Articles 146, 148 and 316 of the Labor Code of the Russian Federation legally establish that the wages of workers employed in regions with special climatic conditions should be indexed using an increasing regional coefficient.

Law of the Russian Federation of February 19, 1993 N 4520-1 “On state guarantees and compensation for persons working and living in the regions of the Far North and equivalent areas” establishes the size of special regional coefficients for wages as of 2020.

In this publication, we will look at what the regional wage coefficient depends on, how it is determined, which payments apply and which do not.

- What is included in the Far North and areas equated to its regions?

- Correct determination of the size of the regional salary coefficient

- “Northern allowances” for part-time workers

- “Northern coefficient” for seasonal and temporary workers, shift workers

- “Northern supplement” for remote workers and homeworkers

- Regional coefficient for the salary of workers with a traveling nature of work

- The procedure for calculating the regional coefficient for wages

- What payments are subject to the regional coefficient?

- What payments are not subject to the regional coefficient?

- Higher regional coefficients

- The size of regional coefficients for employee wages

Let's start with a quote from Article 316 of the Labor Code of the Russian Federation:

Article 316 of the Labor Code of the Russian Federation.

Regional coefficient for wages The size of the regional coefficient and the procedure for its application for calculating wages of employees of organizations located in the regions of the Far North and equivalent areas are established by the Government of the Russian Federation. State authorities of the constituent entities of the Russian Federation and local self-government bodies have the right, at the expense of funds from the budgets of the constituent entities of the Russian Federation and the budgets of municipalities, respectively, to establish higher amounts of regional coefficients for state bodies of the constituent entities of the Russian Federation, state institutions of the constituent entities of the Russian Federation, local government bodies, and municipal institutions. A regulatory legal act of a constituent entity of the Russian Federation may establish a limit on the increase in the regional coefficient established by the municipalities included in the constituent entity of the Russian Federation. The amounts of these expenses relate to labor costs in full.

Regional coefficients and percentage bonuses to wages and when assigning insurance pensions in accordance with Articles 15 - 17 Federal Law of December 28, 2013 N 400-FZ “On Insurance Pensions” apply those established by government bodies of the former USSR or government bodies Russian Federation.

What is included in the Far North and areas equated to its regions?

Localities that must be classified as regions of the Far North and localities equated to its regions are determined by Resolution of the USSR Council of Ministers dated January 3, 1983 N 12 “On introducing amendments and additions to the List of regions of the Far North and localities equated to regions of the Far North, approved by Resolution of the Council Ministers of the USSR dated November 10, 1967 N 1029" (together with the "List of regions of the Far North and localities equated to regions of the Far North, which are subject to the Decrees of the Presidium of the Supreme Soviet of the USSR dated February 10, 1960 and September 26, 1967. on benefits for persons working in these areas and localities", approved by Resolution of the USSR Council of Ministers of November 10, 1967 N 1029).

Please note that in addition to the regions of the Far North, this resolution also contains a list of invalid decisions of the USSR Government on the inclusion of certain territories in the list of areas equated to regions of the Far North.

For pensioners and military

The district coefficient by region also affects the formation of pensions. However, there are some subtleties in this issue. The effect of this coefficient lasts exactly as long as the pensioner lives in the corresponding territory. If you leave for permanent residence in a region with a more favorable climate, the amount of the supplement will be recalculated or completely canceled.

But for military personnel, the regional coefficient for regions is even wider. The list additionally includes highland, arid or desert areas. And as an additional item to the list of payments subject to recalculation, an allowance for keeping state secrets is added.

Correct determination of the size of the regional salary coefficient

Russian labor legislation requires employers to use regional coefficients when calculating wages for employees in the Far North and regions equated to the regions of the Far North. We remind you that the costs of paying wages to employees, taking into account the regional coefficient, are included in the enterprise’s expenses, for which the income tax base can be reduced (Article 316 of the Labor Code of the Russian Federation, Article 255 of the Tax Code of the Russian Federation).

In order to correctly determine the size of the regional coefficient for calculating employee salaries, an organization can directly contact the labor inspectorate at the place of registration by sending a written request. The labor inspectorate is obliged to provide advice on the application of Article 356 of the Labor Code of the Russian Federation. Keep in mind that a written response from the labor inspectorate will help avoid future claims from inspectors and problems in labor disputes with employees.

Procedure for applying coefficients

Worker Ivanov A.G. performs duties in an organization located in the Magadan region. It uses a regional coefficient of 1.7.

The employee was accrued the following amounts:

- Salary - 18,000 rubles;

- Additional payment for length of service - 2500 rubles;

- Product development bonus - 3,000 rubles;

- Financial assistance for the birth of a child - 3000 rubles.

The coefficient does not apply to financial assistance.

The total amount to be paid will be: (18000+2500+3000)x1.7+3000=42950 rubles.

Northern allowances for part-time workers

If we talk about “northern allowances” for part-time workers (citizens working part-time), then the third paragraph of Article 285 of the Labor Code of the Russian Federation states:

Persons working part-time in areas where regional coefficients and wage allowances have been established are paid taking into account these coefficients and allowances.

You will also find these norms in the text of the “Review of the Supreme Court of the Russian Federation of the practice of courts considering cases related to the implementation of labor activities by citizens in the regions of the Far North and equivalent areas” (approved by the Presidium of the Supreme Court of the Russian Federation on February 26, 2014).

Wage supplement - types, size and example of calculating the difference between allowances and surcharges

- Based on Article 133 of the Labor Code, any employer does not have the right to set employees a salary that is lower than the minimum wage. Its size is determined by federal and regional legislation;

- Article 143 of the same Code says that the salary is set taking into account the tariff structure, or the tariff schedule, or categories;

- If the working conditions at an enterprise or organization deviate from the standard ones, then employees have the right to compensation for all additional labor costs, as specified in Articles 146 - 154 of the Labor Code of the Russian Federation;

- The employer has the right to set the amount of incentive payments;

- The Labor Code obliges the employer to calculate and pay wages.

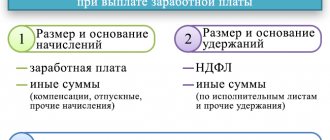

What payments are subject to the regional coefficient?

In accordance with the main 50 of the Labor Code of the Russian Federation (Features of labor regulation of persons working in the regions of the Far North and equivalent areas), the regional coefficient should be calculated for the following payments:

- remuneration for labor depending on the employee’s qualifications, complexity, quantity, quality and conditions of the work performed;

- compensation payments (payments for night work, overtime, work on holidays, etc.);

- incentive payments (bonuses, incentive bonuses and additional payments, as well as other incentive payments).

That is, the regional coefficient is calculated for all three main components of workers’ wages, which are different in their content, purposes and basis for calculation.

Who does it apply to?

All employees, regardless of the organizational and legal form or type of activity of the enterprise, working and living in areas experiencing difficulties with the following basic conditions can apply for a regional supplement:

- transport interchange;

- infrastructure;

- ecology;

- weather and climate;

- features of the organization's activities.

The rules apply to absolutely all employees - both full-time employees and employees working under civil contracts - working and living in the Far East, the Far North (and regions of similar status) and the south of the East Siberian territories.

What payments are not subject to the regional coefficient?

According to the provisions of Articles 129, 135, 315 of the Labor Code of the Russian Federation, the regional coefficient is not calculated for payments that are not included in the wage system, therefore the employer may not apply the regional coefficient when calculating a one-time bonus, for example.

Types of payments for which the regional coefficient is not calculated

- Percentage allowances

- To wages for work in the Far North and equivalent areas

- To wages for work in the southern regions of Eastern Siberia and the Far East

- Average earnings

- Vacation payments

- During the business trip

- During downtime due to the fault of the employer

- During the performance of state or public duties by the employee

- During the training of an employee aimed at vocational training

- Saved for days of blood donation

- Severance pay upon dismissal, etc.

- Material aid

- Payments for vacation

- In connection with the birth of a child

- In connection with an employee's marriage

- Due to a natural disaster

- Upon dismissal due to retirement, etc.

- Compensation for costs associated with the performance of labor duties

- Allowance for shift work in the Far North region (paid in lieu of daily allowance)

- Expenses associated with moving to work in another area

- For the use of the employee’s personal property in the interests of the employer, etc.

- Bonus not provided for by the company’s remuneration system

- For the professional holiday

- Payments on the anniversary date

- Related to the conferment of an honorary title, etc.

How odds are used

Let us show how regional coefficients are taken into account when calculating earnings using an example. Let's say Frolov F.F. lives and works in the Novosibirsk region. The table shows that for this subject of the Russian Federation a regional coefficient of 1.2 is established. Suppose that in the current working month, Frolov, in addition to a salary of 30,000 rubles, is entitled to a regular bonus for meeting targets in the amount of 10,000 rubles. Let's calculate how much money Frolov will receive using the formula:

payable = (salary + bonus) × district coefficient = (30,000 + 10,000) × 1.2 = 48,000 rubles.

If Frolov had received an increase of 10,000 rubles in the form of financial assistance from the organization, for example, in connection with the birth of a child, or a one-time bonus, for example, for a successful rationalization proposal, then the multiplier would have been applied only to the salary. In this case, Frolov would receive:

payable = salary × regional coefficient + financial assistance = 30,000 × 1.2 + 10,000 = 46,000 rubles.

Higher regional odds sizes

State authorities of the constituent entities of the Russian Federation and local self-government bodies have the right, at the expense of funds from the budgets of the constituent entities of the Russian Federation and the budgets of municipalities, respectively, to establish higher amounts of regional coefficients for state bodies and state institutions of the constituent entities of the Russian Federation, local government bodies and municipal institutions. A regulatory legal act of a constituent entity of the Russian Federation may establish a limit on the increase in the regional coefficient established by the municipalities included in the constituent entity of the Russian Federation.

Commentary on Article 316 of the Labor Code of the Russian Federation

In accordance with Article 148 of the Labor Code, the regional coefficient is the numerical value of the increase in wages due to special climatic conditions, in this case in the regions of the Far North and equivalent areas.

Article 316 of the Labor Code, like Article 10 of the Law of the Russian Federation “On state guarantees and compensation for persons working and living in the regions of the Far North and equivalent areas,” contains three rules for establishing the size of the regional coefficient.

1. The size of the regional coefficient and the procedure for its application are established by the Government of the Russian Federation.

2. State authorities and local self-government bodies, at the expense of the corresponding budgets, can establish higher regional coefficients for those working in institutions financed from these budgets.

3. State authorities of the constituent entities of the Federation may establish a maximum amount for increasing the regional coefficient, established by their constituent municipalities.

The regional coefficient refers to wages, and not to guarantees and compensations, and is based on Article 148 of the Labor Code. It is not subject to the provisions of the Law of the Russian Federation “On State Guarantees and Compensations for Persons Working and Living in the Far North and Equivalent Areas” on legislation and financial support for guarantees and compensation for northerners. The provisions of Part 1 of Article 287 of the Labor Code do not apply to the regional coefficient. The coefficient for the earnings of part-time workers is calculated in the same manner as for all other employees, and begins from the first day of work in the Far North and equivalent areas.

The regional coefficient is calculated on the actual earnings received in the corresponding month, both full and incomplete.

Earnings include: payment at tariff rates and salaries, bonuses and additional payments, increased payment for overtime work and work at night, on weekends and non-working holidays, payment for downtime, bonuses determined by the remuneration system, remuneration for long service, paid monthly, quarterly or one time.

At the same time, increasing wages using regional coefficients does not create new salaries and tariff rates. If the legislation provides that certain payments are made only based on the tariff rate (salary), the specified coefficients are not applied.

Also, the regional coefficient is not calculated for various types of compensation, such as bonuses for rotational work and field allowances. In accordance with Article 164 of the Labor Code, they do not relate to wages, but are intended to reimburse the employee for expenses incurred in connection with his work activities.

The regional coefficient is not calculated on percentage increases in wages for work in the Far North and equivalent areas, on one-time incentive payments, amounts of financial assistance, or on personal allowances.

When calculating average earnings, the regional coefficient is not applied due to the fact that it has already been taken into account.

The legislation does not establish a maximum amount of earnings to which the regional coefficient should be applied. Therefore, accrual is carried out for the entire amount of actual earnings, regardless of its value.

The current amounts of regional coefficients for the wages of workers in non-production industries in the regions of the Far North and equivalent areas are given in the information letter approved by the Department for Pensions of the Ministry of Labor of Russia on June 9, 2003 N 1199-16, the Department of Income and Standards of Living of the Ministry of Labor of Russia May 19, 2003 N 670-9 and the Pension Fund of the Russian Federation June 9, 2003 N 25-23/5995. These include, in particular:

Areas where a coefficient of 2.0 is applied to employee wages:

— islands of the Arctic Ocean and its seas (with the exception of the White Sea islands and Dikson Island);

- Republic of Sakha (Yakutia) - areas where enterprises and construction sites of the diamond mining industry are located, at the Aikhal and Udachnaya deposits, the Deputatsky and Kular mines, Nizhnekolymsky district, the village of Ust-Kuiga, Ust-Yansky district;

— Sakhalin region — North Kuril, Kuril, South Kuril regions (Kuril Islands);

— Kamchatka region — Aleutian region (Commander Islands);

- Chukotka Autonomous Okrug - the entire territory of the Autonomous Okrug.

Areas where a coefficient of 1.80 is applied to employee wages:

— Krasnoyarsk Territory — Norilsk and populated areas subordinate to its administration;

— Murmansk region — Murmansk-140.

Areas where a coefficient of 1.70 is applied to employee wages:

— Republic of Sakha (Yakutia) — Lensky district (north of 61 degrees north latitude), Mirny and settlements subordinate to its administration; Magadan region - the entire territory of the region; Murmansk region - urban-type settlement Tumanny.

Areas where a coefficient of 1.60 is applied to employee wages:

— Komi Republic — the city of Vorkuta and settlements subordinate to its administration;

- Republic of Sakha (Yakutia) - Abyisky, Allaikhovsky, Anabarsky, Bulunsky, Verkhnevilyuysky, Verkhnekolymsky, Verkhoyansky, Vilyuysky, Zhigansky, Kobyaisky, Nyurbinsky (formerly Leninsky), Mirninsky, Momsky, Oymyakonsky, Oleneksky, Srednekolymsky, Suntarsky, Tomponsky, Ust-Yansky (except for the village of Ust-Kuiga) and Eveno-Bytantaysky districts;

- Taimyr (Dolgano-Nenets) Autonomous Okrug - the entire territory of the Autonomous Okrug;

- Evenki Autonomous Okrug - northern parts of the Evenki Autonomous Okrug (north of the Lower Tunguska River);

- Krasnoyarsk Territory - Turukhansky (north of the Lower Tunguska and Turukhan rivers) region, areas located north of the Arctic Circle (with the exception of the city of Norilsk and settlements subordinate to its administration), the city of Igarka and settlements subordinate to its administration;

— Khabarovsk Territory — Okhotsk region;

- Kamchatka region - the entire territory of the region (with the exception of the Aleutian region);

- Koryak Autonomous Okrug - the entire territory of the Autonomous Okrug;

— Sakhalin region — Nogliki, Okha districts, Okha.

Areas where a coefficient of 1.50 is applied to employee wages:

— Komi Republic — the city of Inta and settlements subordinate to its administration;

— Republic of Sakha (Yakutia) — urban-type settlement of Kangalassy;

— Republic of Tyva — Mongun-Taiginsky, Todzhinsky, Kyzylsky (territory of Shynaan rural administration) districts;

— Nenets Autonomous Okrug - the entire territory of the Autonomous Okrug;

— Tyumen region — Uvat district;

- Khanty-Mansiysk Autonomous Okrug - the northern part of the autonomous okrug (north of 60 degrees north latitude);

- Yamalo-Nenets Autonomous Okrug - the entire territory of the Autonomous Okrug;

- Tomsk region - Alexandrovsky, Verkhneketsky, Kargasoksky, Kolpashevo, Parabelsky and Chainsky districts, the cities of Kedrovy, Kolpashevo, Strezhevoy.

Areas where a coefficient of 1.40 is applied to employee wages:

— Altai Republic — Kosh-Agachsky, Ulagansky districts;

- Republic of Karelia - Belomorsky, Kalevalsky, Kemsky, Loukhsky districts, the city of Kem and settlements subordinate to its administration, Kostomuksha;

- The Republic of Sakha (Yakutia);

- Tyva Republic;

— Primorsky Territory — Kavalerovsky district (village of the Taezhny and Ternisty mines);

- Khabarovsk Territory - Ayano-Maysky, Vaninsky, Verkhnebureinsky (north of 51 degrees north latitude), named after. P. Osipenko, Nikolaevsky, Sovetsko-Gavansky, Solnechny (Amgun and Dukinsky rural administrations), Tuguro-Chumikansky, Ulchsky districts, the cities of Nikolaevsk-on-Amur, Sovetskaya Gavan and settlements subordinate to its administration;

— Arkhangelsk region — Leshukonsky, Mezensky, Pinezhsky and Solovetsky (Solovetsky Islands) districts, the city of Severodvinsk and settlements subordinate to its administration;

- Murmansk region;

— Sakhalin region.

Areas where a coefficient of 1.30 is applied to employee wages:

— Republic of Buryatia — Bauntovsky, Muysky, Severo-Baikalsky districts, the city of Severobaikalsk and settlements subordinate to its administration;

— Republic of Karelia — Medvezhyegorsky, Muezersky, Pudozhsky and Segezhsky districts, the city of Segezha and settlements subordinate to its administration;

- Komi Republic - Izhemsky, Pechora, Troitsko-Pechora, Ust-Tsilemsky, Udora districts, the cities of Vuktyl and populated areas subordinate to its administration, Sosnogorsk and populated areas subordinate to its administration, Ukhta and populated areas subordinate to its administration, Usinsk and populated areas subordinate to its administration points, Pechora and settlements subordinate to its administration;

- Evenki Autonomous Okrug - the southern parts of the Evenki Autonomous Okrug (south of the Lower Tunguska River);

- Krasnoyarsk Territory - Boguchansky, Yenisei, Kezhemsky, Motyginsky, North Yenisei, Turukhansky (south of the Lower Tunguska and Turukhan rivers) districts, the cities of Yeniseisk and Lesosibirsk and settlements subordinate to their administrations;

- Amur region - Zeya, Selemdzhinsky, Tynda (with the exception of the Murtygitsky village council) districts, the cities of Zeya and Tynda and settlements subordinate to their administrations;

— Irkutsk region — Bodaibinsky, Bratsky, Kazachinsko-Lensky, Katangsky, Kirensky, Mamsko-Chuysky, Nizhneilimsky, Ust-Ilimsky, Ust-Kutsky districts, Bratsk and settlements subordinate to its administration, the cities of Bodaibo, Ust-Ilimsk, Ust -Kut;

— Chita region — Kalarsky, Tungiro-Olekminsky and Tungo-Kochensky districts;

- Khanty-Mansiysk Autonomous Okrug - the southern part of the autonomous okrug (south of 60 degrees north latitude);

- Tomsk region - Bakcharsky, Krivosheinsky, Molchanovsky, Teguldetsky districts.

Areas where a coefficient of 1.20 is applied to employee wages:

— Republic of Buryatia — Barguzinsky, Kurumkansky, Okinsky districts;

- Komi Republic;

- Primorsky Territory - Kavalerovsky (with the exception of the villages of the Taezhny and Ternisty mines), Krasnoarmeysky (urban-type settlement Vostok and Boguslavetskaya, Vostretsovskaya, Dalnekutskaya, Izmailikhinskaya, Melnichnaya, Roshchinskaya, Taezhnenskaya rural administrations), Olginsky, Terneysky districts, Dalnegorsk and populated areas points subordinate to his administration (formerly Dalnegorsky district);

- Khabarovsk Territory - Amursky (urban-type settlement Elban and settlements subordinate to its administration, Achanskaya, Voznesenskaya, Dzhuenskaya, Omminskaya, Padalinskaya rural administrations), Verkhnebureinsky (south of 51 degrees north latitude), Komsomolsky, Solnechny (with the exception of Amgunskaya and Dukinskaya rural administrations ) districts, cities of Amursk, Komsomolsk-on-Amur;

- Arhangelsk region;

- Komi-Permyak Autonomous Okrug - Gainsky, Kosinsky, Kochevsky districts.

Areas where a coefficient of 1.15 is applied to employee wages:

— Republic of Karelia.