Concept and legal regulation of employer's liability

Issues of financial liability of the parties to the Labor Code are given in Chapter 9 of this fundamental document. Chapter 38 of the Labor Code is devoted to the employer's responsibility to employees.

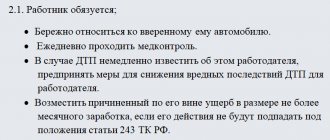

In addition to the mandatory conditions and guarantees for employees contained in the Labor Code, it is also possible to provide some additional ones. They are prescribed directly in an individual employment contract or in a special document that extends its legal force to all employees of the enterprise.

When holding an employer financially liable, you should be guided by the provisions of the Labor Code or individual conditions. But local regulations do not allow arbitrary changes in the ratio of the amounts of financial liability. Literally, this means that the employer’s responsibility to the employee cannot be less than that determined by labor legislation under Art. 232 of the Labor Code.

The peculiarity of financial liability is that after the dismissal of an employee, it remains in effect.

Financial liability can be understood as the employer’s obligation to compensate for damage to an employee resulting from the employer’s commission of certain actions or inaction. An example of such actions is the issuance of a dismissal order, or inaction - non-payment of wages or vacation pay.

As a result of the employer’s unlawful actions, employees experience certain unfavorable circumstances. The Labor Code classifies them as follows:

- impossibility of further work and the associated non-payment of remuneration to the employee under Art. 234 TK;

- causing actual damage to the property of a subordinate under Art. 235 TK;

- non-payment of wages or other payments provided for in the employment contract under Art. 236 TK.

Also according to Art. 237 of the Labor Code of the Russian Federation provides for compensation for moral damage caused to an employee.

Categories

The general principle of contract law is to hold each party to the contract liable for property damage caused to the other party by the party’s failure to perform or improper performance of contractual obligations.

With the adoption and entry into force of the Labor Code of the Russian Federation, the parties to the employment contract were placed in fair conditions when resolving issues of material liability, whereas previously it was only about the employee’s liability for damage caused to the employer’s property (Articles 118–123 of the Labor Code of the Russian Federation).

As stated in Art. 232 of the Labor Code of the Russian Federation, the party to the employment contract (employer or employee) who caused damage to the other party compensates for this damage in accordance with the Labor Code of the Russian Federation and other federal laws.

First of all, one should take into account Art. 15 of the Civil Code of the Russian Federation, which defines losses subject to compensation, in particular, in the event of damage to property.

The use of the term “damage” clearly indicates that a party to an employment contract who, through his actions or inaction, has caused property damage to the other party, is obliged to compensate for actual damage, i.e. expenses incurred by the other party to restore broken, lost or damaged property.

The financial liability of the parties to an employment contract can be “specified” both in the contract itself upon its conclusion, and in an additional written agreement. The parties have the right to enter into such an agreement at any time.

The legal fact from which the legal relationship between employer and employee arises is the employment contract. Relations regarding compensation for damage to the property of an employer or employee arise, although during the existence of an employment relationship, but from another legal fact - the fact of causing property damage. Therefore, termination of employment relations cannot affect the right to compensation for damage, as provided for by the rule formulated in Part 3 of Art. 232 Labor Code of the Russian Federation.

In accordance with Art. 233 of the Labor Code of the Russian Federation, the financial liability of a party to an employment contract occurs for damage caused by it to the other party to this contract as a result of its culpable unlawful behavior (actions or inaction), unless otherwise provided by this code or other federal laws.

Consequently, both the employee and the employer can be held financially liable only if a combination of the following conditions is established:

· presence of property damage to the injured party;

· illegality of actions (inaction) that caused the damage;

· causal connection between the unlawful act and material damage;

· the fault of the violator of the employment contract.

The specified conditions are mandatory. In the absence of at least one of them, the employer or employee cannot be held financially liable.

Let us consider these conditions, since in the application of legislation on the liability of employers there are errors on the part of the judicial authorities considering labor disputes regarding compensation for material damage caused to employees.

An employer can be held financially liable under labor law only if there is direct actual damage and only in cases provided for by the norms of the Labor Code of the Russian Federation, namely:

1. Article 234 of the Labor Code of the Russian Federation

“The employer’s obligation to compensate the employee for material damage caused as a result of illegal deprivation of his opportunity to work.”

Under the employment contract, the employer undertakes to provide the employee with work according to the specified labor function (Article 56 of the Labor Code of the Russian Federation). Thus, the employee is given the opportunity to work and receive a set salary for the work performed. An employee can realize this opportunity provided that the employer fulfills the obligations provided for in Art. 22 of the Labor Code of the Russian Federation, including those determined by the terms of a specific employment contract.

Illegal deprivation of an employee’s opportunity to work may occur as a result of the employer’s inaction or the commission of illegal actions, which is a consequence of the employer’s failure to fulfill the obligations established by the employment contract and regulations stipulating special responsibilities of the employer (for example, in the field of ensuring working conditions).

Article 234 of the Labor Code of the Russian Federation provides for other cases of illegal deprivation of an employee of the opportunity to work and receive earnings in accordance with the concluded employment contract. An employee may be suspended from work on the grounds established by Art. 76 Labor Code of the Russian Federation. In other cases, suspension from work unlawfully deprives an employee of the opportunity to work. An employer’s refusal to reinstate an employee to his previous job, contrary to the decision of the relevant body, is possible in various forms, including in the form of delaying the execution of the decision.

Labor relations terminate with the dismissal of the employee. Consequently, the employee’s obligation to perform a certain job function and the employer’s obligation to pay wages cease. But if the employer does not issue a work book to the dismissed person or issues it with a recording of the wording of dismissal that does not comply with the law, then he thereby illegally deprives the employee of the opportunity to work, i.e. take another job and earn money there. It should be considered that in such circumstances the legal relationship connecting the employee and the employer does not cease, but undergoes certain changes: the employee, from the moment the dismissal order is issued, is no longer obliged to work, but the employer is obliged to pay wages, since his illegal behavior prevents the employee from entering into labor relations with another employer and receive income. In this regard, the Labor Code of the Russian Federation imposes on the employer the obligation to compensate for property damage in the form of payment of earnings.

2. Article 235 of the Labor Code of the Russian Federation “Financial liability of the employer for damage caused to the property of the employee.”

The employee’s property, indirectly involved in the process of performing labor duties, can be considered the clothes in which he is present during working hours on the territory of the organization, at his workplace, in the workroom from the moment of arrival in accordance with the internal labor regulations in force in the organization.

Regardless of whether the employee’s property is used in the labor process by agreement with the employer or whether it is indirectly present in this process, the employer bears property liability for culpable damage to this property. Damage is compensated to the employee in full and is calculated based on market prices prevailing in the area on the day the employee’s claims were voluntarily satisfied, and if the claim was not voluntarily satisfied, then on the day the court made a decision on compensation for damages (Article 393 of the Civil Code of the Russian Federation).

Compensation for damage is usually made in cash, but with the consent of the employee, damage can be compensated in kind.

The employee’s application for compensation for damage is sent by him to the employer, who is obliged to consider this application and make an appropriate decision within ten days from the date of its receipt. If the employee disagrees with the employer’s decision or does not receive a response within the prescribed period, the employee has the right to go to court.

3. Article 236 of the Labor Code of the Russian Federation “Financial liability of the employer for delay in payment of wages.”

The procedure, place and timing of payment of wages and vacation pay are established in accordance with Art. 136 Labor Code of the Russian Federation. The deadlines for payment of wages and vacation pay cannot be changed by a unilateral order of the employer or by agreement of the parties. Changing these deadlines is possible only by federal law for certain categories of workers. Specific payment dates are determined by a collective or employment agreement.

Payments to the employee provided for by law and the employment contract constitute the content of the employer’s monetary obligation. Failure to fulfill this obligation within the prescribed period entails financial liability of the debtor in the form of interest on the amount of the debt.

Interest accrued on the debt amount (monetary compensation to the employee for late payments to him) cannot be less than one three hundredth of the refinancing rate of the Central Bank of Russia (CBR) in force at that time for each day of delay. However, a collective or labor agreement may provide for the payment of monetary compensation in a larger amount, for example, one hundredth of the Central Bank refinancing rate for each day of delay in payments to the employee.

4. According to Art. 237 of the Labor Code of the Russian Federation, an employee is compensated for moral damage caused by the employer through unlawful actions or inaction.

The employer's liability for causing moral harm to an employee is a special case of general liability for causing moral harm to a citizen.

Until 1997, labor legislation did not provide for compensation for moral damage to an employee. Judicial practice used the rules on compensation for moral damage introduced by the Civil Code of the Russian Federation since 1995.

The characteristics of moral damage are given in Art. 151 of the Civil Code of the Russian Federation. This is the physical or moral suffering of a citizen (in relation to labor relations - an employee).

The physical suffering of an employee is expressed in the form of pain, for example, in the event of an accident at work associated with a violation of safety standards that led to injury to a person.

Moral suffering consists of the negative experiences of a person experiencing fear, shame, humiliation, etc.

The obligation to compensate for moral damage is assigned to the employer if he is guilty of causing moral damage, with the exception of cases where the harm was caused to the life or health of the employee by a source of increased danger (Article 1100 of the Civil Code of the Russian Federation).

An employer may cause moral harm to an employee that is not related to property damage, for example, by unfairly imposing a disciplinary sanction. In this case, the employee has the right to demand compensation for moral damage in monetary form. The amount of compensation is established by agreement of the parties, and in the absence of such, by the court.

Resolution of the Plenum of the Supreme Court of the Russian Federation dated December 20, 1994 No. 10 “Some issues of application of legislation on compensation for moral damage”, as amended by the resolutions of the Plenum of the Supreme Court of the Russian Federation dated October 25, 1996 No. 10, dated January 15, 1998 No. 1, it is clarified that moral harm, in particular, may consist of moral feelings in connection with the inability to continue an active social life, loss of a job, dissemination of untrue information discrediting the honor, dignity or business reputation of a citizen, temporary restriction or deprivation of any rights, physical pain associated with injury, other damage to health, or due to illness suffered as a result of moral suffering, etc.

In particular, the court has the right to oblige the employer to compensate the moral and physical suffering caused to the employee in connection with illegal dismissal, transfer to another job, unjustified application of disciplinary action, refusal to transfer to another job in accordance with medical recommendations, etc.

The clarifications of the Supreme Court of the Russian Federation dated December 20, 1994 retain their significance and currently serve as a guideline for the application of Art. 237 Labor Code of the Russian Federation.

The degree of moral or physical suffering is assessed by the court, taking into account the actual circumstances of the infliction of moral harm, the individual characteristics of the victim and other specific circumstances indicating the severity of the suffering he suffered.

When determining the amount of compensation for moral damage, the requirements of reasonableness and fairness must be taken into account.

As already noted, the employer’s financial liability arises for damage caused to the employee as a result of culpable unlawful behavior

(actions or inactions), unless otherwise provided by the Labor Code of the Russian Federation or other federal laws.

In the legislation, illegal behavior is understood as the behavior of a person that contradicts the requirements of legal acts (norms).

An action is considered illegal if it is prohibited by a rule of law. Inaction is recognized as an offense if it is allowed by a person who could and should have committed certain actions, but did not commit them, that is, was inactive.

In relation to an employer, according to labor legislation, his behavior is unlawful when he does not fulfill or incorrectly fulfills his duties established by laws (Article 22 of the Labor Code of the Russian Federation), the internal labor regulations of the organization adopted in the prescribed manner, as well as other local regulatory legal acts.

In order to give a legal assessment of the actions (inaction) of the employer, it is necessary to clearly define the scope of his responsibilities under the employment contract in relation to each employee. This follows from the fact that financial liability under labor law is inextricably linked with the performance of their duties by both employees and the employer, and illegality in their behavior occurs only in the event of non-fulfillment or improper performance of these duties.

A circumstance that exempts the employer from financial liability due to the absence of illegal behavior may be the employee’s failure to fulfill or improper fulfillment of the employer’s legal requirement (order, instruction) to perform certain actions related to the labor function (job duties) of this employee.

Clarification of all the circumstances of the case when considering disputes regarding compensation for material damage by the employer is of particular importance. In each specific case, it is necessary to carefully determine what exactly the illegal actions (inaction) of the employer were, what specific duties were assigned to him, whether they were performed properly, and how the failure or improper performance of the employer’s labor duties affected the occurrence of material damage to the employee.

All regulatory legal acts on financial liability are based on the fact that the responsibility of both employees and the employer occurs for the damage that resulted from their unlawful behavior (misdemeanor).

Consequently, the necessary causal connection between the employer’s behavior and its consequences in the form of material damage to the employee must be established not only as possible or probable, but also as reliable, confirmed by data from relevant documents.

If there is no causal connection between the employer’s unlawful actions (inaction) and the material damage caused to the employee, this damage cannot be blamed on the employer.

Labor law norms (Part 1 of Article 233 of the Labor Code of the Russian Federation) contain a direct indication of the need to take into account the employer’s guilt when deciding whether to hold him financially liable. This requirement, like others, is not always taken into account in practice.

In labor law, guilt is understood as a person’s mental (internal) attitude towards his illegal behavior and its consequences (results).

A distinction is made between guilt in the form of intent (direct or indirect) and in the form of negligence (arrogance, negligence, imprudence).

Direct intent occurs when the employer is aware of the illegal nature of his action (behavior), foresees the possibility of harmful consequences (damage) and desires their occurrence.

Carelessness in the form of arrogance is that the employer, aware of the illegal nature of his action (inaction) and the possibility of material damage as a result, frivolously hopes to prevent the latter.

Negligence and imprudence are evident where the employer was not aware of the illegal nature of his behavior and did not foresee the possibility of causing damage to the employee, but due to the circumstances of the case he should have and could have foreseen.

Any form of guilt can serve as a basis for holding the employer liable under labor law (of course, in the presence of other conditions of liability provided for by law).

It should be noted that when deciding whether to hold an employer liable, dividing intent into direct or indirect has no practical significance.

A detailed study of the employer’s guilt in causing material damage to an employee is also very important for clarifying such a fact as creating appropriate conditions for the employee to perform work duties, especially to ensure the safety of the organization’s property.

When deciding on compensation for material damage caused by the employer, the distribution of the responsibility to prove the guilt of the parties to the employment contract in causing damage is of great practical importance.

From the contents of Part 2 of Art. 233 of the Labor Code of the Russian Federation it follows that the fact of the existence of property damage and the amount of damage, the illegality of the behavior of the violator of the employment contract, the causal connection of the damage with the behavior of the harm-doer is proven by the injured party. The fault of the person causing the damage is assumed.

Today it is becoming increasingly clear that in the sphere of ensuring the protection of the rights and interests of workers and employers, labor law norms do not fully fulfill the tasks defined by Art. 1 Labor Code of the Russian Federation.

Therefore, further thorough analysis of the effectiveness of all regulatory legal acts is required, ensuring not only the complete safety of the employer’s property, but also compliance with the guarantees for employees in the field of labor relations provided for by the Constitution of the Russian Federation, the Labor Code of the Russian Federation, and other federal laws.

The absence of relevant clarifications from the Supreme Court of the Russian Federation on the issue raised, necessary for judicial and economic practice, a number of norms of the Labor Code of the Russian Federation, and other normative legal acts containing labor law norms regarding the procedure for applying Art. 232–237 and others of the Labor Code of the Russian Federation, gives rise to unforeseen individual labor disputes.

It seems that the improvement of legislation in the field of employer's liability and its clarification by the Supreme Courts of the Russian Federation and the relevant government bodies should be carried out taking into account the increase in the level of legal guarantees for employees of all organizations, regardless of organizational and legal forms and forms of ownership.

Conditions for liability

The conditions for the onset of financial liability for the employer include:

- Committing certain actions or inaction that caused material losses to the employee.

- Illegality or culpability of the employer's conduct.

- Real infliction of loss to the employee , which he, as the injured party, must justify and prove.

If the illegality of the employer’s actions or inaction is proven by an act of the competent authority that has entered into legal force, then the employer’s guilt is correlated with the specific individuals who represent it.

In the process of proving the employer's guilt in causing harm, it is necessary to prove the fact of causing damage, the negative consequences of it, justify the amount of damage and identify the cause-and-effect relationship between the employer's behavior and his guilt.

Content

- What is the employer’s financial responsibility to employees?

- Types of full financial liability of the employer

- Depriving an employee of the opportunity to work

- Financial liability of the employer in case of damage to the property of an employee

- Compensation for damage by the employer in case of delay in wages and other payments

- Employer's liability when causing moral damage to an employee

- Application for compensation of employer's financial liability

Damage from the inability to perform labor functions

If an employer dismisses an employee without proper grounds, the employee may receive compensation for the earnings that were not paid to him due to his inability to work.

The circumstances for an employee’s forced failure to perform labor functions and deprivation of his due earnings are given in Art. 234 TK. Restrictions on the implementation of labor functions by an employee according to the specified legal norm may be due to:

- Removal of a person from work , his dismissal or transfer to another job.

- Issuance of a work book to an employee with a delay.

- Registration of the dismissal of an employee with errors (for example, the grounds for dismissal or the date of termination of the employment contract were incorrectly indicated). As a result of committing such offenses, the employee loses the opportunity to find employment and receive income.

- Failure to comply with the decision of the competent authorities to reinstate the employee at work or delay in this procedure.

It is worth considering that these methods of depriving an employee of an objective opportunity to work are not exhaustive. An employee may apply for compensation from an employer in other situations.

The fact that the employer’s actions are illegal must be established by the competent authorities. In particular, the court must recognize the existence of damage to the employee associated with the inability to work when considering a claim from the employee.

Delay of salaries and other payments

The employer's liability for delays in wages and other payments due to the employee is provided for in Art. 236 TK. Financial liability in this case is of a compensatory nature, that is, the employer must compensate the employee in cash for each overdue day when paying wages.

Liability also arises in relation to the employer’s overdue obligations in terms of payment of vacation pay, sick leave, maternity benefits, child benefits, compensation for unused leave upon dismissal, and other incentive and compensatory payments that are provided for in the employment contract or local regulations.

The employer's financial liability implies that he is not only obliged to repay the debt to employees, but also to pay them compensation. Its size is calculated as 1/300 of the refinancing rate for each day of delay. This percentage is applied to the amount of debt the employer owes to employees.

The payment day itself is not included in the calculations: compensation begins to be calculated from the day that follows the established salary payment day. The settlement day itself is not taken into account when determining the amount of compensation.

The timing of payment of salaries to employees must be specified in the employment or collective agreement or internal regulations. The absence of this information is equivalent to a violation of labor laws. Salaries must be paid strictly twice a month. For missing an advance payment, the employer must also pay compensation to the employee. The time interval between the advance payment and the final payment should not exceed 15 days. In this case, the final payment must occur on any date in the first half of the month, but no later than the 15th day of the month following the settlement month.

The employer must strictly adhere to the established deadlines for paying wages so that he does not have to pay penalties. He does not have the right to indicate a time frame in local documentation, for example, the advance payment is transferred before the 25th or in the period from the 21st to the 25th.

Payment of wages and compensation for unused vacation upon dismissal is made on the employee’s last working day.

Coverage of losses incurred by employees may be provided for in the provisions of a collective agreement, local regulation or employment contract. At the same time, the employer has the right to establish compensation exclusively in an increased amount in relation to the value contained in the Labor Code. That is, it should be more than 1/300 of the refinancing rate.

The employer's liability for late payment of wages occurs regardless of the presence or absence of his fault in this. Thus, he must compensate employees for expenses, even if they received their salaries late due to software failures.

Damage caused to employee property

If the property of an organization employee was damaged by a full-time employee of the organization or an employee performing his duties under an employment contract on behalf of the organization, then the employer must compensate the employee for the damage.

An employee's property includes all things owned by him . This could be vehicles, tools, personal belongings of an employee, etc.

The Labor Code does not provide a specific list of employee property for which financial liability arises. It can be assumed that the employer compensates for damages for property that is in the organization with the knowledge or consent of the employer. For example, an employer is obliged to compensate the cost of an employee’s outerwear if the employer assumes the responsibility to ensure its safety (for example, the organization operates a wardrobe).

Understanding the damage caused to the employee must take into account Art. 15 Civil Code. It says here that it includes real damage caused to the employee, and it is subject to compensation in full without restrictions.

When determining the amount of damage, the employee must take into account current market prices or the in-kind form of compensation for damage caused. The latter must be determined by agreement of the parties, that is, the employee’s consent to receive compensation in this form is required, and it must be documented. The determination of the possibility of compensation for damage in kind is contained in Part 2 of Art. 235 TK.

Damage is calculated based on the prices of the employee’s location. The Labor Code does not contain provisions on determining the market value of property for compensation for material damage, therefore, when determining it, you can use special regulations. For example, the provisions of the Federal Law “On Valuation Activities in the Russian Federation” of 1998 No. 135-FZ.

It is also worth considering that damage is determined precisely on the basis of market prices on the day of compensation, and not on the date of infliction. This may be beneficial to the employer, since at the time of compensation the market value of the property may decrease.

Description of property damage

In practice, it is also possible for an employee to suffer material damage from management. Here are just some examples:

- Loss of property.

- Damage.

- Loss of valuables and means of payment belonging to an employee.

The category includes equipment used for the direct performance of the duties of field employees. It doesn't matter whether there are special storage spaces or not. For the right to compensation, it is important that the damage occurs on the premises of the enterprise, otherwise the employer is relieved of any liability.

The employee first describes the current situation in a written appeal to the employer. The other party must make a decision within a maximum of 10 days. If a subordinate does not agree with the outcome, he can challenge it.

Material damage is compensated in cash or in kind.

When reimbursing, one must take into account the average price on the market for property with identical characteristics.

Compensation for moral damage caused to an employee

Moral damage can be understood as physical or moral suffering caused by the employer through his illegal actions (inaction) to the employee. Such actions include late payment of labor, incorrect calculation of wages for overtime work, refusal to conclude an employment contract without proper grounds, etc.

Labor legislation does not limit the rights of an employee to possibly receive compensation for damage caused. Issues of determining the amount of damage and the procedure for claiming compensation for moral damage are given in the Civil Code.

Moral damage is compensated to the employee in the amount determined by agreement of the parties or in court. When considering a claim, the judge, at his own discretion, will determine the validity of the amount of moral damage that the employee has submitted for payment. The court may reduce it or order payment in full.

According to Art. 151 of the Civil Code, when establishing the amount of moral damage, the guilt of the offender, as well as other facts that deserve attention, are taken into account. The court also takes into account the level of moral and moral torment of the victim, taking into account the uniqueness of his personality.

The employee must prove the fact of causing such suffering independently. As confirmation of the facts stated by him, an illness that arose due to the loss of a job, anxiety due to the impossibility of employment, a difficult financial situation, etc.

About moral damage

The following circumstances presuppose exact compensation for damages:

- Forced absenteeism for reasons beyond the citizen's control.

- Transfers between departments and positions without a legal reason.

- Limited access to the place of work.

- Unlawful dismissal.

Mental suffering, personal and moral feelings become the main reason for compensation. The legislation does not specify the exact amount of compensation. The parties independently make a decision on this issue, then consolidate the information in the appropriate document. The employee has the right to appeal to the court if it is not possible to reach a compromise.

Additional liability applies for the disclosure of personal information related to subordinates.

The procedure for holding an employer liable

The employer is held liable in the following order:

- The fact of damage to the employee's property is determined . Typically, the initiative to record damage comes from the employee as an interested party. This fact can be documented in the form of a memo from the employee addressed to the employer. It is drawn up in free form and contains an indication of the employee’s full name, the circumstances of the damage, the date and time of the event and a list of property that was damaged.

- The employer draws up an act of damage to the employee's property based on the received report . The preparation of such an act in this case is the responsibility of the employer, since the act allows not only to record the date and circumstances of the damage, but can also serve as the basis for subsequently bringing the employee, through whose fault the damage to the property of another employee was caused, to financial liability. For example, a cloakroom attendant who did not ensure the safety of an employee’s property, although this was her direct job responsibility. The employer also has the right to conduct its own investigation to establish the causes of the incident and determine the list of those responsible for the incident. For this purpose, a special commission can be created on the basis of the enterprise.

- The employee submits an application to the employer demanding compensation for damage . It is drawn up in two copies: one of them is given to the employer, and the second remains with the employee.

- The employer determines the amount of damage caused to the employee’s property and records it in a regulatory legal act.

- An official order is issued by the employer to compensate the employee for damages . It is drawn up in free form and contains an indication of the list of property of the employee who suffered damage, as well as the amount of payment. The order is also issued if compensation is made by court decision.

The specified algorithm for repayment of damage is conditional and may vary depending on the specifics of the situation.

Where can an employee apply for compensation?

Initially, an employee to whom the employer must pay compensation for damage caused must submit this claim to the employer. The procedure for contacting may be contained in internal documentation. In particular, the procedure for compensation of losses, the amount and timing of payments may be prescribed here.

If the employer refuses to voluntarily pay compensation, the employee may seek protection of his interests:

- to the labor inspectorate;

- to the prosecutor's office;

- to court.