Why is such a certificate needed?

A certificate of no debt, issued by the Bailiff Service, is required in various situations, for example, when a person intends to leave the country. Many points require certification of the fact that the citizen has no debts either to the state or to other people.

Some organizations require the preparation of the certificates in question in the following cases:

- the citizen's intention to travel abroad,

- the need to clarify the fact of the presence or absence of debts to the state,

- participation of organizations in tenders, loans, license registration.

A certificate will also be required in case of participation in real estate transactions.

Can bailiffs seize an apartment for debts?

Certificate of absence of debt from the Tax Inspectorate

For individuals, a certificate may be needed in several cases:

- Registration of an individual as an individual entrepreneur.

- Change of citizenship.

- When applying for a large loan (such as a mortgage), the lending institution may ask for a certificate.

- When applying for tax benefits. For example, on land.

- When making large transactions. For example, selling an apartment, car, land, etc.

When is the certificate provided? The document, upon written application, is provided after 10 working days from the date of receipt of the application (the period is regulated by letter of the Federal Tax Service of Russia dated July 2, 2012 No. 99). Weekends and holidays are not included in this period. The Federal Tax Service may be needed not only by companies or individual entrepreneurs, but also by those categories of citizens who have never engaged in entrepreneurial activity. A certificate is a state-issued document issued by the tax authority upon a written application from organizations and individuals. Tax certificates Contents

- Why and in what situations is a document needed?

- How to make an application and submission procedure

- How often do you need to request a certificate of no tax arrears?

Why and in what situations is a document needed? For organizations and individual entrepreneurs, a document may be needed in the following cases:

- At the request of buyers or supplier.

When there is a risk of delaying the provision of a certificate to the body or company that requested it, you can order the document urgently. To do this, you need to choose one of two methods:

- contacting the tax office with payment of the fee provided for the expedited preparation of the document within three days;

- services of a commercial law firm.

The second method will cost more, but its advantage is that you do not need to spend personal time getting paper. The choice of a company to provide legal services must be approached responsibly, since in the process of work confidential data about your company will be affected. For example, without such a document it is impossible to get a mortgage.

- Privatization of housing.

- Refusal of citizenship in favor of a new one.

- Obtaining a bank loan.

- Employment. Especially for leadership positions for large financial transactions.

- Legal entity Organizations need a certificate for the following purposes:

- Search for investment resources.

- Opening a credit line at a bank.

- Request from the company's counterparty.

- Participation in the state tender.

- Receiving subsidized assistance from the state budget

- Liquidation of a legal entity.

- Dismissal of the chief accountant and hiring of a new one.

- Registration with another branch of the Federal Tax Service when the legal address of the company changes.

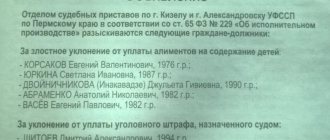

How to find out if you have debts

There are two main ways to determine the existence of debts, which include:

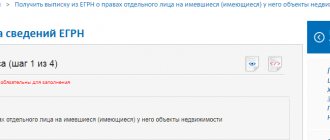

- Contacting the FSSP through the official website of the service. Next, you will need to go to the “Service” section, then select the first line and follow the link. A window will appear on the site that needs to be filled out, after which information about the debts of the person will be generated.

- Personal appeal to the FSSP. This option will allow you to receive an official document signed and stamped by a service employee. Only such a certificate will be considered confirmation of the absence of debts.

By law, the execution of the document should not take more than thirty days.

Attention! Our qualified lawyers will assist you free of charge and around the clock on any issues. Find out more here.

How and where to apply to obtain a document

The best option to obtain a certificate is to contact the FSSP. At the service, the person will be given advice and explained about the nature of the certificate and the procedure for obtaining it. In this case, you need to choose the department where the writ of execution was sent, and in the absence of one, to the FSSP department according to the citizen’s registration address.

If there is no information in the bailiff service, then to obtain information you need to contact the regional department, where a decision will be made to redirect the application to the appropriate department. After receiving the documents, the FSSP, which controls the debts of a particular person, will issue the certificate in question.

The application, if submitted, must be redirected to the regional authority no later than five days from the date of application. After the specified time, the relevant department of the service should already receive the application and begin processing the certificate within a thirty-day period.

Watch the video. How to find out debt from bailiffs, debt repayment:

About the issuance rules

Please note! Taking into account the type of debts and the type of debt certificates, the following general recommendations are provided for a citizen:

- If a citizen needs an exact indication of the amount of debt, for example, for court purposes, then this should be stated in advance. In addition, bailiffs can provide information about the amount of debt and the dates of repayment, which is also done at the request of the person

- If a person has a question of alimony, then a special certificate will be required, which will reflect not all possible debts, but only the status of alimony payments. Such a certificate may be needed by the guardianship and trusteeship authorities, the court, the employer, and so on.

- If a citizen requires information about the beginning and progress of enforcement proceedings, then a corresponding certificate will also be required. Often such a document is required not by the debtor, but by the collector who controls the process of debt repayment.

Each of these certificates acts as an official document, and the information indicated in them has legal force.

Is it possible to pay a debt to bailiffs in installments?

The legislator also defines a clear list of persons who can apply for the issuance of the certificate in question:

- debt payer,

- collector,

- representative of the claimant or payer if there is a power of attorney.

If an attorney is involved in the case, the original power of attorney will be required. Such a document serves as the only confirmation of a person’s right to receive a certificate. Accordingly, information from the certificates is in limited access.

Application for issuance of a certificate of absence of enforcement proceedings

Most often it is ordered by legal entities if necessary:

- reorganization of the company or its complete liquidation;

- transfer of the subject to another tax company;

- at the initiative of the organization itself to confirm payment data, participate in various tenders or competitions, as well as to draw up business plans;

- contacting the bank with a request to provide a service;

- in other cases provided for by law.

The certificate is issued upon a special request, which the taxpayer submits to the appropriate service in person or sends by mail.

The document is drawn up as of a specific date in accordance with the wishes of the customer. If the request does not contain a specific date, then it is drawn up at the time of its registration with the tax office.

Sample application for a certificate from the FSSP

applications for the issuance of a certificate of absence of enforcement proceedings free of charge in word format

Important! In order for an application for a certificate to be accepted by bailiffs, it is necessary to follow the rules for drawing up such an application:

- Written form. This condition is mandatory. Oral appeals are not accepted; the only thing the bailiffs can do in this case is to provide advice on subsequent actions. Also, requests sent by email are not taken into account.

- A notary certification is not required; the application form must be simple in writing. Unified forms are also not used. It is enough to correctly state the request and indicate the type of certificate,

- The date of compilation and the personal signature of the applicant are required. You are also required to provide personal information. If there is no information about the applicant, then the application is considered anonymous, which is not allowed by law,

- The requirements in the application must be specified. If it is not clear from the application what needs to be done, the application will be returned.

How long does it take for bailiffs to write off debts?

If you comply with these requirements, then there will be no problems with submitting and accepting an application to the FSSP. Referral is permitted only through a personal visit to the service or the use of postal services.

When the appeal is made through a personal visit to the bailiffs, you need to draw up two statements. One copy is handed over to the bailiff, the other remains with the citizen with a note indicating acceptance of the appeal for consideration. From this moment the thirty-day period for issuing the certificate begins to run.

Additional rules

When contacting bailiffs, citizens should know that they do not need to indicate the reasons why the certificate was needed and select the grounds for the appeal. Moreover, the bailiff does not have the right to demand explanations and find out why the document is being drawn up.

Important! When receiving a certificate, you need to check whether the document has the seal of the bailiff service and the signature of the bailiff who directly prepared the paper. Unlike an application, a certificate also requires a special form that is filled out by an official. The presence of the form is important because the official seal is affixed to it.

If bailiffs violate the procedure for issuing certificates or provide inadequate services to citizens, this allows officials to be held accountable. Violations, including those related to the deadline for issuing a certificate, must be reported to the prosecutor's office by filing a complaint and attaching supporting documents.

Watch the video. What is the FSSP resolution:

Sample certificate for bailiffs about a salary card

To successfully remove the seizure from other accounts and limit the write-off of funds, the salary certificate must be properly prepared. A sample salary card certificate can be downloaded from the FSSP website, where an example of how to fill it out is discussed in detail.

Thus, it is noted that there is no unified form for such a document, but it must contain:

- Details of the organization, legal form of ownership and name.

- The position of the employee for whom there is a court decision, his passport details and the start date of work.

- The amount of salary and bonuses for a specified period of time.

- Details, including a correspondent account for transferring wages.

- Signature of the director or chief accountant, seal of the enterprise. In cases where the position of chief accountant is not included in the staffing table, a note in the certificate stating that “the position is not provided for.”

It is necessary to understand that the amount of monthly write-off from a salary card can be reduced to 30% or lower in cases where the debtor has minor children as dependents. So, if a family with children is single-parent, then the percentage cannot be more than 25.