Certificate for three months about income for social security in 2021 sample

To avoid difficulties in understanding the essence of the presentation, you should pay attention to the basic concepts used in the provided article: Term Meaning Employee salary Remuneration of an employee who is officially employed.

A certificate of average monthly earnings for six months will also be needed when applying to social security, for example, to receive “children’s” benefits or apply for a subsidy for utility bills. In addition, obtaining a visa to enter some countries will also require the submission of a certificate for six months (although other periods may be indicated).

The accounting specialist also enters the amount of income tax deducted. If the applicant pays alimony or credit obligations established by a court decision, then this is also indicated.

Where can I get a certificate of income for 3 months?

If a person has an official job, in order to create a paper according to the sample, he will have to contact the accounting department or his superiors. If the report is made by an accountant, you still cannot do without visiting management. The director must affix the necessary signatures and seals.

If a person is called officially unemployed, you need to contact the city employment center for a reporting document. Here the fact is verified that it is not possible to complete the registration and receive official income for the last three months.

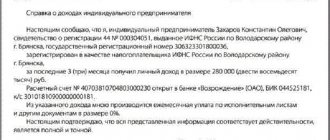

Entrepreneurs may not receive any certificates at all. Individual entrepreneurs confirm their income with constant regularity. They need this to avoid problems with the law. For this purpose, certification of a variety of statements is suitable, which can confirm profit for the last three months of the report or for another period. The income statement is created on the basis of previous certified papers.

Special requirements

As for the informational part, that is, directly the amount of the employee’s income, some social security authorities require this information to be presented in the form of a table. It looks something like this:

| Month | Total amount of payments (RUB) | Withheld (RUB) | Issued by hand (RUB) |

| October | 10 000 | 1 300 | 8 700 |

| november | 10 000 | 1 300 | 8 700 |

| December | 10 000 | 1 300 | 8 700 |

| Total | 30 000 | 3 900 | 2 6100 |

So that the employee does not waste time, and the accountant does not redo the certificate again, it is better to find out in advance in what form the data should be presented.

Attention! One of the purposes of a salary certificate is to receive a subsidy for housing costs. In this case, it should contain data not for 3, but for 6 months . This is the requirement of paragraph 32 of the Rules for the Provision of Subsidies, approved by Decree of the Government of the Russian Federation of December 14, 2005 No. 761.

This is important to know: Supplement to pension for children: amount of payments

Application for a salary certificate

A salary certificate for 2 years is a document that is useful to an employee for calculating compensation for sick leave, as well as for calculating maternity and child care benefits. You can obtain this certificate from your employer based on your application.

An application for a salary certificate for 2 years is written in free form outlining a request for the provision of this document. An employee can request this certificate upon dismissal in order to present it at a new place of work so that the employer can correctly calculate benefits.

An employee can also apply for a salary certificate later, when the need arises. A written application in the form of an application is mandatory; the employer is obliged to provide information to the employee about payments to him, as well as about the periods that are excluded from the calculation of sick leave benefits.

salary certificates can be found at this link. Below is a downloadable sample application for this certificate.

Examples of certificates

In conclusion, we provide sample examples of a certificate of income for 3 months for social protection authorities. Of course, it may look different, but the main thing is that it contains all the necessary data.

Certificate of income - option 1 Certificate of income - option 2 Certificate of income - option 3

A certificate of average earnings is a document confirming that an employee works in an organization and receives a certain income for a specified period. It may be required at an employment center, bank, or when applying for a visa to travel abroad.

How to apply correctly?

If the certificate itself has a standard form, then the application is drawn up in any form.

First of all, it must be addressed to the manager of the former place of work. Write who is the author of this statement.

In the main part of the application form, a request is written to issue a certificate of wages, as well as other payments to the employee (indicate which employee), from which insurance contributions to the Social Insurance Fund were calculated. The years for which information must be provided must be indicated. To calculate sick leave, two calendar years prior to the year of sick leave are taken. You need to ask for a certificate of income for these accounting years.

You should also provide information about the person about whom information is requested: full name, passport details, SNILS, registration address.

The certificate is issued only to the person whose details are indicated in the application. If another person requests a certificate, then there must be a power of attorney to represent interests.

The application is signed and a date is set for its execution.

statements

Sample application for a salary certificate for 2 years - download.

Upon dismissal and registration of pension

Upon dismissal, in addition to the work record book, the employee receives information from the employer about the amount of salary. This information about average earnings is necessary for presentation at the place of your next employment, for applying for unemployment benefits and in other authorities that use this data in their work.

To calculate benefits provided by the Social Insurance Fund, the employee must be issued a document in form No. 182n. Its form was approved by order of the Ministry of Labor of Russia dated April 30, 2013 No. 182n.

It contains information about average earnings for the last and two previous years.

For what purposes is a certificate needed?

The certificate is required to calculate benefits for temporary disability, pregnancy and childbirth, as well as child care benefits for up to one and a half years for those employees who have worked not only in your organization in the last two years. The fact is that all of the listed types of benefits are calculated based on payments for two calendar years preceding the year of the occurrence of the insured event, that is, temporary disability or maternity or child care leave (clause 1 of article 14 of the Federal Law of 29.12 .2006 No. 255-FZ, hereinafter referred to as Law No. 255-FZ).

How can you find out the amount of accruals if the employee has not worked for the organization for the last two years? To do this, you will need a certificate that he brings from his previous place of work.

Applying for loans, subsidies and visas

Credit institutions usually do not require a certificate of average earnings to determine the amount of unemployment benefits, but bankers need a document on the average salary for the last three to six months. Existing legislation does not establish a unified form for such a document and does not specify what information it includes.

But banks require that it contain:

- name of company;

- Contact details;

- employee's length of service;

- job title;

- monthly data on wages.

A similar document is sometimes requested to apply for subsidies.

Where should I submit the certificate?

The described form of document for benefits is required to receive subsidies and submit them to one of two organizations:

- Department of Social Security and Social Security.

- Center for Labor and Official Employment.

In the first case, they are necessary to recognize the family as officially low-income according to the latest data. These families can count on benefits, discounted travel, and partial compensation for daily wages. A family will be considered insufficiently wealthy in a situation if its profit for the last three months is below the minimum. It is worth noting that sometimes one person without a job is recognized as poor.

An important rule is the need to confirm your status annually. If the minimum level increases during any period, employees of the Republic of Belarus or social protection must be immediately notified about this.

As for providing a reporting certificate to the employment center, it is necessary for the official status of the unemployed and to understand how much special benefits to assign to the employee. This rule does not apply to young people who are registering for the first time. They are not required to provide such a document.

To obtain an extract, you should contact the accounting department, verbally explaining the purpose for which the request is being made. At some large enterprises, you need to make a written application to receive it. According to modern legislation, management is given three days. This is the maximum time for a written request from an employee within which the employer must respond to the request.

Certificate of average earnings for the last three months at the last place of work for subsidies

When applying to visa centers and foreign embassies to obtain a visa, you also need this document. It must be printed on company letterhead. Its form is not defined by law, but in practice it is recommended to indicate:

- name of the enterprise;

- Contact details;

- employee position;

- monthly salary for the last six months.

There must also be wording that during the trip abroad the employee retains his job and salary. Embassies of some countries, when considering a visa package of documents, give preference to the 2-NDFL form, since it is real evidence that the visa applicant is legally employed.

What does a sample salary certificate look like in 2016?

Today, payment of wages not lower than the minimum established by law is not a right, but an obligation of every employer.

At the same time, the amount of wages in many cases is a fundamental factor on the basis of which it becomes possible or impossible to carry out any action (applying for a loan, adoption, etc.).

Often, documentary evidence of the availability of wages and its amount is required. That is why, at the request of his employee, the employer is obliged to issue him a special salary certificate.

Today, a salary certificate form is required to perform a variety of actions; it may be required by various institutions - both public and private.

Since to carry out many actions it is necessary to have an official salary. For example, when applying for a loan, the bank must have guarantees that the funds will be returned to it.

Both the employee and his employer should consider the following important questions:

- necessary definitions;

- purpose of the document;

- legal grounds.

This will allow you to avoid various controversial issues when applying for a new certificate of employment. Since the implementation of this procedure is associated with a fairly large number of different nuances.

Necessary Definitions

In order not to experience difficulties in analyzing the legislation, it will be necessary to familiarize yourself with the following important definitions in as much detail as possible:

- wage;

- minimum wage;

- compensation and incentive payments;

- 2-NDFL.

The term wage means payment for the work of an officially employed employee, depending on his qualifications, as well as other points.

Its amount is necessarily fixed in the employment contract. the conclusion of which is mandatory today.

Wages are the basis for calculating pensions, as well as compensation for sick leave and vacation.

Today, wages cannot be less than the amount established at the legislative level.

In 2021, the minimum wage is set at 5,965 rubles. The basis for this is Article No. 1 of Law No. 408-FZ of December 1, 2014.

The employer also has the right to pay its officially employed employee all kinds of compensation and incentive payments.

Their value is established by him independently, but at the same time this moment must be regulated by the employment contract, as well as by the internal regulations of the organization.

Nominally, such payments are not wages, but at the same time they are taken into account as official income - therefore they are necessarily reflected directly in the income certificate.

Most often it is issued in the form 2-NDFL. In fact, this document reflects the amount of personal income tax deductions in favor of the state.

But based on this data, you can very simply determine exactly what the income of an officially employed employee is for a certain period of time.

Also, to confirm the amount of income, a certificate of wages and other income, standard form No. 46, can be used.

This document is specialized, its format is unified and fixed at the legislative level. In it, the actual salary received is indicated for each month separately.

Document Purposes

A certificate of salary is a necessary document in many cases.

Typically, this document is required to complete the following actions:

A document confirming earnings is issued in connection with the need to take out a loan or move to another job.

Since the average salary is used to calculate sick leave, to calculate it it is necessary to obtain information for the last 24 months.

For what a deposited salary is, see the article: deposited salary.

Read the procedure for calculating and paying wages here.

In the absence of appropriate certificates, payment for sick leave will be made at a minimum.

Confirmation of the amount of wages for the Pension Fund of the Russian Federation is also required - when a citizen retires due to age or for length of service.

This point is reflected in sufficient detail directly in the current legislation.

Guardianship and trusteeship and social protection authorities that accept documents to establish guardianship also require a certificate of the type in question.

Photo: sample form 46

Since the potential guardian must confirm that he has the ability to adequately provide for the child taken under guardianship.

It should be remembered that in some cases you will need a certificate not in form No. 46 or 2-NDFL, but in another form. For example, banks often make such a requirement.

The basis for issuing this document is the appropriately expressed request of the employee himself (in writing or orally), as well as legislation.

The employer is obliged to comply with the deadlines for issuing the document of the type in question, and has no right to refuse to issue a salary certificate to its employee.

Legal grounds

The procedure for processing and issuing a salary certificate is regulated by the following regulatory documents:

- Labor Code of the Russian Federation, as amended by Law No. 197-FZ of December 30, 2001.

- By Order of the Ministry of Labor No. 182n dated April 30, 2013.

- Article No. 15.1 of Federal Law No. 255-FZ - according to this provision, the employer bears full responsibility for the accuracy of all information presented in a document of this type.

- Clause 3 of the procedure for issuing a certificate - approved by Order of the Ministry of Labor No. 182n dated April 30, 2013.

The employer should remember that violation of the above legislative acts can lead to quite serious problems with the tax and labor inspectorates.

That is why it is worth studying them all in as much detail as possible. But it is worth remembering that with a certificate in the form of a bank, the situation is somewhat different.

The format of this document is not specified in the legislation, nor is the duration of its preparation. However, it must be completed within a reasonable time.

Sample application for the issuance of work-related documents

______________________________ (full name, position of manager and name of employer) From ____________________________ (full name, position, address)

Application for the issuance of work-related documents

Please provide me with the necessary documents related to my work, namely (select the necessary documents from the list provided or indicate your own):

- a copy of the employment order _________ (if known, indicate the date and number);

- a copy of the dismissal order _________ (if known, indicate the date and number);

- a copy of the transfer order _________ (if known, indicate the date and number);

- a copy of the employment contract _________ (if known, indicate the date and number);

- certificate of wages for the period from ___ to ___ (indicate the period for which wage information is required);

- a certificate of the components of wages for the period from ___ to ___ (indicate the period for which information on wages is required);

- certificate in form 2-NDFL “Certificate of income of an individual” for the period from ___ to ___;

- characteristic in my name, indicating the required information _________ (list the information that must be indicated in the characteristic);

- a certificate of accrued and paid insurance contributions for compulsory pension insurance for the period from ___ to ___;

- extract from the work book.

In accordance with Article 62 of the Labor Code of the Russian Federation, upon a written application from an employee, the employer is obliged, no later than three working days from the date of filing this application, to provide the employee with copies of work-related documents. Copies of work-related documents must be properly certified and provided to the employee free of charge.

Date of application “___”_________ ____ Signature _______

statements:

Application for the issuance of work-related documents

Where else do you need information about average earnings?

Information about income received is required not only for calculating sick leave. Confirmation of income may be required in different cases. Let's consider what documents will have to be prepared for different cases.

Receive a subsidy or scholarship

To apply for scholarships, financial support for low-income families, as well as other subsidies from the state (for example, to reimburse part of utility costs), a free form of income certificate is suitable.

Such a document is filled out in a similar manner. It is permissible to indicate the generalized amounts of accruals for the calendar year. If there were no sick leave or maternity leave or child care leave during the required periods, then a corresponding entry is made in the form in free form. If there were cases of disability during the period of work, they should be described.

When such a salary certificate is drawn up, a free-form sample may look like the one shown below.

Who issues a certificate of income for the last 3 months?

The extract is obtained at the place of employment in the accounting department or from personnel officers. If a person is registered in a small company, the report can be requested from the manager, who usually serves as an accountant.

If the company is liquidated, you can obtain the necessary information from the tax office. You are also allowed to contact the employment and protection center for the unemployed if the individual is registered there. Students need to apply at the place of education, and pensioners issue an extract to the Pension Fund.