07.07.2019

0

125

4 min.

Labor legislation guarantees working citizens reimbursement of expenses for the period of temporary disability. The amounts are paid by the employer in the form of benefits. Taking into account the fact that payments are conditionally the income of an ill employee, many people often have a question: are sick leaves subject to insurance premiums?

Are sick leave insurance premiums covered by the employer?

According to Art. 183 of the Labor Code, all citizens who are sick and issue a certificate of incapacity for work receive benefits for all days of absence from work. According to the general rules, this payment is not subject to insurance premiums, which is confirmed by the provisions of Art. 422 NK. Therefore, hospital payments do not transfer funds to social, pension or health insurance.

Reference! Such rules apply not only to funds paid by employers, but also to money transferred from the Social Insurance Fund.

The benefit is assigned exclusively to persons who are officially employed citizens, therefore, for them, the employer makes monthly contributions to the Social Insurance Fund. The current rate is 2.9% of earnings.

Therefore, these funds are withdrawn from a citizen’s salary so that in the future, when going on sick leave, the person can receive the optimal amount. The first three days are paid for by the employer, after which Social Insurance Fund funds are used. The benefit received on sick leave is not considered a salary, but is represented by a social payment on which insurance contributions are not charged.

Possible deductions from sick leave amount

From the amount of the disability benefit, regardless of whether the employer pays additionally up to the average earnings or not, the following is withheld:

- Personal income tax.

- Alimony . In accordance with Part 1 of Article 101 of Law 229-FZ of October 2, 2007, disability benefits do not belong to the category of payments from which the amount cannot be recovered under a writ of execution.

If the organization has a trade union and dues are paid , then the issue of their deduction from the amount of disability benefits should be defined in internal documents. Let us note that in the standard rules for the payment and distribution of professional contributions given in the Resolution of the General Council of the FNPR of May 29, 1997 No. 3-1, “sickness” payments are exempt from the withholding of these contributions.

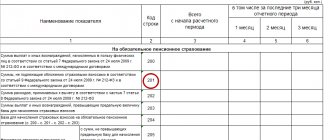

When are insurance premiums transferred from benefits?

Contributions are levied on temporary disability benefits if the benefit amount is above the established maximum. Under such conditions, for the first three days the employer is not only obliged to pay sick leave funds, but also pay a certain amount to the Social Insurance Fund. The current maximum value is 865 thousand rubles.

For example, an accountant receives a salary of 55 thousand rubles. per month. For 2 years of work, the average salary is 1 million 320 thousand rubles.

The calculation is carried out in the following steps:

- average earnings for 3 days is: 1320000/731*3=5417 rubles;

- based on the maximum payment, average earnings should not exceed 6894 rubles;

- therefore, insurance payments are transferred from the difference between these indicators: 6894-5417 = 1477 rubles.

If a hired specialist is a member of a trade union organization, then he is obliged to make monthly appropriate payments. But if a person receives sick leave benefits, then he does not have to worry about reducing this amount.

Trade union dues are levied exclusively on income, and benefits are represented by social payments, so funds are not deducted from them to the Pension Fund or Social Insurance Fund. But on benefits assigned in connection with temporary disability, you have to pay income tax, amounting to 13% of the payment. This fee is the only payment from social benefits, which is of an average size.

Attention! If sick leave is issued for pregnancy and childbirth, then not only insurance payments, but also personal income tax are not collected from them.

Insurance premiums are charged in the following situations:

- Calculation of benefits in the amount of 100% for an employee who does not have the required length of service. Such an initiative on the part of the employer acts as an accrual of additional income. Therefore, all required government payments are collected from the excess. For example, if a citizen’s work experience is less than 5 years, then the benefit amount is 60% of earnings. But the head of the company can, on his own initiative, increase the payment to 100%. But if you exceed the amount, you have to pay insurance premiums equal to 2.9%. From the 4th day, funds are transferred from the Social Insurance Fund. Typically, such a decision to increase benefits is made by the employer for valuable employees who have little experience but bring high profits to the company. The state does not provide for additional payments, therefore, for such a decision, company managers are required to pay insurance premiums.

- The Social Insurance Fund denies the employee benefits. This decision often arises due to illiterate documentation on the part of the employer. Sometimes there are problems coordinating payments with government agency representatives. The heads of organizations that care about the health of their hired specialists decide to assign them a payment at their own expense. But such transfers do not act as social benefits and are therefore recognized as income. They have to contribute funds to various state funds and the Federal Tax Service.

An employer obliged to transfer insurance premiums from sick pay must take into account the deadlines established by law, otherwise the director of the company will be held administratively liable. Therefore, money is paid before the 15th of the next month. At the same time, the payment order is retained, which serves as evidence of the fulfillment of obligations by the employer.

Employer's supplement

As mentioned above, the amount of disability benefits depends on length of service . And if it is small, then the difference between the employee’s potential earnings (if he worked on sick days) and the benefits received will be significant. Therefore, some employers provide their employees with additional pay up to the average earnings for sick days. So, if there is such an additional payment, insurance premiums must be calculated .

The costs of additional payments to employees up to the average earnings for sick days can be taken into account when taxing profits. However, for this it is necessary to establish the provision on additional payment in the internal acts of the employer, labor or collective agreement.

Will the insurance payment change when benefits are transferred?

Company managers save if the payment amount does not exceed the established limit. If the amount exceeds this figure, then you will have to transfer insurance premiums from the excess.

According to Art. 430 of the Tax Code of the Social Insurance Fund compensates the heads of enterprises for the amounts spent on transferring money to employees on sick leave.

But there are exceptions in which it is impossible to reduce insurance transfers by the employer.

These include situations:

- a certificate of incapacity for work is issued on the basis of an injury received by a citizen during the performance of work duties;

- the benefit is paid on the basis of an illness acquired while working in dangerous or harmful conditions;

- the company operates using OSNO, and the employee works in two directions, and in one such direction it is required to pay tax according to UTII.

Therefore, when receiving compensation, the chosen tax regime and the reasons for the employee’s illness are taken into account.

Interested in whether sick leave is subject to personal income tax in 2019?

Having your own website is no longer considered by most business entities as some kind of luxury. This “invisible assistant” has become an integral part of any business. Pharmacy organizations are no exception. Despite the existence of a legislative ban on online sales of medicines and medical products, pharmacies are actively creating and promoting websites in order to attract a larger number of potential buyers and partners. Tax and accounting expenses associated with the creation and promotion of a website have characteristic features. Details below.

The panic over the fake news that the Federal Tax Service will completely control card transfers and charge taxes on “unidentified” transactions has subsided. However, citizens still have questions: in what cases the amount received by transfer to a card can still be recognized as income and subject to personal income tax, and in what cases it cannot.

Imposition of insurance premiums on maternity benefits

If an employee becomes pregnant, then before the birth of the baby she has the right to go on maternity leave, receiving sick leave payments. Insurance premiums and personal income tax are not charged from this amount. This is provided for by the provisions of Art. 217 NK.

No other taxes or contributions are charged on the B&R benefit. Therefore, if for some reason the employer takes extraneous funds from the payment, the employee can contact the labor inspectorate to bring the violator to justice.

When are payments made?

Expert opinion

Semenov Alexander Vladimirovich

Legal consultant with 10 years of experience. Specializes in the field of civil law. Member of the Bar Association.

Russian laws provide clear deadlines regarding mandatory insurance payments that the employer must adhere to. Otherwise, he will face an administrative penalty, which can be quite significant.

Today, payments to compulsory insurance funds, including insurance contributions for sick leave, if any are due, must be made before the 15th of the month following the issue of benefits. Of course, this day may fall on a weekend or holiday.

In this case, the payment deadline is postponed to the next working day after it. For example, if an employer added an additional 20% to the benefit in January, then he must transfer the necessary amounts to the state budget by February 15.

But the 15th day of the second winter month fell on a Sunday, which means that all debts to state funds can be paid off before February 16th.

The main document that must be filled out to pay the amounts due to the Social Insurance Fund or Pension Fund is a payment order. It will serve as proof of the debt fulfilled in the event of claims from government agencies.

Common Mistakes

If the head of a company or accountant makes mistakes when filling out a sick leave certificate, this leads to an incorrect calculation of the payment. They arise due to various factors, for example, an accountant may make an arithmetic error, and software failures often occur.

If such errors are detected, recalculation must be carried out. This leads to underpayment or overpayment. If the employee did not receive a certain amount, then he is paid the due funds. In this case, the amount is divided into two parts, since one is appointed by the employer, and the second is issued by representatives of the Social Insurance Fund. After recalculation, the money is paid on the day you receive your salary.

Important! Attention! company, so he additionally transfers compensation to the employee for each day of delay.

If it turns out that the employee received more funds than he was entitled to, he will have to return the excess. But if the error occurred due to the fault of the employer, then the citizen may refuse to return the money. If he agrees with the manager’s demand, then he draws up a written permission to withhold a specific amount from the salary.

Trade union dues - what are they deducted from, amount, postings

Home — Business organization — Personnel — Norms of domestic legislation, in particular, the provisions of Art. 377 Labor Code and Art. 28 Federal Law No. 10 of January 12, 1996 states that the management of an economic entity is obliged to transfer trade union dues to the account of the primary trade union organization every month without delay.

This topic is very relevant, since the state of the trade union’s budget directly determines its ability to defend the rights of its members.

Why professional contributions are withheld and where they are spent, as well as what kind of transactions this is recorded in, will be discussed further.

Contents: 1. Sources of funds to ensure the functioning of the trade union 2. In what amount and from what are trade union dues withheld 3.

The procedure for withholding trade union dues and their distribution 4. Trade union dues: postings 5.

Taxation of trade union payments 6.

Responsibility of the employer for refusal to withhold and transfer professional contributions 7.

Examples from practice Sources of means to ensure the functioning of a trade union The trade union organization (TU) functions in accordance with the provisions of the Charter (clause 4 of article 24 of the Federal Law No. 10 of 01/12/1996). It (or a separate specialized document - the provision on primary software) fixes the issues of forming sources to ensure its normal operation and the use of funds received.

Such, according to Art. 31 Federal Law No. 82 of May 19, 1995, are:

- funds received from lectures, auctions, exhibitions and other events;

- entrance and membership fees;

- income from economic and foreign economic activities;

- other voluntary contributions;

- income from GPC transactions;

- others that do not contradict legal norms.

The first source is considered the most stable and permanent. The rest are available only to some trade unions (those with sponsors or property leased or ready for sale) How much and from what are trade union dues deducted? In the Soviet Union and after its collapse, the amount of trade union dues was and is 1% of labor remuneration.

The amount of contributions to a business entity is determined in accordance with federal and local legislation, as well as the provisions of the collective agreement and the PA Charter. For some categories of workers (retirement age and under 18 years of age, employees on labor and employment leave), it is allowed to reduce it. The basis for withholding professional contributions are the following payments that make up the payroll:

- wages in cash and in kind (including part-time workers), accrued for piecework or time-based wages;

- bonuses and other incentive payments;

- other payments (vacation pay, compensation for downtime due to the fault of the administration or forced absenteeism).

- incentive and compensation payments, bonuses, additional payments (for productivity and quality of work, length of service, professional skills, academic degree or title, difficult working conditions, work at night and on non-working days, overtime work, and so on);