proposal for additional work

Sample order on combining positions

What to pay attention to

The question often arises: who can replace whom? The legislation does not contain an answer to this, so in each case you should proceed from the interests and specifics of your activity and the qualifications of your personnel. For example, in a small company, the director may well fill in for staff during vacations; in this case, an additional payment for the combination should also be established for him. Whether a secretary can perform the duties of a department head depends on the qualifications of both the secretary and the head.

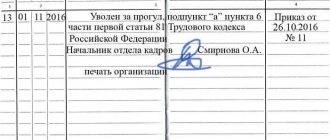

In any case, in order to assign a person the duties of an absent employee, his written consent is required. The employer must issue a corresponding order indicating:

- replacement period;

- FULL NAME. and employee position;

- legally significant action (translation, assignment of duties in a combination manner, etc.);

- payment when replacing a temporarily absent employee;

- employee consent.

Such an order is necessary both for the correct calculation of payment and its attribution to the cost price, and for the possibility of holding the employee accountable for improper performance of assigned duties.

Example of an order

Keep in mind that in all the mentioned cases, the amount of additional payment is not determined by law and is established by agreement of the parties. In practice, additional payment for a temporarily absent employee (the Labor Code has nothing to do with it) usually ranges from 10 to 50 percent of his salary, but sometimes the replacement employee demands that he be paid almost 100%. In order to avoid disagreements, we recommend stipulating this issue in a local regulatory act, for example, in the regulations on wages, which most often in enterprises regulate additional payment for performing the duties of a temporarily absent employee.