Home / Labor Law / Payment and Benefits / Pension

Back

Published: 03/09/2016

Reading time: 8 min

2

7466

One of the categories of citizens who are entitled to receive a long-service pension are federal government employees.

All citizens who belong to this category can, upon the occurrence of certain conditions, apply for its receipt. The conditions and procedure for assigning pensions to civil servants, as well as the procedure for this procedure, will be discussed further.

- Requirements for applicants

- Calculation procedure Average salary for the last 12 months before retirement

- The amount of experience an employee has as a civil servant

Which civilians are entitled to a long-service pension?

Who can receive a pension for long service is regulated by Presidential Decree No. 1141 of September 20, 2010. There you can also learn about its indexing.

Thanks to this law, those employees who worked in positions approved by the Registers of government positions at various levels are entitled to receive a long-service pension. Here are those who are provided with a pension for long service:

- prosecutor's officers;

- employees of the RF IC;

- employees of structures responsible for tax collection;

- customs officers;

- municipal employees whose position is registered in the municipal service register;

- deputies of municipal self-government bodies;

- full-time employees of election committees of regions and localities.

Excerpt from Presidential Decree No. 1141

A special mechanics for calculating length of service is used in the Russian Federation in relation to some federal officials:

- employees of the Presidential Administration;

- members of the Federal Security Council;

- employees of the State Statistics Committee;

- members of the Control and Budget Committee under the State Duma;

- various types of employees of the Senate, State Duma, including senators and deputies;

- Russian diplomats and ambassadors;

- employees of federal courts and judicial bodies such as the Constitutional Court, the Supreme Arbitration Court, the Supreme Court of the Russian Federation;

- deputy staff positions in the CEC and the Accounts Chamber;

- employees of regional executive and legislative institutions.

Important! In addition, a pension for long service is provided to Crimeans who held positions in Ukraine similar to those that we have already listed. But this applies only to those workers who live in Crimea and have Russian citizenship.

Crimeans who have received Russian citizenship also have the right to a long-service pension

The age limit for male civil servants is 65 years, and for females - 60 years.

Classification of pensions by pension provision

According to Article 5 of Law No. 166 of December 15, 2001, a citizen is assigned one or another type of pension under certain conditions:

- for length of service;

- by old age;

- on disability;

- for loss of a breadwinner;

- social pension.

All these pensions come from the state budget. To receive any of them, a person must meet at least one of the following conditions:

- citizenship of the Russian Federation;

- fact of permanent residence in the Russian Federation.

There are several types of pensions

Important! A Russian citizen is not always required to live on the territory of the Russian Federation to receive a pension. But if a person does not have Russian citizenship, he will have to present a residence permit with a registration mark from the Federal Migration Service of the Russian Federation.

Registration by power of attorney

If the future pensioner does not have the opportunity to deal with issues of registration of pension payments personally, then he can delegate these powers to a third party. However, this fact must be certified in the manner prescribed by law, that is, a notarized power of attorney must be issued.

Important! A power of attorney can be drawn up for absolutely any person. The main condition is his full legal capacity.

The document itself should indicate the powers that the principal grants to the authorized person. For example, this is submitting documents to a pension fund. You can also specify the possibility of collecting various papers for the Pension Fund if the existing package of documents is incomplete.

Sample power of attorney:

And finally, there are cases when it is possible to establish this or that fact that is important for calculating a future pension only through the court. In this case, the power of attorney must provide powers related to the conduct of affairs by the authorized person in the interests of the principal in the courts.

Registration of a pension by proxy does not imply the transfer of the right to dispose of the funds received to the authorized person directly involved in this issue.

Under what conditions is a long-service pension granted?

Citizens who have worked in the following areas are entitled to receive this pension:

- federal civil service;

- aviation;

- astronautics;

- army.

To receive a pension for long service, former civil servants must meet the following conditions (Article 7 of Federal Law No. 166-FZ):

- experience of 15 years or more, and starting from 2021 - at least 15.5 years;

- retirement;

- age limit;

- reduction of employees or abolition of a federal body;

- dismissal for medical reasons.

Excerpt from Article 7 of Federal Law No. 166

To receive this pension, former pilots must meet the following requirements (Article 7.2 of Law No. 166-FZ dated December 15, 2001):

- service in units testing aeronautical and aerospace devices;

- experience from 25 (men) and 20 (women) years;

- if there was a dismissal for medical reasons, the working experience of a man must be at least 20 years, and for a woman - from 15;

- The long service pension is equivalent to an old age or disability pension.

It also states under what conditions cosmonauts receive a long-service pension:

- Russian citizenship;

- 20 (women) and 25 (men) years of experience;

- dismissal from a position that gives the right to receive a pension for long work experience.

You must have a certain length of service to receive a pension

According to paragraph 1. Art. 8 Federal Law No. 166, a long-service pension is assigned to military personnel under the following conditions:

- length of service of 20 years;

- at the time of dismissal, a combination of age from 45 years, total work experience from 25 years, of the last at least 12.5 years in military service.

What documents to submit

Regardless of the chosen method of filing an application, Russian legislation establishes a list of required documents. These include the following originals and their photocopies:

- identification documents of the applicant or his representative;

- application for a pension;

- documents confirming Russian citizenship and registration in Russia;

- professional documents confirming length of service and the classification of a person in a special profession;

- a certificate of wages and all additional payments paid to the citizen;

- documents confirming dismissal indicating an article of the Labor Code of the Russian Federation;

- if there is an illness for which the dismissal was made, it is necessary to submit a medical report from a doctor;

- if a person needs additional care, documents confirming this fact;

- documents confirming the presence of dependents.

This is what the statement looks like (clickable image)

applications can be found here.

The Pension Fund has the right to require other documents.

Long service pension for military personnel

Military personnel who are entitled to receive this pension:

- officers;

- warrant officers;

- midshipmen;

- soldiers;

- contract sergeants.

They can receive a long service pension if they served in Russian and/or Soviet security forces. And everyone except judges and prosecutors. In relation to the latter, their own pension system is used. Military pensions are financed from the budget of the department in which the pensioner served.

Military pensions are financed by the budget of the department where the citizen served

Here are the conditions required for a military long service pension:

- 20 years of experience in law enforcement agencies;

- if the maximum service life has been reached or further activity in the same field is contraindicated due to health reasons - at least 12.5 years of experience in law enforcement agencies and a total work experience of at least 25 years.

Important! When assigning a pension for mixed length of service, the entire period of work in areas regulated for insurance pensions is taken into account.

The following periods are also taken into account:

- work in other law enforcement agencies;

- activities in state federal bodies;

- being in enemy captivity;

- being in custody - only if the court has decided that criminal prosecution is illegal;

- study - under certain conditions.

When calculating length of service, time of service, study, etc. is taken into account.

If a citizen served in special or combat conditions, these periods of service give him additional incentives when calculating his pension. Years of study, on the contrary, give accruals half as much as service.

Pension reform 2021

Information about plans to increase the retirement age for police and military personnel appeared a long time ago. But only now can rumors become reality. The future bill on raising the retirement age involves postponing its date by 5 years. But in 2021, all payments are subject to indexation.

There is also information that an innovation could be the merger of the Ministry of Internal Affairs and the Federal Penitentiary Service. The authorities have long been looking for optimization of law enforcement agencies, and this alliance is an excellent solution. But the new law has not yet been issued, so it is too early to analyze it.

The reason for the reform is the economical use of budget funds. Police officers have high salaries, and they are periodically indexed.

Social assistance is also provided in the form of various benefits. All this requires money.

Articles on the topic (click to view)

- How much is added to the pension for years of service?

- How many years of service do you need for a military pension?

- Calculation of a municipal long-service pension: example

- Calculation of length of service for assigning pensions to military personnel

- What determines the size of the long-service pension?

- Municipal long-service pension in 2021

- Minimum military pension for length of service for military personnel

Now a large sum of 400 billion rubles is spent on salaries and pensions for employees of the Ministry of Internal Affairs. In addition, there is a constant need to update the material base, introduce innovations and improve the skills of workers.

Therefore, it is planned to save money, and therefore increase the retirement age.

But there are other reasons for the changes:

- elimination of the large difference between the age of former employees of the Ministry of Internal Affairs and ordinary pensioners;

- retention of experienced professionals in teams;

- Possibility for employees to work longer hours.

Previously, it was believed that to retire it was enough to develop the required length of service. This will probably continue to apply. It’s just that the age is planned to be increased.

Pension for civil servants

This pension is intended to partially compensate for the loss of income from work performed by a federal employee due to medical conditions or age limits.

To receive a long-service pension, a civil servant must have worked for at least the last year as a federal employee, namely in one of those positions that are included in the appropriate list approved by the President of Russia. But this rule is not relevant for those civil servants who were subject to staff reduction or liquidation of a government agency.

Civil servants are also entitled to a long service pension

Since May 2021, Federal Law No. 143-FZ has been in force. It makes changes to some regulations. Thanks to it, civil servants can work until a later age.

From 2021, the retirement age will increase by six months every year. This level will stop rising by 2024. Then she will reach 65 (for men) and 60 (for women) years. The age limit for civil service will also increase to 65 years.

Conditions for assigning an old-age insurance pension

The first is reaching the generally established age.

The law sets the generally established retirement age at 66.5 years for men and 61.5 years for women (currently 61.5 and 56.5 years, respectively). The change in retirement age will take place gradually: a long transition period is expected, which will begin on January 1, 2021 and end in 2028.

For those who were supposed to retire in 2019–2020, a special benefit is provided - retirement six months earlier than the new retirement age. Thus, a person who will have to retire in January 2021 will be able to do so already in July 2019.

It is worth noting here that some citizens may retire earlier. Lists of jobs, industries, professions, positions, specialties and institutions (organizations), taking into account which an early old-age pension is assigned, are approved by the Government of the Russian Federation.

Secondly , the insurance period in 2021 is 12 years. (The increase in length of service requirements occurs gradually and in stages: for ten years it increases by 1 year annually and by 2024 will reach 15 years).

Third - in 2021 - 21 individual pension coefficients (points). (The requirement for a maximum of 30 points is being introduced gradually, with subsequent annual increases of 2.4 until the specified value is reached by 2025).

Pension for astronauts

A citizen of Russia who holds the title of pilot-cosmonaut of the USSR or pilot-cosmonaut of the Russian Federation has special services to the Motherland. And therefore he has the right to receive a pension earlier than the deadline established for other citizens of the Russian Federation.

In order for an astronaut to be granted a long-service pension, it is required that his experience in the flight test unit reach 10 (if he is a man) or 7.5 (if he is a woman) years. The total length of service must be 25 (male) and 20 (female) years.

Excerpt from Article 17.1 of Federal Law No. 166

Important! If an astronaut is dismissed due to illness and/or other medical conditions, the requirements for length of service in the same unit do not change, but the requirements for total length of service are reduced by five years.

An astronaut can receive two pensions at once:

- for length of service;

- for old age - if you have the right to it.

Registration of labor pension

1) An application can be submitted:

- in the Pension Fund office at the place of residence, - in the Personal Account of the insured person (via the Internet), - by mail (the day of application will be considered the date of sending on the postmark);

2) considered:

within 10 working days from the day of receipt of the application with all necessary documents or from the date of submission of the missing documents (if they were submitted within three months).

For test pilots

Those who test new equipment for air travel, aerospace and landing as part of their work can retire after 25 (men) and 20 (women) years of this activity. However, only if at least 2/3 of the length of service was gained in the position that gives the right to a pension for long service.

Dismissed for medical reasons, such an employee has the right to receive this pension if he has served 20 (male) or 15 (female) years.

Test pilots are entitled to a long service pension

When a test pilot's pension is established, he is required to have previously participated in test flights for at least 2/3 of his total working experience.

Early retirement with 37 years of service for women

Raising the retirement age has become the most discussed event. No matter how complicated this process may seem, it was launched in 2021 with the entry into force of Law No. 350-FZ of October 3, 2018.

Pension legislation has undergone major changes, affecting almost every Russian. This topic was especially acute for those whose age was approaching the point when, according to the previously applied rule, the time had come to apply for a pension. It was for them that transitional measures were introduced aimed at easing population tensions.

One of these measures was the opportunity to apply for early retirement for those citizens who have a long career. Let's figure out how to implement early retirement for a woman with 37 years of service. After all, not all periods included in the total length of service are included in accounting for work activity.

New law

The new legislation raises the retirement age by 5 years. At the same time, some benefits are provided for different categories of citizens. An important innovation was the application of a rule that allows, if the necessary conditions are met, to retire a little earlier.

Federal Law No. 350 amended the Law on Insurance Pensions No. 400-FZ. Subclause 1.2 appeared in Article 8, according to which a woman has the right to apply for a pension early if she has the following parameters that she will have on the date of application:

- insurance experience with a total duration of at least 37 years;

- age 55 years.

If these conditions are met, a woman will be able to receive a pension 2 years earlier than the generally established age.

In the first years of the reform, due to the provisions called transitional, and the gradual increase in the retirement age, this norm will postpone the date of applying for a pension not by 24 months, but less, since the obligatory condition is reaching 55 years.

Work experience for early retirement

When establishing an old-age pension, all periods of working activity, as well as non-insurance periods, are taken into account when calculating length of service. All of them are converted into points, which are then converted into the pension amount using a formula.

However, for early retirement in the presence of long work experience, only periods of work for which insurance contributions were transferred to the Pension Fund of Russia are included. Work on the territory of the Russian Federation will be taken into account, as well as time spent on sick leave.

What periods of service will not be taken into account for early retirement?

Thus, from the calendar calculation of a woman’s long experience the following periods will be excluded:

- caring for a child until he reaches the age of 1.5 years;

- caring for an elderly citizen over 80 years of age, a disabled person of group 1 and a disabled child;

- being registered with the employment service and receiving appropriate benefits;

- moving in direction from the employment service to another locality for the purpose of employment;

- participation in paid public works;

- living with a spouse who is a military serviceman under a contract, as well as living abroad of the Russian Federation with a spouse who is a representative of a diplomatic or consular department, when it was not possible to find employment at the place of stay.

Note that for most women who have given birth and raised children, it will be quite difficult for them to earn 37 years of experience at the age of 55. Such an important period in the life of any woman will be excluded from the opportunity to take advantage of the right to early retirement.

But the government has introduced a new rule into the Law on Insurance Pensions, allowing mothers of many children to become pensioners earlier than the generally established age.

At the same time, previously those women who gave birth to and raised five children before the age of 8 were considered to have many children. Now, having given birth and raised three children, their mother has the right to apply for a pension 3 years earlier at 57 years old, and for four children - 4 years earlier at 56 years old.

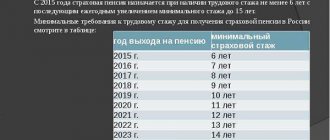

Table of length of service by year for retirement

In the first years of the pension reform (2019-2020), for persons whose age reaches 55 and 60 years for women and men, respectively, a reduction in the age established for transition periods by 6 months is introduced. Therefore, citizens with extensive work experience will be able to retire 1.5 years earlier in 2021.

The table shows how the new legislation will be applied to assign an old-age insurance pension. Accordingly, if you have the required length of service (37 years for a woman), the retirement age will be reduced.

| Year of reaching age 55 (women) | Year of birth | The right to a pension arises | Year of retirement |

| 2019 | 1964 (1st half of the year) | 55 years 6 months | 2019 (II half of the year) |

| 1964 (2nd half of the year) | 55 years 6 months | 2020 (I half of the year) | |

| 2020 | 1965 (1st half of the year) | 56 years 6 months | 2021 (2nd half of the year) |

| 1965 (2nd half of the year) | 56 years 6 months | 2022(I half of the year) | |

| 2021 | 1966 | 58 years old | 2024 |

| 2022 | 1967 | 59 years old | 2026 |

| 2023 | 1968 | 60 years | 2028 |

In conclusion, we present a mathematical calculation. In order for a woman at age 55 to have the right to early retirement with 37 years of work experience, she must begin working at age 18. At the same time, do not study full-time at an educational institution and do not be on parental leave for up to 1.5 years (other periods of care are the least popular).

Thus, 18 years + 37 years of experience = 55 years. The arithmetic is simple, but this option is too rare.

Source: https://trudtk.ru/stazh/dosrochnyj-vyhod-na-pensiju-pri-stazhe-37-let-dlja-zhenshhin/

How big is the superannuation for different categories of recipients?

The amount of the long-service pension for a federal employee is determined by Art. 14 of Law No. 166 of December 15, 2001. It is equal to 45% of the average employee’s salary.

If an employee has worked for more than 15 years, for each “extra” year his pension increases by another 3% of his monthly salary.

According to paragraph 1 of Art. 15 of the Law “On State Pensions”, law enforcement officers receive a pension according to Federal Law No. 4468-1 of February 12, 1993.

Factors key to the size of a military pension for long service:

- duration of service;

- rank and position;

- amount of allowance.

The size of the long-service pension is affected by the length of service, salary, etc.

The amount of the long-service pension is as follows.

| Conditions | Description |

| When exceeding 20 years | 50% DD + 3% DD for each year of service after this period. |

| With 25 years of mixed and general experience, while the experience specifically in this job is at least 12.5 years | 50% DD + 1% DD for each year over 25 years. |

The calculator below will help you calculate your pension amount.

Go to calculations

When the amount of pensions for cosmonauts and pilots is determined, the legislation imposes individual requirements on them, determined by the following factors:

- total work experience;

- number of hours spent in flight;

- duration of stay in special conditions during space/test flights.

What is included in the preferential period

definitely in this length of service :

- labor activity in Russia, when insurance contributions were paid to the Pension Fund;

- funded holidays;

- sick leave when short-term disability benefits were paid.

The benefit period differs from the insurance period in that it will not always include the following periods of time:

- being registered with the Employment Center;

- emergency service;

- maternity leave up to 1.5 years (but not more than 6 years in a lifetime);

- care for disabled people and elderly people over 80.

These indicators will be taken into account only if before or immediately after this period the person immediately got a job and contributions were made to the Pension Fund.

The grace period will be significantly less due to the lack of long periods. Therefore, early retirement is only possible for those who officially started working at a young age.

Procedure and duration of pension assignment

The procedure and terms for assigning a state pension are regulated by Art. 22 and 23 of the relevant Federal Law No. 166 of December 15, 2001.

You need to contact the Pension Fund office to apply for a pension.

Having received the right to this pension, it is necessary to submit an application for appointment personally or through a legal representative to the local branch of the Pension Fund at the place of residence, stay or actual application. At the same time, the application period is not limited. The pensioner can choose the method of contact:

- appear in person at the Pension Fund;

- contact Russian Post;

- online by logging into your “Personal Account”.

Note! Federal civil servants should submit an application addressed to the Chairman of the Board of the Pension Fund of the Russian Federation to their personnel service. If this federal body was reorganized/abolished, then the personnel service of the one that began to do what the liquidated one had previously done.

The long-service pension is granted from the 1st day of the month, which begins after the month in which the application was submitted. After that, the pensioner usually receives it for the rest of his life. But if the long service pension is attached to the disability retirement pension, the citizen receives it only until the insurance pension expires.

As a rule, a long service pension is paid until the end of life

Appointment dates

Pension Fund employees make a decision no later than 10 days from the date of submission of documents. After accepting the papers, the PFR specialist issues a receipt indicating the date of acceptance. From this moment 10 days are calculated.

If the decision is negative, PFR employees are obliged to notify the future pensioner in writing and by telephone about the reasons for the refusal and explain to him his rights to receive this type of pension.

If the decision is positive, the pension will be assigned from the beginning of the pensioner’s right to receive this payment. But the application must be submitted within the first year from the moment the right to do so arises.

If the documents are submitted later, the pension will be paid from the beginning of the month in which the application to the Pension Fund was made.

If, when applying, the future pensioner filled out the application incorrectly or did not submit a complete set of necessary documents, he is given the opportunity to submit the necessary papers within 3 months.

Documentation

Here are the documents that should be submitted when applying to the Pension Fund for a long-service pension:

- passport;

- application for a pension for long service;

- additional documentation.

Specialists may require documents from the last paragraph if they need to clarify and/or confirm information about the applicant’s work. You can find out exactly what you need in advance by visiting the Pension Fund in person. This must be done in order to submit the necessary papers in a timely manner.

You need to provide documents to apply for a pension

How is the superannuation paid?

This pension is delivered once a month. At the same time, the pensioner, while still in the pension fund, has the right to choose the delivery method, which can come through any of the following intermediaries:

- "Post office";

- any of the organizations that deliver pensions - a list of them is available in any branch of the Pension Fund;

- bank - then the pension goes through an ATM or cash desk.

If a long-service pension is assigned to a disability insurance pension, the pensioner receives both at the same time.

A pensioner has the right to choose the method of receiving a pension

When a pensioner chooses or decides to change the method of pension delivery, he will have to submit a written notification to the Pension Fund of the Russian Federation that assigned him the payment.

Receiving a pension

When submitting an application for a pension, you must also indicate the most convenient option for its delivery. By choosing the delivery method through Russian Post, you can receive money at the post office yourself or at home at your place of residence.

But a more convenient option would be to receive money on a Mir bank card. You can withdraw money from it at almost any ATM.

Someone chooses to receive money at a bank cash desk. However, given the constant queues at financial institutions, this method can hardly be called convenient.

To change the desired method of receiving a pension, you also need to write an application.

Two pensions at once

Former military personnel who additionally worked in civilian life immediately receive two pensions. Then they can receive military and insurance pensions. The size of the second is determined by pension points earned in civilian work.

The same also applies to cosmonauts and test pilots, if they can receive an old-age insurance pension.

In addition, a long-service pension can be assigned to a disability insurance pension.

Some categories of citizens are entitled to a mixed pension

Under what conditions is this pension awarded?

There are not so few professions that give the right to a pension for long service. On the other hand, it requires not only a lot of experience, but also compliance with certain conditions. So, when applying for a job in personnel services, you should carefully study those laws where all these conditions are described.

The pensioner himself is obliged to collect documents to prove proper length of service. In this case, the work book must be properly filled out: the positions and names of organizations mentioned must be correct and correspond to what is necessary for assigning a pension for long service.

To prove that a citizen has actually worked for a certain number of years, you need to provide a correctly completed work book

For example, doctors and teachers, in order to receive this pension, must previously work in positions and in institutions that meet special legislatively approved Lists.

Early retirement: nuances of accounting for work experience

At the beginning of 2021, the long-announced pension reform began in Russia. The age for old-age retirement increases annually, in “steps,” for men and women for a total of 5 years. These provisions were put into effect by Federal Law No. 350-FZ dated October 3, 2018.

One of the positive aspects of this reform, the Pension Fund announced the possibility of retiring 2 years earlier than expected (24 months). To do this, you must have a work experience of at least 42 years for men, and at least 37 years for women.

Another condition is that early retirement can be taken advantage of upon reaching a certain age: for men it is 60 years old, for women it is 55 years old. However, the initiators of the reform “remained silent” about other nuances reflected in the law.

This law significantly reduced the periods of service that will be included when determining the right to early retirement pension.

Periods of service not taken into account when exercising the right to early retirement

- To assign an early pension, periods of childcare and maternity leave for women and military service for men are no longer included in the insurance period, and in some cases, the length of service now does not include time spent studying in higher educational institutions.

- When taking into account the length of service required to use the early retirement benefit, only periods of working activity for which the employer calculated and paid insurance premiums, and periods of temporary disability with payments for compulsory social insurance (“sick leave”) are taken into account.

Let’s make a simple calculation: a woman now needs 37 years of service to retire early. For example, a girl entered college or university at age 17 and graduated at age 22. Then she gives birth to a child and goes on maternity leave, as well as parental leave - that’s another 3 years. All these periods are not taken into account for preferential retirement.

The following is simple arithmetic: 25 + 37 = 62 years, i.e., at least she should be eligible for early retirement at 62 years old. But the general retirement age for women is already set at 60 years. For men, too, everything is similar: college and the army “do not qualify for seniority.”

Who will receive?

As you can see, with the introduction of new requirements, it is now extremely difficult to obtain a pension thanks to early retirement.

This means that practically no one will be able to take advantage of this right, because in such circumstances the employee must start working at the age of 18 (or better yet at 16), study part-time, combine work with study, or not study anywhere, and not have children. In such situations, the chance of early retirement will probably be one in 1,000.

A couple of nuances

But that's not all, there are two more tricks to early retirement. Preferential exit can be issued if several conditions are met. In order to retire early, an employee must be dismissed for reasons due to a reduction in position, staffing or liquidation of an organization.

And lastly: a person can work all his life, but if the employer does not pay insurance premiums, then this length of service is not considered insurance and is not taken into account when calculating the length of service required for retirement.

This applies not only to preferential retirement, but also to retirement in general. It is no secret that territorial branches of the Pension Fund often refuse to confirm the length of employment insurance.

Moreover, this year the Pension Fund of Russia has especially zealously begun to remind employees of the need for employees to check the status of their personal account on the Pension Fund of Russia website. As they say, saving drowning people is the work of the drowning people themselves.

There is also a nuance here: the employer must not only pay insurance premiums, but also submit an annual report to the Pension Fund (the so-called confirmation of insurance experience). For example, if the employer paid the insurance premiums, but did not submit the report or submitted it with errors, these insurance premiums do not go to the employee’s personal account, and the periods are not included in the insurance period.

And all these subtleties are often not explained to people. When an elderly worker comes to the Pension Fund to apply for a preferential pension, it comes as a shock to him: it seems that he has done everything that was required, but he does not and cannot have the right to a benefit.

Source: https://www.9111.ru/questions/7777777777667951/

What is required for this pension to be assigned to a military man?

For those military personnel who ensure the defense of our Motherland, a pension for long service is assigned according to the Law of the Russian Federation of February 12, 1993 No. 4468-1. Former military personnel from the armies of the USSR, the Russian Federation or the CIS, except for conscripts, can receive an increased pension for length of service.

Here are other organizations in which service is equivalent to military service:

- ATS;

- drug control authorities;

- Russian Guard;

- State Fire Department;

- FSIN.

Many military personnel are entitled to a long service pension.

To qualify for a long service pension, a military man must serve, at a minimum, 20 years. But this question still remains not so clear-cut. If he does not have the length of service required for this pension, but having reached the age of 45, he becomes entitled to it. However, then it requires at least 25 full years of work experience, 12.5 years of which must be in military service.

Types of pension payments

According to the law, a long-service pension in 2021 is assigned if the following requirements are met:

- If on the day of dismissal the length of service is two decades, the age of the citizen is not taken into account. The amount of payments is 50% of existing earnings, and for each year over 20 an additional 3% is added, but in the end the total amount should not exceed 85% of existing income, which includes not only salary, but also additional incentives for experience, title, food compensation, etc.

- If the total work experience is 25 years or more, while 12.5 or more years of them were given to military service, service in the bodies of: internal affairs; control over the circulation of psychotropic and narcotic drugs; fire service; penal system. The monthly supplement to the pension of civil servants for length of service in this case is 50% of earnings and one percent for each year over 25.

This is important to know: Calculation of length of service for assigning a pension to military personnel

Long service pension for doctors and teachers

It is enough for employees of medical institutions and school teachers to simply develop the appropriate experience. And the age at which they retire does not matter to them. And for the preferential length of service of doctors, the place of work is of some importance: a rural doctor only needs to work for 25 years, while anyone else will have to work 5 years longer.

Important! Starting from 2021, the preferential length of service for doctors and teachers will increase. A transition period begins until 2023, after which representatives of these two professions will retire 5 years later.

Medical workers and teachers are also entitled to a long service pension.

In order to receive a superannuation pension, doctors and teachers need to accumulate experience in certain institutions and in certain positions. Which ones exactly are indicated by the decree of October 29, 2002 No. 718.

Rural doctors can retire five years earlier than urban ones. But for that doctor who worked for some time in the city, and some in the village, the “rural” experience is rated 1.25 times higher than the “urban” one. That is, two years of work in the countryside is equivalent to two and a half years in the city. Work in inpatient surgical departments and in anesthesiology-reanimation departments is rated a little higher - a year in these departments is equal to one and a half years in ordinary ones.

Health workers working in rural areas may retire earlier

A little about early retirement

A citizen is entitled to a preferential pension until the general age for retirement established by law. This measure of support for certain categories of Russians was provided for before the start of the pension “reform”, but in its light it was somewhat expanded.

The legislator retained previously established benefits, and the law was supplemented with new opportunities for early receipt of state benefits.

Exit conditions

Important! In addition, in some cases, the number of accumulated pension points is taken into account. The minimum amount required to assign an insurance pension is established.

Thus, the law establishes the following categories of beneficiaries:

- Persons employed in jobs with hazardous working conditions (such experience must be at least 10 and 7.5 years for men and women, respectively).

- Workers with difficult working conditions, including those employed in underground work.

- Women who have a long history of working on self-propelled, road, and loading equipment.

- Women workers in the textile industry, if their working conditions showed signs of intensity and severity.

- Some railway and transportation workers.

- Persons with work experience in the forestry sector, geological exploration, navy, and civil aviation.

- Drivers of public route transport.

- Teachers, doctors and artists.

- Firefighters and rescuers.

- Employees of the criminal correctional system.

These categories were provided for in legislation earlier. All of them retained their right to early assignment of pension benefits upon reaching the previously established age and meeting other mandatory conditions.

The list has been supplemented with the following as new categories:

- persons with long work experience;

- mothers of many children;

- persons registered as unemployed and unable to find employment.

Is it possible for a woman to receive early retirement after 37 years of service?

One of the newly provided cases of preferential pension is precisely long service. Thus, new changes to pension legislation provide for such a right for women if she has a total length of official work experience and other socially significant periods of activity of at least 37 years. However, the period of experience is not the only prerequisite.

What does the new law say about providing benefits?

The measure in question to support women during the implementation of pension innovations was introduced into the previous law on pensions. Changes to it were made by law dated October 3, 2018 No. 350-FZ as part of changes to the entire pension legislation as part of the so-called reform. This legal act provides for the following conditions when a woman can receive security on preferential terms:

- A woman’s work experience is 37 years or more (we are not talking about work activity, but specifically about insurance experience, which includes not only periods of work, but also time spent performing other socially useful activities).

- The onset of age 55 years.

- Availability of an individual pension coefficient of 30 or more (you can view it in your personal account on the official website of the Pension Fund of the Russian Federation or request information directly from this body).

Important! Even if all the mentioned conditions are met, a woman will be able to go on a well-deserved rest no earlier than 2 years before she could qualify for a pension on a general basis.

The right to the support measure in question for women arises if, in total, the following periods amount to at least 37 years:

- carrying out labor activities under an employment contract with an individual or legal entity, individual entrepreneur (subject to official employment);

- the period of carrying out entrepreneurial activities without forming a legal entity (if there is official registration with the tax authority);

- the time of performance of work or provision of services under civil contracts, if the customer, in accordance with the law, transferred insurance premiums to the Pension Fund of the Russian Federation;

- the time when the woman received benefits due to temporary disability;

- being on parental leave for up to 1.5 years. On this basis, only leave in respect of 4 children is taken into account for length of service. The period of care for 1.5-year-old children exceeding 6 years is not taken into account;

- periods when a woman was registered as unemployed at the employment center and received appropriate benefits;

- performing paid public works;

- the time required to move to a new place of work, if it is carried out in the direction of the employment service;

- work as a judge;

- the time of serving a criminal sentence by a person who was unjustifiably convicted and subsequently rehabilitated, as well as the removal of a woman from office for the period of unjustified criminal prosecution;

- work with operational intelligence agencies on a contractual basis;

- living with a diplomat spouse abroad or a military spouse in an area where the woman reasonably did not have the opportunity to officially work;

- care for a disabled child, group 1 disabled person or an elderly person over 80 years old (if officially registered in accordance with regulatory documents).

What will not apply to work experience?

The most obvious period that will not be counted in the calculation for assigning security on a preferential basis is that the woman did not work and was not registered as unemployed. In addition, the following time periods can be identified that cannot constitute an insurance period:

- being on parental leave for up to 1.5 years for 5 and subsequent children (since the maximum such period is 6 years);

- maternity leave for up to 3 years (although by law the woman retains her job for this period and can even receive appropriate benefits at the employer’s discretion);

- care for a 1.5-year-old child if the child’s father was on official leave (which is not prohibited under current legislation).

Reference! The required length of service does not include periods when a woman performed a labor function, but the employer did not transmit the necessary information to the Pension Fund of the Russian Federation and did not pay insurance premiums for it (this usually happens with unofficial employment).

Once the general retirement age for women is set at 60 years, it will not be difficult to calculate the time for a possible preferential pension if you have 37 years of experience. From 2021 to 2028 there is a transition period when this age increases gradually.

At what age will women retire according to the new law? The table shows the years when a woman can exercise the right to early receipt of state support:

| Woman's year of birth | Possible year of retirement (not earlier) |

| 1964 | 2019 |

| 1965 | 2020 |

| 1966 | 2022 |

| 1967 | 2024 |

| 1968 | 2026 |

Women of subsequent birth years can simply subtract 24 months from the generally established date.

Thus, if there is a long period of work or other socially significant activity, a woman has the right to complete it 2 years earlier than the total period.

However, this will require compliance with a number of conditions, such as the size of the pension coefficient and reaching a certain age.