Tweet

Official explanations on the question of what compensation for unused vacation - full or proportional - to be paid when an employee is laid off for the second and subsequent jobs vary.

Various authorized departments have commented many times on the issue of the amount of compensation for unused vacation when workers are dismissed due to a reduction in the number or staff of the company. In particular, the following documents were devoted to this:

— letters of Rostrud dated 03/04/2013 No. 164-6-1 and dated 08/09/2011 No. 2368‑6-1; — recent Recommendations of Rostrud, approved at a meeting of the working group on informing and consulting workers and employers on issues of compliance with labor legislation and regulations containing labor law standards, protocol No. 2 of 06/19/2014.

To figure out which position should be taken, you need to turn to the regulatory framework.

The Labor Code regulates not only working hours, it establishes the types of rest periods and their minimum duration. Periods of long rest include annual basic paid leave, the duration of which in general is 28 calendar days.

Paid leave is provided annually. The length of service giving the right to this leave includes both periods of work and the time of the leave itself. The following conclusions can be drawn from these standards:

1) each working year (counted from the date of hiring) consists of 11 months of work (rounded) and 28 calendar days of vacation (rounded to one month);

2) for one month of “vacation” service, 2.33 calendar days (28 calendar days: 12 months) of vacation are due.

Since hiring can be done on any day of the calendar year, providing employees with vacations strictly after 11 months of work would be incorrect: someone hired in January would always receive vacation in December, and someone who entered into an employment contract in July would always have a vacation in June. etc. In this regard, full-length leave for the first working year can be granted after six months of continuous work, and the second and subsequent leaves can be granted at any time of the corresponding working year, including in advance.

Thus, on the day of dismissal of an employee, two situations of opposite nature may arise:

- the employee earned a certain number of vacation days, but did not use them; - the employee used vacation in advance, but did not work the corresponding number of months of his last working year.

In the first case, upon dismissal, the employee is paid monetary compensation for all unused vacations.

In the second case, the employer has the right from the salary accrued in the final calculation to deduct the amount of vacation pay attributable to the vacation days used by the employee, but not worked by the day of dismissal.

Regulatory regulation

Labor Code of the Russian Federation Art. 81 contains grounds for termination of a contract at the initiative of the employer

Labor Code of the Russian Federation Art. 127 – receiving compensation for unused vacation

Decree of the Government of the Russian Federation dated December 24, 2007 N 922 determines the calculation of average wages

Rules “On regular and additional leaves” (dated April 30, 1930 N 169) Art. 28-30 are used within the framework that does not contradict the current Labor Code of the Russian Federation

Law of the Russian Federation dated April 19, 1991 N 1032-1 provides for measures to reduce

How is it processed?

In the event that an employee is dismissed due to layoff, compensation for vacation requires the execution of the following documents:

- Employee statements. This is due to the fact that the employee has a choice between compensation and actual vacation. In the latter case, he does not receive compensation, but ordinary vacation pay.

- An order from the employer to pay compensation.

Let's see how these documents are compiled. The easiest way is with a statement. According to Art. 127 of the Labor Code of the Russian Federation, payment of compensation is the responsibility of the employer. Thus, an employee must write a statement only if he wants to take a vacation in whole or in part before dismissal.

The application is drawn up in the name of the head of the enterprise and is written in any form.

The law does not provide any mandatory requirements for this document.

The employer will need to complete the following documents:

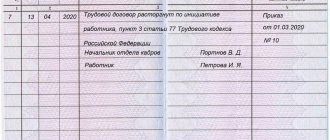

- Order of dismissal in form No. T-8, approved by the above-mentioned resolution of the State Statistics Committee. If several employees are dismissed, an order is issued in form No. T-8a.

- Note-calculation according to form No. T-61. It is filled out jointly by the HR department and the accounting department of the enterprise.

- Personal card (form No. T-2). It must be kept for each employee, and a note about dismissal and payment of compensation is made in it.

Reason for staff reduction

Staff reduction is a change in the staffing table by removing divisions or staffing units from it, that is, all employees working in this position or the entire division. The layoff procedure is quite complicated because employees do not want to lose their jobs and will try to defend their rights in court. Therefore, the reduction procedure consists of the following stages, taking into account periods:

| 1. generation of a reduction order | no less than 2 months |

| 2. informing laid-off workers taking into account the preferential factor and the offer of vacancies | no less than 2 months |

| 3. informing the trade union (if any) and the employment service | no less than 2 months |

| 4. payment of amounts due and issuance of all documents that are issued upon dismissal | on the day of dismissal |

| 5. upon registration of a laid-off person at the employment center within 2 weeks from the date of layoff, but not employed - payment of benefits | for the second month, as well as during the third month by decision of the employment service |

Important! When reducing staff, the employer is obliged to notify laid-off employees on seasonal jobs 7 calendar days in advance, and for an employment contract of up to 2 months - 3 calendar days in advance.

Thus, one of the important points in the reduction process that is important for the employee is receiving compensation for vacation, in which the employee is interested. Upon dismissal for any reason, the employee receives such compensation without fail, taking into account the entire time of work in the organization.

To avoid litigation with dismissed employees, a certain redundancy procedure must be followed.

Senior lawyer at Allen & Overy M. Blagovolina

New position of the department

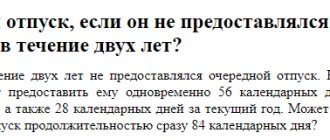

Now Rostrud specialists have changed their position. The rationale is this. Paragraph 1 of the Rules stipulates: every employee who has worked for a given employer for at least 5.5 months has the right to receive another vacation. Regular leave is granted once per working year. The right to the next regular leave for the new working year arises for the employee after 5.5 months from the end of the previous working year. Thus, the entitlement to vacation is linked to the employee's working year.

Consequently, when dismissal due to liquidation or staff reduction, we are talking about the period (working year) for which leave is granted, and not about the total duration of work for a given employer. That is, full compensation for dismissal due to the liquidation of an enterprise or staff reduction is awarded to employees who have worked from 5.5 to 11 months in a working year. Accordingly, an employee who has worked for an organization for more than one year and 5.5 months and is dismissed due to staff reduction has the right to receive full compensation for unused vacation for the last working year. A different interpretation of this norm would mean an unequal position for employees who have worked in the organization for less than a year and those who have worked for a longer period, Rostrud specialists noted.

Procedure for calculating compensation upon dismissal

Upon dismissal, the employee receives compensation for vacation for all years of work in this company, that is, if there are vacation days left since 2014, they will be reimbursed with a cash payment. If the year is not fully worked, then the share of vacation days for each month of work is calculated:

Number of days of vacation due (28, 31, 35, 42, 56 days) / 12 months

It also takes into account how many days the employee worked in a month and is taken as:

- full month – more than 15 days

- month is not taken into account - less than 15 days

With a 28-day vacation for each month, the following is required:

2.33 vacation days = 28 days / 12 months

When calculating compensation, this number can only be rounded in favor of the employee, for example, to 3 days.

Cash compensation for a vacation that was not used

The calculation and payment of compensation for unused vacation in the event of a reduction in staff or numbers is no different from the procedure that applies when dismissing an employee for other reasons. However, there are several non-obvious points that need to be kept in mind.

Calculation of the number of days

Expert opinion

Polyakov Pyotr Borisovich

Lawyer with 6 years of experience. Specialization: civil law. More than 3 years of experience in drafting contracts.

In order to pay the money, the employer needs to know how many days of paid rest the employee was entitled to at the time of dismissal. If he has worked for a full year, this is easy - just look at the employment contract.

However, this situation rarely happens: it usually turns out that more or less than a year has passed since the last vacation. How to be in this case?

It should be noted that this issue has not been fully settled by law. There are two methods for calculating compensation:

- Based on the Rules approved by the CNT of the USSR on April 30, 1930 No. 169 . According to these Rules, it is necessary to multiply the duration of leave under the employment contract by the number of months that have already been worked since the last leave or hire (if the employee has not yet been on leave) - and divide by 12.

- Based on the Recommendations of Rostrud (Minutes dated June 19, 2014 No. 2) . It first calculates how many days of vacation the employee is entitled to for each month worked, and then the resulting number is multiplied by the number of months worked.

When using this method, intervals less than half a calendar month are not taken into account; more are rounded up to the whole value.

For example, if an employee is entitled to 4 calendar weeks of vacation per year under a contract, then for each month he is entitled to 2.(3) (two and three in a period) days. Rostrud recommends rounding this figure to 2.33 days per billing month.

Since there are no instructions in the law yet, the employer has the right to use any of the above methods .

It should be taken into account that the proposal proposed by Rostrud suffers from some inaccuracy: for example, with 6 full months worked, which is exactly half of the year, an employee with 28 days of vacation has the right to count on 14 days - however, when calculating according to the Recommendations, the result is not 14, but 13.98.

In addition, if the employee has not taken a vacation for several years, compensation must be calculated for each year. Finally, if the employee partially used the vacation, then the days used are not taken into account in the calculation.

Calculation of payments

So, the number of days is known. Compensation upon dismissal is paid in the amount of the average daily wage multiplied by the number of days due. But how do you calculate the average salary for one day?

To calculate compensation, you must use the following indicators:

- The amount of income received by the employee at the place of performance of labor duties for the last calendar year. In the formula, this indicator will be designated as D.

- Average number of days per month. According to Decree of the Government of the Russian Federation No. 922 of December 24, 2007, this indicator should be 29.3 in calculations.

- The number of months in the billing period worked in full. Let us denote them in the formula as M1.

- The number of days in months when the employee did not work all days. Let's denote them as M2.

Now let’s look at each indicator separately.

What exactly is included in the amount of earnings?

To calculate the D indicator, it is necessary to take into account the standards set forth in the Decree of the Government of the Russian Federation No. 922

. According to clause 2 of this regulatory act, total income includes:

- Salary for each month of the pay period.

- Additional payments for experience, rank, skill, etc.

- Compensation for overtime work, work on holidays, special working conditions, etc.

- Prizes and bonuses provided for by the internal regulations of the enterprise and paid regularly.

In this case, the following payments received by the employee are not used for calculation :

- Social benefits and financial assistance (payment for vouchers, travel compensation, etc.).

- Dividends on company shares.

- Remuneration to persons participating in supervisory boards, boards of directors and other collective governing bodies of the organization.

What days worked are counted?

Days worked must be calculated in accordance with the production calendar in force at the enterprise . Usually, the calendar year is used as the calculation period, but by its order, the management of the enterprise can introduce other periods of time (quarter, half-year, month, etc.) to calculate the average daily earnings.

When calculating, all days when the employee performed his work duties are used. A full calculation of the number of days is carried out on the basis of time sheets, which must be kept for each employee. Their form was approved by Decree of the State Statistics Committee of the Russian Federation No. 1 of January 5, 2004. Although the use of this form is not mandatory since January 1, 2013, in practice they continue to be actively used.

If the employee worked a full annual pay period, then the average number of days in a month given above (29.3) can be used to calculate compensation . If it is less, then the days are counted.

Watch a video about compensation for leave upon dismissal:

Calculation of average daily earnings

Now we calculate the average daily earnings due to the employee. To do this, take the billing period valid at the enterprise and add up all the amounts included in indicator D.

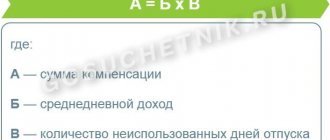

Compensation is calculated using the following formula:

Vacation compensation

Expert opinion

Polyakov Pyotr Borisovich

Lawyer with 6 years of experience. Specialization: civil law. More than 3 years of experience in drafting contracts.

Previously, we received the average daily earnings. In order to determine the amount of compensation due, it must be multiplied by the number of vacation days due to the employee (let’s denote it as O).

As a result, the final formula for calculating compensation (K) will look like this:

This is the amount that should be charged to the employee.

Calculation of the number of days for calculating compensation

First of all, it is necessary to calculate the number of vacation days subject to compensation, and for this it is necessary to calculate:

- full length of service in the organization (in accordance with clause 28 of the Rules: if the length of service of a laid-off employee is 5.5-11 months, then this length of service is rounded up to 1 year)

- the number of days of paid leave for the entire period of work (if the length of service of the laid-off employee is 5.5-11 months, full leave is taken into account), which the employee should have received based on the length of service

- number of days of vacation used during the entire period of work

- difference between allocated and used vacation

Procedure for receiving compensation for unused vacation

According to Art. 140 of the Labor Code, the employer must pay all the money due to the employee on the day of dismissal - not only the salary for the month worked, but also vacation compensation and benefits in the amount of one average monthly income.

IMPORTANT. The dismissed person should not ask to calculate his vacation compensation, and the employer does not have the right to demand a statement from him, or refuse payment on this basis. The Labor Code contains extremely clear wording about the payment of all debts upon dismissal.

But sometimes accounting and personnel differ radically (especially in “gray” companies), and therefore it may turn out that the employee took all the “accounting” vacations, but in fact did not rest for several years.

In this case, the employee should still take care of his finances before the day of dismissal. He must draw up and officially submit a statement to the company's management.

The wording is free, such a plan:

To the Director of Yab LLC

from Ivanov I.I.,

resident: address.

Statement

In connection with the upcoming dismissal, I ask you to calculate my compensation for the vacation days that I did not use while working in the company from 07/07/14 to the present.

Ivanov I.I., signature, date

Documentation of compensation by the employer

On the employee’s last day of work, the employer draws up an order, on the basis of which the accounting department calculates the amount of compensation.

The law does not contain a strict form of the document, so the wording remains at the discretion of the personnel officer.

For example:

Order No. 160-uv

10/15/16 Moscow.

Based

Art. Article 126, 139, 140, 142, 178, 180 of the Labor Code of the Russian Federation,

as well as the dismissal order dated 10.15.16 No. 159-uv

I order:

make a full settlement with Ivanov A.A. and pay him all amounts due,

incl. compensation for unused vacation days for the period of work from 07/07/14 to 10/15/16.

Director of Yab LLC Ivolgin P.I.

Deductions from vacation compensation to the budget

According to Article 422 of the Tax Code, compensation for unused vacation upon dismissal is subject to taxes and fees in the general manner, i.e. from this amount personal income tax is paid - 13%, fees from the Social Insurance Fund, Compulsory Medical Insurance Fund and Pension Fund - 30%.

Example of calculating compensable days

The employee being laid off has been working for the organization since November 13, 2015. The layoff notice informs that August 24, 2021 is the last day of work. The duration of vacation in the organization is 28 days. For 2021, 28 days were used, for 2017 – 23, for 2021 – 21.

Upon dismissal, the organization calculates the number of days subject to compensation (if any).

- total length of service in the organization - 2 years, 9 months (11 days are not taken into account, since they are less than 15 days, but the employer can round up in favor of the employee)

- number of vacation days for all years of work – 77 days

- number of days of vacation used – 72 days

- difference between allocated and used vacation – 5 days

Compensation must be accrued within 5 days.

When unearned vacation pay appears{q}

The following example will help you understand the mechanism by which unearned vacation pay appears.

Technical University graduate P. N. Ptichkin got a job at a helicopter plant on July 1, 2018, and in January 2021 he received the right to go on vacation (paragraph 2 of Article 122 of the Labor Code of the Russian Federation) and took advantage of this opportunity. The duration of his vacation was 28 calendar days (Article 115 of the Labor Code of the Russian Federation).

Find out more about the provision of leave and its duration from the article “Annual paid leave under the Labor Code (nuances).”

During his vacation, he received a more lucrative job offer and immediately after returning from vacation, he quit the plant.

Thus, by the time of his dismissal, P.N. Ptichkin had earned only half of his legal leave: 14 days (6 months × 28 days / 12 months), and used all 28 days. There were 14 vacation days unworked at the time of dismissal (28 – 14).

Since the employee received the full amount of vacation pay before going on vacation, by the time of dismissal he had a debt to the company for the 14 days of vacation paid in advance.

IMPORTANT! The right to vacation for the first working year arises after six months of work in the organization (Article 122 of the Labor Code of the Russian Federation). Subsequent vacations are issued according to the approved schedule.

What the lack of a vacation schedule in a company can lead to, see the material “Unified Form No. T-7 - Vacation Schedule.”

Calculation of compensation amount in case of layoff

Having calculated the days subject to compensation, you need to calculate compensation based on the average daily earnings for the billing period and the procedure for calculating the average daily amount for calculating vacation pay.

Amount of compensation = average daily earnings * number of days subject to compensation

Average daily earnings = the amount of wage payments accrued in the billing period (previous 12 months) / the number of calendar days of the billing period taken into account (12 months * 29.3), where:

29.3 – average monthly number of days taken for calculating vacation pay (not taking into account holidays).

Payments made not for work activities: sick leave, vacation pay, business trips, etc. are not taken into account when calculating the average daily earnings. And those days when the employee received these amounts are excluded from the calculation period as a proportion of the number of these days from 29.3.

"Vacation" rights and obligations

Upon termination of the employment relationship, the employer must perform many mandatory actions regulated by labor legislation. Among them is the obligation to give the employee everything he earned by the time of dismissal.

Vacation payments are one of the elements of the final settlement with a resigning employee. Their composition depends on how many vacation days have been accumulated and whether the employee has exercised his right to vacation in the current period (Article 127 of the Labor Code of the Russian Federation).

For information on the circumstances affecting the calculation of vacation days upon termination of an employment contract, see the material “How to calculate the number of vacation days upon dismissal {q}”.

In addition to this obligation, the employer has the right to withhold from the resigning employee’s income the amount of advance vacation pay (Article 137 of the Labor Code of the Russian Federation).

This right may not be exercised in all cases. If the dismissal of an employee occurs on the grounds listed in Art. 137 of the Labor Code of the Russian Federation, it will not be possible to withhold overpaid vacation pay from him. For example, such a prohibition on retention applies to the situation of dismissal due to staff reduction or closure of a company, as well as in other cases provided for by law.

In addition, the employer can deal with the employee’s debt in a different way. We'll talk about this in the next section.

Find out how to calculate the number of vacation days in 2021 from this publication.

Example of calculating the amount of compensation

The employee is leaving effective August 24, 2021. The duration of vacation in the organization is 28 days. Upon dismissal, the organization is obliged to calculate the amount of compensation within 5 days.

The employee's salary is 35,000 rubles, a bonus is accrued quarterly based on work results in the amount of the salary. The billing period has been fully completed.

Compensation for 5 days will be:

- Billing period: from August 1, 2021 to July 31, 2021.

- During this period the following wages were accrued:

35000 * 12 months + 35,000 * 4 quarters = 560,000 rub.

- Average daily earnings were:

560,000 rub. / (29.3 * 12) = 1592.72 rubles.

- The amount of compensation will be:

5 days * 1592.72 rub. = 7963.59 rub.

This amount is the employee’s income and is therefore subject to personal income tax (13% for residents):

7963.59 rub. * 13% = 1035 rub.

The compensation in hand will be:

7963.59 rub. – 1035.00 rub. = 6928.59 rub.

Dismissal due to reduction before the expiration of two months

An employee who is being laid off and has written consent, but there are no suitable vacancies for him, can quit early, that is, the employment contract with him can be terminated before the expiration of 2 months. This employee is paid compensation additionally, taking into account the days that remain before the expiration of 2 months, for example, notice of layoff from August 24, 2021, but the employee quits from July 2, 2021 and the amount of compensation will be taken into account as if the employee worked until August 24 2021 (Part 3 of Article 180 of the Labor Code of the Russian Federation).

If this employee is dismissed not through layoff, but at his own request (Article 80 of the Labor Code of the Russian Federation), then in this case the employer does not pay compensation, as for dismissal due to layoff (Article 178 of the Labor Code of the Russian Federation).

Important! If an employee terminates the contract early during layoff, he receives: compensation in proportion to the time remaining before the expiration of the notice period and other payments under Art. 178 Labor Code of the Russian Federation.

What to do if money is not paid due to a decrease in the number of employees?

If the employer violates the deadlines for transferring the amounts due for the reduction or does not pay them at all, the injured individual can contact the following authorities:

- trade union;

- Labour Inspectorate;

- prosecutor's office;

- court.

To begin with, a citizen can write a complaint to the company management and the trade union. If it is not satisfied, then it makes sense to seek justice in government bodies. It is recommended to write a statement to the court only if it was not possible to resolve the issue of violation of the employee’s rights through the labor inspectorate and the prosecutor’s office.

It should be noted that situations may occur when the amount of compensation paid is less than due due to an accountant’s error. Therefore, it is best to check the correctness of the money accrual yourself using the formulas given in the article. It should be remembered that some types of compensation may be less due to the withholding of personal income tax from them.

If you find an error, please select a piece of text and press Ctrl+Enter.

Error when contracting a pregnant woman

If the position being laid off is occupied by a pregnant employee, is it possible to lay off the position with her consent?

The employer does not have the right to reduce this staff position occupied by a pregnant woman, whose termination is not allowed at the initiative of the employer in accordance with Part 1 of Art. 261 Labor Code of the Russian Federation. Exception: liquidation. Thus, the dismissal of a pregnant employee at the initiative of the employer, clause 2, part 1, art. 81 of the Labor Code of the Russian Federation will be illegal. Even with the consent of the employee, based on the results of the GIT inspection, administrative liability is provided (Part 1 of Article 5.27 of the Code of Administrative Offenses of the Russian Federation). And in case of unjustified dismissal of a pregnant woman, there is criminal liability (Article 145 of the Criminal Code of the Russian Federation).

Due date

Compensation must be accrued and paid to the employee on the last day before dismissal.

If he did not work that day, then all payments and compensations must be made no later than the next day after he applies for payment (Part 1 of Article 140 of the Labor Code of the Russian Federation).

In the event that there is a dispute between an employee and an employer about the amount of payments due, the management of the enterprise must pay the amount with which both parties agree. The issue of payment of the remaining portion is resolved separately, if necessary - in court.

Answers to common questions

Question No. 1 : Should an individual entrepreneur, when laying off workers, follow the layoff procedure and pay compensation and severance pay?

Answer : Such an obligation arises when these guarantees are specified in the employment contract with the employee. The norms of the Labor Code of the Russian Federation are guaranteed to employees whose employers are legal entities. Termination of a contract with employees of an individual entrepreneur must be carried out in accordance with Art. 307 of the Labor Code of the Russian Federation, established on the basis of the specifics of work activity.

Question No. 2 : Should compensation be paid to a pensioner when staffing is reduced?

Answer : According to the Labor Code of the Russian Federation, a pensioner is an employee, like others, therefore his rights cannot be infringed. He must be accrued compensation for vacation on the same basis and average earnings for the second month after dismissal.

Taxation and contributions

However, the above calculation is only the first step. We must not forget about taxation and contributions. According to Art. 217 of the Tax Code of the Russian Federation, personal income tax is paid on compensation for vacation in case of staff reduction. Therefore, the dismissed employee will receive a smaller amount.

When calculating personal income tax, you need to keep the following factors in mind:

- Tax rate. For residents, that is, citizens permanently residing in Russia, it is 13%.

- Amount of accrued compensation.

Compensation is not subject to personal income tax only in one case - if the employee died before receiving it, and it is inherited by his relatives (clause 18 of article 217 of the Tax Code of the Russian Federation).

In addition to personal income tax, contributions to the Pension Fund, Social Insurance Fund, and the Federal Compensation Fund are withheld from compensation. The basis for this is clause 2, clause 1 of Art. 422 of the Tax Code of the Russian Federation. These contributions are transferred to the budget in the usual manner, that is, on the 15th day of the month following the dismissal.

Features of compensation for certain categories of employees

According to the legislation of the Russian Federation, just like the Labor Code, pensioners and minors are equated to special categories of citizens to whom slightly different employment rules apply. But do the restrictions imposed on them apply when they are laid off from their current place of work? Indeed, in addition to the technical regulations, the internal regulations of the enterprise also influence the management’s decision. It may stipulate slightly different conditions for the calculation of employees.

Part-timers

Part-time work is the performance by one worker of several different types of work during the day at two or more enterprises. Just like permanent employees, he is given a salary at a uniform rate established in the employment agreement. But upon his dismissal, the salary will be calculated not by days, as prescribed in the Labor Code of the Russian Federation, but by the hour.

It is important to know! In addition, if a part-time worker is laid off from an additional job, and not from the main one, then payment of unused vacation is also not accrued for him. As for the coverage of sick leave and severance pay, their manager carries out them based on the requirements of the internal regulations of the enterprise, and not according to the Labor Code.

For pensioners

As for the payment of compensation to older people, it should follow a standard algorithm provided for all categories of workers. The only exception in this case is the additional bonus for early retirement. The process of laying off a person of pre-retirement age is somewhat different from the procedure for dismissing ordinary specialists.

For example, before leaving his position, he does not need to undergo work for two weeks, as required by the Labor Code. The very fact that an employee reaches retirement age, according to Art. 3 of the Labor Code of the Russian Federation is not a reason for its calculation. Therefore, sometimes it is easier to lay off newcomers than to lose valuable personnel in the person of people who have worked at the enterprise for decades.

Seasonal employees

Seasonal workers employed for a period of up to 2-3 months cannot, by law, claim any payments upon dismissal due to staff reduction. The main reason for this limitation is the time frame for the execution of orders by superiors.

Indeed, in accordance with the Labor Code of the Russian Federation, the manager is obliged to warn subordinates about their calculation no later than 60 days before the appointed date. For short-term employment, these deadlines cannot be met. Therefore, the only thing seasonal workers can count on is the salary accrued from the moment the last advance was issued until the date of their departure from the enterprise.

How to process a refund of vacation pay for an employee who took time off in advance{q}

If the owner nevertheless decides that the employee must repay the debt for unworked vacation, then on the day of dismissal it is necessary to draw up an order to withhold funds indicating the article under which the contract between the employee and the organization is terminated.

Also in this order it is necessary to indicate for how many days it is necessary to deduct from the salary for excessively used rest days, indicating the amount. In this case, the amount of payments in the order must be indicated taking into account income tax.

If it is necessary to withhold other amounts from the employee (for workwear, damage to the enterprise and other deductions), this must also be specified in the order.

We suggest you read: Bankruptcy of housing cooperatives with debts - Lawyer.Rf