After considering a child support dispute between the child’s parents, the court comes to a certain decision and may oblige one of the parties to pay child support. The court decision and the writ of execution are the main documents regulating the further process of deductions. In addition to the above documents, citizens often come across such a document as a certificate of alimony. What is the essence of this certificate, where can I find a sample certificate of alimony, how to get it and what is needed for this?

Dear readers! The article talks about typical ways to resolve legal issues, but each case is individual. If you want to find out how to solve your particular problem , contact a consultant:

+7 (499) 938-81-90 (Moscow)

+7 (812) 467-32-77 (Saint Petersburg)

8 (800) 301-79-36 (Regions)

APPLICATIONS AND CALLS ARE ACCEPTED 24/7 and 7 days a week.

It's fast and FREE !

Concept and purpose

A certificate of withholding of alimony payments is a written document that confirms the fact of deductions in favor of the recipient. The need for such a certificate may arise in various situations, both for the payer of alimony and for the recipient.

Citizens who apply to banking institutions for loans are required to confirm all their income with relevant documents.

To confirm income in the form of alimony, you will need the above certificate.

The absence of a certificate of withheld alimony can become an obstacle when applying for subsidies, benefits, various social benefits and types of government assistance. The certificate is needed in any situation when the applicant needs to confirm all funds received into his account.

A person who pays alimony may need such a certificate in the following cases:

- reduction or deduction of taxes on the amount of alimony payments;

- confirmation of financial position in legal disputes;

- for argumentation when communicating with bailiffs collecting funds;

- confirmation of payment of the full amount of established alimony or debt to close the proceedings by the bailiff.

Also, a certificate of alimony may be needed in cases where it is necessary to determine the total family income and the average monthly income for each member.

Does the father have the right to child support? The answer is presented in the article “Can the father of a child apply for alimony for his maintenance.” You can find out how alimony is paid to your ex-wife here.

Issued by

A certificate of alimony can be obtained from different institutions, depending on the circumstances of payment of contributions.

If the payer works officially, does not hide the amount of his earnings and regularly makes payments through the accounting department at his place of work, then a certificate of alimony can be obtained directly from the employer’s accounting department.

The employer must cooperate with the FSSP on issues of withholding alimony and provide relevant information on the implementation of the writ of execution. Therefore, the second place where you can turn for help is the bailiff service.

Also, only a bailiff will be able to issue a certificate of alimony if it is collected on the basis of a voluntary alimony agreement between parents, since such an agreement has the force of an executive document.

In special cases, a certificate can be obtained from the pension authority or from an educational institution where a scholarship is paid to the child for whom alimony is being collected.

If the employer of the alimony payer is an individual entrepreneur, then you need to contact him or his accountant for a 2-NDFL certificate. A payer who does not work and is registered at the employment center must obtain a certificate from the same authority.

If the payer does not work and is not registered with the employment center, and a voluntary alimony agreement has not previously been drawn up between the parents, then no organization will be able to issue a certificate of receipt or non-receipt of alimony.

Place of issue

A certificate is issued about the withholding of alimony and its amount in the organization where the payer receives income:

- in the company's accounting department during official employment;

- In the FSSP, if collection is carried out in court;

- In the Pension Fund, if contributions are made from a pension;

- in an educational institution, if the payer makes transfers from the scholarship;

- at the employment center if your only income is benefits.

An individual entrepreneur can submit Form 2-NDFL, which reflects income and expenses. The expenses column must indicate alimony payments. When transferring child support under a notarial agreement, a certificate is issued at a notary's office.

If there is no official document on the case, and the payer transfers money by agreement with the second parent, then a bank account statement can be provided as confirmation. This document will be valid if, when transferring money, you do not forget to indicate the purpose of the transfers, indicating the details of the creditor and the period for which the payment was made.

They issue a certificate to the employee about the withholding of alimony free of charge, regardless of the place where it was received.

Where to present

To obtain a certificate, you must prepare a written application to the FSSP authorities or the relevant institution, company or organization that collects alimony under a writ of execution. In addition, the law does not prohibit an applicant’s oral request for a certificate.

Forms of certificates of alimony look approximately the same and are stored in almost every accounting department. The information included on the forms is often standard. The law does not establish a specific form for sample certificates, but some requirements have been approved in office practice.

Often, bailiffs are busier than the employer’s accounting department employees, so it is advisable to contact the accounting department directly to save time.

If a certificate is required by social security authorities, then in some territorial authorities the applicant may not be required to provide a certificate of alimony payments received at all.

In this case, they will be asked to indicate the place of work of the alimony payer - employees will request all other data on their own.

Is alimony provided from the state? The answer is presented in the article “Is it possible to receive alimony from the state in 2021?” You can find out how to apply for child support here.

Kinds

There are several types of alimony certificates that the recipient and payer of alimony funds need to know about.

About retention

A certificate of withholding of alimony payments from a citizen is drawn up taking into account the requirements of document flow, and its form is independently approved by the accounting department of each institution.

A document on withholding payments is issued by a financial institution that makes alimony payments on the basis of a notarized voluntary agreement of the parties or a writ of execution issued by the court.

The list of institutions mentioned above includes:

- employers' accounting departments;

- bailiff services;

- banking institutions.

About payment

The certificate of payment of alimony funds has some differences from the document about the withholding of alimony.

Such a certificate is drawn up in the name of the alimony payer indicating his personal information and position.

The contents indicate the document on the basis of which deductions are made, their frequency, amount and payment deadline.

At the end of the document, the date of issue and the signature of the employee authorized to issue it are indicated. When requesting information from the applicant, the certificate may also detail the amounts of transferred alimony for a certain period.

About debts

A certificate of alimony arrears should be obtained from the bailiff who is responsible for collecting alimony. A statement must be written in his name, which has the following structure:

- FSSP details;

- information about the applicant (full name, residential address);

- name “application for debt settlement”;

- description of the data of enforcement proceedings: who, to whom and for whose maintenance pays alimony, since when the collection occurs;

- indication of the day of the last alimony payment made and the reason for stopping payments;

- a description of the need to calculate the debt for the required period;

- a request to calculate the amount of accumulated debt on deductions;

- list of papers for the application;

- date, signature and its decoding.

It is necessary to write an application for a certificate of alimony arrears when alimony has not been paid for a long period, and the debt has not been calculated by the bailiff.

If the bailiff refuses to issue a certificate, then you can complain to the leadership of the FSSP or to the prosecutor's office, because the law provides for the duty of the bailiff to pay the debt on time.

How to submit an application

An application for a certificate of alimony is written in free form; there are no specific requirements for it. But you need to write in compliance with the rules of business correspondence, logically and consistently listing all the circumstances of the case.

The application must include the following information:

- name of the service where the application is submitted;

- personal data of the applicant.

The content must include a request to issue a certificate of deducted alimony indicating the amounts for a certain period. It should be indicated that the document is required for presentation at the place of demand. At the end, do not forget to put the date of writing and a signature with a transcript, that is, indicate your last name and initials.

You can write the application by hand or print it on your PC. After submitting and registering this document, the organization must issue the required certificate within 3 days.

General structure

In general cases, an application for issuing a certificate of alimony must contain the following details:

- information about the recipient and payer of alimony;

- the name of the organization or institution that transfers funds for alimony;

- personal data and positions of company employees who are responsible for transferring alimony payments;

- frequency of payments;

- expiration date of the certificate (in fact, the document does not have a specific expiration date, and its data will be relevant at any time);

- breakdown of accrual amounts for certain periods (if there is a need to display payments monthly, quarterly or for other periods of time);

- alimony debt.

The certificate is certified by the round seal of the enterprise, the signature of the manager and the official who issued the document.

The office also affixes a corner stamp with the date and reference number.

Why is a certificate of alimony withholding and its amount issued?

Confirmation of the fact of payment of allowance to children is a certificate. The sample certificate of alimony withholding and its amount is not approved by law, but contains standard points.

This is not just paper, but an official document. It is required by social security when registering:

- pensions and benefits;

- one-time payments for low-income people;

- benefits for utility bills;

- issuing free medicines.

A certificate is required if it is necessary to confirm the level of the family’s financial situation or income for each household member. The need to obtain a document may arise from both the claimant and the person who is obliged to pay alimony.

Officials can also receive a document confirming the withholding of payments:

- from social security authorities - to calculate benefits and subsidies;

- from the employment agency, if the only income of the alimony payer is benefits;

- from a judicial authority or the FSSP to suspend or close the proceedings;

- from the Federal Tax Service - to calculate the amount subject to taxation.

To receive a document confirming the withholding of alimony payments, you need to submit an application.

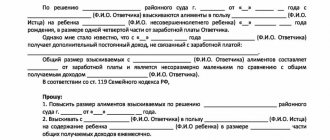

Sample certificate of alimony

Before contacting your employer or the FSPP for information about withholding or paying alimony, you should familiarize yourself with an example of an alimony certificate. After printing and taking the certificate form with you to the appointment, you can try to ask the bailiff or an accounting employee to fill it out orally.

Subsequently, the completed certificate is valid for presentation to social protection authorities, judicial, banking and other institutions.

Sample documents

There is no generally accepted certificate form developed. The applicant himself, who requires a certificate of the amount of alimony withheld, does not need a sample, since officials are responsible for issuing it. The basis for drawing up and issuing is a statement in which a request or claim is stated in any form.

Examples of document preparation:

- Sample application for the issuance of a certificate of withholding of alimony under a writ of execution.

- Sample certificate of withholding of alimony to bailiffs.

The certificate of alimony withholding and its amount does not have a validity period, since it displays data for a certain period. But in order to submit to the social protection authorities, it is necessary to submit a document issued no later than six months ago.

Is there a validity period

A certificate of alimony is often issued to confirm payments made over the past period of three to six months.

This document has no expiration date and will be valid throughout the entire period of its presentation.

This is explained by the fact that any other certificate describing payments for the same period will contain identical figures and indicators.

If a certificate is required for a different period of time, then the current one will no longer be valid for presentation, since it does not cover the required period.