First of all, it should be noted that, as a general rule, the transfer of ownership of an apartment to another person is the basis for termination of the right to use residential premises by family members of the previous owner (Clause 2 of Article 292 of the Civil Code of the Russian Federation). However, the law may provide exceptions to this general rule. As practice shows, such exceptions are established not only by law, but also by judicial acts (explanations given by the Constitutional Court of the Russian Federation and the Supreme Court of the Russian Federation).

How beneficial is a gift agreement with the right of lifelong residence?

This question cannot be answered unequivocally, since each party to the contract has both its pros and cons. Therefore, this type of deed of gift is carried out both between close relatives and between unrelated persons. In order for the gift agreement to fully enter into force, you will need to undergo mandatory registration of the agreement and carry out a number of procedures.

From the donor's side

What advantages does the donor receive when signing a contract:

- If a person decides to draw up a deed of gift with the right of lifelong residence of the donor in the apartment, this gives him the right to protect himself from eviction. He can also use the apartment in domestic aspects.

- The financial benefit of the donor lies in the transfer of responsibilities for paying for utilities to another person while retaining the right of use and the right of lifelong residence of the donor.

- According to Article 558 of the Civil Code of the Russian Federation, the donor, after drawing up a gift agreement with the right of lifelong residence, has the right to maintain registration.

In general, the donor has the opportunity to indicate in the text of the agreement a certain amount of non-property conditions under which real estate, be it an apartment or a house, passes to the recipient. If these obligations are not fulfilled, the donor can terminate the contract in court and return the apartment to himself. This is stated in Article 450 of the Civil Code of the Russian Federation.

Now about the cons:

- when drawing up an agreement, the donor cannot count on property benefits, since the deed of gift is an agreement for the gratuitous transfer of property;

- After completing the transaction, the recipient has the right to dispose of the apartment or house at his own request, for example, to transfer or sell the received property to third parties.

From the recipient's side

Let's consider the advantages of a donation agreement for an apartment with lifelong residence of the donor in it for the other party to the agreement:

- The most important advantage is receiving real estate free of charge.

- The opportunity to dispose of the received apartment at your own request and discretion.

- When such an agreement is concluded, other relatives on the donor’s side can no longer claim the donated apartment, since the property will no longer be part of the inheritance or part of the jointly acquired property.

- After receiving an apartment through a deed of gift, the recipient becomes the sole owner of the transferred property, after which, for example, a spouse during a divorce cannot claim a share in the donated apartment.

In the case of a deed of gift with the right of lifelong residence of the donor in an apartment without specifying the conditions of the donor’s dependency, the recipient will not be required to maintain or care for the donor.

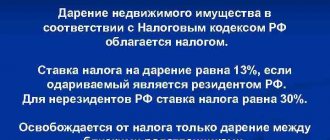

It is also worth noting that there is no need to pay income tax after receiving real estate. But the deal also has some downsides:

- When concluding a gift agreement with the right of lifelong residence, the recipient will not be able to evict the donor from the living space in the future.

- After receiving ownership of the apartment, the new owner, although he is free to dispose of the received apartment as he wishes, having a tenant on a permanent basis will become a significant obstacle to many transactions.

Prerequisites

General theses about rent, which do not contradict the current legislation of 2021 regarding the free use of an apartment, can be applied to this type of agreement. The conditions for the provision of such housing include:

- one party undertakes to transfer the living space to the other party, who must maintain the original condition of the property;

- an apartment or other residential premises must be provided for use free of charge - without any payment for the accommodation itself under the contract;

- the employer undertakes to pay every month for the services of the resources used (electricity, gas, water, etc.);

- The parties to the current agreement are 2 parties - the lender and the borrower. The lender is the owner of the premises or an authorized owner, according to regulatory documents. For example, an apartment can be transferred for free use by current tenants;

- The legal validity period of such an agreement is regulated by the general rental provisions.

In such an agreement the subject matter must be individualized. Such information includes: exact address, floor, etc. The document may contain additional conditions that do not contradict the current legislation of the Russian Federation.

Procedure for completing a transaction

The agreement for the donation of an apartment with lifelong residence must be drawn up in the presence of both parties to the transaction and with their full consent to the agreed terms. The deed of gift comes into full force after official registration in accordance with Article 574 of the Civil Code. To conclude an agreement you will need:

- collect a package of documents;

- draw up a gift agreement specifying all the conditions for the transfer of real estate;

- register the completed transaction in Rosreestr;

- obtain a certificate of ownership for the new owner of the apartment.

In this case, you should check whether the donor is really the sole owner of the apartment. In the case of shared ownership of real estate, it is necessary to obtain the written consent of the co-owners to conclude a deed of gift. These documents must be notarized.

Features of the agreement

If we talk about the features when drawing up a gratuitous rental agreement, it is worth noting that there are the following three types of rental:

- Social rent, when real estate from the housing stock of the state or local municipality is transferred for use;

- Special rental, when housing is provided in the form of dormitories, communal apartments, but mainly for a special category of citizens, which include migrants, refugees and the like;

- Commercial rental, when not housing, but premises for business are provided for rent, and the tenant is an individual or legal entity.

The conclusion of an agreement must be made only in writing and mainly between individuals. If we are talking about long-term rent and use of a residential property for more than a year, then the transaction is subject to registration. The maximum lease period is considered to be five years. After this, it must be restarted.

Documents for registration of deed of gift

To conclude a donation agreement for an apartment with lifelong residence of the donor, the following package of documents will be required:

- identity cards of both parties entering into the contract;

- drawn up agreement in triplicate;

- if the interests of the parties are represented by a trusted person, provide a notarized power of attorney;

- a document from the BTI containing information about the estimated value of the transferred property;

- an extract from the house register or a certificate stating how many people live in the apartment (number of registered persons);

- cadastral passport for living space;

- written consents of share owners, certified by a notary (if there are such persons);

- certificate of ownership of the transferred apartment, as well as a document confirming payment of the state fee due to registration and applications from both parties.

When an apartment is considered part of the jointly acquired property of the spouses, the written consent of the spouse to carry out the transaction will be additionally required.

What does the court take into account when determining the procedure for using an apartment?

First of all, the right of ownership and the proportionality of the allocated shares are taken into account, as well as the actual established procedure for use and the need of the owners. Many are confident that the court is obliged to take into account the interests of minor children, disabled people or pensioners who live in the disputed apartment. However, if these citizens are not participants in shared ownership, but are only members of the owner’s family, the court may consider the claim to assign them the use of one or another premises in the apartment as unfounded and reject it.

To resolve controversial issues regarding the determination of the right to use an apartment, contact a housing lawyer. Please note that filing a claim to determine the procedure for using an apartment in court is a last resort. After all, after legal proceedings, relations between owners may deteriorate so much that none of them will be able to exercise their legal right of use. Sign up for a consultation with an experienced lawyer who will help you break down the legal provisions and understand how best to act in your particular situation.

What must be specified in a real estate gift agreement?

In addition to the mandatory mention of the conditions regarding the right of lifelong residence of the donor in the donated apartment, the document must contain:

- date of conclusion of the contract;

- place of signing the deed of gift;

- information about both parties to the transaction;

- the most thorough description of the property being transferred, in this case an apartment;

- confirmation that the apartment does not have any obligations or debts, such as a mortgage or debt for rent and utilities.

Since the deed of gift is a gratuitous agreement, it is necessary to indicate a clause in which the donor confirms that he is formalizing the transfer of real estate consciously and agrees with the conclusion of such a transaction.

Despite the fact that after concluding a real estate donation agreement, the donor is released from the rights of ownership of this property and cannot dispose of it, he has the right to reclaim the apartment if the conditions for transferring the apartment under the concluded agreement are not met. The reason could be, for example, an attempt to evict the donor from the donated apartment, which is a direct violation of the main condition of the executed deed of gift.

DOWNLOAD: Sample gift agreement with lifetime residence of the donor.

How to determine the procedure for using a privatized apartment?

This can be done in one of two ways: voluntarily or compulsorily. Determining the right to use an apartment on a voluntary basis involves drawing up a special document - an agreement on the procedure for using housing. Such a document can be drawn up only if all owners of the apartment agree to determine the procedure for use. A real estate lawyer will help you draw up an agreement; you can have the document certified by a notary. The agreement must be drawn up legally and not violate the legitimate interests of the owners.

If the owners cannot come to an agreement, the issue can be resolved in court (forcibly). The plaintiff (a person who wants to establish the right to use shares of the apartment) can go to court at the location of the disputed real estate. After the court determines the procedure for using shares of the apartment , each owner has the right to dispose of his share at his personal discretion.

Is a written agreement for the free use of housing necessary at all?

Of course, only close people are allowed into their homes for free. In such a situation, signing an agreement will seem strange to many, an unnecessary reinsurance. The legislation, indeed, does not require the mandatory signing of paper documents for concluding agreements between individuals (not organizations). They can enter into agreements orally, including a loan agreement. And such an oral agreement is recognized as valid civil legislation of the Russian Federation. But it's not that simple.

The validity of an oral contract only means that in court, to prove its existence, the parties to the contract can refer to witness testimony. Unfortunately, the validity of a contract does not make it convenient for the parties or workable. And, honestly, how often do people connected by personal trusting relationships resolve conflicts in court? And why bring the matter to court if it is easier to resolve all issues at the stage of concluding a written free rental agreement.