Home / Salary disputes / Find out how many days the employer has the right to withhold wages

According to statistics, every 5 working citizen has encountered a violation of his labor rights. Most often, such violations are related to the timing of payment of wages. In order to defend your interests, you need to study the norms of labor legislation.

For how long does an employer have the right to delay wage payments? Which authorities should I contact if the delay exceeds the legal deadline? Let's look at these questions in more detail.

What is considered a violation of payment deadlines?

The procedure for calculating wages is fixed in. It establishes the following restrictions regarding the timing of salary transfers:

- Payment is made in two installments, 2 times a month;

- Payment must be made no later than 15 days after the end of the accrual period;

- If the payday coincides with a weekend or non-working holiday, then the transfer must be made on the next working day preceding the specified date;

- Vacation pay is paid no later than three days before the start of the vacation.

In addition, it contains a special rule that requires a full settlement to be made upon termination of an employment contract on the day of dismissal.

Violation of any of these provisions will be considered as a fact of non-compliance with labor laws and may subject the employer to various types of liability.

How long can wages be delayed?

As the Labor Code of the Russian Federation states, 15 days is the only acceptable period for delaying wages. After this period, employees have the right to suspend activities until the full amount withheld is received. To do this, a written notice to the employer about the temporary cessation of work is drawn up. It is advisable to make two copies at once so that the manager has the opportunity to mark receipt on one of them. This copy remains with the employee as evidence of timely notification to management. After this, the employee has the right not to attend the workplace until he receives his salary.

Even in the event of a delay in payment, representatives of some positions do not have the right to suspend work. Among them:

- civil servants;

- workers in hazardous types of production;

- workers in the energy, heat and water supply sectors;

- ambulance and communications staff.

Suspension of activities is allowed until the announcement of the date and time of debt repayment. The exception is the period when a state of emergency is declared in a locality or throughout the state. In all other cases, the law obliges the employer to pay all amounts due during the downtime period. However, lawyers recommend that production employees who want to stop working before payroll take into account the peculiarities of the enterprise’s functioning. Long-term absence of labor can lead to bankruptcy of the organization and loss of jobs for all employees.

Note!

According to the Labor Code of the Russian Federation, employees are required to resume their work activities starting from the next day after receiving notification of the employer’s readiness to pay the due wages.

If the payment was not made within the prescribed period, the employee has the right to either submit a new notice of temporary termination of activity, or file a statement of claim against the employer. The purpose of the claim will be to bring the authorities to administrative or criminal liability.

Not only the organization, but also responsible officials, including the director, chief accountant and others, can be held liable for violation of deadlines. After employees who have not received their money on time go to court, the court is obliged to establish the employer’s guilt in this offense. The statute of limitations for the crime is two months from the date of the first delay. This is the period during which citizens have the right to report an offense.

An administrative offense may be a one-time delay of wages for a period of up to two months in the amount prescribed by law.

In case of delay of more than two months, criminal liability arises. In this case, the fact of selfish interest of the employer must be proven.

Delay of wages from the legal point of view

The procedure and timing of settlements with employees are regulated by Art. 136 Labor Code of the Russian Federation. According to parts 5 and 6, the salary must be issued directly to the employee at the location of the enterprise or transferred to a bank account. The frequency of payments is at least once every 15 days. Accordingly, the employee must receive two or more payments each month.

The norms of the Labor Code of the Russian Federation do not determine the percentage of payments. Therefore, one of them may be larger in size than the other. For example, the system for paying employees may be as follows: the first payment includes only the salary at the tariff rate, and the second, in addition to the salary, includes bonuses and other additional payments.

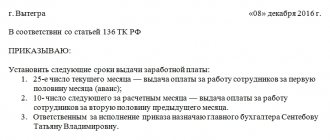

Specific dates for payment of wages, in accordance with Part 4 of Art. 136 of the Labor Code of the Russian Federation, are determined in the collective labor agreement for all employees equally or are stipulated directly in the contract with each employee. Moreover, if the payment date falls on a weekend or holiday, then the calculation is made the day before.

For individual payments, special deadlines may be established within which the administration of the organization must make them. So, for example, vacation pay, according to Part 9 of Art. 136 of the Labor Code of the Russian Federation, are transferred to the employee no later than three days before the start of the vacation.

Accordingly, if an enterprise does not comply with these requirements and pays the employee at the wrong time or does not pay the due money at all, then we are talking about delayed wages.

Responsibility for delayed wages lies in the application of financial and other sanctions to the administration of the enterprise in accordance with the norms of the Labor Code, Code of Administrative Offenses and the Criminal Code of the Russian Federation - depending on the timing and amount of accumulated debt.

If necessary, you can go to court to collect wages.

What is “Payment Delay”

The employer is obliged to pay its employees remuneration for the work performed. Payments must be made at least 2 times a month and every 15 days. That is, wages must be paid to the employee no later than 15 days from the end of the month for which it was accrued. For example, salaries for July must be paid no later than August 15.

Deviation from these deadlines in the direction of increase is called “wage delay”. This is a violation of workers' rights, which is punishable in accordance with labor and administrative legislation.

The dates for payment of remuneration for labor must be specified in the employer’s local documents. Such documents may be:

- collective agreement;

- employment contract;

- another document that regulates the payment of wages at a given enterprise.

The employer is obliged to adhere to the deadlines specified in these documents. Otherwise, for each day of delay in payments, he will have to pay workers compensation.

Employer's liability for delayed wages

During a downturn in the economy, many businessmen do not have enough money to make all the necessary payments. Therefore, delays often occur, including in settlements with employees. Let's consider what threatens an employer who does not pay wages .

Administrative responsibility

Punishment can only occur if the manager is guilty of delaying payment deadlines.

The employer is responsible for delayed wages with the following consequences (Article 5.27 of the Code of Administrative Offenses of the Russian Federation):

- manager and individual entrepreneur: warning or fine of 1000-5000 rubles. Repeatedly ─ up to 20,000 rubles (Part 4 of Article 5.27 of the Code of Administrative Offenses of the Russian Federation), ban on holding a position for no more than 3 years.

- fine for the institution: 30,000-50,000 rubles. In case of a repeated incident, a penalty of up to 70,000 rubles is imposed (Part 4 of Article 5.27 of the Code of Administrative Offenses of the Russian Federation).

Disciplinary responsibility

Delayed wages due to the fault of the manager or official representatives is an improper performance of their direct duties. This may entail receiving one of the disciplinary sanctions in the form of a reprimand, reprimand or dismissal (Article 192 of the Labor Code of the Russian Federation). If the facts of violation are proven, the employer applies appropriate enforcement measures to the management of the institution (Article 195 of the Labor Code of the Russian Federation).

To carry out an inspection, a representative of the interests of employees (this may be a trade union) submits a corresponding application to the employer, which indicates violations on the part of management. The employer is given 1 week to review this document (Article 370 of the Labor Code of the Russian Federation). Next, he takes measures to eliminate violations, selects the form of disciplinary punishment and notifies the applicant about this (Article 22 of the Labor Code of the Russian Federation).

The period of validity of this punishment is 1 year from the date of its imposition.

Financial liability for late wages

If there is any delay in payment to employees, the employer must pay the employee compensation for the delay. The amount of compensation should not be less than 1/150 of the current key rate of the Central Bank of the Russian Federation for each day of delay (Article 236 of the Labor Code of the Russian Federation).

Compensation may be greater; for this, the increased amount must be stipulated in the employment or collective agreement.

Compensation

Additionally

Remedies for late payment of wages:

- are not subject to personal income tax;

- are not included in income tax expenses;

- are subject to insurance premiums for compulsory insurance in the same way as wages.

From October 2021, the procedure for calculating compensation for non-payment of wages to employees has changed. Interest is accrued in accordance with the key rate of 1/150 (Article 2 No. 272-FZ of July 3, 2016). For example, a fixed salary payment date in a company is the 10th day of each month. The employee’s payment for January (50,000 rubles) was made on 02/20/2017. For 10 days (from 02/10/2017 to 02/20/2017 inclusive), taking into account the rate of the Central Bank of the Russian Federation (10%), compensation in the amount of 333 rubles was accrued.

Previously, this rate was 1/300. Thus, the minimum amount for compensation has been doubled by the Law. At the request of the employer, the amount of compensation can be increased and must be specified in the employment agreement or local regulations (Article 236 of the Labor Code of the Russian Federation).

Payment for late wages is the direct responsibility of the employer: the employee does not need to submit any documents or complain to higher management. Compensation is paid at the same time as the delayed salary amount.

Suspension of official duties

An employee may not come to the workplace until the day of payment of wages if the delay in payment of wages exceeds 15 days (Article 142 of the Labor Code of the Russian Federation). You should inform management of your desire in writing.

When management begins making payments, that employee is notified by notice in writing. After receiving it, he must go to his workplace. If he did not do this, this act is regarded as truancy.

All days during the period of suspended work must be paid in the amount of the average wage (document No. 14-2-337 of the Ministry of Labor of Russia dated December 25, 2013). Read about payment for forced downtime due to the employer's fault here.

It is worth noting: there are some nuances in the issue of suspension of labor activity. Such self-defense actions are legal only in case of delay in payment of wages. If the employee was not paid vacation pay, and he decided not to go to work after the vacation until it was paid, then this will qualify as absenteeism. To defend the payment of vacation pay on time, there is another mechanism of influence.

Some categories of employees cannot stop performing their job duties (Part 2 of Article 142 of the Labor Code of the Russian Federation):

- military and civil servants;

- people who support people’s livelihoods (electricians, doctors, etc.) or who work in particularly hazardous industries and equipment;

- when a state of emergency is declared.

How much will it cost to delay wages for up to 10 days?

| Who will pay | Amount of fine or punishment | |

| First violation | Repeated violation | |

| Director, chief accountant | 10,000 – 20,000 rub. or warning | 20,000 – 30,000 rub. or disqualification for 1-3 years |

| Individual entrepreneur | 1000 – 5000 rub. | 10,000 – 30,000 rub. |

| Company | 30,000 – 50,000 rub. | 50,000 – 100,000 rub. |

Example

The amount of unpaid wages is 50,000 rubles, the delay is 20 days, the key rate of the Central Bank of the Russian Federation is 4.25%. The amount of standard compensation will be equal to:

K = 50,000 x (4.25% / 150) x 20 = 283.3 rubles.

What are the fines under criminal penalties?

The application of fines in a criminal case is possible only by court decision. To initiate criminal proceedings, the delay must last:

- For part of the amount – more than 3 months;

- For the full amount of salary – more than 2 months.

It is also necessary to have intent on the part of the employer, selfish motives. As a rule, this means that a company official had funds for a salary, but he deliberately did not pay it, or conditions were deliberately created for the lack of funds in the accounts to pay off wage arrears. If an official is found guilty, he may face one of the following types of fines.

| Type of violation | Partial delay over 3 months. | Full delay or payment of the minimum wage for more than 2 months. | Any of these violations that resulted in grave consequences. |

| Amount of fine | up to 120,000 rub. or in the amount of annual income | from 100,000 rub. up to 500,000 rub. or the amount of receipts for a period of up to 3 years | from 200,000 rub. up to 500,000 rub. or income for a period of one to 3 years |

The period of delay in the interests of applying criminal penalties is calculated from the date following the approved day of payment of wages. In addition, if months of delayed wages alternated with months of payment, then the periods of non-transfer for these purposes are not cumulative.

A prerequisite for the application of punishment is the presence of guilt of the official and his selfish intent, personal interest. If such evidence is not provided or is considered insufficient by the court, the application of fines in criminal proceedings is impossible.

In addition to fines, other punishments may be applied in terms of being subjected to correctional labor or a prison sentence of varying lengths. Along with fines, it is possible to introduce restrictions for managers to occupy leadership positions.

Criminal punishment and the peculiarities of its application

The most severe measure of liability for non-payment of wages on time is the application of criminal punishment under Art. 145.1 of the Criminal Code of the Russian Federation. This provision presupposes the presence of two independent elements of a crime. Thus, for Part 1 to apply, two conditions must exist:

- Salaries are paid partially for three or more months in an amount less than half of what the employee is entitled to.

- The reasons for incomplete payment are the selfish interest of the employer. That is, if an enterprise cannot pay its employees in full due to objective reasons, for example, there is simply no money in its accounts and there is no way to replenish them, then it is impossible to bring the management to criminal liability.

The penalty for this act varies from a fine to 120 thousand rubles to a year in prison.

To use Part 2 of Art. 145.1 of the Criminal Code of the Russian Federation it is necessary that:

- the enterprise did not pay wages at all or paid less than one minimum wage per month;

- the debt period exceeded two months;

- the reason for the debt is the employer’s self-interest.

The severity of the sanctions in this situation will be greater: a fine of up to 500 thousand rubles or imprisonment for up to three years.

If, in the presence of any of the specified parts 1 or 2 of Art. 145.1 of the Criminal Code of the Russian Federation, if additionally serious consequences occur, for example the death of a person, then the employer will face a fine of up to 500 thousand or imprisonment for up to five years.

Features of bringing to criminal liability for non-payment of wages

In Art. 145.1 of the Criminal Code of the Russian Federation also has a note that allows the management of the enterprise to avoid a fine or imprisonment. If the committed act did not entail serious consequences, was committed for the first time and within two months from the date of initiation of the criminal case the debt to the employees was fully repaid, the guilty person is released from liability under this article.

Upon dismissal

Changes in legislation state that full payment must be made to the employee upon dismissal.

This includes:

- all wages and accumulated debts, if any;

- the required bonuses and thirteenth salary, when it is provided for in the internal regulations on bonuses or contracts;

- compensation in case of unused legal leave or days of delay;

- severance pay issued upon termination of activity or reduction of staff (the amount is within the monthly salary);

- allowance necessary for employment (it is approximately the average two-month salary).

An employee has the right to receive unemployed status six months after dismissal. Therefore, he will be given benefits for three months.

An entrepreneur is not always ready to make a full payment upon dismissal. The injured employee must follow similar actions as in the case of delays in payment of wages.

Before contacting the inspectorate, prosecutor's office or court, you need to make a list of your claims and present them to your employer. Failure to comply with legal requirements will allow for an inspection and trial, after which a positive verdict will be issued

How should employees act?

If your money has been delayed for more than 15 days, and you are not ready to wait any longer and make concessions to management, you must follow these steps:

- submit an application to the state labor inspectorate, reporting the employer’s violation of current labor legislation;

- suspend work after 15 days by notifying management in writing;

- go to court by filing a statement of claim demanding payment of the due wages, as well as monetary compensation for the entire period of suspension of work;

- file a petition to initiate a criminal case with the police or prosecutor's office if funds have not been paid for more than two months.

The employer will have the opportunity to challenge the existence of the debt

The matter is resolved more quickly if there is a trade union in the organization - a voluntary public association of workers. He has the right to represent and protect the interests of all employees of the enterprise in court and other bodies. Depending on the nature, statute of limitations of the offense and the professionalism of the defense, a court or other executive body may oblige the company to pay the debt or insist on holding court hearings for a detailed trial of the case.

Having a conflict with your employer? Our lawyers will help you settle it before trial. They will negotiate with your superiors, identify possible options for resolving the conflict situation, draw up a settlement agreement taking into account your interests, and protect your rights in the labor inspectorate.

Employees can initiate bankruptcy

Company employees have the right to initiate bankruptcy of the company or to submit their demands for payment of wage arrears and severance pay in the bankruptcy procedure itself. In 2021, the first such cases appeared and, alas, their results are sad for companies.

According to paragraph 1 of Article 7 of the Law of October 26, 2002 No. 127-FZ “On Insolvency (Bankruptcy),” employees, including former ones, can apply to the court to declare the employer bankrupt due to wage debts.

To state their claims in bankruptcy proceedings, employees must hold a meeting no later than five working days before the date of the meeting of creditors and state their claims. At the meeting, employees elect their representative who will protect their interests in the bankruptcy process of the employer. Claims for payment of wage debts are included in the register of creditors' claims by the arbitration manager.

Employees can stop working

In 2021, there were often reports in the media that employees did not come to work due to salary arrears. Yes, and in general, conflicts over salaries have become a trend in 2021. Let's just remember the scandal surrounding Ford's exit from the market. The employees demanded both what they were entitled to under Russian law and what went beyond all reasonable limits.

It only takes one employee who didn't get paid on time for you to be punished.

Employees have the right to stop working if their wages are delayed by more than 15 days. The amount of debt and the degree of guilt of the employer do not matter.

Before stopping work, employees are required to inform the director of the company in writing about their intentions, and only after that do they have the right not to go to work. Work may be stopped until the wage arrears are fully repaid.

Days when the company does not work at the initiative of employees due to delayed wages are paid in the amount of average earnings.

To resume the company's work, management is obliged to notify workers in writing of their readiness to pay the debt and do this on the day the workers return to work.

Days when the company's work was suspended due to the company's wage debts to employees are paid in the amount of average earnings.

Article 142 of the Labor Code of the Russian Federation provides a list of works for which it is prohibited to suspend work. This mainly concerns the military, workers, the Ministry of Emergency Situations, firefighters, civil servants and workers in areas related to ensuring the livelihoods of the population.

How to correctly write a complaint to the FIT

The first authority to which employees usually complain if they cannot resolve the problem with the employer peacefully is the labor inspectorate.

In Art. 7 of Law No. 59-FZ specifies the information that must be contained in a complaint to the FIT. This:

- about the labor inspection itself - full name, location address;

- information about the applicant - full name, address of registration, position, contact information (phone number and email address);

- document's name;

- essence of the complaint. It is necessary to indicate the problem itself, provide examples of how the applicant tried to solve the problem before contacting the FIT, provide links to the norms of the Labor Code of the Russian Federation and other regulations;

- a request to conduct an inspection and timely notify the applicant of its results;

- application. If there are documents confirming the described facts, then you must attach copies of them. This may be an employment contract or another document that states the date of payment of wages;

- date of document preparation;

- the applicant’s signature, and also its transcript.

A complaint can only be made in writing, subject to the following rules:

- without swear words and phrases;

- without insulting the honor and dignity of others;

- containing only reliable information.

If an appeal to the FIT does not produce results or the employee wishes to immediately go to court, this is his right. But it is necessary to comply with the application deadlines.

Sample letter to FIT regarding non-payment of wages

How can an employer avoid criminal penalties?

Since 2021, employers have the opportunity to avoid criminal punishment , including in the form of fines. This is permitted in the following circumstances:

- This is the first offense in the employer's practice;

- The debt was repaid within 2 months from the date of initiation of criminal proceedings;

- All due penalties have been paid along with the debt;

- During the inspection, no signs of another crime were found.

Thus, the employer, showing good will, can obtain exemption from criminal punishment.

Four conditions for exemption from criminal liability for non-payment of wages

The Criminal Code has been supplemented with a provision that allows employers to avoid criminal liability if they violate the terms of payment of salaries and other payments to employees (Article 145.1 of the Criminal Code of the Russian Federation).

It is stated that a person who has committed a crime in the form of partial non-payment of wages for more than 3 months or complete non-payment for more than 2 months is exempt from criminal liability if:

- this crime was committed for the first time;

- within 2 months from the date of initiation of the criminal case, the debt is fully repaid;

- all employees were paid interest for failure to pay wages on time;

- there is no other corpus delicti in the actions of the perpetrator.

Federal Law of December 27, 2021 No. 533-FZ “On Amendments to Articles 76.1 and 145.1 of the Criminal Code of the Russian Federation and the Criminal Procedure Code of the Russian Federation”

Note:

Article 145.1 of the Criminal Code of the Russian Federation provides for the following liability:

1) for partial non-payment of wages, pensions, scholarships, allowances and other payments for more than 3 months, committed by the employer out of selfish or other personal interest (either):

- a fine of up to 120 thousand rubles or the salary of the convicted person for a period of up to 1 year;

- deprivation of the right to hold certain positions for up to 1 year;

- forced labor for up to 2 years;

- imprisonment for up to 1 year.

Partial non-payment means payment in the amount of less than half;

2) for complete non-payment for more than 2 months or payments during this period in an amount below the minimum wage, made by the employer out of selfish or other personal interest (either or):

- a fine in the amount of 100 to 500 thousand rubles or the salary of the convicted person for a period of up to 3 years;

- forced labor for up to 3 years with deprivation of the right to hold certain positions for the same period or without such deprivation;

- imprisonment for a term of up to 3 years with or without deprivation of the right to hold certain positions for up to 3 years.

3) the infliction of grave consequences by any of these acts entails (either or):

- a fine in the amount of 200 to 500 thousand rubles or the salary of the convicted person for a period of 1 to 3 years;;

- imprisonment for a term of 2 to 5 years with or without deprivation of the right to hold certain positions or engage in certain activities for a term of up to 5 years.

How to fulfill the conditions for exemption from criminal liability for non-payment of wages

So, four conditions have been introduced that an employer must fulfill in order for the general director of an organization or an entrepreneur not to be prosecuted.

Let's look at what is hidden behind the wording of the law.

Crime committed for the first time

First, you need to understand who exactly the non-payment of wages should be committed for the first time: the organization or its general director? After all, the company directly pays salaries to employees, and the subject of criminal liability is the head of the employer, so this question is quite natural.

The new amendments to the Criminal Code of the Russian Federation use the term “person who has committed a crime for the first time.” According to Article 145.1 of the Criminal Code of the Russian Federation, a crime can only be committed by an individual, that is, the general director of an organization. Consequently, if the company itself has already committed non-payment of wages, but its current manager has never been convicted of committing such a crime, then this condition should be considered met - the crime has been committed for the first time.

The second aspect: what is meant by committing a crime for the first time?

The fact is that in criminal law this term is used not only in the literal sense. A person who has previously:

1) never committed such a crime;

2) either committed, but is no longer convicted, because, for example:

- was not convicted in connection with active repentance (Article 75 of the Criminal Code of the Russian Federation), reconciliation with the victim (Article 76 of the Criminal Code of the Russian Federation), compensation for damage (Article 76.1 of the Criminal Code of the Russian Federation), imposition of a court fine (Article 76.2 of the Criminal Code of the Russian Federation) or expiration of 2 -year limitation period (Article 78 of the Criminal Code of the Russian Federation);

- a conviction for a previous crime has already been expunged or expunged: for example, it is expunged one year after the execution of a sentence more lenient than imprisonment, and 2 years after serving a sentence of imprisonment for crimes of minor or moderate gravity (Article 86 of the Criminal Code of the Russian Federation) .

- the previous sentence against him did not enter into legal force.

Such clarifications follow from paragraph 26 of the Resolution of the Plenum of the Supreme Court of the Russian Federation dated February 1, 2011 No. 1.

The salary debt has been fully repaid

The head of the company needs to have documentary evidence that all arrears of wages have been transferred to the card accounts of employees or given to them in cash.

Supporting documents will be:

- a bank statement, from which it follows that the amounts of debts were transferred to the accounts of employees;

- payment orders for salary payments;

- payment statement;

- payslips.

In the case of payment of wages from the cash register, a pay slip signed by the employee and the accountant.

If there is no dispute about the amount of debt, then these documents will be quite sufficient. This is confirmed, for example, by the appeal rulings of the Moscow City Court dated November 20, 2021 No. 33-50328/2021, dated July 26, 2017 No. 33-29122/2017, dated March 16, 2021 No. 33-1681/2021.

If employees had complaints about the settlement, then when paying off the debt, it is worth taking from each of them a receipt addressed to the general director of the company stating that the arrears of wages were received in full and there are no claims against the employer.

Judges accept such receipts as proof of full payment. An example is given in the Appeal Determination of the Samara Regional Court dated September 25, 2021 No. 33-11831/2021. Although in undisputed situations, it would also not hurt to take such receipts - just in case.

Interest paid on arrears

Article 236 of the Labor Code of the Russian Federation states that if an employer violates the deadline for paying wages, he is obliged to pay it with interest in an amount not less than 1/150 of the Bank of Russia key rate in effect at that time on the amounts not paid on time for each day of delay.

The period begins to count from the next day after the due date for payment of wages until the day of actual payment, inclusive. In case of incomplete payment, interest is calculated from the actual unpaid amounts.

Thus, the calculation of compensation for delayed payment of wages should be made using the following formula:

A x B / 150 x C,

Where:

A is the amount of unpaid wages;

B — key rate;

C is the number of days of delay.

Example:

The salary is 50 thousand rubles, the key rate is 7.75 percent, the payment delay is 3 months - from January 10 to April 10, 2021.

The resulting calculation is: 50,000×7.75% / 150×80 days = 2,250 rubles.

The fact that interest is transferred to employees should also be reflected in statements and statements.

The perpetrator has not committed another crime

Crimes associated with non-payment of wages can be, for example:

- misappropriation or embezzlement (Article 160 of the Criminal Code of the Russian Federation), that is, theft of someone else’s property entrusted to the culprit;

- non-payment of salary taxes - personal income tax and insurance contributions (Article 199 of the Criminal Code of the Russian Federation). True, only in the case when the amount not paid to the budget is more than 5 million rubles for 3 years in a row or simply more than 15 million rubles;

- abuse of power (Article 201 of the Criminal Code of the Russian Federation): the use by the head of a commercial or other organization of his powers contrary to the legitimate interests of this organization and in order to obtain benefits and advantages for himself or other persons or causing harm to other persons.

Similar “bouquets” occur; an example is given in the Appeal Resolution of the Moscow City Court dated May 24, 2017 No. 10-8801/2017.

Suspension of labor activity

What is the best thing to do and what step will be right after another delay in payment, if it exceeds half a month.

Of course, the employee will be able to continue working, but he also has the right to suspend activities for a certain time. Here it is important to adhere to established standards, study the legislation and anticipate the entrepreneur’s retaliatory steps in order to avoid unpleasant consequences in the form of a reprimand or dismissal.

Indeed, in case of absenteeism, the employer tries to count this day as absenteeism, which will serve as grounds for dismissal. To justify your actions, a notice of payment of debts is sent on the day of absence. If an employee does not come to work because he did not receive this information in a timely manner, then dismissal becomes completely legal.

We must not forget one more important point.

Suspension of work will become impossible if the employee is:

- civil servants;

- employee of enterprises engaged in hazardous production;

- specialist in water, heat and electricity supply organizations and enterprises;

- military, rescuer, medical and ambulance workers.

6-NDFL from wages for December, in accordance with tax legislation, is paid in January of the following year. The deadlines for paying salaries this year are indicated in this article.

If a person does not fall into these categories, then the following procedure must be followed:

- a delay of more than half a month will provide the opportunity to draw up a written statement in two copies, one of which will remain with the official;

- a free form of presentation is used, but the reasons why work is suspended up to the payment of debts must be indicated;

- a copy must be handed directly to the manager, personnel officer or personal secretary, who will put his signature on it;

- refusal to accept the paper will allow it to be sent via registered mail with a mandatory inventory and return notification.

In order not to waste time, you can contact other authorities that will help speed up the consideration of the case.

Material and administrative responsibility

The first sanction applied to the administration of an organization is financial liability under Part 1 of Art. 236 Labor Code of the Russian Federation. For each day of delay in payment of money to the employee, interest is charged on the amount owed. Starting from the day following the day on which wages are due and ending with the day the debt is actually repaid.

Important! The amount of interest is determined by Part 1 of Art. 236 of the Labor Code of the Russian Federation and is 1/150 of the key rate of the Central Bank of the Russian Federation for each day of delay.

The second sanction that an employer must be subject to for delaying wages and other payments due to an employee is a fine, defined in Art. 5.27 Code of Administrative Offenses of the Russian Federation. When brought to administrative responsibility, the period of delay and the amount of unpaid wages on time do not matter. That is, to qualify the actions of an organization as an administrative offense, a delay in payments of one day is sufficient.

The amount of the fine for non-payment of wages depends on whether the employer committed the violation for the first time or repeatedly within a year. For first-time violators of Art. 136 of the Labor Code of the Russian Federation regarding the timing of settlements with individual entrepreneurs, the amount of the fine under Part 6 of Art. 5.27 of the Code of Administrative Offenses of the Russian Federation will range from 1 to 5 thousand rubles, for organizations - 30 to 50 thousand.

If an individual entrepreneur or organization has repeatedly accumulated salary debt during the year, the amount of the fine for unpaid wages will be greater and will amount to 10 to 30 thousand rubles for individual entrepreneurs, and from 50 to 100 thousand for organizations (Part 7 of Article 5.27 Code of Administrative Offenses of the Russian Federation).

The ConsultantPlus system has many ready-made solutions, including information about what happens if wages are delayed. If you don't have access yet, you can get it for free on a temporary basis. For further use of the system, obtain the current K+ price list.

What to do if the company management refuses to pay compensation

In most cases, the employer does not charge compensation for late wages by default, especially if the delay was only one day. The amount to be paid with such a delay will be very small, but in this case, workers must still defend their rights.

To begin with, you can contact the management of the enterprise in writing with a request to accrue the compensation due. The application is drawn up in free form.

.

If management refuses to calculate compensation, the employee can appeal the violation of his rights to the relevant organizations.

In the table below you can see where a person whose rights have been violated can turn:

| Name of company | Application procedure | Complaint consideration period |

| State Labor Inspectorate | The employee writes a statement listing all the facts of what happened. | Within 7 days |

| Prosecutor's office | The employee writes a statement (complaint) in which he indicates all the facts of what happened | Within 30 days |

| Judicial authorities | The employee files a statement of claim, which must contain the specific demand of the plaintiff, in this case the calculation of compensation | In the order of consideration of cases by the court |