Measures to eliminate the violation

When you receive an order, you must carefully study it and outline an action plan to correct the violation. The response itself must be provided only after the relevant measures have actually been carried out (no later than the deadline specified in the administrative document). These measures include:

- Development of various documentation - orders, contracts, agreements, safety instructions, manuals for workers and many others.

- Conducting training events – for example, on safety precautions.

- Re-equipment of premises, vehicles, engineering systems - for example, installing a means of monitoring the presence of a car on the line. Financial documents are provided confirming the purchase of equipment, furniture, etc.

- Sending explanations in connection with the elimination of the violation to all divisions of the company, branches and representative offices (confirmed by relevant letters, orders and other documents).

- Disciplinary sanctions against employees - this can be a reprimand, a reprimand, or even dismissal for appropriate reasons.

A response to a proposal to eliminate identified violations is drawn up only if the enterprise agrees with the position of the inspector. If there is disagreement, this can also be indicated in the letter. However, it is more important to first draw up a statement of appeal addressed to management or a claim to a judicial authority.

The circle of persons entitled to submit a proposal for elimination

A proposal to eliminate the causes and conditions that contributed to the commission of an administrative offense may be made by one of the persons considering the case. These include judges, government agencies and their representatives.

It is these officials who have the right to consider such cases. As the Code of Administrative Offenses regulates, in addition to judges, state bodies in whose department these offenses are located can consider cases of administrative offenses.

Attention! Our qualified lawyers will assist you free of charge and around the clock on any issues. Find out more here.

Let's look at an example. Part 1 of Article 14.4 of the Code of Administrative Offenses is associated with the sale of goods whose quality does not correspond to the samples, or the provision of services that do not meet the requirements of legal acts. Thus, if such offenses are detected, Rospotrebnadzor has the right to independently consider the case without involving the judiciary. Upon detection of such violations, Rospotrebnadzor will independently submit a proposal to eliminate the violation.

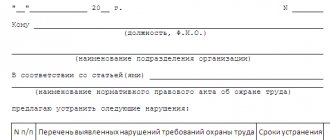

Sample response to an order to eliminate violations

There are no strict requirements for the sample response to instructions, so the company has the right to compose it in any form in compliance with the standard structure for such documents. The answer is drawn up on A4 sheets or on the organization’s letterhead. The text must reflect the following information:

- The name of the department, full name, position of its head or other employee in whose name the response was drawn up.

- Name of the organization, full name, position of the director sending the letter.

- Address, details and contact details of the company.

- Registration mark in the journal of outgoing correspondence (document number and date of sending).

- Title: “Response to the order to eliminate violations” indicating the number of this order and the date of its preparation.

- The actual text of the document contains a description of the specific measures that were taken to fulfill the requirements of the inspector or other official. Can be presented in the form of a list, table or other convenient way.

- Appendixes – a list of documents that confirm the fact of the measures taken.

- Date, full name, signature of the director, seal of the organization.

A sample of a real response to an order looks like this.

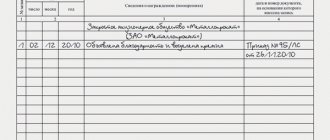

You can also create a document in the form of a table. The columns list the sequence of activities carried out, the requirements of the regulations that they fulfill, as well as specific content with references to the documents drawn up (orders, instructions, etc.).

Explanatory note on the fact of violations identified during inspections

The first option is preferable, especially in the case of an internal investigation, since even if explanations are not received from the employee within two days, it is impossible to draw up a report - there is no evidence that the employee was asked for explanations. Therefore, it is better to make a request in writing: in two copies, give one to the employee, and on the other let him sign for receipt and put the date. In what cases does this happen? An explanatory note is written in any cases where the employer considers it necessary to request an explanation from the employee on one issue or another. I discovered this at 8.00. She immediately called a repair team and tried to save her own property from damage. A team of workers arrived an hour and a half after my call, and they began work on fixing the leak at about 10.00. The repair was completed at 13.30. Since my working day lasts until 14.00, I didn’t have time to come to work. I am attaching to the explanatory note a certificate from the housing office confirming the break in the heating pipe and the fact that it was repaired.”

We recommend reading: Change of name charter

IMPORTANT! Documents for review are submitted in compliance with the requirements of the Law “On Personal Data” dated July 27, 2021 No. 152-FZ, Art. 6 of the Law “On the Procedure for Considering Appeals...” dated 02.05.2021 No. 59-FZ. In the event of an unscheduled inspection based on a complaint, the applicant’s personal data is not subject to disclosure without his consent (decision of the Constitutional Court of the Russian Federation dated December 22, 2021 No. 2906-O, resolution of the Constitutional Court of the Moscow Region (F05) dated October 15, 2021 in case No. A40-53027/2021).

Is the manager required to write a response?

First of all, it is important to understand that the organization is not required to prepare a report (response) on the measures taken, since it is assumed that the inspection body can subsequently organize a new scheduled inspection. Its purpose is to ensure that the company has taken all necessary measures to eliminate the violation, i.e. At the time of the new inspection, the order must be fulfilled.

However, if the manager writes a response and lists the actions taken, a secondary review may not follow if the inspectors consider that the actions described in the document are sufficient. Another important point is that during a new visit to the company, inspectors may find other violations. If you compose and send a comprehensive response in a timely manner, such a risk is practically eliminated.

Thus, failure to respond does not constitute a violation, and no penalties are provided for this situation. However, it is in the company’s interests to respond to the order in writing and eliminate any violations found.

02.06.2021List of unreliable companies from the Bank of the Russian Federation as of June 1, 2021.

Using a special monitoring system, the Bank of Russia identifies companies and projects with signs of illegal activity. Lists are published on the bank's website.

02.06.2021How to take into account costs that are prohibited from being included in the cost of NP and GP

As you know, starting from 2021, the cost of work in progress and finished products cannot include some expenses, including management. There aren't many of them. But, nevertheless, if they cannot be included in the cost, then how can they be taken into account?

02.06.2021VAT deduction on an invoice from a “simplified”

Organizations and individual entrepreneurs using the simplified tax system should not prepare invoices. But there is no prohibition on this in Chapter 21 of the Tax Code of the Russian Federation.

02.06.2021What should an accountant do if vacation pay is paid late?

Vacation must be paid no later than three full calendar days before it begins. What to do if the deadline for paying vacation pay is missed? After all, the company and the manager face liability for delays in payment.

02.06.2021Small Business Legal Mistakes

Legal problems are among the TOP 16 reasons why startups fail, according to the analytical company CB Insights. At the same time, in Russia, many beginning entrepreneurs often make similar, from a legal point of view, mistakes. We tell you how to minimize such risks.

02.06.2021Return from the cash register of cash received to the current account

A buyer who mistakenly paid for an item by bank transfer, most often, cannot count on a refund through the store’s cash register. The store will be able to return the cash only after it has deposited the money into the cash register from its own current account.

02.06.2021Can a company remain on the simplified tax system after reorganization?

The LLC was transformed into a JSC. Before the reorganization, the company used the simplified tax system. Is she considered to have switched to the simplified tax system after the reorganization? Or does the JSC need to submit an application to switch to the simplified tax system again?

02.06.2021The company is reorganizing: what about the contributions?

To optimize the production process, an organization may need to change the form of its existence, for example, to merge with another company. How to determine the base for insurance premiums in such a situation?

02.06.2021How to avoid pitfalls with a bank guarantee

When a company has doubts that its counterparty will fulfill its obligations under the contract, it may require a bank guarantee. But such security does not always work, and then you have to demand money from the bank. And he may not pay.

01.06.2021How to take into account cheap tools for different purposes from one invoice

Some inventories can be put into operation immediately upon receipt and written off as expenses for the current period. As a rule, this applies to a variety of cheap tools and other small items. In order to save time, many accountants take such inventories, even if they have different purposes, for accounting according to the supplier’s invoice as one item and write them off as expenses, one item at a time. However, this does not meet the requirements of FSBU 5/2019.

01.06.2021Mandatory appeal. How will the new order work?

Starting from the summer, it has become mandatory in Russia to appeal against the actions of auditors from 19 regulatory agencies. The magazine “Raschet” found out how the new mechanism will work.

01.06.2021Will the tax overpayment be refunded if there is an overdue arrears?

The organization wants to return the overpayment of overpaid tax. But she has an arrears on another tax, the collection deadline for which the tax authorities missed. Will the organization be able to return the overpaid amounts or will the inspectorate first count them against the existing tax debt? The answer to this question was given by representatives of the Ministry of Finance in a letter dated April 28, 2021 No. 03-02-11/32596.

01.06.2021New child benefits: you need to be low-income to receive them

Federal Law No. 151-FZ of May 26, 2021 established new types of targeted social benefits. They will be provided to single low-income mothers and fathers and pregnant women. The Ministry of Labor determines who cannot be considered low-income. He has already developed the criteria.

01.06.2021The new SZV-M came into force on May 30, 2021

By Resolution of the Board of the Pension Fund of April 15, 2021 No. 103p, the SZV-M form was changed. All accountants must submit the new form, starting with reporting for May 2021. SZV-M is submitted monthly on the 15th day of the month following the reporting month.

01.06.2021Sick leave for child care: new calculation rules from September 1, 2021

From September 1, 2021, new rules for calculating sick leave benefits for child care will come into force. Federal Law of May 26, 2021 No. 151-FZ.

01.06.2021The court allowed VAT deduction on the invoice issued by the partner on the simplified tax system

The organization claimed a VAT deduction, but the Federal Tax Service denied it. The basis for the refusal was the fact that the organization received the invoice from the counterparty using the simplified tax system. The company did not agree with this and went to court.

01.06.2021The court found that the company created fictitious document flow with its counterparty

The Federal Tax Service conducted an audit of the company’s activities and found that it had created a formal document flow with its counterparty to obtain unjustified tax benefits.

01.06.2021Criminal offense for negligence: clarifications of the Constitutional Court of the Russian Federation

An official of Rosreestr was accused of negligence after one of the citizens lost his plot of land due to the carelessness of a civil servant. During the investigation, the state registrar died, and his relatives were asked to close the criminal case. But his brother opposed it - he tried to achieve rehabilitation. The courts rejected him. This problem was dealt with by the Constitutional Court, which put an end to the matter (Resolution No. 21-P dated May 24, 2021).

31.05.2021The Armed Forces of the Russian Federation did not deny the income tax system a VAT deduction when returning to the general regime

The organization used the simplified tax system, but then switched to the general taxation regime. At the same time, she claimed VAT for deduction. The tax authorities refused the deduction due to the fact that during the period of issuing invoices the organization applied the simplified tax system with the taxable object “income”. The dispute went through all the courts and became the subject of consideration by the Supreme Court, which came to an unexpected conclusion.

31.05.2021When is salary deduction illegal?

Russian labor legislation provides for a large number of types of deductions from wages.

Each has its own limits and rules. Since there are many types of possible deductions, employers sometimes try to commit illegal actions. 1 Next page >>

Recommendations for drafting the document

The response is a progress report. It is drawn up on the basis of the regulation itself - a duplicate record of violated norms, links to relevant laws and other regulatory documents. The actions themselves must contain specific measures aimed at eliminating the violation.

In addition, the letter can indicate that the organization will take all possible measures to prevent the occurrence of such errors in work. The document is drawn up as briefly as possible in an official business style. All described actions must be supported by specific documentary evidence.

- in person or by courier;

- by mail (by registered mail with written notification and a list of attachments);

- by email, if the inspection organization allows this possibility.

It is better to prepare a response in advance so that the deadlines for eliminating violations are not violated; otherwise, the organization may face an administrative fine.

Source of the article: https://2ann.ru/obrazec-otveta-na-predpisanie-ob-ustranenii-vyyavlennyx-narushenij/

Explanatory note about an error in work

The regulatory authorities have a slightly different approach to this issue. For example, the Tax Code of the Russian Federation provides for a financial penalty for refusal to provide explanations. When it comes to situations involving the police or accident investigations, refusal to testify may result in criminal liability.

- An error in the amount of the calculated salary means trouble with the employee, even going to court;

- Understating obligations for taxes and duties - troubles and fines from the Federal Tax Service;

- Late payment or reporting deadlines are subject to administrative liability or sanctions under the Tax Code of the Russian Federation.

We recommend reading: Until what time will the hypermarket sell out alcohol?