Preparing for a business trip

Before arranging a business trip, it is necessary to check whether the seconded employee does not belong to the category of persons who, in accordance with the labor legislation of the Russian Federation, are prohibited from being sent on a business trip.

Even with their consent, you cannot process business trips for pregnant women and teenagers under 18 years of age (except for certain categories - artists, athletes, etc.).

It is also worth considering that some employees have restrictions when sent on a business trip. Therefore, written consent must be obtained from them. This:

- women with children under 3 years of age;

- single parents and guardians with children under 5 years of age;

- persons with disabilities, if this conflicts with their rehabilitation program;

- foreign citizen or highly qualified specialist (special features must be taken into account);

- persons who have entered into a student agreement with the employer;

- candidate for elective office;

- other categories.

In the absence of written consent, the employer cannot insist on sending such an employee on a business trip.

Business trip abroad: rules 2021

If an employee goes abroad and for a foreign business trip he needs to obtain a foreign passport and pay a visa fee, then the sending organization must compensate for these expenses. In this case, the advance can be issued in rubles or foreign currency. If an employee received an advance in rubles and independently exchanged currency, it is important to save and attach a certificate from the exchange office to the advance report. Changes in exchange rates on the date of exchange and the date of approval of the report may affect the reimbursement of travel expenses. Without a certificate indicating the purchase and sale rate, recalculation into rubles will be carried out at the rate current on the day the advance report is approved, and, depending on the economic situation, the amount due for reimbursement may decrease.

As already mentioned, increased daily allowances are required for trips abroad. The days during which daily allowances are accrued at an increased rate are limited by marks of crossing the state border. In accordance with the Decree of the Federal Tax Service of Russia for the city of Moscow dated 08.08.2008 No. 28-11/074505, in the case when the accounting department does not have a traveler’s international passport, the basis for calculating the daily allowance is the manager’s order to go on a trip, a printout or photocopy of the ticket or boarding pass and invoice for hotel accommodation. If there is a long way to go from the border or the business trip continues for some time on the territory of the Russian Federation, then the remaining days are paid at the domestic rate. It is important that all supporting documents in a foreign language are attached to the expense report with a line-by-line translation into Russian.

Business trip arrangements: documents

What documents should I start with and how to arrange a business trip?

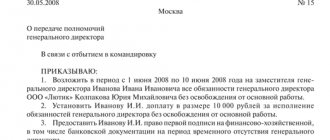

First of all, an order from the manager is needed. For example, this could be an order to send an employee on a business trip. There is no specifically approved form. You can use the unified form T-9 or T-9a (if you are sending several workers).

Currently, travel certificates and official assignments legally abolished . However, the employer, by virtue of Part 1 of Art. 8 and para. 7 hours 1 tbsp. 22 of the Labor Code of the Russian Federation, by internal regulations, can establish its own documents, which must be prepared when registering a local business trip or a foreign business trip. This could be a memo, a report on the results of a business trip, etc.

Another document that must be filled out is a time sheet . The report card is filled out on the basis of a signed order to be sent on a business trip. It must contain the letter code “K”. The duration of time in this case is not indicated.

As a rule, a business trip for 1 day is not issued , because if the employee managed to return to his place of work on the same day, such a trip is not considered .

What is a business trip

Some types of work may require employees to travel long or short distances that are directly related to the performance of core job duties.

According to Art. 166 of the Labor Code of the Russian Federation, a business trip is any departure of an employee during working hours outside the enterprise related to the performance of work tasks. The minimum duration of a business trip can be one working day, but the maximum is not limited. The duration of a business trip is determined by the need to complete the assigned task, taking into account its complexity and volume. The employer must formally formalize the departure of employees on business trips, defining their goals and objectives in advance. On long-term business trips that involve leaving their hometown, employees are entitled to a daily allowance—additional funds for living expenses. They can also count on compensation for travel expenses and rental housing.

It is important to understand the differences between a business trip and a job that requires constant travel. Let's present the similarities and differences in the form of a table:

| Signs | Business trip | Traveling work |

| Number of trips | One-time, up to several times a year. | Permanent. |

| Regulatory norms of the Labor Code of the Russian Federation | Articles 166 - 168 of the Labor Code of the Russian Federation. | Part 2 Art. 57 (in the area of concluding an employment contract); Article 168.1 of the Labor Code of the Russian Federation. |

| Travel region | Any. | Any, prescribed in the employment contract. |

| Nature of work | Performing specific individual tasks or instructions from the employer. | Carrying out basic job duties. |

| Payment | Based on average daily earnings. | Salary, rate (conditions contain the employment contract). |

| Decor | Special order (instruction) of the head. | The procedure is regulated by the employer in local regulations. |

| Travel reimbursement |

|

|

| Reimbursement Options | In accordance with the supporting documents attached to the advance report. | According to local regulations:

|

| Supporting documents |

| In accordance with local regulations or an advance report. |

Business trip advance

The posted employee must receive an advance payment to cover travel expenses. It is issued for expenses related to living outside the home. The employee can also be provided with money for travel and hotel expenses.

As a rule, an advance is issued on the basis of an estimate or preliminary calculation or a written application from the employee. The forms of these documents and the procedure for registering an employee’s business trip are also approved in local regulations.

The advance is issued taking into account:

- duration of the business trip;

- established daily allowance limit;

- who buys the ticket and pays for the hotel - the employee or the company.

When making business trips abroad, an advance can be issued in the currency of the country of travel.

An advance can be issued for a business trip in one day, for the preparation of documents, payment for notary services, and the purchase of materials.

Business trip on a day off: paperwork, 2020

It happens that an employee has to start a work trip on weekends or holidays. For example, leaving early in order to spend a full working week at the destination, necessary to solve the task. In such situations, increased pay is due for working on weekends or, at the employee’s request, he is granted leave on any other day of the year, according to Art. 153 Labor Code of the Russian Federation. This is also true if you are returning on a weekend. Travel and other travel expenses are reimbursed according to the usual rules.

Change of business trip

In connection with changes in the plans of management or contractors, as well as for other reasons, the question arises - how to formalize an extension (change) of a business trip. So: business trip dates can be changed, extended, or the business trip can be completely cancelled.

In the event of a change in the timing of a business trip, employees from whom consent must be obtained by law are also asked to agree to change or extend the timing of the business trip.

An order must also be prepared , with which the business traveler must be familiarized.

If, due to production needs, the employee must return earlier than the planned date, then he should be recalled from the business trip. How to properly write a review from a business trip?

The recall procedure is not regulated by labor legislation. However, in practice, the company independently develops the procedure for processing business trips and recalls. It is possible to provide for the issuance of an appropriate order , reflecting in it the manager’s decision to change/reduce the duration of the business trip and the early return of the employee. In the future, this will make it possible to amicably resolve issues with penalties for returning/exchanging tickets, canceling hotel reservations, etc.

If there is a manager’s decision, formalized by order, all fines for cancellation of tickets and hotels are paid by the employer . If the employee is at fault for changing the travel dates, the manager may decide to refuse compensation for such penalties.

CANCELLATION OF A BUSINESS TRIP: SAMPLE ORDER

Payment of employee expenses

Expenses also include per diem, which must be paid for each day the employee is on a business trip. The procedure for determining the number of days away on company business and the procedure for calculating and paying daily allowances are determined by Resolution No. 749. The organization determines the amount of daily allowances independently, fixing it in its LNA. At the same time, according to the norms (Tax Code Article of the Tax Code of the Russian Federation), for a business trip in Russia, daily allowances in the amount of over 700 rubles and for a foreign business trip in the amount of over 2,500 rubles for each day are not included in expenses that reduce taxable profit.

The employee submits to the organization’s accounting department a report on the business trip with a list of expenses incurred and the calculation of daily allowances and confirms the expenses incurred with travel tickets, receipts and agreements on payment for rental housing and others. The main document, in accordance with Resolution No. 749, is the advance report, for which a unified form No. AO-1 has been developed.

The employee must provide an advance report within 3 days upon returning from a business trip. Otherwise, he will not be reimbursed for his expenses.

Legal documents

- Article 166 of the Labor Code of the Russian Federation

- Article 167 of the Labor Code of the Russian Federation

- Article 168 of the Labor Code of the Russian Federation

- (Tax Code Article of the Tax Code of the Russian Federation)

Returning from a business trip

How to prepare documents upon returning from a business trip?

First of all, upon returning from a trip, the employee must prepare and submit an advance report. 3 days are given for this . At the same time, the excess of the advance payment must be returned to the employer: in cash at the cash desk or deduction from wages is acceptable at the request of the employee.

For a business trip abroad, the paperwork is similar .

If was not enough , the employer is obliged to reimburse the expenses incurred on the basis of supporting documents - tickets, hotel bills, sales receipts for purchased materials, etc.

If the employee does not return the balance of the unused advance, the employer has the right to withhold this amount from the salary in accordance with paragraph. 3 hours 2 tbsp. 137 Labor Code of the Russian Federation. However, this can only be done if the employee does not dispute the amount.

Therefore, it is necessary to obtain consent to deduct from his salary. A similar position is set out in the letter of Rostrud dated October 7, 2019 No. PG/25778-6-1. If the employee does not agree with the amount of deduction, then it can only be recovered through the court.

Timesheets

During a work trip, the employee retains his workplace and receives wages. The tariff for this period is equal to the average daily earnings if the trip falls on weekdays, or double the average daily earnings if going to work on weekends or holidays. The time sheet (form T-13) must reflect the hours worked of all employees sent on business trips. Based on the order, travel days are marked in the timesheet with the letter code “K” or the digital code “06”. The length of time worked on these days is not indicated, since they are paid according to average earnings and the actual hours worked on these days are not taken into account.

If a short deadline has been allocated for completing work or assignments, but there is a lot to be done, and you have to work harder than on ordinary days, then this will also need to be reflected in the report card using the code that is adopted for this in the organization. Work will be paid at an overtime rate.

Results

We looked at how to arrange and pay for business trips, as well as changes to them. For answers to other questions on how to properly arrange and calculate a business trip, see the articles on our website:

- “How to calculate travel allowances (expenses)”;

- “Amount of daily allowance for business trips and their calculation”;

- “What are the daily allowances for a business trip abroad in 2020.”

Read also

26.01.2021

Local business trip

A business trip without leaving the locality is called a local business trip. In 2021, this process is included in the local travel log.

For a day

When making payment and going on a business trip for one day, there are no differences from long-term trips.

In accounting documentation and personnel certificates, the days presented are taken into account and paid in the same way:

- if the day falls on a working day, the employee receives his average salary at his place of work;

- If it coincides with a holiday or just a day off, then double the amount is paid.

A significant difference is that daily allowances are not paid in this case.

If a specialist goes on a business trip for up to one day abroad, then he is paid half of the average salary.

When traveling for several days, current legislation provides for mandatory compensation, which is not subject to value added tax:

- up to 700 rub. for the Russian Federation;

- up to 2.5 thousand rubles when traveling abroad, paid in the currency of the point to which the employer sends.

An employer should not leave its specialists without compensation. Of course, the law does not oblige, but it does not prohibit encouraging your employees.

The obligation to reimburse expenses is specified in internal local documents. Otherwise, this may be specified in the collective agreement.

Otherwise, the employer must issue an appropriate order for additional payment. Unlike a standard trip, the employer pays for the main expense only when traveling on a business trip.

For a one-day trip, the employer only reimburses the cost of travel. But sometimes you have to compensate for the cost of living.

An employee has the right to travel by personal transport, as well as by official transport.