How is the application of disciplinary sanctions related to the deprivation of bonuses to employees?

The procedure for depriving a bonus is not prescribed by law. At the same time, by virtue of Part 2 of Art. 135 of the Labor Code of the Russian Federation, the procedure for awarding and depriving bonuses can be enshrined in collective agreements, agreements, or local acts adopted at the organizational level. In addition, the procedure may be reflected in the employment contract with a specific employee due to the provisions of Art. 57 Labor Code of the Russian Federation.

p, blockquote 7,0,0,0,0 —>

Most often, companies have Regulations on bonuses, which are adopted in the form of local acts. In such a Regulation, the employer can establish both the grounds for bonuses (for example, for fulfilling the plan, for impeccable adherence to labor discipline, for the quality of products) and the grounds under which bonuses will not be paid to employees.

p, blockquote 8,0,0,0,0 —>

In particular, the basis for depriving an employee of a bonus may be bringing him to disciplinary liability during the time period for which the bonus is awarded.

p, blockquote 9,1,0,0,0 —>

Disciplinary offense: when can a bonus not be paid?

Why was they deprived of money?

For disrupting the production assignment, Alexey M., foreman of site No. 23 of Monolit JSC, was reprimanded. The employee admitted his guilt and did not object to disciplinary action. However, when at the end of the month he was not paid a bonus, and in addition his name was not included in the order for bonuses to the company’s employees on the occasion of its 10th anniversary, he was indignant. Alexey believed that he was deprived of these payments illegally. After all, for improper performance of official duties, he has already been punished in the form of a reprimand. And you cannot punish twice for the same offense. Due to non-receipt of bonuses, the employee lost half of his monthly salary. For Alexey’s family budget, this amount was significant. So he decided to fight for her.

The employee contacted the accounting department for clarification. The payroll accountant explained that the order for non-payment of bonuses based on the results of work for July 2009 was prepared on the basis of the company's current Remuneration Regulations. However, the employee found this argument unconvincing. And he declared his intention to defend his right to remuneration up to the point of going to court. In order to dot the i's and avoid litigation, the accountant turned to a lawyer for help, who agreed to accept the employee and explain to him from the point of view of the law what he was doing wrong.

From the Labor Code of the Russian Federation

The employee’s salary is established by the employment contract in accordance with the current employer’s remuneration systems.

Remuneration systems, including tariff rates, salaries (official salaries), additional payments and allowances of a compensatory nature, including for work in conditions deviating from normal conditions, systems of additional payments and incentive allowances and bonus systems * are established by collective agreements, agreements, local regulations in accordance with labor legislation and other regulations containing labor law standards.

* Color highlighting – ed.

Award prize discord

Bonuses determined by the remuneration system and incentive bonuses: the main differences.

Lawyer Anatoly N. agreed with the employee that for each disciplinary offense, indeed, only one penalty can be applied (part five of Article 193 of the Labor Code of the Russian Federation). But is failure to pay a bonus a disciplinary sanction?

This is important to know: Statement of claim for divorce and collection of alimony for a child and spouse: sample

The fact is that the punishments that an employer has the right to apply to an employee in the event of non-fulfillment or improper fulfillment of the labor duties assigned to him are determined by Article 192 of the Labor Code. This is a reprimand, reprimand, dismissal for appropriate reasons. This list is exhaustive 1 . Therefore, deprivation of a bonus is not a disciplinary sanction. This means that, along with punishment (for example, a reprimand), the employer, under certain conditions, has the right not to pay the employee a bonus.

Only information about incentive bonuses is entered into the employee’s work book and personal card.

Anatoly drew Alexey’s attention to the fact that the bonuses, about which this whole dispute arose, belong to two different types. One of them - based on the results of work for the month - is a bonus determined by the remuneration system (Article 135 of the Labor Code of the Russian Federation). Another - on the occasion of the 10th anniversary of the company - is a bonus, which is an incentive for work (Article 191 of the Labor Code of the Russian Federation) (see table).

Bonuses determined by the remuneration system and incentive bonuses: main differences

Bonus due to the remuneration system (Articles 129, 135 of the Labor Code of the Russian Federation)

Deprivation of bonuses - what the law tells us

Deduction of bonuses is the non-payment of a bonus or part thereof. But the Labor Code prohibits making deductions from wages, except in specially specified cases. It should be noted here that the bonus is a variable part of payments to the employee. And if he violates his duties, the bonus is not deducted from the salary, but is simply not accrued or is accrued partially. It is impossible to arbitrarily deprive an employee of a bonus. The terms of payment must be specified in the local acts of the organization.

Is the procedure legal?

A bonus is an irregular share of earnings, so the employer may not accrue it if the worker failed to fulfill the monthly plan, his responsibilities, or deviated from the labor rules. In such a situation, the concluded agreement and general documents of the enterprise must contain an explanation that: “The salary of an employee in this organization consists of a constant salary and a variable part - a bonus.”

Internal regulations should also be developed that specify the systems and conditions for deprivation of bonuses.

Video about whether deprivation is legal:

If there is no additional agreement, and the concluded agreement contains information that the salary consists of its constant parts: salary, bonus and personal allowances, depreciation is unacceptable. An employee can hold his employer liable.

Grounds for payment of bonus

- Improves labor discipline;

- Increases the responsibility of both employees and management;

- Allows you to highlight those employees who really deserve the bonus.

The conditions for receiving a bonus are fixed by an internal act of the company, these can be:

- employment contract,

- collective agreement,

- regulations on bonuses for employees,

- wage regulations.

Bonus criteria are spelled out very clearly, and the employee gets acquainted with them upon signature. The grounds for paying a bonus may be:

- No collections in the accounting period (month, quarter, half year, year).

- Fulfillment of planned indicators.

- Exceeding the norm.

- No delays.

- Fulfillment of duties stipulated by the employment contract.

If the local regulation does not indicate that the bonus is not paid, for example, in the event of a reprimand, then this will be an illegal deprivation of the bonus.

Can a pregnant woman be deprived of bonuses for being late?

Is it possible for a pregnant woman to be deprived of a bonus due to her violation of labor discipline, in particular due to being late? Yes, you can.

Pregnancy does not give the right to any special treatment for a woman expecting a child. Therefore, if a violation of labor discipline (i.e., a disciplinary offense) has occurred and this basis is present among the reasons indicated in the internal regulatory act as leading to the deprivation of a bonus, then a deprivation of bonuses will certainly follow.

It may not exist if the regulatory act specifies the presence of a disciplinary sanction as a basis for non-payment of bonuses. In this case, if when committing an offense there is no decision on punishment for it, there will be no deprivation of the bonus.

Procedure for accrual and deprivation of bonuses

Non-payment of premium must be documented. A memo is being written to deny the bonus. The sample is not provided for by law, so it is enough to indicate the basic details:

- In whose name the note is written, it is usually the head of the organization.

- From whom – position, last name, first name, patronymic.

- The position and surname of the employee who will be deprived of the bonus.

- Grounds for depriving an employee of a bonus: failure to meet targets; if there is a disciplinary sanction, the number and date of the order must be indicated.

This is important to know: Judicial practice in collecting debt on loans

Based on the note, an order is issued for non-payment of the premium or partial payment. The law also does not provide for a sample of such an order. You need to pay attention to how the order is drawn up; it should not look like a penalty.

What to do if bonuses were deprived without reading the order?

Can an employer deprive a bonus without an order? Yes it is possible. In a situation where, in the internal regulatory act on bonuses, which the employee was promptly familiarized with on receipt, one of the reasons for deprivation of a bonus is the reason why he was not accrued a bonus for the corresponding period, there is no need to draw up a separate order. In this case, the reason must be documented - the basis for not accruing the bonus. An employee who does not agree with the fact that he was deprived of a bonus will have to challenge not the reason for its non-accrual, but the legality of the basis on which the deprivation became possible.

The presence of an order to reduce bonuses becomes mandatory when the decision not to pay a bonus to an employee is made by the employer. This is possible in the following situations:

- when the basis for deprivation of a bonus is not in the list given in the regulatory act on bonuses, but the same act gives the manager the right to make a decision on deprivation of bonuses;

- when the regulatory act on bonuses indicates a decision on this made by the manager as the only reason for deprivation of a bonus;

- when the manager has the right to establish the amount of the share by which the amount of bonuses is reduced upon the occurrence of the grounds provided for deduction of bonuses by the normative act;

- when the normative act on bonuses does not indicate the grounds for deprivation of the bonus at all.

Attention! Sample from “ConsultantPlus” See sample order for deprivation of bonus from K+.

Illegal deprivation of bonus

The rules for calculating bonuses must be specified in the employer’s local regulations. Employees of the organization get acquainted with the working conditions and wages upon hiring upon signature.

The following points are indicated:

- Grounds for awarding bonuses.

- Payment procedure and amount.

- Positions of employees who are entitled to receive bonuses.

- Conditions for reduction or non-payment of bonuses, for which the employee can be deprived of a bonus.

The bonus should not be part of the salary. If the employment contract states that wages consist of a bonus, salary and allowances, then non-payment of the bonus is considered illegal. The remuneration system is structured in such a way that bonuses are considered an additional payment if the employee complies with certain working conditions. If the employer’s local regulations do not indicate the grounds and procedure for deduction of bonuses, he will not be able to withhold the bonus. The grounds for partial payment of the bonus must be specified, for example, for failure to fulfill the plan, the employee will lose 50% of the bonus, and for absenteeism, the bonus will be completely deprived (what other penalties are provided for absenteeism under the Labor Code, read the article https://otdelkadrov.online/5956- vidy-otvetstvennosti-za-proguly-bez-uvazhitelnoi-prichiny).

You cannot deduct an already accrued bonus from your salary. The Labor Code of the Russian Federation does not include deductions for employees in the list of legal grounds for making deductions.

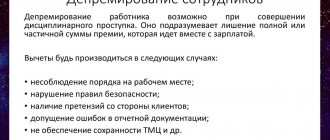

In what cases is it used?

When an employer denies an employee a bonus, he is obliged to clearly formulate the reasons for such a decision. Most often, employees are deprived of these payments for the following violations:

- Violation of disciplinary and behavioral standards, for example: neglect of safety requirements;

- absence from work for 4 or more hours without warning;

- causing damage to the organization’s property, which resulted in losses;

- absence from work without a valid reason;

- failure to comply with management orders;

- reporting to work under the influence of alcohol or drugs.

This is also important to know:

What does Article 193 of the Labor Code of the Russian Federation say?

In addition to the listed violations, a person may be subject to penalties for minor violations, for example, for being late or leaving work before the end of the working day. As a rule, in these cases partial depreciation is applied.

Article 192 of the Labor Code of the Russian Federation states that for one violation an employee can be subject to only one type of penalty . For example, an employer does not have the right to simultaneously reprimand and reprimand a violator. In addition, when imposing a punishment, management must take into account the severity of the violation, the presence of consequences and other circumstances.

How to appeal illegal deprivation of bonuses

Let's look at how to challenge the deprivation of a bonus. An employee has the right to contact the Labor Inspectorate (you can find out how to write a complaint to the Labor Inspectorate here) or the judicial authorities with a claim against the employer if he believes that the deduction was made illegally. Upon application, the Labor Inspectorate checks whether the deductions made are in compliance with the law. First of all, the existence of grounds and the correctness of the documentation of the violation are verified.

Evidence of the illegality of the deprivation of the bonus must be presented to the court. To do this, it is necessary for the employer to provide documents related to the calculation of bonus payments. These may be copies of documents such as:

- employment contract,

- bonus regulations,

- wage regulations,

- collective agreement,

- memo about deprivation of bonus,

- order for accrual and deduction of bonuses,

- order to impose a disciplinary sanction,

- explanatory notes from the employee.

The employer is obliged to issue copies of work-related documents to the employee upon his application within 3 working days.

The following video discusses the question of what type of bonus deduction can be considered illegal and how to defend your rights to legal wages

Results

The provisions of the Labor Code of the Russian Federation oblige the employer to independently develop rules for bonuses for employees, enshrining them in an internal regulatory act. These rules usually include a section devoted to situations in which an employee is deprived of the right to receive bonuses. Most often, the loss of a bonus is tied to the commission of disciplinary offenses or the presence of penalties for them, which requires special care when drawing up all procedures related to violations of a disciplinary nature. For a number of situations, it is necessary to issue an order to forfeit the bonus, and the absence of such an order in these cases makes non-payment of the bonus illegal.