Special social support measures are provided for disabled children in Russia. Thus, they are subject to payments that are not provided for some other preferential categories. In 2021, their sizes have been updated.

Having a child with a disability is a challenge for parents. In some cases, families are entitled to serious compensation for the illnesses of minors. Thus, in Irkutsk, a woman was ordered to pay 1 million rubles, since the perinatal center did not notice anomalies in the development of the fetal eyes in a timely manner. But this is a special case. Typically, support for disabled children is limited to social programs.

Which children are recognized as disabled

Based on Federal Law No. 181 of November 24, 1995, a disabled person is a person who has a permanent impairment of health due to illness, injury or congenital defects and who cannot lead a full social life due to the complete or partial loss of necessary skills.

This provision applies to both adults and children; all of them equally need to undergo a special medical and social examination (MSE) in order to receive the status of a disabled person.

Medical and social examination will need to be repeated every 1, 2 or 5 years, depending on the disease. But there are diseases, for example Down syndrome, in which disability is issued once and for all.

For children under 18 years of age, disabilities are not divided into groups like for adults; they are simply assigned the status of “disabled child.”

Determination of disability usually occurs at the local ITU bureau, but if parents do not agree with the decision of the commission, they can contact a higher authority - the Federal ITU Bureau.

The examination is scheduled within 30 days after filing the application. The commission announces its decision immediately. If the ITU was in absentia, then the decision is sent by mail.

The ITU Commission must not only announce its decision on paper, but also issue a special certificate, with which one must then apply for various payments.

How much do they pay for families raising disabled children?

If a family has adopted a child who has a disability, then the social service department pays such a family a lump sum - 124 thousand 929 rubles 83 kopecks.

Maximum amount of payments for children

Allowance for maintenance and care of children who have disabled status:

- If parents or adoptive parents (guardians) serve children - 19 thousand 930 rubles 57 kopecks;

- If care and maintenance is carried out by another person, the amount of the benefit is 15 thousand 630 rubles 57 kopecks.

When providing care for a disabled minor from childhood:

Disability group No. 1:

- If the mother, or the father, or a guardian serves, the amount of charges is 20 thousand 942 rubles 03 kopecks;

- If served by a stranger - 16,642.03 rubles.

Child disability group No. 2 - the benefit is 12,446 rubles. 79 kopecks

Disability group No. 3 - the amount of accruals is 6238 rubles. 84 kopecks.

Child disability group No. 2

Who can receive payments for disabled children

Not only his parents, but also any other legal representatives, for example, grandparents, other relatives, guardians, and trustees can receive all the required payments and benefits for a disabled child.

When applying for benefits, it will be enough to attach to the list of required documents the child’s birth or adoption certificate, or another document confirming the fact of relationship. For example, grandparents must additionally attach the birth certificate of their child, that is, the father or mother of a disabled child.

What instead of a certificate

What documents, instead of a certificate from the other parent’s place of work, must be provided to receive additional days off to care for a disabled child, if the other parent does not work or provides himself with work?

In this case, each time an employee applies for additional days off, he must submit documents (copies thereof) confirming that the other parent does not work or provides himself with work.

A document confirming that the second parent is not in an employment relationship can be his work book, if it does not contain a current record of employment.

If the second parent is registered as unemployed, then the supporting document may be a corresponding certificate issued by the employment service authority.

Persons who provide themselves with work include, in particular, individual entrepreneurs, lawyers, and private notaries. For example, a certificate of state registration of an individual as an individual entrepreneur can serve as a document confirming entrepreneurial activity.

The status of a lawyer can be confirmed by an appropriate certificate.

What payments and benefits are due to a disabled child and his parents?

At the federal level, disabled children and their parents are paid pensions, compensation and part of the funds from maternity capital if the child is born second or next in the family.

Social pension

The main and main benefit that is paid to a disabled child is the social disability pension. In 2021, its size is 13,804 rubles. It is indexed annually.

If a disabled person lives in the Far North or other regions with difficult climatic conditions, then the benefit is increased by the regional coefficient, which is constantly valid in such regions. For example, in the city of Norilsk there is a regional coefficient of 1.8, which means the amount of the benefit will be equal to: 13,804 * 1.8 = 24,874.20 rubles.

To receive a pension, you need to contact the pension fund and provide the following documents:

- statement;

- parent's passport;

- child's birth certificate;

- document confirming citizenship;

- act of the commission that conducted the ITU.

The pension is assigned from the 1st day of the month in which the applicant applied, and is paid starting from the next month.

A pension is paid until the age of 18. With the onset of adulthood, another examination is required by the ITU commission, which will assign a disability group or remove the disability.

List of social privileges

Social services are social protection services that are provided in kind to children, and parents can also receive equivalent compensation in money for them.

In order to receive financial compensation for services, you must submit an application to the Pension Fund and indicate which social services. The child will receive services in kind, and for which services the child will receive cash payments.

The amount of NSO accrued for 2021:

| set of social security services provided | equivalent in money |

| the whole range of services provided | 1048 rub. 97 kopecks |

| · provision of medications in accordance with the doctor’s prescription; | 807 rub. 94 kopecks |

| · provision of specialized medical products; | |

| · providing food products that have a medicinal effect. | |

| providing vouchers for treatment in a sanatorium or at a resort. | 124 rub. 99 kopecks |

| free travel by road and rail to the destination for treatment and the return journey. | 116 rub. 04 kop. |

If a disabled person must travel and undergo treatment, accompanied by a social worker or mother, then the second voucher is issued to the mother or an accompanying person.

Also, free travel is provided for mothers who accompany children of this category to the place of treatment or rehabilitation.

When calculating EDV, NSU can be received in kind. You can receive a social package of services only if you provide a certificate from the Pension Fund of Russia.

The help has the following content:

- Child status category: disabled child, or disabled since childhood;

- Up to what age is EDV accrued;

- What services provided is he entitled to use in 2021?

This certificate is provided at railway ticket offices, or at bus stations to obtain a travel ticket, as well as at medical clinical institutions and pharmacy kiosks.

If a family refuses to provide NSS and wishes to receive compensation, then the application must be submitted before October 1, 2021 in order to receive payments from January 1, 2021.

Benefits for disabled children

This category of citizens is provided with federal benefits, as well as benefits provided by local and regional authorities.

Housing benefits are provided to families with children with disabilities:

- 50.0% discount for housing and communal services payments;

- 50.0% discount for telephone.

Benefits in the amount of 50.0% of the total cost for the use of transport are provided to disabled children from October 1 to May 15 inclusive on all types of transport. There is also a discount of the same amount for one accompanying parent.

In the summer, this category of children can take advantage of the benefit only once, accompanied by their mother or father.

Tax benefits for disabled people under the age of majority:

If real estate is registered in the name of a child, then he is exempt from paying property tax.

In accordance with tax acts, parents raising such children are provided with a tax deduction on income (monthly) in the amount of RUB 3,000.00.

A deduction is also provided for the treatment of a minor in the amount of no more than 120 thousand Russian rubles.

When such a child visits a preschool educational institution, the kindergarten management must provide a range of rehabilitation services for the child’s accelerated adaptation to society.

The following benefits also exist for such children:

- Enrollment in a preschool educational institution outside of the waiting list;

- Interruption of a child in kindergarten is fully funded by the state;

- If the children are ready for school, then he has the right to a home form of education (children with cerebral palsy must study at home);

- Disabled people who wish to study at universities have privileges to enroll in a budget-funded form of education without competition, if they successfully pass exams during the admission period.

If real estate is registered in the name of a child, then he is exempt from paying property tax.

Medical

According to the law on disabled people, disabled children receive benefits in medical care:

- Receiving medications without payment, as prescribed by the doctor;

- Free prosthetics, including dental prosthetics;

- Providing orthopedic shoes;

- Wheelchairs;

- Vouchers for a sanatorium type of treatment and an additional voucher for an accompanying person.

Social benefits, in addition to unpaid travel, as well as the provision of medical devices, and for families raising disabled children, priority is provided in Russia for receiving housing

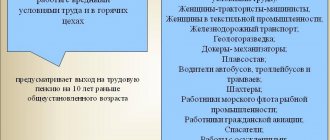

Labor privileges for parents

According to the labor code, mothers who work in enterprises and have children with disabilities who are not yet 16 years old must work part-time and receive wages in accordance with the hours worked.

An employer does not have the right to force a woman who is raising a disabled person to work beyond the allotted time, and also, if she refuses, does not have the right to fire her, or lower her wages.

One of the two working parents is entitled to preferential days off, but no more than 4 days per month.

Parents can divide the weekend at their own discretion, or one person can take advantage of this benefit.

If a business trip is planned at work, then a woman who is raising a disabled person has the right to refuse the trip without violating the law in her refusal.

An employer does not have the right to refuse a woman who has come to apply for a job just because she is raising a disabled child.

For such a refusal, the head of the enterprise faces administrative liability.

If a parent cannot work for the reason that constant care is needed for a disabled person with group No. 1, then the parent is entitled to a social benefit, which is paid monthly.

When a child with 2 or 3 disability groups reaches 18 years of age, then they are not entitled to care, and the parent automatically stops receiving maintenance and care benefits and can go to work.

Benefits for disabled children and their parents

In addition to financial assistance, families with disabled children are entitled to various benefits, for example, a tax deduction for working parents or preferences for children when enrolling in universities.

Such families receive land plots as a matter of priority, if such is provided in the region. Let's consider such cases in more detail.

Tax deduction for parents

According to Article 218 of the Tax Code of the Russian Federation, parents and guardians of a disabled child are entitled to tax deductions, and in an increased amount.

- parent in the amount of 12,000 rubles;

- adoptive parents and guardians - 6,000 rubles.

Moreover, this tax deduction comes in addition to the usual deduction for children, which is equal to 1,400 rubles for the first and second children and 3,000 rubles for the third and subsequent children. This decision was made by the Presidium of the Supreme Court of the Russian Federation.

We recommend that you study the detailed article about tax deductions on our website.

Benefits for disabled children when entering a university

Disabled children have a priority right to enroll in a university.

In different universities, the conditions for enrolling children with disabilities differ and admission is possible according to one of 3 options:

- enrollment without entrance exams;

- enrollment after passing exams;

- priority enrollment. If, for example, two students have the same entrance scores, preference is given to the disabled student.

The benefit for entering a university is provided only once.

Amount of security and subsidies in 2021

| name of financial payment | disabled children | disabled people from childhood | ||

| group No. 1 | group No. 2 | group No. 3 | ||

| social type of security | 11903 rub. 51 kopecks. | 11903.51 | 9919.73 rub. | 4215.90 rub. |

| cash payment, which is carried out monthly (if you refused the NSO package) | 1478 rub. 09 kop. | 2489 rub. 55 kopecks | 1478 rub. 09 kop. | 973 rub. 97 kopecks |

| 2527 rub. 06 kop. | 3538 rub. 52 kopecks | 2527 rub. 06 kop. | 2022 rub. 94 kopecks | |

| NSO (set of social services for a child) | in financial equivalent - 807.94 rubles. + 124.99 rub. + 116.04 rub. = 1048.97 rub. | |||

| payments for maintenance and care of sick children (every month) | · for parents and official guardians - 5500.00 rubles; · for strangers - 1200.00 rub. | no accruals provided | ||

Pension for a disabled foster child

In order for adoptive parents or guardians to receive a pension for a disabled child under their care, they need to contact the Pension Fund of the Russian Federation and provide a standard list of documents plus an order to appoint guardianship or create a foster family.

While the child was in the orphanage, the state paid him a pension, but it went to a special bank account. Guardians and adoptive parents cannot receive this money. Part of the funds can be withdrawn only with the permission of the district guardianship department. You need a good reason for this. For example, payment for urgent treatment, expensive medicine or rehabilitation equipment.

After the child is accepted into the family, the pension is paid to the nominal account of the guardian or adoptive parent. To do this, you need to open a nominal account in any bank and transfer its details to the Pension Fund of the Russian Federation.

The rights of a disabled child to receive a social pension

Children with disabled status are entitled to a social pension benefit, which has a fixed amount.

These benefits are indexed every year. This pension is accrued for disabled children until their 18th birthday.

If, after 18 calendar years, MSEC leaves a disability, then new accruals occur in the pension fund, but the amounts of payments will differ slightly.

In order to be able to receive social security for disabled children, in accordance with the Law, you need to submit the following documents to the Pension Fund:

- Permanent registration in the territory of the Russian Federation of the applicant;

- A document that confirms the identity of the applicant;

- Confirmation of disability (MSEC certificate);

- Document confirming the birth of the child;

- For adoptive parents or guardians - a decision on adoption, or the provision of guardianship.

What are the EDV requirements?

Monthly financial support is paid to all families with disabled children. In addition to EDV, the child is also entitled to free social services.

The amount of the EDV depends on the fact whether the patient’s family uses NSU, or whether they receive compensation for services translated into a monetary equivalent.

| the amount of the EDV with the preservation of the NSO, or not | disabled child | disabled since childhood | ||

| group No. 1 | group No. 2 | group No. 3 | ||

| with a full NSO package | 1478.09 | 2489.55 rubles | RUB 1,478.09 | RUB 973.97 |

| upon refusal of the NSO package | 2527.06 | RUB 3,538.52 | 2527.06 rub. | RUR 2,022.94 |

| While maintaining the rights of a person with childhood disabilities to: | ||||

| DLO, and along with it for sanatorium treatment, as well as resort rehabilitation, but if you refuse the services of the railway | RUB 1,594.13 | 2605.59 rub. | RUB 1,594.13 | 1090.01 rub. |

| receiving medications | 1719.12 | 2730.58 | 1719.12 | 1215 |

| treatment in a sanatorium, but refusal of DLO, as well as railway services | 2402.07 | 3413.53 | 2402.07 | 1897.95 |

| free tickets for railway transport, as well as for receiving medications | 1603.08 | 2614.54 | 1603.08 | 1098.96 |

| free transport by rail, as well as treatment in sanatoriums | 2286.03 rub. | RUB 3,297.49 | 2286.03 | RUR 1,781.91 |

| free tickets for travel on railway transport, and waiver of DLO and sanatorium | 2411.02 | 3422.48 | 2411.02 | 1906.9 |

In order to apply for EDV, the parent must contact the territorial department of the pension fund, where the applicant was accrued a pension for a disabled person.

To accrue EDV, you need to write an application (there is a standard form), and also submit the following types of documents:

- A document confirming the identity of the applicant;

- MSEC extract;

- Documents that confirm the right to EDV;

- Statement of what services the family refuses.

MSEC extract

Remember

- To receive disability benefits, you need to pass a special ITU commission.

- Not only parents, but also any other legal representatives of the child can receive benefits and benefits.

- In 2021, the size of the social disability pension is 13,804.46 rubles.

- A disabled child is entitled to monthly cash payments (MCB), or a set of social services (NSS); payments can be partially combined with services.

- Compensation payment to parents, guardians, adoptive parents of a disabled child is equal to 10,000 rubles. per month.

- Money from the maternity capital certificate can be spent on purchasing rehabilitation equipment for a disabled child.

- Parents and guardians of a disabled child are entitled to a tax deduction when paying personal income tax. The first in the amount of 12,000 rubles, the second - 6,000 rubles.

- Parents of a disabled child can retire early. Women at 50 years old, men at 55 years old.

- At the regional level, authorities also pay benefits and compensation. their size is established by local governments.

- Parents are required to pay child support for their disabled adult children.

- Families with disabled children can apply for improved housing conditions.

- The disability pension stops being paid when the child reaches 18 years of age, unless he is assigned disability group 1.

Video for dessert: 11 Most Amazing Inhabitants of the Mariana Trench

Regional payments

Subjects of the Russian Federation have the right to establish their own types of support for children with disabilities. Thus, in Moscow and the region, families are entitled to an additional allowance of about 12,000 rubles. Residents of St. Petersburg receive 6,223 – 14,021 rubles transferred to their social card. for children with mental disorders. The funds cannot be cashed out, only spent on the needs of the recipient.

Own payments for disabled minors exist in Yaroslavl, Samara and other regions. But their sizes are usually smaller than those in the capital.

0

Grounds for termination of payments

In some cases, payments to guardians of a disabled child may be cancelled. This is possible if:

- The recipient of the benefit stopped caring for the disabled person. There may be several reasons for this, including the death of the ward or the guardian himself;

- The guardian returned to the workplace and stopped continuously caring for the disabled person. Also, financial support will be interrupted if a person begins to receive unemployment benefits or goes on an age pension with social contributions;

- The disabled person turned 18 years old, and after passing the commission he was assigned category 2 or 3 disability. Upon receipt of category 1, payments do not stop;

- The disabled person was no longer entitled to a social pension. The assignment of benefits is directly related to receiving a pension based on the condition of the body, so if one stops, the other will also stop;

- The money the guardian receives is spent inappropriately.

When the weekend won't work

Additional days off are not provided in the following cases:

1. If the employee requests unused days off for the previous calendar month. Additional days off unused in a calendar month are not transferred to another calendar month.

2. If the employee requests additional days off during the period of the next annual paid leave, leave without pay, leave to care for a child under three years of age. At the same time, the other parent (guardian, trustee, other person raising a child without a mother) retains the right to four additional paid days off.

If an employee is given additional days off during the specified periods, the employer may be denied reimbursement for the costs of paying them.

If circumstances arise that entail the loss of the right to use additional paid days, the employee is obliged to notify the employer about this.

If it is discovered that additional days off have been provided to an employee who did not have the right to do so, the employer may be denied reimbursement of expenses for their payment, including if he did not know or could not know about these circumstances.