How often can an employee change credit institution?

There are no restrictions on the number of changes to a credit institution by an employee. The bank is changed on the basis of an application indicating the bank details, as well as the employee’s account number.

There are restrictions only on the timing of filing this application. It must be written and submitted to the employer up to 5 days before the salary payment date.

Important! The employer can change the credit institution at his discretion. To do this, he must write an application indicating the details of another bank. But in this case, the employee bears all expenses for maintaining the card.

How are personal income tax and other taxes taken into account?

When paying wages, the employer must immediately deduct personal income tax and other payments to the state treasury. Cashless payments are no exception.

According to the law, namely Article 226 of the Tax Code of the Russian Federation, the employer is obliged to deduct the amount of tax on any income received by an employee of a company through interaction with this company. The income tax in our state is 13%.

The employer (tax agent) deducts this percentage of the taxpayer’s (employee’s) profit on the same day the payment occurs . Technically, it looks like this: a company accountant or other responsible person, along with documents for salary payments, submits a payment order to pay taxes to the budget.

The same thing happens with insurance and other contributions .

Results

Today, transferring salaries to bank cards is the norm, while all labor payments in cash are gradually becoming a thing of the past. The law does not prevent the transfer of salaries to someone else’s card, but it is necessary to prepare an appropriate document justifying this operation.

Sources:

- Labor Code of the Russian Federation

- Civil Code of the Russian Federation

- International Labor Organization Convention No. 95

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Payment order

When filling out a payment order for several employees, consider the following features:

- in the “Recipient” field, indicate the name and location of the bank in which the employees’ accounts are opened;

- in the “Amount” field, indicate the total amount that needs to be transferred to employee accounts;

- in the “Purpose of payment” field, indicate the purpose of the payment and make a reference to the date and register number (the entry may look, for example, like this: “Transfer of wages for January 2015 according to register No. 2 dated February 6, 2015”).

Apply these rules regardless of whether the organization transfers salaries through a bank in which the organization has a current account, or through a bank in which employees are serviced, and the organization does not have a current account with it.

This procedure follows from Appendix 1 to the Regulations approved by the Bank of Russia dated June 19, 2012 No. 383-P.

If the salary is transferred to the account of one employee, then indicate in the payment order:

- in the “Recipient” field – the employee’s last name, first name, patronymic;

- in the “Recipient's Account” field – the number of his individual account.

This procedure follows from Appendix 1 to the Regulations approved by the Bank of Russia dated June 19, 2012 No. 383-P.

Foreign employees can be either residents or non-residents.

Residents for the purposes of currency control, in particular, are recognized as:

- citizens of Russia (except for those who permanently reside in a foreign country);

- foreign citizens and stateless persons who permanently reside in Russia on the basis of a residence permit.

The remaining individuals are non-residents.

Such rules are specified in paragraphs 6–7 of part 1 of article 1 of the Law of December 10, 2003 No. 173-FZ.

The currency transaction code must be enclosed in curly brackets and have the following form: .

There should be no spaces inside the curly braces.

Such rules are specified in paragraph 3.2 of Bank of Russia Instruction No. 138-I dated June 4, 2012.

An employee's salary can be transferred to another person's account. But only if this is provided for in the employment contract and the employee has written a statement.

As a general rule, the employer must pay wages directly to the employee (Part 3 of Article 136 of the Labor Code of the Russian Federation). However, the employment contract may provide for a different procedure. Including by transferring money to a third party account. This is stated in Part 5 of Article 136 of the Labor Code of the Russian Federation.

If there is such a condition in the employment contract, the organization has the right to transfer the employee’s salary to the bank account or card of another person (for example, a relative or other family member). To do this, the employee must write a corresponding application.

The procedure for transferring salaries to cards

The procedure for transferring salaries to employee cards depends on whether the salary is transferred to the accounts of one or several employees.

To transfer salaries to the accounts of several employees, submit to the bank:

- register for transferring funds to employees;

- payment document(s).

Documents can be drawn up both in paper and electronic form (clause 1.9 of the Regulations approved by the Bank of Russia dated June 19, 2012 No. 383-P).

The procedure for accepting, recalling and returning (cancelling) payment documents (including those with registers) is established by the bank. This information must be specified in the agreement with the bank, as well as by posting information at customer service points (clause 2.2 of the Regulations approved by the Bank of Russia dated June 19, 2012 No. 383-P).

The procedure for submitting and filling out payment documents and the register is established by clauses 1.17, 1.19, 1.24 and Appendix 1 to the Regulations approved by the Bank of Russia dated June 19, 2012 No. 383-P.

In the register, indicate in particular the following information:

- about employees to whom funds are transferred;

- about banks in which employees have salary accounts;

- dates, numbers of payment documents, their total number;

- amounts for each employee.

If necessary, in agreement with the bank, additional information can be specified in the register.

This procedure is provided for in subclause 1.19 of the Regulations approved by the Bank of Russia dated June 19, 2012 No. 383-P.

After transferring money to the employees’ accounts, the bank returns one copy of the register to the organization with a mark of execution. The register and the corresponding account statement indicate that the salary has been credited to the employees’ cards. The total amount of the register must match the total amount of the payment order(s). This conclusion follows from subclause 1.19 of the Regulations approved by the Bank of Russia dated June 19, 2012 No. 383-P.

When transferring salaries to the account of one employee, there is no need to create a register. It is enough to submit a payment order to the bank.

Making a payment

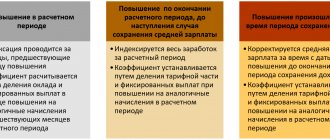

Specific deadlines for when money should arrive in the account are usually specified in the agreement for servicing bank cards. Costs for reimbursement of services are reflected in the debit and credit of accounts.

- Accounting entries relating to the transfer of money for salary payments, accrual of funds and other transactions are associated with debits and credits, which are well known to any accountant.

- Before you provide the payment to the bank, you need to make some deductions. First of all, we are talking about personal income tax. This tax is imposed on any individual. Therefore, a paper confirming its payment is sent as an attachment in order to avoid a fine.

- Insurance, pension and medical contributions are collected, which are transferred every month no later than the 15th. A lot has to do with the reporting period. Failure to comply with this requirement may result in administrative liability and even suspension of the company.

- The name and details of the bank are indicated on the payment slip. The total amount and purpose of payment are stated, as well as the registry number.

Here you can make a free payment order

In addition to wages, various compensations, travel allowances, vacation pay or bonuses are transferred to the card. If the date of receipt of money coincides with a holiday or weekend, then it is possible to withdraw the amount the day before.