What should be paid to a resigning employee?

On the last day of working with the employee, the final payment must be made. On this day he must be paid:

- salary, bonuses, allowances until the last day of work;

- compensation for unused vacation;

- severance pay by law or in accordance with the employment contract.

In addition, if an employee is dismissed due to layoffs, then he retains income for the duration of his employment in the second, and in exceptional cases, the third month after termination of the employment contract.

Income tax for a manager

The employer must also know whether he must pay income tax. Russian tax legislation (Article 255 of the Tax Code of the Russian Federation) defines this type of payment as labor costs (can be made in cash or in kind). Thus, there is no need to pay tax. The same applies to material compensation, which is paid to the employee for unused vacation. It is worth noting that the specific amount of compensation does not matter.

The position of the tax authorities is somewhat different, they claim that compensation cannot be considered as labor costs, therefore income tax is withheld. This position is justified by the fact that the payment of compensation is not provided for at the legislative level, and the additional agreement, which usually states the need to pay compensation to the dismissed employee, is not part of the employment contract itself. If you pay attention to the judicial practice of recent years, you can come to the conclusion that the courts do not offer a clear solution to this issue.

In order to avoid such controversial situations, the company recommends that the parties, when drawing up an additional agreement, explicitly indicate that the document is part of the employment contract. An alternative option is to include a clause on the payment of compensation benefits directly in the content of the work contract.

It is important to remember that compensation can be considered labor costs only if they meet the following requirements (Article 252 of the Tax Code of the Russian Federation):

- produced for profit;

- are justified from an economic point of view;

- have documentary evidence.

The employer may have problems with the first two points, since it is quite difficult to prove the expediency of the waste. Arbitration courts most often accept the position of tax departments that such waste cannot be considered financially justified, since they are not aimed at generating any income.

The conclusion described above is quite logical, since an employee who was fired from the company by agreement of the parties (personal income tax, insurance premiums are not collected) will no longer work in it and make a profit. In such a situation, the entrepreneur may refer to the fact that the company is going through times of crisis and the reduction of an employee, which is accompanied by the payment of compensation, will significantly reduce labor costs.

Which payments are taxable and which are not?

Salaries for the last month of work are taxed as usual. If the employee is a resident, then the deduction should be made at a rate of 13%, if not, at a rate of 30%.

A special taxation procedure has been established for severance pay and retained earnings during employment. Such compensation upon dismissal is subject to personal income tax if it exceeds the employee’s three-month average earnings. For employees of organizations in the Far North and equivalent territories, this limit is six average monthly earnings. It does not matter on what basis the severance pay was paid: by law or under the terms of the employment contract. In any case, the excess amount must be withheld and transferred to the personal income tax budget.

Leave compensation upon dismissal is subject to personal income tax in full, regardless of the grounds for termination of the employment contract (clause 3 of article 217 of the Tax Code of the Russian Federation).

Dismissal: final settlement

On the last working day (day of dismissal), it is necessary to make a final payment and pay all amounts due to the employee.

Typically this is:

- Wages (salary, bonuses, allowances, additional payments for part-time work, etc.) accrued for time worked.

- Leave compensation upon dismissal (subject to personal income tax).

- Compensation payments based on dismissal.

Compensation payments based on dismissal include:

- Severance pay for redundancy.

- Severance pay upon dismissal for disability pension.

- Redundancy benefits while looking for a new job.

- Compensation to the manager, his deputies, and the chief accountant upon termination of the employment contract.

On the day of dismissal, it is necessary to transfer the entire accrued amount minus income tax (calculated according to the Tax Code of the Russian Federation) to the employee’s personal account or issue it at the company’s cash desk.

The employer has no right to delay payment (even if the bypass sheet is not signed).

Personal income tax upon dismissal: transfer deadline

Tax must be withheld from payments during the final settlement on the employee’s last day of work. The amounts due to the employee minus his deduction are paid.

It is necessary to transfer the withheld tax amount to the budget no later than the next day (clause 6 of Article 226 of the Tax Code of the Russian Federation). If the day of transfer falls on a non-working weekend or holiday, then the deadline for paying personal income tax upon dismissal is postponed to the next working day. This rule for postponing the deadline is established in clause 7 of Art. 6.1 Tax Code of the Russian Federation.

Payment of personal income tax upon dismissal: deadlines and procedure for filling out reports

The employer is required to submit two reports to the Federal Tax Service regarding income paid to individuals and withheld income tax:

- 2-NDFL certificates: submitted once a year no later than April 1 of the year following the reporting year;

- Form 6-NDFL: submitted quarterly no later than the last day of the month following the reporting quarters, and at the end of the year - no later than April 1 of the following year.

The reports include only those payments to the resigning employee that are taxable.

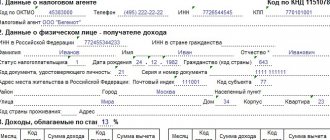

In the 2-NDFL certificate, income is reflected monthly, indicating the codes established by the Order of the Federal Tax Service of September 10, 2015 No. ММВ-7-11 / [email protected] Until 01/01/2018, all paid amounts of the final settlement were reflected under one code 2000. Any compensation upon dismissal; The personal income tax code 2021 for these payments has new meanings introduced by the Order of the Federal Tax Service dated October 24, 2017 No. ММВ-7-11/ [email protected] :

- 2013 - compensation for unused vacation,

- 2014 - taxable amount of severance pay exceeding three months' earnings.

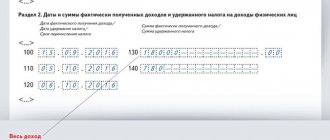

In 6-NDFL, payments of the final settlement, tax amounts calculated and withheld from it should be reflected in the quarter of dismissal. There is a peculiarity if the tax payment date falls on the next quarter. For example, an employee quit and received the final payment on June 30, then the tax must be transferred no later than July 1. In this case, the accrued final calculation and the withheld amount of personal income tax in section 1 of the report will be reflected in the second quarter. Payments must be reflected in section 2 of the report in the third quarter. Such clarifications are given by the Ministry of Finance in Letter dated November 2, 2016 No. BS-4-11/ [email protected]

How personal income tax is paid for employees who quit

According to Art.

140 of the Labor Code of the Russian Federation, the administration of the enterprise must pay in full to the person resigning on the date of termination of the employment relationship, that is, issue, transfer to a bank card salary, compensation for unused vacation, severance pay. The date when the taxpayer receives income is the last paid day of work (clause 2 of Article 223 of the Tax Code of the Russian Federation). Personal income tax must be calculated on this date. The deduction is made simultaneously with the payment of settlement payments (clauses 3, 4 of Article 226 of the Tax Code of the Russian Federation), on the last day of work.

If the quitter applied for payouts later than the date of termination of the employment contract, the money due is paid no later than the next day.

Payment of personal income tax upon dismissal of an employee is carried out no later than the day following the day of payment of settlement payments (clause 6 of Article 226 of the Tax Code of the Russian Federation). If the day is a non-working day, then the deadline for paying personal income tax is shifted to the first working day (Clause 7, Article 6.1 of the Tax Code of the Russian Federation).

An employee resigns on 10/08/2018, you need to determine when to pay personal income tax upon dismissal of an employee.

It is necessary to calculate the payroll as of 10/06/2018, calculate personal income tax, and on this day transfers must be made to the bank card of the person resigning. Tax payments can be made on the same or next day.

- income received is summed up; deductions and deductions are carried out; the rate is determined; payment is calculated.

For residents the rate is 13%, non-residents - 30%. Residents are persons who have been in Russia for 183 days over twelve consecutive months.

Tax base = employee income, in monetary terms – deductions and deductions.

- salary; compensation for unused vacation; severance pay.

Tax not withheld from the advance payment is calculated when calculating for the month (Letter of the Ministry of Finance of Russia dated September 24, 2009 No. 03-03-06/1/160).

Vacation compensation is taxed in full, regardless of the reason for dismissal (clause 3 of Article 127 of the Tax Code of the Russian Federation).

The right to a tax deduction is established by Art. 218-221 Tax Code of the Russian Federation. Parents of children in their care have the right to use it. Amount of deduction provided:

- 1400 rub. for the first, second child, for each; 3000 for the 3rd and subsequent ones, for each.

In a letter dated October 28, 2016, the Ministry of Finance of the Russian Federation explains: the accounting department takes into account the income of the employee during the month, after which the final base is determined.

The letter from the Ministry of Finance dated April 10, 2015 says: tax can be withheld in the next month if the actual payment is made after the end of the month of accrual.

Soloviev I.P. resigns due to staff reduction on 10/11/2018. He was accrued a salary in the amount of 21,000 rubles, compensation for unused vacation - 25,000, severance pay - 39,500. Severance pay is not subject to taxation, because does not exceed three months' salary.

Personal income tax = (21000+25000) * 0.13 = 5980 rub.

Arise in connection with withholding for vacation, which was provided in advance. Consider three cases.

- The employee used his vacation in advance and was paid vacation pay. Due to the termination of the employment relationship, the employee had unworked rest days.

The accounting department withholds overpaid vacation pay from the employee. If this fails, you need to try to collect them through the court. If the court decision is not made in favor of the organization’s administration, it is necessary to take a written refusal from the dismissed person to repay the debt. Based on the refusal to write off the outstanding debt to the financial result of the enterprise. After the statute of limitations period has passed, the debt can be treated as debt forgiveness.

- The dismissed person has been forgiven the debt for overpaid vacation pay. The amount is not subject to taxation: it is received minus the tax payment.

- The dismissed person voluntarily returns the vacation pay paid in advance. There is no taxable income: the funds were paid minus tax (Letter of the Ministry of Finance of the Russian Federation dated October 30, 2015 No. 03-04-07/62635).

The employer is required to submit two reports for employees to the Federal Tax Service:

- 2-NDFL – provided every year after April 1 of the following year. Income is reflected on a monthly basis; 6 NDF - provided every quarter no later than the last day of the next month, at the end of the year - no later than April 1 of the next year.

Dismissal amounts are displayed in section 1 6-NDFL for the period of their payment. In section 2 - for the period in which personal income tax must be paid. Severance pay within the limits not subject to taxation should not be reflected (Letter of the Ministry of Finance dated April 18, 2012 No. 03-04-06/8-118).

How to fill out the form if estimates were accrued and paid in one quarter, and the tax payment was made in another?

The amounts of income, deduction, and calculated tax are displayed in section 1 of the reporting form for the first quarter, and in the next quarter should be displayed in section 2 of the form.