Postings for accounting services

Accounting entries for services Accounting entries for transport services Accounting entries for sales of services

Accounting entries for services

The source of income for an enterprise can be not only the sale of goods, but also the provision of services. This activity has its own characteristics. And this, naturally, is reflected in the accounting.

Accounting entries for services for the customer and the contractor will, naturally, be different. The service provider uses account 90 “Sales” for this purpose.

On it, actual expenses are taken into account as a debit, and as a credit, the revenue received is taken into account in accordance with the established tariffs.

From the very specifics of the operation it follows that account 43 “Finished products” is not used in this case. After all, services are always transferred directly to the client.

The answer to the question whether account 40 is used in this case (that is, “Output of products (services)”) depends on whether the enterprise uses the planned cost in current accounting.

Accordingly, the accounting entries for services in this case look like this: the amount of revenue from the debit of account 62 is transferred to the credit of account 90 (under subaccount 90-1).

This is how the debt for services rendered is reflected. The actual cost is taken into account by posting Debit 90-2 – Credit 20 “Main production” (or account 23).

If the company pays VAT, then it is necessary to reflect the tax accrual - posting Debit 90 (under subaccount 3) - Credit 68 (under the subaccount of the corresponding tax).

When the buyer pays for the services, this will be reflected by an entry in which the amount of debt will be written off to the debit of account 51 from the credit of account 62.

Otherwise, the purchase of services from the customer is reflected. The costs of their purchase must be taken into account in accordance with PBU 10/99.

Expenses that are generated for ordinary activities include all costs for the acquisition of services, except those related to the creation or purchase of fixed assets or other non-current assets.

As for the accounting entries for services , settlements with the contractor are reflected by entries Debit 60 - Credit 51 (this entry is made on the basis of a bank statement).

The receipt of services itself is reflected in the following entry: Debit account 20 – Credit 60..

Based on the invoice provided by the service provider, a posting is made that takes into account VAT - Debit 19-4 - Credit 60.

If services are related to the creation of non-current assets, they are subject to the rules of another standard - PBU 6/01. There are also a number of other nuances associated with the acquisition of certain services.

Accounting entries transport services

The sphere of transport services is a category of carriers that differs not only in the organizational and legal form of transport companies, but also in the scale of activities at a transport enterprise, document flow and the specifics of taxation.

Transport is a branch of material production that transports people and goods. In the structure of social production, transport belongs to the sphere of production of material services.

Accounting entries for transport services have their own characteristics for a transport organization and include the need to maintain:

- vehicle accounting (transport accounting)

- generation and printing of waybills

- purchase and consumption of fuel and lubricants

- monitoring fuel consumption for each vehicle

- generation of management reporting

The hired company maintains accounting records in the transport organization and ensures the balance sheet of the transport company and carries out accounting entries for transport services in such a way as not only to simply conduct it correctly in full compliance with the requirements of the law, but also to help the head of the transport company make a profit, reduce taxes paid and obtain, if necessary, the needs of this transport enterprise, the approval of the bank to obtain a loan for a car or to approve a leasing company to receive funds for the purchase of the necessary special equipment for the provision of transport services, including special construction equipment, with full respect for the confidentiality of your information.

Accounting entries for sales of services

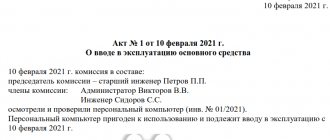

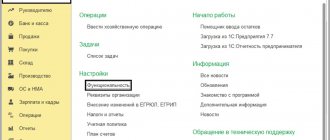

Accounting entries for the sale of services in Accounting 8 can be made using the document “Sales of goods and services” or the document “Act on the provision of production forms the following entries:

- Reflection of proceeds from sales. Debit – 62.01 Credit – 90.01

- VAT has been charged. Debit – 90.03 Credit – 68.02

- The cost of services sold is written off. Debit – 90.02 Credit – 41, 43, 45

The document “Act on the provision of production services” generates the following transactions:

- Reflection of proceeds from sales. Debit – 62.01 Credit – 90.01

- VAT has been charged. Debit – 90.03 Credit – 68.02

- The cost of services sold is written off. Debit – 90.02 Credit – 20.01

Source: https://gala-acc.ru/buhgalterskie-uslugi-provodki.html

Agency agreement and its features

The parties signing the contract are called the principal (service customer) and the agent. Accounting for agency agreements, including remunerations thereunder, is determined by the following conditions:

- the agent acts on behalf of himself or on behalf of the principal;

- does the agent take part in the settlements;

- whether goods are stored in the agent's warehouses;

- the procedure for calculating remuneration (in the form of a percentage of the transaction, a fixed amount, as part of amounts received from third parties, or as a payment from the principal, etc.);

- agent reporting procedure, reporting composition, frequency;

- other significant nuances of the contract.

A form of the agent’s report to the customer of services is developed and attached to the contract. Supporting documentation is attached to this primary document - the expenses reimbursed to the agent and the calculation of his remuneration.

Agency reporting is an important factor that determines the contract and minimizes problematic issues under it. In practice, controversial situations can arise both between the parties to the contract (up to and including lawsuits), and between the company and the regulatory authorities in terms of confirming settlements with primary documents.

In addition to the report with attachments, an accountant can work with the following documents:

- agreements, acts, invoices – documents of the counterparty, if the agent acts directly on behalf of the principal (or copies thereof, if on his own behalf);

- invoices for agent remuneration.

Note! If the agent is a VAT payer, he is obliged to issue invoices with VAT charged on them (Tax Code of the Russian Federation, Art. 146, p.

1-1, Art. 156, paragraph 1). This procedure also applies in cases where the goods, the subject of purchase and sale, are exempt from VAT (Tax Code of the Russian Federation, Article 149, paragraph 7). There are exceptions to this rule (Tax Code of the Russian Federation, Article 156, paragraph 2), for example, some medical products.

Accounting entries for services rendered

Quite often, to carry out the financial and economic activities of an organization (firm), we use the concept of service.

It can be provided to the organization by contractors - suppliers or provided by the organization itself to third-party contractors - consumers of services.

In this article, let's look at the topic of how they are provided by third-party organizations and are provided by the company itself, and also explain what accounting entries for services are prepared for these operations.

Let's first start with what types of services exist. Depending on the field of activity, services are divided into groups:

- Transport and forwarding nature;

- Auditing;

- For rent, for example, transport, premises, fixed assets and inventories (MPS) and others;

- Communications, these include postal services, as well as telephone and telegraph services, Internet services, and others;

- Health care services are the services of medical workers in clinics, hospitals, clinics and other similar institutions;

- Services in the field of trade (services of specialists in displaying goods, consulting services on goods and others);

- Education services;

- Legal services;

- And others.

If they are provided to an organization (firm, company), there are always two parties:

The main document that is provided upon receipt is the certificate of completion (rendered) of work (services) and the second document is an invoice, it is issued by organizations - VAT payers, mainly firms (companies) located on the general taxation system (OSNO ).

If the services were received earlier than payment, then the relationship with the seller is reflected first for the received costs specified in the act.

The debit of the account indicates the expense account, and the credit of account 60 shows subaccount 01, which in the accounting chart of accounts is called “Settlements with suppliers and contractors.”

When receiving (receiving) different services, the same accounting account is not always indicated by debit; the following postings for services are generated, for example:

- For transport costs, the accounting account may be different, it could be:

- Account 26, when receiving office supplies for office workers by transport supplier;

- Account 44.01 “Distribution costs in organizations engaged in trading activities” when transporting sold goods to a counterparty by transport of a third-party organization;

- Account 44.02 “Business expenses in organizations engaged in industrial or other production activities” when transporting products of its own production by a transport organization;

- Account 26, reflected when sending correspondence when using the Internet line;

- For audit purposes, the account is indicated by debit. 26 “General business expenses”;

- Account 26, selected when receiving legal services and advice;

- Account 23 “Auxiliary proceedings”, Part. 20 “Main production”, count. 26 “General business expenses” when renting premises, warehouses, buildings, as well as equipment and fixed assets;

- Account 08 “Capital investments” upon receipt of a formalized estimate drawn up for the construction of a fixed asset facility (store, warehouse).

- And others.

When choosing a cost account, it is necessary to take into account “what these services were used for”, for the maintenance of the administrative apparatus, then we select account 26 “General business expenses”; for production, then select account 20 “Main production”; for the activities of auxiliary production, then select account 23 “Auxiliary production” or account 25 “General production expenses”.

When posting the act of completed (rendered) work (services) and the invoice received from the counterparty (service provider), do not forget to take into account the VAT amount separately on account 19 “Value Added Tax”, for further reimbursement of these amounts from the Federal Budget of the Russian Federation .

When making payments for services to a current account, entries are made in the accounting accounts on the debit of account 60.01 and on the credit of account 51 “Current account”. After this, mutual obligations are considered closed.

When selling a service, exactly the same documents are drawn up as upon receipt; this is an act of completed (rendered) work (services). The act must contain the following mandatory details:

- Date and name of the document;

- Name of the organization that issued the act;

- Name of the counterparty;

- operations;

- A business transaction must be expressed in physical and monetary terms;

- FULL NAME. officials who signed the document;

- Signatures on both sides.

If the organization is a value added tax payer, then an invoice is issued along with the act in two copies, one copy is transferred to the counterparty (buyer), the other remains with the seller.

When selling services, accounting entries for services are generated:

- By revenue by debit account. 62.01 “Settlements with buyers and customers” on credit account. 90.01 “Revenue”;

- By writing off the actual cost on the debit of the account. 90.02 “Cost of sales” on credit account. 20 “Main production” or accounts 23 “Auxiliary production”;

- Reflection of value added tax if the organization is a VAT payer in the debit of the account. 90.03 “Value added tax” on credit account. 68.02 “VAT calculation”;

- When paying for services by debit account. 51 “Current account” for a loan account. 62.01.

When entering expenses into an accounting program, you need to approach each operation individually and choose the right accounting and tax account; the financial result of your company will depend on this in the future.

Accounting - postings for services

Accounting for services - postings for transactions involving it will be discussed in the article - is regulated by PBU standards. Let's consider the main methods of accounting for services.

Services are a type of activity that does not have a material expression, the results of which are sold and consumed in the process of economic activity of the enterprise (Clause 5 of Article 38 of the Tax Code of the Russian Federation).

Services exist in a wide variety, in particular:

In accounting, all services are included in costs based on primary accounting documents.

The main primary documents confirming the execution of services are:

- Agreement.

- Certificate of completion of work or other document confirming acceptance of services.

Source: https://moibuhechet.ru/buxgalterskie-provodki-po-okazannym-uslugam/

Examples of reflecting transactions

In practice, various options for the above correspondence accounts can be used. Let's look at some examples of such transactions and how transactions are reflected in accounting records.

Example 1 (customer accounting)

produces stone products. attracts clients for it according to the GPC agreement, the remuneration is 6% of sales. At the end of the month, payment for the product amounted to 150,000 rubles, the cost of products was 100,000 rubles.

Agent's remuneration in costs:

- 150,000*6% - (150,000*6% *20%) = 7200.00 rub. D 20 - K 76 - 7200.00.

- 7200 *20% = 1440.00 - VAT is charged on the remuneration. D 19 - K 76 - 1440.00.

- D 68/2 - K 19 - 1440.00 - accepted for deduction of VAT on remuneration.

- D 90 - K 20 - 100,000.00 - written off products (including costs for agency services).

Agency fee in settlements with the agent: 150,000 * 6% = 9,000 rubles. Income minus remuneration: 150,000 - 9000 = 141,000.00 rubles. D 51 - K 62 - 141,000.00 - income received minus remuneration. D 76 - K 62 - 9000.00 - the remuneration is offset against payment from the buyer.

Example 2 (accounting with an agent)

For a fee of 5% of the goods sold (settlement on payment) the company sells products - equipment for animals. During the month, goods worth 100,000 rubles were shipped, including VAT - 16,666.67 rubles.

Goods sold for 75,000 rubles, including VAT - 12,500 rubles. Payment for goods - 70,000 rubles, including VAT - 11,666.67 rubles. Agent costs 250 rub.

Postings:

- D 004 - 100,000.00 - goods accepted for storage.

- D 62 - K 76, K 004 - 75,000.00 - goods sold.

- D 51 - K 62 - 70,000.00 - goods paid for.

- D 76 - K 76 (according to subaccounts) 70,000.00 - report to the customer for goods sold.

- 70000*5% = 3500 rub. D 76 - K 90/1 - 3500.00 - remuneration accrued.

- D 76 - K 76 - 3500.00 - remuneration is withheld from sales income.

- D 90 - K 68/VAT - 583.33 - VAT on remuneration.

- 3500 - 583.33 - 250 = 2666.67 rubles. - agent's profit. D 90 - K 99/9 - 2666.67.

- 70,000 - 3500 = 66,500 rubles. revenue minus remuneration. D 76 - K 51 - 66500.00 transfer of proceeds to the customer of services.

Briefly

The accounting of settlements between the principal and the agent depends on the contractual terms. The agent's report forms the basis of the accounting documentation for transactions. Accounting is maintained on accounts for settlements by counterparties - 76, 62, using off-balance sheet accounts 002, 004, as well as standard accounts for income, VAT, and cash.

Accounting for services provided: basics

May 22, 2021 2507 Comments (0)

Greetings! Today, our attention will come not so much to the area of accounting as to a certain type of business transaction. It will affect many areas of accounting. And now we will get to know her in more detail.

Accounting for services provided - a minimum of theory

The event is “Our company buys a service from other companies and pays for it.” The main task is to decide which accounts to send the amount of the service to and what to call it. This is the second action. And the first action we must answer is the question.

Is it possible for a company to buy this service at all?

Can. Any service can be purchased from a company. However, every time a business buys something, it is necessary to think before the end result. For example, like this:

“Whatever a company buys will ultimately fall into the financial result formula. The company is required to pay income tax.

Of course, the tax code monitors what an enterprise can and cannot enter into the financial result formula.

The Tax Code especially ardently monitors the types of expenses and clearly defines: “Any expense must be justified and have a production necessity. Those. directly influence the ability to conduct business"

What does this give us? This is a mental filter through which we pass every purchase, especially the purchase of services.

In other words, we may have services that can be included in the financial result formula and reduce income taxes.

Or there may be services that cannot be included in the formula and reduce taxable income; The company will be able to pay for such services only from its net profit.

A clear example of a service that cannot be included in the formula, but will have to be paid for out of net profit, may be the purchase of drinking water for the company’s offices, or payment for employees’ lunches in catering establishments. And why all? Because these are not production costs. They do not directly affect the implementation of activities.

So, we decided that we buy only those services that can be plugged into the financial result formula. The main list of accounting accounts where purchased services are collected is as follows: 20, 23, 25, 26, 44, 91.2

Now we will repeat a little bit of what we already know, just go through the cost accounts and repeat the main ideas.

Accounting for services provided: main accounting accounts

Account 26 is an accounting of all expenses of the company as a whole. More suitable for management and administration. In other words, these are the costs that fall on the entire enterprise, on all its accounting areas. These expenses cannot be accurately attributed to either sales or production.

Account 44 is an accounting section that collects expenses related to trade. And it doesn’t matter whether it’s goods or our own finished products.

Here are the salaries of sellers, and advertising, and the rental of retail space, or utilities, electricity, and taxes on wages of personnel associated with trade.

91.2 account is an expense account that participates in the financial result formula. The most common expenses for 91 accounts are bank services for servicing a current account, interest on loans, etc.

25 account - this account collects expenses that cannot be accurately and immediately attributed to a specific type of product.

We repaired the oven where 5 types of products are baked.

Is it possible to say to which products the repair amount can be accurately attributed? What about the electricity consumption of this oven? What about cleaning the room in which this stove is located?

Account 20 – this account collects direct costs for a specific type of product. The point of the 20th account before the “closing of the month” is to collect only those types of expenses that can definitely be attributed to specific products.

The most striking example of such expenses will be raw materials, which we know exactly what and in what quantities are used for a specific type of product.

People’s salaries can also be 20, but on the condition that it is calculated depending on the quantity of specific products made.

That's the whole point of buying a service:

- We decide whether we can buy it in order to reduce taxable income. To do this, we ask ourselves: “Is the service of production value?” and “What does the Tax Code say about the types of expenses for the taxation system in our company?”

- We decide what specific type of service it is. Either immediately to 91.2, or we look at the remaining expense accounts.

Primary documents for accounting of services provided to us

The service provider issues us a certificate of service provision. If we agree with everything, we sign it. Next, in our accounting, we draw up the primary document:

Look at examples of primary documents.

Look at the tabular parts of the documents - everywhere they indicate the name of the service, department (if necessary), expense account (correspondent account), amount. And in the header of the document we indicate the service provider and the contract. If necessary, also information about the supplier's invoice.

Source: https://buhucheba.ru/uchet-v-buhuchete-okazannih-nam-uslug/

Reimbursement for cellular calls

From the amount of compensation of the employee for the use of cellular communications for personal purposes:

- Insurance premiums are not charged;

- The amount of compensation after payment is included in non-operating income;

- It is not taken into account when calculating income tax, since it does not relate to the activities of the enterprise.

The reflection of this operation in accounting is formed by the posting:

Dt73 Kt60 – reflects the amount of personal telephone conversations that was reimbursed by the employee.

If the amount of expenses is not reimbursed by the employee, then the employer has the right to forgive the employee’s debt, then;

- The amount not reimbursed by the employee is recognized as income and is subject to personal income tax;

- Insurance premiums are calculated on this amount;

- For tax purposes it is included in other expenses.

The organization formalizes the operation with the following posting:

Dt91.2 Kt60 – the amount of personal telephone conversations that is not reimbursed by the employee.

postings for services rendered

Let's continue to consider the documents used in production accounting when using 1C Accounting. It is known that, along with the receipt of goods and their write-off for production, documents on the production itself are used to produce the final product.

https://www.youtube.com/watch?v=Ng4Ifp0Mgog

Let’s fill out the document “Certificate of Production Assistance”. in the case where the enterprise provides services related to its production activities.

Accounting entries for services rendered

Accounting entries for services rendered are a document that contains completed correspondence of accounts.

Here, in a strictly mandatory manner, credited and debited accounts and the total amount of business transactions are indicated, which are then registered.

If at an enterprise accounting is carried out in journal-order form, then the correspondence of accounts takes place in journals-orders.

Accounting entries

It is known that the bank is a commercial organization, therefore, for the services provided, they will need to pay a commission type remuneration.

The main bank entries, the accounting entries for working with which will be given below, must be indicated in the accounting.

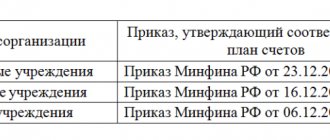

By order of the Ministry of Finance, accounting was approved, which, when working with a bank, uses the following accounts:

These basic transactions are necessary to work with the banking system.

Accounting in the service sector

The scope extends to both the population (household, health and beauty services for the population) and services to legal entities (notary, legal and accounting support).

The greatest difficulties arise, as a rule, in the fact that versatile knowledge is required in all areas of accounting knowledge. In this regard, it is too difficult to find your own accountant to do accounting in the service sector.

Accounting posting services

Many companies, when carrying out their activities, resort to third-party organizations. Most often this is associated with activities related to the production or sale of products. Any services provided to your organization must be justified and reflected in the accounting entries.

The legal regulation of accounting for the provision of services is based on the agreement that you have drawn up with the counterparty.

Performance of work, provision of services

Revenue received from services provided and work performed are income from ordinary activities and are recognized in accounting on the date of signing the acceptance certificate for services provided, in accordance with paragraphs 5, 12 of PBU 9/99. In accounting, the indicated income is reflected in account 90 “Sales”, subaccount 90-1 “Revenue”.

Costs associated with the provision of services are expenses for ordinary activities and, as they are carried out, are taken into account on account 20 “Main production” in correspondence with Credit accounts 10,70,69,02, etc.

Mabd "accountant's directory"

The main agreement defining the legal relations of the parties in the service sector is the contract for paid provision, regulated by Chapter 39 of the Civil Code of the Russian Federation.

The provisions of this chapter apply to contracts for the provision of communication services, medical, veterinary, auditing, consulting, information services, training, tourism services and others (except for those provided for in Chapters 37 - 53 of the Civil Code of the Russian Federation).

Do a favor

We are currently observing how the service sector is rapidly developing. The volume of services offered is constantly growing, and the range of services provided is expanding.

In this regard, proper legal regulation of relevant relations becomes important. The main role in such regulation belongs to the Civil Code of Ukraine dated January 16.

2003 (hereinafter referred to as GC).

The Civil Code of Ukraine, in comparison with the Civil Code of the Ukrainian SSR, pays more attention to the settlement of relations related to the provision of services.

Provision of services accounting entries

Any enterprise, in its economic activity, needs not only goods, but also counterparties (third-party organizations). These operations must be directly related to the processes of production and release of finished products; more precisely, they must be economically reliable.

https://www.youtube.com/watch?v=cmpclb9Vas0

Mig-Partner will provide you with any accounting and legal services in no time. You can rely on us, knowing that we will not make mistakes.

Provision of services: reflection in accounting

We will use the concept given in the Tax Code of the Russian Federation: activities, the results of which do not have material expression, are sold and consumed in the process of carrying out this activity (Part 1, Chapter 7, Article 38, paragraph 5).

The legal basis for the provision of services is based on the concluded contract. In the new edition of the Civil Code of the Russian Federation, a separate chapter 39 is devoted to the contract for compensation.

Postings for services rendered

Source: https://lawyersfree.ru/provodki-po-okazannym-uslugam-24823/

Examples of reflecting transactions

In practice, various options for the above correspondence accounts can be used. Let's look at some examples of such transactions and how transactions are reflected in accounting records.

Example 1 (customer accounting)

produces stone products. attracts clients for it according to the GPC agreement, the remuneration is 6% of sales. At the end of the month, payment for the product amounted to 150,000 rubles, the cost of products was 100,000 rubles.

Agent's remuneration in costs:

- 150,000*6% - (150,000*6% *20%) = 7200.00 rub. D 20 - K 76 - 7200.00.

- 7200 *20% = 1440.00 - VAT is charged on the remuneration. D 19 - K 76 - 1440.00.

- D 68/2 - K 19 - 1440.00 - accepted for deduction of VAT on remuneration.

- D 90 - K 20 - 100,000.00 - written off products (including costs for agency services).

Agency fee in settlements with the agent: 150,000 * 6% = 9,000 rubles. Income minus remuneration: 150,000 - 9000 = 141,000.00 rubles. D 51 - K 62 - 141,000.00 - income received minus remuneration. D 76 - K 62 - 9000.00 - the remuneration is offset against payment from the buyer.

Example 2 (accounting with an agent)

For a fee of 5% of the goods sold (settlement on payment) the company sells products - equipment for animals. During the month, goods worth 100,000 rubles were shipped, including VAT - 16,666.67 rubles.

Goods sold for 75,000 rubles, including VAT - 12,500 rubles. Payment for goods - 70,000 rubles, including VAT - 11,666.67 rubles. Agent costs 250 rub.

- D 004 - 100,000.00 - goods accepted for storage.

- D 62 - K 76, K 004 - 75,000.00 - goods sold.

- D 51 - K 62 - 70,000.00 - goods paid for.

- D 76 - K 76 (according to subaccounts) 70,000.00 - report to the customer for goods sold.

- 70000*5% = 3500 rub. D 76 - K 90/1 - 3500.00 - remuneration accrued.

- D 76 - K 76 - 3500.00 - remuneration is withheld from sales income.

- D 90 - K 68/VAT - 583.33 - VAT on remuneration.

- 3500 - 583.33 - 250 = 2666.67 rubles. - agent's profit. D 90 - K 99/9 - 2666.67.

- 70,000 - 3500 = 66,500 rubles. revenue minus remuneration. D 76 - K 51 - 66500.00 transfer of proceeds to the customer of services.

The accounting of settlements between the principal and the agent depends on the contractual terms. The agent's report forms the basis of the accounting documentation for transactions. Accounting is maintained on accounts for settlements by counterparties - 76, 62, using off-balance sheet accounts 002, 004, as well as standard accounts for income, VAT, and cash.

Calculation of simplified tax system 6% of income: postings

The tax base (TB) under the special simplified tax regime of 6% is the total amount of income recorded in the accounting records. To determine the NB for the tax period, income is calculated quarterly with a cumulative total. At the end of the year, the total income result is summed up.

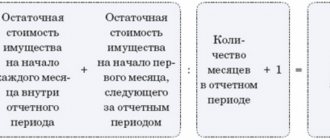

The marginal tax rate is 6%, but regional authorities are given the right to set the rate from 1 to 6%. Advance tax is calculated using the formula:

In this case, the amount of the advance payment can be reduced by the amount of insurance premiums paid in the reporting period (for contributions of individual entrepreneurs without employees, “you can reduce the tax in full for yourself, insurance premiums of companies and individual entrepreneurs with employees can reduce the amount of calculated tax by 50%), and also trade fee. When calculating the tax for the year by intra-annual periods, the amounts of previously transferred advances are also deducted from the calculated tax amount.

At the end of the year, at the final tax calculation, either an additional payment or an overpayment may arise, which is counted against future payments or returned to the company’s account. The decrease in the final tax amount is recorded by posting: D/t account. 68 – K/t count.

99.

Accounting for the disposal of materials from the organization to third parties

How do materials leave the organization? Just as in the case of fixed assets, materials can be disposed of as a result of sale, gratuitous transfer (donation), as well as when materials are contributed to the authorized capital of another enterprise.

Let's take a closer look at each case of disposal of materials.

Materials can be sold, donated, transferred to another organization in the form of a contribution to the management company. Depending on the method of transfer of material assets, the accounting process in the accounting department of a disposal company may change. Below, the most popular methods of leaving an MC from an organization are discussed in detail with postings.

Sales of materials

Materials must be sold at market prices including VAT. If this sale does not relate to the main activities of the enterprise, then the proceeds resulting from the sale are included in other income and are credited to account 91 “Other income, expenses.” Accordingly, expenses arising during the sale are classified as other expenses and are recorded in the debit of account 91.

The sale of materials begins with writing off their cost from the account where they were recorded (10 “Materials”), to other expenses on the 91st account (entry D91/2 K10).

As mentioned above, they are sold at the market price (including VAT), and it can be either higher or lower than cost. The proceeds received from the sale are recorded by posting D62 K91\1.

If the rate is 18%, then in order to isolate the tax from the amount of revenue, you need to multiply the revenue by 18% and divide by 118, the resulting value will be the tax that the organization must transfer to the budget. This tax is an expense from the sale of materials and is reflected by posting D91/2 K68.

https://youtube.com/watch?v=ngqjoIILYt4

As a result of the operation, it is necessary to calculate the financial result. To do this, you need from the debit turnover of the 91st account. (subaccounts 2 (cost + VAT)) subtract the credit turnover of the 91st account. (revenue):

- if the received value is greater than 0, then we received a loss from the transaction, it is entered into the credit account. 91/9 in correspondence with account. 99 “Profits and losses”, posting – D99 K91/9.

- if the resulting value is less than 0, then we received a profit from the transaction, which is entered into the debit of the account. 91/9 in correspondence with account. 99, wiring – D91/9 K99.

After payment is received from the buyer of the materials, you need to make the posting D51 K62 in accounting.

All accounting entries are made on the basis of primary documents, in this case the primary document will be:

- invoice for the release of materials to the side, form M-15;

- invoice;

- waybill (waybill);

- bank statement indicating receipt of payment from the buyer.

If in the process of selling materials the organization incurred some other expenses (for example, transportation costs), then they are also reflected in the debit of the account. 91 (posting D91/2 K76), after the organization pays for these services, posting D76 K51 (50) is performed. Postings are made on the basis of documents confirming the provision of services and payment for these services by the organization.

Adding another company to the charter capital

If materials are transferred to the authorized capital of another organization, then this cannot be recognized as an expense of the organization. This contribution is recognized as a financial investment of the enterprise and is reflected in the account. 58/1: posting D58/1 K76 reflects the debt on the contribution to the authorized capital, and posting D76 K10 directly formalizes the transfer of material assets to the authorized capital of another organization.

In this case, materials are removed from the enterprise at the cost at which they are recorded in accounting.

Free transfer (donation)

Expenses for the gratuitous transfer of materials are included in other expenses (entry D91/2 K10 writes off the cost of inventory and materials). Materials are written off at the cost at which they are recorded in accounting (book value). Just as in the case of the sale of materials, it is necessary to accrue and pay VAT to the budget; VAT is charged on the market value of goods and materials (entry D91/2 K68.

From the site: https://buhland.ru/uchet-vybytiya-materialov-iz-organizacii-na-storonu/

Accrual of the simplified tax system: postings nachislenie_usn_provodki. jpg

The application of the simplified special tax regime is regulated by Chapter. 26. 2 Tax Code of the Russian Federation. This system is distinguished by the ease of accounting, the possibility of paying a single tax, which replaces a number of mandatory fees, and the availability of benefits when calculating it. The simplified tax system remains a relevant scheme for small industries and small businesses.

Let's look at how accounting is organized in "simplified" terms and what records accompany the accrual/payment of a single tax.

Agency fees in accounting for principal and agent

The remuneration of agents in accounting is directly related to the receipt of money, the calculation of VAT, and payment for goods, so the transactions must be considered in their entirety.

The agent's basic invoice correspondence schemes will be below.

This option is used when the agent works directly for the customer. He does not own the goods, he has no income (expenses) from third-party goods and materials (PBU 9/99):

- DT 51 - CT 76 - money was received from the principal to pay for the transaction (including VAT and remuneration).

- DT 76 - CT 90/1 - agency fees are reflected in accounting.

- DT 90/3 - KT 68/2 - VAT on remuneration.

- DT 60 - CT 51 - paid to the counterparty for the MC for the customer.

- DT 76 - CT 60 - agency expenses (reimbursable) are reflected in accounting, including VAT.

Customer goods are accounted for on an off-balance sheet basis - D002. After shipment to the customer, the MC is written off from K002.

The scheme is applied by the agent when he acts as an intermediary:

- DT 62 - CT 76 - revenue according to the contract.

- DT 51- CT 62 - the buyer transferred the money.

- DT 76 - CT 51 - transfer of money for sold goods and materials to the customer (minus remuneration).

- DT 62 - CT 90/1 - the agent’s remuneration is reflected in the accounts.

- DT 90/3 CT 68/2 - VAT on remuneration.

- DT 76 CT 62 - agent’s remuneration to be credited.

Off-balance sheet accounting of inventory items is maintained: D004 – capitalization of inventory items for sale, K004 – sold assets are written off. Accounting for the customer of services, the principal, reflects the other side of the same transaction. The postings are similar to those used for settlements with suppliers, but they also reflect the work of the agent.

The scheme applies if the agent works directly on behalf of those who ordered the services:

- DT 76 - CT 51 - money was transferred to the agent for various purposes (purchase of goods and materials, reimbursement of expenses, remuneration).

- DT 41 - KT 76 - goods were purchased through an agent (remuneration, TZR, is added to the cost of the goods by the same transaction).

- DT 19 - KT 76 - VAT on the purchase price of goods (the same posting takes into account VAT on remuneration, TZR).

- DT 68/2 CT 19 - VAT deductible.

This is how transactions are reflected if the agent works as an intermediary in a transaction:

- DT 51 - CT 62 - money received from the agent (received from the buyer).

- DT 62 - CT 90/1 - revenue from the agent is taken into account (according to the report).

- DT 90/3 CT 68/2 - VAT on revenue.

- D20 (or other “cost” account) - K76 - the agent’s remuneration is taken into account.

- DT 19 - CT 76 - VAT on remuneration taken into account.

- DT 68/2 - KT19 - VAT, deduction.

- DT 90/2 - CT 20 (other “cost” account) - costs for the agent’s services are written off.

- DT 76 - CT 62 - agent's remuneration to be offset.