Among the official documents that an employer must issue to a resigning employee are papers that are mandatory for issuance under the Labor Code of the Russian Federation, as well as certificates that are additionally issued at the employee’s written request.

It is necessary to understand what certificates an employee is entitled to receive upon dismissal from work. In addition, you need to find out for what purpose such papers are drawn up, within what time frame they are transferred to the dismissed person, and what to do if the company’s management refuses to issue them.

Terminology and essence of the document

The essence of the document is expressed in its unofficial name “certificate of income”. It is submitted annually to the tax service for each employee. In addition, it may be required when obtaining a loan, as well as for calculating state benefits and social benefits. The issuance of certificate 2 of personal income tax upon dismissal and in other cases is carried out at the request of the citizen. This is one of the features of the document, prescribed in the corresponding order. However, the company does not have the right to refuse an employee such a request.

How to get it from your employer

To obtain an extract, the employee must contact the employer with a corresponding application drawn up in any form. It indicates the necessary details of the employee and the tax agent. For those who are interested in how long it takes to prepare a 2-NDFL certificate, we answer: the employer is obliged to issue it within three days. If he violates this rule, it is recommended to send the application by a valuable letter with an inventory of the contents and notification of receipt. If within three days from the date of receipt of the letter the employer has not issued the document, the employee has the right to file a complaint with the labor inspectorate. Please note that not only officially employed citizens receive this paper, but also those who quit their job no more than three years ago.

How to obtain a personal income tax certificate 2 under duress

What to do if the employer refuses to issue a personal income tax certificate; in this situation, the protection of the rights and interests of the employee “lies” in another regulatory document - the Labor Code. In accordance with the content of this code, namely Article No. 62 “Issuance of documents related to work,” the employer is obliged to issue, at the request of the employee, documents (certificates) relating to the citizen’s work activity at the enterprise (organization).

Such documents include, for example,

- salary certificates,

- about the period of work and so on.

Moreover, the article of the Labor Code of the Russian Federation states that these documents must be prepared and issued within three working days from the date of the employee’s official request.

Write an application addressed to the employer with a request to provide a certificate, hand the application to an authorized person against signature, or send it by mail.

Thus, it is possible to hold an employer accountable for failure to issue a Form 2-NDFL certificate by referring to labor legislation.

Certificate of income upon dismissal

The dismissal procedure is regulated by the Labor Code of the Russian Federation, in particular the provisions are spelled out in Art. 84. It is indicated here that some documents are issued in person in any case, and others at the request of the employee. The latter also includes personal income tax certificate 2. Its issuance depends on the will of the citizen and necessity. First of all, we are talking about whether a document is required at the new place of work in order to see the level of income of the new employee and the amount of tax deductions for previous periods. This is necessary for the correct calculation of due payments, compensation and benefits.

Functional purpose

First of all, a personal income tax certificate upon dismissal serves as proof that a person had official income during a certain period of time (for which it is issued), and accordingly he paid taxes on it. Taking into account this function, the document is provided to the following authorities:

- Tax Service;

- Banks, when applying for a loan;

- To a new place of employment, where with its help the employer makes the necessary calculations for sick leave, tax deductions, and compensation payments.

It is important to know! As for the issuance and the requirement for it, upon dismissal you can take the certificate immediately. In the future, this will save you from wasting extra time and effort, since the document may be needed at any time.

Displayed information

The certificate must take into account several types of information. In particular, correct filling requires indicating:

- The period covered by the document;

- Its serial number and date of compilation;

- Codings of the institution that accepted tax reporting;

- Company data, including its payment details;

- Information about the recipient, including his place of registration (residence), TIN, nationality;

- The estimated rate on the basis of which contributions to the tax authorities were made;

- Monthly income and total amount. This includes wages and income for a certain time;

- Monthly deductions, including taxes, alimony (if any).

As a result, the document is signed by the head of the organization and the chief accountant, a stamp is placed on it and in this form it is transferred to the recipient.

Time frames covered

Typically the time period for which a certificate is issued is 1 year. This is due to the fact that the new company is interested in up-to-date information in order to make the necessary accruals based on it. At the same time, the deadlines may vary - it all depends on the purpose of the document. For example, banks often require quarterly and semi-annual data. In state-owned companies, the period varies depending on the specifics of reporting. In particular, tax authorities request the certificate annually.

Filling Features

The main point is to provide information. This is information about the sources of income on which tax was paid. The form and structure of the document was approved by the Order of the Tax Service of the Russian Federation back in 2015. It contains the main details of the certificate, namely:

- Issuance exclusively to a person who officially received income from the organization;

- The basis is in the form of his appeal;

- Indication of income and deductions in rubles and kopecks;

- Reflection of income tax exclusively in ruble equivalent. Balances above 50 kopecks are rounded to the nearest ruble; smaller amounts are not taken into account.

2 personal income tax certificates can be found here.

In this case, the general rules that guide the department or employee providing the certificate are given.

Explanations for completing sections 3–5

Sections 3 and 4

The 2-NDFL certificate for a dismissed employee reflects monthly (Article 216 of the Tax Code of the Russian Federation):

- all income from the beginning of the year to the month of dismissal - in section 3;

- the amounts of deductions provided during the year are in section 4.

Income and deduction codes are established in Appendices 1 and 2 to the Federal Tax Service order dated September 10, 2015 No. ММВ-7-11/ [email protected] Since 01/01/2018, additions have been made to the List of income codes (Federal Tax Order No. ММВ-7- dated October 24, 2017 11/820). One of the newly introduced codes, 2014, is intended for severance pay and compensation calculated on the basis of average monthly earnings.

The payment codes for Alekseev A.A. in 2021 are as follows: salary - 2000, ballot - 2300, compensation for unused vacation - 2013, excess of non-taxable severance pay - 2014. All these codes are entered in the certificate lines in section 3 in accordance with the month of payment , and in the adjacent column the payment amount is indicated.

In section 4, opposite the standard deduction code for the first child, 126, we put the single amount of deductions provided for the year, without breaking them down monthly.

Issuance procedure and deadlines

The dismissal itself is not the basis for issuance and the certificate is not included in the list with other documents. It is compiled and issued only at the request of the recipient. He does not have to be on the company's staff, i.e. in fact, the agreement of the parties may already be terminated. It is enough for a former (current) employee to notify an employee of the accounting department or human resources department about the need to extradite. Sometimes management is approached with a similar request. The deadlines for preparing 2 personal income taxes after dismissal do not differ from the situation when the citizen is still working in the organization. In all cases they are 3 days.

When is the 2-NDFL certificate not submitted?

A certificate in form 2-NDFL is not required to be submitted in the following cases:

- When payments are made that are not subject to income tax. According to the Tax Code, these include maternity benefits, alimony, etc.

- An employee who is on maternity leave and does not receive a salary was paid financial assistance or a gift in an amount not exceeding 4 thousand rubles. These payments are exempt from personal income tax.

- When an organization purchases property from its employee. In accordance with Article 226 of the Tax Code, tax is not subject to calculation and withholding, as well as reflection in 2-NDFL. An individual is required to independently report the income received in the form of a tax return in Form 3-NDFL.

- Payments made to the entrepreneur are reported to the INFS by the entrepreneur himself. In this case, the organization must first request the following documents from the individual entrepreneur: TIN, Unified State Register, as well as BSO in confirmation of the funds received.

Actions if the document is not issued upon dismissal

It happens that for one reason or another (conflicts, reluctance to part with an employee, accounting errors, excessive “busyness”) the document is not issued. The best way to be on the safe side is to write a statement. The very fact of its preparation already takes the situation out of the ordinary, since in most cases such requests are oral.

The appeal is written in a free format, and the main task of the compiler is to clearly present the request. In addition, it is important to register an application for the issuance of a 2nd personal income tax upon dismissal. The accounting or human resources department may refuse, then you must send the application by registered mail. In this case, refusal will mean a direct violation of the law with all that it entails, in the form of a complaint to Rostrud and (or) the prosecutor's office.

In this case, a fine is provided, reaching 1-5 thousand rubles for officials, and 30-50 thousand rubles for a company. Sanctions are applied in accordance with Art. 5.27 Code of Administrative Offences.

Help on form 2-NDFL in 2021

Home / Reporting for employees

| Download form 2-NDFL (valid until the end of 2021) View a sample of filling out the certificate Below are detailed instructions for filling out | The following situations are considered: 1. Income was taxed at different rates 2. Salary for December was paid in January |

ATTENTION!

From January 1, 2021, the 2-NDFL form will be updated again.

What has changed + new forms can be found in this article.

2-NDFL is an official document about the income of an individual received from a specific source (usually an organization or individual entrepreneur) and the personal income tax withheld from this income.

Organizations and individual entrepreneurs submit certificates only in case of payment of income to employees and other individuals. But individual entrepreneurs do not draw up form 2-NDFL for themselves.

You are required to submit certificates both to the tax office and to your employees.

2-NDFL employees are issued within three working days from submitting an application for a certificate. A certificate may be needed when leaving a job and moving to another job, filing tax deductions, applying to a bank for a loan, applying for a visa to a significant number of countries, applying for a pension, adopting a child, submitting documents for various benefits, etc. .

Due dates

Tax certificates are submitted once a year:

- no later than April 1 (until April 2, 2021, since the 1st is a day off);

- until March 1, if it is impossible to withhold personal income tax (certificates with sign 2).

Information about the income of non-employees in the company

In the following common cases, we must file income information for individuals not employed by the company:

- The company paid for the work/services under the contract;

- The LLC paid dividends to participants;

- Property was rented from an individual (for example, premises or a car);

- Gifts worth more than 4,000 rubles were presented;

- Financial assistance was provided to those not working in the organization/individual entrepreneur.

When not to submit 2-NDFL

There is no obligation to file 2-NDFL when:

- purchased real estate, a car, goods from an individual;

- the cost of gifts given by the company is less than RUB 4,000. (in the absence of other paid income);

- damage to health was compensated;

- financial assistance was provided to close relatives of a deceased employee/employee who retired from the organization or to the employee/retired employee himself in connection with the death of his family members.

In what format to submit 2-NDFL

1) If the number of completed tax certificates is 25 or more, you need to transmit 2-NDFL via telecommunication channels (via the Internet), for which an agreement must be concluded with a specialized organization (operator of electronic document flow between taxpayers and inspectorates).

The list of operators can be viewed on the tax service website. You can also use the Federal Tax Service website to submit certificates.

2) If the number is smaller, you can submit certificates on paper - bring them in person or send them by mail.

When submitting 2-NDFL in paper form, a register of information on income is also compiled - a consolidated document with data about the employer, the total number of certificates and a table of three columns, the first of which contains the numbers of the tax certificates submitted, the second indicates the full name of the employees, the third their dates of birth are indicated.

The register also reflects the date of submission of the certificates to the tax authority, the date of acceptance and the data of the tax officer who accepted the documents. The register is always filled out in 2 copies.

The current form of the register is given in the order of the Federal Tax Service of Russia dated September 16, 2011 No. ММВ-7-3/ [email protected] When submitting via the Internet, the register will be generated automatically and there is no need to create a separate document.

When accounting is carried out in a special program (for example, various versions of 1C Accounting), personal income tax reporting is generated automatically; all that remains is to double-check the correctness of filling out. Also, some developers offer separate programs for filling out personal income tax reporting (for example, the resource 2ndfl.ru).

Instructions for filling out the 2-NDFL certificate

Cap part

We indicate:

- The year for which 2-NDFL was compiled;

- Serial number of the certificate;

- Date of compilation.

Column "sign"

Specify the value:

- “1” – in all cases where personal income tax was withheld, if the certificate is submitted by a tax agent (“3” – if the form is submitted by the legal successor of the organization or its OP on the same grounds);

- “2” – when it was not possible to withhold personal income tax if the document is submitted by a tax agent (“4” – if the form is submitted by the legal successor on the same basis).

The need to provide 2-personal income tax with sign 2 may arise in such common cases as:

- Presenting a non-monetary gift worth more than 4,000 rubles to a person who is not an employee of the company;

- Payment of travel and accommodation for representatives of counterparties;

- Forgiveness of debt for a resigned employee.

It should be borne in mind that submitting a certificate with feature 2 does not cancel the obligation to submit a certificate with feature 1 for the same income recipient.

Column "Adjustment number"

When the certificate is submitted for the first time, “00” is entered. If we want to correct the information from the previously provided certificate, the column indicates a value greater than the previous one by one - 01.02, etc.

If a cancellation certificate is submitted to replace the one submitted earlier, “99” is indicated.

Note: when filling out the corrective document, the successor of the tax agent must indicate the number of the certificate submitted by the previously reorganized company and the new date of preparation.

Code of the tax office with which the organization or individual entrepreneur is registered

You can find out on the Federal Tax Service website through this service).

Section 1

OKTMO code

OKTMO is the All-Russian Classifier of Municipal Territories. The code can be viewed on the tax service website in this service).

Individual entrepreneurs on UTII and PSN indicate OKTMO at the place of business in relation to their employees employed in these types of business.

The legal successor of the tax agent fills out OKTMO at the location of the reorganized company (RP).

TIN and checkpoint

Extracted from the tax registration certificate. In 2-NDFL for employees of separate divisions, OKTMO and KPP of these divisions are indicated. Individual entrepreneurs do not indicate checkpoints.

If the certificate is submitted by the successor of the tax agent, the TIN/KPP of the legal successor is filled in.

Tax agent

The abbreviated (if absent, full) name of the organization (full name of the entrepreneur) is indicated.

If the certificate is submitted by the legal successor, the name of the reorganized company (RP) should be indicated.

Reorganization (liquidation) codes

In the “Form of reorganization” field, the codes of reorganization (liquidation) of the legal entity (LP) are indicated:

| Code | Name |

| 1 | Conversion |

| 2 | Merger |

| 3 | Separation |

| 5 | Accession |

| 6 | Division with simultaneous accession |

| 0 | Liquidation |

The codes of the reorganized company (OP) are entered in the TIN/KPP field.

If the certificate is not submitted for a reorganized legal entity (LE), these fields are not filled in.

If the title of the certificate contains the sign “3” or “4”, these fields must be filled in in the prescribed manner.

Section 2

Taxpayer status

Indicated by code from 1 to 6:

Code 1 - for all tax residents of the Russian Federation (persons staying in the territory of the Russian Federation for 183 or more calendar days within 12 consecutive months), and for those who stayed less than 183 days, the following codes are indicated:

- 2 – when the recipient of the income is not a resident and does not fall under other codes;

- 3 – if we invited a highly qualified specialist to work;

- 4 – if our employee is a participant in the program for the resettlement of compatriots;

- 5 – if the employee brought a certificate of recognition as a refugee or provision of temporary asylum in the Russian Federation;

- 6 – when our employee is accepted on the basis of a patent (foreign workers from countries whose citizens do not require entry visas to the Russian Federation, with the exception of those included in the Customs Union. For example, citizens of Azerbaijan, Tajikistan, Uzbekistan, Ukraine , temporarily staying in Russia, for the right to work for legal entities and individual entrepreneurs are required to obtain patents).

We determine the status at the end of the year for which information is submitted. Those. if the employee became a resident during the year, in the “Taxpayer Status” column we enter the number 1. This does not apply only to filling out certificates for those working on the basis of a patent (for them, code is always 6).

If the 2-NDFL is issued before the end of the year, the status is indicated as of the date the document was drawn up.

Country of citizenship code

Indicated in accordance with OKSM (All-Russian Classifier of Countries of the World). For example, for Russian citizens this is code 643. For codes for other countries, see this link.

Identity document code

Indicated according to the directory “Codes of types of documents proving the identity of the taxpayer” (see table below). Usually these are codes 21 (passport of a citizen of the Russian Federation) and 10 (passport of a foreign citizen). Next, indicate the series and number of the document.

| Code | Title of the document |

| 21 | Passport of a citizen of the Russian Federation |

| 03 | Birth certificate |

| 07 | Military ID |

| 08 | Temporary certificate issued in lieu of a military ID |

| 10 | Foreign citizen's passport |

| 11 | Certificate of consideration of an application for recognition of a person as a refugee on the territory of the Russian Federation on its merits |

| 12 | Residence permit in the Russian Federation |

| 13 | Refugee ID |

| 14 | Temporary identity card of a citizen of the Russian Federation |

| 15 | Temporary residence permit in the Russian Federation |

| 18 | Certificate of temporary asylum on the territory of the Russian Federation |

| 23 | Birth certificate issued by an authorized body of a foreign state |

| 24 | Identity card of a military personnel of the Russian Federation |

| 91 | Other documents |

Sections 3-5

Indicators (except for personal income tax) are reflected in rubles and kopecks. The tax amount is rounded according to arithmetic rules.

If we paid income that was not subject to personal income tax in full (the list of such income is given in Article 217 of the Tax Code of the Russian Federation), we do not include the amount of such income in 2-personal income tax. For example, 2-NDFL does not reflect:

- benefits for pregnancy and childbirth and child care up to 1.5 years;

- payment to the dismissed employee of severance pay in the amount of no more than three monthly salaries;

- one-time payment at the birth of a child in the amount of up to 50,000 rubles.

Section 3

It includes data:

- about income taxed at one of the rates (13, 15, 30, 35%);

- about tax deductions applicable to these types of income (in particular, amounts not subject to personal income tax).

Income received is reflected in chronological order, broken down by month and income code.

Employee income was taxed at different rates - how to fill it out?

If during the year one person received income subject to taxation at different rates, one certificate is filled out containing sections 3 - 5 for each rate. Those. all employee income, regardless of the type of income, must be included in one certificate.

If all the data does not fit on one sheet, fill out the second page of the certificate (in fact, we will have 2 completed 2-NDFL forms with the same number).

On the second page, indicate the page number of the certificate, fill in the heading “Certificate of income of an individual for ______ year No. ___ dated ___.___.___” (data in the header, including the number, are the same as on the first page), enter data in sections 3 and 5 (sections 1 and 2 are not filled in), the “Tax Agent” field (at the bottom of the document) is filled in. Each completed page is signed.

An example of such a situation is an organization issuing an interest-free loan to its employee. The recipient of the loan will have both income taxed at a rate of 13% (salary) and income subject to a rate of 35% (material benefit).

If dividends to a participant who works in the organization, they are reflected along with other income. There is no need to fill out separate sections 3 and 5 for dividends.

For example, on June 5, 2021, participant Nikiforov, who also works as Deputy General Director, was paid dividends of 450,000 rubles. In the data for June (see sample above), we will reflect wage income with code 2000 and dividend income with code 1010.

Income and deduction codes

Income and deduction codes are established by orders of the Federal Tax Service (the latest changes were approved by order dated October 24, 2017 No. ММВ-7-11/ [email protected] ). See the full list of income codes here.

But most often you will have to indicate the following:

| The most used deductions for this section:

|

See the full list of deduction codes here.

If there are no total indicators, a zero is entered in the certificate columns.

Salary for December was paid in January – how to reflect it?

In the certificate, income is reflected in the month in which such income is considered actually received according to the norms of the Tax Code. For example:

1) Our employee’s salary for December 2021 was paid on January 12, 2021 - we will reflect its amount in the certificate for 2021 as part of income for December (since, in accordance with paragraph 2 of Article 223 of the Tax Code, the date of receipt income in the form of wages is recognized as the last day of the month for which income is accrued in accordance with the employment contract).

2) For a craftsman working for us under a contract, payment for work completed in December 2021 was made on January 12, 2018 - this amount will be included in 2-NDFL for 2021 (since there are separate standards for payment for contracts of a civil law nature are not provided for by the Tax Code, therefore, we apply the general rule, according to which the date of actual receipt of income is defined as the day of its payment - clause 1 of Article 223 of the Tax Code of the Russian Federation).

Vacation pay is reflected in the certificate as part of the income of the month in which they were paid (Letter of the Ministry of Finance of the Russian Federation dated 06.06.2012 No. 03-04-08/8-139).

For example, our employee Nikiforov was on vacation from January 9 to January 21, 2021. Vacation pay was paid to him on December 29, 2021. In 2-NDFL for 2021 (see example of filling), we include the amount of vacation pay in income for December with code 2012.

Some types of income are not taxed up to certain limits. In 2-NDFL, opposite such income, you need to indicate the code and deduction amount in the amount of the non-taxable amount.

For example, for his birthday (September 10), employee Nikiforov was given a phone worth 18,000 rubles by the company. Because The cost of gifts for the year is not subject to personal income tax in an amount not exceeding 4,000 rubles. In the 2-NDFL certificate in the data for September (see example of filling) we will reflect:

- income 18,000 rub. with code 2720 (price of gifts);

- deduction 4000 rub. with code 501.

Section 4

The most commonly used deduction codes:

- 126, 127, 128 – deductions for the first, second, third and subsequent children;

- 311 – for expenses for the purchase of housing;

- 312 – for mortgage interest paid;

- 324 – for treatment expenses.

See the full list of codes here. Deductions are received exclusively by tax residents in respect of income taxed at a rate of 13% (except for dividends).

We can provide a social or property deduction at the place of work if the employee has brought a notification from the tax office about the right to such a deduction. Notification details are indicated at the bottom of section 4.

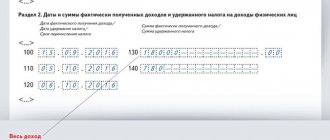

Section 5 states:

- Total amount of income from section 3 (add up the indicators in the “Amount of Income” column);

- Tax base (from the total amount of income we subtract the amount of deductions from the columns “Amount of deductions” of sections 3 and 4);

- The amount of tax calculated and withheld from this income (indicator in the column “tax base” * tax rate; in certificates with the attribute “2” (“4”), the amounts of calculated and withheld tax will differ);

- The amount transferred to the personal income tax budget.

The columns for information on fixed advance payments for a patent are filled out in certificates for those working on the basis of a patent based on information from the notice of confirmation of the right to a tax reduction received from the tax office.

In the “Tax Agent” column the following is indicated:

1 – when the certificate is presented by the head of the organization (successor company) in person or the certificate is sent with a digital signature of the head;

2 – in other cases (for example, when submitting 2-NDFL on paper by the chief accountant or courier).

Below are the details of the person who submitted the certificate and his signature.

The representative also indicates the power of attorney data.

Did you like the article? Share on social media networks:

- Related Posts

- Sample of filling out the calculation of insurance premiums

- Form SZV-M in 2021 - monthly report

- Form 4-FSS in 2021

- Zero calculation for insurance premiums (9 months 2021)

- Form SZV-K – reporting to the Pension Fund for employers

- Sample of filling out the SZV-K form

- Sample of filling out the zero 4-FSS for the 1st quarter of 2021

- Unified calculation of insurance premiums to the Federal Tax Service

Discussion: 17 comments

- Elena:

02/01/2018 at 12:24Good afternoon. Please tell me, in section 5 on “tax amount transferred”, it is necessary to indicate the actual personal income tax transfers and salary payments in January for the accrued December salary, or will “calculated tax amount”, “withheld” and “transferred” be the same?

Answer

Alexei:

02/03/2018 at 04:04

Hello. If on the date of filing the 2-NDFL certificate the tax had already been withheld and paid to the budget, then it should be indicated as calculated, as withheld, and as transferred.

The fact of tax withholding and payment in 2021, and not in 2021, does not matter (letters of the Federal Tax Service of the Russian Federation dated 03/02/2015 No. BS-4-11/3283, dated 02/03/2012 No. ED-4-3/ [email protected] and No. ED-4-3/ [email protected] , dated 01/12/2012 No. ED-4-3/74). Thus, all Section 5 tax amounts will be the same.

Answer

02/13/2018 at 15:56

tell. An employee of mine purchased an apartment in 2021. He needs to submit a 2nd personal income tax certificate

Answer

- Alexei:

02/14/2018 at 16:45

Hello. If an employee was paid income during 2017, a 2-NDFL certificate must be submitted. Apparently, your question concerns how property deductions for purchased housing are reflected in the certificate.

The deduction is provided on the basis of a notification from the Federal Tax Service submitted by the employee and is reflected in 2-NDFL in the following order:

In section 4 you enter: deduction code “311” and the deduction amount.

Below you provide the details of the Federal Tax Service notification confirming your right to a property deduction.

The “Tax Base” column of Section 5 is filled out taking into account the amount of the deduction provided. If its size exceeds income, then the tax base is recognized as equal to 0.

Answer

03/24/2018 at 16:11

How to fill out section 5 in 2-NDFL, if the organization calculates salary monthly, pays with a delay of 9 months (in cash), and has never transferred personal income tax to the budget for the year (the account is blocked)? For example, the amount of tax calculated is 50,000 the amount of tax withheld is 20,000 the amount of tax transferred is 0

Answer

- Alexei:

03/25/2018 at 18:51

Hello. The following point is important here: whether the salary was issued and, accordingly, personal income tax was transferred before the submission of 2-NDFL certificates, that is, already in 2021. If you have paid off your obligations before submitting the certificate, fill out the form as usual.

If at the time of submitting the certificate there is a debt to employees and the tax has not been received into the budget, then in section 5 the indicators for the amount of tax calculated, withheld and transferred will differ, and the line “Amount of tax not withheld by the tax agent” will be filled in. In this case, after paying off obligations to employees and the budget, you will need to submit corrective certificates to the Federal Tax Service in Form 2-NDFL with the same number, but with a new date.

Answer

03/27/2018 at 21:11

Please tell me in form 2-NDFL for 2021 in the column “Tax amount transferred”:

1) Indicate the amount transferred for 2021 accruals? After all, the tax for December 2021 was also transferred in 2021.

2) How to distribute the tax among people if for November 2017 the tax amount calculated for all employees was 10,000 rubles, and 7,000 was paid to the budget? And the remaining 3,000 tax for November and tax for December have not yet been transferred.

Answer

- Alexei:

03/28/2018 at 00:54

Hello. If the tax for the past tax period was transferred to the budget before the date of submission of certificates in Form 2-NDFL to the Federal Tax Service, then such tax should have been included in these reports. Thus, the tax for December 2021 paid in Q1. 2021 should have been included in the primary reporting for 2021.

In cases where, on the date of submission of certificates in Form 2-NDFL, the tax has not been repaid in full, the amounts of calculated, withheld and transferred tax in Section 5 of the primary certificates will differ. After transferring personal income tax to the budget, the tax agent is required to submit corrective certificates, in section 5 of which the above amounts coincide.

Therefore, personal income tax for 2021 should not appear in certificates for 2021 (letter of the Federal Tax Service dated March 2, 2015 No. BS-4-11/3283).

As for the distribution of the amount of personal income tax not transferred, there are no official explanations on this issue, but there is the following opinion: since in this case the tax agent is clearly at fault, it is more logical for the personal income tax transferred from employee remuneration to be reflected in full, and the amount of the debt to be included in the manager’s certificates and founders.

Whether to follow this recommendation or distribute the amounts in proportion to the number of employees is up to you.

Answer

12/15/2018 at 19:02

Good evening! Can you please tell me that the 2-NDFL certificate must have the employer’s stamp?

Answer

01/15/2019 at 12:01

Good afternoon. How to generate (print) a 2-NDFL certificate for an employee? When printing from the program, it issues Appendix No. 1 to the order ММВ-7-11/566 dated 10/02/2018. Is this form suitable for issuing to employees? They will take it to the Federal Tax Service for reimbursement of costs.

Answer

01/24/2019 at 09:54

Good afternoon. Please tell me this is the situation. A husband and wife in an official marriage purchased an apartment, but the husband refused his share, but now he wants to receive a deduction for the purchase of this apartment, since his income is much higher than that of his wife. Does he have the right to make a deduction in 3-NDFL? We purchased the apartment in 2017, but never rented it out for 3-personal income tax.

Answer

02/05/2019 at 13:36

Good afternoon. If the accountant did not take into account the deduction of 4,000 rubles. from the gift and in the personal income tax report 2, this deduction is not indicated; will this be considered an error?

Answer

02/26/2019 at 20:28

Good evening. I don’t quite understand the answer to the question: Should the employer’s signature be stamped on the Form 2 personal income tax certificate?

Answer

01/23/2020 at 21:30

Please tell me, the amount of tax calculated is 54,000, withheld and transferred 9,600, and not withheld by the tax agent 44,600, what should I indicate in the 3NDFL certificate?

Answer

01/29/2020 at 16:35

Hello! My husband works in the Ministry of Internal Affairs. Recently he took out a certificate of 2nd personal income tax. In my opinion, paragraph 4 is filled in incorrectly. If 1400 per child, then it should be 16800 for each child. Deductions for two children. You can check and comment.

Answer

01/29/2020 at 16:37

I wanted to attach a scan, but it seems it’s not possible here. Now in the certificate in the deductions line it is 126-8400 and 127-8400. Certificate for 2021 for 12 months

Answer

02/04/2020 at 16:43

For which last months should 3 and 6 months be indicated in the certificate? A certificate must be submitted to the tax office for a package of documents for purchasing a home for a tax refund.

Answer

Leave a comment Cancel reply

When to submit 2 personal income taxes for a fired person to the tax office

Declaration 2 of personal income tax for 2021 is made for each individual. to a person, including a dismissed person. The application must be submitted to the Tax Inspectorate no later than April 2, 2018.

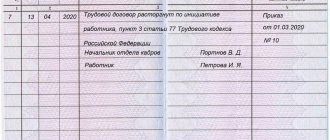

Certificate 2 of personal income tax for an employee dismissed during the calendar year contains the same number under which he was registered upon dismissal. The same rules apply to dates.

If according to physical the person has a personal income tax debt, the certificate must be submitted to the fiscal authorities no later than March 1, 2021 and at the same time the former employee must be notified about the resulting debt.

Example of registration of 2 personal income tax upon dismissal

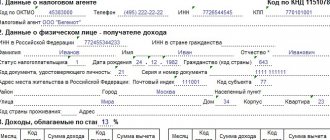

Let's consider a sample of filling out personal income tax certificate 2 upon dismissal, using the example of employee Pyotr Ivanovich Semenov.

The employee wrote a letter of resignation of his own free will in April 2021. When filling out the certificate, the following parameters are taken into account:

- During this period he was paid the following types of remuneration:

| month | type of income | sum |

| January | salary | 32000 rub. |

| February | payments under personal income tax; salary | 19000 rub. 11000 rub. |

| March | salary | 32000 rub. |

| April | salary; compensation for unused rest days; severance pay in excess of the non-taxable amount | 21000 rub. 17000 rub. 14000 rub. |

- Deductions provided: standard for 1 child, in the amount of 1400 rubles.

- The tax rate is 13%.

- Income tax is withheld from all types of profit and transferred to the consolidated budget in a timely manner.

Formation of 2 personal income taxes:

| section name | filling | calculation |

| A cap | · document's name; · reporting period – 2019; · date of certificate - day of dismissal 04/25/2019; | — |

| Tax agent information | · OKTMO code -53701000; · INN/KPP –5610070999/561001001; · Romashkin House LLC | — |

| Data about an individual | · Taxpayer INN – 561007179999; · Full name - Semenov Petr Ivanovich; · resident – “1”; · country code – 643; · document code – 21; · document details – 53 05 254965 | — |

| Income taxed at 13% | Income received is indicated in the form of codes and is entered by month: 2000 – salary; 2300 – LN; 2013 - compensation payments for unused vacation; 2014 – excess of the tax-free base for severance pay | |

| Deductions | deduction code -126, the amount is paid for the entire period, without monthly breakdown | 1400*4=5600 rub. |

| Total income and tax amounts | Cumulative amounts are shown: · income; · tax base; · calculated, withheld and accrued personal income tax | total income: (32000+19000+11000+32000 +21000+17000+14000)=149 tr. tax base: (149000 – 5600) = 143.4 tr. Personal income tax: 143000*13%= 18642 rub. |

At the end, the signature of the employee who prepared the document and the seal of the organization are affixed.