Author of the article: Anastasia Ivanova Last modified: January 2021 22198

Calculating alimony as a percentage is the most common option for withholding money to provide for a child. The Family Code specifies the amount of payments; it depends on the number of children: from 25% to 50% of earnings. In some cases, the court may order alimony of 70 percent if there are grounds for this. Let's consider the circumstances under which the amount of financial assistance to a child will be increased.

Can 70% of the salary be withheld for alimony?

The amount of alimony in the Russian Federation is regulated by Article 81 of the RF IC. The regulation states that up to half of the spouse’s earnings can be withheld. The amount depends on the number of children. However, the legal act regulates the amount of alimony according to the law. In practice, parents can voluntarily agree to provide financial support for their children. In this case, the list of regulatory legal acts changes. The issue of withholding 70 percent of alimony from earnings on the basis of a voluntary agreement is regulated by Article 110 of the RF IC. The document states that the maximum amount of payments may exceed 50% of the salary if the husband and wife voluntarily agreed on this.

IMPORTANT

If the payer has a debt for alimony, the violator will be treated much more strictly. Art. comes into force. 99 Federal Law No. 229 of October 2, 2007. The document states that up to 70% of alimony can be withheld from a citizen’s salary. The amount of the penalty is increased to speed up the repayment of the debt.

In what cases can 70 percent of alimony be deducted from the salary?

Withholding 70% of wages is not possible in the following cases:

- Answer a few simple questions and get a selection of site materials for your case ↙

1

What's your gender

Select your gender.

Woman

Man

Your answer progress

- The presence of debt on alimony payments collected in favor of a minor child (Part 3 of Article 99 of Federal Law No. 229-FZ “On Enforcement Proceedings”).

If the defendant has accumulated a debt for an unjustifiable reason, in the event of his subsequent employment, retirement or registration with the employment center, deductions in favor of the recipient will reach 70% after tax until the debt is fully repaid (see example 1). Example 1 . Gr. Petrov had alimony obligations in favor of his son in the amount of 1/4 of the income according to a court decision. After leaving his job, Petrov deliberately did not find a job for 3 months, worked unofficially, and arrears accumulated in payments according to shared deductions from the average monthly salary in the Russian Federation (1/4 share of 37,140 rubles) in the amount of 27,855 rubles. After warning the bailiff about the mandatory payment of alimony and taking an explanation, Petrov got a job with an official salary of 16,000 rubles, after sending a writ of execution and a resolution on calculating the debt to the new place of employment, the employer deducted 70% of the salary in favor of the claimant Petrova in the amount of 11,200 rubles. until the debt is repaid. - Availability of alimony obligations in relation to three or more children, or if one of the children(ren) has disability.

If payments are assigned to 3 or more children, according to Art. 81 of the RF IC, 50% of payments are withheld from the parent’s salary, and this 50% must be divided equally into three parts - one for each of the children.If among the needy children there is a disabled child, naturally, a larger amount than on other children, however, they should not receive payments that infringe on their normal life activities. In such situations, the court may immediately order the withholding of 70 percent of the income of the alimony payer (see example 2).

Example 2 . Gr. Evseev has three minor children from different marriages. When divorcing his two ex-wives, Evseev acquired alimony obligations and contributed 1/3 of his salary to the children. The third wife gave birth to a disabled child, but Evseev left the family, and she also decided to collect alimony. When making its decision, the court established a 70 percent deduction from the defendant’s wages, taking into account the disability of the last child.

Is it legal to withhold 70 percent of wages for alimony?

If the husband and wife voluntarily agreed to collect alimony in the amount of 70% from wages, or funds are forcibly withheld to pay off the debt, this will not constitute a violation (Article 99 of Federal Law No. 229 and Article 110 of the RF IC). When alimony is established by the court, payments usually do not exceed 50 percent. However, the authority has the right to adjust the amount of payment taking into account the financial or marital status of the husband or wife (Article 81 of the RF IC). When changing the amount of alimony, the following circumstances are taken into account:

- the presence of other children under 18 years of age with the payer;

- the amount of income of the alimony-obligated citizen;

- health status of the child and the payer.

The amount of alimony in the amount of 70% of earnings to provide for those in need can be increased or decreased. It all depends on the specifics of the situation.

What determines the amount of alimony payments based on earnings?

The amount of alimony from earnings is influenced (Article 81 of the RF IC):

- Number of minor children. The more offspring there are, the higher the amount of alimony.

- Financial situation of the parties. If the father receives a higher salary and the child is in need, the amount of child support may be increased.

- Health status. A sick child costs a lot of money.

- Social status of father and child.

If there is no debt, the amount reflected in the agreement or court decision will be withheld from the citizen’s monthly income. Otherwise, forced collection will be carried out. The amount of payments cannot be changed without going to court. The exception is solid alimony. Payments are subject to indexation annually (Article 117 of the RF IC).

Amount of alimony withholding

The amount of funds for monthly deduction from the person liable for alimony will directly depend on the method of their assignment:

- Equity retention funds are possible when collecting alimony in favor of minor children and is carried out according to the rule of Art. 81 of the Family Code (SC) of the Russian Federation):

- for the 1st child – 1/4 share of the payer’s income;

- for two children – 1/3;

- for three or more – 1/2 share of earnings.

- Collection of funds in a fixed amount of money (according to the rule of Article 83 of the RF IC) is used to assign alimony for children, parents, and other needy persons.

In the first case (when collecting funds as a share (percentage) of income), the percentage of withholding established by the court will be written off monthly from the person liable for alimony. In the second case, the payer will be charged a fixed amount every month, specified in the writ of execution (agreement).

If the payer does not have alimony debt, monthly payments from wages as a share of income or a fixed sum of money will be written off from him strictly in the amount established by the writ of execution: write-offs in a larger or smaller amount are unacceptable.

However, payers of alimony in a fixed amount should take into account the fact that the fixed amount is subject to quarterly indexation - an increase in proportion to the increase in the cost of living for the socio-demographic group of collection in the region where the funds are allocated (Article 117 of the RF IC). Therefore, the once “fixed” alimony payment will gradually increase in order to keep up with the increase in consumer prices.

Who cannot receive 70% of their salary for alimony?

When determining the amount of alimony as a percentage, the court is guided by the provisions of the law and the personal characteristics of the situation. The health status of the payer, the social status of the parties, and whether the parent living separately has other children are taken into account. Those in need will not be able to receive 70% of their salary for alimony in the following cases (Article 81 of the RF IC):

- a married couple has one healthy child;

- the parent needs expensive treatment, or their health condition does not allow them to provide themselves and the child with a sufficient level of financial security;

- the financial situation of the parent left with the child allows him to easily support himself and the minor;

- a child support agreement has been concluded, according to which parents are obliged to pay child support less than 70% of the salary;

- there is no alimony debt.

To whom can 70% of alimony be withheld from wages?

The parent will be required to pay alimony in the maximum amount - 70% of the salary in the following situations (Article 81 of the RF IC, Article 99 of Federal Law No. 229):

- arrears have arisen for alimony, which are forcibly collected from the payer;

- the child is sick and needs additional financial support;

- a separated married couple has several minor children at once, and the financial situation of the wife does not allow her to support the children on her own;

- the spouse is healthy, and his financial situation allows him to increase the amount of alimony.

Please note:

In each situation, a personal decision is made to assign alimony in an amount greater than that provided by law. Parents can influence the court's verdict by providing evidence confirming the need for alimony payments in the amount of 70 percent of the salary, or the inability to increase the maximum amount of financial assistance.

In what situations can 70% of alimony be awarded?

To understand how often 70% of alimony is prescribed, it is necessary to understand the situations in which this can be done.

There are cases when the child support payer does not fulfill his financial obligations regarding the child for unjustified reasons. Debt on alimony is the reason for increasing the amount to 70%. This amount of alimony will have to be paid until the entire debt is fully repaid.

If the payer has three children, then by law he is obliged to give them 50% of his income. This amount is divided equally between the three minors. If one of them is disabled, then the amount of financial assistance should be greater than usual. In this case, alimony will be withheld in the amount of 70% of earnings.

When parents enter into an agreement regarding child support between themselves, they can independently determine its amount. The main condition is that they should not be less than the amount established by law. In this situation, it is also possible to collect alimony in the amount of 70% of earnings. The number of children will not affect this decision in any way.

Also, the amount of alimony may be increased if the child receiving it has suffered physical or moral harm. In such situations, the minor often has to pay for expensive treatment or rehabilitation. But before increasing the amount, the judge must make sure that the payer has enough funds left for normal living. As a comparative criterion, the size of the minimum wage, which is established by law, is taken into account.

The reason for increasing the amount of alimony is the loss of legal capacity of the parent with whom the minor child lives.

Grounds for withholding 70% of alimony from salary

The issue of increasing the amount of alimony to 70% of wages is described in detail in Article 99 of Federal Law No. 229. The regulatory legal act states that the basis for increasing payments may be:

- Accumulation of alimony debt for a good reason. If a citizen refuses to voluntarily make a payment, the obligations will be collected by force. Moreover, the amount of alimony will be up to 70% of wages until the debt is fully repaid.

- After the divorce was filed, the married couple was left with three minor children together, and one child was recognized as disabled. In a classic situation, the amount of payments would be half of the parent’s salary. However, the presence of a child with a disability radically changes the situation. Minor citizens need constant care, and a child with disabilities also needs medical support, therefore the amount of payments will be increased. Alimony in the amount of 70% of salary is prescribed by the court.

- The parties voluntarily entered into a child support agreement, the amount of payments under which is 70% of the parent’s salary. At the same time, they do not take into account how many children a married couple has left. An agreement is concluded in which the parents voluntarily set the amount. Subsequently, the amount of payments cannot be changed at the request of only one spouse. The exception is situations when the document was prepared with violations, and one of the parents wants to challenge the agreement on alimony in the amount of 70% of the salary in court.

- The parent caused mental or physical harm to the child. The representative of the minor offspring has the right to go to court and demand an increase in the amount of payments as a percentage.

- Alimony is established in the form of a fixed amount. The payer is obliged to provide funds regardless of what percentage of the salary the payment is.

In what cases is 70% alimony prescribed?

Recovery of 70% of alimony is possible under the following circumstances:

- Debt on alimony payments. If the payer allowed the accumulation of debts for unjustified reasons, 70% of alimony will be collected from his subsequent earnings, pension, unemployment benefits until the amount is fully repaid.

- The payer is the parent of three or more children, and one child has a disability. The Family Code requires paying 50% of income for three children. This amount is divided into three equal parts - one for each child. However, if there is a disabled child in the family, financial assistance for his maintenance should be larger. In this case, the court may assign alimony of 70%.

Parents who have entered into a child support agreement can voluntarily determine the amount of benefits in the amount of 70% of the payer’s income. The number of children does not affect this decision. The agreement is concluded in writing and notarized. Three copies are made, one of which remains with the notary. The second is sent to the employer, who will withhold a percentage from the employee's salary. Without visiting a notary's office, the document has no legal force.

To draw up an agreement, parents will need:

- Original passports;

- Child's birth document;

- Certificate of marriage or divorce.

Agreement on payment of alimony (sample)

The amount of payments may be increased due to moral or physical harm to the health of a child in need. Before making a decision, the judge must make sure that the payer, after collecting alimony, still has the amount necessary for a normal existence. The balance should not be lower than the minimum wage established by law.

Another reason for increasing child support is the deprivation of legal capacity of the parent who lives with the child.

Is maximum alimony legal?

In most cases, payers consider the decision to pay 70% of alimony to be unreasonable. Many of them are trying to appeal the actions of bailiffs. Practice shows that such measures are legal for the gradual write-off of debt and the maintenance of more than three children.

Having received an amount of 30% of earnings, payers try to convict former spouses of illegal actions, as well as bailiffs of exceeding their authority. Errors in calculations during debt determination cannot be ruled out. Therefore, if a citizen is confident that he is paying alimony in good faith, he should file a complaint with the FSSP. In addition, you need to study the legislation regulating the procedure and amount of payments. These include:

- Family Code of the Russian Federation;

- Federal Law “On Enforcement Proceedings”.

Expert commentary

Kireev Maxim

Lawyer

The payer has the right to familiarize himself with the financial statements of the enterprise regarding the deduction of alimony from his wages. If the calculation was made incorrectly and the funds were overpaid, the damage is compensated by the official who made this error. It should be remembered that when transferring alimony there are costs. Within three days after receiving the salary, the accountant is obliged to transfer the amount of money to the recipient's account. For any transfer method, bank or postal, a commission is charged. If alimony was ordered by the court, all additional costs are covered by the payer.

Transfer of alimony to a bank account

Part of the funds can be transferred to the child’s personal account if the payer suspects the recipient of misuse of alimony. To achieve this opportunity, you will need to present to the court the facts of embezzlement of money for the personal needs of the recipient. The grounds for appeal may be the unlawful lifestyle of the ex-spouse, alcohol abuse, drug abuse. Doubts may arise due to large purchases made on the day of receiving alimony payments. Evidence may include statements from neighbors, receipts and checks with dates of purchases that are not intended for the child. Also, child support can be transferred to the child’s bank account if he:

- Placed in an orphanage, boarding school;

- Is in the family of a guardian who supports him;

- Fully provided by the ex-spouse under an alimony agreement. The funds transferred by the second parent are accumulated for the child’s further education.

Even with the maximum amount of alimony, up to 50% of the accrual amount can be transferred to the child’s account.

Difficulties in collecting maximum alimony payments

As judicial practice shows, payers try to avoid paying the maximum amount of alimony. They hide their real income and get jobs unofficially. Refusal to pay for financial assistance does not relieve the parent of the obligation to support the child. If a large debt accumulates, a malicious evader may be brought to administrative as well as criminal liability.

Expert commentary

Gorbunova Olga

Lawyer

If the parent is unable to pay child support in the amount of 70% of the salary, the debt can be repaid by seizing securities, real estate, and shares. The debt is transferred from cash equivalent to the cost of housing owned by the payer. An apartment or other space will be awarded to minor children.

Alimony 70% from a small salary

For a payer who has unstable and uneven earnings, the court assigns alimony in a combined form.

This can be a fixed amount of money and a share of wages. For example, 1/6 of the official salary and 1/3 of the minimum wage established in the region. According to the applicants, withholding the amount based on the minimum wage is much more profitable than receiving a percentage from the payer’s small salary.

How to reduce the amount of alimony

Guided by Family Law, the payer can file a claim in court to reduce the amount of alimony. He will need to prove that the debt arose for good reasons.

Statement of claim to reduce the amount of alimony (sample)

In what cases is 70 percent alimony reduced to the norm:

- Acquisition by the payer of complete or temporary incapacity;

- Reduction, dismissal, transfer to a low-paid position;

- The payer has disabled close relatives who need his care;

- Force majeure (natural disasters, military conflicts, fires, difficult life circumstances).

Expert commentary

Leonov Victor

Lawyer

If one of the above reasons is confirmed in court, the debt is reduced. In some situations, the payer is completely exempt from paying the debt. Thus, the amount of monthly alimony is reduced.

In order for the claim to be satisfied, the payer must provide sufficient evidence to support his words.

Normative base

In order to correctly collect alimony in an increased amount - 70% of the salary, you need to know the regulatory framework. First of all, the issue is regulated by the Family Code of the Russian Federation. It is necessary to pay attention to the following articles:

- Art. 80. Obliges parents to support their minor children, determines the specifics of support, the nuances of claiming funds in the event of divorce.

- Art. 81. Determines the amount of payments if financial support for a child is assigned in court.

- Art. 82. Fixes the types of income from which monetary support can be collected.

- Art. 99. Determines the possibility of voluntarily establishing payments for minor children.

- Art. 100. Fixes the rules for preparing an agreement on the provision of alimony and establishes the need for notarization.

- Art. 101. Fixes the procedure for making changes to the agreement, features of termination of the document and invalidation. Thus, the legal act states that unilateral refusal to comply with the provisions of the agreement is not permissible. However, you can terminate the agreement by going to court.

Separately, it is worth paying attention to the provisions of Federal Law No. 229. The regulatory legal act comes into force if the citizen does not voluntarily transfer funds and arrears in alimony have arisen. Based on the law, bailiffs will begin enforcement.

Where to go to recover 70 percent of your salary for alimony?

When the question arises of where to go to collect 70% of the payer’s salary for alimony, it is necessary to act, guided by the provisions of Art. 99 of the Law on Enforcement Proceedings. Bailiffs are responsible for collecting debts. Representatives of the authority act on the basis of a writ of execution. Bailiffs are engaged in the forced collection of funds from defaulters. To initiate collection of alimony debt, you will need to prepare and submit an application (Article 30 of Federal Law No. 229).

IMPORTANT

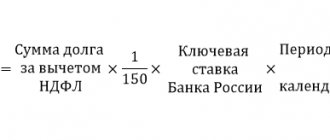

For untimely provision of funds to provide for needy family members, the violator is charged a penalty. Sanctions are applied in accordance with the requirements of Article 115 of the RF IC. The defaulter is obliged to provide 0.1% of the amount of unpaid alimony for each day of delay. The amount of the penalty may be reduced due to the financial or family situation of the obligated person.

It is necessary to go to court only to collect a penalty. The authority will not make a decision on the alimony case a second time. Bailiffs are responsible for collecting debt and collecting 70% of alimony from the salary of the debtor parent.

To claim a penalty, you must first determine the amount of alimony debt. The calculation of the amount is carried out by representatives of the FSSP. The information is reflected in the resolution. To receive official paper, you will need to prepare an application. A sample document can be obtained when applying to the FSSP or prepared in advance.

An approximate sample application for calculating alimony debt to the FSSP can be found

The calculation of the penalty is included in the list of documents for going to court and is submitted along with the statement of claim.

How to reduce alimony in the amount of 70%?

A way out of such a situation exists only for those debtors whose debt arose in the absence of their fault , i.e. unintentionally.

“Good” reasons for the formation of alimony debt include:

- Force majeure circumstances, difficult life situations (the payer is in an area of military or natural disasters, loss of property due to flood, fire).

- Serious illness of the payer or his close relatives (children, parents, spouse), requiring significant material investments, supported by documents.

- The appearance of new dependents on the debtor, associated with a difficult financial situation (for example, the birth of a disabled child, or twins and triplets, into a new family, the burden of a disabled parent, etc.).

If there are good reasons for the formation of alimony debt and the possibility of documenting them, the debtor has the right to apply to a magistrate's court with a claim for full or partial relief from payment of the debt in accordance with Art. 114 RF IC.

A sample application to reduce the amount of alimony debt can be downloaded from the link.

A statement of claim of such content must have sufficient documentary support - i.e. actually confirm the lack of intentionality in creating the debt. If the court finds the arguments presented convincing, the plaintiff can count on a reduction or cancellation of the debt, but monthly alimony payments will continue to be written off until the child reaches adulthood.

An example of calculating alimony debt at 70% of salary

Determining the amount of alimony debt in the amount of 70% of the salary takes into account the provisions of Article 102 of Federal Law No. 229. The legal act states that the bailiff is responsible for determining the amount of overdue payments. The recipient of financial assistance can verify the correctness of determining the amount of collection of funds from the debtor. The amount of alimony is taken into account, as well as the period during which payments were not made.

Example

Let’s say that a citizen liable for alimony is obliged to provide 70% of alimony from the amount of wages. A person earns 30,000 rubles. The obligated person did not transfer funds for four months. The amount of income did not change.

In this case, the FSSP employee will carry out the following calculations:

(30 000 * 70%) * 4 = 84 000

In practice, the amount of income for each month may vary. In this case, the amount of alimony in each month is initially calculated, and then the final results are summed up.

In which court can you recover 70% of your salary for alimony?

If alimony is only set at 70% of the salary, the choice of authority for collecting funds is clear. It seems permissible to collect obligations in percentage amounts greater than those established in Article 81 of the RF IC only in a district court (Article 24 of the Code of Civil Procedure of the Russian Federation). The magistrate's court issues a child support order only as a percentage of earnings: for one child - one quarter of the salary, for two children - one third, for three or more children - half of the salary. In all other amounts and forms, provision for those in need, (including in the amount of 70% of income), funds are recovered through the federal courts.

If a decision in the case of alimony in the amount of 70% of the salary has already been made, the courts do not deal with debt collection. This responsibility lies with representatives of the FSSP Federal Law No. 229, which was previously described in more detail. Only the collection of penalties is carried out through the court.

Withholding 70% of alimony payments in practice

To understand the grounds and conditions for withholding 70% of alimony, you should consider cases that may arise in practice.

Example 1. The court ordered Petrov I.A. to pay 50% of his earnings monthly for the maintenance of two children. The citizen was not officially employed for two months, which resulted in a debt of 40,000 rubles. When Petrov I.A. got a job, the company’s accounting department received from the bailiff a decree to withhold 50% of wages, as well as a document to collect the resulting debt. In such a situation, the accountant is obliged to withhold half of Petrov I.A.’s salary for current alimony payments, and write off another 20% as a debt. When the debt is fully repaid, Petrov I.A. will retain only half of the income.

Example 2. Vorobyov D.V. pays half of the salary for the maintenance of children from his first marriage. The second wife of Vorobyov D.V. filed a petition with the court to assign alimony for their common child. The wife did not indicate in the statement that the defendant has children from his first marriage for whom deductions are made. The court ordered the defendant to pay alimony in the amount of 25% of income. Having received the court order, Vorobyov D.V. did not appeal the document, and it was sent to the bailiff service for execution. The accountant of the company where D.V. Vorobyov works had two writs of execution pending execution. The payer will be deducted 50% for one court order, and 20% for the second. The remaining 5% will accumulate as debt, since more than 70% cannot be retained by law.

How to collect 70 percent of alimony from wages?

It is necessary to prepare for the collection of arrears of alimony, set at 70% of earnings. First of all, you need to collect the necessary package of documents. If the spouse does not provide for the child, and the mother wants to recover money in an increased amount, it is necessary to initiate enforcement proceedings. The procedure is carried out in accordance with the provisions of Article 30 of Federal Law No. 229. The above regulatory legal act provides a list of documents to be provided.

To collect alimony debt in the amount of 70% of earnings, the applicant must present to the FSSP:

- completed application;

- performance list;

- identification;

- an account statement confirming the absence of funds received from the payer.

Additionally, you may need a certificate of the child’s health, an extract from the house register demonstrating cohabitation with a minor offspring.

When it is planned to go to court to collect a penalty for alimony prescribed at 70% of the salary, the list of papers is regulated by Article 132 of the Code of Civil Procedure of the Russian Federation. You will need to provide:

- statement of claim based on the number of participants in the proceedings;

- the applicant's identity card;

- children's birth certificate;

- receipt for payment of state duty;

- an account statement confirming that no funds were received within the specified period.

The list is not exhaustive. The list can be supplemented with other documents at your own discretion. Documents must support all arguments presented in the claim.

The procedure for assigning and calculating alimony

To understand the question of how often 70% of alimony is assigned, you must first decide on the general rules and calculation procedure.

There are two ways to assign child support to a parent who does not live with the child:

- drawing up a voluntary agreement between parents, which is certified by a notary. This option is suitable if the parents were able to independently find a common language;

- filing a lawsuit by a parent who does not receive child support or does not agree with its amount.

Initially, you should try to draw up a child support agreement. Such an executive document has legal force, and with it it will be much easier to resolve the issue of payments for the child.

To draw up an alimony agreement, you need to prepare the following documents:

- the child’s birth certificate (or passport if he is over 14 years old);

- originals of parents' passports;

- marriage certificate (its conclusion or dissolution).

The agreement must be drawn up in triplicate. One option will remain with the notary, another with the parents, and the third will be sent to the employer, who issues the salary to the child support payer.

The amount of alimony can be determined both in a fixed monetary amount and as a percentage relative to the level of earnings. If you choose the second option, the amount of alimony will be determined as follows:

- for one child – 25%;

- for two children – 33%;

- for three or more children – 50%.

If children are born in different marriages from the same parent, they have equal rights to child support. Their size also cannot be affected by the order in which children are born.

Alimony in a fixed amount should not be less than that provided by law.

There are cases when the amount of contributions for a child can be increased to 70 percent. This condition is stated in paragraph 3 of Article 99 of Federal Law No. 229 “On Enforcement Proceedings”. But, in practice, such situations are quite rare, since the alimony payer will have 30% of his earnings to live on. The number of children does not play a special role for bailiffs. For example, if there are 8 minor children, they still cannot recover more than 50% of the salary. But, in certain circumstances, the amount of alimony may increase.

How to file an application for collection of alimony debt?

The application form for starting enforcement proceedings to collect the alimony debt assigned in the amount of 70% of the salary is not fixed by law. However, they will agree to review the document if it contains the following mandatory information:

- the name of the authority to which the application is sent;

- information about the recipient and payer of alimony in the amount of 70 percent of earnings, indicating data for operational communication;

- information about the writ of execution;

- demands for forced collection of funds;

- additional information about the payer, which can help obtain alimony;

- list of applications;

- date and signature.

An approximate example of an application to initiate enforcement proceedings to collect arrears of alimony is available.

You can submit your petition during a personal visit to the bailiffs or send it by mail.

In practice, circumstances may change significantly. So, if a child is assigned a disability, or a woman finds out that all these years a man has been hiding additional income from her, you can demand a review of the amount of alimony. To do this, prepare a classic statement of claim to the court in accordance with Article 131 of the Code of Civil Procedure of the Russian Federation. The document reflects:

- information about the participants in the proceedings;

- information about the court that will hear the case;

- the essence of the current situation;

- the requirements put forward;

- references to legal norms confirming the applicant’s correctness;

- list of applications;

- date and signature.

The procedure for collecting arrears of alimony in the amount of 70% of the salary

To collect arrears of alimony, set at 70% of the salary, you must proceed according to the following scheme:

- Try to resolve the issue with the defaulter peacefully. To do this, the recipient of alimony contacts the parent living separately from the offspring.

- If an agreement cannot be reached, the applicant collects a package of documents in accordance with Art. 30 Federal Law No. 229 and applies to the FSSP.

- The bailiff considers the application and initiates enforcement proceedings. Compulsory penalties are initiated against the violator. Bailiffs have the right to apply measures reflected in the chapters of Federal Law No. 229. One of the ways to recover debt is to increase the amount of monthly alimony collection to 70% of wages.

- The citizen receives a resolution to calculate the debt, fills out a statement of claim and goes to court to collect the penalty.

- The court considers the application within 5 days and then makes a decision to initiate proceedings or reject the claims (Article 133 of the Code of Civil Procedure of the Russian Federation).

- Participants in the proceedings are sent notices indicating the date and time of the hearing.

- Husband and wife take part in the proceedings. The court examines the positions of the parties, analyzing the evidence presented.

- They make a final decision. If it does not suit the plaintiff or defendant, the verdict can be challenged by preparing an appeal (Article 320 of the Code of Civil Procedure of the Russian Federation).

Applying to bailiffs does not require paying a state fee. However, the debtor may be charged an enforcement fee in the amount of 7 percent of the amount (Article 112 of Federal Law No. 229). The bailiffs will perform actions taking into account the provisions of Article 36 of Federal Law No. 229. The regulation states that 2 months are given to claim alimony debt in the amount of 70% of the salary. If the debt cannot be collected, the writ of execution may be returned.

When it comes to court proceedings, the case will be considered within up to two months (Article 154 of the Code of Civil Procedure of the Russian Federation). There is no state duty for the process of collecting alimony penalties in court (subclause 2 of clause 1 of Article 333.36 of the Tax Code of the Russian Federation). The fact is that the claim for payments is carried out in the interests of the children.

How is 70 percent of alimony withheld from wages?

The deduction of alimony in the amount of up to 70% of wages is carried out by the accounting department of the organization in which the payer works. The ability to make payments through a company is enshrined in Article 109 of the RF IC. The basis for requesting funds is the provision of a notarized agreement or writ of execution. Payments are transferred no later than 3 days from the date of accrual of wages or other income. Initially, income tax is withheld from earnings. Only after this is the transfer of 70: alimony from wages for the needs of a disabled relative.

Is it legal to collect 70%?

Alimony payers often ask the question of whether they can withhold 70% of alimony and whether it is legal. In most cases, they believe that the assignment of such amounts of payments to a child is not legal, and they try to appeal such a decision in court. In practice, this amount of alimony is considered legal when it is written off from the account in stages and the parent needs to support more than three children.

When the alimony payer begins to receive only 30% of his earnings, he tries to take all measures to expose the second parent for illegal actions or for exceeding the powers of the bailiff. Also, when calculating the amount of alimony, errors may be made.

If the parent who pays child support is sure that the current amount is assigned incorrectly, he has the right to file a complaint with the FSSP. But, before that, he needs to study the Family Code of the Russian Federation and the Federal Law “On Enforcement Proceedings”. Such documents regulate the amount of alimony and the procedure for its payment.

To prove that an error was made in calculating the amount of alimony, the payer has the opportunity to contact the accounting department of the organization in which he works and familiarize himself with the documents that set out the procedure for deducting alimony.

During the transfer of alimony, costs may arise. They must be transferred to the recipient’s account no later than three days after the alimony payer received his salary. There is a fee for bank or postal transfers. In the case where alimony was awarded in court, the alimony payer is obliged to cover all additional costs independently.

Is it possible to cancel debits?

It is impossible to cancel deductions of 70% of alimony from wages. The father is obliged to support the child until the age of 18 (Article 120 of the RF IC). The exception is arrears of payments. In accordance with Article 114 of the RF IC, a citizen can file a claim with a request to be completely exempt from paying the debt. The application may be approved if the person was unable to provide funds in a timely manner for the following reasons:

- there is a disease of the payer;

- there are force majeure circumstances;

- the citizen has other dependents.

Be sure to take into account the current financial and family situation of the applicant. The alimony debt is not always written off completely.

How to cancel 70% of alimony write-off?

If the monthly write-off of 70 percent of wages or other periodic income has become the harsh reality of the debtor, there is a way out of this situation, but not for everyone.

The law provides for the abolition of the withholding of 70% of wages for alimony only in relation to debts resulting from the unintentional actions of the defaulter, i.e., provided there is no fault of his own.

In particular, valid reasons for the unintentional formation of alimony debt are:

- Long-term serious illness of the debtor (associated with hospitalization, surgery, expensive treatment, acquisition of disability, etc.).

- The appearance of other dependents on the payer (needy parents, children, disabled children, etc.) together with a difficult financial situation.

- Force majeure circumstances (difficult life situations associated with military operations, natural disasters, fire, flood, etc.).

If there are really good reasons, the debtor has the right to apply to the magistrate's court with a statement of claim for full or partial exemption from payment of alimony debt (reduction in its amount) in accordance with Art. 114 RF IC (see below).

In other words, if the court decides to reduce or cancel the alimony debt, the monthly amount written off from wages or other income will also become lower.

Sample statement of claim for debt relief

A claim for relief from debt on child benefits can be downloaded from the link.

To the Magistrate's Court of the Fokinsky District of Bryansk , Bryansk, st. Sadovaya, 37

Plaintiff: Mikhail Yurievich Andropov , Bryansk, st. Koroleva, 27, tel xx-xx-xx

Defendant: Andropova Irina Vyacheslavovna, Bryansk, st. Krasnoarmeyskaya, 14, apt. 18, tel. xx-xx-xx

Statement of claim for exemption from payment of alimony debt

Based on the writ of execution dated 04/11/2008 (Series BC No. 142210669), I am obliged to pay monthly alimony in the amount of 1/4 of my earnings or other income for the maintenance of my minor daughter, Larisa Mikhailovna Andropova, born on 08/18/2006.

At the time of collection of alimony payments, I had a permanent place of work, my salary was 15,000 rubles, and the amount of 3,750 rubles was deducted monthly for the child. In addition to alimony payments, I regularly congratulated my daughter on holidays (birthday, March 8, Knowledge Day, New Year), gave gifts, sometimes purchased items of clothing and shoes, although rarely, I brought food. While communicating with the child, we did not maintain a relationship with my wife.

In April 2021, my workplace experienced a reduction in staff and as a result I was laid off. Knowing that I had alimony obligations, I tried to find a job, but given my age - 47 years old, I was unable to find a job, and therefore, for alimony payments from this period, alimony arrears were accrued in the amount of the average monthly salary in the Russian Federation in the amount of 62,728, 75 rub. (according to the resolution on the calculation of the debt of the bailiff V.M. Tiushina).

In September 2021, I found myself in a difficult life situation: my house in which I live burned down, as a result of which I ended up in the hospital with burns, was discharged at the end of October, and currently live with my mother.

I am not hiding from the bailiff; I also spoke with the recipient by phone and told about my plight. I also haven’t found a job yet, but I’m going to register with the employment center to apply for some kind of job. Considering my difficult financial situation related to recovery from burns, lack of housing, from Art. 131-132 Code of Civil Procedure of the Russian Federation, art. 114 IC RF

I ASK FOR COURT:

- exempt me from paying alimony debt in the amount of 62,728.75 rubles.

I am attaching the following documents to the statement of claim (in 2 copies):

- Statement of claim.

- Copy of the passport.

- A copy of the writ of execution for the collection of alimony.

- A copy of the resolution on the amount of debt.

- A copy of the debtor's explanation at the reception with the bailiff.

- A copy of the fire report.

- A copy of the fire certificate.

- A copy of an extract from the patient's medical history during hospitalization.

- A copy of the dismissal order due to staff reduction.

- A copy of the screenshot of the Avito website page about posting a resume to apply for a job.

11/14/2017 _____________ M.Yu. Andropov

How to reduce the amount of alimony payments from your salary if 70% is withdrawn?

If we are not talking about debt write-off, you can try to reduce the monthly alimony payment in the amount of 70% of the salary. Payment adjustments are made taking into account the provisions of Article 119 of the RF IC. The amount of alimony can be reduced in the amount of 70 percent of earnings in the following cases:

- the financial situation of the alimony recipient has changed (loss of job and additional income);

- a person has a new child;

- the obligated person has suffered from a serious illness;

- Unforeseen circumstances have arisen that prevent the provision of alimony in the previous amount.

The trial to change the amount of alimony from 70% of earnings to a different amount will take place within the framework of the norms of the Code of Civil Procedure of the Russian Federation. You will have to proceed according to the following scheme:

- Collect a package of documents confirming the deterioration of your financial situation or the creation of a new family.

- Prepare a statement of claim taking into account the requirements of Article 131 of the Code of Civil Procedure of the Russian Federation and go to court.

- Take part in the proceedings. The date will be announced in advance.

- Find out the final solution. The court's verdict can be challenged by preparing an appeal (Article 320 of the Code of Civil Procedure of the Russian Federation).

- If the authority has satisfied the requirements, after the court decision enters into force, alimony will begin to be written off in a new amount.

Is it possible to illegally write off 70% of alimony payments from your salary?

In practice, mistakes and illegal debiting of 70% of alimony from the salary are possible. There is a factor of mechanical failures in the functioning of accounting and banking systems. In this case, the obligated person must contact the accounting department and demand justification for the write-off. The demand for funds is considered legal only on the basis of a decree of a bailiff, a voluntary agreement or a writ of execution.

For your information

If the illegal write-off of alimony as a percentage was carried out at the request of the FSSP, you will have to visit the authority and prepare an application for familiarization with the records of the case. There must be a resolution requiring the withholding of 70% of wages. In accordance with Article 116 of the RF IC, overpaid funds will remain with the recipient of alimony. The refund is made by the official who made the mistake.

Is it legal to withhold 70% of alimony?

Most alimony payers believe that the decision to pay 70 percent of alimony is illegal. Citizens often appeal the actions of bailiffs. But in practice, such measures are perfectly legal, subject to exceptional circumstances. When the payer receives only 30% of the salary, he accuses the ex-wife of illegal actions and the bailiffs of abuse of power.

70% of alimony may be withheld as a result of an error in determining the debt. If the alimony provider is confident that he is fulfilling his obligations to support the child in good faith, he needs to file a complaint with the FSSP.

Legislative acts regulating the procedure for assigning alimony:

- Family Code of the Russian Federation,

- Federal Law “On Enforcement Proceedings”.

The bailiff conducting enforcement proceedings may make a mistake that will result in a violation of the rights of the claimant or debtor. Also, incorrect calculation of alimony may occur due to the fault of the accountant calculating wages.

If 70 percent of the salary was written off, and the citizen has no alimony arrears, and was not summoned to a trial to change the amount of payments, then such a write-off is illegal.

To find out whether more than half of the income is legally withheld, the alimony payer should:

- Contact the settlement department at your place of employment to familiarize yourself with the document on the basis of which the funds were withheld. Since the accountant does not have the right to independently change the amount of deductions, he must provide a bailiff's order or a writ of execution.

- Draw up an application for familiarization with the enforcement proceedings and send it to the bailiff. The case materials must contain a decision to withhold alimony in the amount of 70%, as well as the grounds for such withholdings.

The alimony payer has the right to contact the prosecutor's office with a complaint against the bailiff. In accordance with Art. 116 of the RF IC, erroneously collected funds remain with the claimant, and the return to the payer is carried out by the person who made the mistake.

If, according to one executive document, 70% is already withheld from a citizen, then for other debts the accountant does not have the right to write off a larger percentage. That is, the total amount of deductions should not exceed 70% for all types of income. If deductions are made in a larger amount, such actions are illegal.

Problems and nuances

If a citizen maliciously evades the obligation to support a minor child and does not transfer 70% of his earnings to provide for the needs of the child, the violator may be brought to the following types of liability for non-payment of alimony:

- Administrative (Article 5.35.1 of the Code of Administrative Offenses of the Russian Federation). It is permissible to collect a fine of up to 20,000 rubles, compulsory labor for up to 150 hours, or administrative arrest for up to 15 days.

- Criminal (Article 157 of the Criminal Code of the Russian Federation). The violator may be imprisoned for up to one year.

- Malicious evasion of alimony payments may become grounds for deprivation of parental rights (Article 69 of the RF IC).

Collection of alimony in the amount of up to 70% of wages is possible. However, there must be exceptional circumstances for this to happen. The amount of payment is influenced by the number of children, the state of health of the child, and the financial situation of the former spouses. If a debt has arisen to provide for needy children, funds are forcibly recovered from the negligent parent. One of the effective measures is to increase the amount of collection of alimony payments from wages to 70%.

Comments Showing 0 of 0