Is accounting of work books required at an enterprise?

An employer who hires a person who does not have a work book is obliged to issue it within a week after he starts work (Article 65 of the Labor Code of the Russian Federation, clause 8 of the Rules approved by Decree of the Government of Russia of April 16, 2003 No. 225, hereinafter referred to as the Rules ).

Note! Starting from 2021, there is no need to create a paper work book for an employee who is getting a job for the first time. For such an employee, issue only an electronic version of the document. For an employee who is hired for the first time during 2021, create an electronic and, if desired, a paper work book. See here for details.

Subsequently, the employer has the right to request compensation from the resigning employee for the work book (clause 47 of the Rules) and withhold it based on his application. But at the same time, the employee is not obliged to agree to this compensation. And if he refuses, the employer will still have to issue him a work book (determination of the RF Armed Forces dated September 6, 2007 No. KAS07-416).

The acquisition by an employer of work record forms, like any other business transaction, is subject to reflection in accounting. Write-off of work books is also subject to accounting. Thus, maintaining accounting records of work books is a mandatory procedure for organizations. If the employer is an individual entrepreneur, he will keep records of work books only in terms of compliance with the requirements for filling them out and storing them.

You can learn more about the specifics of maintaining and storing work books in the article “Instructions for filling out work books.”

Documents used to record work records

In accordance with clause 40 of the Rules for maintaining and storing work books, producing work book forms and providing them to employers (approved by Decree of the Government of the Russian Federation of April 16, 2003 No. 225) in order to record work books, work book forms and inserts in it, Employers are required to maintain:

- receipt and expenditure book for accounting of work book forms and inserts in it;

- a book of accounting for the movement of work books and inserts in them. Read also the article: → “Book of labor records.”

The forms of these books are approved by the Ministry of Labor and Social Protection of the Russian Federation.

What object should a work book be taken into account as?

This issue is not regulated by law and remains controversial to this day. In our opinion, the following approach is correct:

- The work book is accepted for accounting as a strict reporting form (SRF), since it is legally recognized as such in the period between the moment of its acquisition from the supplier and the moment of registration for the employee (clause 42 of the Rules).

- From the moment the form is issued for an employee, the employee’s debt for the work book issued to him becomes the object of accounting. Subsequently, the accounting reflects the operation to repay the debt (or the fact of its inclusion in expenses).

At the same time, the financial department (letter of the Ministry of Finance dated May 19, 2017 No. 03-03-06/1/30818) considers this issue as follows:

- work books should be taken into account with the allocation of VAT (that is, as goods and materials);

- when compensation is collected, non-operating income arises, and when compensation is not provided, a gratuitous sale occurs.

In other words, within the framework of the scheme proposed by the Ministry of Finance, it is planned to keep records of work books using account 41.

At the same time, in earlier clarifications, for example in letter dated June 10, 2009 No. 03-01-15/6-305, the Ministry of Finance cites completely different theses - that:

- work books are purchased by the employer not for the purpose of selling to employees;

- Providing a work book to an employee is not a service.

Electronic work books, mandatory for use from 2020, will help avoid these issues. For details, see the material “How to switch to electronic work books from January 1, 2020.”

Taking into account the contradictory positions of officials, the enterprise needs to independently assess all possible risks and choose the optimal accounting scheme, which must be enshrined in the accounting policy. However, our opinion is that a work book is not a product, and now we will tell you why.

Payment for books

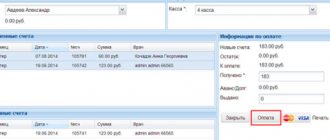

Every month, data is submitted to the accounting service about funds received from employees as reimbursement for the cost of work books and their inserts. The money is accepted by a responsible official with the obligatory execution of a receipt order.

The employee does not pay for the work record form immediately upon hiring the position. The compensation fee for the form is charged to him at the time the document is issued.

The employee does not reimburse the cost of a new work book provided that:

- the employer made mistakes when making the first entry on the form, so the document had to be sent for destruction and an additional blank form was required;

- the document was damaged due to the fault of the enterprise management;

- personnel work books are lost or damaged as a result of an emergency.

Also see “Entering a missed entry in the work book.”

Arguments in favor of the fact that a work book is not a product

The workbook should not be considered a product because:

- A product is property that is sold or is subject to sale, that is, transferred from one person to another on a reimbursable basis (clause 3 of Article 38 of the Tax Code of the Russian Federation, clause 1 of Article 39 of the Tax Code of the Russian Federation). The transfer of goods on a reimbursable basis is secured by an agreement (Article 423 of the Civil Code of the Russian Federation). An agreement (or transaction) presupposes the expression of the will of 2 or more parties (Article 154 of the Civil Code of the Russian Federation, paragraph 50 of the Resolution of the Plenum of the Supreme Court of the Russian Federation dated June 23, 2015 No. 25). At the same time, the transfer of a work book from an employer to an employee occurs not by virtue of their will, but by virtue of the requirements of the Labor Code of the Russian Federation and the Rules. In fact, the law obliges them to carry out a legal relationship in the form of transferring a work book, while citizens and legal entities are free to enter into contracts (clause 1 of Article 421 of the Civil Code of the Russian Federation).

- According to paragraphs. 3–4 of the Procedure approved by Order of the Ministry of Finance of the Russian Federation dated December 22, 2003 No. 117n, the only “legal” seller of books is GOZNAK (or authorized organizations). Other persons do not have the right to implement them (appeal ruling of the Bryansk Regional Court dated 05/07/2013 in case No. 33 1206/2013).

- A company that charges an employee a fee for a work book receives an amount no more or less than it spent, that is, it actually reimburses its own costs for acquiring it. Such operations are not recognized as sales (resolution of the Federal Arbitration Court of the North-Western District dated March 2, 2007 No. A56-44214/2006).

There is one more nuance: the collection of compensation is provided for only by the Rules, while the Labor Code of the Russian Federation - a legislative act higher in the legal hierarchy - does not mention it and does not impose such an obligation on the employer.

What transactions should be used when purchasing or writing off a workbook in 1C and other programs?

The fact of purchasing a work book within the framework of the scheme that we offer is reflected in the accounting registers by posting Dt 76 Kt 51 (in the amount corresponding to the purchase price of the forms).

Next, before the first entry is made in them, the books are placed on off-balance sheet accounting as BSO - posting Dt 006.

When registering a copy of the work book for an employee, the registers reflect the fact that the form has been written off - Kt 006. At the same time, the employee’s debt to the employer is reflected: Dt 73 Kt 76 (in the amount that corresponds to the purchase price of the form).

When compensating the cost of the book, the employee deducts the amount from his salary: Dt 70 Kt 73 (or Dt 50 Kt 73, if the compensation went through the cash register).

If the employee refused to compensate for the cost of the work book (and, as we already know, he has the right to do so), the registers reflect the occurrence of other expenses: Dt 91 Kt 73.

You can learn more about the features of BSO accounting in 1C in the article “Procedure for maintaining BSO accounting in 1C: Accounting (nuances).”

What accounting entries should reflect the acquisition and issuance of a work book to an employee?

If an organization charges a fee for issuing work books, the transaction is reflected in account 73 “Settlements with personnel for other transactions.” If the organization withholds the fee for the work book form from the employee’s salary, use account 70 “Settlements with personnel for wages”.

Type of organization: charitable, non-profit organization on the simplified tax system. Funding from the founder target 86 account. We do not use the score 91.2. According to the employee's application, the cost of work records was withheld 1012 rubles from their salaries. What wiring should I make?

This is interesting: What personnel documents should an organization have in 2021

What work logs should be used?

In accordance with paragraph 40 of the Rules, the employer must keep logs. Resolution of the Ministry of Labor of Russia dated October 10, 2003 No. 69 approved the form of journals:

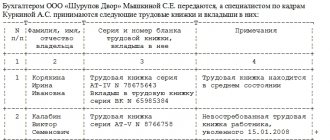

- Accounting for blank forms and inserts - that is, a receipt and expenditure book that contains information about BSO suppliers. Accounting is usually responsible for its maintenance.

- Accounting for completed work books and inserts. Maintaining this document is usually the responsibility of the personnel department.

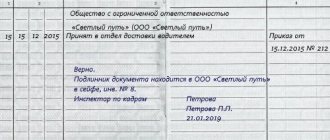

Both of these journals must be (clause 41 of the Rules):

- numbered;

- laced (that is, stitched);

- certified by the director's signature;

- secured with a wax seal or seal.

The forms of both documents were introduced by the above-mentioned Resolution 69.

Storage period for journals (Order of the Federal Archive of Russia dated December 20, 2019 No. 236):

- registration of forms in the organization’s archive - 5 years;

- accounting of work books and inserts - 75 years.

At the same time, the firmware and sealing of these documents has a number of nuances.

Procedure for maintaining the accounting book

Enterprise managers appoint persons responsible for maintaining the journal. The movement of documents is carried out in the company's accounting department.

When maintaining records, the procedure established by the Rules is applied:

- The magazine sheets are numbered and stitched with thread. The tabular part of the document after stapling must be accessible for writing and reading or photocopying.

- A seal is installed on the firmware indicating standard text about the number of sheets, the name of the enterprise and information about the certifying person. The entry must be certified by the signature of the director or a substitute person in accordance with the order.

- Records of the movement of forms or inserts are made in the book. Documents are issued to the personnel officer responsible for maintaining work records.

- Records are kept for each document indicating the series and number.

At the end of each monthly period, the responsible person must provide a report on the movement of books, the quantity at the beginning and end of the period, and whether they are registered. Additionally, indicate the amount of funds received to compensate for the costs of the enterprise.

What is it for?

- For order in working with work books.

- To determine liability for the loss of work books and their inserts.

Current legislation obliges employers to have, maintain and store this document (Section VI of the Rules approved by Government Decree No. 225 of April 16, 2003).

Who fills it out

The book is filled out and maintained by the employee responsible for documenting the hiring and dismissal of employees.

Most often in an organization it is:

- personnel officer

- accountant

- HR manager

Any other employee may be appointed by order of the employer as the person responsible for maintaining, filling out and storing this document.

Technical nuances: how to flash a work record book

The technology for flashing workbook logs is not legally established anywhere. To resolve this issue, we suggest that you use the recommendations of the Ministry of Finance, reflected in letter No. 03-02-RZ/62336 dated October 29, 2015, and concerning the rules for preparing copies of documents required by the Federal Tax Service during tax audits.

So, the Ministry of Finance advises:

- sew with a strong thread using 2–4 punctures when bringing the thread to the back of the document;

- affix the stapled document with the signatures of the responsible persons indicating their full names;

- indicate information about the number of sheets, the date of signing the journal;

- bind a document so that any page can be easily read or photocopied.

However, this is not all - it is necessary to comply with the legally established rule for sealing or sealing magazines.

How to fill it out correctly?

Filling out the income and expenditure book of work books starts from the first page . Here the name of the organization is indicated in strict accordance with the constituent documents (charter or agreement of establishment).

Data on the starting date of maintaining the book is also filled in. The end date, total number of records, and storage periods are indicated at the end of the book.

The second page is intended for recording information about the responsible persons maintaining the book. The full name of the person responsible, the dates he kept the book, the basis document are indicated, and the signature of this person is affixed.

From the third page to the end of the magazine there is a form for recording forms. It consists of 12 columns. Records of new labor and inserts are made immediately after their acquisition or transfer to personnel officers.

They purchase forms from GOZNAK or from official distributors; the fact of purchase is formalized in a contract. The transfer is made upon the application of a specialist from the personnel department, drawn up in free form, indicating the required quantity.

The basis for writing off forms as expenses may be damage or loss, which is documented in an act.

Column 1. “No.” The serial number of each entry is written in Arabic numerals.

Columns 2, 3, 4. “Date”. The date and month are indicated by two Arabic numerals, the year by four. When receiving forms, the date of signing the contract is indicated, when on vacation - the date of filing the application, when writing off - the date of drawing up the act.

Column 5. “From whom it was received or to whom it was issued.” Write the name of the company that sold the forms or the position, initials and surname of the recipient of the forms (applicant).

For example: “IP “Blankdistribution”, or “HR Specialist I.I. Ivanova”.

Column 6. “Base”. Information about the document on the basis of which the forms were received or issued is entered.

For example: “Invoice No. 345 dated 09/30/2015” or “Application dated 09/28/2015 No. 3”.

If damaged forms are written off, indicate information about the write-off act.

Columns 7, 8, 9. “Parish”. To be completed when purchasing forms. The “Quantity” column indicates how many pieces were received, their series and numbers. For example: “8 pieces, AN series, numbers from 0205588 to 0205606.” In the “Amount” column - the total cost of payment, this is the basis for calculating the amount of compensation received from employees.

Columns 10, 11, 12. “Consumption”. Fill in the same way as columns 7-8. The “Amount” column indicates the amount of payment made by the employee of the organization or deducted from his salary. At the discretion of the organization, this payment may not be collected from employees.

If damaged forms are written off, their total cost is indicated. If the damage occurred through no fault of the employee (incorrect entry, loss as a result of force majeure), payment is borne by the company.

Application of seals and wax seals

If a seal is preferable for the employer, then it must be made using a special device, the procedure for use of which is regulated by GOST 31282-2004.

Such a device must:

- have signs of identification;

- protect the journal from unauthorized changes in its structure;

- ensure protection of the seal from intentional violation of its integrity.

Among the most convenient seals, which are provided for by the specified GOST, are film ones. In their structure there are areas where you can record the date of sealing of the document.

The employer should also issue a local legal regulation regulating:

- procedure for using sealing devices;

- the procedure for recording seals (for example, in a separate journal);

- actions of employees upon detection of a violation of the integrity of seals.

As for the use of wax seals, it may look less preferable compared to fillings, because:

- sealing wax can crumble over time (while the magazines in question have a long shelf life);

- sealing wax must be heated using potentially flammable devices before use, and their use in an employer's office may not be advisable.

But if sealing with wax is still chosen, the following should be fixed at the level of local legal acts:

- print format (its content);

- the procedure for using the seal by employees;

- lists of documents that are certified by such a seal.

Violations in recording work records: responsibility

Violations in the accounting of work books, which lead to untimely provision of work books to employees, may be a reason for applying the following sanctions to the employer, provided for in paragraph 1 of Art. 5.27 Code of Administrative Offenses of the Russian Federation:

- a fine of 1,000–5,000 rubles for employers with the status of individual entrepreneurs and officials;

- a fine of 30,000–50,000 rubles for employers with the status of legal entities.

Violation of the procedure for accounting work books can lead to a fine of 5,000–10,000 rubles imposed on an official (Clause 1 of Article 15.11 of the Code of Administrative Offenses of the Russian Federation).

In both cases, repeated violations lead to significantly increased sanctions.

If the work books are lost from the archives of the enterprise with the personal connivance of the employer, then the sanctions provided for in Art. 325 of the Criminal Code of the Russian Federation: a fine of up to 200,000 rubles, correctional labor, imprisonment.

You can learn more about the procedure for an enterprise to bear responsibility for violations of the procedure for recording and storing work books in the article “What is the responsibility for non-use or loss of BSO?”

Category “Questions and Answers”

Question No. 1. When applying for a job, the employer asked me to bring a blank work record book, purchased at a bookstore or kiosk. Is this legal?

Legislation obliges employers to provide work books to newly hired employees (if for some reason the work book is missing). The only point is that upon dismissal, you will have to reimburse the cost of the work book, for which the employer will make the appropriate accounting entry.

Question No. 2. Our newly created company plans to recruit employees with appropriate registration in accordance with labor legislation. Please tell me how to ensure the safety of work records?

Work books are official documents of strict accountability, which must be stored in cabinets or safes that prevent loss or damage.

Results

Accounting for work records is a mandatory procedure for organizations. The choice of accounts for its management is a very controversial issue and is interpreted ambiguously by officials. We propose to use a scheme in which work books are accepted for accounting as BSO.

You can learn more about the features of accounting for work records in the articles:

- ;

- “How to properly certify a work book - sample”.

Sources:

- Labor Code of the Russian Federation

- Decree of the Government of the Russian Federation dated April 16, 2003 N 225

- tax code

- Resolution of the Ministry of Labor of Russia dated October 10, 2003 No. 69

- order of Rosarkhiv dated December 20, 2019 N 236

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.