Recently, the connection between generations has lost its relevance. Often, difficulties in communication between young and old people lead to quarrels and serious misunderstandings. This is precisely where the unpopularity of the annuity agreement in Russia lies. There are many elderly and lonely people in the world who, due to their age, need constant care and help. And so the pensioner decided to ensure a decent old age for himself by transferring his real estate in exchange for financial support and care. What should he prefer: a deed of gift, a will or an annuity agreement?

Let's take a closer look at all the options and decide what to choose.

Pros and cons of a gift agreement

Ch. 32 of the Civil Code of the Russian Federation gives the concept and reveals the essence of such a transaction as a gift. Its main characteristics are gratuitousness and unilaterally binding nature . Based on the analysis of the norms of this chapter, it is not difficult to identify the following advantages and disadvantages of using deeds of gift.

Positive aspects of giving:

- Availability of its completion (availability of oral and simple written form in the cases provided for in Article 574 of the Civil Code of the Russian Federation).

- Transfer of ownership at the time of conclusion of the contract (except for future donations and real estate).

- The object of the gift is the property of the person to whom it is given (there is no common joint property of the spouses). Basis - art. 36 of the Family Code of the Russian Federation.

- Possibility of exempting the donee from paying tax.

Main negative points:

- When giving a gift, the donor receives nothing from the transaction.

- Availability of taxation for the person to whom the gift is transferred.

- In case of termination of the contract, as well as in case of invalidity, the object of the donation returns to the donor. Grounds - clause 2 of Art. 167, paragraph 5 of Art. 578 Civil Code of the Russian Federation.

Donation

A deed of gift for property is widely used by people who want to remove property from the inheritance and transfer it to an heir ahead of schedule. This tool has some advantages:

- there is no need to have the contract certified by a notary;

- the donor does not have to spend his own money to complete the transaction.

But the risks in the case of a gift in exchange for an inheritance are much greater. In particular, the donor is deprived of absolutely all rights to real estate. This threatens him with immediate eviction.

Suppose that a certain citizen A. succumbed to the persuasion of an acquaintance and issued a deed of gift for an apartment in Moscow in his name. In return, the acquaintance promised to pay citizen A. money for life. But as soon as the recipient registered the property, he forcibly evicted citizen A. from the apartment, even though it was the only housing.

As can be seen from the example, citizen A. simply confused the meaning of the terms “donated” and “issued an annuity.” But if the annuity agreement had been drawn up, nothing would have worked out for my friend, citizen A.

Pros and cons of an annuity agreement

According to Art. 583 of the Civil Code of the Russian Federation, rent is a transaction for the alienation of property from one person (the recipient of the rent) to another (the payer). In this case, the latter undertakes, in exchange for the transferred property, to pay the recipient certain sums of money or otherwise maintain it. Thus, the defining feature of rent is its remuneration .

The current civil legislation of the Russian Federation provides for two types of such transactions: permanent and lifelong annuity . The difference between them is as follows:

| Basis for comparison | Constant annuity | Life annuity |

| Recipient | Citizens, non-profit organizations (clause 1 of Article 589 of the Civil Code of the Russian Federation) | Only citizens (Clause 1, Article 596 of the Civil Code of the Russian Federation) |

| Succession | Yes (clause 2 of article 589 of the Civil Code of the Russian Federation) | No (with the exception of the case of identifying several recipients of rental payments at once - in terms of the share of the deceased) clause 2 of Art. 596 Civil Code of the Russian Federation |

| Payment form | Cash, things, provision of services, performance of work (within the cost of payments) Art. 590 Civil Code of the Russian Federation | Only monetary terms (Article 597 of the Civil Code of the Russian Federation) |

| Payment terms | Quarter (unless otherwise stated) Art. 591 Civil Code of the Russian Federation | Monthly (unless otherwise agreed) art. 598 Civil Code of the Russian Federation |

| Ransom | Yes, both at the request of the recipient and by the right of the payer (Articles 592 - 593 of the Civil Code of the Russian Federation). The redemption price is established by the contract. | Yes, at the request of the recipient (in case of a significant violation of the terms of the agreement on the part of the payer) clause 1 of Art. 599 of the Civil Code of the Russian Federation. |

| Risk of accidental loss (or damage) of property | In the case of a free transfer of property, the rent payer bears the rent; in the case of a paid transfer, the rent is borne by the recipient (Article 595 of the Civil Code of the Russian Federation) | Does not relieve the payer from fulfilling the contract, i.e. the risk lies with him (Article 600 of the Civil Code of the Russian Federation). |

Information

At the same time, a notarial form is required for both types of contracts, as well as the amount of rental payments, which cannot be less than the subsistence level. A general condition is that the transfer of property can be either paid or free (Article 585 of the Civil Code of the Russian Federation).

Example

First situation: Ivanov and Petrov entered into a rental agreement for a residential building, according to which its transfer is free of charge, i.e. in this case, this agreement will also be subject to Chapter. 32 of the Civil Code of the Russian Federation - rules on donating property.

Second situation: Ivanov and Petrov entered into the same agreement, but the transfer of the house was valued at 1 million rubles. In this case, the rules on the purchase and sale of real estate will apply to the rental agreement.

The content of such an agreement may raise a lot of questions regarding its execution and purpose. In this regard, we will try to highlight the main features of annuity, i.e. its positive and negative aspects.

The advantages of the transaction are available for both the annuity recipient and the payer:

| Recipient of rent payments | Payer | |

| 1. | The contract is difficult to challenge, incl. after the death of the recipient (if the performance was in good faith) | |

| 2. | The notary is an independent person when certifying a transaction and confirming the legality of its completion. | |

| 3. | In addition to indicating rental payments, such an agreement specifies the terms of reference of the rent payer ( i.e., the clarity and scope of the terms of the agreement ) | |

| 4. | Has the right to further use of the property | The transfer of property itself may be free |

| 5. | Receives additional regular income in the form of rental payments, as well as the value of property (if its transfer to the payer is paid) | The property becomes the property of the payer in any case, since the recipient cannot sell it to another person |

However, rent is characterized by the following disadvantages:

- The requirement of a notarial form entails additional costs for completing the transaction.

- Even minimal failure to fulfill the contract may lead to its termination. In this case, the costs incurred are not subject to reimbursement . Moreover, with a lifelong annuity, the recipient has the right to demand compensation for losses from the payer (Article 599 of the Civil Code of the Russian Federation).

- If the annuity payer is dishonest, the annuity recipient will need to apply to the judicial authorities to terminate the annuity agreement.

- To become a full-fledged owner of the property, the rent payer will have to wait for an indefinite period.

- Taxation in some cases applies to both parties to the transaction.

- For the rent payer, not only the payment of rent payments is established, but he may also be assigned additional responsibilities, as well as payment of utilities (if we are talking about residential premises).

- The transferred property may be alienated by the annuity recipient to the payer on a paid basis.

- With a lifelong annuity, it is impossible to redeem it at the will of the payer .

- Disposal of the transferred property by the payer is possible only with the written consent of the annuity recipient .

- Rent is an encumbrance upon alienation of real estate (Article 586 of the Civil Code of the Russian Federation).

- The recipient of the rent acquires the right to pledge the property (Article 587 of the Civil Code of the Russian Federation).

Risks and pitfalls of each option - which is safer?

The table above should make it roughly clear to the reader exactly what the risks and benefits of each option are. If we determine not the benefit, but the safety of the method, then the annuity agreement comes first . There are several important reasons for this:

- Unlike a will, an annuity agreement cannot be adjusted. This eliminates the possibility of sudden non-fulfillment of obligations.

- Unlike a deed of gift, property is transferred into ownership under an encumbrance, i.e. the new owner of the property cannot use it to the fullest - sell, donate or otherwise alienate rights. This guarantees the fulfillment of obligations on the part of the annuity recipient.

- The contract can be terminated only by the voluntary consent of the parties or in court (we described how rent is contested in court here). Thus, the contract termination procedure provides additional legal protection to both parties to the transaction.

- There is no need to be guided not by pragmatic, but by emotional considerations (when drawing up a will or deed of gift, one of the parties essentially agrees to the conditions only because of trust in the other party).

- If the relatives of the deceased suddenly show up, it is most difficult to challenge the annuity agreement in court. On the contrary, it is quite easy to challenge a will and deed of gift, because The right of inheritance is legally established for all relatives of the first category (children, parents and spouse).

More details about drawing up a rental agreement can be found in a special article.

Important ! All of the arguments listed above clearly establish an annuity agreement as the most optimal and safest way to transfer property in exchange for dependency.

Of course, the benefit and convenience of each method greatly depends on what position the reader takes, as well as how high the level of trust is in relation to the other party to the transaction. But life, like people, is unpredictable; Therefore, it is best to ensure maximum legal protection for yourself in any case.

What is better - donating or renting an apartment?

Quite often, transactions related to the alienation of property, usually real estate, need to be formalized either through rent or donation. In order to understand what is included in the content, as well as the nuances of the execution of each of these agreements, we will resort to comparing them using the example of the alienation of an apartment.

| Apartment rent | Donation of an apartment | |

| Norms of the Civil Code of the Russian Federation | Ch. 33 of the Civil Code of the Russian Federation (using the rules of Chapter 30 and Chapter 32 of the Civil Code of the Russian Federation) | Ch. 32 Civil Code of the Russian Federation |

| Parties to the transaction | Recipient and payer of rent (Article 583 of the Civil Code of the Russian Federation) | Donor and donee (Article 572 of the Civil Code of the Russian Federation) Prohibitions - Art. 575 of the Civil Code of the Russian Federation. |

| Contract form | Notarial (Article 584 of the Civil Code of the Russian Federation) | Simple written, in some cases oral (Article 574 of the Civil Code of the Russian Federation) |

| Nature of the transaction | Paid | gratuitous |

| Availability of state registration | Yes, in both cases required, since an apartment is real estate. The grounds and requirements for the procedure are provided for by Federal Law No. 122-FZ of July 21, 1997 “On state registration of rights to real estate and transactions with it.” The amount of the state duty for the transfer of ownership: 2000 rubles (clause 22, clause 1, article 333.33 of the Tax Code of the Russian Federation - Tax Code of the Russian Federation). | |

| Object of the agreement | Apartment. It is necessary to indicate the address of its location, floor, number of rooms, area, incl. residential, cadastral (conditional) number | |

| Condition about cost | Necessarily | Optional (required for tax purposes) |

| Rights and obligations of the parties | The list is wide | The list is narrow |

| Prerequisites | Information about title documents (state registration certificate of ownership: series, number, date of issue), complete information about the parties to the transaction, an indication of the presence or absence of restrictions, encumbrances, pledges; information about persons who have the right to use and reside in residential premises; an indication of the procedure for registering the transfer of ownership. | |

| Additional Required Terms | an indication of the amount and timing of payments, the risk of accidental loss or damage | No |

| Availability of a transfer deed | The Civil Code of the Russian Federation does not provide for this document as mandatory (however, if the provisions of purchase and sale are applied when transferring property for rent, then the transfer and acceptance certificate becomes mandatory - Article 556 of the Civil Code of the Russian Federation) | |

Additionally

It should also be noted that when carrying out state registration of such agreements, the notarized consent of the second spouse to carry out the transaction may be required, as well as the consent of the guardianship and trusteeship authorities when a minor lives in the residential premises and the transaction may affect his rights and interests.

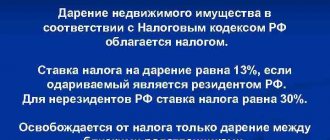

Taxation is also important when considering this issue. It should be noted here that when making a gift, the donor is not subject to taxation under the Tax Code of the Russian Federation, since such a transaction is gratuitous in nature. In this case, the donee bears the burden of paying personal income tax (NDFL) on the basis provided for in paragraphs. 5 p. 1 art. 208 Tax Code of the Russian Federation. The amount of such tax is 13% of the value of the property transferred to him under the transaction (Article 224 of the Tax Code of the Russian Federation). At the same time, this person is exempt from paying tax when there are close family ties between him and the donor (clause 18.1, clause 1, article 217 of the Tax Code of the Russian Federation).

Taxation of annuities is carried out somewhat differently than gifts. The rent payer, becoming the “legally” owner of the property from the moment of state registration, is obliged to pay the appropriate taxes. It is at this moment that this person may have an obligation to pay taxes associated with the purchase of an apartment. It depends on how he received it - for a fee or free of charge.

If the transfer of the apartment to the rent payer was carried out free of charge, then in this case the rules on donation apply. This also applies to taxation. Since apartment rental agreements are rarely concluded between relatives, the personal income tax payment will be 13% of the cost of the apartment.

In the case where the transfer of the apartment to the payer was paid, then personal income tax is not paid, and he, in turn, has the right to claim a property deduction associated with the acquisition of residential premises (Article 220 of the Tax Code of the Russian Federation).

The annuity recipient is also a beneficiary of the contract and must pay income tax. This includes the receipt of rental payments (clause 4, clause 1, article 208 of the Tax Code of the Russian Federation), as well as income received from the transfer of an apartment for a fee (clause 5, clause 1, article 208 of the Tax Code of the Russian Federation). The tax rate in this case will also be 13%.

Important

Moreover, this taxpayer also has the right to a property deduction from the sale of an apartment if he owned it for less than 3 years (up to 1 million rubles) - Art. 220 of the Tax Code of the Russian Federation, or it may be exempt from paying sales tax if the ownership was more than three years (clause 17.1, clause 1, article 217 of the Tax Code of the Russian Federation).

In addition to the above, the annuity recipient has the right to take advantage of the standard tax deduction provided for in Art. 218 Tax Code of the Russian Federation. This is regulated by clause 3 of Art. 210 Tax Code of the Russian Federation.

Taxation

When accepting an inheritance under a will, a state fee is paid. There is no additional taxation.

Property received under a rent agreement is not the income of the rent payer and is therefore not subject to taxation. For the annuitant, the maintenance provided to him is income, and therefore is subject to taxation at a rate of 13%.

When donating, income received by individuals from individuals is not subject to taxation, with the exception of donations of real estate, cars, and shares. Gifts between family members and close relatives, including real estate, vehicles, shares, are not subject to taxation.

Consequences of using a gift agreement instead of an annuity agreement

Sometimes when registering transactions related to property, incl. With its alienation, unreliable persons are trying to circumvent the current legislation with all sorts of tricks in order to obtain a certain benefit.

Example

Reducing the amount of sales tax, violating the property regime of spouses, etc.

Moreover, in order to achieve their goals, such persons often replace one transaction with another, incl. it may be associated with rent and gift. However, such a substitution can easily be discovered, and the transaction will be declared void from the moment of its conclusion (Articles 167, 170 of the Civil Code of the Russian Federation).

In simple words, this transaction does not have any legally significant consequences for the parties who entered into it. At the same time, the regulation of such transactions will have to be carried out according to the norms to which it actually applies.