Russian military personnel are a significant social group, whose members can count on special support from the state.

Dear readers! The article talks about typical ways to resolve legal issues, but each case is individual. If you want to find out how to solve your particular problem , contact a consultant:

8 (800) 700 95 53

APPLICATIONS AND CALLS ARE ACCEPTED 24/7 and 7 days a week.

It's fast and FREE !

Typically, this assistance takes the form of cash benefits and benefits provided not only to the military themselves, but also to members of their families.

In particular, a number of payments are addressed to their wives, who are among their immediate relatives.

Concepts

The legislation of the Russian Federation indicates that wives of military personnel have the right to receive state social support. However, the exact list of benefits and allowances due to them is not given anywhere.

Therefore, you often have to search for the required articles of the law on your own, but before you undertake this, you need to understand the basic concepts:

- Benefits are additional rights or guaranteed benefits in various areas (payment of housing and communal services, use of transport, health care, purchase of housing) for certain categories of citizens. Benefits are provided if a person can confirm his membership in the relevant social group.

- Benefit is government assistance, usually presented in monetary terms and is a way of compensating for harmful living and working conditions, or other problematic issues. Also, benefits are assigned in the event of a citizen’s incapacity for work.

It can be either monthly or one-time, depending on the needs of the recipient and his membership in a particular social group.

In some cases, benefits and allowances are provided to citizens for life.

Features of state aid

State support when transferring to a new duty station is provided not only to the citizen performing military service, but to his entire family who decides to move. All payments are reflected in state law dated November 7, 2011 No. 306-FZ.

There are two types of cash payments that help make military relocation more convenient:

- lifting allowance;

- daily payments.

Even when concluding the first contract, a person liable for military service can submit a report to receive allowances. Of course, only in the case when the contract soldier, having taken up his family, is ready to move for service.

Moreover, the location of the new unit or subdivision does not necessarily have to be in another region. Even moving to a nearby locality requires the issuance of government assistance.

Types of assistance

Benefits are assigned to the wives of military personnel based on their needs and financial situation. Benefits are provided in any case and allow their owners to:

- use public transport free of charge;

- spend less on utility bills (electricity, gas, water);

- enter universities in the country under special conditions;

- receive leave at the same time as your spouse (the right is granted only after contacting the employer on this issue).

You can also identify separate categories of payments assigned in connection with:

- with a deterioration in the health of the serviceman and his family members;

- with the pregnancy of military wives;

- with the need to undergo retraining or advanced training courses (also applies to wives of employees).

In the latter case, the citizen receives a monthly benefit equal to the average salary.

Legislation

The main list of benefits due to the wives of military personnel can be found by studying Law No. 76-FZ “On the Status of Military Personnel.” This legal act stipulates:

- military status;

- conceptual framework;

- a list of available benefits and allowances (with clarification of their scope and methods of registration).

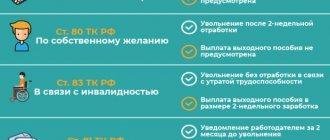

Issues of obtaining benefits in the labor sphere are covered by the provisions of the Labor Code of the Russian Federation. It grants military wives the right not to work if there is no opportunity to find a job that matches their qualifications.

The Labor Code also establishes the procedure for calculating average monthly earnings, without which it is impossible to calculate severance pay when moving with a spouse to a new duty station.

Refusal to pay benefits to a military wife

These cases are quite rare, but still occur. If all the conditions for receiving a subsidy are met, and the soldier’s wife by law has the right to receive the payment, then she does not have the right to refuse this. If this does happen, you must go to court and demand monetary benefits. Also, the amount of the claim can include material damage and all costs of litigation.

Judicial practice shows that the majority of such claims are satisfied and the woman receives all the payments she is entitled to. As a rule, only those spouses who receive benefits for wives of military personnel upon dismissal from their previous place of work due to the transfer of the spouse to a new military unit receive a refusal.

You need to prepare for the fact that when you go to court, you will need to present all the facts confirming the transfer of your spouse to a new place of service, as well as a certificate stating that this benefit was not issued at the previous place. The judge may require confirmation that the spouse also did not receive this payment, since according to the law, either spouse can issue it and receive the funds.

Who is eligible

The types of benefits and benefits under consideration can only be received by women who are officially married to a military personnel. However, Article 12.5 of Federal Law No. 81 states that benefits provided to the wife of a military man can be paid to other relatives of the military man.

This happens due to:

- with the death or disappearance of a spouse;

- with deprivation of the wife's parental rights or restrictions on them;

- with the inability of a woman to provide the child with the necessary care due to health problems;

- with the incapacity of the spouse;

- with the mother's evasion of parental responsibilities.

If we are talking about a one-time pregnancy benefit, then it is paid to the spouses of military conscripts who are carrying a child for at least 180 days (this must be documented).

Wives of cadets studying at military schools and universities are not entitled to such payments.

Features of writing a report

There is no single sample report for a serviceman who wants to receive allowances. However, there are several requirements that determine whether the government will provide the necessary funds.

- The report is written on a blank A4 sheet.

- In the upper right corner it is indicated to whom the report is addressed. It is necessary to write down the details of the commander (last name, first name and patronymic and his military rank).

- Then follows a paragraph describing the situation - the basis for issuing the lift. If the report is being written in a new part, you must write the name and number of the translation document. Then the personal information of everyone who arrived with the serviceman is indicated.

- The next paragraph lists all the attached documents, after which the paper is signed and dated.

This is important to know: Agreement on cooperation and joint activities: sample 2021

The report is submitted with official documents attached to it:

- an order for admission to the new garrison;

- a passport of a Russian citizen with a registration mark at the address of the new home;

- a document containing data on registration at the place of stay (in case of moving abroad or enrolling in studies);

- a certificate of family composition, which is issued on the basis of an entry in the personal file;

- an extract from the house register confirming the legality of residence in the new place;

- an identification document of the second spouse;

- marriage certificate;

- birth certificates of all children (or passports if children are over 14 years old);

- a mark on crossing the Russian border (when traveling abroad).

Features of receiving benefits for the wife of a military man

To get advice on the issue of providing benefits or benefits, citizens married to military personnel can contact social security or another institution involved in issuing such guarantees (for example, a branch of the MFC).

There you can also clarify which documents are required in each individual case.

It should be understood that wives with different statuses receive different payments:

- for children: both natural and adopted (if any);

- for pregnancy and childbirth;

- for the loss of a breadwinner (if the spouse died).

This should be taken into account when submitting an application and collecting the required papers.

One-time benefit for pregnant wives of military personnel

If a husband undergoes compulsory military service, his wife has the right to receive a one-time maternity benefit. But not all spouses who are in an interesting position can count on this payment.

During pregnancy, in order for a military wife to receive payments, a number of conditions must be met, namely:

- the pregnancy must be 180 days or more;

- both spouses must be Russian citizens;

- the marriage must be officially registered;

- You can apply for benefits up to 6 months from the end of your spouse’s military service.

Either spouse can apply for payment. When calculating and accruing, other payments established by the state are not taken into account and do not affect the amount of the subsidy.

You can submit documents at the social protection department located at the place of permanent or temporary registration of spouses, as well as at the MFC or through the government services portal.

Important!

When making these payments, you do not need to pay a state fee.

Register now and get a free consultation from Specialists

How can you earn a pension?

If a military man moves to another area (on duty) and takes his wife with him, the latter is employed on preferential terms, including:

- preferential right to obtain employment in government agencies and military units;

- the right to cash benefits if it is impossible to obtain a position with the required qualifications;

- accrual of work experience during periods when a woman remained unemployed.

If a serviceman's wife finds herself unemployed for reasons other than her husband's relocation, she must officially obtain unemployed status.

In this case, the employment service will look for vacancies with suitable conditions primarily for it.

This will take into account what specialty the woman studied, what experience she has, etc. This is the nature of support for military wives in the matter of pension benefits.

In addition, if her salary turns out to be low, then in the event of the death of her spouse, she will be able to obtain a double pension for herself.

Conditions of appointment

When considering the conditions for assigning benefits to military wives, it is necessary to take into account that there are several categories of payments, and the assignment of each of them is carried out in a special manner.

The most important thing is to understand all the significant points in advance, since in some cases, failure to comply with certain requirements becomes the reason for the complete loss of the right to receive government compensation.

On exit

When retiring, a military wife can apply for a special benefit that allows her to add to her existing experience the years she spent in distant garrisons with her husband.

In this case, the following conditions are met:

- the years during which a woman remained unemployed due to the lack of suitable vacancies at her husband’s place of service are included only in the total length of service;

- specialized experience is calculated separately;

- the total duration of the additional work experience taken into account cannot be more than 5 years.

In addition, the possibility of calculating additional years of experience remains only if the citizen, during the corresponding periods, officially registered with the Employment Center at her place of residence, where the fact of unemployment was officially recorded.

Accrual

When applying for a pension, it is recommended to take into account that for citizens with offspring, additional length of service may be accrued for children. This occurs in accordance with the following rules:

- maximum additional length of service for one child – 1.5 years;

- the maximum total length of service for all children is 4.5 years;

- The length of service for children is added to the additional length of service for unemployed periods.

Also, a woman can claim special benefits in the event of the death of a military spouse, but they are accrued only if the cause was an injury or contusion received while serving.

In addition, wives of military personnel are often assigned a double pension benefit: their own (for disability or old age) and from their husband.

However, receiving such a payment becomes impossible if she marries another citizen.

At the birth of a child

In accordance with Article 1 of Federal Law No. 81-FZ (dated May 19, 1995), all citizens of the Russian Federation, regardless of place of work, are provided with financial support upon the birth of a child.

It also states that military personnel, like other categories of citizens, have the right to receive maternity capital from the state, as well as child benefits (Order of the Ministry of Health and Social Development No. 1012n and Government Decree No. 1100 of December 29, 2009).

Regarding going on maternity leave, it should be noted that only a military wife, and not her husband, can take advantage of this opportunity. However, this rule does not apply to female military personnel.

Benefits for a military wife at the birth of a child can be accrued only in a few cases:

- when studying as a full-time student at one of the institutions of the Russian Federation;

- upon dismissal due to the liquidation of the company in which the citizen was employed;

- upon dismissal due to the need for the spouse to move on duty to another region.

Depending on the reason for the appointment, the final payment amounts differ.

All benefits paid to contract military personnel upon the birth of a child are provided in the accounting department of the military unit.

If the child does not live in the family, then all rights to benefits, the assignment of which is determined by his birth, are canceled.

Pregnant

Only wives of conscripts can count on special assistance from the state in the event of pregnancy. Other citizens married to military personnel receive standard payments.

When assigning regular benefits to pregnant women, the length of their own insurance coverage is taken into account. Cash assistance to the unemployed is calculated based on the husband's contributions.

The last option is possible only if the marriage to a military man has been officially registered. Otherwise, additional payments are not permitted.

Documentation

Depending on the type of benefit being issued, the list of documents requested for presentation differs markedly. If the question concerns pregnancy, then the package of papers may include:

- report to superiors (statement);

- certificate of incapacity for work (issued by the medical institution where the applicant is registered);

- the original certificate from a specialist from the antenatal clinic about the duration of pregnancy (it should be indicated not in weeks, but in days);

- original extract from the military unit with data on the start and end dates of service;

- passport of a military wife (certified copies of completed pages);

- marriage certificate (certified copy);

- work book and certificate from the employment center regarding registration (for the unemployed);

- a certificate stating that the requested amount has not been received elsewhere;

- an extract (order in part) about the accrual of the exact amount indicated (the document must indicate the name, gender and date of birth of the baby).

To apply for children's benefits or benefits up to 1.5 or 3 years, you will need:

- application for payment;

- a certified copy of the baby’s birth certificate (it must contain a record of the military father);

- original birth certificate;

- an extract confirming the fact that the child’s father performed military service as a conscript (with deadlines, from the military registration and enlistment office at the place of conscription or from a military unit).

If the right to payment is transferred to other citizens, then you must present (one of):

- death certificate of the baby's mother (copy);

- an extract from the court decision that is the basis for the transfer of rights (about the missing mother, about deprivation of her parental rights, etc.);

- a doctor’s conclusion that the mother’s health condition does not allow her to care for the child.

If a stillborn child is born, benefits will not be paid.

Size

Military wives who register before the 12th week of pregnancy receive a payment in the amount of 628.47 rubles.

Also, Article 12.7 of Federal Law No. 81 states that military wives have the right to a one-time benefit, the amount of which corresponds to the average monetary allowance (6,000 rubles per child).

This provision also applies to the wives of military contractors.

How and where can a non-working mother receive child care benefits? What is unemployment benefit in Russia? Find out here.

In addition, the woman is given leave, the duration of which varies depending on the circumstances:

- 140 days if pregnancy proceeds without complications;

- 156 days if there were complications;

- 194 days if pregnancy is multiple.

From the beginning of this period until the child turns 3 years old, the soldier’s wife receives monthly cash benefits: 40% of the monthly salary, and if there are several children, then no more than 100%.

For unemployed people, monthly amounts will be as follows:

- for the firstborn: 3,795.6 rubles;

- for the second and subsequent children: 6,284.65 rubles.

Finally, Article 12.4 of Federal Law No. 81 states that the benefit to the pregnant wife of a serviceman is transferred at a time and in 2021 represents a payment in the amount of 22,958.78 rubles.

Social security provides this amount even if the woman is a housewife.

The only condition set in this case concerns the duration of pregnancy, which must be at least 180 days.

Also, military personnel are assigned another one-time benefit in the amount of 16,873.54 rubles (if several babies are born, this amount will be transferred to each of them). You can receive it within six months from the birth of the child.

Transfer of wife to husband's duty station

1. A serviceman may be transferred to a new place of military service from one military unit to another (including one located in another area) within the Armed Forces of the Russian Federation (other troops, military formations or bodies, military units of the State Fire Service) in the following cases :

a) for official reasons;

b) in order of promotion;

c) for health reasons in accordance with the conclusion of the military medical commission;

d) for family reasons at a personal request (for military personnel performing military service under a contract);

e) at a personal request (for military personnel performing military service under a contract);

f) in connection with organizational and staffing activities;

g) in connection with a planned replacement (for military personnel performing military service under a contract);

h) in connection with enrollment in a military educational institution, postgraduate studies, military doctoral studies;

i) in connection with expulsion from a military educational institution, postgraduate studies, military doctoral studies;

j) if, taking into account the nature of the crime committed, the serviceman who has been sentenced to a restriction on military service cannot be retained in a position related to the management of subordinates.

2. A serviceman performing military service under a contract may be transferred to a new place of military service due to official necessity with appointment to an equal military position.

——

5. The transfer of a serviceman performing military service under a contract to a new place of military service for family reasons is carried out in the following cases:

a) if it is impossible for family members of a serviceman (wife, husband, children under the age of 18, children who are students under the age of 23, disabled children, as well as other persons dependent on the serviceman and living with him) to live in this terrain in accordance with the conclusion of the military medical commission;

b) if there is a need for constant care for a father, mother, sibling, grandfather, grandmother or adoptive parent living separately, who are not fully supported by the state and who, in accordance with the conclusion of the state medical and social examination body at their place of residence, need permanent outside care (assistance, supervision).

6. If, when transferring a serviceman performing military service under a contract, the place of residence of his family changes to a new place of military service, and the wife (husband) of this serviceman is also undergoing military service under a contract, then simultaneously with the decision to transfer the serviceman to a new place of military service service, the issue of transferring his wife (husband) to this area is being decided.

If it is impossible to simultaneously appoint military spouses to military positions within the same locality (garrison) and in the event of refusal to dismiss one of them from military service, transfer to a new place of military service is not carried out.

Benefits if the husband serves under a contract

If a woman marries a military contractor, the state provides her with the following types of benefits:

- priority provision of the desired position;

- accrual of additional length of service during periods of official unemployment due to the spouse moving to a new place of service and the lack of suitable vacancies there;

- registration of pension benefits on preferential terms;

- assignment of subsidies that can be spent on improving living conditions;

- free medical care;

- vouchers giving the right to visit military recreation centers;

- financial assistance provided in the event of the death of a spouse or when he is transferred to the reserve.

Each of them, except the last one, can be used repeatedly. The severance pay provided to the wife upon transfer of a contract spouse is a one-time payment and in total equals two average salaries.

The certificate required to receive severance pay is provided at the place of work from which the citizen is leaving.

During military service

If a woman’s husband is a conscript, then she is provided with two types of special benefits.

How much is unemployment benefits in 2021? What cash benefits are available for the birth of 1 child? Find out here.

Is severance pay available to orphans after graduation? Read on.

The first is a one-time payment during pregnancy (covers a period of 180 days), and the second is monthly cash assistance for the child.

Benefits for military wives

Federal Law No. 76 regulates the procedure and amount of benefits for wives of military personnel. Payments depend on what type of service her husband is doing: contract or conscription. Let's consider all the options for benefits in various cases.

Register now and get a free consultation from Specialists

Benefits for wives of military personnel under contract

Military wives who serve under contract can count on certain benefits established by the state. They provide:

- Advantages of getting a job with special rights at your new place of residence.

- Special rules for retirement and increased benefits.

- Possibility of improving living conditions.

- The right to treatment and rest in specialized clinics of the Ministry of Defense.

- Financial assistance in the event of the death of a spouse during service or after transfer to the reserve.

In addition, wives of contract workers can count on a special procedure for calculating seniority. There are no other benefits and allowances for this category.

Benefits for the wife of a conscripted soldier

Wives of active-duty soldiers have the right to receive benefits for the entire duration of their spouse's service or until their child turns 3 years old. During this time, she can count on increased maternity payments, the amount of which is indexed in accordance with current legislation.

The amount of benefits for the birth of a child for the wives of military personnel is calculated at the place of residence. To do this, you need to contact the department for social protection of the population or the MFC with a complete package of documents. The amount of payment in each region is calculated individually, but in general it is about 11 thousand.

Important

! The child's guardians or immediate relatives of the military personnel who are raising the child while the father is serving can also become recipients of the benefit in question.

Register now and get a free consultation from Specialists

Retirement benefit

Benefits and allowances for the wives of retired military personnel are aimed at improving their well-being and standard of living. Federal law stipulates that a wife’s length of service includes the period of her husband’s military service, but not more than five years between them. To do this, she needs to register with the territorial employment service and receive official unemployed status.

Note that if at the time of retirement the husband died or died from previously suffered injuries, then the wife has the right to receive two benefits at once:

- for loss of a breadwinner;

- by old age.

Important!

The main condition for receiving payments is that the woman must not enter into a new marriage.

Subsidies for the purchase of housing

If necessary, the following types of housing subsidies may be provided to a military wife:

- funds for the repair of a serviceman’s apartment or his official housing;

- provision of living space in the event of the death of a spouse.

In the second case, it is necessary to take into account that housing can be issued only once, and its area will depend on the number of family members at the time of provision.

Therefore, there is no need to rush in this matter.