When it comes to the traveling nature of work, for some reason everyone immediately imagines drivers. Of course, as a rule, this type of work is established for them, but in fact it can be established for absolutely any employee whose work function involves traveling. The specialized literature and legislation say very little about the procedure for establishing the traveling nature of work and the preparation of reports by employees in the specialized literature and in the legislation, and some employers are at a loss in these matters. Let's find out...

The main features of traveling work.

The traveling nature of work in the Labor Code is mentioned only in two articles and, apparently, there are no plans to make any changes or additions to them.

So, in Art. 57 establishes that one of the mandatory conditions to be included in an employment contract is a condition that determines the nature of the work (mobile, traveling, on the road, etc.), and in Art. 168.1 contains an open list of expenses that the employer reimburses to employees with a traveling nature of work (as well as employees whose permanent work is carried out on the road, working in the field or participating in work of an expeditionary nature). Such trips, like business trips, are called business trips.

For your information:

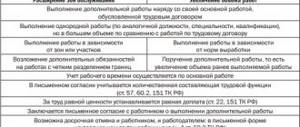

A business trip is a trip by an employee by order of the employer for a certain period of time to carry out an official assignment outside the place of permanent work. At the same time, business trips of persons whose permanent traveling work is carried out on the road or is of a traveling nature are not recognized as business trips (Article 166 of the Labor Code of the Russian Federation).

Like business travelers, persons whose permanent work is of a traveling nature, the employer reimburses expenses for travel, rental of living quarters, etc. However, when an employee is sent on a business trip, his average earnings are retained, and if the work is traveling, the salary is simply paid.

From some regulatory documents it can be concluded that traveling work is one in which regular work trips are carried out within the service territory with the possibility of daily return to the place of residence. That is, as a rule, within a locality or region.

But if we proceed from the provisions of Art. 168.1 of the Labor Code of the Russian Federation, such an employee, as on business trips, can travel longer distances and does not always return home on the same day. Therefore, the main sign of the traveling nature of work is that such trips occur constantly. Business trips are carried out periodically, irregularly, for a period determined by travel documents. This was noted by Rostrud in Letter No. 4209-TZ dated December 12, 2013.

That is, if an employee is constantly traveling, regardless of his position, he may be assigned a traveling nature of work.

Question

Does a ban similar to the ban on sending certain categories of workers, such as pregnant women, on business trips apply to employees with a traveling nature of work?

The Labor Code contains a ban on sending a pregnant woman on a business trip (Part 1 of Article 259 of the Labor Code of the Russian Federation), but does not contain a ban on establishing the traveling nature of work.

However, the employer must take into account all the peculiarities of the work of a pregnant employee, the results of a special assessment of working conditions for the presence of contraindications, and also check them for compliance with SanPiN 2.2.0.555‑96 “2.2. Occupational hygiene. Hygienic requirements for working conditions for women. Sanitary rules and norms”, approved by the State Committee for Sanitary and Epidemiological Supervision of the Russian Federation of October 28, 1996 No. 32, Methodological recommendations No. 11-8/240-09 “Hygienic assessment of harmful production factors and production processes hazardous to human reproductive health”, approved by the Chief State Sanitary Doctor of the Russian Federation 07/12/2002 No. 11‑8/240‑09, Hygienic recommendations for the rational employment of pregnant women, approved by the State Committee for Sanitary and Epidemiological Supervision on 12/21/1993, by the Ministry of Health on 12/23/1993.

And the employer should take into account that with the traveling nature of the work, the negative impact of working conditions on the employee may be no less, but even greater - for example, if there are many such trips. In this case, it is better to offer the pregnant employee a transfer to lighter work. And she will definitely have to do this if she writes a statement and provides a medical report (Article 254 of the Labor Code of the Russian Federation).

We also believe that the restrictions established for certain categories when sent on business trips should also be applied to other categories of workers, especially in cases where employees are not able to return home during business trips.

On my way

If in the previous paragraph the employee has the opportunity to return home at the end of the working day, then such an opportunity is not provided .

Suitable professions include working as a conductor, flight attendant or freight forwarder.

Train conductors often literally spend the night at their workplace.

Comfortable home or office rest is impossible in such conditions.

Freight forwarders are one of the typical professions for this category.

One of the most important documents is Government Decree N554. A forwarder is an employee who performs or organizes the performance of transport services .

Of course, this implies a long stay on the road. Forwarding work is distinguished from field work by its focus on providing transport services.

How is the traveling nature of work established?

First of all, in accordance with the requirements of Part 2 of Art. 168.1 of the Labor Code of the Russian Federation, the employer must determine for which specialties and positions it is necessary to establish a traveling nature. It can be established by a collective agreement, agreements, or local regulations.

It is still better to fix the list of positions (as well as the size and procedure for reimbursement of expenses and forms of documents) in a local regulatory act (regulations on the traveling nature of work), since it is easier to make changes to it if necessary than to a collective agreement. The list of positions can be approved by a separate order from the head of the organization.

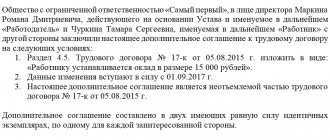

In addition, as already mentioned, the condition regarding the traveling nature of the work must be included in the employment contract. Moreover, if such a nature of work is established already in the course of employment, the employee should be notified of changes in the terms of the employment contract two months in advance. If an employee agrees to work under new conditions, an agreement is immediately concluded with him in accordance with Art. 72 of the Labor Code of the Russian Federation, and if not, then the employer makes changes to the employment contract after two months unilaterally in accordance with Art. 74 Labor Code of the Russian Federation.

Note:

An employment contract with an employee may indicate the territory within which the work will be carried out (for example, “within the city of Moscow and the Moscow region”).

A provision regarding the traveling nature of the work must also be included in the job description.

For employees of budgetary institutions with a traveling nature of work, a work time sheet should be filled out (f. 0504421). The time spent traveling will be reflected by the letter code “F” - actual hours worked. In this case, the organization has the right to supplement the used symbols as part of the formation of its accounting policies.

If employees, due to business trips, are unable to maintain daily or weekly working hours, it is advisable for the employer to establish a summarized recording of working hours for them. Depending on the specifics of travel, they may be given a flexible schedule or irregular working hours.

Employer's actions

In order for internal regulations to optimally organize the work process that involves employee travel, the following measures must be taken by the enterprise management:

- Make sure that all contracts for employees with a traveling nature of work contain a reference to a special work procedure.

- Fix in a separate local document a list of professions where the above nature of employment is acceptable, and also indicate which positions and responsibilities require this type of travel arrangement.

- Introduce document flow rules for persons who frequently move around the country.

- Allowances and the procedure for calculating payments are specified in the collective agreement, or included in employment contracts, or adjustments are made to contracts of both types.

The procedure for preparing documents confirming expenses.

By virtue of Part 1 of Art. 168.1 of the Labor Code of the Russian Federation for employees whose permanent work is of a traveling nature, the employer compensates for the following related to business trips:

- travel expenses;

- expenses for renting residential premises;

- additional expenses associated with living outside the place of permanent residence (daily allowance, field allowance);

- other expenses incurred by employees with the permission or knowledge of the employer.

According to Part 2 of Art. 168.1 of the Labor Code of the Russian Federation, the amount and procedure for reimbursement of expenses related to business trips are established by a collective agreement, agreements, local regulations, and can also be established by an employment contract.

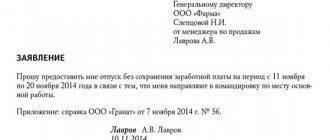

An employee, as an accountable person, can receive cash from the company's cash desk for travel-related expenses. Issuance is carried out on the basis of an order from the manager or an application from the employee.

At the same time, in accordance with the procedure established by the collective agreement and (or) local act, funds (advance) for expenses associated with business trips can be transferred to the bank account of an employee whose permanent work is of a traveling nature. The final payment for actual expenses incurred is made after the employee submits an advance report accompanied by documents confirming the expenses.

Note:

These payments are compensatory and are established to reimburse employees for the costs associated with the traveling nature of the work. But in the absence of documents confirming the expenses, these payments will not be recognized as such (Letter of the Ministry of Labor of the Russian Federation dated September 30, 2014 No. 17-4/B-462).

These compensations for traveling work are exempt from personal income tax, since the employee’s expenses are related to the performance of his labor duties (clause 3 of Article 217 of the Tax Code of the Russian Federation) and are not subject to insurance contributions (clause 2 of clause 1 of Article 422 of the Tax Code of the Russian Federation).

Travel-related expenses are reimbursed to employees on the basis of advance reports and supporting documents: travel tickets, receipts, etc.

Question

How long after the trip must the employee submit an advance report?

According to the Decree of the Government of the Russian Federation dated October 13, 2008 No. 749 “On the peculiarities of sending employees on business trips,” upon returning from a business trip, an employee is required to submit a report to the employer within three working days. But since the provisions on business trips do not apply to employees with a traveling nature of work, we turn to the Directive of the Bank of Russia dated March 11, 2014 No. 3210-U “On the procedure for conducting cash transactions by legal entities and the simplified procedure for conducting cash transactions by individual entrepreneurs and small businesses,” according to to whom the accountable person who received the cash is obliged to submit an advance report to the chief accountant or accountant (in their absence, to the manager) within a period not exceeding three working days after the expiration date for which the cash was issued for the report, or from the date of going to work, for example after vacation or sick leave.

The employee must attach original documents confirming the expenses incurred to the advance report.

For your information:

Previously, Instruction No. 3210-U contained a provision (now no longer in force) that the issuance of cash on account is carried out subject to full repayment by the accountable person of the debt on the amount of cash previously received on account.

Thus, the period for which cash or non-cash money is issued on account (for example, a week, month), and the period for submitting a report on amounts received in non-cash form, the employer should set independently in local regulations.

Moreover, upon receipt of cash, the employee will have to report within three days after the expiration of this period. And for non-cash payments, he will be able to report within the deadline set by the employer.

Registration in the Labor Code

When registering an employee with a traveling nature of work, the personnel officer must be guided by Article 168.1 of Chapter 24 of the Labor Code of the Russian Federation. This article provides the basis for determining compensation for business travel expenses. Until a certain time, all types of field activities of employees were written off precisely under this article. But here it is important to take into account that Article 166 gives a precise definition of a business trip. According to it, a business trip in 2021 is considered to be the performance of official duties outside the workplace for a certain period of time. This formulation makes it possible to separate a business trip from the away nature of the work, since the first implies a certain period of time, the second - one working day.

This difference was noticed when processing personal income tax and insurance contributions, since their amount decreases when paying for travel allowances. In order to make adjustments, Law No. 90 of June 30, 2006 was adopted, which considered the feasibility of applying Article 168 to determine the traveling nature of work.

Attention

Given the relevance of this provision, personnel officers should take into account that compensation for expenses for field work cannot be processed in 2021 as one-day business trips. This is already classified as an offense and entails additional assessment of not only taxes, but also penalties and fines.

Business trip

According to labor legislation, a business trip is understood as a trip during which an employee carries out official assignments of the employer outside his main place of work (166 Labor Code of the Russian Federation). For registration, the employer issues an order according to which the employee is sent on a business trip for a certain period of time. By this definition, we can understand a business trip as a business trip of an employee that is one-time. And for the employee, constant such trips are not included in the job duties. An example is the official trip of the company’s financial director for the purpose of a one-time inspection of a structural unit located in another city (

Salary

Important! The entire time the employee is on a business trip, he retains his average earnings (167 Labor Code of the Russian Federation). Instead, you can’t just pay him a regular salary.

When working on the road, even while traveling, the employee is paid his normal salary. The time an employee spends on a business trip is not taken into account when calculating vacation or sick leave benefits, including the average earnings paid for this time. For employees who work in traveling conditions, the calculation of vacation and sick leave benefits occurs differently. The salary that was accrued to the employee during trips is taken into account when calculating vacation and sick leave payments.

All amounts paid to employees as daily allowances or compensation (travel and accommodation) should not be included in income taken into account when calculating vacation pay. Moreover, both in the case of a business trip and during traveling work. The same rule applies when calculating sick leave benefits and maternity benefits. This is due to the fact that such payments are not paid to the employee for his work (Read also the article ⇒ Compensation for business trips).