Double payment and daily allowance

On the day of returning from a business trip, as well as on the day of departure for a business trip, the employee does not engage in personal affairs, but acts in the interests of the employer.

Therefore, such days cannot be considered days of rest, even if they fall on Saturday, Sunday or holidays. In this case, the employer is obliged to apply Article 153 of the Labor Code, according to which work on a weekend or non-working holiday is paid at least double the amount. This point of view is shared by officials from the Ministry of Labor (letter dated October 13, 2017 No. 14-2/B-921; see “The Ministry of Labor explained how days of departure and arrival from a business trip that fall on weekends or holidays should be paid”) and judges (decision of the Supreme Court of the Russian Federation dated June 20, 2002 No. GKPI02-663). Please note: average earnings for such days are not calculated.

Calculate “complex” salaries with coefficients and bonuses for a large number of employees

There is another opportunity to “compensate” for time spent on the road on a weekend or holiday - pay for the day of departure on a business trip (or the day of return) in a single amount, but at the same time provide the employee with time off during working hours. There is one important nuance here: this option is permissible only if there is a written application from the employee (Article 153 of the Labor Code of the Russian Federation).

In addition, for the time spent on the road, including days falling on weekends and holidays, the employer must pay the employee daily allowance. This follows from paragraph 11 of the Regulations on the specifics of sending employees on business trips (approved by Decree of the Government of the Russian Federation of October 13, 2008 No. 749). It says that per diem is accrued not only for each day you are on a business trip, but also for each day spent on the road.

If the business trip falls on a weekend

The citizen filed a lawsuit to invalidate paragraphs 1 and 3 of paragraph 8 of Instruction No. 62 dated 04/07/1988 “On official business trips within the USSR.” The applicant indicated that the contested provisions of the regulatory legal act do not comply with the Labor Code of the Russian Federation and limit the rights of workers.

The Ministry of Finance recommends the following: if the internal regulations approved by the head of the organization provide for working hours on weekends and holidays, the costs associated with paying compensation to employees for the days of departure on a business trip and the days of arrival from a business trip that fall on weekends can be taken into account as part of labor costs on the basis of clause 3 of Article 255 of the Tax Code of the Russian Federation, subject to their compliance with the criteria established by clause 1 of Article 252 of the Tax Code of the Russian Federation.

How to calculate salary for travel time

Accountants often ask the question of how to correctly calculate the salary for a weekend or holiday spent by a business traveler on the road: based on an hourly or daily rate? In other words, do you need to pay for the exact number of hours spent traveling that day? Or can you calculate wages based on 8 working hours a day, and if the journey takes two days off, then multiply 8 hours by 2?

Calculate the salary of a posted worker using the web service Calculate for free

There is no exact answer either in the Labor Code or in other legal acts. We believe that both approaches are acceptable, since they do not contradict Article 153 of the Labor Code of the Russian Federation. It states that those who receive a salary must be paid for work on weekends and holidays at either daily or hourly double rates. This means that a company or entrepreneur has the right to choose any of these options and enshrine it in a local regulatory act, for example, in a regulation on business trips, or in a collective agreement.

Let's take a closer look at each of these options.

Payment based on the number of hours

This method of payment is familiar to accountants, because it is what is usually used in situations where a person spends weekends or holidays at his workplace. In relation to leaving or returning from a business trip, the “hourly” approach means that the time to be paid is determined on the basis of travel documents with departure and arrival stamps. Moreover, on the day of departure, the paid time is counted from the moment of departure until 24.00, and on the day of return - from 00.00 until the moment of arrival.

To calculate wages, the hourly tariff rate of the current month is used.

Example 1

When returning from a business trip, employee Sidorov boarded the train on Saturday at 6.00 and arrived at the destination station on the same day at 20.00. Sidorov’s place of residence is one hour’s drive from the station. The accountant determined that on Saturday Sidorov’s working time was 21 hours (from 00.00 to 20.00 plus 1 hour for the journey from the station to the house). Sidorov did not submit an application requesting additional time off instead of increased pay.

The standard working time in a given month for a 40-hour work week is 159 hours. Sidorov's salary is 50,000 rubles. The accountant calculated that Sidorov's hourly rate is 314.47 rubles. (RUB 50,000: 159 hours). For the time spent on the road when returning from a business trip, Sidorov was credited 13,217.4 rubles (314.47 rubles × 21 hours × 2).

Payment based on the number of days

This option requires less effort and time from accountants, since there is no need to calculate the exact number of hours on the road. Here, paid time is determined on the basis of 8 hours a day, and the daily tariff rate of the current month is used to calculate wages.

Example 2

Employee Kuznetsov went on a business trip on Sunday, the train departed at 15.00, and arrived at the destination station on the same day at 22.00. It took Kuznetsov two hours to get to the station.

The standard working time in a given month for a 40-hour work week is 21 days. Kuznetsov’s salary is 60,000 rubles. The accountant calculated that Kuznetsov’s daily rate is 2,857.14 rubles. (RUB 60,000: 21 days). For the time spent en route on a business trip, Kuznetsov was credited 5,714.28 rubles (2,857.14 rubles × 1 day × 2).

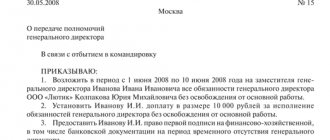

Order on time off for previously worked time

- Which day was or will be worked and counted as worked. A specific date must appear, including the year.

- Full name of the employee and his position. Very often, just a last name and initials are enough.

- Which day will be a day of rest on account of hours worked? If there are several such days, then the dates are listed separated by commas.

- Payroll. It may simply say: “Calculate wages in accordance with the order,” or it may mention the specific name of the accountant who will sign at the end.

- Who is responsible for familiarizing employees with the issued order? This is a rather formal procedure, since according to the law, employees should already be aware, since they themselves wrote an application requesting this time off.

An employee can receive time off for time already worked or work it in the future. It all depends on the nature of the agreement with the employer. As for legal norms, this possibility is clearly stated in Article 153 of the Labor Code of the Russian Federation.

It is necessary to refer to it in the document.

How to fill out a time sheet

The day of departure on a business trip (or the day of return from it), coinciding with a weekend or holiday, must be correctly reflected in the working time sheet (unified form No. T-13, approved by Resolution of the State Statistics Committee of the Russian Federation dated 01/05/04 No. 1). The personnel officer must make two marks in the corresponding cell at once, separating them with a “/” sign. The first is a “business trip”, which is designated by the letter code “K” or the digital code “06”. The second is the “duration of work on weekends and non-working holidays,” which is indicated by the letter code “РВ” or the digital code “03.”

Keep timesheets for free in an accounting web service

It is also necessary to indicate on the timesheet the number of hours that are paid by the employer. If payment is made based on an hourly rate, then you need to put the number of hours that the person actually spent on the road (in our example 1 this value is 21). If payment is made based on the daily rate (as in our example 2), then the number 8 should be entered.

Next, you need to correctly take into account such a day when entering the final information into the timesheet. In particular, in columns 5 and 6 (intended to indicate days and hours worked), enter the numbers that took into account the hours and days of departure on a business trip and return from it. Based on this indicator, the accountant will calculate the employee’s salary for the time spent on the road. Plus, the hours and days of departure on a business trip and return from it must be taken into account when filling out columns 10-13 (intended to indicate the reasons for non-appearance). Based on this indicator, the accountant will accrue the employee’s daily allowance for days spent on the road.

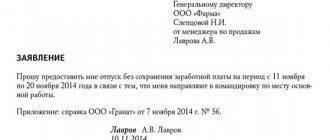

Business trip extension: how to apply

- persons who are parents or guardians of children under 5 years of age and raising them without the help of a spouse;

- persons who are parents of children with disabilities;

- women who have a child under 3 years of age;

- persons caring for sick family members.

- a report or official note from the employee in which he reports the need to extend the business trip. The reasons may be personal or work-related. For example, an employee could get sick or not have time to complete a task.

- employer's order on the need to extend the business trip. This will also include a memo from the immediate supervisor or work manager of an employee who is on a business trip.

How to reflect an additional day off on your timesheet

It is possible that a posted worker will exercise his right to ask for an additional day off (instead of double payment for travel time). Then, in the work time sheet, the day spent on the road must be indicated in exactly the same way as with double payment, that is, put “K / RV”. But the time off provided should be designated as a day off (letter code “B”, digital code “26”). It is better to attach a statement from the employee to the timesheet, which indicates the date of the day off. Based on these documents, the accountant will calculate a “single” salary for the day of departure on a business trip or return from it.

Day of return from a business trip on a day off

- First option. If the order does not indicate departure on a day off, the report card will contain code “K” or “06”. For the period of a business trip, the schedule is 5 working days. Weekends are not paid. Accordingly, during the business trip Sukhanov will receive: average daily earnings * number of working days = 1050 * 5 = 5250 rubles.

- Second option. The order indicates departure on a day off; the report card indicates the code “RV” or “03”. For working days, Sukhanov will receive the same average earnings in the amount of 5,250 rubles.

Dear readers! The article talks about typical ways to resolve legal issues, but each case is individual. If you want to find out how to solve your particular problem , contact a consultant:

25 Jul 2021 jurist7sib 76

Share this post

- Related Posts

- Scheme of Chinese Law in Modern Times

- What taxes should an individual entrepreneur pay and when?

- In Belarus, Benefit for the Guardian of an Incapacitated Disabled Person of Group 2

- Size Only Heroes of Russia in 2021

Pros of working on business trips

Travel jobs may pay more.

Yes, of course, since travel often involves more strenuous work, it should be paid accordingly. But, in fact, this does not always happen.

True, you can earn something extra if you manage to save on daily allowances.

Working in this type of work will give you more varied experience.

Additional experience and skills are always good.

Business trips will allow you to significantly increase your network of business contacts, in different regions and countries.

Extensive connections are indeed a very important plus for you as a specialist, and may come in handy more than once in the future.

However, many people are not very keen on travel work, and here's why.

Disadvantages of working with frequent business trips

Difficulties in family life.

When you are away from home for a long time, this is not the easiest circumstance for your family. Not every family can withstand the test of constant and long separations.

Physical and mental stress.

Constantly traveling for work, you have to incur certain costs. Long periods of travel, changes in climate and time zones create additional stress to the already existing difficulties in work.

The possibility of incurring some additional expenses that the employer may not compensate.

For example, this could be paying for something at a higher cost than originally planned, taxi trips, exchange rate differences on unspent currency (when you find yourself in the red), etc.

Further. When choosing between a job with or without business travel, you need to keep the following in mind.