Each organization is obliged to monthly calculate its income, expenses, as well as the profit or loss received, and reflect this data on its accounting accounts. A total of three accounts are used for these purposes - “Sales”, “Other income and expenses”, “Profits and losses”, that is, 90, 91 and 99, respectively. After closing each of them at the end of the year, the total result is calculated, as a result of which the activity of the enterprise for 12 months is recognized as profitable or unprofitable.

At the moment we are interested in account 90, intended to reflect transactions for the sale of goods, provision of services, and work related to the main activities of the organization. In addition, it is the main account for VAT, excise taxes and export duties included in the price or charged on products sold. It has a number of features that will be discussed in detail in this article.

Trade and its types

Trade “in general” is the resale of any material assets. A businessman buys goods and then sells them at higher prices.

The following types of trade are distinguished:

- Wholesale. In this case, goods are usually sold in large quantities. Sometimes - not very large, but in any case it is not a single product. As a rule, both the seller and the buyer in wholesale sales are legal entities or individual entrepreneurs.

- Retail. This is the sale of goods individually or in small quantities. Buyers here are usually individuals.

- Commission. It is carried out within the framework of both retail and wholesale trade. In this case, the seller (commission agent) receives the goods from its owner (committent) and sells them to third parties for a fee.

Description of the “Value Added Tax” account

Subaccount 90.03 “Value Added Tax” reflects the amount of VAT that is due to be received from the customer (buyer). Postings to the account are made upon the fact of services rendered, work performed, products shipped. Receipt of funds from the customer is reflected in the credit of subaccount 90.03. The basis for posting amounts in subaccount 90.03 is an invoice.

Accounting account 90 is an active-passive “Sales” account, used to reflect information related to the sale of finished products for the main activity of the enterprise. The account is one of the most difficult in terms of accounts. Its peculiarity is that at the end of the period it must be closed without any balance. Using standard postings and practical examples for dummies, we will understand the specifics of using account 90 and consider closing account 90 at the end of the month and at the end of the year.

Accounting in wholesale trade

To record the values sold, account 41 “Goods” is used.

Receipts of goods from the supplier are recorded in correspondence with account 60 “Settlements with suppliers and contractors”.

DT 41 – KT 60

If a businessman works on a general system, then the amount excluding VAT goes to account 41, and the tax itself is reflected in account 19.

DT 19 – CT 60

Purchasing goods often involves additional costs. These are transport services, loading, for imports – customs payments, etc. As a general rule, they should be included in the cost of the product using the same posting as its purchase price.

However, small businesses that qualify for simplified accounting may not allocate shipping costs to individual items. They have the right to attribute these amounts to current costs (clauses 13.1 - 13.3 PBU 5/01)

To account for current expenses, trade organizations use account 44 “Sales expenses”.

Services of third parties are reflected by postings:

DT 44 – KT 60 (76)

DT 19 – KT 60 (76) - when working with VAT

Thus, it is necessary to take into account not only delivery costs for small businesses, but also all other “external” services that are associated with the sale: advertising, packaging, insurance, etc.

Account 44 also takes into account the company’s internal costs: salaries, insurance premiums, depreciation of equipment, etc.

DT 44 – KT 70 (69.02...)

Sales in trade are reflected in account 90 “Sales” in correspondence with account 62 “Settlements with buyers and customers”.

DT 62 – KT 90.1 – goods shipped

DT 90.3 – KT 68.2 – VAT charged on sales

DT 90.2 – KT 41 – cost of goods sold written off

DT 90.2 – KT 44 – current sales expenses written off

DT 51 (52.50) – CT 62 – payment received from the buyer

Account 90 “Sales”: general characteristics

All income recognized as revenue from the company’s ordinary activities is recorded in account 90 “Sales” in accordance with accounting rules. It can be called quite complex due to the need to open several sub-accounts that are regularly used by the accountant to reflect certain transactions. Every month throughout the year, debit and credit turnovers accumulate on each of them.

Let us immediately note a distinctive feature - it is completely closed only at the end of the year when calculating the final financial result. Interim totals for the subaccounts are written off to the “Profit/Loss from Sales” subaccount every month, and with the beginning of a new month, the turnover for the remaining subaccounts accumulates again.

Accounting transactions are reflected both as debit and as credit, depending on what they are for the organization - income or expenses. It is important that the revenue is related specifically to the main activity of the company. In all other cases, the “Other income and expenses” account is used, which reflects any one-time results (for example, the result from the sale of a fixed asset).

Retail Accounting

Retailers have the right to keep inventory of goods in two ways:

- At purchase prices

With this option, revenue accounting is similar to wholesale trade. Each unit of goods is reflected in accounting based on the supplier's price and (if necessary) additional delivery costs.

DT 41 – KT 60

DT 19 – KT60

When selling at retail, the entire amount of revenue received per day is reflected in account 90. Correspondence here can be with account 50 when selling for cash or with accounts 51 or 57 “Transfers in transit” when using acquiring. The need to use account 57 is due to the fact that many banks do not immediately credit incoming non-cash proceeds to the businessman’s account.

DT 50 (51.57) – CT 90.1 – revenue accrued

DT 90.3 – KT 68.2 – VAT on revenue

DT 90.2 – KT 41 – cost of goods sold is written off.

- At sales prices

Unlike wholesalers, retailers know in advance at what price they will sell the product. Therefore, it is possible for them to record received goods at future sales prices. In this case, the cost of the goods “falls” into account 41, already taking into account the markup. And to the two receipt transactions discussed above, a third is added, using account 42 “Trade margin”.

DT 41 – KT 60

DT 19 – KT60

DT 41 – CT 42

Thus, a markup on them is added to the purchase price of goods, which is already reflected in account 41. The total amount of the markup for all purchased goods is “collected” on account 42.

Basic transactions for sales and cost accounting will also be similar to the first option. But in this case, on account 41, the goods are taken into account along with the markup, so the amount of written-off cost will be equal to the sales amount.

To highlight a businessman’s income, the cost of goods sold should be reduced by the amount of the markup on them. To do this, additional posting is required for the debit of account 42 and the credit of account 90.2

But account 42 is passive, so it cannot have a debit balance. Therefore, the necessary posting is carried out by “reversal”, i.e. with a minus sign. In accounting practice, such transactions are traditionally highlighted in red.

DT 90.2 - KT 42 (RESTORNO)

Formation of sales results at the end of the month

Turnovers for all subaccounts are calculated at the end of each calendar month, then the financial result is displayed. It can be both negative and positive. This is defined as follows:

- The balance is calculated for each subaccount - for credit 90-1, for debit 90-2, -3, -4 and -5 (if any).

- Next, the total turnover on the debit of account 90 is added up, from which the turnover on the loan is subtracted. You can talk about profit or loss depending on what sign the value turns out to be (plus or minus). In the first case, if expenses exceed income, there will be a loss, in the second - profit.

- Then the financial result is reflected using subaccount 90-9 and, according to accounting rules, written off to account 99. If a profit is made, then the entry “Dt 90-9 - Kt 99 (Profit and Loss)” is used, if a loss, then the reverse entry is “ Dt 99 - Kt 90-9." This will be the closing entry of the month.

Next month, we transfer the corresponding balance to each section of the newly opened “Sales” account. Accounting for transactions continues - and so on monthly until the end of the year.

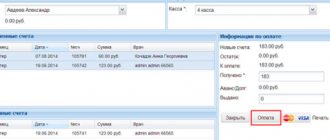

Example of accounting for account 90

Let’s say in March 2014 we sold creativity kits, delivering two batches. The cost of the first was 50 thousand rubles, and the revenue was 80 thousand. VAT was charged on this amount in the amount of 12,203.40 rubles. The cost of manufacturing the second batch is 70 thousand rubles, and the proceeds from this operation are 120 thousand. The tax was assessed in the amount of 18,305.08 rubles. What correspondence should be compiled for these transactions for accounting purposes? The following accounting entries will be used:

- Dt 90-2 - Kt 43 - 50,000 rubles - the cost of the first batch of products sent for sale was written off;

- Dt 62 - Kt 90-1 - 80,000 rubles - revenue from the first batch of goods sold is reflected;

- Dt 90-3 - Kt 68 - 12,203.40 rubles - VAT on sales was charged on the first batch of goods.

Using similar entries we reflect 70,000 rubles - the cost of the second batch of sets; 120,000 rubles - proceeds from the second batch; 18,305.08 rubles - VAT accrued on the second batch.

By posting “Dt 90-9 - Kt 99” (49,500 rubles) we show the profit from the shipment made for March.

Let us explain the above entries. During March, all sales were recorded, and VAT was charged on each batch sold. Then, at the end of the month, the balance of account 90 was calculated (in terms of subaccounts, debit and credit) and a financial result was obtained, which was written off to account 99: (50,000 + 70,000) + (12,203.40 + 18,305.08) - (80,000 + 120,000) = - 49,491.52 rubles. A negative value indicates that there was a profit in March.

Accounting in trade in case of damage to goods

With any type of trade, valuables in the warehouse sometimes lose their presentation. In such cases, account 94 “Shortages and losses from damage to valuables” should be used.

DT 94 – KT 41 – damage to goods detected

Further operations depend on whether the amount of losses “fits” the established norms of natural loss and whether the culprit is found.

DT 44 – KT 94 – write-off within the limits of natural loss

DT 73 – CT 94 – losses attributed to the guilty party

DT 91 – CT 94 – excess losses are written off as losses (if the culprit is not found)

If accounting in account 41 was carried out taking into account the markup, then it would be incorrect to write it off as losses on damaged goods, since the company did not receive this income. Therefore, one more additional wiring will be required.

DT 94 – KT 42 (STORNO)

Calculation of the annual financial result and complete closure of the account

The end of the year means for the accountant that the accumulating account 90 must be brought to zero. To do this, you need to close each subaccount using debit or credit 90-9. It happens this way:

- We reset the credit balance to 90-1. To do this, we use the wiring “Dt 90-1 - Kt 90-9”.

- To bring the debit balance for 90-2 to zero, we make the entry “Dt 90-9 Kt 90-2”.

- In the same way, we write off the Value Added Tax, which was accrued under debit 90-3. The wiring looks like this: “Dt 90-9 Kt 90-3.”

- If there were excise taxes and duties, we calculate the turnover on them and attribute them to the debit of subaccount 90-9.

- We calculate the final balance in the “Profit/Loss from Sales” subaccount. As a result of all transactions made, it should be equal to zero.

Account 90 “Sales” is completely closed. From the first month of the new year, it will be reopened to account for operations to generate income from sales within the company's activities.

If, when checking in the balance sheet, you see balances of 90, then you need to check whether the previous periods (month/quarter) were closed correctly. And depending on the software you're running, manually reformat or recalculate closing transactions.

These entries are part of the so-called annual balance sheet reformation, carried out before the preparation of final statements.

Accounting in commission trade

Accepting goods on commission is something between trade and services. The commission agent sells the goods of the principal and receives remuneration from him for this.

- Accounting with a commission agent

The commission agent does not become the owner of the valuables being sold, therefore he takes into account their receipt off the balance sheet, in the debit of account 004.

When the goods are sold, revenue is reflected in the debit of account 62 (for wholesale trade) or accounts 50, 51 (for retail sales). Account 76 is credited, in which it is necessary to allocate a separate sub-account for settlements with principals.

DT 62 (50.51) - KT 76.1

The commission agent does not charge VAT. This tax is paid by the owner of the goods - the principal, if he has such an obligation.

At the same time, the goods sold must be written off to the credit of off-balance sheet account 004.

The commission agreement may provide that part of the commission agent's own expenses for the sale is reimbursed by the principal.

DT 76.1 – KT 60 (10,69,70...)

The remaining costs associated with the sale of consignment goods are borne by the commission agent himself.

DT 44 - CT 60 (10,69,70...)

The commission agent's remuneration is reflected in accounting as any provision of services.

DT 76.1 – KT 90.1

If the commission agent pays VAT, then this tax must also be charged.

DT 90.3 – KT 68.2

Next, you need to write off the commission agent's unreimbursed expenses for the sale.

DT 90.2 – KT 44

Based on the results of the transaction, the commission agent pays the principal the cost of the goods sold, minus his remuneration and reimbursable expenses.

DT 76.1 – KT 51 (50)

- Accounting with the principal

At the time of transfer of the goods to the commission agent, it should be reflected in account 45 “Goods shipped”.

DT 45 – CT 41

When the commission agent sells the goods, the principal must reflect this operation as a regular sale.

DT 62 – KT 90.1

DT 90.3 – KT 68.2

DT 90.1 – KT 45

The commission agent's remuneration, including VAT, and his reimbursable expenses must be taken into account by the principal as part of the sales expenses.

DT 44 – KT 60

DT 19 – CT 60

Structure 90: subaccounts and their purpose

Accounting on account 90 is carried out in the context of subaccounts, of which several can be opened. The main ones include the following:

- “Revenue” (90-1) - reflects income from the sale of products, goods, (90-2) - is intended to account for the cost of products sold.

- “Value added tax” (90-3) - this reflects the amount of VAT that is charged on sales.

- “Excise taxes” (90-4) - necessary for accounting for excise taxes assigned to the cost of products sold and goods.

- “Export duties” (90-5) - duties associated with the transferred goods are taken into account.

- “Sales profit or loss” (90-9) is the final result of the organization’s activities at the end of each month.

Income from the sale of products, goods and services is reflected in credit 90, and the cost and costs associated with their acquisition are reflected in debit. In the first case, subaccount 90-1 is used, in the second - subaccounts 90-2, -3, -4 and -5.