Despite the specifics of the company's employment, every worker, in accordance with the law, has the right to annual rest, provided within the framework of the priority schedule.

At the same time, both the employee and the employer have the right to postpone the vacation to another time, taking into account that family problems, as well as production needs, make their own adjustments, which are also taken into account by the norms of the Labor Code of the Russian Federation.

Labor Code Norms

In pursuance of the norms of the law, namely Article 123 of the Labor Code of the Russian Federation, each institution draws up a vacation schedule until December 15 based on the establishment of planned vacation periods for the next year.

At the same time, taking into account that the agreed document is a local act approved by both the manager and the chairman of the trade union committee, the schedule is subject to mandatory compliance by both parties to the legal relationship, which in this case are the employee and the enterprise.

Also, taking into account that it is not realistic to foresee all possible problems, both production-related and personal, a year in advance, the law gives the right to make changes to the schedule with the transfer of rest time to another time. After all, an employee cannot know in advance that he may need sanatorium treatment due to deteriorating health, and the manager cannot predict the same industrial accident or other circumstances.

That is why, for such situations, the law provides for the possibility of postponing a previously planned rest period to another date, especially if the worker’s absence from the workplace may adversely affect the production process.

At the same time, in pursuance of the norms of Article 124 of the Labor Code of the Russian Federation, the main vacation can be moved for a reason, but only if several conditions are met , in particular:

- availability of the worker’s consent;

- compelling reasons for changing the period of use of legal rest;

- provision of unused vacation at another time, namely until the end of the current year or no later than the next.

But next year, in accordance with Article 114 of the Labor Code of the Russian Federation, the worker will be entitled to another vacation, which must also be implemented in accordance with the period specified in the schedule, which, in fact, leads to the fact that the vacation for the previous year remains out schedule, while annual vacation is currently being used, thus accumulating days of unpaid vacation .

How much can “accumulate”

Unused vacation from previous years accumulates, which leads to the need to solve the problem. There are several ways out of the situation:

- provision of due days in full;

- compensation for missed vacation.

Attention: replacing a vacation with a cash equivalent is only allowed in exceptional cases.

Compensation for the entire period is made only when the employment relationship is broken. Employee rest standards are strictly regulated. Leave must be used no later than 12 months after the end of the working year for which it is granted; it is prohibited not to release an employee from his place of service for more than two years in a row (Article 124 of the Labor Code of the Russian Federation). In addition, in Art. 123 of the Labor Code of the Russian Federation provides the procedure for the employer to organize rest for employees. The rules are:

- annually, before 15.12, a vacation schedule is drawn up and approved;

- the document is mandatory for execution by employees and management;

- each shall temporarily retire on a specified date in order to exercise his right to reinstatement.

Important: changes in the schedule are possible due to compelling reasons.

Moreover, both the employee and his boss can deviate from the approved register of vacation periods. True, different reasons are given:

- An employee may request a reschedule due to family circumstances. These do not need to be documented.

- The employee has the right to divide the vacation period into several parts. But one of them must be at least 14 days.

- The employer is obliged to confirm the need to retain the employee in the service. It is usually associated with difficulties in the tasks being performed or with force majeure situations.

Nevertheless, a lot of leftover residue accumulates. The specific period depends on:

- the employee's total length of service;

- his attitude towards compulsory rest (not everyone strives to go for a walk every year);

- managerial responsibility (many people welcome work without interruptions).

Attention: 14 days must be provided to the employee annually.

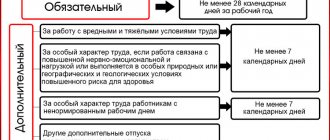

The rest accumulates. When studying the issue, it is necessary to remember that employees are entitled to various types of paid waste department:

- main (OO);

- additional (AD): within the framework of current legislation;

- according to the norms of the collective agreement.

In addition, in certain situations, employee recall is practiced. This also contributes to the accumulation of days off. It must be remembered that interruption of the vacation period for any reason is prohibited for the following categories of workers (Article 125 of the Labor Code of the Russian Federation):

- minors;

- pregnant women;

- working in difficult and dangerous conditions.

How much can “accumulate”

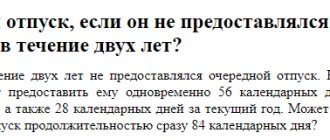

Based on Article 124 of the Labor Code of the Russian Federation, it is prohibited not to provide rest for two years in a row, which, in principle, is done, given that employees, as a rule, use part of the rest throughout the year, while the remaining days are postponed until later.

At the same time, next year a similar situation arises, which ultimately leads to a fairly large number of unrealized days of rest for several years in a row.

And since the employer cannot provide all the days of legal vacation for two years, given that the worker is expected to be absent for quite a long time, they prefer not to remember about unused vacations, until the termination of the employment relationship. At the same time, if an employee works for a sufficiently long time in a company that, for operational reasons, practices the division and transfer of vacations, by the time the employee is dismissed, a fairly significant number of days of unrealized vacation have accumulated, which can only be compensated in two ways, monetary compensation or the provision of vacation.

It should be noted that this situation arises because the law does not establish a limit on the duration of unrealized vacations , because it is assumed that employees rest on time based on the priority schedule or use the unrealized part in the next two years.

Options for “getting rid of” unused rest periods

In fact, to realize accumulated rest unused within the prescribed period in only two ways, namely:

- in monetary terms, by receiving compensation;

- providing part of the unused vacation by adding it to the main vacation over subsequent years.

At the same time, regardless of which method of repaying unrealized rest days is chosen, it is worth taking into account some legislative nuances. So, in particular, in accordance with Article 126 of the Labor Code of the Russian Federation, replacement of vacation in full with monetary compensation for the current year is not allowed. But parts of the vacation remaining for previous years can be repaid in this way, but provided that the company has sufficient funds and the management of the institution agrees to such an equivalent vacation.

You should also take into account the fact that only those vacations that are basic and only in excess of 28 days can be replaced in monetary terms At the same time, additional leave provided for the restoration of health cannot be replaced in the form of material compensation, especially when it comes to periods of rest provided in connection with employment in dangerous conditions or for work in the northern regions.

How to calculate correctly in 2019?

To correctly calculate the amount of compensation, the provisions of the following regulatory documents should be taken into account:

- Regulation of the Government of the Russian Federation No. 922 of December 24, 2007.

- Rules on regular and additional vacations dated 02/02/1930 (to the extent that does not contradict modern labor legislation).

Step-by-step calculation algorithm:

| Step 1 | The length of service that gives the right to paid leave is considered (in full months) - vacation experience calculator |

| Step 2 | The number of unused days for compensation is determined - calculate in the online calculator |

| Step 3 | The billing period is set |

| Step 4 | The total income for the billing period is calculated |

| Step 5 | The number of days worked in the billing period is determined |

| Step 6 | Average earnings for 1 day are calculated - calculator for calculation. |

| Step 7 | Compensation is being calculated |

Formulas for calculation:

Compensation = Avg.Day.Dar. * Days of non-vacation.

Wed.Day.Dawn = Income for the billing period / Calendar days worked.

Days worked in a full month = 29.3.

Days worked in an incomplete month = Calendar days of work in the month * 29.3 / Calendar number of days of the month.

How to calculate compensation upon dismissal for less than a month?

Below is an explanation of how exactly compensation is calculated.

How many days off work are compensated?

Cash payments are made for those days of annual leave that the employee did not use in the course of his work.

To determine this indicator, it is first calculated how many days of vacation a person is entitled to during the entire period of work in the company.

We recommend reading: how many days of vacation are required upon dismissal after 11 months of work?

Step-by-step calculation procedure:

- The period of work from the date of admission to the date of dismissal is taken and the number of working full years and full months is calculated. The rest of the days less than half of the month are discarded; those equal to or more than half are rounded up to a full month.

- Years are converted to months based on 12 months. for every year.

- The number of allotted days of rest for the vacation period is calculated. For each full month, the number of vacation days is due = Annual duration / 12.

- To calculate non-vacation days, those already used on the date of dismissal are subtracted from the total number of vacation days.

Example:

Petrov was hired by the company on September 10, 2019, and leaves on October 18, 2020. In July 2021, Petrov took 14 days of vacation.

As of the date of termination of the employment contract, the following hours have been worked: 1 full working year, 1 full month and 9 days. 9 days are not taken into account since it is less than half.

Thus, the length of service is 13 full months, for which 28/12 * 13 = 30.33 days of vacation are due.

Unused days = 30.33 – 14 = 16.33 – compensation must be paid for this time.

Billing period

According to the Regulations on the calculation of average wages from Resolution 922 for the billing period, the following is accepted:

- 12 cal.months (from the 1st to the 30th or 31st), which precede the month of dismissal;

- if in the previous year there were no days worked, no income, or it consisted of an excluded period, then 12 calendar months preceding this year are taken;

- if there were no accruals or days worked before the start of the billing period, then the calculation is carried out according to the indicators of the month of dismissal;

- if the employee had no earnings or days worked during the entire period of work, then compensation is calculated based on the salary or established tariff.

Examples:

- The employee was hired on September 10, 2019, and left on October 7, 2020. The billing period is from 10/01/2019 to 09/30/2020.

- The employee was hired on September 10, 2019, and left on September 7, 2020. The billing period is from 09/10/2019 to 08/31/2020.

- The employee was hired on September 10, 2019 and left on September 30, 2019. The billing period is from September 10, 2019 to September 30, 2019.

Clause 5 of the Regulations specifies excluded periods that are not included in the calculation period:

- maternity leave for pregnancy or child care;

- temporary disability;

- the period when the employee was accrued average earnings - all types of vacations, business trips, etc.;

- downtime due to the fault of management or for reasons beyond our control;

- lack of work activity due to a strike;

- additional days off to care for disabled people.

Average earnings

If leave is provided in calendar days (almost always), then the calculation is performed using the formulas:

Average daily earnings = Income for the billing period / Calendar days worked.

Income includes all charges related to wages.

Not included:

- benefits for pregnancy and child care;

- hospital benefits;

- vacation pay;

- business trips;

- material aid;

- compensation for travel, food, communications, recreation, training.

Days worked are taken in calendar terms. If an employee was present at the workplace for a full month, it is considered that 29.3 days were worked there.

If there were events excluded from the calculation period (listed above), then for such a month it is necessary to carry out separate calculations of days worked using the formula:

Work days in an incomplete month = Actual work. days per month * 29.3 / Total number of cal days per month.

If leave is provided in working days, then the calculation is based on working days according to the production calendar for a six-day working week. On working days, rest is provided only when concluding a fixed-term employment contract for a period of up to 2 months, as well as when hiring employees for the duration of the season.

Examples of calculating compensation for dismissal under a fixed-term employment contract.

Payment calculation example

Initial data:

Ivanova was hired by the company on November 18, 2021, and was dismissed on July 10, 2021. I didn't take a vacation.

Earnings by month:

- November = 12000;

- December – March at 28,000;

- April 22000 (sick leave for 5 days);

- May and June 28,000 each;

- July = 10000.

Compensation calculation:

Vacation experience - from November 18, 2019 to July 10, 2020 is 7 months. 23 days is rounded up to 8 full months.

If the annual vacation duration = 28 days, 2.33 days are allocated for each month.

Vacation during work = 2.33*8 = 18.64 days. – a completely unused period for which compensation must be paid upon dismissal.

The billing period is from November 18, 2019 to June 30, 2020. In this period, 6 months were fully worked out and 2 were partially worked out (November and April).

Work days in November = 13 * 29.3 / 30 = 12.70.

Work days in April = 25 * 29.3 / 30 = 24.42.

Work days in other months = 29.3 * 6 months. = 175.80.

Total worked out in the billing period = 12.70 + 24.42 + 175.80 = 212.92.

Total income excluding sick leave = 12,000 + 28,000 + 28,000 + 28,000 + 28,000 + 22,000 + 28,000 + 28,000 = 202,000.

Average daily earnings = 202,000 / 212.92 = 948.71.

Compensation for unused vacation = 948.71 * 18.64 = 17683.95.

Personal income tax of 13% is withheld from this amount and contributions are calculated at a total rate of 30%.

Useful video

We invite you to watch this video, which explains step by step and sequentially how to correctly calculate the compensation payment for unused vacation upon termination of an employment contract:

The procedure for providing periods for previous years

In fact, vacation not taken at the time is no different from the main vacation, which is provided annually, therefore, the procedure for registering the period not taken off will be similar, with some exceptions.

In particular, in accordance with Article 123 of the Labor Code of the Russian Federation, when granting annual leave, notification is required two weeks before the vacation, but if the vacation is not provided according to schedule and at the request of the employee, notification is not required .

In such a situation, the worker submits an application for consideration by management, which actually reflects a request to use the unrealized part of the vacation for previous years in the form of rest from a certain date or material compensation. Moreover, taking into account that unused parts are not included in the schedule, the employer has the right to refuse to provide rest at exactly the time required by employees, but again with the condition of its use at a later date, for example, after submitting the quarterly report.

If the manager does not object to the implementation of the rest of the leave for previous years, a resolution is imposed on the application, on the basis of which an order is issued to provide legal leave in full or only part of it, with subsequent implementation in another period.

Moreover, if the employee wishes to use the unrealized parts of the vacation not in the form of rest, but in monetary terms , an application is also submitted, and on its basis, again, an order is issued to pay compensation, but only if the institution has sufficient funds.

How to calculate for a maternity leaver who quits at her own request

If a woman on maternity leave decides to resign of her own free will, then she has every right to do so. At the same time, you also need to calculate if she has unused vacation days on the date of dismissal; if they exist, compensation should be paid.

When calculating for a maternity leave, there are a number of nuances:

- The calculation period for compensation is the 12 previous calendar months, with the maternity leave period excluded. That is, for a woman on maternity leave, the billing period should be 12 months preceding the month the maternity leave begins.

- For women on maternity leave, it is important to correctly calculate the number of vacation days for compensation. It is important to remember that the period of maternity leave gives the right to annual leave, but the period of parental leave does not give such a right. If maternity leave according to BiR lasts 140 days (rounded up to 5 full months), then during this time the woman receives 5 * 2.33 = 11.65 days of leave (can be rounded up to 12 days).

- Before maternity leave, a woman could take advantage of the right to leave under Article 260 of the Labor Code of the Russian Federation, and she could take these days in advance. On the date of dismissal, it is important to check whether the maternity leaver has any unused days for compensation. It may also be that the employee still owes money to the employer. In this case, it may be necessary to withhold overpaid vacation pay upon dismissal; no more than 20% can be withheld; if this is not enough, then the overpayment of vacation pay can only be returned with the consent of the woman herself.

Example

Initial data:

Semenova got a job on 03/01/2017, from 10/10/2017 she went on maternity leave under the BiR for 140 days and then from 02/27/2018 on maternity leave. Before maternity leave, annual leave was issued for 14 calendar days according to BiR. from 09/26/2017 to 10/09/2017 The date of voluntary dismissal is 09/23/2019.

All months before maternity leave have been fully worked out. Monthly salary = 20,000, in September 2021, due to the vacation taken, the salary was 18,000.

Calculation:

- Vacation period – from 03/01/2017 to 02/26/2018 (sick leave according to the BiR is included) – 11 months. 26 days, rounded up to 12 full months.

- Number of days during vacation period = 28 days.

- Number of unused days for compensation = 28 – 14 = 14 days.

- The settlement period for compensation is from 03/01/2017 to 09/30/2017.

- Total income for the billing period = 20,000*6 + 18,000 = 138,000.

- Days worked in September = 25 * 29.3 / 30 = 24.42.

- Average daily wage = 138,000 / (29.3*6 months + 24.42) = 689.24.

- Vacation compensation = 689.24 * 14 = 9649.39.

Compensation calculation

In accordance with Article 114 of the Labor Code of the Russian Federation, for the period of taking annual rest, the employee retains not only his position, but also his average earnings , the calculation procedure for which is carried out in accordance with the norms of Article 139 of the Labor Code of the Russian Federation . So, in particular, all accrued amounts for the last 12 months are taken into account, including salaries, sick leave and bonuses, not to mention incentive payments.

The agreed upon accruals are summed up and divided by 12, thus calculating the average monthly earnings . Then, from the received amount, daily earnings by dividing the average monthly wage by a factor of 29.3, which, in fact, is the average indicator of the number of days in a month.

Upon completion of the calculations, the resulting amount of daily earnings is multiplied by the number of days of vacation provided and transferred to the employee as vacation pay.

If the worker does not plan to use the accumulated vacation days in kind, that is, through rest and wants to receive the agreed vacation in the form of monetary compensation, vacation pay is calculated in a similar way.

Unused vacation and its monetary compensation without dismissal and upon dismissal

- You can receive compensation after you take your required basic leave, while remaining in your position. Anything in excess of these mandatory vacation days can be received in the form of cash compensation. But only after management approval! And in reality, it is very rare that an employer agrees to such payments without dismissing an employee. But you shouldn’t blame the management either, because such payments are not mandatory. Employees often deliberately do not go on vacation in a timely manner in order to receive compensation in money. These manipulations are illegal and your right to receive such payments should not be abused. Even if you were lucky once and, while continuing to work, received compensation in money, this does not mean that this will always be the case. After all, the employer understands everything, but next time most likely will not meet you.

Important: The Labor Code explains the possibility of replacing part of the vacation with monetary compensation. It is partially provided only for certain categories of citizens working in the field of healthcare, education, in the Far North and is carried out at the discretion of the manager. Only the employer, taking into account all the circumstances, can decide to replace unused vacation days with monetary compensation. However, even he does not have the right to make such a decision in relation to minors, disabled people or citizens who work in hazardous work - their management is obliged to provide them with adequate rest.

Reference!

- A more stable scheme is when, upon dismissal, an employee receives compensation for unused vacation or certain days. At the same time, you should know that their number does not matter - compensation must be paid in any case and amount! The only thing is that, perhaps, in order to shorten the vacation period, the employee will be sent to rest on a voluntary-compulsory basis the day before. But this is also completely acceptable!

- If we talk about timing, then cash receipts occur on the day of dismissal, which is often the last working day. But the maximum allowable waiting period is 1 day. For accounting purposes, all days worked for a year or a certain period of six months are taken.

We also invite you to read our article “How compensation for unused vacation upon dismissal is calculated and calculated - a sample application.”

By sending subordinates on vacation, management protects itself from administrative fines. HR professionals have an important role to play in promoting employees' use of their paid vacation time to eliminate or minimize unused vacation time. The real trick is to find a way to fit vacations into your busy work schedule.

What to do before maternity leave

Based on Article 260 of the Labor Code of the Russian Federation, a pregnant woman on the eve of childbirth, as an additional support measure, is given the right to use the main leave outside the schedule and duration of employment. At the same time, the employee can take advantage of the agreed type of rest of her choice both before going on maternity leave and after, immediately after the end of sick leave or maternity leave.

If a pregnant worker does not have enough experience to take full advantage of her vacation, she is given leave in advance. If a woman’s vacation has not been used, moreover, additional days of rest have accumulated over the past years, the period of release from work is still provided only in the amount of annual leave, given that the agreed norm is enshrined in law and the employer does not have the right to refuse.

At the same time, the issue of providing additional days of rest that were not used at the time established by the schedule is resolved in agreement with the company’s management, due to the fact that the obligation to implement them before or after the maternity leave is not established by law. That is, in essence, the issue of using unpaid leave in relation to a pregnant woman is resolved in a working manner and taking into account production processes .

Is it possible not to take vacation at all: can you be fired for unused vacation?

- For every person who is officially employed in our country, the right to rest is provided, which is determined by the norms of the Labor Code of the Russian Federation. Amendments to existing regulations establishing standards for state-guaranteed workers' rights are made only at the federal level. According to Art. 6 of the Labor Code of the Russian Federation , neither regional authorities nor individual employers have such rights. And any violation of the law is qualified as an administrative or even criminal violation.

- The duration of “working holidays” is 28 calendar days, with the exception of some “preferential” categories of citizens whose vacation may be longer. This aspect is protected by Article 115 of the Labor Code. By the way, about preferential categories, we suggest reading our article “Who is eligible for extended leave?”

- It is worth noting that each company has its own vacation schedule, which is grouped until December 17 of each year. An employee has the right to leave 6 months after employment. We also recommend that you read the article “When is the first vacation after employment due?”

- Let's answer one question right away - no employer has the right to fire for unused vacation or their accumulation, and also in case of refusal! But he can, without your permission and consent, issue a decree that it is time to take time off from a certain date. And this will be a completely legal action!

Let's lean on!

Upon dismissal

In accordance with Article 127 of the Labor Code of the Russian Federation, upon termination of labor relations, the company is obliged to pay the employee compensation for all days of unused vacation, which was not realized at the time of dismissal.

That is, in essence, regardless of whether annual leave was used at the time established by the schedule or not, and regardless of how many days were accumulated, the employer is obliged to pay compensation for all days in the amount of the average wage, calculated taking into account the standards enshrined in Article 139 of the Labor Code of the Russian Federation.

Sample of filling out a settlement note upon dismissal

[ads-pc-2] [ads-mob-2]

Filling out the front side

At the top of the document the name of the company and its registration code with the statistical authorities (OKPO) are indicated.

Form T-61 must have a serial number and the date of its execution.

The HR inspector fills in information about the personnel number, full name, position and name of the structural unit in which the resigning person works.

Below you must indicate who initiated the dismissal, crossing out the unnecessary option, as well as the date of termination of the employment contract. Information about this is also filled in with reference to the relevant article of the Labor Code of the Russian Federation, and the details of the dismissal order are recorded - number and date.

Information about the availability of unused or advance vacation days with an explanation of the period for which it is due is also indicated here.

At the bottom of the page, the HR specialist endorses the calculation note, confirming the accuracy of all the data filled in by him, indicating his position and full name.

Filling the reverse side

[ads-pc-4] [ads-mob-4]

The calculation of compensation upon dismissal is carried out by an accountant.

To do this, he fills in the appropriate tables. The first contains data with the name of the month, year of the billing period and the amount of salary accepted for calculation. The “Total” line records the amount of all wages applied to accounting. The second table fills in the number of calendar days or hours in a given period, depending on the payment system used. Next, the average daily (average hourly) earnings are calculated, which must be entered in the appropriate column.

The following plate indicates the number of vacation days indicated by the HR specialist on the front side, and calculates vacation pay to compensate the employee upon dismissal, or to deduct from his salary for time not worked.

In the bottom plate, the accountant fills in information about all accruals due to the dismissed person, as well as deductions for personal income tax, alimony, etc., if any. In the columns with debt, the amounts of previously existing debts of both the employee to the company and the company to him are recorded.

The value of column 19 is calculated as the sum of columns 13 and 17, from which the indicators of columns 16 and 18 are subtracted.

Next, the amount received in hand must be written down in words and here you must indicate the details of the payment documents according to which it will be paid.

The accountant signs his side of the document with a transcript of personal data.

Employer's liability

In fact, within the framework of the law, the formation of unused rest is not a violation , but only if the worker had the opportunity to rest for at least two weeks a year with the obligatory condition of implementing the rescheduled rest over the next two years.

Moreover, if, in violation of the norms of Article 124 of the Labor Code of the Russian Federation, legal rest was not provided at all , and for more than two years in a row, the company management will be subject to punishment in the form of an administrative penalty, which is expressed in penalties based on Article 5.27 of the Code of Administrative Offenses of the Russian Federation in the amount of 30 up to 50 thousand rubles.

Of course, every employer strives to ensure that its employees work, and therefore make a profit, constantly, which is why vacation debt for previous years is formed.

But, nevertheless, no amount of money, as well as production needs, can replace proper rest, which is provided by law for a reason, but in order to preserve the health and ability of workers.

For information about unused legal periods of exemption from work, see the following video: