What is part-time work

The law contains the term “part-time work.” This means that a person has two jobs: the main one and the additional one. He does extra work in his free time - after work or on weekends. For example, he works for one company as a marketer, and on weekends he sets up advertising in an agency.

You can also combine them within the same company. For example, from 9 to 18 an employee works as an administrator, and from 18 to 19 as a cleaner.

The main condition is to work part-time outside of working hours and no more than 4 hours a day. If the administrator is obliged to wash the floors during the working day, then this is no longer a part-time job, but a combination of responsibilities. More on this later.

Is an employee obliged to inform the employer about opening an individual entrepreneur?

Any employer wants to get high-quality work done from its workers for a minimal fee. Therefore, if he knows that his employee has opened an individual entrepreneur, this is unlikely to make him happy. For him, this will mean that the employee’s productivity will decrease, since the new entrepreneur will now have to direct his efforts not only to his main job, but also to his own business.

Important! Nowhere does it say that official employment is an obstacle to running your own business (with the exception of certain positions). Also, no one obliges a part-time businessman to notify his boss that he has founded an enterprise. It would be in the interests of the new IP to remain silent about this.

However, before starting a business, you need to think through everything: determine approximately how many hours a day you will have to devote to it, whether you will need to leave your workplace. It will be more convenient to combine your business and your main job with a free schedule or shift work than with a five-day work week. If the business takes off, profits will be stable and growing, you will be able to devote all of yourself to a new endeavor, and finally leave official employment.

Attention! The employer will not be involved in making an entry in the work book about the start of entrepreneurial activity of one of his workers; this does not concern him in any way, and this is not within his powers. An individual entrepreneur should also not create a work book for himself, but only for his workers. Information about the beginning and end of entrepreneurial activity is already contained in the state register of the Unified State Register of Individual Entrepreneurs.

When is a part-time job suitable?

In reality, there are not many situations when part-time work is suitable. This is rather a term from the past: it is in labor legislation and old-school accountants love it. Here are the cases when it is beneficial to use it.

There is a part-time vacancy, but the desired candidate is already working elsewhere.

This usually applies to simple work for two to three hours. For example, you need a cleaner to clean your office morning and evening. It is convenient to hire a woman who works as a cleaner in other companies.

Quickly replace another employee.

For example, the hotline person on duty suddenly quit or took a long sick leave. While you are looking for a replacement, you can ask the administrator to do his job part-time. It is important that this employee is able to work outside of regular working hours.

Signs of a part-time job

Chapter 44 of the Labor Code of the Russian Federation is devoted to part-time work . This is the performance by an employee of other paid work in his free time from his main job. An employment contract for part-time work is concluded with such an employee.

You can work part-time within one organization ( internal part-time job ), that is, the main employer and part-time employer will be one company or individual entrepreneur. External part-time work is also permissible , when, in addition to the main place of work, an agreement is concluded with one or more employers.

So, part-time work has the following characteristics:

- Performed in free time from main work.

- It is regular and paid.

- It is carried out on the basis of an employment contract, which must indicate that this is a part-time job.

Other options for registering a part-time employee

In addition to part-time work, there are other registration options: part-time work, civil contract (CLA) or part-time work.

The scheme is like this:

If the employee does not work anywhere else → part-time.

If he does additional work during his working hours → combination.

If you need to perform one specific task → GPA.

Part-time.

If the employee has no other place of work, he is given a part-time job and a regular employment contract is concluded. Part-time work is not suitable in this case, because the person works nowhere else. And if you register this as a part-time job, you can get a fine.

By combination.

This mode of work is similar to part-time work, but in this case the person performs additional duties not in his free time, but during his working day.

For example, an administrator takes on the role of a cleaner and mops the floors during her shift. Or an accountant takes on more work and runs another holding company, but at the same time works the same from 9 to 18.

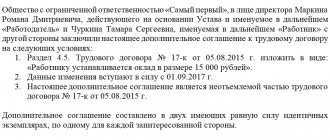

The combination can only be issued for an employee from his own company. There is no need to conclude a new employment contract; it is enough to sign an additional agreement and agree on additional payment for new responsibilities.

Civil contract

. This is an agreement with an individual to perform specific work, for example, writing an article or laying out a website. When working under the GAP, you do not register an employee on the staff, you do not have to pay contributions in connection with maternity, and also vacation and sick leave. You will only have to pay personal income tax, contributions to compulsory medical insurance (5.1%) and compulsory health insurance (22%).

True, the tax office closely monitors such agreements. To prevent it from being equated to labor, it is imperative to indicate a specific amount of work, results, deadlines and a fixed amount of remuneration. For example, to design a website by February 21, 2021 for 20,000 rubles.

For regular work such as an administrator or accountant, this option is not suitable.

Paying taxes

What happens when a person is officially employed, but at the same time takes up entrepreneurship? He receives a salary at his place of work, and the organization also pays all the necessary contributions to the funds for him. At the same time, the entrepreneur himself transfers fixed insurance and pension payments. There is some duplication, but it is impossible to change this situation.

There is only one option to reduce payments. By agreement with the employer, you can terminate the employment contract, and for the same scope of activity enter into an agreement with him as an individual entrepreneur.

Additional Information! This can be done if there are suitable areas among the available OKVEDs. You can also add them, the procedure will not require additional payment.

It may be beneficial for an employer to accept such an offer. After all, he not only pays salaries, but also pays almost 50% additionally in the form of taxes and contributions. You can draw up an agreement with an individual entrepreneur, increasing direct payments so much that he receives at least 30% more and has enough to pay 6% of the simplified tax system and remain in the black.

However, this option is legal only if certain conditions are met:

- An entrepreneur receives money for performing a certain amount of work.

- There is no job description.

- There are no mandatory hours in the office.

- Vacations and sick leave are not paid.

- The individual entrepreneur does not bear financial responsibility and works with other contractors.

Specific conditions must be carefully discussed with the employer before terminating the employment contract. If, in fact, there is an employment agreement, it cannot be disguised by passing it off as other forms.

Difference between part-time and combination

Part-time and combination are different concepts.

Part-time job

- outside of working hours and with any person who has a main job. It doesn't matter if it's in your company or someone else's.

Combination

- only with your employee and during regular working hours.

If the administrator washes the floors instead of the cleaning lady after his working day, this is a part-time job; if during a shift, it’s a part-time job.

Therefore, if an employee already works for you, it is easier to choose a combination. But if new responsibilities do not fit into the main working day or the employee works in another company, part-time work remains.

Who cannot be registered as a part-time worker?

Employees who do not have another official job.

Employees who perform additional duties during their regular working hours.

Persons under 18 years of age.

Drivers, pilots, if they do the same job part-time.

All civil servants - officials and military.

Workers with harmful and dangerous working conditions, if they also have the same conditions.

How is part-time work paid?

The main thing to remember when calculating part-time wages is that a part-time worker is the same employee as everyone else, he just works part-time or part-time, depending on his work schedule.

Remuneration for part-time workers is calculated on a general basis, taking into account all additional payments, bonuses, coefficients and allowances that are due to main employees.

For example, those performing work in the Far North and similar areas are entitled to a bonus for working conditions - this bonus also applies to part-time workers.

Back to contents

Part-time salary

The specifics of calculating wages for a part-time worker are regulated by Article 285 of the Labor Code of the Russian Federation. As a rule, part-time workers are paid based on hours worked. Therefore, the minimum wage for part-time workers is lower than for main workers, even taking into account all the bonuses, incentives and allowances. For civil servants, a part-time working day cannot exceed four hours.

Nevertheless, sometimes it happens in enterprises that a part-time worker receives a salary equal to the salary of the main employee and even exceeding it. This is a rather risky move on the part of the administration, since the main workers, receiving wages according to the payroll, may be outraged by this state of affairs and complain to the State Labor Inspectorate about wage discrimination.

Theoretically, this should not happen, because a part-time worker works half as much as the main employee, and under the same conditions, according to the law, remuneration should be carried out equally for everyone. At the same time, the Labor Code provides for the possibility of setting wages for part-time workers not according to the number of hours worked, but according to other conditions. For example, by the number of production units assembled; by the quantity of goods sold; by volume of services sold.

Thus, for half a working day, a part-time worker with higher qualifications, better skills and greater efficiency can earn more than the main employee. If this point is stipulated in the employment contract, the employer has the right to pay a part-time worker greater amounts than the main employees of the enterprise receive - the law will not be violated, and the labor commission inspector will not have any questions for you.

Back to contents

Advance for part-time workers

Since a part-time worker, as we have already found out, is practically no different from the main employee, he receives wages in the same way as everyone else. If all employees of an enterprise receive wages and an advance, exactly the same provision applies to a part-time worker - he receives cash at the same time as the main employees. Advance payments - usually forty percent of wages - must also be specified in the employment contract.

Back to contents

Minimum wage for part-time work

Since a part-time worker has all the rights and social guarantees of an ordinary employee, the provisions on the minimum wage (minimum wage) also apply to him - according to the Labor Code, the employee cannot receive less than this amount. At the same time, the legislation stipulates that the minimum wage is established subject to fully worked working hours; accordingly, a part-time worker who has worked half the established working time during the billing period receives half the minimum wage for part-time workers.

If a part-time worker has worked a quarter of the established working hours, he receives a quarter of the minimum wage, and so on. At the same time, when calculating wages taking into account all allowances and coefficients, the amount may be less than the minimum wage.

For example, from January 1, 2021, the minimum wage per month is 9,849 rubles. Your part-time worker works at a quarter of the rate, a quarter of 9849 rubles is 2462 rubles. After making all the calculations, the amount you must pay to your part-time partner is 2,187 rubles - that is, it turns out to be below the established minimum. What to do in this case? The law provides for additional payment up to the minimum wage for part-time workers. That is, the employer pays an additional 275 rubles to the part-time worker from the above example to get the minimum wage.

Was the information interesting or useful?

Yes483

No64

Share online

How to register a part-time worker

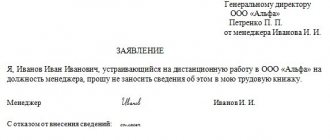

The procedure is as follows:

1. Ask to see your passport. If necessary, you can request a diploma.

2. A work book is not needed for registration; it is kept by the main employer. It is not necessary to make an entry in it, only if the employee asks.

3. You enter into a part-time employment contract. It is similar to the usual one, but it is important to clearly state two points: working in this position is a part-time job for the employee; the working day is no more than 4 hours.

4. Make an order for part-time employment and notify the employee about it against signature.

If an employee is the owner of a legal entity, individual entrepreneur or mother on maternity leave, he can still be registered as a part-time employee in another company. No special documents are needed.

If the employee is the general director of another legal entity, written permission is required from the owner of the legal entity or the board of directors.

What you need to know about hiring a part-time worker for more than part time

Ivan Naumchik and Elena Voronova, experts from the Legal Consulting Service GARANT, find out whether it is possible to overcome the restrictions on working hours provided for part-time workers in a legal way.

Does a company have the right to hire an employee on an external or internal part-time basis for more than 0.5 times the rate, provided that he is employed at 0.5 times the rate at his main place of work?

Article 60.1 of the Labor Code of the Russian Federation provides for the right of an employee to enter into employment contracts to perform other regular paid work with the same employer (internal part-time job) and (or) with another employer (external part-time job) during free time from the main job.

When considering the issue of concluding an employment contract with both internal and external part-time workers, the employer must take into account the norms of Chapter 44 of the Labor Code of the Russian Federation, regulating the peculiarities of the work of part-time workers.

In particular, the employer must comply with the provisions of Art. 284 of the Labor Code of the Russian Federation, limiting the duration of working hours when working part-time. According to this standard, the duration of working hours when working part-time should not exceed four hours a day. On days when the employee is free from performing work duties at his main place of work, he can work part-time full time (shift). During one month (or another accounting period), the duration of working time when working part-time should not exceed half of the monthly standard working time (or, accordingly, the standard working time for another accounting period) established for the corresponding category of employees.

Note that this rule is common to all part-time workers, regardless of the conditions under which they work in their main job. Limitations on working hours when working part-time, established by Art. 284 of the Labor Code of the Russian Federation, do not apply only in cases where the employee has suspended work at his main place of work in accordance with part two of Art. 142 of the Labor Code or suspended from work in accordance with part two or four of Art. 73 Labor Code of the Russian Federation.

When determining the standard working time, one should be guided by Art. 91 of the Labor Code of the Russian Federation, according to which the normal working time cannot exceed 40 hours per week (the duration of daily work is 8 hours with a 5-day working week). Accordingly, for part-time workers, the working week should not exceed 20 hours.

Therefore, when working on a part-time basis, an employee cannot take more than 0.5 times the wage rate under the employment contract, even if he works at 0.5 times the wage rate at his main place of work (remember that the labor legislation does not contain a definition of the concept “rate”. Based on In the meaning usually given to this term, full-time work is considered to be work in a position during normal working hours).

Within the meaning of labor legislation, an employee can only enter into one employment contract at his main place of work. However, the maximum permissible number of simultaneously valid employment contracts for part-time work is not limited by law (part two of Article 282 of the Labor Code of the Russian Federation), that is, there is no prohibition on concluding several employment contracts for part-time work (both internal and external).

As indicated by the courts (see, for example, resolutions of the Federal Antimonopoly Service of the North-Western District dated 06.08.2009 N A13-11107/2008, the Twelfth AAS dated 12.12.2013 N 12AP-10991/13, FAS North Caucasus District dated 04.08.2014 N F08- 1524/14 in case No. A20-2704/2013), the possibility provided for by the Labor Code of the Russian Federation for an employee to conclude several employment contracts for part-time work indicates his right to independently manage his time, determine the duration as working time depending on the number and conditions of concluded employment contracts, as well as time for rest (at the same time, we note that for certain categories of employees there are restrictions on concluding employment contracts for part-time work: for example, for heads of organizations it is necessary to obtain the consent of the employer at the main place of work (part one of Article 276 of the Labor Code of the Russian Federation), and for workers employed in harmful or dangerous working conditions, part-time work in the same conditions is completely prohibited (part five of Art. 282 Labor Code of the Russian Federation)).

Consequently, employees have the right to enter into several employment contracts for part-time work, both with their own and with other employers. At the same time, the restrictions on the duration of working hours when working part-time, established by part one of Art. 284 Labor Code of the Russian Federation.

Unfortunately, the law does not make it possible to unambiguously determine whether these restrictions must be observed within the framework of each part-time contract, for all such contracts with one employer, or in general for all contracts for external and internal part-time work.

Based on the definition of part-time work given in Art. 282 of the Labor Code of the Russian Federation, part-time work is recognized as work under each employment contract in free time from the main job. In our opinion, this means that the restrictions on working hours established by part one of Art. 284 of the Labor Code of the Russian Federation must be applied separately to each part-time employment contract, and not to all part-time employment contracts concluded by the employee in the aggregate. In other words, a part-time worker cannot work under one contract, for example, 6 hours every day, but can enter into two contracts to work for 4 hours and 2 hours a day, respectively. This point of view is also shared by specialists from regulatory authorities (see, for example, the answers from the Rostrud information portal “Onlineinspektsiya.RF” to the questions “I work officially: 1) company A is the main place of full-time work with an 8-hour working day; 2) company B - external part-time job at 0.5 rate with a 4-hour working day; 3) company B - external part-time job at 0.5 rate with a 4-hour working day. Is this correct?..” (March 2021), “Does legislation limit the duration of work of external part-time workers?..” (September 2015)).

Since labor legislation does not contain norms that directly confirm or refute such a conclusion, the interpretation of the first part of Art. 284 of the Labor Code of the Russian Federation may be different. However, in judicial practice there are no examples where the question of the legality of bringing an employer to administrative liability for using the labor of a part-time worker in excess of the working time limit in the amount of several contracts is considered.

Thus, in our opinion, the law does not prohibit an employee from concluding several part-time employment contracts (including with the same employer), provided that for each of them the employee will work at no more than 0.5 times the rate. Therefore, if the employer has a need for a part-time employee to work for more than half the rate, he should conclude with him an additional one or more employment contracts (also part-time), each for no more than 0.5 times the rate.

In addition, you should pay attention to the fact that if an employee has several employment contracts for part-time work for a period of time exceeding the amount limit established by Art. 284 of the Labor Code of the Russian Federation, is the object of close attention from the FSS of Russia. Representatives of the Fund often qualify this state of affairs as the creation of an artificial situation in order to obtain funds to pay benefits to this employee in an inflated amount. Courts, as a rule, recognize that the mere existence of several employment contracts for part-time work, the duration of working hours for each of which does not exceed 4 hours a day, complies with the requirements of Art. 284 Labor Code of the Russian Federation. At the same time, this circumstance, together with other factors, may indicate the employer’s dishonesty as an insurer. When it is proven that part-time work existed only on paper, in fact the work under the employment contract was not performed or could not be performed because the total working time exceeded a reasonable limit, there was no physical opportunity to complete the amount of work under all contracts, the court sides with the representatives of social insurance (see, for example, resolutions of the Presidium of the Supreme Arbitration Court of the Russian Federation dated July 19, 2011 N 282/11, FAS of the West Siberian District dated March 27, 2012 N F04-1045/12, FAS Volga-Vyatka District dated May 5, 2012 N F01-864/12).

The GARANT system will help you get acquainted with the texts of the documents mentioned in the experts’ response without spending a lot of time on independent analysis.

Who pays vacation pay, sick leave and maternity pay?

Employers pay contributions for part-time workers and provide a social package.

Vacation.

A part-time worker goes on vacation in all places of work at the same time. The employer at the second place of work is obliged to let him go, even if he has not yet worked for 6 months. In this case, leave is given in advance. Both employers pay vacation pay.

Sick leave.

If a part-time worker gets sick, he receives sick leave at all places of work, even if there are ten of them.

Decree.

You can go on maternity leave in all places of work at the same time, if the employee has worked in at least one for more than 6 months.

Maternity benefits are provided by each employer, while child care benefits are paid by only one employer - at the mother's choice. The Social Insurance Fund reimburses companies for these payments.

Requirements and restrictions for registering as an individual entrepreneur

Article 18 of the Civil Code of the Russian Federation talks about your right to engage in business if you are a citizen of Russia, of legal age and legal capacity.

And even lack of citizenship or young age can be circumvented by going through a bureaucratic obstacle course. There are also direct prohibitions. Entrepreneurs cannot be:

- state and municipal employees;

- lawyers and notaries;

- deputies;

- law enforcement officers.

How to fire a part-time worker

The rules for dismissal are almost the same as for a regular employee: the easiest way is to dismiss at your own request. If a person does not want to leave, he can be laid off or fired for absenteeism - this is more difficult: evidence must be collected and documents drawn up. The conditions are the same as in the labor code for ordinary dismissal.

There is an additional reason for a part-time worker: he can be fired if a main employee is hired for this position. This kind of forced dismissal is the easiest to formalize.

The procedure is as follows:

1. Give the employee written notice 14 days before termination. As a reason, indicate that you hired an employee for whom this work will be the main one.

2. Pay the employee for wages and compensation for unused vacation, if applicable.

3. Make a standard dismissal order. The employee must sign it on the last working day.

Labor Code: part-time work

Employees may be busy performing their duties only part of the working day .

Payments are made in proportion to the time worked or the amount of work completed . Otherwise there are no restrictions.

This regime is established initially by agreement. Either the working hours are reduced or the number of working days in the week is reduced .

Part-time work may be established by special order of government bodies for certain categories of workers :

- for a pregnant woman,

- a parent whose child is under 14 years old,

- the child is disabled and under 18 years of age, the employer, at the request of the employee, must agree to part-time work for such an employee,

- who has family members who need constant care. The need for such care is confirmed by a medical report.

Therefore, the Labor Code even obliges the employer to establish part-time work for some employees .