Home / Labor Law / Payment and benefits / Wages

Back

Published: March 16, 2016

Reading time: 8 min

1

3977

The business trip is related to the employee’s performance of labor functions, so it is subject to mandatory payment. Certain peculiarities arise in this case if any of its days coincide with weekends.

We will determine what the payment procedure is and how the employee can be compensated for his lost day off.

- Rules for paying for business trips on weekends and holidays

- Payment procedure and calculation example

- How to take payment into account when calculating income tax?

- How to compensate an employee for a lost day off

Where does it say about payment for a business trip?

The general rules for paying a posted employee for days off are regulated by the Labor Code and the Regulations on the specifics of sending employees on business trips, which was approved by Decree of the Government of the Russian Federation dated October 13, 2008 No. 749 (hereinafter referred to as the Regulations on Business Travel).

In particular, it says how to pay daily allowances and how to pay for work if the employee was at the place of business trip on a weekend or holiday. Compose HR documents using ready-made templates for free

How to calculate daily allowance for weekends on a business trip

According to paragraph 11 of the Business Travel Regulations, per diem must be paid for each day of a business trip, including weekends and non-working holidays, as well as for days spent en route, including during a forced stop. Thus, the employee must receive daily allowance for each calendar day of the business trip, including the days he spent on the road when traveling to and from the business trip.

IMPORTANT. Each employer can set the amount of daily allowance that it considers necessary. In practice, the amount of daily allowance usually does not depend on what day it is paid for - a working day, a weekend or a holiday. This means that calculating daily allowances for weekends on a business trip is no different from calculating daily allowances for working days.

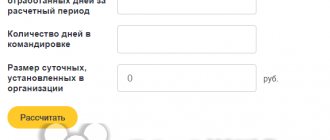

To determine how much the employee should receive, you need to multiply the amount of daily allowance established in the organization by the number of calendar days of the business trip, which starts from the day of departure and ends on the day of arrival.

The rules for determining the day of departure and day of arrival are established in paragraph 4 of the Regulations on Business Travel. The day of departure on a business trip is the date of departure of a train, plane, bus or other vehicle from the place of permanent work of the posted employee. The day of arrival from a business trip is the date of arrival of the specified vehicle at the place of permanent work. When a vehicle is sent before 24.00 inclusive, the day of departure for a business trip is considered the current day, and from 00.00 and later - the next day. The day the employee arrives at his place of permanent work is determined similarly.

Other nuances

When traveling on a business trip on a weekend, employees may have some questions.

Business trip to an institution with a different schedule for providing days off

When going on a business trip, an employee must comply with the work schedule established at the enterprise receiving him.

One-day business trip on a weekend

There is no daily allowance for a one-day trip. However, the employer can independently determine the amount of compensation. Salary in general - at a standard rate with subsequent time off or at an increased rate.

Is it possible to return to my place of residence for the weekend?

Yes, the employee can do this. This is a fairly common practice if the business trip location is close enough to your place of residence and main work. However, the employee will not be reimbursed for travel.

Impact on holiday pay

Wages of double or more are taken into account when calculating vacation pay.

Accounting for wages for travel days when determining income tax

Regulatory agencies agree that wages for days off while traveling can be classified as expenses when calculating income tax. Daily allowances are also taken into account, but as other expenses.

How to calculate average earnings for weekends on a business trip

The Regulations on Business Travel do not directly say whether it is necessary to pay the average salary for weekends or holidays on which the business trip occurred. It is only stipulated that payment for a seconded employee if he is involved in work on weekends or non-working holidays is made in accordance with the labor legislation of the Russian Federation.

Automatically calculate the salary of a posted worker according to current rules Calculate for free

However, from this general phrase we can draw the following conclusion: it is necessary to calculate average earnings for weekends and holidays only if the person was actually involved in work on these days. This means that if an employee, while on a business trip, rests on weekends and holidays, then the average salary for these days is not paid to him.

If the employer decides that the posted worker must work every day, including on weekends, then he will have to pay for work on those days that are intended for rest. Moreover, in an increased (at least double) size. Or the employee must be given a day off for each day he worked on his day off (subject to his written application). Then the work itself on a day off is paid at a single rate (Article 153 of the Labor Code of the Russian Federation).

REFERENCE. According to Article 153 of the Labor Code of the Russian Federation, work on a weekend or a non-working holiday is paid at least double the amount. Specific amounts of payment for work on a specified day can be established by a collective agreement, local regulations, or employment contract.

Taking into account the above, the rule for paying for days off on a business trip is as follows: if the employee is resting on these days, no payment is made (average earnings are not calculated). If, by decision of the management, a posted employee works on a weekend or holiday, then this day must be paid at least double the amount, or, at the request of the employee, be given a day off (then work on a day off is paid at a single rate). Please note that it is more correct to pay for “working weekends” during a business trip not according to average earnings, but based on the remuneration system established for the employee - salary, tariff rate, etc. (Article 153 of the Labor Code of the Russian Federation, clause 9 of the Regulations on business trips).

Calculate “complex” salaries with coefficients and bonuses for a large number of employees

How are salaries and daily allowances calculated?

Payment for days off on a business trip is made in any case, but it all depends on whether he worked or not, or whether he was on the road.

The employee was working

The salary of a business traveler on weekends is the same as at the main place of work - at least multiplied by 2.

But there is another option - the employee can receive as compensation not an increased salary, but a day of rest. Then his work will be paid at a single rate.

Table: payment for hourly and piecework, salary

| Piece workers | Time-paid employees | Employees with monthly salary |

| Double piece rate | Double daily or hourly rate | Single daily or hourly rate in addition to salary, subject to work within the monthly standard |

| Double daily or hourly rate subject to work in excess of the monthly norm |

The employee was not working

If an employee did not work on a business trip on a day off, he does not receive a salary. However, he is given a daily allowance. The employer sets the amount of daily allowance independently, but most often they are paid in amounts that are not subject to personal income tax according to the Labor Code:

- 700 rubles per day in Russia;

- 2500 rubles per day when traveling abroad.

If the daily allowance is higher, then personal income tax must be withheld from the difference.

An example of calculating daily allowance for a business traveler, taking into account weekends

Plumber M.P. Kapitonov, who works for, is sent on a business trip from Vladivostok to Komsomolsk-on-Amur for seven days, two of which fall on Saturday and Sunday, when he usually rests at his main place of work. It took a day to get to Komsomolsk-on-Amur, and another day to get back. The daily allowance is set at 1 thousand rubles per day (nationwide).

For the entire period of M.P. Kapitonov was accrued daily allowance in the amount of 1000 * 7 = 7 thousand rubles, but he will receive less in hand, since it is necessary to deduct income tax from the difference between 1000 and 700 rubles.

The personal income tax amount will be (1000–700)*7*13%=300*7*13%=2100*13%=273 rubles.

“Clean” daily allowance for plumber V.V. Kapitonova: 7000–273=6727 rubles.

The employee was on the way

For the days of travel to the place of travel and upon return, a daily allowance is provided. The actual duration of the business trip must be confirmed. Usually these are tickets, because they indicate the departure and arrival dates of an airplane, train, electric train, etc. When traveling by air, you also need a boarding pass.

Government agencies have different interpretations on this issue. The position of the Ministry of Labor is that wages for days off while traveling should be paid, and in double amount. However, by and large, this contradicts the concept of salary, because this is a reward for work, and there is no labor along the way. The Federal Antimonopoly Service believes that compensation for days off while traveling should be based on average earnings. But in this case, claims from the tax service are possible.

Experts note that, given the ambiguity of the issue, the organization must independently determine according to which scheme to pay wages for travel days. This rule must be enshrined in the company’s documents.

Video: position of regulatory agencies on payment for a day of travel

https://youtube.com/watch?v=czbTsEskspY

How to pay for days off while traveling

Accountants often have difficulty calculating average earnings for the weekends that a posted worker spent on the road. This situation can arise not only by the decision of management, who planned the employee’s trip in this way, but also unintentionally, for example, due to a flight delay or cancellation, employee illness, etc. Do days spent on the road count as work? Do I need to pay them double?

The Labor Code and the Regulations on Business Travel do not provide answers to these questions. Judges and officials believe that days of departure, arrival, as well as days en route during a business trip that fall on weekends or non-working holidays are paid in accordance with Article 153 of the Labor Code of the Russian Federation at least double the amount, unless the employee is given another day of rest. Such clarifications are contained in the decision of the Supreme Court of the Russian Federation dated June 20, 2002 No. GKPI2002-663, in letters of the Ministry of Labor of Russia dated October 13, 2017 No. 14-2/B-921, dated September 5, 2013 No. 14-2/3044898-4415 and dated December 25. 13 No. 14-2-337.

Thus, if an employee leaves for or arrives from a business trip, and is also on the road on a day off (according to the schedule of the sending organization), then this is regarded as being hired to work on a day off. This means that you need to pay for this day and provide time off, or pay double for work on this day. It is also more correct to pay for weekends on the road not according to average earnings, but based on the wage system established for the employee.

These provisions apply subject to the rules mentioned above for determining the day of departure and arrival. For example, if an employee left on a business trip on Friday and arrived at his destination no later than 24:00 on the same day, then the average earnings do not need to be calculated for Saturday and Sunday (unless, of course, he will work on these days as directed by management). But if a train (plane, bus) leaves the place of work or arrives at the place of business trip after 00.00 on Saturday, then you will have to pay for this day (with the provision of time off or at an increased rate).

ADVICE. If possible, plan your business trips so that your arrival and departure dates do not fall on weekends or holidays.

Working on a day off: do you need the consent of a posted worker?

A business traveler is entitled to rest on a day off, but often they are sent on a business trip to perform urgent tasks, for example, to repair equipment or construction, so the employee has to work on weekends. In this case, the employer must obtain the employee’s consent. He can refuse, for this the organization cannot apply sanctions to him (fine, reprimand, dismissal, etc.).

Please keep in mind that you cannot be unreasonably required to work on your day off. We are not talking about institutions that usually work on Saturday and Sunday (restaurants, shops, bus stations, airports, etc.). This means working on a day off, which is scheduled.

Sample consent to work on a day off

However, sometimes consent from the employee may not be obtained. These are exceptional cases related to the prevention of disasters and accidents, for example, fires, natural disasters, train accidents, leaks of hazardous substances, etc.

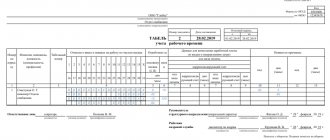

How to reflect weekends during a business trip in the report card

In the Timesheet, each calendar day of a business trip is marked with a special code (K or 06) without indicating the number of hours. This code is also indicated for the weekends on which the business trip occurred (remember that usually weekends are marked in the Timesheet with code B or 26).

ATTENTION. For a posted employee, codes B and 26 are not used in the Timesheet. If an employee worked on a business trip on a weekend or holiday, then for this day an additional code РВ or 03 is entered into the Timesheet. The number of hours of work is entered only if there is an order from the employer (at the main place of work) indicating the number of hours that this The employee must work on a specific weekend or holiday.

As for weekends (holidays) on which the employee was on the way to the place of business trip or back (including if the day of departure or arrival fell on a holiday or day off), they are marked in the Timesheet with the double code K/RV or 06/ 03 without specifying the number of hours.

Such explanations for filling out the Working Time Sheet are given in paragraph 2 of the letter of the Ministry of Labor of Russia dated February 14, 2013 No. 14-2-291.

Maintain timesheets and calculate salaries in the Vesti web service for free

Example

Manager I.I. Based on the order, Ivanov was sent on a business trip. The order stipulates departure for the trip on the weekend of February 23, 2021. The daily allowance for one day is 1000 rubles. Ivanov’s salary is 35,000 rubles. There are 19 working days in February.

If Ivanov refuses time off, he needs to calculate compensation for the day off. Let's calculate his daily salary:

35,000 / 19 = 1842.10 rubles

Weekend pay will be:

1842.10 x 2 + 1000 = 4684.20 rubles

If Ivanov decides to take advantage of the right to time off, he will receive compensation in a single amount. In this case, the payment for this day will be equal to:

1842.10 + 1000 = 2842.10 rubles

If an employee is sent on a business trip to perform work on weekends, they are also entitled to double pay. At the same time, depending on what remuneration system the company uses, compensation will also depend:

- For workers on piecework wages, a double piecework rate is established;

- For time-paid workers – double daily (hourly) rate;

- For salaried employees, compensation will vary depending on how the monthly norm was worked - within or above the norm. If the norm is worked within the established monthly limit, then compensation is established in the amount of a single daily (hourly) rate. If worked in excess of the norm per month, then in the amount of double daily (hourly) rate.

Accounting for travel expenses

The fact that the business trip “occupies” weekends or holidays does not in any way affect the accounting procedure for the corresponding expenses incurred by the employer. Daily allowances accrued for weekends (including days en route, including the day of departure and day of arrival) are not subject to personal income tax and insurance premiums according to the same rules as daily allowances accrued for working days. Namely: they are exempt from personal income tax and insurance contributions up to 700 rubles. for each day of a business trip in Russia, and within 2,500 rubles. for each day of being on a foreign business trip (clause 3 of article 217, clause 2 of article 422 of the Tax Code of the Russian Federation).

The average earnings accrued for the weekends on which the posted employee was involved in work or was on the road (including the day of departure or arrival) are subject to personal income tax and insurance contributions in the same way as the average earnings accrued for weekdays (letter of the Federal Tax Service of Russia dated April 17, 2018 No. BS-4-11/ [email protected] ).

ATTENTION. For tax accounting purposes, the average earnings paid to a posted employee on weekends are regarded as wages.

For personal income tax purposes, the date of actual receipt of income in the form of average earnings paid for a day off on a business trip will be considered the last day of the month for which this income was accrued. The date of actual receipt of income in the form of daily allowances paid in excess of the non-taxable rate is the last day of the month in which the business trip report is approved. Tax must be withheld when paying (transferring) the corresponding amounts (subclause 6, clause 1 and clause 2, article 223, clause 4, article 226 of the Tax Code of the Russian Federation). Insurance premiums must be calculated simultaneously with the calculation of average earnings and excess daily allowances in accounting (clause 1 of Article 424, clause 1 of Article 421 of the Tax Code of the Russian Federation). The entire amount of payment for a business trip in 2021 is taken into account as part of expenses both under the OSNO (clause 6 of Article 255, subclause 12 of clause 1 of Article 264 of the Tax Code of the Russian Federation) and under the simplified tax system (subclauses 6 and 13 of clause 1 of Art. 346.16 Tax Code of the Russian Federation). In particular, this amount includes daily allowances for all days of the business trip. It also includes the average earnings for work on a business trip on weekends and holidays and for the time spent on the road on these days. The basis for writing off costs will be the Time Sheet and business trip documents.