How are daily allowances paid?

The most common questions asked by employees and employers on the Internet are:

- What are daily expenses for a business trip?

- Daily allowance and travel allowance: what is the difference?

- Is per diem paid for 1 day of business trip?

- Is per diem allowed on weekends while on a business trip?

Daily allowance (travel allowance) or daily allowance for business trips are additional expenses of an employee for living outside his place of residence (paragraph 4, part 1, article 168 of the Labor Code of the Russian Federation).

What is included in daily and travel expenses? Daily expenses (or daily allowances for business trips) include employee costs for food and similar daily needs . But expenses for travel (on a business trip and back home) and accommodation (for example, in a hotel) are paid to the employee separately. They are not included in travel expenses (per diems).

According to labor law, the employer must pay daily allowances for business trips:

- for each day an employee is on a business trip (daily allowances are calculated, including for weekends and holidays, days on the road, days of forced stop);

- sick days if the employee gets sick during a business trip.

If the employee was sent on a business trip, but can return home from there every day, in this case he is not paid . The decision on the daily return of the employee in each specific case is made by the manager, taking into account:

- range of the place of assignment;

- transport connection;

- purpose of the trip.

But daily allowances for traveling nature of work are paid in accordance with Art. 168.1 of the Labor Code of the Russian Federation, since such workers have constant work on the road.

As for the period for payment of daily allowances for business trips, it is not approved . It is more logical and correct to pay the business traveler an advance for daily expenses before the start of his business trip. Currently, the maximum duration of a business trip within Russia and beyond its borders has not been established . Therefore, it is very important to correctly calculate the advance for a business trip so that the employee is not left without money in a foreign city or country.

What is included in the daily allowance

The composition of daily expenses, in order to cover which the employee is entitled to daily payments, is not regulated by law, although they are separated in regulatory regulation from the costs of transport and accommodation (clause 11 of the Regulations approved by Decree of the Government of the Russian Federation of October 13, 2008 No. 749 (hereinafter referred to as the Regulations) ).

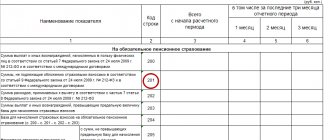

The employer determines the amount of daily allowance in internal corporate regulations. Payments of up to 700 rubles for business trips in Russia and up to 2,500 rubles for employees traveling abroad are not subject to tax and social contributions (clause 3 of Article 217 of the Tax Code of the Russian Federation).

Per diems are usually spent on food. But the traveler can spend it on anything at his own discretion; he is not required to report on the content of such expenses.

Daily allowance amount

Accountants and personnel officers often look for information about the abolition of travel and daily allowances, a decree that cancels these expenses. There is no such resolution . But there is a Decree of the Government of the Russian Federation dated December 26, 2005 No. 812 “On the amount and procedure for payment of daily allowances in foreign currency and allowances for daily allowances in foreign currency for budget employees on business trips in foreign countries.” It was last amended on July 19, 2019. It describes how per diem is paid on a business trip.

For travel expenses, each employer determines the amount of daily allowance independently and enshrines this in its internal regulations - an order or regulation.

How much is the daily allowance? The fact is that in paragraph 12 of Art. 217 of the Tax Code of the Russian Federation specifies a daily limit when issuing daily allowances for business trips, which is exempt from personal income tax .

For a business trip in Russia it is 700 rubles, and daily allowance in foreign currency cannot exceed 2500 rubles. for each day of a business trip abroad.

How much per diem to pay - 100 rubles or 700 rubles - is decided within each company based on the distance of business trips, transportation support, etc.

The employer is not required to pay one-day daily allowances , since if the employee has the opportunity to return home on the same day, he does not incur additional expenses. Therefore, daily subsistence allowances are not paid for one day of business travel. The basis for this is para. 4 clause 11 of the Regulations on business trips.

If an employer decides to accommodate employees and pay daily allowances for a business trip for 1 day, he faces risks associated with taxation. In this case, the very legal nature of the concept “what is daily allowance on a business trip” is lost, as stated in the letter of the Ministry of Labor of Russia dated November 28, 2013 No. 14-2-242. In other words, daily allowances are not paid .

What do you need to pay?

Starting this year, employees are sent on business trips according to the new 2021 rules; daily allowance and other expenses are reimbursed slightly differently.

The employee must document the costs of travel, renting accommodation and permitted expenses. Otherwise, no payment will be made. There is no maximum limit on daily allowances, but the institution has the right to independently approve the norms. As for average earnings, the accountant makes calculations according to the working time sheet and the order of the manager.

With per diem, things are different. This type of expense does not require documentary confirmation by checks and receipts. However, previously, accountants used a travel certificate to confirm and accrue such payments. The document indicated the dates of departure for the trip and return from it (arrival date). But in January 2015 the form was canceled. Now the employee’s departure and return dates must be confirmed on the basis of tickets, residential rental agreements or fuel receipts. It’s a complicated method, which is why many organizations continue to issue travel certificates to their employees.

Per diem allowance for a business trip abroad

Payment of daily allowances for business trips outside the Russian Federation is made in the following order:

- when staying and traveling around Russia, daily allowances are paid in the amount established by internal order or in accordance with local instructions on business trips in Russia;

- when staying and traveling through the territory of a foreign state, payment of daily travel expenses is made in the amount of 2,500 rubles per day (remember that this is a limit not subject to personal income tax).

Moreover, the procedure for paying daily allowances to business travelers is such that when crossing the territory of Russia - when the employee is just going on a business trip - the date of travel across the border of the Russian Federation is included in the days when daily allowances are paid in foreign currency . But when an employee returns from a business trip, the border crossing date is included in the days when daily allowances are paid in rubles.

EXAMPLE

Employee Sergeev S.S. sent from Moscow to Vilnius from March 1 to 5. The plane flies to Vilnius on March 1 at 7 a.m., and already on March 1 Sergeev S.S. is located in Vilnius. Therefore, the employee will receive the daily allowance for March 1 “at the foreign rate.” If Sergeev S.S. took off at 23:00 and landed in Vilnius at 0:50 on March 2, then for March 1 he would receive daily allowance according to Russian limits, and for March 2 - as abroad.

What is the daily allowance for on a business trip abroad? The same as in Russia: such payments cover the traveler’s expenses for food and the purchase of household items, since he is located outside his place of residence.

Payment of daily travel expenses in 2021

In order for an accountant to correctly calculate the amount of payments, the number of days spent on a business trip should be multiplied by the approved daily expenses. When calculating the number of days, consider:

- all days of the trip, including holidays and weekends;

- days spent en route, including days of departure and arrival;

- days of forced downtime or delay.

Typically, a business trip order contains an order for the payment of an advance. It can be transferred to the employee’s card or issued in cash through the institution’s cash desk. Upon return, the employee is required to provide an advance report to the accounting department.

IMPORTANT!

When an employee is sent on a one-day business trip, daily subsistence allowances are not paid, in accordance with paragraph 11 of Government Decree No. 749. But transportation costs are reimbursed.

How to determine daily allowance on a business trip

Travel expenses (per diem) must be paid before the start of the business trip and for all days spent on a business trip, starting from the date of departure and including the date of return.

Payment of daily allowances on weekends on a business trip is also made immediately. Regardless of whether the business traveler was resting or working that day.

It happens that they decided to send an employee on a business trip, signed an order and paid travel allowances. However, due to operational necessity or employee illness, the business trip was decided to be canceled or postponed. Then it is necessary to prepare an order to cancel the business trip or change its dates.

Daily allowances are also being waived. That is, the employee must return the money received if the trip does not take place.

EMPLOYEE'S STATEMENT FOR TRAVEL ALLOWANCE RETENTION: SAMPLE

It happens that an employee returns from one business trip in the morning, and in the evening he flies to another. That is, 2 business trips in one day. In this case, the daily allowance for this day is paid only for one business trip.

Let's look at an example of how to pay for 2 business trips according to the new rules. Let’s assume the daily allowance is 700 rubles.

EXAMPLE

Ushanov M.Yu. I was on a business trip in Saratov from March 1 to March 3, and on March 3 in the evening I had to fly to St. Petersburg. He will return back only on March 7th. How is the daily allowance paid in this case?

From March 1 to March 3: daily allowance must be accrued for 3 days.

From March 3 to March 7: must be credited within 4 days.

If the employee is entitled to 700 rubles. for daily allowance, then the amount of travel expenses for both business trips will be 3 × 700 + 4 × 700 = 4900 rubles, respectively.

How to report money received for a trip

Within 3 days after a business trip, the employee reports expenses, attaching supporting documents. These include:

- travel tickets, including for public transport;

- an agreement for the provision of hotel (hotel) services and a receipt for payment (if the employee lived in an apartment - a rental agreement);

- checks or other strict reporting forms, which can be used to determine other expenses, for example, entertainment expenses.

As for daily allowances, you do not need to report them. This is not provided for at the legislative level, so the employer has no right to ask what the money was spent on.

Legal documents

- Art. 167 Labor Code of the Russian Federation

- Art. 168 Labor Code of the Russian Federation

- Government Decree No. 729 dated 02.10.2002

- Government Decree No. 812 dated December 26, 2005

- Government Decree No. 749 dated October 13, 2008

What are travel allowances issued for?

Any employee whose work is not of a traveling nature can be sent on a business trip. That is, if a person works in the same building, he may be sent on a business trip to another area, where he will perform the same job duties. Days of absence must be paid.

Payment of travel expenses in 2021 occurs according to the rules. When traveling to another city (a trip to an employer's branch is also a business trip), the employee will certainly have some expenses that must be compensated for. The employer must do this. Travel expenses that are subject to compensation from the employer include:

- wages for days of absence from your main workplace. Actual absence from the workplace at the initiative of the employer (in particular, a business trip) is not considered an offense and is paid according to the general rules;

- payment for travel to the place of performance of official duties and back home. Travel costs for all types of transport – train, plane, bus, etc. – are subject to compensation. Taxi expenses, booking fees, insurance payments during the trip and other related expenses are not eligible for compensation;

- payment for accommodation. The person can be either in a hotel or in a private apartment. All expenses must be compensated;

- daily allowance. In addition to all expenses for housing, travel, etc., management must pay for each day of stay on a business trip, including the day of arrival and day of departure. The exception is one-day business trips and trips to another city, but not far away (that is, a person has the opportunity to travel home every day). There is a daily allowance rate. The amount of these payments depends on where the employee is sent - on a trip around Russia or to another country;

- additional expenses. By agreement with management, an employee may travel on a business trip in his own car. Then the employer will have to compensate him for his expenses on gasoline.

If management sends its employees on business trips, all the nuances of this process must be legalized. Therefore, it is necessary to issue a local regulatory act, for example, the Regulations on Business Travel. It lists all additional expenses that are subject to compensation. For example, during a business trip, a senior manager has the right to use the services of a VIP taxi. All expenses will be compensated for him. But a lower-level manager may not have such a right.

An employer can compensate expenses in the following way:

- give the employee an advance payment, then make an advance payment using checks in a working manner;

- First, the employee spends certain amounts, then management returns him the checks from the cash register.

Important! All payment documents during a business trip must be kept.

Foreign business trips

The duration of a business trip to another country is calculated according to general rules. If a decision is made to send a person by train rather than by plane, although the train will travel, for example, for several days, all days on the road are taken into account. The calculation also includes the day of departure from Russia and the day of arrival in another country.

When a person returns from a business trip abroad, the calculation is made in the same way.

Daily allowance in foreign currency

For frequent trips to other countries, the employer can set the daily allowance in the currency of the country to which he sends his employee. If rubles are used in this country, then you can pay in rubles.

A different situation is when the daily allowance is set in the currency of another country, and the employee receives the equivalent in Russian rubles at the exchange rate on the day of payment. The procedure for calculating personal income tax is the same for payments in Russian and foreign currency.

For state employees, a minimum daily allowance has been determined when traveling to other countries. For example, when traveling to Belarus you need to pay 57 dollars per day, and when traveling to the USA - 72 dollars.

Cost calculation example

In order to calculate the amount of expenses per person on a business trip, you need to know his average earnings. To do this, the accountant must calculate the amount of “labor” income. The resulting value must be divided by the number of days that the employee actually worked. All calculations are made for the last calendar year.

For example, employee P. is sent on a business trip for 10 calendar days. According to local regulations, his daily allowance is 700 rubles. According to calculations, the average daily income is 1,452.36 rubles. Thus, for 10 days of business trip he must be paid:

- 1,452.23 * 10 = 14,522.3 rubles - this is his salary;

- 700 * 10 = 7,000 rubles – these are travel allowances.

Important! If there is a regular work schedule during a business trip, then wages are not paid for weekends. If a person worked on his day off, this is recorded in the time sheet, then this day must be paid in double amount.