Home / Labor Law / Labor book

Back

Published: 06/19/2018

Reading time: 4 min

0

228

Russian labor legislation obliges all entrepreneurs acting as employers of individuals to properly document labor relations with them. The work books of hired workers must promptly reflect reliable data on their official employment, and any violation of the regulatory regulations is fraught with administrative sanctions for individual entrepreneurs in accordance with Article 5.27 of the Code of Administrative Offenses of the Russian Federation.

Let's consider an important question for novice businessmen: do you need to make an entry in your employment record when working for yourself? Who and how should record this information in the registration document and the length of service of the entrepreneur himself?

- Is it necessary to fill out a work book for individual entrepreneurship?

- In what cases can the work book of the individual entrepreneur himself be filled out?

- The procedure for filling out a work book for individual entrepreneurship

Do I need a work book for an individual entrepreneur?

Typically, this document is needed in practice for two purposes:

- confirmation of length of service for sick pay;

- when submitting the necessary documents for registration of pension payments.

In the first case, we are talking about insurance experience.

The legislation provides that the specified length of service includes the time when a person was an individual entrepreneur and paid contributions to the Social Insurance Fund. Sick leave may be required by an individual entrepreneur in the following cases:

- He stopped working and is now an employee and is sick or injured.

- He continues to be an individual entrepreneur and at the same time is an employee who has been given sick leave.

- The entrepreneur writes out sick leave for himself.

He has the right to issue sick leave for himself if he contributed money to the Social Insurance Fund (SIF) for himself on a voluntary basis. In this case, he has the right to apply to the Social Insurance Fund for payment, which is provided to him in full at the level of the minimum wage, if at that time he had at least two years of insurance experience. This is his difference from an employee, to whom his employer is obliged to pay part of the amount.

If he is issued sick leave as an employee, then the time during which he voluntarily paid contributions to the Social Insurance Fund if he is registered as an individual entrepreneur is included in the insurance period.

When it comes to calculating pensions, the law allows the period of entrepreneurial activity of an individual entrepreneur to be taken into account as pension experience. This is done on the condition that he paid contributions to the Pension Fund during this time.

Therefore, an individual entrepreneur can resolve such issues without maintaining a work book. If before starting his entrepreneurial activity he was an employee, then during this period labor will still be needed.

When is a duplicate needed?

Does the individual entrepreneur fill out work books issued as duplicates? Yes! The duplicate is filled out and issued to the citizen by the employer within 15 days from the date of filing the application for the document.

A citizen has the right to receive a duplicate in case the Labor Code is lost or the document is not in proper form. You can also request the issuance of a duplicate due to the fact that the information entered in the original does not correspond to the reality. But this fact must be proven in court. As a result, a duplicate is issued without the record being challenged in court.

The document contains information about the citizen’s work experience and detailed information about the place of work. At the request of the citizen, detailed entries from the original made by past employers are duplicated. If necessary, the employer must make a request to the organization where the work was carried out.

On video: Duplicate of the Work Book: sample filling

Registration as an individual entrepreneur

By definition, an employee is a citizen who enters into an employment agreement with an employer that provides for existing conditions. The law provides for two parties to the agreement: the employer and the employee. Therefore, the regulations do not provide for opening a book from an individual entrepreneur for oneself, i.e., filling out the document for oneself.

However, concluding an employment agreement between two independent individual entrepreneurs is permitted. The employment contract is concluded in the usual form, since the individual entrepreneur is an individual.

Entry in the work book of an individual entrepreneur

Since the individual entrepreneur does not fill out a work book for himself, information about him may appear there in one of the following cases:

- An individual entrepreneur registered a legal entity and accepted a job there, registering a work permit.

- An individual entrepreneur works as an employee at the same time as carrying out business activities.

In the first case, it is necessary to take into account that a legal entity, its founder and employee are different legal entities, even if in all three cases we are talking about the same person. Therefore, the registration of labor in this case complies with the law.

In the second case, work with labor occurs in the usual way. In both cases under consideration, registration occurs in accordance with generally accepted rules.

Design nuances

Making the necessary entries in the Labor Code of working employees of individual entrepreneurs must comply with established rules. Individuals who are not entrepreneurs are prohibited from making any entries. Every entrepreneur needs to know the following.

- Abbreviations in the name of the individual entrepreneur are not allowed, so it is indicated in full. The correct spelling is indicated in the example: “Individual entrepreneur Vorontsov Sergey Viktorovich.”

- If a record needs to be changed, this should be done in accordance with standard rules.

- It is necessary to indicate changes in the surname of the individual entrepreneur. Many people ignore this rule, but if a woman gets married and changes her personal data, then this is indicated in all documents, otherwise subsequent entries will be considered invalid.

- The employee’s personal data indicated on the title page is also subject to change.

If the technical documentation contains errors or typos, they must be corrected, otherwise the owner will subsequently have serious problems. When the previous employer made mistakes, he is the one who can correct them. The individual entrepreneur has the right to do this only on the basis of the relevant official papers.

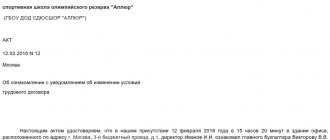

When changes are made, the incorrect entry is crossed out, and the new one is confirmed with the document details. This is done to correct personal information. If you need to change information about a person’s work or awards, you cannot cross out anything. You just need to indicate that this entry is invalid and enter the correct information.

If the TC is over, a special insert is pasted in indicating its details. It is filled out in exactly the same way as the main part of the document. The law does not establish a limit on the number of such inserts. If you lose your labor code, it can be restored based on information about the employee from other employers.

Filling out work books is the responsibility of an individual entrepreneur. If an individual entrepreneur does this for the first time, he should familiarize himself with the changes in labor legislation - then he will be able to easily enter all the information. Otherwise, the employee’s work activity cannot subsequently be confirmed.

Sample entry in the work book of an individual entrepreneur

An example of an entry in the work book of an individual entrepreneur

When an individual entrepreneur hires employees, he must issue a work book for them in accordance with the law. This does not have to be done if a person works here part-time.

However, even in this case, if an employee asks to make such records (this may be important, for example, when it is necessary to certify work experience in a certain profession), then the individual entrepreneur will be obliged to do so.

If the employee did not have such a document before being hired, the individual entrepreneur is obliged to buy it at his own expense and carry out its initial registration. The law stipulates that registration must be done within five days after hiring.

Procedure for registration of technical documentation

The question often arises: how to fill out an individual entrepreneur’s work book? Entries on the form must be readable to the naked eye. To enter new data, you can use a blue/black ballpoint or helium pen. Other colors and types of pens are prohibited. The substance of the writing pen must have light-resistant properties.

An entry in the Labor Code is made in the state or national language of the republic, which is part of the Russian Federation. When filling out, abbreviations and abbreviations are prohibited. Some information is entered exclusively in numbers and letters (for example, date).

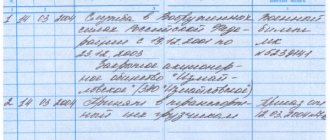

All entries in the book are entered with an assigned serial number. It is displayed in 1 column, to the left of the information. The serial number is entered under each entry, as well as correction or addition of data. When filling out the document, use this format “No. 000”.

On video: Issuing a work book upon dismissal

IP experience

IP experience is calculated:

- for payment of benefits for temporary disability and similar;

- for calculating old-age insurance pension.

In order to confirm your experience, the following documents are required:

- Confirming the registration of individual entrepreneurs.

- If he has ceased his entrepreneurial activity, then a supporting document is needed.

- A certificate from the Pension Fund stating that contributions were paid during the period of the individual entrepreneur’s activity (these payments are mandatory). The document is required when determining the length of service to receive a pension.

When determining the length of service for payment of sick leave, maternity benefits and in connection with the birth of a child, you need a document that confirms the payment of contributions to the Social Insurance Fund for a certain period. Contributions are paid by individual entrepreneurs on a voluntary basis. If these documents are available, the individual entrepreneur’s experience is documented.

Error correction

There may be a situation when it is necessary to correct errors in the work book. It happens that no mistakes were made, but the employee’s data has changed. This is possible, for example, when an employee got married and changed her last name.

When making corrections on the title page, you need to cross out the incorrect information with a horizontal line and write the correct information next to it. In this case, both the crossed out inscription and the correct one must be clearly visible. A detailed record of the reason for the corrections made is made on the inside cover.

For example, if the surname was changed due to marriage, then the entry must contain an indication of the document that was presented to change the surname. The seal of the individual entrepreneur, if any, is placed under the entry. If he works without a seal, then a signature is placed.

If an error was discovered when filling it out, made at a previous place of work, then to correct it you need to contact the previous boss and ask him to make the appropriate corrections.

If errors are made in the part of the document where entries about hiring, dismissals or awards are made, then you cannot cross out here. A new entry is simply made, in which it is indicated that a certain text is incorrect and the following should be read instead - then the correct text of the corrected entry is entered.

So, the law does not provide for entries in the work book for individual entrepreneurs. But it is possible to confirm his experience in other ways.

Your actions if incorrect records are found in your labor record or there is no record of your work are in this video:

How to confirm your experience?

Article 6 of the Federal Law of December 15, 2001 No. 167-FZ “On Compulsory Pension Insurance in the Russian Federation” states that the individual entrepreneur himself is classified as an insured under the compulsory pension insurance program. Therefore, his length of service is taken into account through the contributions he pays to the Pension Fund. In order to confirm the existence of experience as a legal entity, the Pension Fund of the Russian Federation issues a corresponding certificate during deregistration.

Calculation of sick leave and other benefits

To calculate benefits for illness, pregnancy and childbirth, the total length of service of an individual entrepreneur does not necessarily need to be confirmed by an entry in the employment record. In accordance with the requirements set out in paragraph 11 of the Order of the Ministry of Health and Social Development dated 02/06/2007 No. 91 “On approval of the rules for calculating and confirming insurance experience...”, periods of individual work activity are confirmed either by certificates from financial authorities or archival institutions about the payment of social insurance payments (if it is refers to the period before January 1, 1991), or a document from the territorial body of the Social Insurance Fund of the Russian Federation on the payment of social insurance payments (for the period from January 1, 1991 to December 31, 2000, as well as for the period after January 1, 2003). The length of service confirmed in this way can be reflected in the employee’s personal card (form T-2).

Features of maintaining a work book for individual entrepreneurs

When making entries for individual entrepreneurs, the same rules apply as in other cases. In this case, it is necessary to indicate the name of the employer. For individual entrepreneurs, an inscription is made here: “Individual entrepreneur, full name.”

The law allows individual entrepreneurs to operate without a seal. In this case, there will be no stamp in the work book.

In other matters, there are no special features in the design.

How to make an entry for employment with an individual entrepreneur

If a citizen has not previously been employed or has lost his work book (this situation is separately covered by Article 65 of the Labor Code), the individual entrepreneur or the responsible employee fills out a new form within 7 days, starting with the title page.

It indicates:

- Full name of the employee;

- Date of Birth;

- education (based on the presented document on education);

- profession or specialty;

- date when filling occurs;

- personal signature of the employee;

- blue seal and signature of the responsible person.

Clause 1.1 of the instructions specifies that the ink color when filling is allowed to be black, blue or purple. The pen can be a gel pen, a ballpoint pen, or even a fountain pen. The text is entered in capital (not printed) letters, legibly and without blots.

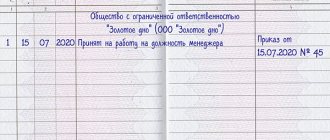

Admission information is indicated on the spread:

- The block of records from the employer opens the name of the organization (for example, individual entrepreneur Ivanov Ivan Ivanovich), entered in the work information column.

- Below in column 1 is the serial number of the entry.

- Date of entry to work - as in the order and employment contract.

- The text of the entry is in what capacity he was employed (for example, “Hired as a salesperson”).

- The basis is the number and date of the order, as in the Book of Orders.

The stamp is placed only upon dismissal; it is not needed when hiring.

A citizen who worked for an individual entrepreneur before 2006 can ask the entrepreneur to provide information about this. The basis can be not only an order, but also an agreement.

The form contains all information related to work activity. Change of surname, additional training courses, etc. - the employer is obliged to record all this in the book on the basis of supporting documents.

Since filling out a work book by an individual entrepreneur is a responsible procedure, it is better for an inexperienced person to look at a sample on a specialized website on the Internet.

Any changes directly related to labor are entered into the labor records of their employees as a regular entry. This could be a change of position, a transfer within the organization (IP), or an external transfer. In this case, the serial number and date of the event are also entered, in column 3 the main entry (for example, “Transferred to the position of senior salesperson”), then the number and date of the order that made the transfer.