Provisions of the Labor Code of the Russian Federation

The chief accountant of an organization, as an official, occupies a special place in the activities of any company. After all, it is this person who organizes the work of calculating and paying taxes and insurance premiums, developing accounting policies and reporting to government agencies.

Labor relations between the chief accountant and the employer arise on the basis of an employment contract (Article 16 of the Labor Code of the Russian Federation). An employment contract with the chief accountant can be concluded for either an indefinite or a definite period by agreement of the parties.

When concluding an employment contract with the chief accountant of an organization, it must reflect the mandatory information and terms of the employment contract listed in Art. 57 of the Labor Code of the Russian Federation is:

- surname, name, patronymic of the chief accountant and the name of the employer who entered into the employment contract;

- information about the employee’s identity documents;

- TIN;

- information about the employer’s representative who signed the employment contract and the basis on which he is vested with the appropriate powers;

- place and date of conclusion of the employment contract;

- place of work;

- labor function (work according to the position in accordance with the staffing table, profession, specialty indicating qualifications).

Who can be appointed chief accountant?

In 2021, the same order of the Ministry of Labor dated February 21, 2019 No. 103n is in effect, which sets out the qualification requirements for the chief accountant and accountant - the professional standard “Accountant”. They contain information about what education and work experience an applicant for the position should have.

Such standards are mandatory for joint stock companies, state corporations, insurance organizations, non-state pension funds, investment companies and other entities, etc. For LLCs, they are only advisory in nature, which is confirmed by letters of the Ministry of Labor No. 14-2/ОOG-6465 dated 07/06/2016 and No. 14-0/10/В-2553 dated 04/04/2016.

The Labor Code (Article 195.3) confirms that professional standards are the basis of qualification requirements when hiring employees for positions. But their mandatory nature is established only in cases of admission to a position named in reference books and standards, the application of which is determined by federal laws or the labor code. In other cases, they are used only in advisory form.

In practice, when formalizing labor relations with the chief accountant, attention is paid to education and work experience in the specialty. After all, such a specialist must have sufficient qualifications to keep high-quality and correct records of the organization’s activities.

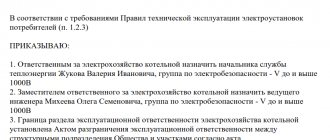

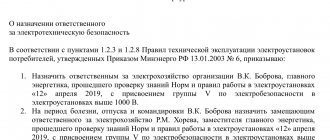

Example of an order

When hiring an employee on the basis of a concluded employment contract, an order (instruction) of the employer is issued (Article 68 of the Labor Code of the Russian Federation). The order (instruction) on hiring an employee is signed by the head of the organization. You can also issue an order to appoint the chief accountant of an LLC or JSC to the position of chief accountant. Here is a sample of such an order issued in 2021. However, let us make a reservation that such an order is drawn up in any form. There is no universal form for such an order. Therefore, you can order this for informational purposes only. You can download an example of placing an order using this link.

Read also

01.01.2018

Accountant for individual entrepreneurs – desirable or necessary. How can an entrepreneur hire an accountant?

Anyone who starts their own business and registers a business will soon ask themselves the question: do they need an accountant for an individual entrepreneur? Keeping accounting records by an individual entrepreneur is not prohibited by law.

The state provides special tax regimes, which, in theory, should make accounting easier for taxpayers.

Why hire an extra person to do your bookkeeping? The activities of an entrepreneur are often not as large-scale as the activities of many legal entities.

Isn’t it easier, finally, to take an accountant course for individual entrepreneurs and do everything yourself. We'll talk about this in the article.

In what cases does a sole proprietor need an accountant?

It is absolutely clear that the need for an accountant or even an entire accounting department will arise as the scale of activity increases.

Here the entrepreneur will need to perform managerial functions, and transfer all the rest to his subordinates, including the accountant.

But in situations where the volume of activity is small, it is best to look at parameters such as the availability of employees and the tax system applied.

Find out whether the chief accountant can work part-time: https://ipshnik.com/rabota-s-kadrami/sovmestitelstvo/glavnyiy-buhgalter-i-sovmeshhenie-dolzhnostey.html

First, let's decide whether an individual entrepreneur should keep accounting records at all.

In relation to the obligation to maintain accounting records, the law divides all business entities into the following three types:

- maintain accounting records,

- keep accounting records in a simplified form (not to be confused with the simplified tax system),

- do not keep accounting records.

Entrepreneurs are included in the group of economic entities that do not keep accounting records if they:

- keep records of income,

- manage income and expenses,

- maintain other objects of taxation or physical indicators.

In turn, tax legislation stipulates that entrepreneurs using the simplified tax system keep a book of income and expenses, and therefore do not keep accounting records.

The issue with entrepreneurs on “imputation” is resolved in a similar way. It would seem that this is the answer. No accounting means no need for an accountant. But most individual entrepreneurs still resort to accounting services.

Why do they do this?

The responsibilities of an individual entrepreneur accountant, and any other accountant, include not only accounting activities. Accountants prepare and submit reports to state extra-budgetary funds, prepare and submit tax returns.

It is important to know: the absence of an obligation to keep accounting records does not exempt you from the need to prepare and submit reports.

In the end, the books of income and expenses are also, as often happens, kept by accountants. Of course, an individual entrepreneur can take accounting courses. But in this case, it is important not only to gain knowledge, but also to be able to apply it in practice. Accounting and tax legislation changes frequently, but courses are taught only once.

Perhaps an entrepreneur will never find the opportunity to constantly update his knowledge as a professional accountant does. In addition, an experienced accountant, accustomed to accuracy and pedantry, will not miss numerous reporting deadlines.

All this leads to the fact that a significant number of entrepreneurs resort to the services of accountants.

If an entrepreneur has come to the conclusion that it is necessary to transfer accounting to an accountant, then the choice of his candidacy must be approached carefully. There are two criteria by which you should choose an employee or company that will carry out accounting:

- material criterion,

- professional criterion.

To carry out any activity, you need some material assets. Accounting is no exception. An accountant will need a modern computer, updated software, and Internet access to transmit reports. Incoming accountants work primarily at home, and it is most likely impossible to verify the presence of the above.

But when choosing an accounting firm, pay attention to the office environment. You can also check with the company about the availability of licensed software. So that in the absence of a license, your accounting department would not “go away” along with the seized computers to the investigators’ offices.

Accordingly, if you hire an accountant under an employment contract, then you should worry about having all of the above.

Read all about choosing an accountant for individual entrepreneur accounting in this article: https://ipshnik.com/vedenie-ip/buhgalteriya-ip/osnovnyie-kriterii-vyibora-buhgaltera-dlya-vedeniya-ucheta-individualnogo-predprinimatelya.html

When determining the professional qualities of a candidate for a position, it is necessary to ensure that he has a diploma and work experience. Take an interest in the previous places of work indicated in the work book.

Try to choose an accountant who already has experience working for an entrepreneur doing similar activities to you. Experience in a particular taxation system is also important.

As we have already decided, an accounting firm can also provide accountant services for individual entrepreneurs. The same rules should be followed when choosing a company.

If an individual entrepreneur has decided that he will not independently maintain accounting records and submit all necessary reports, he can proceed as follows:

- hire an accountant to the staff (conclude an employment contract),

- use the services of a visiting accountant (conclude a civil law agreement),

- use the services of a specialized company, this is also called outsourcing.

If the individual entrepreneur does not yet have other employees, then the first option is not the best thing that can be recommended. From the moment an entrepreneur becomes an employer, he has many additional responsibilities, including to the state.

With new responsibilities comes more work for the accountant whose work you pay for. In this case, the problem of an accountant for an individual entrepreneur can be solved by using the services of a specialized accounting company. Depending on your performance indicators, the accounting firm will select the appropriate tariff for you.

Subscriber accounting services for individual entrepreneurs just starting their business is a good solution.

What is included in the financial statements of an enterprise: https://ipshnik.com/vedenie-ip/buhgalterskaya-otchetnost/chto-vhodit-v-buhgalterskuyu-otchetnost-predpriyatiya-sroki-sdachi-buhgalterskoy-otchetnosti.html

But if the scale of your activity no longer allows you to keep records remotely, then it’s time to hire an accountant on staff.

Since, most likely, the accountant will not be your first employee, there should be no issues with his acceptance. The main task is to organize the workplace and prepare the necessary documents.

In particular, an entrepreneur hiring an accountant will have to complete the following personnel and legal formalities:

- add accountant positions to the staffing table (maintaining a staffing table is of course not necessary, but its absence can complicate the work),

- prepare a job description for an individual entrepreneur accountant (not necessary, but, as in the case of ShR, it is better to use),

- sign an employment contract with the candidate for the position and familiarize him with the job description,

- issue an order for employment,

- make an entry in the accountant's work book.

If an accountant is the first employee of an entrepreneur, then the individual entrepreneur must register with the Pension Fund as an employer.

After answering the question “does an individual entrepreneur need an accountant?” the next question that may arise is: “does an individual entrepreneur need a chief accountant?”

Let's figure out what a “chief accountant for individual entrepreneurs” is? The Accounting Law obliges entrepreneurs and heads of legal entities to entrust accounting to the chief accountant or other employee. Requirements for the qualifications of a chief accountant for some business entities are established by law.

But entrepreneurs who have the right to maintain simplified financial statements are allowed to assume the responsibility for maintaining financial statements. An entrepreneur has the right to choose whether to assign the responsibility for accounting to the chief accountant, to an accountant (if there is no chief on staff) or to leave it to himself.

However, the latter case does not exclude the hiring of an accountant who will keep the accounting records.

— “Accounting and its forms of maintenance”

Source: https://ipshnik.com/vedenie-ip/buhgalteriya-ip/v-kakih-sluchayah-ip-neobhodim-buhgalter-pravila-nayma-na-chto-obratit-vnimanie-pri-vyibore-buhgaltera.html

How to correctly draw up an order for the appointment of a chief accountant?

In 2021, the Ministry of Labor issued Order No. 103n dated February 21, 2019, which sets out the qualification requirements for the chief accountant and accountant - the professional standard “Accountant”. They contain information about what education and work experience an applicant for the position should have.

In total, there are 3 types of acts, divided into groups depending on the subject and purpose of their preparation:

- Solving organizational issues . For example, an order may concern the liquidation/reorganization of a company, the creation of collegial bodies, the formation of a schedule, and the management of the company at all levels.

- Issues related to production activities . For example, an order may concern the procedure for financing a company and providing materials. The document is needed to create a scientific and technical policy and summarize the results of the company’s work.

- Questions regarding personnel . The order may concern the hiring of employees, training of employees, or transfer to another position. Based on the document, specialists are encouraged and workers are dismissed. It is needed to implement social guarantees: payments to pregnant women, financial assistance.

And in the event that the employee’s absence is obviously for a long period of time - a long business trip, parental leave and other reasons.

If the director for some reason cannot or does not want to keep accounting records, the law “On Accounting” allows for the possibility of performing the duties of the chief accountant by any official of the enterprise, in addition to him. For example, such an official may be a financial director, accountant, manager, administrator who has the necessary education and work experience.

Features of drawing up an order for the appointment of a chief accountant if he is a manager

It is possible for a manager to be a chief accountant at the same time. This is a fairly common practice for small organizations. In this case, the conditions must be met when the manager is allowed to act as the chief accountant:

- the company has no more than 100 employees;

- the organization's turnover does not exceed 800 million rubles per year;

- Legal entities have the right to participate in the capital of an LLC, but their share should not exceed 49% of its total volume.

In this case, the manager issues an order indicating that he assumes the responsibilities of the chief accountant and refers to the absence of such a position in the organization’s staffing table. Additionally, it is necessary to secure the right of first signature on documents related to settlement, credit and monetary obligations of the company. The order is certified by the signature of the manager and a signature below is required for review. Such an order can be presented at the place of request: tax office, banks, etc.

Combining the positions of chief accountant and director

Don’t know what to open – an LLC or an individual entrepreneur? Right here you will find all the answers.

You need to act differently if there is already a chief accountant at the enterprise, but the director performs his duties temporarily.

First, you need to draw up an additional agreement to the employment contract drawn up for the director. What needs to be included in it?

- Amount of surcharge associated with combination.

- The period for which the combination is issued. For example, while the chief accountant is on vacation.

- An indication of the fact that for some time the director will also perform the duties of another employee.

An example of an order when working with a combination of positions.

After this, they move on to the simplest form of order for combining positions. The director’s personal card does not need to include information that he will perform additional work. The same applies to the work book. Rostrud agrees with this option for part-time registration.

Are you closing an LLC and are afraid of doing something wrong? Instructions on how to properly close can be found at this link.

If the combination is formalized temporarily, then the duties cease automatically as soon as the main employee returns to duties. No additional documents are required for this.

You can find out how to formalize the transfer of affairs by the chief accountant in this video:

Enter the site

In order to ensure healthy and safe working conditions, the availability and maintenance of production equipment, fire extinguishing equipment and timely monitoring of compliance with labor protection legislation

1. Organizational work on labor protection, industrial sanitation and fire safety is entrusted to the acting labor protection engineer (if there is an engineer, then even better) ___________ 2. Management and control over the organization of work and the state of labor protection, production culture, fire safety is entrusted to position and full name 3. The above mentioned fulfill their labor protection responsibilities set out in the “Regulations on the organization of work on labor protection of the enterprise” and be guided in their daily work by the current “Rules for training in safe methods and techniques of work, conducting briefings and testing knowledge on safety issues labor", "General fire safety rules of the Republic of Belarus for industrial enterprises" in PPB RB 1.01.-94, job descriptions, regulatory documents and instructions of the head of the enterprise. 4. Submit the order to the responsible persons against signature.

We recommend reading: Russian Residence Permit by Marriage

How to write a document correctly

These requirements are not mandatory for private enterprises. However, any manager will want to have a responsible, experienced chief accountant with no criminal record.

The order also indicates the place of work (for example, a specific structural unit or branch of the organization), the employee’s position, start date of work, salary and other conditions. An order is an operational act that is relevant until the occurrence of a certain circumstance. An example of such a document is an order on the formation of a commission. It will be in effect until this commission resolves the required issue. A relatively wide range of employees can sign orders.