Reasons for receiving an advance

The reason for writing an application for an advance can be a variety of circumstances: a wedding or the birth of a child, the illness of a relative or loved one, the need for urgent loan repayment, renovations, a large purchase, etc. An advance is the best alternative to urgent loans, the interest on which, as we know, is incredibly high.

- Form and sample

- Free download

- Online viewing

- Expert tested

FILES

It should be noted that an application for an advance is written when the advance is not provided for in the employment contract between the employee and the employer or its term or amount differs from what is required.

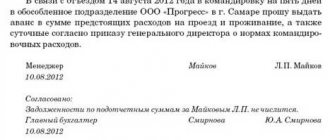

Another, completely separate reason for an employee to receive an advance: a business trip or other corporate needs (purchase of office supplies, materials or equipment).

In this case, in the application for an advance, the future traveler or other employee of the enterprise must write the purpose of receiving the advance, as well as how exactly he intends to spend the funds received. Money is issued strictly on account and the balance must be returned back to the company's cash desk. If there is not enough money, then the accounting department is obliged to pay the employee the missing funds. At the same time, all actions must be documented.

Application for reimbursement of travel expenses - sample

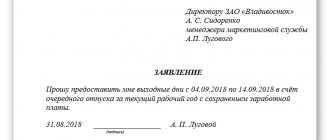

The application is drawn up addressed to the general director of the company, indicating the following information and details:

- Name of the enterprise, full name manager and seconded person indicating positions.

- Number and date of the order for sending on a business trip.

- Purpose of the trip.

- List of costs that need to be reimbursed.

- List of attachments in the form of documents confirming the implementation of expenses.

- Date and signature of the posted employee.

It would also be useful to refer to local regulations (orders, instructions, job descriptions, etc.), which indicate the maximum amount of daily expenses compensated for this category of workers.

Calculate travel expenses correctly by reading our material “How is a business trip paid on a day off (nuances)?”.

For your convenience, we provide here a sample application for travel expenses. You can download it from the link below:

What to do to receive an advance

Issuing an advance (unless it concerns official needs) is the exclusive will of the employer. In other words, the initiator of the application is always an employee of the enterprise or organization, the final decision is made by the manager .

In order for the boss to put a positive resolution on the application, you must not only try to maintain good relations with him and conscientiously fulfill your work duties, but also prepare in advance a package of documents justifying the need to receive funds.

As a rule, employers rarely pay more than half of the average monthly salary in advance, so asking for a large amount is not practical, but getting 25-30% of your salary or salary is very possible.

It should be noted that the manager can leave the advance amount unchanged or adjust it depending on his ideas and the capabilities of the company.

The time period for consideration of such an application has not been established, but as practice shows, it usually takes from several hours to three days.

Does an employer have the right to refuse an advance?

An employer has the right to refuse an advance payment to an employee, but not always. Let's start with the fact that, by law, enterprises and organizations must pay their employees salaries at least twice a month (most often this is the middle and end of the month). If the employer pays wages once a month, then he violates the law, so his refusal to pay an advance automatically becomes illegal - in this case, the employee can safely contact the labor inspectorate to protect his rights.

In situations where the requirement to pay wages in two stages is met, the employer has every right to refuse to pay the advance.

As for advances for work purposes, the employer does not have the right to refuse (although he can change the amount of the advance payment), since if the answer is negative, the implementation of the task will be problematic.

Other expenses

As mentioned above, the list of travel expenses is open, and the employer can establish in a local act the expenses, amount, and reporting procedure for typical expenses for the organization. For example, in relation to entertainment expenses, limits, a list and forms of documents necessary to confirm travel and entertainment expenses may be established. Moreover, for recognition as expenses for profit tax purposes, there has always been increased attention to entertainment expenses, and with regard to negotiations on business trips, the recognition procedure and requirements for documents are similar (Letter of the Ministry of Finance of Russia dated November 16, 2009 No. 03-03-06/1/ 759). The Ministry of Finance of Russia in its Letters dated November 13, 2007 N 03-03-06/1/807, dated November 1, 2010 N 03-03-06/1/675 provides an approximate list of documents. Therefore, the application for travel expenses may include an attachment, for example, of estimates and programs for entertainment events. And also subsequently, a report on the event should be attached to the advance report, indicating the participants, the venue, the issues discussed at the meeting, and the results achieved.

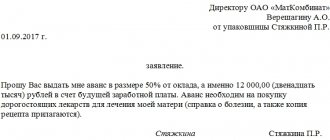

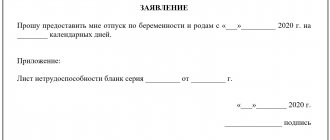

Rules for writing and completing an application for an advance

Today, there is no mandatory, unified sample of this statement, so employees can write it in any form or according to a template developed and approved within the enterprise. Regardless of which option is chosen, the document must meet certain requirements. It must indicate the addressee :

- Company name,

- job title

- and full name of the manager,

as well as similar information about the applicant : his position and full name. In addition, the document itself must include the request for an advance , indicating its reasons.

The main text should be consistent and sufficiently succinct - usually the main idea fits into one - a maximum of three sentences.

If there are any circumstances in connection with which the employee wants to receive an advance and which he can document, this must also be reflected in this document in the form of a clause on attachments.

Finally, the application must be signed by the applicant (with a transcript of the signature) and dated on the day of submission.

The application is drawn up in two copies :

- one of which is endorsed by the secretary and subsequently remains in the hands of the employee,

- and the second is transferred to the organization.

After its consideration, depending on the decision made by the manager, a resolution is written on the application. If it is positive, based on this document, the accounting department calculates and issues the required amount. In any case, after the application loses its relevance, it is transferred for storage to the archive of the enterprise.

Do I need to write an application for an advance on travel expenses?

The regulations for conducting cash transactions dictate that it is mandatory for workers to write an application for the issuance of money on account to fulfill the assignment of the enterprise management.

With the entry into force of new regulations, it is allowed to issue money to a contractor with whom a civil contract has been signed. He also reflects his request for cash in writing.

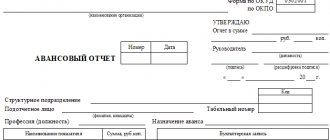

The main purpose of the application is a detailed recording of the goals and timing of the allocation of funds.

Having received the application, the director, upon approval, puts his signature on the form for the accounting department, approving the timing of the trip and the amount of issue.

Based on the request of the worker, an expense cash order is issued. If the director put his signature on the application for the advance, then its presence on the expenditure document is not necessary. Payment to the employee is carried out on the basis of an order, funds are transferred to a current account or issued in cash.

When do you need to obtain consent for a business trip?

Who can apply for travel expenses?

Each time you pay money for a business trip, you must fill out an application; this rule also applies to the head of the enterprise.

In many companies, it is the head of the company who is the accountable person and the application is still completed. It is more logical to issue only an order, but a written request is a mandatory condition for issuing funds for a business trip.

In large corporations, the manager does not write a statement to himself, but, for example, the addressee is the financial director.

The advance is issued to an employee sent on a business trip by order of the director upon presentation of an identity card.

If there is a notarized power of attorney, payment can be made to the employee’s representative.

Correct design

The application is drawn up in free form. If the company already has a ready-made template, then fill it out in accordance with the developed sample.

At the legislative level, there are no special requirements for the document; it is usually written in the name of the director of the company.

Information contained in the text part of the form: deadline for issuing cash, date and signature of the applicant, purposes for which the funds are issued.

To accept a document, an accounting employee must have the following information:

- details of the manager’s order for the business trip;

- date of departure and arrival;

- name of destination (country, city);

- the amount of the advance payment (in digital and letter designation);

- breakdown of the amounts of individual expense items (accommodation, daily allowance, travel).

Applications containing errors or typographical errors will not be accepted for consideration. The form must contain the signature of the accountant, which proves his consent to the release of funds and indicates that the workers have completed reports on previous trips.

An advance for a business trip can be transferred to the employee’s bank account; in this case, it is also necessary to take an application from the employee (clarification of the Ministry of Finance dated August 25, 2014 No. 03-11-11/42288).

The text part contains all the recipient's bank details. This statement is also proof that the transfer to the card is not income (the purpose of the payment indicates “accountable money”), and personal income tax withholding is not required.

Private entrepreneurs fill out a form if they use money for business needs; the document is not issued for personal use.

Government Decree No. 749 dated October 13, 2008 is devoted to business trips, paragraph 10 provides for the mandatory issuance of an advance for business trips. An employee should not travel outside the enterprise at his own expense to carry out the director’s assignment. The specific amount given to the worker is based on a preliminary assessment of the costs of travel to the destination, hotel accommodation in the locality, and the amount of daily allowance regulated by the local act of the company.

After the trip, it is necessary to submit an advance report to an accountant, who carries out the actual expenses with the declared ones. As a result, inappropriate use of funds may be found, to which the employee did not have the right (these expenses are not taken into account by the accounting employee).

It should be remembered that the presence of an application when issuing travel expenses is mandatory. When issuing funds without a written request, there is a risk of imposing a fine under Article 15.1 of the Administrative Code in the amount of a fine of up to 50,000 rubles.

.

If the advance is paid but the work is not completed or the service is not provided

Situations where the employer paid an advance, but the subordinate did not complete his tasks, are not common, but still happen. In such a development of events, the employee is obliged to return the unused funds to the company’s cash desk. And this can be done in different ways:

- the employee can independently make a refund in cash or by bank transfer,

- the employer may withhold the amount paid from his salary until the debt is fully repaid.

In the second case, it is necessary to notify the employee in advance that part of the salary will be withheld to repay the advance.

If the employee quits and refuses to return the money, the former employer has the right to apply to the court to have the amount issued recognized as unjust enrichment.