The current labor legislation establishes that incentive payments (bonuses) are included in wages and, accordingly, they are subject to the requirements of regulatory legal acts in the field of labor. But if everything is more and less clear with the fixed part of the salary, then its bonus component often becomes the subject of a dispute between the employee and the employer. Let us recall that the main principles of remuneration for educators were the mandatory inclusion of an incentive component in wages and the conclusion of a so-called effective contract, which must contain the conditions for assigning incentive payments and its size.

First of all, it is worth considering that the law provides for the right of the employer to independently determine the grounds and procedure for paying bonuses. These issues should be reflected in the internal local acts of the organization, for example, in the regulations on remuneration or in the regulations on employee incentives. In addition, questions about bonuses may also be reflected in the employment contract with a specific employee. However, when formulating these rules, the employer must not discriminate against any employee.

Taking into account the norms of legislation on the right of an employer to independently determine the procedure for paying bonuses to employees, we can say that it directly depends on the employer how many justified claims it will receive from employees regarding the payment of bonuses. Properly formulated provisions of the company’s internal documents regulating issues of employee incentives will allow the employer to minimize conflict situations and take an advantageous position in court.

So, in what situations can an employer refuse to pay a bonus to an employee, and when is he obliged to pay it? Let us consider this issue using the example of some court cases.

Payment of bonuses is an employer’s right, not an obligation.

Resolving a dispute over the collection of a bonus, the Moscow Regional Court indicated that, taking into account the provisions of the employer’s internal local acts, payment of a bonus is the right of the employer, and not its obligation . The decision to pay a bonus is made by the head of the company, provided that the necessary indicators are met both in the company as a whole and in the department where the employee works, as well as by the employee himself (Appeal ruling dated September 24, 2014 in case No. 33-21137 /2014).

The claim for the recovery of bonuses from the employer, according to the appeal ruling of the Vologda Regional Court, was rightfully rejected by the court of first instance. The Court of Appeal pointed out that, according to the current regulations on remuneration and bonuses in the organization, payment of bonuses is the right, and not the obligation, of the employer. In this document, in particular, it was stated that bonuses to employees are assigned if the employer has financial capabilities and are issued by order of the head of the organization on a monthly basis (Appeal determination dated September 20, 2013 N 33-4262/2013).

The court of the Chukotka Autonomous Okrug refused to satisfy the employee’s demands for payment of a bonus and pointed out that the provisions of the Unified Recommendations for the Establishment of Remuneration Systems for Employees of State and Municipal Institutions for 2014, establishing, in particular, the dependence of employee salaries on their qualifications and the complexity of the work performed , quantity and quality of labor expended; The employer's provision of equal pay for work of equal value when establishing the amount of incentive payments does not exclude the possibility of canceling the bonus or reducing it . In addition, the court noted that these recommendations also allow the employer, at his own discretion, to formulate a remuneration system and establish criteria for the appointment and payment of bonuses (Appeal ruling dated December 18, 2014 in case No. 33-206/2014, 2-66/2014) .

Sometimes payment of the bonus is still the responsibility of the employer. For example, if the company’s internal document establishes a guaranteed payment for Women’s Day – March 8th. In this case, the employer assumed the obligation to pay bonuses to the company's employees annually on a certain date, regardless of the company's financial performance and the performance of specific employees.

The employee's demands for payment of the bonus were satisfied by the Sverdlovsk Regional Court. At the same time, the court took into account the fact that the collected bonus was not a one-time bonus, but a permanent one (paid monthly) and, according to the provisions of the employment contract, was included in the wages along with the official salary. Based on these provisions, the court concluded that payment of the bonus is the responsibility of the employer and the employer must also prove that the employee does not achieve the criteria or indicators necessary for awarding the bonus (Appeal ruling dated November 20, 2014 in case No. 33-14971/2014).

Is deprivation of bonuses a disciplinary sanction?

Disciplinary punishment under labor legislation is provided for failure to perform and improper performance by an employee of labor functions through his fault.

An employer does not have the right to impose a disciplinary sanction against its employee in the form of deprivation of bonuses . This is due to the fact that this type of recovery is not listed in Part 1 of Art. 192 of the Labor Code. This legal norm contains reference only to the following types of collection:

- comment;

- rebuke;

- dismissal.

The employer himself chooses the appropriate form of punishment depending on the severity of the offense committed: for example, with regular and systematic violation of labor discipline, he faces dismissal.

As you can see, deprivation of bonuses is not included in this list. Federal laws and regulations on the discipline of certain categories of employees may provide for other types of punishment: for example, a representation of incomplete official compliance, a severe reprimand, etc.

At the same time, the absence of deprivation of bonuses in the list of disciplinary sanctions does not make deprivation of bonuses illegal. The basis for depreciation may be bringing the employee to disciplinary liability in the form of a reprimand, reprimand and dismissal in the time period in which the bonus is awarded.

It is necessary to note that imposing a disciplinary sanction is a right, not an obligation of the employer (based on Article 22 of the Labor Code). Based on the results of considering the severity of the offense, the commission may come to the conclusion that there is no need to punish the employee. In such a situation, if the basis for deprivation of bonuses is the presence of an outstanding penalty, then the employer does not have the right to deprive the employee of a bonus.

Also, the employer should formalize disciplinary action and deprivation of bonuses in the form of separate orders.

The size of the bonus is determined by the employer

The Kaliningrad Regional Court confirmed the legality of the court's decision to reject claims for the payment of a bonus to an employee from among the civilian personnel of a military unit. When making its decision, the court was guided by the Order of the Ministry of Defense, which established the procedure for bonuses for civilian personnel. The court indicated that, according to this procedure, bonuses for employees are possible only by saving budget funds within the limits of budget obligations for wages. When determining the specific amount of the bonus, the amount of funds allocated for these purposes is taken into account, as well as the results of the employee’s performance of his official duties. Taking into account these provisions, the court came to the conclusion that bonuses to employees are not guaranteed payments , but are accrued and paid only if funds are available for this. In this case, no funds were allocated for bonuses to employees and no order was issued to all employees. In addition, the court indicated that the specific amount of the bonus is determined solely by the employer and depends in this situation on the employee’s performance (Appeal ruling dated July 17, 2013 in case No. 33-3184/2013).

The Novosibirsk Regional Court expressed a similar point of view when resolving a dispute over the recovery of a premium. The court indicated that when assigning bonuses to employees, the application of the principle of equal pay for work of equal value (that is, the size of the bonus for employees occupying the same positions should be equal) is erroneous. The employer himself has the right to determine the specific amount of the bonus for each employee based on the personal contribution of this employee to the implementation of assigned tasks. In this situation, the court does not have the right to replace the employer and determine the amount of the bonus for him (Decision of October 16, 2014 in case No. 33-8818/2014).

In some cases, the specific amount of the premium may be established by local regulations. For example, the company’s wage regulations may establish an annual bonus payment for the professional holiday of the organization’s employees in the amount of 1,000 rubles. In this situation, the employer cannot reduce the amount of payment at its discretion.

Note! The Supreme Court of the Russian Federation in 2013 indicated that labor legislation allows the establishment of salaries, as components of employee salaries, in an amount less than the minimum wage, provided that their salary is not less than the minimum wage. At the same time, the regional coefficient and the percentage bonus for continuous work experience must be added to the salary in excess of the established minimum wage (Definition of the Supreme Court of the Russian Federation of May 17, 2013 N 73-KG13-1).

General algorithm for depriving a bonus

When depriving of bonuses on the basis of being subject to penalties in the current period, the following scheme will be legal: at the first stage, the employee is subject to disciplinary liability, and at the second, his bonus is deprived.

At the same time , in order to deprive an employee on the basis of bringing an employee to disciplinary action, the employer must follow the procedure established by law :

- obtaining explanations from the employee about the reasons for the misconduct (if the employee provided compelling reasons in his favor, then he can avoid penalties);

- convening a special commission to assess the misconduct;

- issuance of a collection order.

The employer chooses the form of punishment at his own discretion, but only one form of punishment is allowed for one offense (for example, for absenteeism you cannot make a remark and reprimand).

At the same time, for one offense the employer can impose a penalty and deprive the employee, and this will not become a violation. Deduction in this case should also be issued in the form of a separate order, where the basis for deprivation of the bonus will be the order of collection.

Fired employees

The court of the Yamalo-Nenets Autonomous Okrug noted that the employer should not worsen the situation of dismissed employees in terms of paying them bonuses only on the grounds that they quit before the order to assign the bonus was issued. The court ruling noted that if the order to pay the disputed bonus was not issued on the day of the employee’s dismissal, this does not mean that the employer is not obligated to pay this bonus to the employee for the period of time worked (Appeal ruling dated November 10, 2014 in case No. 33- 2773/2014).

In another similar situation, the court sided with the employer and refused to satisfy the request for the recovery of an annual and quarterly bonus for the dismissed employee. At the same time, the court took into account the provisions of the local act on bonuses, according to which these bonuses are awarded only to persons who have an employment relationship with the organization (Appeal ruling of the Lipetsk Regional Court dated December 17, 2014 in case No. 33-3122/2014).

Deprivation of bonuses - what the law tells us

Deduction of bonuses is the non-payment of a bonus or part thereof. But the Labor Code prohibits making deductions from wages, except in specially specified cases. It should be noted here that the bonus is a variable part of payments to the employee. And if he violates his duties, the bonus is not deducted from the salary, but is simply not accrued or is accrued partially. It is impossible to arbitrarily deprive an employee of a bonus. The terms of payment must be specified in the local acts of the organization.

To determine whether deprivation of a bonus is a disciplinary sanction or not, we will be helped by referring to the Labor Code of the Russian Federation. Article 192 of the Labor Code of the Russian Federation talks about the following disciplinary penalties: reprimand, reprimand and dismissal on appropriate grounds. The general rule establishes that an employer cannot impose double punishment on an employee for the same offense. Deprivation of an employee’s bonus is not provided for under the Labor Code of the Russian Federation and is a consequence of disciplinary action. Therefore, a reprimand and deprivation of a bonus at the same time are not double punishment.

Bonuses for part-time workers

The Supreme Court of the Komi Republic satisfied the demands for the recovery of a bonus from an employee who performed the duties of a part-time social teacher. At the same time, the court indicated that the payment of the bonus should depend on the results of work, not only of the main employees, but also of part-time workers, since part-time work is independent work and for it the employee must receive a full salary, including a bonus. In addition, the court noted that the employer cannot arbitrarily exercise its right to assign bonuses to employees or not (Appeal ruling dated December 8, 2014 in case No. 33-5943/2014).

What can be considered a bonus?

A bonus can be considered any income that an employee receives for his work in excess of his salary. Bonuses (also sometimes called incentive payments) can be very different, but they all have one goal - to reward an employee for high-quality and conscientious work, compliance with labor standards, or simply long service.

In this case, awards should be divided into several groups:

- Bonuses for certain employees for the performance of their work;

- Bonuses awarded for achieving certain goals.

- Bonuses accrued on certain dates or periods : 13th salary, annual or semi-annual bonus, monthly bonus for the best employee, etc.

Is it always legal to pay a bonus?

When assigning incentive payments to a budgetary institution, there is a risk of being held accountable based on the results of an audit of the expenditure of budgetary funds. For example, the State Budgetary Educational Institution of Secondary Vocational Education of the Vladimir Region “Vladimir Polytechnic College”, based on the results of the audit, issued a proposal in which it was proposed to take measures within a certain period of time to eliminate the identified violations of the unreasonable spending of funds on the payment of incentive bonuses to employees’ salaries, compensation for damage caused and bringing the perpetrators to justice. The audit body indicated that incentive payments were made to employees for the performance of their direct official duties (Resolution of the Federal Antimonopoly Service of the Volga-Vyatka District dated June 9, 2014 in case No. A11-3916/2013).

Author of the article: Irina Dobrynina, lawyer

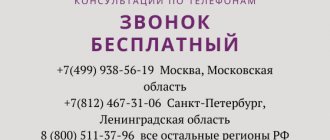

How to appeal illegal deprivation of bonuses

Let's look at how to challenge the deprivation of a bonus. An employee has the right to contact the Labor Inspectorate (you can find out how to write a complaint to the Labor Inspectorate here) or the judicial authorities with a claim against the employer if he believes that the deduction was made illegally. Upon application, the Labor Inspectorate checks whether the deductions made are in compliance with the law. First of all, the existence of grounds and the correctness of the documentation of the violation are verified.

Please note: the employer may not deprive the bonus, but pay it in a smaller amount. This is true when the bonus is calculated in proportion to the time worked. For example, the organization provides for the payment of quarterly bonuses, but if the employee actually worked only 1 or 2 full months, then the amount of the quarterly bonus will be recalculated accordingly.

Evidence of the illegality of the deprivation of the bonus must be presented to the court. To do this, it is necessary for the employer to provide documents related to the calculation of bonus payments. These may be copies of documents such as:

- employment contract,

- bonus regulations,

- wage regulations,

- collective agreement,

- memo about deprivation of bonus,

- order for accrual and deduction of bonuses,

- order to impose a disciplinary sanction,

- explanatory notes from the employee.

The employer is obliged to issue copies of work-related documents to the employee upon his application within 3 working days.

The following video discusses the question of what type of bonus deduction can be considered illegal and how to defend your rights to legal wages