Types of funds stored in the cash register

The following are subject to accounting through accounting account 50, allocated to reflect the funds in the cash register (Chart of Accounting Accounts, approved by Order of the Ministry of Finance of the Russian Federation dated October 31, 2000 No. 94n):

- money in Russian and foreign currencies;

- monetary documents.

In accounting, money is necessarily divided by type of currency. In this case, foreign currencies are taken into account in two equivalents (foreign and Russian) and recalculated at their exchange rates on the dates of transactions and on the date of preparation of accounting reports (clause 4-8 of PBU 3/2006, approved by Order of the Ministry of Finance of Russia dated November 27, 2006 No. 154n) .

Another principle of division is based on the location of the cash registers. In addition to the main cash register, an organization or individual entrepreneur may have operational cash desks that work with customers at their locations remote from the location of the main cash register (i.e., in separate divisions). Money received in the operating cash desk is handed over to the main cash desk daily or at certain intervals, but can also be transferred directly to the bank if a separate division is vested with such a right. In this case, compliance with the cash balance limit is of particular importance.

Monetary documents listed in the cash register include those paid for but not received by the person who will use them:

- stamps (postage, bills of exchange, state duties);

- travel tickets;

- vouchers;

- Gift certificates.

Cash documents are taken into account according to the actual costs of their acquisition, but in accounting they must be divided by type.

In order for all the rules for dividing the objects to be taken into account to be carried out correctly, the corresponding sub-accounts are allocated on account 50. The main ones are the Instructions for the Chart of Accounts (approved by Order No. 94n):

- 1 - corresponding to the types of the main cash register;

- 2 - corresponding to operating cash desks;

- 3 - intended for monetary documents.

However, each of these subaccounts can be divided additionally - based on the principles requiring their division.

/ postings

It can be seen that the source of our asset (money in the bank) is the authorized capital. In fact, the postings here are different (through account 75), but we are not studying the postings here, but an asset with a liability - it’s simpler. Then we receive an advance payment from the buyer for the goods. 51 kr. 62.2 118000 (this amount includes VAT 18000) as a result, we have in the bank (debit account 51) 128000 (asset!): 10000 from the authorized capital (credit account 80), 118000 - from the debt to the buyer (credit account 62.2). Balance again! From this prepayment we must charge VAT on the advance payment: db. 76.AV cr. 68.2 18000 in the debit of account 68.2 - 18000 - we have to pay the tax - a liability, but we will offset this tax later - therefore this amount is taken into account in a special account 76.AB - an asset! (In general, VAT clutters the perception of very novice accountants - I know from myself) Then we receive the goods from the supplier (without prepayment - the supplier trusts us): db. 41 kr. Hello, can you check the wiring? Help me solve the problem! You need to: 1) Open accounting accounts using balance sheet data. 2) Enter correspondence with accounts Tatyana, no one will do such tasks for thanks. You need to spend 1-2 hours of time on this. Postings: Received from the supplier materials - D-t 10 K-t 60-35 Transferred from suppliers D-t 60 K-t 51 -94 Tools purchased through Ivanov D-t 10 K -t 71-90 The balance of funds from Ivanov was accepted to the cash register D-t 50 K-t 71-20 The invoice for materials received at the warehouse was accepted D-t 10 K-t 60-39 Registered by email. light bulbs purchased by Petrov D-t 10 K-t 71-15 Reimbursed for overexpenditure from the cash register D-t 71 K-t 50-5 Transferred to the enterprise with a settlement D-t 60 K-t 51-35 Issued to subdepartment Sidorov D-t 71 K- t 50-10 Repaid to the budget Dt 68 Kt 51-20. If you want to do everything, send it.

Let's sum it up

- Cash transactions are understood as transactions performed with cash or monetary documents stored in the cash register. Accounting for these material assets is carried out on one general account (account 50), but is organized by highlighting in its analytics data relating to different currencies, different cash desks and documents of different types.

- All cash register transactions are divided into 2 groups: incoming and outgoing. The primary documents for their registration are cash receipts and expenditures. In each order, in addition to account 50 (with the analytics related to it), the accounts corresponding to account 50 with the analytics necessary for them are also indicated.

- In an accounting entry reflecting a cash transaction, there is always an indication of account 50. In the debit part of the entry, it appears in transactions of funds entering the cash register, and in the credit part, in transactions of withdrawal from the cash register. The range of corresponding accounts is quite wide, and this determines the variety of cash register entries. The main correspondence is given in the Chart of Accounts, but if necessary, their list can be expanded.

If you find an error, please select a piece of text and press Ctrl+Enter.

Basic cash register transactions

Accounting entries for cash accounting include the receipt of cash, the issuance of money for various purposes (salaries, reporting, travel allowances, payments for goods or services, etc.), movement through collection, etc. Let's consider the main ones, which are typical for any company, regardless of the type of activity and legal status.

Receipt of funds to the cash desk - postings

When the proceeds are posted to the cash register, entries are made to the debit of the account. 50 in correspondence with the account. 51, 55, 52, 57, as well as count. 62, 60, 66 or 67, 73, 71, 79, 76, 75, 90, 91, etc. Examples of entries when posting cash proceeds to the organization’s cash desk:

- Received to the cash register from the current account - posting D 50 K 51 (52).

- The receipt of cash from special accounts is reflected - D 50 K 55.

- The receipt of cash “in transit” to the company’s cash desk is reflected - D 50 K 57.

- Receipt of cash from the buyer to the company's cash desk for goods or services (work) sold - D 50 K 62.

- The balance of the accountable amount was returned to the cash desk - posting D 50 K 71.

- Refund of the prepayment previously transferred to the supplier - D 50 K 60.

- Receipt of borrowed funds in cash at the company's cash desk - D 50 K 66 (67).

- Compensation by an employee of the organization for the damage caused – D 50 K 73.

- Investment by the founders of the companies in cash to the charter - D 50 K 75.

- Identification of excess cash in the cash register during an organization’s inventory – D 50 K 91.

- Sale of goods and materials belonging to the organization for cash - d 50 K 91.

- Transfer of cash between different cash desks of one enterprise - d 50 K 50.

- Receipt of cash on claims – D 50 K 76.

- Cash receipts from a branch of the organization - D 50 K 79.

- The receipt of cash on deposits under joint venture agreements is reflected - D 50 K 80.

- Targeted financing of the company was received in cash - D 50 K 86.

- The receipt of gratuitous cash assistance is reflected - D 50 K 98.

Note! The posting of cash proceeds to the organization's cash desk, posting D 50 K 51 (52), is carried out on the basis of PKO f. KO-1. This document confirms the receipt of funds.

Removal of funds from the cash register - postings

When spending cash, the turnover on the account. 50 is reduced by the loan in correspondence with accounts - 55, 52, 51, 57, 60, 58, 62, 69, 68, 66, 71, 70, 73, 79, 76, 75, 99, 80, 94, etc. Documented such a transaction must be recorded in RKO f. KO-2. When cash is withdrawn, the following accounting entries can be prepared:

- The cash was delivered to the bank - D 51 K 50.

- The organization's cash was collected - D 57 K 50.

- The company's personnel were given salaries - D 70 K 50.

- Accountable employees of the organization were given cash - D 71 K 50.

- Cash assistance was issued to the company’s specialists – D 73 K 50.

- Loans previously received by the enterprise were repaid in cash - D 66 (67) K 50.

- Payment was made to the company's supplier in cash in advance - D 60 K 50.

- The prepayment previously received from him - D 62 K 50 - was returned to the buyer of the product.

- The company's personnel were issued vouchers paid for by the Social Insurance Fund - D 69 K 50.

- Other cash payments from the cash register are reflected - d 76 K 50.

- The founders of the organization were given dividends in cash - D 75 K 50.

- The previously deposited salary was issued to the company's employees - D 76 K 50.

- The repurchase of shares from the company’s own shareholders is reflected - D 81 K 50.

- The exchange rate difference in foreign currency is reflected - D 91 K 50.

- The shortage of cash identified during the inventory of funds is reflected - D 94 K 50.

In company accounting, all cash transactions should be reflected upon their completion. Typical postings are carried out in 1C on the day of implementation. At the same time, primary cash documents are generated - orders, statements, statements, reports, cash books, etc. Such actions help control the organization's cash flow and ensure the completeness of the posting of cash proceeds.

Retail revenue – cash register entries

If a company sells products or services (work) to retail customers, it is necessary to reflect transactions for settlements with customers in accounting. The account is also intended for these purposes. 50. Postings can be done either using an account. 90, and without it:

- D 50 K 90.1 – reflects the receipt of cash from the retail buyer of goods.

- D 90.1 K 62 – sales of products are reflected.

- D 50 K 62 - or you can credit cash to the seller’s cash desk directly through the account. 62, that is, without the use of count. 90.1.

Regulation of cash transactions

Cash flow is typical for almost all enterprises and individual entrepreneurs.

The specifics of conducting cash transactions are enshrined in the instruction of the Central Bank of the Russian Federation No. 3210-U dated March 11, 2014. The document regulates the registration and accounting of cash flows of economic entities. Since November 30, 2020, the document has been in effect in a new edition, which has introduced a significant number of changes. For example, cashiers are required to accept worn-out banknotes, but they can no longer be issued. They will have to be handed over to the bank. The description of such banknotes is given in the table:

ConsultantPlus experts told us what other innovations in the procedure for recording cash transactions came into effect on November 30, 2020. Get trial access to the K+ system and go to the review material for free.

Currently, there is still a need to independently determine the cash settlement limit each year. However, for small businesses and individual entrepreneurs the obligation to set a cash limit has been abolished. They no longer need to monitor their cash balance on a daily basis.

For more details, see the article “Cash discipline - cash balance limit for 2021 - 2021”.

Read about other nuances of working with cash:

- “Nuances of documenting cash transactions”;

- “What is the procedure for preparing cash documents?”;

- “What is the limit for cash payments between legal entities?”

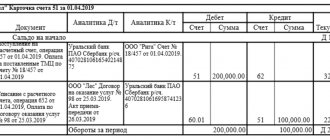

Receipt of proceeds to the current account – postings

Account 51 “Current accounts” is intended to summarize information about the availability and movement of an organization’s funds in rubles on its current accounts opened with credit institutions. The debit of the account reflects the receipt of funds to the organization's current accounts. For a loan – writing off funds from current accounts. Important! When opening a current account, you do not need to notify the Federal Tax Service, Pension Fund and Social Insurance Fund. In accordance with Order of the Ministry of Finance of Russia No. 94n dated October 31, 2000, account 51 corresponds with the following accounts.

| By debit | By loan | ||

| check | Name | check | Name |

| 50 | "Cash register" | 04 | "Intangible assets" |

| 51 | "Current accounts" | 50 | "Cash register" |

| 52 | "Currency accounts" | 51 | "Current accounts" |

| 55 | "Special bank accounts" | 52 | "Currency accounts" |

| 57 | "Translations on the way" | 55 | "Special bank accounts" |

| 58 | "Financial investments" | 57 | "Translations on the way" |

| 60 | "Settlements with suppliers and contractors" | 58 | "Financial investments" |

| 62 | "Settlements with buyers and customers" | 60 | "Settlements with suppliers and contractors" |

| 66 | “Calculations for short-term loans and borrowings” | 62 | "Settlements with buyers and customers" |

| 67 | “Calculations for long-term loans and borrowings” | 66 | “Calculations for short-term loans and borrowings” |

| 68 | "Calculations for taxes and fees" | 67 | “Calculations for long-term loans and borrowings” |

| 69 | “Calculations for social insurance and security” | 68 | "Calculations for taxes and fees" |

| 71 | "Calculations with accountable persons" | 69 | “Calculations for social insurance and security” |

| 73 | “Settlements with personnel for other operations” | 70 | "Calculations with accountable persons" |

| 75 | "Settlements with founders" | 71 | “Settlements with personnel for other operations” |

| 76 | Settlements with various debtors and creditors" | 73 | "Settlements with founders" |

| 79 | "Intra-economic settlements" | 75 | Settlements with various debtors and creditors" |

| 80 | "Authorized capital" | 76 | "Intra-economic settlements" |

| 86 | "Special-purpose financing" | 79 | "Authorized capital" |

| 90 | "Sales" | 80 | "Translations on the way" |

| 91 | "Other income and expenses" | 81 | “Own shares (shares) |

| 98 | "Revenue of the future periods" | 84 | “Retained earnings (uncovered loss) |

| 99 | "Profit and loss" | 96 | “Reserves for future expenses” |

| 99 | "Profit and loss" | ||

Money can be transferred to your current account in several ways:

- from the current account of another organization or individual entrepreneur (IP);

- in the form of cash from the organization’s cash desk;

- through the terminal from other organizations or individuals;

- using plastic cards;

- from the budget or extra-budgetary funds

In this case, the supporting documents for non-cash payments can be:

- money orders;

- payment requirements;

- payment orders;

- letters of credit;

- collection orders;

- checks

Results

The cash register is an important area that is present in the accounting records of almost every business entity.

Therefore, every accountant should know the correspondence schemes for cash accounting accounts. Also, do not forget that cash register documentation is strictly unified and filled out in accordance with the normative procedure, and violations of cash discipline are fraught with fines. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.