Who can receive benefits

A one-time benefit at the birth of a child can be received by one of the parents of the baby (father or mother) or a person replacing them (guardian).

In this case, these persons may be either employed or unemployed. Existing legislation determines that payments to grandparents and other relatives are not made if the baby has a father and mother.

Payments are always calculated and issued at the place of employment or service, if at least one of the parents has an employment agreement. Sometimes a situation occurs when both parents do not have concluded employment contracts. Then, to receive benefits, one of them needs to contact the territorial social security authority.

Placement benefits are issued:

- Employed citizens;

- Civil servants of military units located in other states.

To apply for a payment through the social security authority, you need to contact:

- Who is undergoing military or equivalent service on a contract basis;

- Who was dismissed from military units due to the expiration of the contract, or due to the transfer of a military unit from the territory of another state;

- Persons who are currently unemployed or are registered with the employment service;

- Those undergoing full-time training on a free or paid basis.

Attention! When the parents are divorced, the payment is transferred to the person with whom the child currently lives.

Basic Rules

The mother, father, as well as legal guardians and guardians have the same right to demand financial compensation. The appeal is of a declarative nature. Financial support is provided to parents of a newborn if the following conditions are met:

- if applicants are covered by compulsory social insurance for maternity and disability, documents should be submitted to the company with which the employment contract is concluded;

- if only one of the spouses is employed in the family, it is he who applies for the accrual;

- the unemployed address the application to the structural units of social protection of the population;

- if the spouses are officially divorced, the person with whom the child lives is asking for help;

- You must submit documents within the time limits established by law.

A certificate confirming the non-receipt of money by another entity is required in almost any case. This is explained by the fact that the law provides for the opportunity to receive funds from various government agencies or the employer. Having a reference confirmation allows the government to avoid double improper funding.

How long does it take to receive a lump sum benefit?

The child's parents have the right to receive this amount within 6 months from the date of birth of the baby. To receive payment, they submit an application and prepared documents to their employer.

If 6 months have passed, the decision on the transfer of funds will be made directly by the FSS. To do this, the fund must provide evidence confirming the impossibility of applying for benefits within the prescribed period.

The decision to issue benefits after submitting a package of documents is made within 10 days. During the same time period, social insurance, if the decision is positive, makes the transfer. In a situation where the fund refuses to pay, it must report this within five days and return the documents provided.

Attention! The validity period of a certificate of non-receipt of benefits is not determined by regulations. They only say about the need to provide it. In practice, the social security authority requires that such a document be issued no later than 1 month before applying for benefits.

This is justified by the fact that such a certificate only records the event on the date of its issue, and therefore may become irrelevant over time. Therefore, it is recommended to first contact the authority where the payment will be processed and clarify their accepted period for the validity of the certificate.

You might be interested in:

Order on appointing a person responsible for personal data: is it necessary to draw up, who to appoint as responsible, sample filling

Where is the certificate required?

The certificate is required to assign a lump sum benefit upon the birth of a child. It should be provided to where the payment is calculated. Employed citizens are required to submit a document to the accounting department of the organization where they work.

For those who are temporarily unemployed, the payment is accrued in the SZN. In this regard, it is necessary to contact the government organization at the place of registration.

Social service employees will ask you to write an application, to which you will need to attach a copy of your birth certificate and other documents.

What documents are required to receive benefits?

The composition of the set of documents varies depending on how you are requesting benefits - through your employer or through the social security authority. In the latter case, it is more voluminous and also includes SNILS, a certificate from the housing department and other forms.

When applying for benefits through an employer, you must provide:

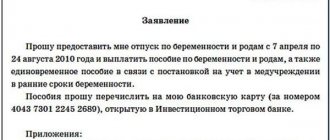

- Application for benefits using the employer’s form (filled out freely or on a template);

- Certificate of birth of a child, form F24 (it is issued by the registry office upon receipt of the certificate);

- Passports of existing parents for verification, as well as their copies;

- Birth certificate - copy and original for verification;

- Certificate of non-receipt of a one-time benefit for the birth of a child from the second spouse. Such a certificate is issued: If he/she is employed - in the accounting department or HR department of the company;

- If he/she does not work - in the territorial social security agency;

- If he/she is self-employed (individual entrepreneurs, lawyers, notaries, etc.) - in the territorial body of the Social Insurance Fund.

A certificate of non-receipt must be issued by the parent who does not plan to receive benefits. It should be borne in mind that of the two working parents, it is always paid to the employed one.

Attention! Unfortunately, a situation may arise when the parents do not live together, but at the same time have not formalized the divorce. But the second spouse refuses to provide the document, or simply ignores requests to issue it. The law does not provide for action in such a case.

It will be necessary either to establish contact with the spouse and convince him to issue a certificate, or to contact his employer in writing, indicating in the request that the second spouse refuses to issue the document. However, most likely the management of the employing company will refuse, due to the fact that such information is personal data.

In addition, after a certain period (usually 70 days from birth), you will need to apply for a babysitting allowance. Then, when requesting it, you will also need to provide a document confirming the non-receipt of benefits for a child up to 1.5 years old.

It makes sense to receive both certificates at the same time in the case when maternity leave has begun (and with it the right to a monthly benefit has arisen), but a one-time payment has not yet been issued until this moment.

Attention! An individual entrepreneur must obtain a certificate of non-receipt of benefits from the Social Insurance Fund of his district.

List of documents

To receive benefits, a parent must fill out an application and provide the following information:

- employer's name;

- information about yourself: full name, status (mother, father, guardian, etc.);

- passport details;

- registration and residence address;

- type of benefit and method of receiving it;

- account details;

- signature, date.

The application must be accompanied by:

- a certificate establishing the fact that the second parent did not receive financial state assistance for the child;

- birth certificate of the baby.

When a parent is divorced, he must have a divorce certificate with him. If the second parent is missing, has died, or has been deprived of parental rights, then all this will need to be confirmed with documents.

If the child was born abroad, you will need to provide a photocopy of the relevant certificate or other document. An employee can receive it at a Russian consular office abroad. A line-by-line translation of the document is required, as well as an apostille and legalization.

When the applicant is a guardian, adoptive parent or foster parent, the following is attached to the package of documents:

- an extract from the decision on adoption or guardianship of a child;

- a photocopy of the court order on adoption;

- a photocopy of the agreement on transferring the baby to live with a foster family.

The documents are sent to the applicant's employer. If a person does not work, then they must be provided to a social security officer. In this case, an extract from the work book about previous employment is attached to the documents.

The maximum period for providing documents is 6 months. If the parent does not make it in time, then he is not entitled to payments. The rule applies to all applicants for benefits.

How to obtain a certificate from work about non-receipt of benefits

To compile this certificate, there is no special form or standard form that must be used. As a rule, a document in companies is drawn up in any form using company letterhead.

You might be interested in:

Order to cancel an order: why it is issued, grounds for cancellation, how to fill it out correctly

At the top of the document the name of the company, TIN, KPP and OGRN codes, location address and bank details should be indicated.

Below on one line the date of filling out the certificate and the place are indicated.

After this, in the middle of the new line the name of the form is indicated - “Help”.

The text must indicate:

- Issued to: full name. employee;

- An indication that he actually works for the company. It is necessary to indicate the date of admission, position, information about the order for admission;

- Statement that during the specified period of work he did not apply for a lump sum benefit for the birth of a child;

- Information about the child for whom the payment is requested - full name, date of birth.

Below you need to indicate for what purposes the certificate is issued. You can indicate a standard phrase stating that the document was issued for presentation at the place of request.

The certificate is signed by the head of the company and the chief accountant. In cases where the document is drawn up by a responsible person (for example, a billing accountant, a personnel officer, etc.), then he can also put his signature.

What must the employer indicate in the certificate?

There is no legally approved form for such a certificate, so the employer develops his own form for it. The main thing is that the certificate contains all the necessary information:

- Name and other important information about the organization.

- Place where the certificate is issued.

- Outgoing number. Under it, the certificate is recorded in the journal of documentation issued to employees.

- Date of issue of the certificate.

- Title of the document.

- Position and full name of the recipient of the certificate.

- Confirmation that the employee actually works for the organization and has not received child care benefits for up to one and a half years.

- Full name and date of birth of the child.

- Validity period of the certificate. It is 30 days.

- Signatures of the head of the organization and the chief accountant.

- Organizational seal, if applicable.

The certificate must be printed on the business entity’s letterhead.

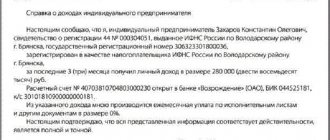

If an individual entrepreneur issues such a certificate for himself, then he indicates similar information about himself and signs it.

How to obtain a certificate from social security authorities

When one or both parents do not have a job, a certificate of non-receipt of payment must be issued at the territorial social service agency. protection. At the same time, you can simultaneously issue a certificate of non-receipt of benefits for a child up to 1.5 years of age, if parental leave for a child up to 1.5 years is also issued at the same time.

In addition to the unemployed, the following types of citizens should also apply here:

- Registered with the employment service;

- Unemployed citizens of retirement age or with disabilities;

- If the parent is not accommodated for any other reason;

- Students who are studying full-time.

Obtaining this form is not difficult; when contacting the authority, you must have two documents with you:

- Passport of the person (parent) who will receive the certificate.

- Child's birth certificate.

Attention! Some regions also require you to provide a completed application, the form of which can be obtained on site. After checking the information, a certificate of non-receipt of a one-time benefit at the birth of a child is issued on the same day.

Obtaining a certificate as an individual entrepreneur

Individual entrepreneurs apply to the social protection authorities for a completed certificate. An entrepreneur cannot receive benefits for a child at the expense of the Social Insurance Fund (except for situations where he, at his own discretion, entered into legal relations with social insurance for disability and maternity, which will need to be confirmed with a certificate from the Social Insurance Fund).

The FSS has a negative attitude towards certificates that individual entrepreneurs write out for themselves. Specialists may additionally require a certificate from the social security authorities stating that the person did not receive benefits at his/her address.

Since the individual entrepreneur does not have an employment relationship with himself, he is not able to provide a certificate of employment. For this reason, he needs to contact the social security authorities. This will prevent disputes in the FSS and possible litigation. Judicial practice shows that an entrepreneur is likely to receive a positive decision in his favor, but the proceedings will require a lot of time and effort.