A claim for recovery of wages is one of the ways to protect the legitimate interests of an employee in the event of a delay in payment for his work by the employer. Files in .DOC:Form of claim for recovery of wagesSample statement of claim for recovery of wages

The claim is based on the employee’s contractual right to receive wages on time and in full and the corresponding obligation of the employer to make this payment.

How to file a claim correctly

An example of a statement of claim for the recovery of wages consists of the following parts (see Article 131 of the Code of Civil Procedure of the Russian Federation):

- name of the court;

- FULL NAME. and the plaintiff's address;

- name and address of the defendant;

- the cost of the claim is the total amount of the claim, including the amount not paid on time, interest on it and moral damages, if the employee considers it necessary to collect it.

- history of the relationship between the employee and the company: when he started working, when he quit, if he quit;

- the established salary amount with all additional payments and the date, standard period of payment;

- the amount actually paid or an indication that the employee received nothing at all;

- calculation of penalties.

3. Final part:

- requirements for the defendant;

- list of attachments - copies of the employment contract, employment order, regulations on the employer's salary, other orders of the employer that relate to the applicant, and an extract from the employee's salary account.

The plaintiff dates and signs the wage claim.

Author of the document

| Contract-Yurist.Ru offline Status: Legal company rating460 84 / 6 Private message Order a consultation | number of consultations: |

| noted as the best: | 5 |

| answers to documents: | |

| documents posted: | 927 |

| positive feedback: | |

| negative reviews: |

B (name of court)

court address

Plaintiff: full name, passport details, contact information

Plaintiff's postal address, incl. for agendas

Defendant: Name, legal and actual address and contact information about the defendant

Claim price ____ rub. __ kop.

Sample statement of claim for unpaid wages

To Leninsky District Court

Ekaterinburg, Sverdlovsk region

Plaintiff: Ivanov Ivan Ivanovich,

st. Bardina, 1, apt. 2

Defendant: FSBI "ALLUR"

Claim for recovery of wages

- 29,411.76 rubles - salary for the period worked before dismissal;

- 33,333.33 rubles - compensation for unused vacation.

In accordance with the requirements of Art. 140 of the Labor Code of the Russian Federation, the employer is obliged to make payments on the day of the employee’s dismissal.

Contrary to the requirements of the law, settlements with me have not been made to this day.

In accordance with Art. 236 of the Labor Code of the Russian Federation, if the deadline for payment of payments due to an employee is violated, the employer is obliged to pay them with interest not less than one hundred and fiftieth of the key rate of the Central Bank of the Russian Federation for each day of non-payment.

The interest amount as of October 22, 2021 is:

Based on the above, guided by Art. 21, 22, 80, 84-1, 135,136, 140, 165, 236, 395 of the Labor Code of the Russian Federation,

- a copy of the statement of claim;

- employment history;

- employment contract;

- a copy of the employment order;

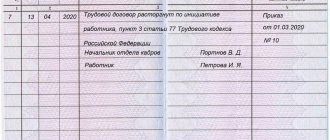

- a copy of the dismissal order;

- certificate of cash flow for the period from October 1, 2018 to October 1, 2021

Case practice: what answer to expect?

Going to court with a demand from the employer to repay the salary debt is the most effective way to hold the violator accountable. After filing a statement of claim, an inspection of the enterprise can be initiated, and if the fact of non-payment of wages is established, the manager faces liability.

For overdue wages, you can demand compensation: 1/150 of the refinancing rate of the Central Bank of the Russian Federation for each day of delay in payments. The employer will also be required to pay all expenses incurred by the plaintiff when going to court.

In addition to obligations to repay the debt, the employer may also receive a fine . If the salary delay is more than three months, then the head of the enterprise may face criminal liability, which includes punishment in the form of imprisonment and large fines.

Do you need to worry if the employer does not comply with the court decision? No, that's what the bailiff service exists for. If the manager does not return the salary debt to the employee, then state enforcement agents have the right to enforce collection, including the seizure of the company’s accounts and property.

General information about compensation for delayed wages is described in a special material. Recommended reading.

When is it easier to collect wages?

The situation is more complicated when you have an employment contract in your hands, which states the amount of the monthly salary, but does not indicate the amount of the bonus and additional payments (percentage of sales, payment for additional work, etc.). In this case, the task is complicated by the subject of proving exactly how much the employer owes you for salary payments, for how long and on what your calculation will be based.

When collecting wages, the court proceeds primarily from documentary evidence. The testimony of witnesses in this category of cases regarding the amount of wages is not used by the court as a means of proof, please keep this in mind.

A very difficult situation is when an employment contract has not been concluded with you and the payments made to you by the employer are not indicated anywhere. In this situation, in addition to having to prove that you had an employment relationship with the employer, you will also have to prove what your average monthly salary is.

Therefore, it is extremely important that you have an employment contract.

List of required documentation

Your main task is to competently file a claim with the defense authorities and prepare full evidence that will confirm that you are right. Let's list the necessary certificates and papers:

- Employment contract. It will be considered a weighty argument in the process of collecting funds. This document must indicate the amount of wages, as well as the period of its payment. The judge will pay special attention to the content of the employment contract, pay your attention to this.

- A photocopy of the employment order. If during this time you were transferred from position to position, then you must also prepare copies of these orders.

- Salary certificate issued by the accounting department. Bonuses, various one-time payments and additional payments should be reflected there.

- A document that can confirm discrepancies in payroll. For example, this could be a bank account statement if funds were transferred to a card.

- A document confirming the existence of wage arrears.

- If possible, try to collect testimony from witnesses. Enter them into your protocol and present them to the defense authorities.

- If you additionally want to demand compensation for moral damage, then prepare a document that can confirm this.

How to file a claim correctly

When preparing for a trial, it is extremely important to know some of its features:

- The applicant has the right to file a claim both at the place of registration of the employing company and at the place of residence of the employee.

- The applicant has the right to submit an application both in writing, in compliance with all the rules for its execution, and in printed form. But the signature must be genuine.

- You can submit a claim either during a personal visit to a court office or by sending it by mail.

This is important to know: Sample letter for the return of erroneously transferred funds

Period during which wage arrears can be collected

The plaintiff has the right to initiate legal proceedings within one year. If the employee approached the process correctly, followed the rules for document execution, and collected a full package of certificates and papers, then a positive outcome will be guaranteed. The countdown of one year begins from the date when the employee learned of the fact of unlawful actions. That is, the day after the employer did not pay it.

Expert opinion

Kostenko Tamara Pavlovna

Lawyer with 10 years of experience. Author of numerous articles, teacher of Law

In a situation where the employee’s wages are accrued, but for various reasons are not paid to him, then such a violation will be considered ongoing. This fact gives the employee the opportunity to contact the defense authorities at any time to claim his money. But if a person no longer works for a given employer, then the period will also be equal to one year, since he was obliged to finally calculate it on the day of dismissal.

What is the easiest way to claim earned money?

The easiest way to do this is in the defense authorities, namely in court. If your wages have been accrued but not paid, then this is much easier to do. You will not need to prove the fact of the debt.

The process will be slightly complicated by an employment contract, which states the amount of your salary, but does not indicate the amount of bonuses, one-time payments, percentage and sales, etc. Here you will have to make efforts to prove the amount of payment that you want to recover from the defendant. It is necessary to present all the facts and calculations with significant arguments. The judge will be guided by documentation, not words, to make a decision.

Please note that in such a trial, the judicial institution does not accept the testimony of witnesses!

Well, it’s a very difficult situation when an employment contract was not concluded with you. You will have to prove by all means that you worked for this employer. And also prove the amount of your salary. Try not to allow this to happen, but immediately enter into a contract with your future employer.

Rules for drawing up a statement of claim for recovery of wages

If you do not want to immediately go to court, you can try asking the labor inspectorate for help. Sometimes this is enough for a negligent employer to pay the entire amount down to the penny.

If you are determined to seek the truth from the defense authorities, then it is extremely important to collect all the necessary certificates and papers that can confirm the amount of your salary. To receive them, you need to send an application to the company addressed to the director. The employer is obliged to issue a list of documents within three days from the date of application. All photocopies must be certified by an employee of the HR department or an authorized representative.

Expert opinion

Kostenko Tamara Pavlovna

Lawyer with 10 years of experience. Author of numerous articles, teacher of Law

In the statement of claim, it is important to specify the amount of the salary and the procedure for calculating it (period). For example, in the sample application (see above) there are two payments per month in equal parts. In addition, the employee has the right to demand compensation for delayed wages. The applicant must make a calculation of this payment in the application itself or in an appendix to it.

This is important to know: Appealing a decision on an administrative offense of the traffic police

When filing a claim

In ________________________ (name of court and address) Plaintiff: ________________________ (full name and address) Defendant: ________________________ (full name and address) Third party: ________________________ (full name and address)

Cost of claim: ______ rubles; State duty: ______ rubles.

STATEMENT OF CLAIM for recovery of wages

I, _____________ (indicate full name), was (or am) an employee in ____________ (indicate the name of the organization) since ___________ (indicate the start date of the employment relationship), in the position of ______________ (indicate position). The dismissal occurred on the basis of ______________ (indicate the reason for dismissal).

According to the terms of the employment contract, the plaintiff’s salary is _________________ rubles per month. On the day of going to court, the defendant owes me wages in arrears in the amount of ____________ rubles, for the period from _____________ to _______________ years (indicate the period of the debt).

The defendant does not respond to my repeated demands to the employer, and no money has been paid to me.

In accordance with Art. 78 of the Labor Code of the Russian Federation, an employment contract can be terminated at any time by agreement of the parties to the employment contract, but this does not relieve the employer from paying the employee the wages due.

Expert opinion

Mikhailov Vladislav Ivanovich

Lawyer with 6 years of experience. Specializes in family law. Knows everything about the law.

By virtue of Part 4 of Art.

84.1 of the Labor Code of the Russian Federation, on the day of termination of the employment contract, the employer is obliged to issue the employee a work book and make payments to him in accordance with Article 140 of this Code. In accordance with Part.

1 tbsp. 140 of the Labor Code of the Russian Federation, upon termination of an employment contract, payment of all amounts due to the employee from the employer is made on the day of the employee’s dismissal.

According to Art. 236 of the Labor Code of the Russian Federation, if the employer violates the established deadline for payment of wages, vacation pay, dismissal payments and other payments due to the employee, the employer is obliged to pay them with interest (monetary compensation) in an amount not less than 1/300 of the Central Bank refinancing rate in effect at that time RF, from amounts unpaid on time, for each day of delay, starting from the next day after the established payment period until the day of actual settlement inclusive.

- To collect from ___________________ in favor of the plaintiff the arrears of wages for the period from _______________ to ________________ in the amount of ______________ rubles.

Appendix: 1. A copy of the statement of claim for the parties to the case, the court and third parties; 2. A copy of the employment contract; 3. A copy of the work record;

Date of application “____”____________ 20____ Plaintiff's signature ____________

In ____________ district court of _______

__________________________ plaintiff: ______________________________ __________________________________ defendant: ____________________ _____________________________

State duty: on the basis of clause 1, part 1, article 333.36 of the Tax Code of the Russian Federation, the Statement of Claim is exempted from payment of state duty for the recovery of wages and compensation for moral damage

_______________ year between me, ___________________ and the closed joint-stock company “__________” a contract No. 0467 was concluded for the performance of a set of works determined by the Agreement and the task, which, in this case, was an employment contract. In addition, an agreement on full financial responsibility was concluded with me. However, despite all the terms of the contract that I fulfilled, I was fired from my job and CJSC “__________” did not pay me wages in the amount of _________ rubles. According to Art. 178 of the Labor Code of the Russian Federation, upon termination of an employment contract due to the liquidation of an organization (clause 1 of part one of Article 81 of this Code) or a reduction in the number or staff of the organization’s employees (clause 2 of part one of Article 81 of this Code), the dismissed employee is paid severance pay in the amount of the average monthly salary earnings, and also retains his average monthly earnings for the period of employment, but not more than two months from the date of dismissal (including severance pay).

In exceptional cases, the average monthly salary is retained by the dismissed employee for the third month from the date of dismissal by decision of the employment service body, provided that within two weeks after the dismissal the employee applied to this body and was not employed by it. Thus, according to current legislation, when an employee is dismissed for the specified reason, he retains the average monthly salary for three months.

However, despite appeals to the administration of the organization for payment of wages, my legal demands have not yet been fulfilled, which is a significant violation of the labor rights guaranteed by the Constitution of the Russian Federation. In accordance with Art.

142 of the Labor Code of the Russian Federation, the employer and (or) representatives of the employer authorized by him in the prescribed manner, who have delayed the payment of wages to employees and other violations of wages, are liable in accordance with this Code and other federal laws, and by virtue of Art. 236 of the Labor Code of the Russian Federation, if the employer violates the established deadline for payment of wages, vacation pay, dismissal payments and other payments due to the employee, the employer is obliged to pay them with interest (monetary compensation) in the amount of not less than one three hundredth of the Central Bank refinancing rate in force at that time Bank of the Russian Federation from unpaid amounts on time for each day of delay starting from the next day after the established payment deadline until the day of actual settlement inclusive.

The amount of monetary compensation paid to an employee may be increased by a collective agreement or employment contract. The obligation to pay the specified monetary compensation arises regardless of the employer’s fault.

In addition, according to Art. 237 of the Labor Code of the Russian Federation, moral damage caused to an employee by unlawful actions or inaction of the employer is compensated to the employee in cash in amounts determined by agreement of the parties to the employment contract.

In the event of a dispute, the fact of causing moral damage to the employee and the amount of compensation for it are determined by the court, regardless of the property damage subject to compensation. Thus, the norms of the current labor legislation clearly oblige the employer to make a full settlement with the employee on the day of dismissal. The amount of wages to be paid is _________ rubles, which is unacceptable on the part of the employer, since, part 2 of Art.

22 of the Labor Code of the Russian Federation obliges him to pay in full the wages due to employees within the time limits established in accordance with the Labor Code of the Russian Federation, the collective agreement, internal labor regulations, and employment contracts. By virtue of Art. 395 of the Labor Code of the Russian Federation, if the body considering an individual labor dispute recognizes the employee’s monetary claims as justified, they are satisfied in full. Consequently, in my favor, the defendant must recover the unpaid wages in full in the amount of _______ rubles. In addition, in accordance with Art.

21 of the Labor Code of the Russian Federation, an employee has the right to compensation for damage caused to him in connection with the performance of work duties and compensation for moral damage in the manner established by this Code and other federal laws. By virtue of Art. 237 of the Labor Code of the Russian Federation, moral damage caused to an employee by unlawful actions or inaction of the employer is compensated to the employee in cash in amounts determined by agreement of the parties to the employment contract. In the event of a dispute, the fact of causing moral damage to the employee and the amount of compensation for it are determined by the court, regardless of the property damage subject to compensation. I believe that the defendant’s failure to fulfill his duties resulted in moral suffering for me, which is in a cause-and-effect relationship. It was after the defendant’s failure to fulfill his obligation, who has so far refused to fulfill his obligations to pay the wages due to me, that I experienced psycho-emotional stress. Moral harm was caused to me by the fact that, counting on the defendant to fulfill his duties, I had certain hopes, linking my personal plans with this. The defendant’s disrespectful attitude in the form of refusal to pay wages also caused me moral suffering, since it deprives me of the opportunity, due to lack of funds, to financially support my family. Based on clause

63 of the Resolution of the Plenum of the Supreme Court of the Russian Federation, in accordance with part four of Article 3 and part seven of Article 394 of the Code, the court has the right to satisfy the demands of a person who has been discriminated against in the sphere of labor, as well as the demands of an employee dismissed without legal grounds or in violation of the established procedure for dismissal, or illegally transferred for another job, for compensation for moral damage. Considering that the Code does not contain any restrictions for compensation for moral damage and in other cases of violation of the labor rights of employees, the court, by virtue of Articles 21 (paragraph fourteen of part one) and 237 of the Code, has the right to satisfy the employee’s claim for compensation for moral damage caused to him by any unlawful actions or inaction of the employer, including violation of his property rights (for example, delay in payment of wages). In accordance with Article 237 of the Code, compensation for moral damage is compensated in cash in an amount determined by agreement between the employee and the employer, and in the event of a dispute, the fact of causing moral damage to the employee and the amount of compensation are determined by the court, regardless of the property damage to be compensated. The amount of compensation for moral damage is determined by the court based on the specific circumstances of each case, taking into account the volume and nature of moral or physical suffering caused to the employee, the degree of guilt of the employer, other noteworthy circumstances, as well as the requirements of reasonableness and fairness. Thus, in accordance with current labor legislation, I have the right to compensation for moral damage. Based on the above, guided by Art. 21, 22, 80, 84-1, 135,136, 139, 165, 237, 395 of the Labor Code of the Russian Federation, -

1. To recover from CJSC "_____________" in my favor wages in the amount of _________ rubles, compensation for moral damage - ________ rubles, and a total of _________ rubles. 2. To recover from CJSC “_____________” in my favor the costs of legal services in the amount of ________ rubles.

Applications: 1). A copy of the statement of claim.

_______________ " " ______________ of the year

Labor disputes regarding wages are not that rare, but such conflicts do not often reach the court. At the same time, solving the problem in court is more of a last resort rather than an everyday practice.

This is due both to the duration of the procedure and to the need to have special knowledge to correctly draw up a statement of claim.

- In which court and how to file a claim for unpaid wages?

- How to file a claim?

- What reasons could there be for returning an application?

- What should I include as support for my claim?

- Samples of claims for recovery of wages

Related documents

- Statement of claim for collection of arrears of wages

- Statement of claim for recovery of underaccrued and unpaid wages (in terms of ensuring the minimum wage)

- Statement of claim for recovery of settlement upon dismissal and monetary compensation for violations of the Labor Code of the Russian Federation by the employer

- Statement of claim for recovery of the cost of work not performed (service not provided)

- Statement of claim for damages and payment of penalties for goods of inadequate quality

- Statement of claim for compensation for damage caused by flooding of residential premises

- Statement of claim for violation by the contractor of deadlines for completing work (rendering services)

- Statement of claim for improper performance of utility services, payment of penalties and compensation for moral damage

- Statement of claim for termination of the purchase and sale agreement, recovery of losses, penalties and compensation for moral damages for low-quality goods

- Statement of claim for wage indexation

- Statement of claim for wage indexation 2

- Statement of claim for indexation of awarded amounts in accordance with Art. 208 Code of Civil Procedure of the Russian Federation

- Statement of claim for indexation of awarded amounts

- Statement of claim for the exchange of a defective product for a product of good quality, if the store voluntarily refused to replace the purchased product

- Statement of claim to eliminate deficiencies in heat supply services and reduce the amount of payment (recalculation) for the provision of services of inadequate quality

- Statement of claim to eliminate the consequences of improper maintenance of a residential building

- Statement of claim to eliminate obstacles to access to sanitary equipment of housing cooperative No. and to the use of common property of housing cooperative

- Statement of claim in case of detection of deficiencies in the work performed (service provided)

- Statement of claim for recovery of lost wages in terms of ensuring the minimum wage

- Complaint to the Management Company for poor quality provision of housing and communal services

In which court and how to file a claim for unpaid wages?

Cases related to labor conflicts are heard in the district court. At the same time, either the employee himself or his representative can file a claim for liability for delayed payment of wages. The latter must have a properly executed power of attorney to represent the interests of the applicant.

Until October 2021, such claims were filed only at the location of the defendant. From 03.10.2016 after the entry into force of Federal Law dated 03.07.2016 No. 272-FZ, the applicant had a choice: to initiate proceedings in court at his own place of residence, or at the address of the defendant.

A citizen has 1 year from the day following the due date of payment, as set forth in the company’s local regulations, to file a claim in connection with delayed wages. If this deadline is missed for a good reason, then at the request of the employee whose rights have been violated, it can be restored by the court.

If the money was not paid upon dismissal, then the period must be counted from the day after the date of termination of the contract.

You can submit a claim in one of the following ways:

- In person at a reception with the judge;

- Submit to the court office, and the copy must be stamped with acceptance;

- Send by registered mail with notification.

Claims for recovery of wages are exempt from payment of state duty.

We file a claim with a judicial institution

Such applications are considered in the district court at the location of the employing organization. There is no need to pay state duty.

If wages will be forcibly collected upon reinstatement at work, then it is necessary to draw up a statement according to the sample

Do I need to file a claim if I am not officially employed?

Although the employment contract is considered one of the main documents in the legal process, it is not the only proving fact. There is other evidence that will prove you are right. Therefore, even if you receive a salary “in an envelope,” there is a high probability of a positive result. You can and should file a claim. Both the labor inspectorate and the prosecutor's office can prove the fact that you work for this particular employer. They will be able to do this after checking the organization.

It will be difficult to prove your salary and total debt. To defend your interests the following can be used:

- Testimony of witnesses.

- Bank statements.

- Time sheets, waybills, orders and other documentation.

- Correspondence within the company.

- Audio and video recordings.

All of the above facts will be considered in court in their entirety. It is important to note that collecting wages “in an envelope” is much more difficult.

To be sure to win the case, an employee can contact a competent lawyer. He will help him correctly draw up a claim in court and prepare a complete evidence base.

How to file a claim?

Expert opinion

Mikhailov Vladislav Ivanovich

Lawyer with 6 years of experience. Specializes in family law. Knows everything about the law.

An application to the court is submitted in any written form, but in accordance with the requirements of procedural legislation. It must contain the following information:

- Name of the court to which the appeal is addressed;

- Information about the plaintiff’s place of residence, as well as his full name;

- Identification data of the subject acting as a defendant in the claim;

- An indication of violations committed by the defendant;

- Description of the situation and circumstances of the offense;

- The requirements that the applicant makes to the defendant;

- Indicate the amounts of debt and penalties, monetary compensation for moral damages, with the obligatory presentation of the calculations on the basis of which they were obtained;

- List of attached documents serving as evidence.

Particular attention should be paid to correctly filling out the details, since errors in some cases can lead to refusal to accept the claim.

Employer's payment obligations

It is the employer’s responsibility to pay employees in compliance with the deadlines established for this (Article 22 of the Labor Code of the Russian Federation, hereinafter referred to as the Labor Code of the Russian Federation).

The amount and terms (days) of payments are generally established by the Labor Code of the Russian Federation and, more specifically, in collective and labor agreements. According to Art. 136 of the Labor Code of the Russian Federation, salary payments must be made every half month. If an employee resigns, the final payment is made on his last day of work.

Note! There are situations when an employer has the right not to pay wages and other payments to its specialist.

For example, according to the general rules, if an employee, in accordance with Art. 76 of the Labor Code of the Russian Federation, he is suspended from work; he is not paid for this time. Also Art. 137 of the Labor Code of the Russian Federation provides for a number of grounds on which deductions are made from wages.

Important! The employer's lack of funds is not considered a valid reason for delaying salary payments (Resolution of the RF Armed Forces dated May 18, 2015 No. 25-AD15-2).

One of the measures aimed at restoring the violated rights of an employee is going to court.

In connection with the changes made to the Labor Code of the Russian Federation, the period for filing is 1 year for claims for which the first overdue day of salary payment falls on October 3, 2016 or later; for previously arising requirements - 3 months from the date of delay (Article 392 of the Labor Code of the Russian Federation).

What should I include as support for my claim?

Documents related to the plaintiff’s work may serve as evidence of the stated claims. The following are considered as such:

- Orders on personnel composition (hiring, dismissal, awarding bonuses);

- Acts, explanatory notes, memos;

- Employment contracts;

- Work schedules;

- Time sheets.

During preparation for the trial, missing documents, as well as those with limited access, may be additionally requested by the judge.

Samples of claims for recovery of wages

The format that is used to draw up a claim can be obtained from a legal framework, obtained from a stand in court, or provided by a consulting lawyer.

- A standard claim form (as in the example above) for the recovery of wages - download.

- Download a completed sample claim for recovery of wages.

- Claim for recovery of wages when working without an employment contract - download.

- The claim can be filed not only individually, but also collectively, sample - download.

- In addition, you can submit a clarification to a previously filed claim - download.

If any difficulties arise, you can contact a labor lawyer on our website, who will help you do everything correctly and quickly.

The claim is based on the employee’s contractual right to receive wages on time and in full and the corresponding obligation of the employer to make this payment.

Comment on the rating

Thank you, your rating has been taken into account. You can also leave a comment on your rating.

Is the sample document useful?

If the document “Statement of Claim for Collection of Arrears in Wages and Unpaid Compensation for Unused Vacation” was useful to you, we ask you to leave a review about it.

Remember just 2 words:

Contract-Lawyer

And add Contract-Yurist.Ru to your bookmarks (Ctrl+D).

You will still need it!

Is it necessary to write a complaint?

To a certain extent, all attempts to peacefully resolve a labor dispute are a waste of time. The fact is that a delay in payment of wages is not always the employer’s malicious intent. As a rule, delays are explained by completely objective reasons, especially in times of crisis.

At the same time, the employer himself is fully aware that he is violating the law, which means that no claims or appeals to the labor dispute commission can change the situation, since the decisions of these authorities are not binding even if an administrative fine is imposed on the head of the enterprise.

In any case, wages will begin to be paid when there is money in the payroll fund.

At the same time, the enterprise may well have money in other funds, but the employer has no right to transfer it to the payroll fund. But a bailiff has the right to do this, who, in pursuance of a court decision, can withdraw money from the employer’s current account and transfer it to the employee.

Thus, if the delay in payment has been going on for a long time, and there is no chance of promptly replenishing the company’s accounts, there is simply no point in trying to peacefully resolve the dispute. It is necessary to file a claim in court, especially since:

- claims for labor disputes are not paid with state duty;

- Along with wages, you can ask the court to recover from the employer a penalty for the delay.

Statute of limitations

The statute of limitations is the period of time during which an employee whose rights have been violated can file a claim in court for payment of delayed wages. Today this period is one year. It seems that the period is very long and there is no need to rush into legal proceedings. But it is not always the case.

The statute of limitations does not count from the moment the statement of claim is filed, but from the moment the court makes a decision.

Considering that litigation can be lengthy, there is no need to wait too long to restore your rights. A claim should be filed immediately after an employee's wages are withheld.

Deadlines for going to court

In most not entirely professional sources, you can read about a 3-month period for filing a lawsuit in labor disputes. Let us immediately clarify that no deadlines can apply to delayed wages.

Let's explain this in more detail. Late wages is a tort, which is an offense covered by civil law. For every tort, offense and crime there is a concept of “continuing”. That is, a certain offense, starting on a certain day, can last for years.

Torts related to delays in wages, vacation pay, compensation, etc. are classified as continuing offenses, beginning on the day fixed for payment and ending immediately on the day of actual payment.

This means that no matter how long the delay lasts, the employee’s appeal to the court will be timely if he applied during the delay.

If payment was made, but the employee decided to collect a penalty from the employer, then in this case the 3-month limitation period will begin to apply from the date of actual payment.

There will also be a 3-month period for delays in wages in the event of an employee’s dismissal.

The procedure for determining the time limits for judicial collection

To determine the temporary procedure for filing a claim, it is necessary to establish the fact of accrual of earnings.

If wages are accrued but not paid, the citizen’s application is considered by the judicial authority in the order of writ proceedings. Such a violation is classified as continuing and provides the employee with the opportunity to file a statement with the court at any time to protect his interests.

A situation in which an employee’s salary is not accrued and paid is the basis for considering the case in a general court. The deadline for filing an application is limited to 3 months from the moment the victim establishes the fact of the violation.

In addition, it is important to understand that a 3-month period for judicial appeal is provided to a citizen in the event of termination of employment relations, with accrued but not paid wages, since such circumstances require the establishment of a violation by the employee on the date of dismissal, when the employer was obliged to carry out full calculation.

Should I go to a lawyer?

You can contact a lawyer to draw up a statement of claim. With the same success, you can compose it yourself, using the standard template available on the site, which you only need to supplement with your own specific information.

In no case do we set ourselves the task of depriving lawyers of their fees; we simply draw the attention of citizens to the fact that the fee in this case will not correspond to the real complexity of drawing up a claim, even if, at the same time as the salary, it is expected to collect penalties and moral damages.

Calculating the penalty is very simple. Moreover, if this arithmetic operation seems complicated, then you can use the late wage penalty calculator, which is also available on the website. The calculator will only need to indicate the amount of debt, and it will carry out all calculations independently in strict accordance with Art. 236 Labor Code of the Russian Federation.

Additionally, we would like to draw the readers’ attention to one more nuance.

If the claim is satisfied, all money spent by the plaintiff on legal assistance, including the participation of a lawyer in the court hearing, is recovered from the defendant.

But there is one drawback to this penalty. It is not a fact that wages will be collected immediately after the court decision, since there may be no funds in the employer’s account. As for other penalties, they will be last in line.

If we assume that 100 workers simultaneously go to court and receive a decision, then only the queue to receive wages will consist of 100 people with equal rights. As money arrives in the employer's account, they will all receive equal parts, and such payments may take a long time.

As for the collection of legal expenses (lawyer fees), their turn will come after the repayment of wages to employees. That is, collection can take years and the money will not be returned to the employee immediately, and in the event of bankruptcy of the enterprise, it will never be returned.

Whether a lawyer is needed at a court hearing is something everyone decides for themselves. Let us simply draw your attention to the fact that wage collection is a category of undisputed claims. There is no need to prove anything in court; the very fact of the delay and the existence of an employment contract are sufficient.

Advice from a labor lawyer from our law firm

- The claim must be accompanied by copies of the employment contract, payslips for the months in which wages were paid, you can attach a printout from the salary card confirming the absence of transfers from the employer for the disputed period and other copies of documents, if the plaintiff has them. If you do not have any documents, please contact your employer in writing to obtain them. If the employer does not provide the requested copies of documents, then during the trial process, petition the court to request copies of the documents from the defendant.

- The statement of claim should indicate the price of the claim, that is, the amount that the plaintiff demands from the defendant. It is also necessary to provide a calculation of the stated requirements, indicating how the amount of wages that the employer must pay is determined. If there are other claims, for example, for payment of compensation for delayed wages, these amounts are also included in the cost of the claim and it is necessary to provide a calculation of the corresponding amounts.

- Indicate and attach documents (if any) in support of the pre-trial procedure for resolving the dispute, that is, that the plaintiff contacted the defendant regarding the issue of non-payment of wages. However, compliance with pre-trial procedures in this category of cases is not mandatory.

- Further, in the pleading part of the claim, it is necessary to indicate the demands directly stated by the plaintiff, namely, to recover unpaid wages from the defendant in such and such an amount. You can also specify other additional requirements related to non-payment of wages.

- After the requirements, you should indicate a list of copies of documents that are attached to the claim.

- At the end of the application, the date is indicated, the plaintiff puts a signature, and next to it is a transcript of the signature.

- The statement of claim with documents must be submitted to the court in two copies if there is only a plaintiff and a defendant in the case. Don't forget to make one copy for yourself.

PLEASE NOTE : failure to comply with the claim form will result in its abandonment, that is, the court will set a deadline for the plaintiff to eliminate inconsistencies in the claim form. If the comments are not corrected, the application will be returned to the plaintiff.

We are drawing up a claim

There is no need to worry about the evidence. If the employer issues a certificate of arrears of wages, that will be great. If not, no big deal. Simply, in the statement of claim, it will be necessary to inform the court that it is impossible to obtain supporting documents from the employer, and at the same time ask the court to request them.

Drawing up a claim is an extremely simple operation, especially if you use a standard template.

The claim filing scheme consists of the following components:

- “cap”, which includes the name of the court, full name and address of the plaintiff and the name and address of the employer involved as a defendant;

- preamble or introductory part, in which the court is informed about the date of conclusion of the employment contract, the position and the amount of wages;

- the motivational part, which includes a statement of the events that led to the application to the court. For the category of claims under consideration, we will be talking about the fact of a delay in payment from a certain date. The same part provides a calculation of the amount that the plaintiff asks to recover from the employer. The amount includes either the net amount of wages for the period of delay, or the amount including penalties;

- list of attached documents.

Place of delivery

The district (city) court is considering a claim for non-payment of wages.

Labor disputes are distinguished by alternative jurisdiction at the choice of the plaintiff.

As a general rule, a claim is filed at the location (residence) of the defendant, but the plaintiff, at his choice, has the right to appeal to a judicial authority (Article 29 of the Code of Civil Procedure):

- at the address of the branch or representative office where he worked;

- at your place of residence.

Thus, the following disputes are considered through the procedure of claim proceedings:

- on the collection of unaccrued wages and other amounts;

- if the claim in court is more than 500,000 rubles;

- if a dispute has arisen between the employee and the employer regarding accrual or non-accrual, the amount of bonuses, compensation, benefits, etc.;

- on salary indexation;

- about the amount of deductions;

- on payment for overtime work, weekends and holidays;

- and so on.

And the collection of unpaid wages, vacation pay, dismissal payments and (or) other amounts that have already been accrued to the employee, if the cost of the claim does not exceed 500,000 rubles, and the amount is not disputed by either the employee or the employer, is carried out by a magistrate in the order of writ proceedings (Articles 22.1, 121, 122 of the Code of Civil Procedure of the Russian Federation).

Separately about moral damage

There are no moral damage calculators, since assessing one’s own mental suffering is entirely the prerogative of the plaintiff. No one prohibits the plaintiff from requesting any amount as compensation for moral damage, including one hundred or more million rubles.

Expert opinion

Mikhailov Vladislav Ivanovich

Lawyer with 6 years of experience. Specializes in family law. Knows everything about the law.

Another thing is that such a requirement will not be satisfied by the court in any case. Moral damage will be compensated, but the amount will correspond to the court’s assessment of damage. Therefore, one should be guided by the rule of excess of actual damage.

In this case, the presence of moral damage must be confirmed independently. Confirmation options may be:

- certificate confirming that the second spouse is on parental leave;

- an extract from the medical card in case someone from the family fell ill during the salary delay;

- certificate of salary of the second spouse if this salary does not provide a living wage for each family member, etc.