The activities of many employees employed in various labor sectors involve business trips. There are regulations that define the procedure and rules for sending employees on business trips.

Dear readers! The article talks about typical ways to resolve legal issues, but each case is individual. If you want to find out how to solve your particular problem , contact a consultant:

8 (800) 700 95 53

APPLICATIONS AND CALLS ARE ACCEPTED 24/7 and 7 days a week.

It's fast and FREE !

One of the important issues that arise when arranging a business trip is related to working hours.

Every employer is required to keep such records. Special timesheets are provided for this. Similar documents must be prepared every month for all departments of the enterprise.

Working time is the time interval when an employee, based on the terms of the contract with the employer, performs the powers assigned to him.

Each day, the employer must note on the time sheet the number of hours actually worked by each employee during his shift or working day. Also in this document, the employer is obliged to indicate the employees’ rest days, absenteeism, time on vacation, etc.

In some cases, filling out the timesheet is controlled by the enterprise’s personnel service.

Legislation

Article 91 of the Labor Code of the Russian Federation gives the concept of working time and establishes that the employer is obliged to maintain it.

To display the time actually worked by an employee, in 2021 the forms of time sheets approved by Resolution No. 1 are used. They are designated T-12 and T-13.

The Ministry of Labor in its letter No. 14-2-291 established that the days of an employee’s business trip should be indicated in the relevant document by code “K” or “06”.

The number of hours actually worked is not entered. This is due to the fact that the employer is physically unable to take into account working hours during employee business trips.

If, during a business trip, an employee was involved in work on his day off, then this day must be designated in the report card as “RV” or “03”.

Working hours on a business trip

Many employers are interested in whether there is working time during a business trip. According to the definition, at this time the employee, based on the terms of the contract with the employer, must perform his own job duties.

Since on a business trip the employee is not engaged in the performance of work duties, but is working on a job assignment, this period does not apply to working time.

However, the employer must still display it on the time sheet.

On weekends and holidays

An employee on a business trip is subject to the work and rest time schedule provided for at the place of business trip.

However, the average earnings are retained for all working days of the employee according to the schedule of the main place of work.

This means that the employee rests on a business trip on those days that are set as days off by the new employer.

If an employee was sent on a business trip on his legal day off, then after returning from it he is given an extra day of rest or monetary compensation.

Weekends and holidays that fall while the employee is on a business trip are marked by the employer on the timesheet as days off in accordance with the adopted local regulations[/anchor].

For example, weekends that fall during a business trip are usually designated by the letter “B”. If an employee worked on his legal day off, then the code “RV” is entered.

Duration

The employer does not set the standard length of his working day for a posted employee. It must be determined by the employee independently, based on the complexity and nature of the official assignment.

When determining the length of the working day, the employee must be guided by the goal of completing the assigned task during the business trip.

However, if an employee fails to complete a work assignment during a business trip, the employer may increase the duration of the trip or require overtime work.

Payment for a business trip on a holiday is increased. How is sick leave paid on a business trip? See here.

Overtime work

Overtime work during a business trip is an excess of daily work hours over the number of working hours established at the employee’s workplace.

Overtime work during business travel is not subject to the labor law provisions that apply to normal overtime work.

What privileges can be applied to an employee if he is involved in such work on a business trip:

- increased pay for additional hours;

- providing additional rest;

- increasing an employee’s vacation by adding additional days;

- payment of a special bonus for overtime work.

Any organization may introduce additional incentives for working beyond normal limits during a business trip.

If the working days of a business trip are indicated in the time sheet by the letter code “K”, then the days of overtime work can be indicated as “SK”.

Main features of summarized labor time tracking

Labor laws limit the time devoted to work. Its normal duration is established as not exceeding 40 hours per week (Article 91 of the Labor Code of the Russian Federation), which, with a 5-day working week, corresponds to an 8-hour working day. But it is not always possible to comply with the requirement established by the Labor Code of the Russian Federation, since there are types of work that do not allow organizing work in the appropriate mode.

For such cases, a summarized accounting of work time is introduced (Article 104 of the Labor Code of the Russian Federation). With it, deviations from the normal daily and weekly duration of labor are allowed, but for the period established as an accounting period (it cannot exceed 1 year), the norm of working hours related to it must be observed.

This norm is calculated monthly (to obtain the total for the accounting period, the resulting figures are summed up), based on the normal weekly working hours established by Art. 91 of the Labor Code of the Russian Federation, taking into account the impact on it of reducing labor time on pre-holiday days (Article 95 of the Labor Code of the Russian Federation).

Work with summarized accounting, as a rule, is carried out according to a pre-approved schedule drawn up for a specific employee and providing for the reflection of both working days and weekends. Moreover, working days can coincide with general days off and non-working holidays, and weekends can fall on weekdays of the week.

Accounting

According to the Labor Code of the Russian Federation, working time on a business trip must be recorded from the moment the employee leaves until the day of his return, inclusive. Accounting is carried out in days.

Business travel days must be displayed by the employer on the time sheet in accordance with the conventions used for such documents. They are contained in the Regulations on Timesheets of Working Time.

Reflection in the report card

The timesheet must display each day of the employee’s business trip. This document will subsequently be used by the chief accountant to calculate salaries and bonuses to employees.

Most often, the days of an employee’s business trip are indicated by letter codes:

- “K” – business trip;

- “RW” - work on days off;

- "On a weekend;

- "SK" - overtime work during a business trip.

Sometimes when filling out a timesheet for a posted employee, the designation “B” is used. This can be used to mark employee sick days. The type of payments that will need to be given to the employee will depend on which letter appears on the time sheet - “K” or “B”.

In the first case, travel allowances are paid, and in the second, sick leave. An employee cannot be on a business trip and on sick leave at the same time.

We can give two examples of situations:

- The employee fell ill before the start of a business trip, and the order to be sent on a business trip had already been issued. An employee on sick leave cannot be forced to go on a business trip, but he can go on it of his own free will. However, if an employee closes his sick leave before a business trip, then its days will be marked in the time sheet with the letter code “K”.

- An employee fell ill while on a business trip. In this case, the days of his sick leave are marked with code “B”. In this case, it is considered that the employee interrupted the performance of his work assignment due to illness. Decor

The employer can use both the T-13 and T-12 time sheet forms. In the first case, the document is filled out by hand, and in the second - in an automated way. In practice, most organizations continue to use the T-12 form.

A sample of the T-12 working time sheet is here,

A sample time sheet, form T-13, is here.

Regardless of what form of timesheet is used, this document must contain the following information:

- Title of the document;

- date of compilation;

- name of the enterprise;

- columns where the attendance or absence of employees is displayed;

- working hours in days or hours;

- Full name and position of employees;

- Full name and position of the person responsible for maintaining the time sheet;

- signatures of authorized persons.

A document is considered valid only if all relevant details are present in its form.

Travel certificate

According to clause 7 of the Regulations, based on the employer’s decision, the employee is issued a travel certificate confirming the duration of his stay on a business trip (date of arrival at the destination point(s) and date of departure from it (from them)), with the exception of being sent on a business trip outside the territory of the Russian Federation. The question of the need to issue travel certificates for one-day business trips is ambiguous. The Ministry of Labor, considering the issue of issuing such business trips in Letter No. 14-2-291, did not agree with the need to issue a certificate. The department justified its position in paragraph 2 of the Instruction and the opinion of the Ministry of Finance, presented in Letter dated May 26, 2008 N 03-03-03/06/2/60, according to which a travel certificate may not be issued if the employee must return from a business trip to his place of permanent work on the same day on which he was sent. Later, the Ministry of Labor changed its point of view and considered that a travel certificate is still necessary when sending an employee on a one-day business trip. In Letter No. 14-2-242 dated November 28, 2013, the department indicated: clause 7 of the Regulations determines that when sending employees on business trips, it is necessary to issue a travel certificate, except for the cases specified in clause 15 of the Regulations. Other cases when a travel certificate is not issued have not been established. Thus, we can conclude that a travel permit must be issued in all cases of business trips across the territory of Russia, including one-day business trips. The next question that concerns employers is: how to confirm that an employee is on a business trip if it is not possible to mark arrival and departure? The Ministry of Labor spoke on this issue in Letter No. 14-2-291. In particular, the department indicated: indeed, the actual period of stay at the place of business is determined by the marks on the date of arrival at the place of business and the date of departure from it, which are made on the travel certificate and certified by the signature of an authorized official and the seal of the organization to which the employee is sent, for certification of such signature. But if it is impossible to mark the arrival at the place of business trip and departure from it on the travel certificate, the fact of being at the place of business trip at the established time can be confirmed by other documents, in particular: - an order (instruction) on sending the employee on a business trip; — an official assignment for sending on a business trip and a report on its implementation; — travel documents, which indicate the dates of arrival and departure from the destination; — a hotel invoice confirming the period of stay at the place of business trip. A similar position is presented in Letter of the Ministry of Finance of the Russian Federation dated August 16, 2011 N 03-03-06/3/7. To avoid any difficulties with regulatory authorities, we recommend that the procedure for documenting a travel certificate be fixed in an internal local document of the organization.

Payment

During a business trip, an employee does not receive a salary, but an average salary. It includes a variety of bonuses and allowances, so the rate for an employee on a business trip may be even higher than his regular salary.

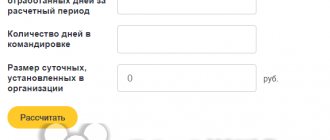

In addition to the average salary, during a business trip the employer is obliged to pay the employee a daily allowance.

The minimum amounts for these payments are provided - 700 rubles per day for business trips in Russia and 2,500 rubles per day for business trips abroad.

Such amounts are not subject to personal income tax, so employers are not recommended to accept larger daily allowances for employees.

However, at his own discretion, the employer has the right to increase the amount of daily allowance, but in this case the amounts will be subject to personal income tax in full.

Salary on a business trip is mandatory. How to apply for a business trip extension? Information here.

What documents are required for a business trip using personal transport? Details in this article.

Reimbursement

Based on labor legislation, the employer is obliged to reimburse the employee for expenses associated with renting housing during a business trip, travel to and from the destination, as well as other types of expenses.

For delays in transit, the employee also has the right to demand payment - double the amount if it occurred on a weekend, and at the regular rate - for delays on weekdays.

In order to confirm the existence of expenses, the employee must provide the employer with checks, receipts and other documents from the trip.

Reimbursement

When an employee is sent on a business trip, he is guaranteed to retain his place of work (position) and average earnings, as well as compensation (Articles 167, 168 of the Labor Code of the Russian Federation): - travel expenses; - expenses for renting residential premises; — additional expenses associated with living outside the place of permanent residence (per diem); - other expenses made with the permission or knowledge of the employer. For organizations financed from the federal budget, the amount of reimbursement of expenses is established by Decree of the Government of the Russian Federation of October 2, 2002 N 729 “On the amount of reimbursement of expenses associated with business trips on the territory of the Russian Federation to employees of organizations financed from the federal budget.” At the same time, these institutions are allowed to reimburse expenses in a larger amount, but at the expense of savings allocated from the federal budget for their maintenance, as well as at the expense of funds received by organizations from entrepreneurial and other income-generating activities. For commercial organizations, reimbursement standards have not been established at all. Therefore, the procedure and amount of compensation to employees for expenses related to business trips are determined by a collective agreement or a local regulatory act, unless otherwise established by the Labor Code of the Russian Federation, other federal laws and regulations (Part 4 of Article 168 of the Labor Code of the Russian Federation). It should be noted that labor legislation does not establish the obligation to pay expenses associated with business trips to all employees in the same amount. The amount of compensation is determined based on the financial capabilities of the organization. The employer has the right, by its local regulations, to provide for a differentiated amount of these expenses for employees occupying different positions. For example, if an employee is on a business trip abroad, according to Letter of the Federal Tax Service of the Russian Federation dated March 21, 2011 N KE-4-3/4408, the employer must compensate the employee for his actual expenses, namely the amount in rubles that he spent to purchase the amount of currency spent. The amount to be reimbursed is calculated based on the amount of currency spent according to the primary documents at the exchange rate, which is determined by the certificate of purchase of foreign currency by the business traveler. Is it necessary to pay an employee daily allowance if he is sent on a one-day business trip? The answer was given by the Ministry of Labor in Letter dated November 28, 2013 N 14-2-242. In particular, the department indicated that the payment of daily allowances for one-day business trips is not provided for by law. In this regard, such a payment cannot be established by a local regulatory act of the organization, since this would contradict what is established in Part 1 of Art. 168 of the Labor Code of the Russian Federation on the legal nature of daily allowances - additional expenses associated with living outside the place of permanent residence. For a one-day business trip, such accommodation is not available.