Account 76: dividend payments

Sub-accounts to account 50 are opened in accordance with the recommendations in Instruction 94n:

- 50-1, on which all cash movements are to be reflected: receipts from sales, salary payments, cash deposits to the bank, etc. When making payments in foreign currency, it is necessary to organize analytics for each type of currency;

- 50-2 is used if necessary when there are operating rooms, that is, several cash registers remote from the main office, in which the receipt of money for a shift is recorded in the book of the cashier-operator, and not in the cash book;

- 50-3 is used to account for monetary documents in the amount of costs for their acquisition; a separate analytics is created for each type of document.

They reflect in chronological order all the data on the account for the selected period, and the total is transferred to the general ledger. Maintaining them is not mandatory.

Subaccount 55-2 “Checkbooks” takes into account the movement of funds in checkbooks.

The main account has been replenished. Postings on deposit transactions for 51 accounts Let's assume that Osen LLC transferred 2,000,000 rubles to the deposit. at 10.5% per annum (compound interest) for one year.

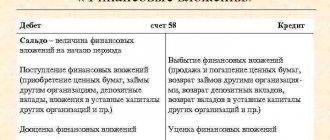

The sale of securities (in our case, shares) is a completely familiar procedure that requires a special approach. Cash and other funds received as payment for these important documents can be accounted for through several methods and options :

- Together with the credit account, which is opened specifically for these purposes, or under account 76, which is referred to as “Settlements with various debtors and creditors.”

- In the form of targeted income from investors for the purchase of shares on the credit of account 86 (a special sub-account is used for this). The account itself is called “Targeted Financing”.

- As additional capital under Kt 83.

- According to the CT of the special subaccount for account 80.

- By credit of a new account, which is formed specifically for the implementation of these targets.

Account 50 in accounting: typical entries, examples

According to the instructions for using the Chart of Accounts for accounting financial and economic activities, position 50 exists in order to summarize data on the availability and movement of funds held in the cash register of organizations.

The account in question contains several subaccounts , for which certain accounting transactions are also carried out:

- 75-1. We are talking about settlement transactions for deposits in the fund. Here the accounting of settlement actions with the participants of the company on deposits is carried out. In the process of creating a joint-stock company, a debit in correspondence with line 80 takes into account the amount of debt associated with the payment of shares. If we are talking about the actual receipt of deposit amounts in the form of money, entries are made in correspondence with the accounts associated with the accounting of money. Thus, the count is often used in a system with a line of 10, 15, 08, 80, etc.

- 75-2. Here the calculation actions related to the payment of income are reflected. Records are kept of settlements with the founders of the company for the payment of interest payments to them. To fully reflect various operations, correspondence with lines 84, 70, 68 is used.

Account 86 in accounting Typical entries for account 86 Examples of using account 86 in an organization Results Account 86 in accounting Account 86 “Targeted financing” is used to control funds received from third-party companies and budget organizations to perform certain tasks.

Line 1530 indicators at the end of the previous two years are usually transferred from the balance sheet for the year preceding the reporting year.

Table of accounting entries for account 50

As a rule, cash payments are used in organizations whose activities are related to retail trade. After all, the amount of revenue that the company receives goes to the cash desk in the form of cash. Let's look at typical cash transactions in retail organizations:

| Dt | CT | Description | Document |

| 50.01 | 90.01.1 | Receipt of sales proceeds to the organization's cash desk | Cash register |

| 50.01 | 90.01.1 | Receipt of income from other operations into the organization's cash desk | Cash register |

| 50.01 | Transfer of cash from the cash desk to the bank for subsequent crediting to the organization’s current account | Account cash warrant | |

| 55.01 | 50.01 | Transfer of cash from the cash desk to the bank for subsequent crediting to a special account of the organization | Account cash warrant |

An enterprise can use its own cash to pay contractors (suppliers of goods, contractors, etc.). These transactions are reflected in accounting by the following entries:

| Dt | CT | Description | Document |

| 50.01 | Payment to the supplier (contractor) for goods received (work performed) | Account cash warrant | |

| 50.01 | Refund of advance payment to the buyer from a special bank account | Account cash warrant | |

| 76 | 50.01 | Repayment of debt to other counterparties | Account cash warrant |

| 04 | 50.01 | Acquisition of an intangible asset | Account cash warrant |

An important aspect of using account 50 is the accounting of cash settlements with personnel. Through the cash register, an enterprise can pay:

- employee remuneration (salary, bonuses, allowances, etc.);

- funds to report for business needs;

- travel expenses.

Accounting for these transactions is reflected in the following entries:

| Dt | CT | Description | Document |

| 50.01 | Payment of salaries to employees in cash through the cash register | Account cash warrant | |

| 50.01 | Return to the cash desk of unused funds issued to an employee for business needs | Receipt cash order | |

| 73 | 50 | A loan was issued to an employee of the company | Account cash warrant |

| 50 | An employee of the company was given an advance for a business trip | Account cash warrant | |

| 69 | 50 | Debt on contributions to social funds was repaid in cash through the cash register | Account cash warrant |

In addition, account 50 is used to reflect cash settlements with the company’s shareholders, as well as with the participants of the partnership:

| Dt | CT | Description | Document |

| 75 | 50 | Dividends were paid to shareholders | Receipt cash order |

| 80 | 50 | The debt to the participants of the simple partnership has been repaid | Receipt cash order |

| 81 | 50 | Redemption of the organization's own shares | Receipt cash order |

| 58.4 | 50 | Contribution of cash by a participant as a contribution to the partnership share | Receipt cash order |

Using line item 50 in accounting

We will tell you about the latest news and publications. Read us anywhere. Always be aware of the main thing!

Results Posting Dt 90 Kt 90 means closing the internal subaccounts of account 90 in accordance with the financial result obtained.

Wiring diagram (3):

- Dt 76 Kt 86 – for the amount of concluded contracts, as they are concluded;

- Dt 50, 51, 55 Kt 76 - for the amount of actual receipts from investors (shareholders) as funds are received;

- Dt 08.3 Kt 60, 76, etc.

Transfer of special clothing and footwear from the warehouse into operation are documented with internal wiring: Dt 10/11 - Kt 10/10.

Similar entries in Accounting

Situations may arise in an organization when:

- in the reporting period, shortfalls from previous periods were identified that should be closed in the future;

- income has been received or accrued in the current period, but it can only be accepted in the future;

- etc.

Monitoring of account transactions is carried out on the basis of cost items, which, in turn, allows you to quickly determine the directions of accounting policy to minimize costs and maximize profits.

The purpose of using the funds is to purchase a plot of land for the construction of a printing factory (construction period - 1 year). On January 24, 2015, the funds were credited to the current account of Status Plus LLC.

If there is no established limit, it automatically takes on a zero value; the entire cash balance must be transferred to the bank daily.

Acceptance and transfer certificate State financing of a manufacturing enterprise Let's consider an example: Status Plus LLC received funds from the state budget in the amount of 3,985,000 rubles.

Account 76 is also used to reflect transactions under a commission agreement. Let us recall that a commission agent is an economic entity that provides intermediary services under an agreement with the principal.

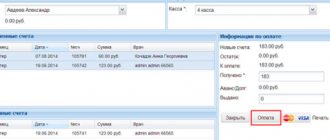

At the same time, 50,000.00 rub. 51 counts. accounting account 51. debit 51 account Each operation for the movement of funds on a current account must be documented with a primary document: a check, payment order, collection order, announcement for a cash contribution, and the corresponding accounting entry: Important! The basis for making entries are cash receipts and expenses (form KO-1 and KO-2).

A separate author's commentary for each of the postings indicated here can be found in the database of this module.

In addition to advance receipts from clients, it is advisable to reflect on this account such types of income as:

- payment for rent stipulated by the contract, received in advance ahead of the deadline specified in the contract;

- subscription fee for the operation of telephone landline and mobile communications and the Internet, paid by counterparties before the onset of the periods specified in the contracts;

- property and assets that the organization has capitalized under donation documents;

- planned receipts for shortages that occurred in previous periods, but are documented in the current period.

The debit of account 50 “Cash” reflects the receipt of funds and monetary documents at the organization’s cash desk. The credit of account 50 “Cash” reflects the payment of funds and the issuance of monetary documents from the organization’s cash desk.

Business entities, taking into account the specifics of their activities, can perform cash transactions while observing the rules of cash discipline.

All employees of the organization receive wages for their work. Labor costs “fall” onto the cost of production (goods or services). Account 70 is intended to reflect settlement transactions with the organization's personnel. In addition to wages, this includes benefits, bonuses, financial assistance, issuance of work clothes, etc.

Dt 76 - Kt 51: rent was transferred by the tenant to the landlord; the debt to the transport company, communication organizations, etc. has been repaid.

For your convenience, we store all files in Word format; the text can be printed, edited or used at your discretion.

Accounting for monetary documents

IMPORTANT! A sample log of receipt, issuance and write-off of monetary documents from ConsultantPlus is available at the link

Instructions for using the chart of accounts 157-n (clause 170) provide for the registration of incoming and outgoing transactions with cash documents using cash orders, incoming and outgoing transactions.

At the same time, the inscription “stock” is required on cash orders. Orders for the movement of monetary documents are registered in the cash register and cash register registration journal separately from those similar in cash movement.

In the cash book for monetary documents, separate sheets marked “stock” are also filled out. Receipt of monetary documents occurs in the event of receipt from a counterparty or a surplus identified during inventory. Disposal is characterized by expense transactions through accountable persons, write-off of identified shortages and return to the supplier, if such a condition is fixed in the contract with him, etc.

In the journal of transactions for other transactions (using f. 0504071), based on the cashier’s report and the primary documentation for it, all transactions involving the movement of monetary documents are reflected. The law does not prohibit the creation of your own journals for recording monetary documents in compliance with all the necessary details in their form.

Typical entries for accounting for monetary documents may be as follows:

- Dt 50.3 Kt 60, 76 – monetary documents were received from the supplier and other counterparties;

- Dt 60, 76 Kt 51 – payment of monetary documents;

- Dt 76 Kt 50.3 – a monetary document was sold to employees of the company (voucher);

- Dt 50.1 Kt 76 - the employee paid for the trip through the cashier or Dt 91.2 Kt 50.3 - monetary documents were written off for expenses.

Transactions for the accounting of monetary documents with the participation of accountable persons are discussed in detail below.

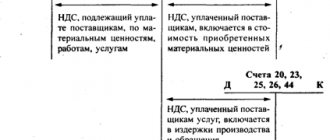

VAT on purchased monetary documents should be taken into account on account 19 only if the amount is allocated in the document itself or in the invoice received with it. Otherwise, it is prohibited to allocate VAT (letter No. 03-07-11/01 of the Ministry of Finance dated 10-01-13). The monetary document is credited to account 50.3 at the actual cost of its acquisition.

Application of account 76: non-tax payments

When making cash settlements, the company must set a limit on the cash balance (with the exception of individual entrepreneurs and companies related to small businesses). Proceeds in excess of the limits are transferred to the bank for crediting to the current account in person or through collection. An exception is the days when employees payroll.

Accounting account 90 is synthetic, active-passive, depending on the subaccount used in a particular situation. It does not have a balance (remaining) at the beginning and end of the period and is not reflected in the balance sheet. The main purpose of this account is to determine the financial (interim) result from the operation of the enterprise for the current period.

You can identify a large number of directions with which line 75 interacts, here is an approximate list of them.

- 01 "OS";

- 04 “Intangible assets”;

- 07 “Equipment intended for installation, building materials”;

- 08 "Long-term investments";

- 10 "Materials";

- 11 "Animals";

- 41 "Commodity items";

- 43 “Finished food units”;

- 50 "Cash register";

- 51 “Calculation directions”;

- 58 “KFV – short-term financial deposits”;

- 52 "Settlements with buyers";

- 58 “Calculation activities for taxes”;

- 80 "Statutory fund";

- 82 "Reserve capital";

- 83 "Additional Fund";

- 84 “Profits that have not been distributed”;

- 91 “Other receipts and deductions.”

The production (full) cost of manufactured products is formed on costing accounts and written off to account 41, 43, 45, 40. At this price, it is taken into account in the finished goods warehouse, where it is stored until the moment of sale.

Account 50 “Cash” in accounting

Documentation of cash transactions, setting mandatory limits, rules for mutual settlements with counterparties in cash are carried out within the framework of the norms prescribed in the Directive of the Bank of Russia dated March 11, 2014 No. 3210-U.

Obtaining reliable information about the structure, dynamics, and volume of operating results is possible only if the data is correctly reflected in the specified accounts.

Regardless of the area, any company can receive income that must be attributed to future periods in accordance with approved regulations.

In the case under consideration, subaccounts corresponding to the type of fee or duty paid can be opened to account 76.

Account 76: application by partnerships

Each subaccount is filled throughout the year with business transactions. The generated turnover at the end of each period is closed at 90/9 and has no intermediate balance. The financial and economic result of work for the month is calculated as the difference between the debit turnover and the total credit turnover of the subaccounts.

To reflect assets recognized according to PBU (accounting regulations) 9/99, subaccount 90/1 was created as income from the main activity. It takes into account revenue from products sold, work performed, goods sold, services, etc. The amount of income received appears on the credit of the subaccount in correspondence with account 62 “Settlements with customers” by debit.

Let's assume that one of the company's employees was given an advance to purchase paper for the office. The amount of the advance was 3,700.0 rubles. In fact, the cost of the purchase was 3,820.0 rubles, while the amount of VAT was 573.0 rubles. The overspent portion of the funds was returned by the employee by depositing cash into the company cash desk.

If we talk about the standards regarding the cash register limit, then the latter should be understood as the maximum allowable amount of cash that is allowed to be stored in the cash register of the enterprise at the end of each working day. The organization sets the designated limit independently based on the amount of revenue received by issuing an internal order.

Typical debit entries*

Debit | Credit | Operation |

| 50-01 | Other cash receipts | |

| 50-01 | 50-02 | Cash was deposited from the operating cash desk to the main cash desk |

| 50-01 | 51-00 | Funds withdrawn from the current account (salary, benefits...) have been received at the cash desk. |

| 50-01 | 52-01 | Cash withdrawn from a foreign currency account has been received at the cash desk |

| 50-01 | 55- | Funds withdrawn from a special bank account were received at the cash desk |

| 50-01 | 57-00 | The cash was received at the cash desk in transit (sent by transfer) |

| 50-01 | 60-00 | Refund of amounts previously paid in excess by the supplier |

| 50-01 | 62-00 | Cash received from buyers (customer) has been received at the cash desk. |

| 50-01 | 66-00 | Cash received under a short-term loan agreement was received at the cash desk |

| 50-01 | 67-00 | Cash received under a long-term loan agreement has been received at the cash desk |

| 50-01 | 71-00 | Cash previously issued on account has been received at the cash desk |

| 50-01 | 73-01 | Cash received from employees previously provided in the form of a loan |

| 50-01 | 73-02 | The cash desk received funds from employees to compensate for swearing. damage |

| 50-01 | 75-01 | The funds contributed to the authorized capital have been received at the cash desk |

| 50-01 | 76-01 | Cash received from the insurance company |

| 50-01 | 76-02 | Cash received from the recognized (awarded) claim |

| 50-01 | 76-03 | Cash received at the cash desk on account of dividends from participation in other organizations |

| 50-01 | 79-02 | Cash received from the branch (parent company) |

| 50-01 | 79-03 | Cash was received at the cash desk on account of profits from trust management |

| 50-01 | 80-00 | Cash was received at the cash desk as a deposit under a joint venture agreement |

| 50-01 | 86-00 | Targeted financing funds have arrived at the cash desk |

| 50-01 | 90-01 | Cash received at the cash desk for products, goods, works, services sold |

| 50-01 | 98-01 | Cash received at the cash desk from deferred income |

| 50-01 | 98-02 | Free funds received at the cash desk |

| 50-01 | 99-00 | Cash received at the cash desk as a result of emergency events |

*the most frequently used wiring is marked in yellow

| Top of page |

Correct wiring dt 90 kt 86 01

Summarizing the above, it is impossible to credit income to a balance sheet asset that cannot currently be compared with the expenses related to them.

If the property is on the balance sheet of the lessor:

- Dt 76.9 Kt 51 - lease payment transferred;

- Dt 20 Kt 76.9 - the lease payment is reflected in the accounting;

- Dt 19 Kt 76.9 - VAT is taken into account in the lease payment.

A gradual transition to the new rules is provided, depending on the activities carried out by companies and individual entrepreneurs, which will be fully completed in July 2021.

Cash documents and accountable amounts

Purchasing monetary documents by bank transfer, as a rule, does not cause difficulties or questions for an accountant, while transactions of accountable persons with monetary documents have features that are important to remember.

Let's look at an example. Let manager Sidorov A.A. received an order from management to purchase air tickets. For this purpose, he was given 27 thousand rubles for the report. The tickets are intended for employee I.I. Ivanov, whom the company sent on a business trip. Sidorov purchased 2 tickets: round trip at a price of 10 and 12 thousand rubles, respectively, including VAT. The VAT rate on air tickets is 10%. VAT is highlighted on the ticket.

The following entries will be made:

- Dt 71 Kt 50.1 - 27,000.00 rub. - issued to Sidorov A.A. to report for the purchase of tickets for Ivanov I.I.

- Dt 50.1 Kt 71 - 5000.00 rub. — Sidorov A.A. returned the balance of the unused accountable amount to the cashier.

- Dt 50-3 Kt 71 - 10,000.00 rub.

- Dt 50-3 Kt 71 — 12000.00 rub. — purchased by Sidorov A.A. were capitalized tickets.

- Dt 71 Kt 50-3 - 22000, 00 - tickets for the trip were issued to Ivanov. I.I.

The VAT amount for 1 ticket is RUB 909.09. The VAT amount for the 2nd ticket is RUB 1,090.91.

- Dt 19 Kt 71 - 2000.00 (909.09+1090.91) rub. — VAT deductible on purchased tickets

- Dt 44 Kt 71 - 20000.00 (9090.91+10909.09) rub. - based on the av. report of Ivanov I.I. The cost of tickets is included in expenses, excluding VAT.

By the way! Monetary documents that have no time interval between their storage and use are not reflected in account 50.3, but are immediately included in the supporting documents of the advance report. For example, a used ticket purchased by a business traveler at the ticket office of a transport company is not reflected in account 50.3.

Please note that in relation to coupons for fuel and lubricants, the definition of “monetary documents” is not always applicable. Coupons received from the supplier after prepayment must have value indicators, and not natural, liter ones. Only in this case are they recognized as monetary documents. Fuel cards, as another option for purchasing fuel, are also problematic to recognize as monetary documents, since they lack a cost indicator.

Postings for “cash” coupons for fuel and lubricants can be made as follows:

- Dt 60 Kt 51 - an advance payment has been made to the supplier.

- Dt 50.3 Kt 60 - coupons received.

- Dt 71 Kt 50.3 - coupons were issued to the dispatcher for reporting.

- Dt 20 Kt 71 - the dispatcher reported on the use of coupons. The cars were in main production.