Features of loan accounting

According to the terms of the agreement between the borrower and the lender, not only financial assets, but also material assets can be transferred into debt. For example, fixed assets of the organization, inventories, raw materials, finished products or goods, intangible assets and other property of the company.

Reflect the provision of a loan to another organization (entry) in the amount of financial assets issued or at the cost of transferred material assets. If the loan was issued in foreign currency, the accounting department is required to make entries in rubles.

Note that the conditions for issuing loans play a key role in accounting. In this situation, the first question that should arise for the lending company is whether the transferred funds are financial investments or not.

Conditions for recognizing borrowed funds as financial investments:

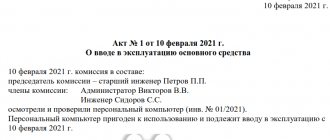

- the fact of transfer of assets on loan (property for temporary use) is documented, that is, the corresponding agreement is signed between the borrower and the seller;

- the lending company officially assumes the risks of non-payment and non-repayment of the loan (credit);

- the assets transferred into debt will bring economic benefits; the lending company plans to make a profit on interest for the transfer of assets for use to another company or individual.

If assets transferred as debt do not meet these three conditions, then they cannot be classified as financial investments. In this case, an interest-free credit (loan) agreement is concluded between the borrower and the seller.

Features of tax accounting when issuing a loan.

In the process of issuing loans to other business entities, enterprises are faced with two taxes, namely VAT and income tax.

With regard to income tax, it should be noted that interest received from the issuance of a loan is considered non-operating income.

At the same time, the procedure for recognizing these interests as income depends on which method is used by the enterprise.

Under the accrual method, interest on loan agreements whose validity period exceeds one reporting period is recognized as income and included in non-operating income at the end of the corresponding reporting period. If the contract expires in the middle of the reporting period, income is recognized on the date of expiration of the contract in this reporting period.

Under the cash method, interest is recognized as income at the time it is credited to the lender's current account or to its cash desk. Accordingly, they are displayed in the tax period when they were actually received.

As for VAT, it all depends on the form of the loan. If the loan is issued in cash, then according to the Tax Code it is not subject to VAT.

Important! If the loan is issued in kind, it is necessary to take into account that at the time the loan is issued, ownership of the transferred property passes to the borrower. This process is the basis for charging VAT to the lender. The basis for calculating VAT is the value of the property, based on the prices of such property without VAT.

If an interest-bearing loan is provided: entries under the interest agreement

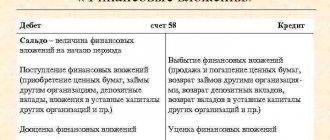

Thus, when concluding an interest-bearing loan agreement, entries are made using special account 58 “Financial investments”, and a separate sub-account “Funds transferred for loan” should be opened for this accounting account.

| Contents of operation | Debit | Credit |

| Loan issued, accounting entries: | ||

| In cash | 58 | 50 "Cashier" 51 “Current accounts” 52 “Currency accounts” |

| In kind | 01 "Fixed assets" 10 “Materials, raw materials” 41 "Products" | |

| Repayment of borrowed funds | 50, 51, 52, 01, 10, 41 | 58 |

How to account for a loan between organizations?

If a non-banking entity lends money to another firm at interest, the accounting would be as follows:

- Debit 58, Credit 50 (cash), 51 (non-cash), 52 (currency), 40 (goods), 10 (materials).

Remember, if the loan is interest-free, we use account 67.

- The repayment of the loan to the organization is documented by reverse posting: Debit 50,51,40,10, Credit 58.

A separate issue concerns VAT accounting: if the loan is issued in kind (in goods). According to the Tax Code, this operation is considered a sale, so VAT will have to be taken into account:

- Accounting for VAT when issuing a loan: Debit 91.2 Credit 68

- Input VAT on loan repayment: Debit 19 Credit 58

- If the loan is issued to a company employee, we use Debit 73, Credit 50 or 51.

If an interest-free loan agreement is drawn up: transactions

If borrowed funds are issued to another organization under an interest-free agreement, entries are generated using accounting account 76 “Settlements with other debtors and creditors.”

| Contents of operation | Debit | Credit |

| Loans issued, transactions: | ||

| In cash | 76 | 50 "Cashier" 51 “Current accounts” 52 “Currency accounts” |

| In kind | 01 "Fixed assets" 10 “Materials, raw materials” 41 "Products" | |

| Loan repayment, posting | 50, 51, 52, 01, 10, 41 | 76 |

IMPORTANT!

When transferring borrowed assets in non-monetary form, value added tax should be charged (clause 1, clause 1, article 146, clause 15, clause 3, article 149 of the Tax Code of the Russian Federation). To do this, make an entry: debit account 76 or 58, depending on the terms of the agreement, and credit account 68.

After the return of such a debt, VAT can be charged to the giving company; reflect the operation as a debit to account 19 and a credit to accounts 76 or 58.

Accounting for transactions under an interest-free loan agreement

Accounting for the borrower organization

An organization acting as a borrower takes into account the amount of the principal debt (hereinafter referred to as the debt) in accordance with the terms of the interest-free loan agreement in the amount of funds actually received or in the valuation of things provided for in the agreement. This debt is accepted for accounting at the time of the actual transfer of money or things and is reflected in accounts payable.

Depending on the period for which the agreement to receive borrowed funds is concluded, the debt on the received interest-free loan is divided into short-term and long-term.

Short-term debt is considered to be the repayment period of which, according to the terms of the agreement, does not exceed 12 months. Debt whose repayment period exceeds 12 months is considered long-term.