Rules for calculating sick leave

The rules for calculating length of service on sick leave in the Russian Federation are legalized by the following documents:

- Law “On individual accounting in the system of state pension legislation”;

- Federal Law of December 29, 2006 N 255-FZ “On compulsory social insurance in case of temporary disability and in connection with maternity” (hereinafter referred to as Law N 255-FZ);

- Regulations on the specifics of the procedure for calculating benefits for temporary disability, pregnancy and childbirth for citizens subject to compulsory social insurance, approved by Decree of the Government of the Russian Federation of June 15, 2007 N 375;

- Rules for calculating and confirming insurance experience to determine the amount of benefits for temporary disability, pregnancy and childbirth, approved by Order of the Ministry of Health and Social Development of Russia dated 02/06/2007 N 91.

- Subp. 2 clause 2 of the 2007 Rules, part 1 art. 16 of Law No. 255-FZ, letter of the FSS of Russia dated 08/09/2007 No. 02-13/07-7424.

Important! The main measures on which the amount of compensation depends on the bulletin are the salary and length of service of the worker.

It also happens that an unemployed person has the right to apply for compensation for disability.

Main conditions

The legal framework provides for several types of insurance experience. The first is taken into account for the accurate calculation of an employee’s labor pension, while the second allows one to determine the amount of social benefits in the event of partial or temporary disability of an individual.

To correctly calculate your pension, you need to understand the difference between length of service and insurance coverage, and how this affects the amount of payments.

The recommendations from this article will help you figure out how to determine your insurance experience.

Social benefits for temporary disability are even easier to obtain, since in accordance with a special order of the Ministry of Health and Social Development, the period of military service must be taken into account in the process of calculating the insurance period, regardless of any secondary circumstances.

Special attention should be paid to the fact that in addition to the years that Russian citizens devote to military service, the insurance period also includes the following periods of time:

- work in internal affairs bodies;

- performing duties in the State Fire Inspectorate;

- work in specialized institutions involved in controlling the trafficking of drugs and other prohibited substances;

- labor activity in the field of the penal system.

It is worth noting that in the process of registering a future employee, an employee of the company’s personnel department must make a corresponding entry stating that he served in the army, indicating its duration (this information is taken from the military ID provided by this citizen).

Differences between labor experience (TrSt) and insurance experience (StrSt)

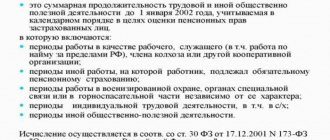

The first of these is compiled by periods of time of the employee’s activity, according to the notes entered in the worker’s work book before January 1, 2002.

The second type of length of service also accumulates the recorded time periods of work during which social insurance contributions were made.

What is insurance period for sick leave?

This includes fulfilling obligations under the labor contract (employment contract) and public service. Any other occupation within the time frame of which the worker contributed social security payments is also necessarily included.

Components of length of service for sick leave:

- fulfillment of the obligations specified in the TD,

- civil service,

- military service,

- any occupation during which social activities were carried out. deductions: entrepreneurship, deputy activity, church service, work of a convicted person.

It is noteworthy that StrST accumulates the work performed, not limited by location only outside the Russian Federation , but also outside its borders, while compliance with the rules is mandatory:

- If you want to work abroad, then your work must comply with Russian legislation or be secured by international treaties.

- You make insurance contributions to the Pension Fund.

When working on a fixed-term TD , you provide Social Security only if you make social insurance payments, otherwise the time of your activity will not be reflected in this type of work experience.

Is military service included in the length of service for calculating sick leave? And is training included in the insurance period for sick leave?

Military service and study are included in the insurance period for sick leave if the employee studied and was already working before 01/01/2007, since students worked in production for some time.

The period of study at the institute and technical school is not taken into account.

If a woman’s activities are supported by TD, the StrSt necessarily adds the terms of leave for labor and employment and for caring for a child up to 3 years old . (Law 2).

Is maternity leave included in the insurance period for accrual of sick leave? A woman can safely take a vacation and care for her baby, knowing that this will not entail the termination of her employment contract and she will definitely have a place in which she can work after returning from vacation.

Even if you did not make insurance contributions during this time to the FSS of Russia, this does not affect anything. If the time when you cared for the baby fell on the period before 01/01/2007, then it is added to the continuous TrSt.

In the StRS of foreign citizens, only the time of their employment in the territory of the Russian Federation is accumulated.

Citizens of other countries working in Russia can count on the summation of their Social Security only for the time they were employed here . Work abroad is not taken into account. But for citizens of Belarus, Uzbekistan, Kazakhstan, and Armenia, the procedure for labor relations is based on the Agreement of these states on the mutual acceptance of TrST by all participants who signed the Agreement (Law 4).

It follows from this that when calculating length of service for hospital experience, you must adhere to the rules of this document and count periods of employment in the specified countries.

The necessary documents for calculating the insurance period for sick leave must be translated into Russian and officially certified.

Important! If you combined two jobs in one period of time, then you will have to write a statement and indicate the preferred period, which will serve as the basis for calculating compensation.

Now let's see how to calculate the insurance period for sick leave.

When calculating length of service for sick leave, the following time intervals are accumulated:

- Duration of military service . This also includes employment in the penitentiary system, police department, etc.

- The period of illness for which a certificate of incapacity for work was opened.

- The periods of time in which you took care of the baby up to one and a half years old. A mother who went on several such vacations can only claim 4.5 years of StrSt, although, in general, they lasted longer.

- The time when a person is at the labor exchange and receives unemployment benefits . Periods of time spent moving to a new job, with a referral from the employment service.

- If you are caring for a disabled person of group I, a disabled child or elderly people over 80 years old, this time will also be counted in the StrSt.

- If a person is detained without reason in places of detention and periods of repression during subsequent rehabilitation.

- For spouses of military personnel , the StrSt includes the time the husband spent at the place of service, during which it was not possible to get a job. This only counts 5 years of the total. The same applies to spouses of diplomats located abroad.

The time periods listed above will be taken into account in the Social Security Policy if the person worked until the situation arose and began work immediately after them with the transfer of insurance funds to the Pension Fund.

Taking into account the specifics of working conditions and locality, the length of service required to pay sick leave is divided into general and special. The first involves working under normal conditions with the payment of insurance contributions. The second implies, as an indispensable circumstance, a special status for calculating insurance compensation if the employee’s activities take place in a particularly harmful or difficult environment, as well as in territories with specific natural conditions.

Important! In areas where wages are paid taking into account special regional coefficients (Murmansk region), if the Labor Standard is less than six months, compensation payments should not exceed the minimum wage, including these coefficients.

General points

Is military service included in the total length of service? Law No. 76-FZ directly states that time spent in the Armed Forces under a contract is included on the basis of 1 day of service = 1 day of work.

Please note: this proportion changes (1 day of service = 2 days) if the serviceman entered service not under a contract, but as a result of conscription, including by decree signed by the President. Special conditions for those who held positions with increased health hazards; this time they receive special service, which is subsequently counted when calculating pensions. There is a list of such positions. The same applies to employees of internal affairs bodies (Law No. 342-FZ). According to paragraph 5 of Art. 38 time in the army must be taken into account.

This is about general length of service, but payroll accountants often have a more specific question: is military service included in the length of sick leave or not? Let's look at the answer below.

Necessary documents for calculating length of service for sick leave

Documentary evidence of the Labor Code, based on which compensation calculations are made, is mainly the work book. Those. all time periods of the employee’s activity, recorded in it and correctly formatted.

And here it does not matter whether the worker took vacation during this period of time and whether he was paid a salary. If the work book provided by the employee contains data with incomplete, inaccurate or blurry entries and seals, or it does not contain notes about any periods of work, then you can provide other documentary evidence of his employment in a specific organization:

- TD with the organization for which you worked;

- Certificate received from the organization;

- Copies of enterprise orders;

- Bank account and accounting statement in which the receipt of salary is recorded;

- Entrepreneurs, lawyers, notaries have the opportunity to provide official paper from the Federal Social Insurance Fund of Russia about the social insurance contributions made;

- Employees of military structures have in their arsenal of evidence a military ID or a certificate from the commissariat.

If you take additional documents to confirm sick leave for calculation, please note that everyone must have:

- number and date of issue,

- FULL NAME. worker

- Date of Birth,

- name of the organization and time of service in it,

- duties performed,

- the document that served as the reason for issuance is indicated (order, invoice, etc.).

If there is no date and month on the provided official papers (only the year is recorded), the countdown is from July 1 of the specified year; if there is no date (there is a month and year), the length of service is calculated from the 15th of the confirmed month.

The insurance period for sick leave is calculated in a similar way.

To determine the amount of compensation according to the bulletin, the first step is to calculate the worker’s SST.

When calculating the STS of workers, no emphasis is placed on the intervals during which the person did not work. Periods of employment in any occupation add up.

You may also be interested in the following articles on the topic of sick leave6

- How is sick leave paid for a domestic injury?

- What to do if the sick leave falls on a day off?

- How is sick leave paid on holidays?

The summation of these periods occurs in a time sequence, with a whole month being 30 days and a whole year being 12 months. Any consecutive 30 days are summed up into a whole month and every 12 such months add up to a whole year (clause 21 of Law 4).

The next step in calculating the amount of sick leave depending on length of service comes to determining the amount of the payment itself.

We understand military service and BC calculations

By law, both contract and conscription service in the Armed Forces are included in a citizen’s insurance record, and then, based on it, sick leave benefits can be calculated.

This experience also includes the citizen’s stay in military educational institutions, in which the citizen was engaged in mastering the corresponding army specialty. This length of service can be maintained even if the service was interrupted, but it will be necessary to combine all completed military service (breaks are not taken into account) in order to obtain the final duration of this process.

When calculating payments under the BC, the length of service when a citizen serves is taken into account

If an officer has been called to service by the state, he also has the right not only to retain his place at work, but also to have the period of service included in the corresponding length of service recognized as insurance.

To obtain sick leave, it does not matter what the period of employment after military service was. But receiving a pension is possible only when both the beginning and the end of this period correspond to the extreme points of the work experience.

It does not matter whether the citizen had an official place of work before he left to serve, the main thing is to find a job immediately after the moment of demobilization - then all the requirements of the law will be satisfied.

Important ! A citizen has a year (but no more) to find an official place of work, otherwise it will be problematic to calculate his pension.

It is important that a citizen gets a job within a year after service

Percentage of payment for sick leave depending on length of service

So, let’s look at what length of service is taken into account when calculating sick leave. Sick leave pay based on length of service is paid in the following amounts (Law 2):

| Insurance experience | Benefit amount |

| From 8 years | 100% of the employee’s average salary |

| From 5 to 8 years | 80% of the employee’s average salary |

| From 6 months to 5 years | 60% of the employee’s average salary |

| Up to 6 months | Does not exceed the minimum wage for 1 month |

As you can see, sick pay depends on length of service. The duration of StrSt may change the amount of compensation for pregnancy and childbirth.

A woman who has worked at an enterprise for less than six months has the right to expect to receive benefits calculated no more than the minimum wage for each month of her work , unless special coefficients are applied in the area where she works (Law 2).

Note! The HR department indicates the duration of the StrSt on the certificate of incapacity for work.

Admission rules

Military personnel have one advantage over civilians in the length of service accrual format. If the requirements for employment before and after service are met, then the period in the army itself will be calculated in a ratio of one to two, that is, for a day in service two will be added to the length of service.

This rule applies only to conscripts. For those who serve under a contract, the calculation is one to one.

Healthy! If the service took place in extreme conditions and at the time of hostilities, then one day of service will be equivalent to three workdays.

Example of sick pay depending on length of service

The worker went on maternity leave on September 9, 2014. Maternity leave was issued on July 28, 2014.

StrSt is added up, including September 8, 2014. In all time intervals, each day is counted in order, forming months of 30 days and years of 12 months. Then, having received the total Stst, we add up separately the years of each time period, months and days. This is how the employee’s full StrSt is obtained.

Thus, we examined in detail what is included in the length of service for sick leave, how to calculate the length of service for sick leave, from what length of service 100% of sick leave is paid, how to find out the length of service for sick leave. Now you definitely won’t get confused in calculating your insurance and work experience, as well as calculating the required disability compensation.