Many of our fellow citizens work all their lives in order to retire at a certain age and receive government support. But Russian legislation in the field of pensions changes so often that many have no idea what they can count on in old age. Therefore, knowledge of the laws will help you navigate and structure your work activity in such a way that you can receive decent security in old age. For a number of reasons, not everyone can work out a certain length of service; they work unofficially or work part-time. We will consider the question of how length of service is considered if you work part-time.

Does part-time work count towards seniority?

If there is a question about early assignment of an old-age pension, then only the period of full-time work is included in the special length of service. The same applies to the calculation of special length of service for the “northern” pension. The fact that you will work half-time, in terms of length of service, will not disadvantage you in any way; everything is fine with this matter. The only thing you lose in this case and what is not profitable at all is how much you will earn, since you will be paid at least half as much. Important The main thing for everything to work is that the work is official, that is, according to labor. You can rest assured. A part-time job (0.5) counts towards seniority, just like a full-time job (1.0). Moreover, such work (at 0.5) is included both in your work experience and in your insurance. In theory, according to the law, it should be included in the work experience, but everyone still knows that our favorite enterprises where we work.

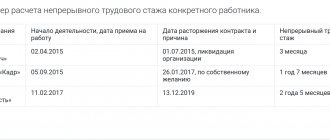

For example, pedagogical. Continuity of experience Continuous experience is considered to be the time a citizen works at one or more enterprises, provided that the break between dismissal and employment did not exceed a period of 30 to 90 calendar days. For each specific case, this period differs depending on the circumstances.

Previously, with continuous work at one or several enterprises, one could count on a higher pension, but today, with the introduction of new laws, only the amount of contributions made during work is taken into account. Pension if there is no experience A complete lack of experience or the minimum established by law leads to the fact that a person is deprived of the right to receive an insurance pension.

But this does not mean that the citizen in this case will be left without state support. Such persons are assigned a social pension.

Requirements for length of service when calculating pensions

Until 2015, persons wishing to receive a pension were required to work for at least five years. With the adoption of a new law, new rules come into force in the country, and the minimum length of work experience increases every year.

Read more: How is payment calculated for major home repairs?

Thus, in 2015, a new minimum of 6 years of experience was established. Then every year this figure increases by 1 year. So, in 2016 it was necessary to have already 7 years of experience, and in 2021 - 8. The growth of the required minimum will stop only in 2025 at around 15 years.

Today, if you have 35 years of experience and provided that your salary corresponds to the average level of earnings in the country, you have the right to apply for a labor pension. Moreover, its size will be at least 40% of your average earnings. This coefficient directly depends on your experience.

Does part-time work count towards insurance coverage?

Loading...Does part-time work count towards seniority?

- Work experience includes both full-time and half-time work. That is, when working part-time, you will be entrusted with a certain amount of work, which you will have to complete in half the working time and for half the payment. The main condition is that the employer transfers contributions to the pension fund. But there is a small nuance. If there is a question about early assignment of an old-age pension, then only the period of full-time work is included in the special length of service. The same applies to the calculation of special length of service for quot; northernquot; pensions.

- In theory, according to the law, it should be included in the work experience, but everyone still knows that our favorite enterprises where we work.

- Part-time work also counts toward seniority as does full-time work.

How will transferring to part-time work affect your length of service and future pension?

The period of part-time work is included in the insurance period on a general basis, both for calculating sick leave and applying for a pension. The only exception is special length of service for early assignment of a pension (for example, for hazardous work or work in the Far North).

Important

In this case, it is important that the job is full-time, full-time.

- Work experience is considered regardless of whether you work full-time or part-time. Also, if you work in a budgetary organization where they pay compensation for utilities (medics, teachers), then in this case compensation for the apartment is paid in full, just like full-time employees.

Experience does not apply only if you work under a contract.

Important

In addition, I would like to add that the insurance period for assigning a labor pension includes periods of work and (or) other activities during which contributions to pension insurance and other periods counted in the insurance period were subject to transfer. So, according to clause 6, part 1, art. 11 of the Federal Law “On Labor Pensions in the Russian Federation” dated December 17, 2001 N 173-FZ, the insurance period for assigning a labor pension includes, in particular, the period of care provided by an able-bodied person for a group I disabled person, a disabled child or a person who has reached age 80 years. Thus, I take into account that your employer transfers insurance contributions for compulsory pension insurance for you, then your work experience is progressing.

How will part-time work be taken into account in the length of service for retirement?

Work experience is considered the same, and the rights that a person working part-time enjoys are the same as those of “one-timers.” Only, as far as I know, “hot” work experience can only be earned full-time. For example, a part-time teacher does not increase his teaching experience. Part-time work also counts toward seniority as does full-time work. The employer is also obliged to pay contributions to the Pension Fund and provide annual paid leave in full. Work experience includes both full-time and half-time work.

That is, when working part-time, you will be entrusted with a certain amount of work, which you will have to complete in half the working time and for half the payment. The main condition is that the employer transfers contributions to the pension fund.

But there is a small nuance.

Vacation

When drawing up an annual vacation schedule for part-time employees, you should pay attention to Article 115 of the Labor Code of the Russian Federation. It defines the following nuances:

- Regardless of whether a person works full-time or part-time, he is entitled to annual paid leave of 28 calendar days.

- In the first year of work, an employee has the right to take half of the vacation six months after joining the organization. Further - according to schedule.

As for the calculation of vacation pay, their total amount is calculated based on average earnings. In this case, it is worth paying attention to the provision of additional leave. The HR employee calculates the number of days based on the number of hours worked. Therefore, the additional vacation for an employee who works part-time will be less than for someone who works 8 hours in production.

Part-time and pensionable experience

The basic rules governing pension provision are set out in Law No. 400-FZ “On Insurance Pensions”.

In particular, Art. 8 of this document indicates the presence of insurance experience as one of the necessary conditions for granting a pension.

The conditions for including periods of work in the insurance period are reflected in clause 1 of Art. 11 of Law No. 400-FZ. To do this, it is necessary that the work activity is carried out on the territory of the Russian Federation, and that the employer pays contributions to the Pension Fund for these periods.

How to register

This article was published on the website zakon-dostupno dot ru.

If you are posting this article on another site, then it has been stolen. The registration procedure corresponds to the standard scheme of interaction between the employee and management and the services involved in personnel matters.

Before you begin registration, you should discuss how to place a 0.5 bet:

- The moment of transition to a new schedule.

- Choice of part-time (up to 4 hours at ½ rate) or working week (with additional days off).

When working part-time on maternity leave, they often prefer the part-time option, when parents and relatives share the responsibilities of caring for the baby by day of the week.

The scheme of actions when switching to part-time is presented below:

- Discussion of employment conditions in the new schedule. It should be borne in mind that during this period of work, an employee is unlikely to be able to count on career growth, and in the event of layoffs, he falls into the “first wave” if the law does not provide protection due to the presence of young children or other social status.

- The employee writes a statement according to the sample provided by the personnel service. The application addressed to the manager states a request to be enrolled part-time in a specific position. The document is signed and dated.

- After receiving a management visa, the application is transferred to the personnel department to prepare the appropriate order and receive the necessary personal papers from those applying for a job at the enterprise. The order reflects the name of the position, the amount of earnings, the regime, and the date of enrollment. If necessary, include some special conditions for the performance of duties.

- When drawing up the contract, the inclusion of mandatory clauses is taken into account. After signing, one copy remains with the employee, the second is stored at the enterprise.

Mandatory details include the following items:

- General points describing the conditions of employment, features of the working day, work and rest hours.

- Employee rights.

- Responsibilities under the contract.

- Terms of payroll.

- Description of the conditions for carrying out work activities (including hazardous types of work).

- Information about the signatories - the employer and the employee signing the document.

If necessary, the clauses of the contract are supplemented based on the specifics of employment. The main thing is that the introduced points do not contradict the basic norms of civil and labor legislation.

Download

Example of a part-time employment contract (99.5 KiB, 115 hits)

How does the size of your pension depend on your length of service?

The work of a chief nurse, regardless of the time when this work was performed, is counted towards the length of service provided that it is performed under normal or reduced working hours. In the case where the work was carried out part-time (the combined work must be related to the protection of public health) during part-time work, the period of its performance is counted towards the length of service if, as a result of summing up the employment (volume of work) in these positions (institutions), a normal or reduced working hours in the amount of full time for one of the positions. The Pension Fund of the Russian Federation refused to grant an early pension? Trust our lawyers to restore your right to a preferential pension! At your service: calculating length of service and drawing up claims to the Pension Fund online. If you live in

Part-time work experience

Law on Pension Insurance at the request of the person applying for a pension, from the period for which wages are taken into account for calculating the pension (the period of insurance service starting from 07/01/2000 “+”, optionally, another 60 months until 07/01/2000) periods of up to 60 calendar months of insurance experience are excluded, provided that these periods in total amount to no more than 10% of the duration of the insurance period. So, a person may not feel the impact of a part-time working week and, accordingly, a smaller salary when a pension is assigned. It would be worse if, as a result of part-time work, the monthly salary would be below the minimum wage.

How does it affect experience?

An important issue that concerns an employee is how longevity is considered for pension purposes, because the work is not being done to the fullest extent. Newly hired employees who are concerned about whether employment at ½ rate affects their length of service should be reassured. The period of work is necessarily included in the length of service when it comes to the basic pension.

To understand whether such employment is included and how part-time work affects length of service, it is important to distinguish between general experience and special experience. In case of early retirement, special experience will only include full-time work. “Northern” experience is calculated similarly.

Does your work experience count if you work part-time in hazardous conditions?

A special situation is when an employee acquires the right to early retirement.

The conditions for such an exit are provided for in Art. 30 of Law No. 400-FZ. We are talking about work in harmful, dangerous conditions or work activities associated with increased tension.

Paragraph 5 of the Explanation approved by the resolution of the Ministry of Labor of the Russian Federation says that the right to preferential length of service for early retirement arises only when working in appropriate working conditions on a full-time basis. In this case, a full day means performing work for at least 80% of the working time.

Thus, for employees working in hazardous industries part-time, this period of work will only form “ordinary” length of service, but will not give the right to early retirement.

Subscribe to news

A letter to confirm your subscription has been sent to the e-mail you specified.

March 21, 2021 12:35

Along with the normal working hours (40 hours per week), labor legislation provides for other working hours, for example, part-time work.

Thus, in cases where the reasons are related to changes in organizational or technological working conditions and may lead to mass layoffs of workers, the employer, in order to preserve jobs, has the right to introduce a part-time working day (shift) and (or) a part-time working week.

In accordance with the Decree of the Government of the Russian Federation dated July 16, 2014. No. 665, the calculation of periods of work giving the right to early assignment of an old-age insurance pension in accordance with Articles 30 and 31 of the Federal Law “On Insurance Pensions” is carried out using the Rules for calculating periods of work giving the right to early assignment of an old-age pension in accordance with with Articles 27 and 28 of the Federal Law “On Labor Pensions in the Russian Federation”, approved by the Decree of the Government of the Russian Federation dated July 11, 2002. No. 516.

According to paragraph 4 of Rules 516, the length of service in the relevant types of work includes periods of work performed continuously during a full working day, unless otherwise provided by these Rules and other regulatory legal acts.

Paragraph 6 of Rules 516 establishes the procedure for calculating periods of work based on time actually worked in cases where such work was performed part-time but full-time due to a reduction in production volumes (except for certain work), as well as periods of work determined The Ministry of Labor of Russia in agreement with the Pension Fund of the Russian Federation, or provided for by the Lists, which, due to the conditions of labor organization, cannot be carried out constantly. At the same time, according to paragraph 14 of the Explanation of the Ministry of Labor of Russia dated May 22, 1996. No. 5, the minimum calculated value can only be a full working day, during which the employee was employed at a preferential job.

As for the transfer of time worked in the relevant types of work when calculating length of service based on actual time worked into the monthly duration of such work, the procedure in force before January 1, 2002 is applied, when the number of months accepted for inclusion in the length of service in the relevant types of work is determined by dividing the total the number of full days actually worked per the number of working days in a month, calculated on average for the year (21.2 – with a five-day working week; 25.4 – with a six-day working week). The number obtained after this action is rounded to two digits if necessary. The integer part of the resulting number is the number of calendar months. For the final calculation, the fractional part of the number should be converted into calendar days on the basis that 1 calendar month is equal to 30 days. In this translation, the whole part of the number is taken into account (rounding is not allowed).

Order a legal consultation Lawyer topics: Inheritance Housing. Real estate. Earth Family. Marriage. Children Biography: Graduated from the Faculty of Law of St. Petersburg State University. I live in St. Petersburg. Private practicing lawyer. I specialize in the field of inheritance, housing, and family law. Comments: August 22 00:23 Hello! You do not indicate the position you hold in a government agency, and this may also have a significant role in answering your question. 1. As for the total insurance period for assigning a pension, the rate does not matter. What matters is the amount of deductions, and as a fact, the amount of earnings. But if you have the right to early retirement, such a condition as part-time work may be important. So, teachers: In general, teachers’ work experience is counted (clause

Read more: Protective case for bank cards from being swiped

Part-time work and seniority

Attention An exception to this rule is the work as a primary school teacher in general educational institutions (schools of all types, lyceum, gymnasium, education center, cadet school, Suvorov Military School, Nakhimov Naval School, Cadet Corps, Naval Cadet Corps), teachers located in rural areas of general education schools of all types (with the exception of evening (shift) and open (shift) general education schools) is included in the work experience, regardless of the volume of the teaching load performed. For medical workers, according to the legislation of the Russian Federation, periods of work in positions and institutions giving the right to early retirement, starting from November 1, 1999, are counted towards the length of service provided that it is performed in normal or reduced working hours.

How is it different from a shortened day?

How it is formalized For example, men often prefer this option as a measure of reducing the amount of alimony if they work part-time, since deductions for the child are reduced proportionally.

In such cases, periods when the length of the working day (shift) is at least 80 percent of the length of the working day (shift) established in the organization in accordance with labor legislation and recorded in the internal labor regulations, and during this entire time the employee performs the relevant types of work.

Part-time mode

The legal basis for working on a reduced schedule is established by Art. 93 Labor Code of the Russian Federation. It provides that the parties to an employment contract may include a part-time clause.

In general, the final decision to transfer an employee to a shortened schedule is made by the employer. But there are a number of categories of employees for whom employers are obliged, at their request, to establish a part-time working schedule:

- Pregnant women.

- One of the parents (guardians) of a child under 14 years of age or a disabled child under 18 years of age.

- Persons caring for a sick family member. The need for care in this case must be confirmed by a medical report.

The Labor Code of the Russian Federation prohibits restricting part-time workers in their labor rights. But the procedure for assigning pensions is regulated by a separate section of law. Let's consider how short-time work is taken into account from the point of view of pension legislation.

Northern experience (2018)

Info

Expert's recommendation You need to contact your employer with a request to cancel the transfer to 0.5 rates and establish a part-time working schedule for you (working day or working week). The employer will not have the right to refuse you. Order a lawyer's consultation Legal topics: Labor law and social security Civil law.

Contracts. Transactions Taxes and fees Biography: In 2007, he graduated from the Moscow Financial and Legal Academy. Qualified lawyer with a specialization in Jurisprudence.

Who can claim a pension payment

According to Russian legislation, the retirement age for men and women is different; it corresponds to 60 and 55 years, but it is not enough to reach a certain age to be able to receive a state payment. To do this, you need to carry out official work throughout your life and make contributions to the pension fund, as well as to a personal savings account, in order to ultimately increase the amount of old-age benefits.

There are various features for certain categories of citizens who may qualify for pension benefits 5 or even 10 years earlier than the established retirement age. These include employees of medical and educational institutions, employees of the Ministry of Internal Affairs, contract military personnel and others. In addition, the insurance period, which plays a role in calculating payments, includes some other periods, in particular, service in the Armed Forces, for women - the period of pregnancy and child care, caring for an elderly person or disabled person.

Please note that you can apply for state old-age benefits only if the work was carried out officially and there were contributions to the pension fund from the employer; grace periods will not be taken into account if there was no real work experience before or after them.

When retiring, you need to have a minimum insurance period in the current year, it is 9 years. If you do not have official work experience during this period, then you should not count on a full old-age payment; the most you can count on is a social benefit, which will not exceed the subsistence level in the region.

Insurance experience

To correctly calculate the year of insurance coverage. Check out the information below. Insurance experience is considered to be the time of a person’s working activity for which insurance premiums were accrued and paid to the Pension Fund. The accumulation of insurance experience began in 2001.

To correctly calculate your own insurance period you need to have the following documents :

- Work book.

- All contracts with printed employee data (both passport and contact details), his position and company data and, of course, a seal. If some documents were lost, they can be completely restored (by interviewing witnesses and collecting facts).

According to the law, when a person reaches his retirement age, in order to receive a pension he must have a minimum insurance period , which for 2021 is eight years.

If this is not enough, the Pension Fund refuses to pay pensions. It remains only possible to pay social pensions, the retirement age for which is 65 years for men and 60 years for women. And every year the required length of insurance coverage to receive a pension will increase by one year, up to 15 years, which it will reach in 2024.

Calculation of experience for seasonal work

Some, due to various life circumstances, work only seasonally, for example, agricultural workers. They are also entitled to a pension payment, and their length of service will be calculated as follows: 1 season is equal to one calendar year. Accordingly, even with actual activity for 6–8 months, the entire calendar year will be taken into account when calculating the pension.

For such situations, the calculation of pension payments will be quite simple, all periods worked are added up and they form a single insurance period, which will be taken into account when calculating the pension. It is worth noting that the monthly payments include:

- experience;

- insurance part;

- accumulated pension points.

If the work was carried out officially, then you can confirm the presence of work experience using a work book or other document from the HR department from the employer, with which you can calculate the number of periods worked. If the work activity was not carried out officially, then there is no point in contacting the Pension Fund, since no deductions were made to the personal account.

How is it calculated?

A person’s length of service is calculated only on the basis of federal laws.

The calculation is made only for calendar periods, with the exception of seasonal work. In them, one season worked is considered one year.

How is this experience calculated correctly? The formula for calculating it is very simple, and includes only the addition procedure - all periods of official work activity and additional periods taken into account are added. And all calculations can be easily done using an ordinary calculator . And the greater the length of service, the greater the pension paid to the person.

Labor records may serve as supporting documents. book, as well as certificates from the place of work (which can be issued by any recruitment agent). If due to force majeure circumstances (only not through the fault of the employee) these documents were lost, then two (or more) witnesses will be enough to confirm the official work experience. To confirm the fact of caring for the sick and disabled, additional supporting documents about the patient’s disability are not required - the entire period, even without these documents, will be included in the pension experience, and thus will affect the size of the future labor pension.

Calculus Example

For an example of calculation, we can take the following situation: there is a woman of almost retirement age who raised two children (she was given maternity leave of three years for each).

According to the data from the work book, 25 years passed from the start of her working career until her dismissal, plus ten years the woman was engaged in entrepreneurial activity, and she worked for the first 2 years.

It is impossible to take into account all 25 years of work, because she was on maternity leave for 6 years. For each child, a woman is counted no more than one and a half years - a total of three years. She worked for two years of her entrepreneurial time, but all 10 years are already counted, and therefore these couple of years cannot be counted twice. The total result is the following picture: (25-6+3)+10=32 years of pensionable service.

The impact of the rate on the employee’s social guarantees

The administration does not have the right to limit a person’s right to a social package. Including payment of child care benefits when working part-time. Having worked the term assigned under the Labor Code, the employee has the right to go on another vacation, and if his health deteriorates, issue a certificate of temporary incapacity for work.

A partial day or week only affects the amount of earnings that the employee will receive at the end of the month.

When working part-time for supplies, the Labor Code of the Russian Federation ensures full rights to receive vacation pay and general principles for calculating sick leave pay.

Working on maternity leave

While on maternity leave, many women think about continuing to work in order to provide their expanding family with sufficient funding. Options for temporary part-time work, work without experience, or part-time work with the main employer are being considered.

It should be remembered that when a woman returns to work full-time, she loses her right to benefits for up to 1.5 years due to early retirement. In order not to lose benefits, a woman often chooses part-time work, receiving additional days off when working a part-time week.

What does the concept mean?

Before agreeing to a part-time position, it is recommended to study the specifics of the design and application of civil and labor legislation in relation to the employee being hired. It is necessary to study what it means to work part-time, and what social guarantees a person retains with such a design option.

There are some nuances to working part-time. What it is is determined from the meaning of the term “rate”, which implies full employment and workload according to the schedule at the enterprise with full wages according to the staffing table.

What is part-time is determined according to the Labor Code of the Russian Federation. In particular, Article 93 of the Labor Code of the Russian Federation, registration for a part-time schedule occurs in agreement with the employee or on his initiative at the time of hiring, or in the order of transition to a light schedule after full-time work.

In other words, in order to understand the principle of employment at ½ rate, you need to understand how work is paid in this mode. Since the contract provides for half-time employment of a person, his earnings are calculated in the same amount. As established by the Labor Code of the Russian Federation, the number of hours a person works per week does not affect his right to leave, registration of an entry in the work book, or crediting of length of service.

Part-time work can be done not only in the form of ½ rate. Alternative solutions include switching to remote work (outsourcing) or working from home.

How is it different from a shortened day?

The half rate does not affect the formation of a mandatory social package from the employer and the state, however, when applying, it is important to clarify how exactly part-time employment is reflected in the documents. Sometimes an employer dictates new conditions regarding the workload of an employee, transferring the enterprise or individual positions to a shorter working day. In contrast, working at 0.5 rate is purely voluntary.

There are also differences in other evaluation parameters:

- Payment for part-time work is calculated based on 50% of the salary according to the staffing table, and may be lower than the minimum wage. With a shortened working day, payment below 1 minimum wage is unacceptable.

- A shortened schedule is expected only for specific categories of employees, and ½-time work is mandatory only in certain exceptional cases (for example, part-time work), or by mutual agreement.

- Irregular hours and overtime are unacceptable at 0.5 rates, which cannot be said about a shortened day.

Questions and answers

Is it true that working part-time does not count towards seniority, and that for retirement, working part-time is the same as not working at all?

Expert:

Part-time work is counted towards seniority. The employer is obliged to make contributions to the Pension Fund of the Russian Federation.

Expert:

Irina! The time you work part-time is included in your seniority.

Article 93 of the Labor Code of the Russian Federation: By agreement between the employee and the employer, a part-time working day (shift) or a part-time working week can be established both upon hiring and subsequently.... When working on a part-time basis, the employee’s wages are paid in proportion to the time worked by him or depending on the amount of work performed by him. Part-time work does not entail for employees any restrictions on the duration of annual basic paid leave, calculation of length of service and other labor rights.

One of the conditions for granting an old-age pension according to Art. 8 of the Federal Law of December 28, 2013 N 400-FZ “On Insurance Pensions” is the presence of insurance experience. That is, the key point in deciding whether a specific period is included in the insurance period for a pension or not is the fact of “calculation and payment of insurance contributions to the Pension Fund of the Russian Federation” (Article 11 of Federal Law No. 400-FZ).

While studying full-time as a graduate student, I worked as an engineer at the department part-time. Is this time included in the length of service when calculating a pension?

Expert:

Vladimir!

The time you work part-time is included in your seniority.

Article 93 of the Labor Code of the Russian Federation: By agreement between the employee and the employer, a part-time working day (shift) or a part-time working week can be established both upon hiring and subsequently.... When working on a part-time basis, the employee’s wages are paid in proportion to the time worked by him or depending on the amount of work performed by him.

Part-time work does not entail for employees any restrictions on the duration of annual basic paid leave, calculation of length of service and other labor rights.

One of the conditions for granting an old-age pension according to Art. 8 of the Federal Law of December 28, 2013 N 400-FZ “On Insurance Pensions” is the presence of insurance experience.

That is, the key point in deciding whether a specific period is included in the insurance period for a pension or not is the fact of “calculation and payment of insurance contributions to the Pension Fund of the Russian Federation” (Article 11 of Federal Law No. 400-FZ).

Due to the difficult financial situation, they want to transfer the employees of our individual entrepreneur to part-time. How will this affect the length of service (for example, 2016 will be credited as 0.5 years?) and how will this affect my pension?

Expert:

Article 93 of the Labor Code of the Russian Federation By agreement between the employee and the employer, a part-time working day (shift) or a part-time working week can be established both upon hiring and subsequently. The employer is obliged to establish a part-time working day (shift) or part-time working week at the request of a pregnant woman, one of the parents (guardian, trustee) with a child under the age of fourteen years (a disabled child under the age of eighteen years), as well as a person carrying out caring for a sick family member in accordance with a medical certificate issued in the manner established by federal laws and other regulatory legal acts of the Russian Federation. When working part-time, the employee is paid in proportion to the time he worked or depending on the amount of work he performed. Part-time work does not entail for employees any restrictions on the duration of annual basic paid leave, calculation of length of service and other labor rights.

Part-time work only affects wages. Vacation and work experience are calculated on a general basis

Expert:

Due to the difficult financial situation, they want to transfer the employees of our individual entrepreneur to part-time. How will this affect the length of service (for example, 2016 will be credited as 0.5 years?) and how will this affect my pension? Galina Galina, in general, transfer to part-time work is possible only with the consent of the employee. In accordance with the Labor Code of the Russian Federation (Article 93), by agreement between the employee and the employer, a part-time working day (shift) or a part-time working week can be established both upon hiring and subsequently.

When working part-time, the employee is paid in proportion to the time he worked or depending on the amount of work he performed.

Part-time work does not entail for employees any restrictions on the duration of annual basic paid leave, calculation of length of service and other labor rights.

Thus, you will have full experience, but the average earnings will, naturally, be less.

Good luck to you!

Question: I work at 0.5 rate, is this included in the full work experience? year for a year or year for half a year?

Expert:

Sergey.

The grounds and procedure for calculating the insurance period, if necessary for the assignment of an old-age insurance pension, are regulated by the relevant provisions of federal legislation.

Thus, in accordance with Article 10 of the Federal Law “On Labor Pensions in the Russian Federation”, N 173-FZ:

1. The insurance period includes periods of work and (or) other activities that were performed on the territory of the Russian Federation by the persons specified in part one of Article 3 of this Federal Law, provided that for these periods insurance contributions were paid to the Pension Fund of the Russian Federation.

According to:

GOVERNMENT OF THE RUSSIAN FEDERATION DECISION N 1015 of October 2, 2014 On approval of the Rules for calculating and confirming the insurance period for establishing insurance pensions

2. The insurance period includes (counts): a) periods of work and (or) other activities that were performed on the territory of the Russian Federation by persons insured in accordance with the Federal Law “On Compulsory Pension Insurance in the Russian Federation” (hereinafter referred to as the insured persons) , provided that during these periods insurance premiums were accrued and paid to the Pension Fund of the Russian Federation (hereinafter referred to as insurance premiums);

47. Calculation of the duration of periods of work, including on the basis of witness testimony, and (or) other activities and other periods is carried out on a calendar basis based on a full year (12 months). In this case, every 30 days of periods of work and (or) other activities and other periods are converted into months, and every 12 months of these periods are converted into full years.

Those. in this case, the calculation of the insurance period is carried out on the same basis for all, which is also confirmed by the relevant explanations of the Pension Fund of the Russian Federation:

Does part-time work count towards insurance coverage?

November 09, 2015 The period of part-time work is counted towards the insurance period for establishing an old-age insurance pension on a general basis, subject to the calculation and payment of contributions to the Pension Fund of the Russian Federation.

www.pfrf.ru/branches/arkhangelsk/news~2015/11/09/101016

Working period and pension age

In general, retirement experience is the summed length of time spent at all official places of work . Moreover, an unlimited number of activities can be summed up, the main thing is that the work is official. Depending on the categories of citizens, gender and age, the total length of service and pension accruals are calculated differently.

In men

In the Russian Federation, the age for receiving a pension for men is sixty years . The presence of certain working conditions may affect the retirement age - which can be reduced to 45 years.

In addition, there are special pensions that are issued by the state for length of service. They are issued upon completion of municipal/state services.

The following time periods may additionally be included in the length of service:

- Time spent in military service (including contract service).

- Receive disability insurance benefits.

- Maternity leave period. Up to one and a half years of this leave is taken into account for each child, but no more than three years in total.

- Time spent caring for a disabled person of the first or second group.

- The period of caring for a disabled person, in the person of a child or an elderly (over eighty years old) person.

- The length of time that subsequently rehabilitated (or illegally repressed) citizens are kept in custody.

These periods are counted only when official work activity was recorded before or after them.

For example, if a person spent his vacation caring for a disabled person, and after that was not officially employed, then this vacation will not be taken into account when calculating.

For women

Unlike men, women retire a full five years earlier—at age 55 , according to labor laws. The law also provides for the possibility of earlier retirement for women due to the nature of their work activities.

The length of service for women is calculated in the same way as for men, but in addition to all the above additional inclusions, women are also provided with leave in connection with pregnancy or childbirth and others related to legislation on the protection of motherhood and children.