Key points when changing salary

Salary is the unchangeable part of the salary. Usually for different categories of employees it is established by a separate order of the director of the company, fixed in the staffing table and then remains unchanged for a certain period of time.

However, due to any circumstances, the management of the enterprise may decide to increase or decrease the salary - the law does not limit the employer’s right in any way.

The only condition that must be met is to notify those employees who are affected by the salary change in advance and in writing.

If the employee agrees with the proposed salary, it is necessary to conclude an additional agreement with him.

The salary can be changed as often as you like, the main thing is that it is not lower than the minimum wage established by law. A change in salary can affect both a group of employees and a particularly distinguished employee, while the size of the change is also strictly individual.

Procedure

Any changes in salary, both up and down, must be properly documented by the employer. The salary may increase in two cases :

- the employee is transferred to a higher position with a higher salary;

- the employer decided to increase wages.

In the first case, the transfer to a new position and the change in salary occur simultaneously. The parties sign an additional agreement specifying the new position and salary. Based on the agreement, the employer issues an order to transfer the employee to a new workplace, which is recorded in the employee’s work book. Read about how to draw up an additional agreement when changing your position here.

If the position remains unchanged, but the employer decides to increase wages, then an order about this is issued and changes are made to the staffing table. An additional agreement is signed with employees whose wages increase .

When organizational and technological working conditions change, workers' salaries may be reduced.

The salary cannot be less than the established minimum wage, as this would be a violation of Art. 133 of the Labor Code of the Russian Federation (LC RF).

To reduce the salary, the employer must do the following::

- Draw up an order to make changes to the staffing table, of which the organization’s employees must be notified against signature.

- Employees must be familiarized with the upcoming changes 2 months before their introduction at the enterprise (Article 74 of the Labor Code of the Russian Federation).

If an employee is not satisfied with the changed salary, then the employer must offer him another available vacant position (Article 74 of the Labor Code of the Russian Federation). If the employee refuses the proposed changes, then the contract with him may be terminated. - If, upon reviewing the order on changes to be made to working conditions, the employee refuses to sign, then the employer must draw up a statement of refusal.

- If no claims are received from employees, then the employer enters into an additional agreement with them to the TD to reduce the salary.

The procedure for changing salary

In most cases, a proposal to increase the salary of a particular employee of an enterprise is made by his immediate superior, who writes a memo to the director of the company indicating the reasons for such a recommendation.

Further, on the basis of this note, the manager issues an order to change the salary, which reflects all the conditions for increasing or decreasing the salary, indicates the employee who is affected by this change, and also appoints the persons responsible for the execution of this order (as a rule, this is a personnel officer and an accountant).

Then adjustments are made to the current staffing table and an additional agreement is concluded with the employee.

For what purpose is an additional agreement to change the salary drawn up?

An employment contract is a document that regulates the working relationship between an employer and an employee. It specifies the conditions under which the employee begins work and the obligations regarding the provision of a workplace and payment for work by the employer. The requirement to indicate in the contract the size of the employee’s salary is mandatory (Article 57 of the Labor Code of the Russian Federation). If its size changes (up or down), the change in salary in the employment contract must be accompanied by the signing of a separate document indicating the current amount of remuneration for labor. For this purpose, an additional agreement to the employment contract on changing the salary for 2020 is being drawn up. We provide a sample of what the additional agreement to the employment contract on changing the salary looks like below.

Most often, we are talking about salary as a constant part of earnings. A documented and signed addition to the employment contract regarding the change in salary means that the amendment occurred by agreement of the parties, that is, with the consent of the employer and employee.

Main nuances when drawing up an agreement

The agreement form does not have a unified form and, like an employment contract, can be formed in any form or according to a template developed for this type of paper within the company and approved in its accounting policies. However, at the same time, in form and structure it must comply with certain standards of office work, and in text and content - with the rules of the Russian language.

In addition, there is a number of information that must be indicated in the document:

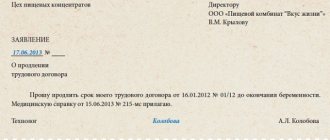

- The form must include the name of the employing company, position, full name of the employee, number and date of the employment contract to which this additional agreement relates.

- Further in the text of the document, you should indicate the fact of reaching an agreement, the reasons for changing the salary (if desired or as necessary), and also reflect point by point all the changed conditions (here you must enter the new salary amount).

- You should also be sure to write down the date on which these changes come into force, and also note that this agreement serves as part of the employment contract.

Salary reduction

An additional agreement on a salary reduction is a document that is rarely drawn up. But sometimes an organization may need to reduce the salaries of individual employees. This situation is most often associated with financial difficulties in the enterprise. Regardless of the reason for the reduction in the worker’s salary, a sample additional agreement on salary changes must be drawn up and signed.

We offer you a free additional agreement to the employment contract on salary changes.

A reduction in rate is a significant change in the contract, so the director must inform the employee about this in advance. If the employee refuses to work under the new conditions, the employment contract with him may be terminated.

If a citizen agrees to work subject to a reduction in wages, his consent must be recorded. For this purpose, a sample additional agreement on salary changes will be drawn up.

What to pay attention to when registering

The law does not impose any special requirements on the content of the document or its execution, so an additional agreement can be drawn up on an ordinary A4 sheet or on company letterhead. It is permissible to write the agreement either by hand or print it on a computer (the second option, of course, is much more convenient).

The main condition is that the document bear “live” signatures of both parties (the use of facsimile autographs, i.e. printed in any way, is completely unacceptable).

It is necessary to certify the form using a seal or stamp only if this norm is established in the internal regulations of the company (from 2021, legal entities may not use stamps when endorsing their documentation).

The agreement is always printed in two copies , one of which is handed over to the employee, the second remains with the employer.

How to draw up an additional agreement to an employment contract on salary changes

When an additional agreement to an employment contract is drawn up, it must include three parts - an introduction, a main text part, and a concluding section.

The text part of the additional agreement may include not only information about changes in the amount of remuneration, but also other information. Therefore, the company does not need to draw up several additional agreements at once; all information can be included in one document.

The introductory part should contain all the necessary information in a concise form. This reflects the legal grounds that allow changes to be made to the employment contract.

In this part of the additional agreement, the following information must also be recorded:

- Date and place of signing of this agreement.

- Complete information about the parties to the labor relationship, allowing them to be identified.

- A position held by an employee of a company.

It is important to remember that the additional agreement must contain the same number of parties to the employment relationship as are stated in the primary employment contract. If this information is inconsistent, then even a signed agreement may be considered invalid.

This part also defines the date from which the additional agreement comes into force. This point cannot be omitted, since it allows you to determine from what moment the employee’s new wage rate begins to apply. Often this date can be the first day of the current or next month.

The introductory part should end with a reference to the order to change the amount of remuneration.

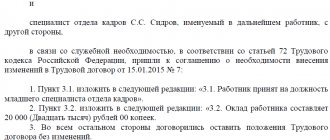

The main part of the additional agreement includes information that is adjusted in comparison with the previously issued employment contract.

Attention: here it is necessary to describe in detail the clauses of the previously signed contract to which changes are made. That is, it is necessary to record the number of the item, subitem, etc.

Information can be excluded altogether, replaced or supplemented. The following is information that will apply in the future.

It must be remembered that all digital values must be recorded using Arabic numerals.

When a salary change is made, first the section of the contract that will be replaced is written down, then the new value is entered.

The final section should contain the following information:

- For legal entities - the full name of the company, its registration codes, as well as the legal address and the address of the location of the facility.

- For an employee, his full name, details of a document allowing him to identify this person, and residential address are reflected.

Attention: a seal on the additional agreement must be affixed in cases where the constituent documents provide for its use. In this part it is necessary to provide for the existence of copies of the agreement and where they will be stored.

The employer’s letterhead must also contain a note indicating that the employee received his copy of the supplementary agreement.

Sample additional agreement on salary changes

However, a reduction in wages cannot be dictated solely by the desire of the employer. It should be due to changes in organizational or technological labor criteria, for example, changes in technology and production technology, improvement of jobs based on their certification, structural reorganization of production, and should not aggravate the employee’s position in comparison with the criteria of a collective contract or agreement (clause 21 Resolution of the Plenum of the Armed Forces of the Russian Federation dated March 17, 2004 No. 2).

Conditions for personal allowance

The Employer and the Employee entered into an Additional Agreement. After some time, the Employer incurred arrears in wages due to financial problems, including arrears in paying bonuses. Currently, the company is bankrupt, and the bankruptcy trustee is going to challenge the clause in the agreement establishing the premium. Is the payment of a personal bonus mandatory if an agreement is concluded between the parties, since the payment of the bonus is essentially of an incentive nature and is paid at the discretion of the Employer? What judicial practice confirms this?

Personal bonuses, as an element of remuneration, are established at the initiative of the organization. Therefore, the need to maintain the employee’s bonus in this case must be assessed by the employer; current legislation does not regulate this issue.

Increase in rate: drawing up a sample additional agreement on salary increase

Now let's talk about when an additional agreement to an employment contract on a salary increase is necessary.

With financial well-being, the organization can change the salary of one or more employees upward. Such an action must be accompanied by the inclusion of relevant information in the contract. It goes like this.

- The employee’s immediate supervisor submits a memo to the company director requesting an increase in salary. It should justify the reasons for this need.

- If a positive decision is made, the director signs an order to change the staffing table. Namely, points that relate to salary.

- Based on the amended staffing table, an additional agreement is signed to increase the salary.

We invite you to familiarize yourself with what an additional agreement on a salary increase looks like.

A sample additional agreement on salary changes is signed by both parties.

How to formalize additional payments and salary increases established at the initiative of the organization?

So, following part. As an example, let’s consider a situation where, for employees with higher qualifications, the management of an enterprise sets a premium for high professionalism and skill, while keeping the staffing table unchanged. In this case, how can we legally formalize this fact and labor relations? We emphasize that in this case, at the request of the part-time worker, an entry can be made in the work book stating that he worked under the second contract. In cases where the combination occurs in the same profession or position specified in the employment contract, we can talk about expanding service areas or increasing the volume of work. Specific figures for surcharges for hazardous work are discussed in the articles of the Labor Code; the latter is even referenced in the sample order provided. However, only the minimum is stated there. The specific employer decides how much extra to actually pay.

Is an additional agreement necessary when indexing wages?

The law obliges employers to carry out periodic indexation of wages (Article 134 of the Labor Code of the Russian Federation). At the same time, the absence of provisions on its implementation in local documentation does not relieve the employer of this obligation (see the definition of the Constitutional Court of the Russian Federation dated June 17, 2010 No. 913-О-О, letter of Rostrud dated April 19, 2010 No. 1073-6-1). Rostrud, in its report for the 3rd quarter of 2021, calls on supervisory and judicial authorities to force employers both to pay indexation and to adopt the corresponding local act.

If the level of wages increases as a result of indexation, 3 situations are possible:

- The condition for increasing wages in connection with indexation was initially provided for by the TD. In this case, drawing up an additional agreement each time a salary increase is not required; it is enough to issue an appropriate order and familiarize employees with it.

- The indexation clause is not contained in the TD in principle and is not included in the next additional agreement on salary changes. In this situation, an additional agreement is drawn up every time after a salary increase.

- The indexation clause was not contained in the original version of the TD, but was included in the next additional agreement. In this case, the conclusion of a new additional agreement after each indexation is no longer required.

Additional agreement to the employment contract; it is a replacement payment according to the average

Rules approved by the Decree of the Government of the Russian Federation of April 16, 2003. No. 225, section 3 of the Annotation, approved by the resolution of the Ministry of Labor of the Russian Federation of October 10, 2003. No. 69). Premature termination of work An employee has the right to prematurely resign from temporary replacement of professions (positions), and the employer has the right to cancel the assignment to perform work ahead of schedule.

We warn the personnel officer. An additional agreement must be concluded with an employee temporarily replacing another. 1st order is not enough. If several employees are entrusted with fulfilling the obligations of a temporarily absent employee, the amount of additional payment may be similar for all or may vary depending on the amount of additional work assigned.

Dear readers!

We describe typical ways to resolve legal issues, but each case is unique and requires individual legal assistance.

To quickly resolve your problem, we recommend contacting qualified lawyers on our website .

Additional agreement for additional payment for additional work

For this replacement, an additional agreement to the employment contract is concluded based on the employee’s application.

1. Please explain whether we must enter into an additional agreement with an employee when assigning him additional payment for an additional amount of work (vacation, sick leave for another employee), while his main job function does not change, or issuing an order for additional payment is enough, employees work at an effective agreement. 2. Is it necessary to notify the employee about the start of vacation or is it enough to have a vacation order? We issue a vacation order 2 weeks before it starts; the organization has a vacation schedule approved by the manager. Thank you

Dear readers!

We describe typical ways to resolve legal issues, but each case is unique and requires individual legal assistance.

To quickly resolve your problem, we recommend contacting qualified lawyers on our website .

Sample order for a personal salary increase – Advisor

The organization determines the procedure for paying the bonus independently in its local documents in the employment or collective agreement, in the regulations on bonuses, etc. If there is no clear procedure for calculating the bonus in the manager’s employment contract, then the corresponding clause should be added to the contract. Otherwise, disputes with the director may subsequently arise. You can add rules for calculating bonuses to an employment contract by concluding an additional agreement with the manager.

Personal allowance (PN) is an additional incentive payment. The employment contract (additional agreement) specifies the amount. changes to the employment contract through an additional agreement.

Is it necessary to draw up an additional agreement and why?

Information on the amount of remuneration in an employment contract is one of the most important terms of the agreement, without which the contract may be considered inappropriately executed.

Important! Simply issuing an order to change employee benefits in a company is not enough. First, you need to reflect changes to the employment contract regarding salary changes in an additional agreement or draw up a new contract with the employee.

What exactly needs to be done is decided by the company administration in consultation with the employee. If you only need to change the salary, and all other conditions remain the same, it is recommended to draw up an additional agreement to the contract previously concluded with the employee.

When changes involve making significant adjustments to the old contract, it would be best to renew the new employment contract.

Only after this can management issue an order to increase wages, and the accountant will be able to accrue remuneration based on the new wages for employees.