A liability agreement is one of the most important aspects of doing business.

Without its existence, entrepreneurship would become too risky. So that you can better understand this issue, we have prepared an article for you. From it you will learn:

- what is an agreement on full liability and in what situations is it concluded?

- how to correctly draw up a sample of such an agreement;

- what nuances need to be taken into account when concluding such an agreement;

- in what cases does full and in what cases arise partial financial liability;

- workers of which professions bear full financial responsibility for the damage they cause, even if they did not enter into a contract.

This will help you manage much more efficiently and reduce potential losses. After all, even the most efficiently managed company can experience difficulties if employees treat its property irresponsibly.

Introduction

A liability agreement ensures that the employee is responsible for the property that was entrusted to him. If, as a result of his illegal actions or even inaction, the property entrusted to him is damaged, he will have to compensate for the damage. As you can see, even inaction can cause problems. And the employee must be clearly aware of this.

In this case, financial liability can be imposed either full or partial. Which approach you choose will likely depend on the extent of the damage that was caused by a particular employee.

Legislative framework and classification

Financial liability in the field of labor relations is

the obligation of one of the participants in these relations to compensate the other party for all damage caused by him in the amount and manner prescribed by law. This type of liability can apply to both the employee and the employer.

In the labor legislation of the Russian Federation (namely in the Labor Code of the Russian Federation), greater attention is paid specifically to the financial responsibility of the employee. The Labor Code contains various types of it, which can be classified according to the following criteria:

- Depending on the subject, it can be established in relation to:

- employee;

- employer.

- By number of perpetrators:

- individual (established by Article 244 of the Labor Code of the Russian Federation);

- collective (Article 245 of the Labor Code of the Russian Federation).

- According to the method of compensation for material damage:

- voluntary;

- by order (order) of the employer;

- judicially.

- According to the scope of rights and obligations:

- complete (Article 242 of the Labor Code of the Russian Federation);

- limited (Article 241 of the Labor Code of the Russian Federation).

- According to the method of distribution of responsibility between the perpetrators:

- share;

- solidary;

- subsidiary;

- collective (brigade).

Each of these types is worth considering in more detail, taking into account all their features and characteristics.

Responsibility

Partial liability means that the employee is responsible for the damage he causes only to the extent of his average monthly earnings. In order to make this recovery, the employer must simply issue an order. However, there are details here: the order must be issued no later than within a month from the day the amount of damage was determined.

And, as already mentioned, you cannot collect more from an employee than the average monthly salary . If you missed time and more than a month has passed, or the employee does not agree with your order, or you want to recover an amount greater than the employee’s average monthly earnings, then you can only recover money through legal proceedings .

If you want to protect yourself in case of loss of larger amounts, it is better to sign an employee liability agreement. The 2021 sample can be viewed below. This will most likely encourage the employee to try to be more considerate and admit his guilt if he has caused harm.

Of course, sometimes it is possible to recover compensation from an employee for damages caused, even if there was no contract. This is done in the cases described in Chap. 38 Labor Code . These are the following cases:

- when there is a shortage of valuables entrusted to him on the basis of a written agreement or received under a special one-time document;

- if it is proven that the employee caused the damage intentionally;

- if the employee caused damage while under the influence of alcohol, drugs or other toxic substances;

- if he caused the damage precisely through criminal actions (but the presence of criminal actions must be proven in court);

- if the damage occurred due to some administrative misconduct of an employee (this must be established and confirmed by the government body dealing with such matters);

- if the damage was the result of your employee disclosing information that relates to a secret protected by Russian law;

- if the damage was caused by the employee at a time when he was not performing his official duties (for example, in his free time: break, day off).

As you can see, this list is quite large. But, nevertheless, in order to protect themselves, many companies prefer to enter into an agreement just in case. And usually this approach is completely justified.

Labor Code on the financial responsibility of the employee (2)

“Human Resources Department of a Budgetary Institution”, 2009, N 7

Labor Code on the financial responsibility of the employee

Financial liability is one of the most important categories of relations between an employer and an employee, and the Labor Code enshrines the concept of material liability for both the first and the second. Managers of budgetary institutions often have a question: is it possible to apply the norms of the Labor Code of the Russian Federation when damage is caused by employees of budgetary organizations? Indeed, during the activities of the institution, employees may allow the theft of valuables. An installation or unit involved in the production process may break down, causing the organization to suffer losses due to downtime and delays in product release. To correctly assign financial responsibility to an employee, it is necessary to understand what he is responsible for, how to determine the amount of damage, whether there are circumstances that exclude financial liability, what the procedure and terms for compensation for damage are.

Types of financial liability

Chapters 37 - 39 of the Labor Code of the Russian Federation establish the rules for applying financial liability to the parties to an employment contract. According to Art. 232 of the Labor Code of the Russian Federation, the financial responsibility of an employee is understood as his obligation to compensate for damage caused to the employer through his fault, within the limits and manner established by law.

The Labor Code provides for two types of responsibility - individual and collective (team). With collective (team) financial liability, valuables are handed over to a predetermined group of persons, who are assigned full financial responsibility for their shortage (Article 245 of the Labor Code of the Russian Federation). The legislator divided individual liability into full and limited.

In case of full financial liability, damages are recovered in full without any restrictions.

If it is limited, the employee compensates for damage within the limits established by the Labor Code (Article 241) - as a rule, within the limits of his average monthly earnings. This rule applies if the amount of damage exceeds average earnings, otherwise only the amount of damage is recovered. Average earnings are determined in the manner established by Decree of the Government of the Russian Federation of December 24, 2007 N 922 “On the specifics of the procedure for calculating average wages.” In Art. 241 of the Labor Code of the Russian Federation does not contain a list of cases for which limited liability occurs. Therefore, it should be applied only when damage is caused to the organization in the presence of all the conditions that allow the employee to be held financially liable, and there are no grounds for imposing the latter in full.

The most common cases of damage for which employees may bear limited financial liability are:

— damage to materials, tools, equipment or their destruction due to negligence or inattention;

— loss of documents in the case when the lost document cannot be restored within the required period, and its absence causes direct actual damage to the organization;

- incorrect preparation or failure to prepare documents, leading to the inability of the enterprise to impose sanctions, for example, for short delivery of goods by the supplier;

— expenses for repairing damaged property;

- incomplete receipt by the enterprise of funds due to it due to the employee’s careless attitude to his duties.

The employer should take into account that it is impossible to withhold the entire average monthly salary of an employee, since Art. 138 of the Labor Code of the Russian Federation establishes a limit on the amount of deductions from wages. For example, if a nurse has an average monthly salary of 4,000 rubles, then by order of the employer, in compensation for damage caused, this amount can only be recovered in installments, that is, the entire 4,000 rubles cannot be withheld. lump sum, leaving the employee without wages for the month.

Article 138 of the Labor Code of the Russian Federation provides that the total amount of all deductions for each payment of wages cannot exceed 20%, and in cases provided for by federal laws - 50% of wages due to the employee. When deducting from wages under several executive documents, the employee must in any case retain 50% of the wages. The restrictions established by this article do not apply to deductions from wages when serving correctional labor, collection of alimony for minor children, compensation for harm caused by the employer to the health of an employee, compensation for harm to persons who suffered damage due to the death of the breadwinner, and compensation for damage caused by a crime. . The amount of deductions from wages in these cases cannot exceed 70%.

The amount of deductions must be calculated from the amount of wages and other remunerations remaining after taxes are withheld, as noted in Art. 99 of the Federal Law of October 2, 2007 N 229-FZ “On Enforcement Proceedings”.

To recover from a guilty employee damages not exceeding the amount of average monthly earnings, an order from the employer is sufficient, which must be issued no later than a month from the date the employer finally determines the amount of damage caused (Article 248 of the Labor Code of the Russian Federation).

Attention! If the monthly period has expired, or the employee does not want to voluntarily pay off the amount of damage caused by him, or the amount of damage exceeds the employee’s average monthly earnings, then only the court can carry out recovery.

In Art. 243 of the Labor Code of the Russian Federation specifies cases of full compensation for damage by an employee:

- when the Labor Code of the Russian Federation or other federal law imposes financial liability in full for damage caused to the employer in the performance of labor duties;

- shortage of valuables entrusted to him on the basis of a special written agreement or received by him under a one-time document;

— intentional infliction of damage;

— causing damage in a state of alcohol, drug or other toxic intoxication (this state of the employee can be confirmed by a medical report, report and testimony of witnesses);

- causing damage as a result of the criminal actions of an employee established by a court verdict, and it does not matter whether the employee is exempt from punishment under an amnesty (clause 11 of Resolution of the Plenum of the Armed Forces of the Russian Federation No. 52 <1>). As an example, we can cite the Ruling of the Supreme Court of the Russian Federation dated 01.08.2008 N 48-B08-7 on the claim of Emanzhelinskhleb OJSC against F. for compensation for damage by way of recourse from the employee. The court found that on October 7, 2005, the driver of the enterprise F., driving a ZIL-431410 car, drove into oncoming traffic, where a collision occurred with a VAZ-2106 car driven by driver B., who died from injuries received as a result of this accident. The traffic police authorities found F. guilty of committing an accident. By a resolution of the district court of the Chelyabinsk region dated March 13, 2006, the criminal case initiated against F. was terminated following the reconciliation of the accused with the representative of the victim. By the decision of the city court of the Chelyabinsk region dated August 28, 2006, compensation for moral damage in the amount of 80,000 rubles was recovered from Yemanzhelinskhleb OJSC in favor of the victim, which were paid by the enterprise. By the decision of the Yemanzhelinsky City Court of the Chelyabinsk Region dated 04/25/2007, left unchanged by the ruling of the judicial panel for civil cases of the Chelyabinsk Regional Court dated 06/14/2007, the claims of Yemanzhelinskhleb OJSC were partially satisfied - to recover 40,000 from F. in favor of the organization in compensation for damages rub., as well as legal expenses. Canceling these judicial acts, the Supreme Court of the Russian Federation indicated that in relation to F. there is no conviction in a criminal case that has entered into legal force, and therefore, the organization does not have the right to demand compensation from F. for damages in full;

———————————

<1> Resolution of the Plenum of the Armed Forces of the Russian Federation dated November 16, 2006 N 52 “On the application by courts of legislation regulating the financial liability of employees for damage caused to the employer.”

- causing damage as a result of an administrative violation, if established by the relevant government body (according to paragraph 12 of the Resolution of the Plenum of the Armed Forces of the Russian Federation No. 52, exemption from administrative liability due to the insignificance of the violation is not an obstacle to the financial liability of the employee. If, before a decision is made to bring the person to administrative liability, an amnesty act was issued, if such an act eliminates the application of administrative punishment or the statute of limitations for bringing to administrative liability has expired (clauses 4 and 6 of part 1 of article 24.5 of the Code of Administrative Offenses of the Russian Federation), then the employee cannot be brought to full material liability under clause 6, part 1, article 243 of the Labor Code of the Russian Federation);

Attention! Bringing an employee to full financial liability under clause 6, part 1, art. 243 of the Labor Code of the Russian Federation is impossible without a resolution to bring the employee to administrative responsibility.

— disclosure of information constituting a secret protected by law (state, official, commercial or other), in cases provided for by federal laws;

— damage caused while the employee was not performing his job duties.

Financial liability occurs in full if it is assigned to the employee directly by the Labor Code of the Russian Federation or other federal laws. For example, by virtue of clause 5 of Art. 68 of the Federal Law of 07.07.2003 N 126-FZ “On Communications”, employees of telecom operators are financially liable to their employers for the loss or delay of delivery of all types of postal and telegraph items, damage to postal mail attachments that occurred through their fault in the performance of their official duties , in the amount of liability that the telecom operator bears to the user of communication services, unless another measure of liability is provided for by the relevant federal laws. In particular, Art. 34 of the Federal Law of July 17, 1999 N 176-FZ “On Postal Services” provides that losses caused during the provision of postal services are compensated by the postal operator in the following amounts: in case of loss or damage (damage) of a postal item with a declared value - in the amount of the declared value and the amount of the tariff fee, with the exception of the tariff fee for the declared value; in case of loss or deterioration (damage) of part of the attachment of a postal item with a declared value when sending it with an inventory of the attachment - in the amount of the declared value of the missing or damaged (damaged) part of the attachment, indicated by the sender in the inventory; in case of non-payment (non-execution) of a postal money transfer - in the amount of the transfer amount and the amount of the tariff fee.

In such and other cases provided for by federal laws, full financial liability arises regardless of the presence or absence of a special agreement between the employer and the employee, however, it can apply to those categories of employees that are expressly named in the relevant law.

Also, financial liability in the full amount of damage caused can be established by an employment contract concluded with the deputy heads of the organization or the chief accountant. It should be borne in mind: if the employment contract does not provide that these persons, in the event of damage, bear financial liability in full, in the absence of other grounds giving the right to hold these persons to such liability, they can only be held liable within the limits of their average monthly earnings (clause 10 of the Resolution of the Plenum of the Armed Forces of the Russian Federation No. 52).

Article 242 of the Labor Code of the Russian Federation establishes that minor workers bear full financial liability only for intentional damage, for damage caused while under the influence of alcohol, drugs or other toxic substances, as well as caused as a result of committing a crime or administrative offense.

By the way, imposing individual financial liability is possible only on employees who hold positions or perform work related to the storage, processing, release (sale), transportation or use of inventory and monetary assets in the production process. The Ministry of Labor and Social Development, in Resolution No. 85 <2>, approved the List of such positions and types of work, as well as the Standard form of an agreement on full individual financial responsibility.

———————————

<2> Resolution of the Ministry of Labor and Social Development of Russia dated December 31, 2002 N 85 “On approval of Lists of positions and work replaced or performed by employees with whom the employer can enter into written agreements on full individual or collective (team) financial responsibility, as well as Standard forms of agreements on full material responsibility."

Conditions for attracting an employee

to financial liability

Material liability is assigned to the employee only if the following conditions are met:

— direct actual damage (Article 238 of the Labor Code of the Russian Federation);

— unlawful behavior of the employee;

— the employee’s guilt in causing damage (Article 233 of the Labor Code of the Russian Federation);

— on the cause-and-effect relationship between the action (inaction) of the employee and the damage.

It is possible to hold a person liable only if all four conditions are present; if at least one is missing, then it will not be possible to recover damages.

Let's consider the first condition for the occurrence of material liability - direct actual damage. Under it in accordance with Art. 238 of the Labor Code of the Russian Federation means:

— a real decrease in the employer’s cash assets;

- deterioration of the condition of the specified property (including property of third parties located at the employer, if the employer is responsible for the safety of this property);

— the need for the employer to make expenses or excessive payments for the acquisition, restoration of property or compensation for damage caused by the employee to third parties.

Such damage may include, for example, a shortage of monetary or property assets, damage to materials and equipment, costs of repairing damaged property, payments for forced absence or downtime, the amount of a fine paid (Letter of Rostrud dated October 19, 2006 N 1746-6-1 ).

Attention! The employer has the right to bring a claim to the employee for the recovery of amounts paid by him to compensate for damage to third parties within a year from the date of payment of these amounts (Part 2 of Article 392 of the Labor Code of the Russian Federation).

The second condition is unlawful behavior of the employee.

Labor legislation defines: this is the behavior of an employee when he does not fulfill or incorrectly fulfills his labor or official duties established by an employment contract (service contract), job description, internal labor regulations, orders and other local acts of the organization. Illegality of behavior can be expressed both in the form of a certain action and in the form of inaction (the employee should have taken some actions, but did not do them). For example, if an equipment adjuster, whose responsibilities include troubleshooting machine tools, did not fix it when a problem was discovered and this subsequently led to a defective issue or suspension of work, such inaction would be unlawful.

Attention! If an employee carries out an order or instruction, the illegality of which is obvious, then he is not exempt from financial liability. For example, the cashier’s execution of the chief accountant’s instructions to withdraw funds from the cash register without documentation may result in financial liability for the cashier.

The next necessary condition is the employee’s fault.

Norms part 1 art. 233 of the Labor Code of the Russian Federation directly indicate the need to take into account the employee’s guilt when deciding whether to hold him financially liable - how the employee relates to the illegal actions or inactions he has committed and their results. In illegal actions, a distinction is made between intent and negligence. Causing damage to the employer is intentional if the employee was aware of the illegality of his action (inaction), foresaw the possibility of harmful consequences (damage) and desired their occurrence.

Example 1. Senior researcher at the research institute D.A. Zyablov I took my laptop from work to finish my work at home. By order of management, he was appointed financially responsible for this laptop. On the way home Zyablov D.A. went into a cafe, from which he left in a state of severe alcoholic intoxication, as a result of which he lost his computer.

Zyablov D.A. in accordance with clause 4, part 1, art. 243 of the Labor Code of the Russian Federation must reimburse the employer for the full cost of the laptop.

If an employee is aware of the illegality of his behavior and foresees the possibility of harmful consequences, but arrogantly hopes to prevent them, such behavior is considered careless. Negligence in the actions of an employee can also include cases where the employee does not realize the illegality of his behavior (action or inaction) and does not foresee the possibility of causing damage, but due to the circumstances of the case he could and should have foreseen.

Example 2. Paramonova O.I. works as a nurse in a clinic. During the next procedure, she received a call, she left the patient and left the office without locking it. Upon returning to the office, she discovered that the patient had left and the magnetic resonance therapy machine was missing.

Paramonova O.A. was negligent in relation to the property of the organization entrusted to her, because, although she did not think about the possible occurrence of negative consequences, she should have foreseen them and prevented them by asking the patient to wait in the corridor or calling back later. Therefore Paramonova O.A. will bear financial liability in the amount of damage caused, but not more than his average monthly earnings.

In practice, there are situations when there is no fault in the employee’s behavior, despite the fact that he acts unlawfully and causes damage to the employer.

Example 3. In the bacteriological laboratory of the research institute, laboratory assistant P.R. Zuev. violated the rules for operating freezing equipment. But there is no guilt in his actions, since he was not familiarized with the rules. Zuev P.R. did not know and could not know that he was violating the rules for operating the equipment. This means that financial liability is excluded and the amount of damage cannot be recovered from him.

The presence of a cause-and-effect relationship between the employee’s action (inaction) and the damage is the last condition. Financial liability arises only when the result necessarily follows from the actions or inaction of the employee. For example, the chief accountant cannot be held liable for theft in a warehouse only for the reason that warehouse accounting was not organized properly. This, of course, created the preconditions for theft, but did not determine it.

If the damage was caused by non-illegal behavior of the employee, it will not be possible to hold him financially liable.

Example 4. The Federal State Institution “Center for Standardization and Metrology” received new equipment for conducting research on food products. During its operation by Kalmykov O.P. a breakdown occurred. During the internal investigation <3> it was established that Kalmykov O.P. worked in violation of the rules for operating this equipment. But the cause of equipment failure was a manufacturing defect, not improper operation.

———————————

<3> Article 247 of the Labor Code of the Russian Federation.

In this case, there is no cause-and-effect relationship between the employee’s actions (improper operation of the equipment) and the occurrence of damage to the Federal State Institution “Center for Standardization and Metrology” (equipment breakdown), therefore O.P. Kalmykov should be held financially liable. it is forbidden.

Attention! Until the employee’s fault for equipment breakdown is proven, the employer does not have the right to recover the cost of damage from him.

To establish the amount of damage caused and the reasons for its occurrence, the employer, according to the rules of Art. 247 of the Labor Code of the Russian Federation must conduct an inspection by creating a commission with the participation of relevant specialists before making a decision to hold the employee financially liable.

It is mandatory to require a written explanation from the employee to establish the cause of the damage. In case of refusal or evasion of the employee from providing the specified explanation, a corresponding act is drawn up.

So, when deciding whether to hold an employee financially liable, you need to keep the following in mind:

- if the amount of damage does not exceed the amount of the employee’s average monthly earnings, then the management’s order to hold him liable must be issued no later than one month from the date the amount of damage was established, and not from the day the fact of damage was discovered;

— if the amount of damage exceeds the employee’s average monthly earnings, the fact of damage must be recorded in writing. If the employee agrees to voluntarily compensate for the damage, this fact is also recorded in writing. When drawing up an order (or other document) recording the fact of damage, it is advisable to refer to the corresponding statement of the employee;

- after a month has passed from the date of establishment of the damage, it can only be recovered through the court. Article 392 of the Labor Code of the Russian Federation gives the employer the right to appeal to the courts in disputes about compensation for damage by the employee within a year from the date of discovery of this damage.

When is an employee’s financial liability excluded?

Article 239 of the Labor Code of the Russian Federation establishes cases when the financial liability of an employee is excluded due to:

— force majeure (an extraordinary and unpreventable event or circumstance, for example, natural disasters (flood, earthquake, hurricane, etc.) or social phenomena (military actions, epidemic));

- normal economic risk (employee actions that correspond to modern knowledge and experience, when the set goal could not be achieved otherwise). That is, the employee properly fulfilled the job duties assigned to him, showed a certain degree of care and prudence, and took measures to prevent damage; the object of risk was material assets, and not the life and health of people (clause 5 of the Resolution of the Plenum of the Armed Forces of the Russian Federation No. 52). Unfortunately, the limits and cases of normal economic risk in labor relations are not legally defined. Therefore, in each specific case, the limits of justified economic risk must be established taking into account the specific circumstances of the case. For example, damage caused by the destruction of materials and instruments during an experiment or scientific research should be classified as a normal economic risk, provided that socially useful results could not be achieved in any other way and the employee took all possible measures to prevent damage;

- extreme necessity or necessary defense;

— failure by the employer to fulfill the obligation to provide appropriate conditions for storing property entrusted to the employee.

To determine the state of extreme necessity or necessary defense, you will have to turn to the Civil and Criminal Codes. In accordance with Art. 1067 of the Civil Code of the Russian Federation, actions performed in a state of extreme necessity are understood as actions of a person that cause harm to someone, but committed to eliminate a danger threatening the causer of harm or other persons, if this danger under the given circumstances could not be eliminated by other means. And necessary defense is recognized as actions to protect the personality and rights of the defender or other persons, the interests of society or the state protected by law from a socially dangerous encroachment, if this encroachment was associated with violence dangerous to the life of the defender or another person, or with an immediate threat of the use of such violence, if its limits have not been exceeded (Article 37 of the Criminal Code of the Russian Federation, Article 1066 of the Civil Code of the Russian Federation). Deliberate actions that clearly do not correspond to the nature of the danger of encroachment are recognized as exceeding the limits of necessary defense.

L.V.Kurevina

Journal expert

"Human Resources Department

budgetary institution"

Signed for seal

07.07.2009

Sample

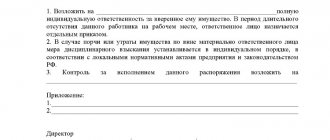

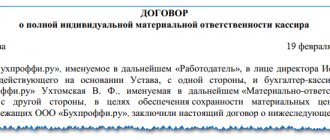

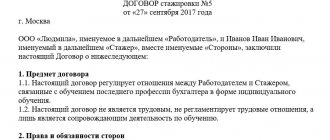

An employee can enter into an agreement on financial liability in 2021 directly with the head of the organization. It can also be concluded with the chief accountant or other representative of the company. However, this representative must be authorized by you to enter into such agreements. The law makes it possible to impose collective responsibility. If we are talking about one person, an agreement on individual financial responsibility is always concluded. The sample document should include the following items:

- date,

- name of the institution,

- name, position of the employee who speaks on behalf of the organization,

- name, position of the employee who assumes financial responsibility (and if this is a collective agreement, then the details of the collective representative)

- the duties of an employee that he must fulfill in order to avoid causing damage to the property of this company,

- the duties of the manager, which he must fulfill in order to prevent the employee from causing any damage to the company’s property,

- rules for determining the extent of damage,

- a guarantee to the employee that damage that arose entirely through no fault of his own will not be recovered from him,

- determining the moment when this document comes into force,

- conditions under which the parties can supplement, change or even terminate this agreement

- details of the parties,

- and, of course, signatures.

Please note one important point. It is possible to conclude an agreement on full financial responsibility in 2021 only with those who are already 18 years old. If damage to your company was caused by an employee who is under 18 ( a minor ), he will be required to bear full financial responsibility only in some cases. These are the following cases: he acted intentionally, was in a state of intoxication (alcoholic, toxic, etc.), committed a crime or some kind of administrative offense.

Responsibility of the company to the employee

Definitely yes. The law applies to both parties to the working relationship. In what case is full financial liability possible on the part of the company?

- Damage to personal belongings was caused. For example, clothes, phone, etc. The situation occurred due to the fault of the employer.

- There was a delay in wages. Moreover, from a legal point of view, in the vast majority of cases, it does not matter for what reason this happened. For example, a delay in bank payments or a lack of funds in the organization’s accounts. The law provides for the payment of a penalty for each day of delay.

- The employer illegally deprived the employee of his job - there was illegal dismissal, refusal to reinstate, delay in payments, etc. It is important to have evidence on hand that can be presented in court.

Ultimately, in practice, they are brought to partial financial liability. Complete is much less common. An employee has the right to refuse to sign a clause on financial liability, but most often this is due to sanctions from the employer. Up to the point of dismissal.

The company is obligated to warn the applicant that he will become a financially responsible person. The employer cannot increase the amount of damages in court. It will remain unchanged after filing a claim.

The law works both ways and in certain situations an employee has the right to receive compensation for damage caused. In any case, collection occurs with the full consent of the participants or in court.

Forms of agreement

The forms of agreements on financial liability of employees in 2018 may be different. The exact form, and especially what kind of material items are involved, may vary depending on who you hire. For example, for a seller it is usually about the product, for a driver it is about the goods being transported. However, there will not be a big, fundamental difference.

There are also special features when concluding collective agreements. Such a liability agreement must clearly state how the specific degree of guilt of each employee of the team will be determined. This must be done by agreement between absolutely all members of the team. Of course, the employer must also give his consent. It happens that one of the parties to the contract does not agree with the decision of the others.

For example, he believes that his fault is small, but other employees believe that most of the blame lies with him. In this case, the dispute will have to be resolved in court.

It should be noted that there are special categories of employees with whom, in principle, there is no need to enter into a liability agreement. By law, they bear this responsibility in any case, simply by virtue of the position they occupy. This applies to cashiers. Despite this, to be on the safe side, some enterprises still enter into special agreements with them, just in case.

However, this is completely unnecessary, since the law protects the enterprise if the company had losses due to the fault of cashiers. You can read about this in clause 33 of the Procedure for conducting cash transactions in the Russian Federation (approved by a decision of the Board of Directors of the Central Bank on September 22, 1993). And exactly the same full financial liability is imposed by default on operators - postal workers. You can read about this in Art. 34 of the Law “On Communications”.

In other cases, an agreement on the employee’s financial responsibility will turn out to be a valuable acquisition. It will make it easier to recover damages incurred by you due to the fault of an employee. Of course, it does not at all deprive the employee of the opportunity to disagree with your assessment of the losses incurred. And yet, in very many cases it turns out to be enough not to bring the case to court.

Types of financial liability

Current legislation allows us to distinguish the following types of employee liability:

- full - the employee compensates for the damage in full;

- limited - pays compensation in the amount of his average monthly salary;

- individual - assigned simultaneously with the appointment of a person to a position;

- collective - introduced when it is impossible to delimit the scope of responsibility of each employee. This is usually due to the production characteristics of the enterprise, when many employees work on the same equipment at the same time.

IMPORTANT!

As a general rule, if the company suffered losses due to the fault of an employee, then he must pay compensation only in the amount of his average monthly earnings (Article 241 of the Labor Code of the Russian Federation).

This amount is calculated in the manner established by the Decree of the Government of the Russian Federation “On the specifics of the procedure for calculating the average salary” dated December 24, 2007 No. 922. The calculation period is 12 months from the date of damage or its discovery.

Video

Articles on this topic

- Will the ruble continue to fall in 2015? Every day, negative trends in the Russian economy are becoming more and more […]

- How to win a tender? When government agencies announce a tender and price, […]

- Credit. Features according to the law Credit is one of the types of loans. According to the Law, a loan is the transfer of one person [...]

- Psychoneurological boarding house for the elderly: when is it better to give for good care Unfortunately, life is not a very simple and complex thing and sometimes we need to […]

Classification by method of compensation for damage caused

Once the fact of damage to the employer’s property has been proven, the employee becomes obligated to compensate it. This can happen in the following ways:

- On a voluntary basis. In this case, an agreement is concluded between the parties in which the employee confirms his agreement to compensate for the damage and indicates the actual conditions for this. That is, he gives an obligation to pay money or provide similar property, specifying specific terms and amounts.

- Based on the order of the manager. In this case, the employer has the right to recover damages from the employee even without his consent, but only within the limits of his average monthly salary. To do this, he issues an order indicating the basis for the penalty and reference to legislative acts (including internal ones).

- By the tribunal's decision. It makes sense to go to court in situations where the employee does not want to voluntarily compensate for the damage, and its amount far exceeds the average monthly salary. In this case, the employer needs to prepare evidence of the employee’s guilt and file a lawsuit. Based on a positive court decision, he will have grounds to receive full compensation from the employee.

An important role in determining the method of compensation is played by the scope of rights and obligations that were established in relation to the employee when financial liability was imposed on him.

Calculate old age pension - do it with us! In what cases can an employee be deprived of a bonus? Read more about this in our article. Remuneration for shift work is a complex issue. You can study it in detail here.

Classification by scope of rights and obligations

The latest classification includes such types of liability as:

Limited

It is applied in most cases and is set within the limits of only one average monthly salary of the employee. That is, even if the actual damage was much greater, the employer will be able to recover only this amount from the employee.