Fixed assets are means of labor that work in production for a long time, participate in many production cycles, do not change their material form and increase the cost of finished products through depreciation.

In the Russian Federation, accounting for fixed assets in transactions is regulated by the corresponding PBU 6/01, which was approved by Order of the Ministry of Finance of the Russian Federation dated March 30, 2001 No. 26n. A more detailed description is provided in the Guidelines for accounting of fixed assets, approved by Order of the Ministry of Finance of the Russian Federation dated October 13, 2003 No. 91.

Fixed assets - what are they?

Fixed assets – cars, machinery and equipment, buildings, computer equipment.

There are two criteria that determine whether inventories belong to the category of fixed assets:

- Service life/useful life (must be more than one year);

- Cost expression (40,000 rubles for operating systems that were put into operation before 2021, and 100,000 rubles - from 01/01/2016).

The unit of accounting for these funds is an inventory object, which can be a separate item or a single complex of several items, but having a common control, for example a computer.

Fixed assets are subject to wear and tear, so depreciation must be charged on them.

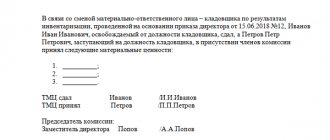

Carrying out an inventory

For accounting, it is extremely important that accounting data agrees with actual information. Therefore, inventories are carried out regularly. It is especially important to do this before the balance.

Upon receipt, a card is created for each fixed asset and an inventory number is assigned. An inventory is compiled according to the INV-1 form, into which the data is transferred: name, assigned numbers. The commission compares the inventory with the actual data. The results are reflected in accounting by the corresponding entries.

What is the main tool?

Paragraph 4 of PBU 6/01 classifies the following as fixed assets:

- assets that must be used to produce products, carry out work or provide services to meet the economic needs of the organization;

- assets intended to be leased to other enterprises.

- The first part of the assets used in business activities is taken into account in transactions on the active synthetic account No. 01 - Fixed assets.

- The second part is assets for rent. Accounted for in account 03 – Profitable investments in material assets. The inclusion of such assets in fixed assets further increases the tax base for income on the company's property.

An increase in the value of fixed assets on the balance sheet as a result of the acquisition of new objects, or the modernization or revaluation of existing ones, is reflected in the debit of the corresponding accounts.

A decrease in the value of fixed assets as a result of the sale of objects or their decommissioning is reflected in the credit of accounts 01 or 03.

- the object is intended for use directly in production, during the performance of work or provision of services, for management purposes, or for rental on a paid basis to third parties;

- the period of use of the object exceeds 12 months;

- subsequent resale of the object by the organization that acquired it is not planned;

- the object brings economic benefits (income) to its owner.

The following objects are not considered fixed assets:

- having a service life of less than 1 year;

- worth up to 40 thousand rubles. for any service life, except for agricultural machines, weapons, construction mechanized tools.

Write-off of fixed assets on accounting accounts

The write-off of fixed assets in accounting occurs in detail in the context of other income and expenses. Account D-91 displays the write-off of its residual value and those costs that occurred upon its disposal. K-tu displays the amount of accrued depreciation and income received from its sale.

A fixed asset is written off at its residual value - this is the difference between the amounts of its original cost and accrued depreciation. When writing off a fixed asset to account 01, it is necessary to additionally open a subaccount, which will be symbolized with the disposal of the fixed asset.

All income and expenses received by the organization when writing off a fixed asset are displayed only in the period in which they occurred.

Get 267 video lessons on 1C for free:

OS object received free of charge

When receiving an item of fixed assets under a gift agreement, the initial value is recognized as the current market value of the property as of the date of acceptance for accounting on account 08 (clause 10 of PBU 6/01). The wiring will be like this:

Debit of account 08 – Credit of account 98 “Deferred income”

Let us recall that future income will be included in other income as depreciation is calculated on a gratuitously received fixed asset item (Order of the Ministry of Finance dated October 31, 2000 No. 94n):

Debit of account 98 – Credit of account 91 “Other income and expenses”, subaccount “Other income”

For example, an organization received a machine free of charge that it plans to use in its main production. Its market value is determined at 218,300 rubles. The useful life is set at 37 months. Depreciation is calculated using the straight-line method.

Let's reflect the above in accounting:

| Operation | Account debit | Account credit | Amount, rub. |

| Machine received | 08 | 98 | 218 300 |

| The machine is accepted for accounting as part of OS objects | 01 | 08 | 218 300 |

| Monthly depreciation accrued (218,300 / 37) | 20 "Main production" | 02 “Depreciation of fixed assets” | 5 900 |

| A portion of future income is recognized as current period income | 98 | 91, subaccount “Other income” | 5 900 |

On the basis of what documents is the receipt of fixed assets regulated?

Regulatory documents that are used as the basis for reflecting fixed assets in accounting and tax accounting at an enterprise include:

- Law “On Accounting” No. 402 FZ - this act defines the principles of accounting and basic concepts.

- Tax Code of the Russian Federation - this act establishes the general concepts of OS and the procedure for accounting for such objects in tax accounting.

- Regulations on accounting and accounting in Russia No. 34 - this act defines the concept of OS, and also provides a classification of these objects.

- PBU 61 is a leading regulatory act that defines not only what fixed assets are, but also establishes the rules for their assessment, accounting, execution using documents, etc.

- Guidelines for maintaining fixed assets accounting No. 91 - this act establishes the main methods for recording fixed assets, and also discusses the features of individual operations for accounting for fixed assets.

- Chart of accounts and instructions for its use No. 94n - defines the accounts on which fixed assets are recorded, and also establishes standard correspondence of these accounts with other accounting accounts.

Attention! When reflecting the receipt of fixed assets, other regulations can be used, for example, PBU 9/99 and PBU 10/99 regarding the occurrence of income and expenses that arise when purchasing fixed assets, as well as guidelines for conducting an inventory

Basic accounting entries for fixed assets

- for new objects - at the original cost. It includes: purchase price, cost of transportation, installation, etc. excluding VAT and other indirect taxes;

- for objects that have already been in operation - according to the cost of their purchase and installation.

Such an operation is formalized by posting Dt 01.01 - Kt 60.01 upon receipt of the object at the enterprise, when paying from the account - Dt 60.01 - Kt 51.

- Depreciation is compensation for depreciation of a fixed asset by transferring its value in parts to the cost of production. Accrued depreciation is reflected on the credit of account No. 02 - Depreciation of fixed assets, and on the debit of accounts 20, 25, 26, 23 - depending on the order of attribution of depreciation to specific cost items. Depreciation does not affect the book value of the asset.

- Repairs can be routine, major, medium or particularly complex. The costs of any repairs do not lead to a change in the book value of fixed assets, but are included directly in the cost of production. If the organization does not have a reserve for repairs, they are reflected in entries Dt 20 (26, 25, 23) – Kt 10 (12.70). If there is - with the subsequent write-off of inventory and other costs: Dt 89-1 - Kt - 10 (12.70).

- Rent – transfer of objects for temporary use for a fee to other companies. For the lessor, leased objects are accounted for in account 03, for the lessee - account 001 (off-balance sheet).

- Liquidation is the complete write-off of a fixed asset due to moral/physical wear and tear or loss.

- Inventory - checking the actual availability of fixed assets. Account 01 reflects shortages and surpluses of fixed assets.

Budgetary organizations have their own chart of accounts, read more - OS transactions in budgetary organizations.

Accounting for fixed assets in 1C 8.3

The most popular program for accountants, 1C Accounting 8.3, implements a full-fledged fixed asset accounting unit. Let's consider the basic operations for accounting for fixed assets.

Video on creating a new fixed asset card, accepting fixed assets for accounting and calculating depreciation:

Receipt of equipment (or Receipt of goods and services with the type of operation “Equipment”) is a document that generates transactions upon the arrival of fixed assets to the organization (for example, Dt 08.04 - Kt 60.01):

The next action is to transfer the fixed asset into operation. This is done using the document Acceptance of fixed assets for accounting . The document makes the posting Dt 01.01 - Kt 08.04:

After the fixed asset has begun to be used, depreciation must be calculated. This is done in 1C 8.3 every month using the routine operation Closing the month . The document makes the following entries:

After the OS is completely worn out (or, for example, was broken), you can formalize its disposal using the document Write-off of OS :

The program will write off depreciation balances and write off the residual value of the fixed asset from account 01.01 to account 91.02 (Income (expenses) associated with the liquidation of fixed assets) through 01.09 (fixed assets for disposal).

Additional costs when registering OS

All costs associated with making the OS ready for use are included in its initial cost. VAT accounting for them is carried out similarly to accounting for refundable VAT when purchasing fixed assets and is not indicated in these transactions. The general rule is that all relevant expenses incurred before putting the asset into operation are capitalized.

Postings:

| Account Debit | Account Credit | Description | Sum | A document base |

| 08.04 | Transferring the OS for installation | Cost of purchased OS excluding VAT | Bank statements, payment orders | |

| 08.04 | ,69,10 | Capitalization of installation costs | Cost of installation work | |

| 08.04 | 60.01,76.05 | Other services (for example delivery) | Cost of services excluding VAT | Help-calculation |

| 08.04 | 68 | Accounting for customs, registration fees and duties | Customs duty excluding VAT, other fees and charges | Bank statements |

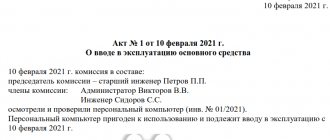

Primary documents - grounds for accounting for introduced fixed assets

No property asset can appear in an enterprise “out of nowhere”: its introduction is necessarily accompanied by a number of documentary evidence. Based on the primary documentation corresponding to a specific group of production assets, each object or their group is registered on the balance sheet. Depending on whether they belong to a group of objects, the introduction of an asset may be accompanied by the following “primary”:

- acceptance certificate - for the acceptance of various objects, a certain form is provided (OS-1a - provided for structures and buildings; OS-1 - for other single objects; OS-1b - for groups of fixed assets, excluding structures and buildings);

- invoice (act) for acceptance of equipment - for equipment that does not require preliminary installation (form OS-14);

- act (invoice) of acceptance and transfer of equipment for the purpose of carrying out installation work - form OS-15.

For each new object from the fixed assets put into operation, it is necessary to create a special inventory card according to the established model:

- for a single OS object - according to the OS-6 form;

- for several grouped objects - according to the OS-6a form.

In it, the asset is assigned a unique inventory number, constant for the entire life of the asset (usually a serial number in a certain series).

These cards will subsequently reflect the entire “life” of the main asset in the enterprise:

- admission;

- depreciation;

- revaluation;

- modernization;

- conservation-depreservation;

- recovery;

- disposal (write-off).

The results are compiled into a single inventory book, where the final accounting of fixed assets is carried out, which must be drawn up in the OS-6b form.

At the end of each month, an accounting statement of the dynamics of fixed assets is compiled using inventory cards.

Reflection of receipts in accounting

Let's now look at the accounting entries for fixed assets. Two accounts are used for accounting: 01 and 08. Both accounts are active.

The peculiarity of accounting is that upon receipt, account 01 “OS” is never used immediately. The entry is made first to the debit of the suspense account 08.

- 08 -60 – this is how the acquisition of property is reflected;

- 01 -08 – a record that the OS was put into operation.

The source of receipt may not necessarily be the supplier. Fixed assets can be donated - 08 -98, contributed as part of the authorized capital - 08 -75. It can be built - 08 -60.

The primary documents are OS-1, OS-1a, OS-1b, OS-14, OS-15. For each received object, an inv. must be filled out. card in the form OS-6, OS-6a, OS-6b.

If an object, for example, a computer, costs less than 40 thousand rubles, then its receipt is recorded as a debit to account 10, and then immediately written off as expenses (account 91). This is the difference between fixed assets and inventories. The cost of fixed assets is written off as expenses gradually through depreciation, and the cost of inventories immediately.

Decommissioning of OS

When property becomes obsolete, deteriorates, or is stolen, we need to write it off, that is, remove it from the register. We write off the initial cost and make the following entries: D 01.2 - K 01.1. Next, we write off the accrued depreciation by posting D02 K01.2 and write off the residual value of D 91.2 and K 01.2.

Often we need to sell our fixed assets or exchange them as a contribution to the authorized capital of another company. For example, a company sells equipment for 359,900 rubles, including VAT of 54,900 rubles. The initial cost was 650,000 rubles. Depreciation was accrued in the amount of 320,100 rubles according to accounting data, and 410,000 rubles according to tax accounting. In this case we make the following wiring:

Cost limit for accounting as part of fixed assets

Property may have all the characteristics of a fixed asset. And have an initial cost equal to or less than 40,000 rubles. The organization has the right to take into account any object within this cost group:

- as part of fixed assets;

- as part of material and industrial reserves (MPI).

Set a specific value limit for classifying property as a particular asset category in the accounting policy for accounting purposes.

Note: paragraph 5 of PBU 6/01.

If the value limit changes, its new value can only be used for fixed assets. Which are accepted for accounting after its adjustment. Such clarifications are contained in the letter of the Ministry of Finance dated January 10, 2012 No. 07-02-06/3.

How to formalize dismantling of fixed assets

After dismantling, it is necessary not only to reduce the cost of the fixed assets, but also to recalculate the amount of depreciation charges. This is explained by the fact that depreciation is calculated based on the cost of fixed assets. It includes the cost of components that are disposed of. The procedure for changing the amount of depreciation charges is reflected in the company's accounting policies. If the useful life of the instrument remains the same, recalculation is performed in proportion to the cost or percentage of the retired component. All necessary information is contained in the book value.

The company has a production line. This is a single accounting item that consists of modules. The production line is partially disassembled. Some components are being confiscated. They lose their functionality because they are not independent tools. Accordingly, they are excluded from the OS. However, disposal is carried out not in relation to one accounting object, but in relation to several items. This is either OS or low-value materials.

How to write off an operating system if a shortage is discovered during an inventory?

If, during the inventory of the OS, a shortage of an OS object or its damage was discovered in the accounting accounts, the following is written:

- Reflection of starting price

- Reflection of depreciation

- Write-off of disappeared OS from the depreciated price

- Writing off the amount of the shortfall to the debt of the culprit (if such a person is identified)

- Writing off the amount of the shortfall as other expenses in a situation where the culprits are unknown

Postings:

| Dt | CT | The essence of the operation | Sum | Primary document |

| 01. | 01.01 | Starting price reflected | 450 | Inventory report |

| 02.01 | 01. | Depreciation reflected | 120 | |

| 01. | The amount shown after depreciation | 330 | ||

| 73.02/76.49 | The price of the shortage/damage is reflected as the debt of the culprit | 330 | ||

| 91.01 | The price of shortage/damage is reflected among other expenses | 330 |

Postings to fixed assets

In this article I propose to understand the basic means. Let's go a little through the key points of fixed assets and look at the postings.

Fixed assets are expensive property (more than 40 thousand rubles), which is used in the production or management activities of the company, used to generate income, but not for resale. Useful life more than 12 months.

. Property worth up to 40 thousand rubles. can be written off as expenses at a time. In tax accounting, such property is not classified as fixed assets. But it is still worthwhile to consolidate this provision in your accounting policy.

The main assets include:

Fixed assets are accounted for on account 01 “Fixed Assets”. But at the same time, there is another account - 08 “Investments in non-current assets”, in which it is necessary to collect the costs of acquiring property. This may include costs for delivery, installation, and other expenses. Let's show this with wiring:

Debit 08 Credit 60 (76) – purchase of fixed assets from the seller; Debit 08 Credit 23 (26.70, 76..) – additional costs that are included in the initial cost.

After collecting all expenses for the purchase of the OS, it is registered and transferred to account 01. In 1C, the OS commissioning operation is performed.

Debit 01 Credit 08 – accepted for accounting and put into operation by the OS.

If we receive fixed assets free of charge, then we use account 98 “Deferred income” and subaccount 98-2 for free receipts. Then the arrival of the OS at the company will look like this:

Debit 08 Credit 98-2 - the market value of property that was received free of charge.

According to the general rules, in the same 08 account it is necessary to collect costs to bring the funds to readiness. After final preparation and collection of all expenses, it is necessary to transfer the operating system from 08 to 01 account.

The process of using fixed assets is accompanied by a process of gradual transfer of their value to costs, i.e. depreciation.

Depreciation begins to accrue from the month following the month in which the asset was registered.

paid for the OS in August, put it into operation in September,

This means that depreciation should be calculated from October.

There are several ways to calculate depreciation, and they differ in accounting and tax accounting.

But for any of the methods of calculating depreciation of fixed assets, you need to know the useful life of this fixed asset, i.e. the period over which depreciation will be calculated.

This period can be taken from:

- OS classification approved by the Decree of the Government of the Russian Federation dated January 1, 2002;

- manufacturer's recommendations or technical specifications (if this OS is not in the Classification).

In the Classification of operating systems, depending on their useful life, they are combined into 10 groups. In addition, for fixed assets included in depreciation groups 8–10, the linear method must be applied.

For each OS, the selected useful life must be formalized by order of the manager.

You set the method for calculating depreciation of fixed assets in your accounting policy.

In accounting, depreciation is calculated in account 02 “Depreciation of fixed assets.” Regardless of the method of calculating depreciation, the posting will be as follows:

Debit 20 (23, 26...) Credit 02 – depreciation accrued for the month.

Debit 01 Credit 01

– shows the residual value of the fixed assets;

Debit 02 Credit 01

– shows depreciation that was accrued during operation.

Separately, you need to show income and expenses from the sale of property:

Debit 62 (76) Credit 91-1

– proceeds from sales;

Debit 91-2 Credit 10 (60, 76...)

- shows the expenses incurred due to the disposal of fixed assets.

The residual value of the sold fixed assets is included in other expenses.

Debit 91-2 Credit 01

– the residual value of fixed assets is reflected as part of other expenses;

To liquidate the OS, an act is drawn up. The residual value and liquidation costs are reflected in other expenses.

Debit 02 Credit 01 – shows depreciation that was accrued during operation.

Debit 01 Credit 01 - shows the residual value of the fixed assets; Debit 91-2 Credit 01 - the residual value of the fixed assets is written off based on the write-off act.

If liquidation occurs by the organization itself

Debit 23 (91/2) Credit 70 (69, 68,10.)

Liquidation with the help of a contractor

Debit 91 / 2 K 60 - expenses for liquidation carried out by contract are taken into account.

Liquidation costs are classified as non-operating expenses.

Capitalization of materials remaining after the liquidation of the operating system

Debit 10 Credit 91 “income”

Now you know:

- what applies to fixed assets;

- what kind of transactions to register the receipt of OS;

- how to calculate depreciation;

- from what month should depreciation be calculated;

- how to determine and approve the useful life of the OS;

- what kind of transactions to register the disposal of fixed assets.

I hope this article will help you.

Fixed assets are purchased for a fee

A typical case of receipt of fixed assets is their acquisition for a fee, for example, under a purchase and sale agreement.

In these cases, the initial cost of the fixed assets consists of the actual costs of the organization for the acquisition, construction and production of property, excluding VAT and other refundable taxes. This means that the cost of an asset includes, in particular (clause 8 of PBU 6/01):

- amounts that are paid in accordance with the contract to the seller;

- amounts paid for delivery of an OS object and bringing it into a condition suitable for use;

- amounts paid to organizations under construction contracts;

- amounts paid for information and consulting services related to the acquisition of fixed assets;

- customs duties and customs fees;

- non-refundable taxes, state duty paid upon acquisition of an asset;

- remuneration to intermediary organizations.

When purchasing an OS object for a fee, the transactions for the formation of its initial cost are usually as follows:

Debit of account 08 – Credit of accounts 60 “Settlements with suppliers and contractors”, 76 “Settlements with various debtors and creditors”, etc.

Example. Under the purchase and sale agreement, an asset was purchased worth 238,950 rubles (including VAT 18% - 36,450 rubles). Additionally, the organization paid for the services of a transport company for the delivery of the fixed asset to the organization’s warehouse in the amount of 29,000 rubles (VAT exempt).

The accounting entries for the acquisition of an asset will be as follows:

| Operation | Account debit | Account credit | Amount, rub. |

| Purchased fixed asset (238,950 – 36,450) | 08 | 60 | 202 500 |

| VAT on the acquired fixed asset has been taken into account | 19 “VAT on purchased assets” | 60 | 36 450 |

| VAT is accepted for deduction | 68 “Calculations for taxes and fees”, subaccount “VAT” | 19 | 36 450 |

| Costs for delivery of fixed asset objects are taken into account | 08 | 60 | 29 000 |

| OS object put into operation (202,500 + 29,000) | 01 | 08 | 231 500 |

This same entry option includes creating an OS object on your own. Then, in addition to settlements with suppliers, contractors and other debtors and creditors, other expenses associated with the formation of the initial cost of fixed assets are usually reflected (for example, materials, employee salaries and deductions from it, depreciation of fixed assets involved in the creation of new non-current assets, etc.). d.):

Debit of account 08 – Credit of accounts 02 “Depreciation of fixed assets”, 05 “Depreciation of intangible assets”, 10 “Materials”, 23 “Auxiliary production”, 70 “Settlements with personnel for wages”, 69 “Calculations for social insurance and security” and etc.

In some cases, interest on loans and borrowings may be included in the initial cost of fixed assets (clauses 7-14 PBU 15/2008, Order of the Ministry of Finance of the Russian Federation dated October 31, 2000 No. 94n):

Debit of account 08 – Credit of accounts 66 “Settlements for short-term loans and borrowings”, 67 “Settlements for long-term loans and borrowings”

Accounting for disposal of fixed assets

To account for fixed assets upon their disposal, separate analytical accounts of the “Fixed Assets” account are also used, ending with 410 and indicating a decrease in the value of the corresponding fixed assets.

The main entries for accounting for fixed assets upon disposal are shown in the table below. Other transactions can be found in clause 10 of the instructions for the chart of accounts (order No. 162n).

| Wiring | Description of posting in fixed asset accounting |

| Dt 040120271 “Costs for depreciation of fixed assets and intangible assets”, 010634340 “Increase in investments in inventories - other movable property of the institution”, 010900000 “Costs for the manufacture of finished products, performance of work, services” (010960271, 010970271, 010980271, 010 990271) Kt 010100000 “Fixed assets” (010134410, 010135410, 010136410, 010138410) | Commissioning of an OS costing no more than 3,000 rubles. |

| Dt 030404310 “Internal settlements for the acquisition of fixed assets”, 040120200 “Expenses of an economic entity” (040120241, 040120242, 040120251, 040120252, 040120253) Kt 010100000 “Fixed assets” (010111410–010113410, 010115410, 010118410, 010131410–010138410) | Free transfer of an object or transfer to trust management |

| Dt 010400000 “Depreciation” (010411410–010413410, 010415410, 010418410, 010431410–010438410) Kt 010100000 “Fixed assets” (010111410–010113410, 010115410, 010118410, 010131410–010138410) Dt 040110172 “Income from operations with assets” Kt 010100000 “Fixed assets” (010111410–010113410, 010115410, 010118410, 010131410–010138410) | OS sales |

Disposal of property

Above we considered only this type of disposal, such as the sale of fixed assets. The postings were reflected in the accounting. However, in practice, equipment does not always “survive” until the end of its service life; it wears out or becomes obsolete much faster. What should I do? Such an object is not needed on the balance sheet, and I also don’t want to pay tax for it, so they write it off.

So, fixed assets have been written off, entries - 01/2 - 01/1 (the original price is written off), 02 - 01/2 (depreciation has been removed), 91 - 01/2 (the balances are written off as enterprise expenses).

If it was necessary to involve third-party organizations for dismantling, then entry 91-76 will appear. Suitable materials from the former fixed asset can be delivered to receipt 10-91.

Accounting for fixed assets, postings, primary documents is a separate section of accounting science. In large enterprises, this is done by a separate specialist. This area is considered quite complex, and therefore requires a specialist with good experience, developed expert opinion and high-quality knowledge of accounting details, and therefore the salary of such a specialist is higher.

Transactions for the acquisition of OS costing over 40 thousand rubles

There is a category of property that falls into the category of value more than 40,000 rubles. Subject to the necessary selections, which are established in paragraphs 4 and 5 of PBU 6/01 (Use period is more than a year, property is necessary for work in the management field, not for resale), it should be taken into account as part of the OC, and not in the MTZ.

The transactions for purchasing such funds are similar to the previous ones:

| Debit | Credit | Operation name | Transaction amount | A document base |

| 08.04 | 60.01 | The cost of the purchased OS is taken into account (excluding VAT) | price without VAT | Clauses 4-5 PBU 6/01 |

| 08.04 | 60.01 (76.05) | The costs of transportation and installation of the OS are taken into account | price without VAT | Clauses 4-5 PBU 6/01 |

| 19.01 | 60.01 (76.05) | VAT on fixed assets allocated | VAT | Clauses 4-5 PBU 6/01 |

| 01.01 | 08.04 | OS commissioning | price without VAT | Clauses 4-5 PBU 6/01 |

The main nuances of writing off a fixed asset

In addition to depreciation of a fixed asset, other cases of its write-off can be distinguished:

- Sales to other organizations;

- Donation, exchange;

- Theft or embezzlement;

- Contribution to the authorized capital;

- Liquidation due to emergency situations:

- Management order, which establishes the composition of the inventory commission.

- The act of writing off the operating system, which indicates the reasons for this action.

It is not a write-off of a fixed asset when it is moved within one enterprise (between structural divisions). If a fixed asset is temporarily not in use due to reconstruction work or additional installation, then it is also not subject to write-off.

Fixed Asset Accounting

The main criterion for property to belong to the category of fixed assets in accounting. This is its useful life. If this period exceeds 12 months. That property can be classified as fixed assets.

In addition to the period of inclusion of property in fixed assets, it also depends on the nature of its use. Fixed assets can be recognized as property that...

- intended for use in the production (managerial) activities of the organization or for rental;

- not intended for resale;

- capable of generating income in the future.

Note: paragraphs 4 and 5 of PBU 6/01

In particular, fixed assets may include:

- buildings, structures;

- working and power machines and equipment;

- measuring and control instruments and devices;

- Computer Engineering;

- vehicles;

- tools, production and household equipment and supplies;

- land;

- environmental management facilities;

- capital investments in land (costs for radical improvement of land) and in leased fixed assets.

Note: paragraph 5 of PBU 6/01.

Definition

OS includes property and items that take part in the organization’s activities (production or trade). Key point: they retain their shape almost unchanged. They can also be rented out.

Let's look at fixed assets. Examples will help us with this. Let's take, say, a computer. Nowadays, almost no workplace can do without a PC. It is the subject of labor, without it the employee will not be able to fulfill his duties. However, a computer may not be the main tool if we are talking about a company that sells computer equipment.

The following examples are an office building, a company car, equipment. These items also take part in the production process at the enterprise. But, for example, scissors cannot be classified as a fixed asset, despite the fact that they are also a tool of labor. These are materials.

Indeed, determining whether a particular property is a fixed asset or not is not always a simple task. But let's try to figure it out.

Features of OS sales operations

In order to correctly carry out the procedure for disposal of fixed assets that are on the balance sheet of the enterprise on the account. 01, subaccount Disposal of fixed assets is used:

Depreciation is taken into account on Kt 02 – passive account:

If the fixed asset being sold has undergone restoration, repair or modernization, the new value does not change, the costs are included in the cost of products, goods, and work. But the fact appears in the accounting cards and in the balance sheet of the enterprise, and is reflected on Kt 10, 12, 70.

The main entries for accounting for the sale of fixed assets are as follows:

- Dt 01/disposal Kt 01.01 – fixed assets are retired;

- Dt 02 Kt 01/disposal – reflection of depreciation of the object;

- Dt 91.2 Kt - 01/disposal - write-off of residual value;

- Dt 62 Kt 91/1 – reflection of revenue from the sale of fixed assets;

- Dt 91/2 Kt 68 – sales VAT calculated;

- Dt 91/2 Kt 01/1 – rest. the cost is included in other expenses;

- Dt 91/2 Kt 10, 60, 76, 70, 69, 71 – summing up the costs of sales preparation, expert assessment, transport, loading work, etc.;

- Dt 19 Kt 60, 76 – generalization of VAT costs for the sale of fixed assets.

The sales procedure is carried out on the basis of a contract, a bill of lading f. TORG-12, invoices, waybills, delivery and acceptance certificate f. OS-1, OS-1a, OS-16, where the date of receipt by the buyer of the subject of the transaction in fact is recorded.

Postings for the sale of OS

| Operation | Dt | CT | Amount, rub |

| Write-off of primary cost | 01/disposal | 01.01 | 743 327,00 |

| Write-off of accumulated depreciation | 02 | 01/disposal | 199 597,00 |

| Residual value consumption | 91.2 | 01/disposal | 543 730,00 |

| Revenue including VAT | 62 | 91.1 | 770 000,00 |

| VAT on sales | 91.2 | 68 | 117 457,63 |

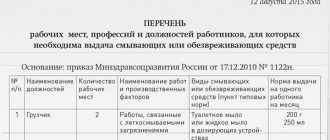

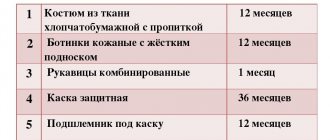

What are primary accounting documents: types

- Agreement. They stipulate the specific terms of the transaction, the responsibilities of the parties and financial issues. In general, all the conditions that are in one way or another related to the transaction are indicated here. Please note that for some transactions a written contract is not required. Thus, from the moment the buyer receives the sales receipt, the transaction is considered concluded.

- Accounts. With the help of documents of this type, the buyer confirms his willingness to pay for the goods (services) of the seller. In addition, invoices may contain additional terms of the transaction and record specific prices that the seller sets for its products and services. If for some reason the buyer is not satisfied with the product (service) presented to him, he has the right to demand a refund of his funds based on the invoice.

- Packing list. It displays a complete list of all goods or materials that are transferred. The invoice must be drawn up in several versions depending on the number of participants in the transaction.

- The act of acceptance and transfer. It is compiled based on the results of the provision of the service as confirmation that the result of the work meets the previously stated criteria and is fully approved by the receiving party.

- Payslips. They display all issues related to payroll settlements with hired personnel. Moreover, all information regarding bonuses, additional payments and other mechanisms for financial incentives for employees should be displayed here.

- Acceptance and transfer certificates No. OS-1. This type of documentation is used to record any activities related to the input or output of fixed assets.

- Cash documents , which include incoming and outgoing cash orders, and in addition, a cash book. They contain information regarding financial transactions carried out as part of the sale.

Interesting read: Tver bailiffs are debtors for alimony

When making any transaction, primary documentation is prepared. As soon as it is fully completed, all information specified in it must be duplicated in the appropriate accounting register. And it is a kind of carrier that accumulates basic information on the transaction. Based on the essence of the register, several classification criteria can be identified. For example, in appearance, registers appear to users in the form of books, simple sheets and index cards.

Postings for fixed assets

Order from the list below postings, within 15 minutes we will publish them if we are on site.

Purchase, acquisition of fixed assets, low-priced goods, small business enterprises, vehicles, land, animals

- According to the purchase and sale agreement

- using borrowed funds

- under a commission agreement and under an agency agreement

- under a financial lease agreement

- purchase of low-value fixed assets

- acquisition of leased fixed assets

- vehicles for their subsequent operation in the organization (or) for rental

- land plots and environmental management facilities

- adult productive and working livestock for the main herd

Exchange agreement, contribution to the management company, free of charge, transfer of goods to the operating system, construction costs

- Receipt of fixed assets under an exchange agreement

- Receipt of fixed assets as a contribution to the authorized (share) capital, funds for special purposes and free of charge

- Transfer of goods and material assets used as profitable investments into the category of fixed assets. Receipt of fixed assets from the perpetrator to compensate for the damage caused

- Costs of construction of fixed assets

Purchase of EQUIPMENT, installation, installation

- Purchase of equipment for installation

- Receipt of equipment for installation as a contribution to the authorized (share) capital, funds for special purposes and free of charge

- Installation of equipment

- Sale of equipment for installation

- Transfer (receipt) of equipment under an exchange agreement

- Transfer of equipment for installation to the authorized (share) capital and free of charge

- Acceptance and transfer of equipment for installation as a contribution under a simple partnership agreement (joint activity agreement)

- Inventory of equipment for installation

Repair, reconstruction

- Writing off the costs of repairing fixed assets to current costs

- Write-off of costs for repairs of fixed assets as deferred expenses

- Write-off of costs for repairs of fixed assets using the reserve for repairs of fixed assets

- Reconstruction (modernization) of fixed assets

Inseparable and separable improvements

- Inseparable improvements to the leased property, agreed upon with the lessor

- Inseparable improvements to the leased property not agreed upon with the lessor

- Separable leasehold improvements

- Inseparable improvements to gratuitously used property, agreed upon with the lender

- Inseparable improvements to gratuitously used property not agreed upon with the lender

- Separable improvements to gratuitously used property

Rent, free use

- Rental of fixed assets

- Free use of fixed assets

- Compensation by the tenant for loss and damage to leased property

- Compensation by the tenant for loss and damage to property rented from an individual

- Compensation by the tenant for loss and damage to rental property

Current maintenance, conservation, depreciation, inventory, write-off, revaluation

- Maintenance and conservation of fixed assets

- Depreciation of fixed assets

- Return and replacement of purchased fixed assets

- Transfer of fixed assets under an exchange agreement

- Transfer of fixed assets to the authorized (share) capital and free of charge

- Acceptance and transfer of fixed assets as a contribution under a simple partnership agreement (joint activity agreement)

- Write-off of unused fixed assets

- Receipt and operation of objects with a useful life of no more than 12 months

- Subscription to periodicals (newspapers, magazines, etc.)

- Inventory of fixed assets

- Revaluation of fixed assets

- Other operations

Modernization and repair: wiring

The difference in definitions has been sorted out, and is now reflected in accounting. We repair fixed assets: postings - Dt 20 (44) Kt 60. The debit account is selected depending on where the fixed asset belongs - to production or to sales. The record shows that repair costs are transferred to the enterprise's expenses immediately.

We are modernizing fixed assets: wiring - Dt 08 Kt 60, then Dt 01 Kt 08. Do you see the difference? Expenses for improvements increase the cost of equipment, which will then be gradually transferred to the enterprise's costs through depreciation.

Methods for calculating depreciation

There are several types of depreciation and each of them has its pros and cons:

- linear method;

- reducing balance method;

- calculation of the amount depending on the performance of the object;

- calculation of the amount depending on the service life of the object.

Linear

The linear method is the simplest. It does not require complex calculations and is paid in equal shares by month when depreciation is calculated. To calculate the amount of depreciation, the cost of the object is taken and divided by the period of use by month. Next, the simple proportion of the interest to the amount is solved. This method is useful in maintaining the quality of manufactured products, regardless of the degree of wear of the object.

Reducing balance method

The second method on our list depends on the annual acceleration rate set by the company. This method is applicable if the quality of the product depends on the level of equipment wear.

Depending on the performance of the object

The productivity write-off method is very convenient for machines, machines and other objects that can be predicted to last. The calculation is made exclusively from the work performed using this object.

Depending on the service life of the object

The method of calculating the amount is simple and is quite often used instead of the reducing balance method, because it is convenient to use if the quality of the product directly depends on the object. Its essence is to pay an amount equal to the ratio of the remaining years of operation to the entire sum of years of operation multiplied by the cost of the object.

Modernization and renovation: what is the difference?

When equipment becomes obsolete, there are two paths you can take. The first is to write off the old and purchase a new one, the second is to modernize. It is very important to distinguish it from repair.

The difficulty lies in the fact that it is not always possible to understand from the primary documents what kind of work was carried out. But the costs of repairs and modernization are distributed differently. An error can lead to incorrect tax calculations, which can be dangerous.

The essence of the repair is that the main product does not become better than it was before, it only returns its properties. Let's say the computer breaks down and its monitor burns out. They bought him a new one instead of the old one. This is a renovation.

Modernization improves fixed assets. Examples: The computer as is is too slow, but is still in good condition. Therefore, it was decided not to replace it completely, but only individual parts that affect the speed. As a result, the equipment began to function faster - this is modernization.

There is a difficult moment. Equipment, especially computer equipment, becomes obsolete quickly. It is no longer possible to replace a broken part with a similar one after just a couple of years; they are simply no longer produced, only with improved characteristics. How then? Did you want a renovation, but got a modernization? If parts with the same parameters really do not exist, then such a replacement will still be considered a repair, but in general, there are indeed many ambiguous points in this matter. They are solved in each individual case individually.

Features of the difference between accounting and tax accounting

For fixed assets put into operation since the beginning of 2016, a certain feature has appeared: property worth more than 40 thousand rubles, but less than 100 thousand rubles must be accounted for as a fixed asset with depreciation in accounting (PBU 6/01), but at the same time, it is written off immediately as an expense in the company’s tax accounting. In this situation, temporary differences appear in accounting, since during the useful life of the object its initial cost in tax and accounting will differ, therefore, the company’s tax accounting profit becomes less than the accounting profit. The deferred tax liability arising in connection with this is reflected in the company's accounting records on the account, which is calculated as the product of the temporary difference and the income tax rate (20%).

At the same time, depreciation only in accounting creates deductible deferred tax assets recorded in account 09.

Tags: asset, balance sheet, accountant, disposal, inventory, capital, coefficient, credit, tax, order, expense, write-off, means, economic