The concept of “travel expenses” includes a certain type of expenses, which also includes compensation for the rental of living quarters. Acceptable standards, conditions and a list of accompanying documents are regulated in legislative acts of the Government and letters from the Ministry of Finance of the Russian Federation.

Dear readers! The article talks about typical ways to resolve legal issues, but each case is individual. If you want to find out how to solve your particular problem , contact a consultant:

8 (800) 700 95 53

APPLICATIONS AND CALLS ARE ACCEPTED 24/7 and 7 days a week.

It's fast and FREE !

What applies to reporting documents

Every employee sent on a business trip for several days has the right to claim compensation for their housing costs (Article 168 of the Labor Code of the Russian Federation). Reporting documents for business travelers officially confirm the employee’s arrival and departure to the place of stay during the trip. If the employee is staying at a hotel, he can provide the accounting department for reimbursement:

- check;

- various checks;

- separate receipts.

Reporting documents for daily living in an apartment will be as follows:

- rental agreement for the duration of stay;

- the act of providing services.

If the employee lives in a company apartment, then payment for it is made directly by the employer in a non-cash form.

Payment for accommodation on a business trip in a budget organization, as in a commercial institution, is carried out on the basis of strict reporting forms provided by the traveling employee. All documentation will subsequently be checked by the tax authorities, which means that all expense registers must be official, with live signatures and seals and filled out correctly. It is also important for an employee of a budgetary institution to remember about the limit on the amount over which he cannot pay per day for housing. This limit is set directly by the management of the budget organization and is enshrined in the collective agreement and regulations on business trips.

Payment for accommodation on a business trip in 2021

How to count?

According to the invoice for the payment of the hotel room, the costs of renting accommodation are accepted for reimbursement in full.

The Tax Code does not contain restrictions on paying living expenses.

Norms, conditions, limits

During the audit, tax authorities may be interested in the costs of compensating for the cost of a particularly comfortable hotel room.

To prevent such controversial issues from arising, it is necessary to separately state in the Business Travel Regulations what conditions at the hotel can be used by:

- ordinary employees;

- administrative and managerial personnel of the enterprise.

Invoices for travel expenses for housing of ordinary employees, issued for an amount in excess of the established norm, in accordance with the Regulations on business trips at the enterprise, are accepted for accounting in full.

Tax accounting reflects expenses within normal limits.

Example:

Marketer V.I. Ivanov was sent on a business trip for three days, the purpose of which was to conclude an agreement for the supply of production equipment. To the advance report on the business trip Ivanov V.I. attached documents for payment for a “Lux” hotel room in the amount of 5,600 rubles. per day. At the same time, according to the Regulations on Business Travel, full-time mid-level employees can stay in hotels, the cost of which should not exceed 3,500 rubles. per day.

After approval of the advance report, the employee was reimbursed for the cost of accommodation in the amount of 16,800 rubles: 5,600 rubles/day* 3 days = 16,800 rubles.

In addition, personal income tax and insurance premiums were calculated on the excess amount:

- 3,500 rubles/day * 3 days = 10,500 rubles. — the maximum allowed amount of living expenses;

- 16,800 – 10,500 = 6,300 rubles. — tax base for calculating personal income tax and insurance premiums;

- 6,300 * 13% = 819 rub. — personal income tax accrued;

- 6,300 * 22% = 1,386 rubles. — Pension Fund insurance premiums;

- 6,300 * 5.1% = 321.30 rub. — FFOMS insurance premiums;

- 6,300 * 2.9% = 182.70 rub. — insurance premiums from the Social Insurance Fund;

- 6,300 * 0.7% = 44.10 rub. — insurance premiums against accidents at work.

How to mark a business trip on your timesheet? Read our article. Do I need to book a business trip for 4 hours? Find out here.

Why do you need a memo for a business trip? See here.

Tax accounting

Accounting characterizes travel expenses as from normal activities.

Tax accounting classifies them in the group of other expenses, and they must be economically justified.

“Apartment” properties accepted for accounting reduce the tax base when calculating income tax. VAT, indicated as a separate line on the hotel invoice, is legally deductible when calculating tax.

If there are supporting documents

If the entire set of documents confirming the legality of residence is attached to the advance report, travel allowances are compensated in full without any restrictions.

Compensation without supporting documents

A lost hotel bill cannot be attached to a travel advance report.

Economic service specialists must answer in detail the employee’s question: “How to pay without documents?”

Without a receipt, the organization has the right to reimburse the accommodation of the posted employee at the expense of the net profit remaining at the disposal of the enterprise. But the company does not have the right to reduce the tax base when calculating income tax by the amount of compensated amounts without proof of residence.

In addition, personal income tax and insurance premiums must be calculated on the amount of compensation.

What documents should be given at the hotel and when?

Payment for a hotel on a business trip can be made by the employee at his own expense, which will then be reimbursed to him at the workplace, or at the expense of pre-allocated money for travel expenses (RF PP No. 749 of October 13, 2008). According to RF PP No. 1085 dated 10/09/2015, all hotel services must be confirmed by a check or other strict reporting form, therefore, the hotel is obliged to provide an invoice or other register demonstrating the fact of the employee’s accommodation on a business trip.

Thus, upon check-out, that is, upon completion of his stay at the hotel, the employee must receive reporting documentation reflecting the fact of his stay for a specified period of time. If the receiving party carries out cash control, then it provides an invoice for hotel services. At the same time, additional services may be included in the check (clause 12, clause 1 of Article 264 of the Tax Code of the Russian Federation).

IMPORTANT!

Various room services, services of bars, restaurants and health centers, and a mini-bar are not paid for, unless other conditions are provided by prior agreement with the employer.

If the hotel does not use cash registers, it can offer the traveler independently developed strict reporting forms (vouchers, receipts, hotel checks) confirming the employee’s actual expenses (Letter of the Ministry of Finance of the Russian Federation No. 03-07-11/9440 dated 02.25.2015).

Reporting documents for hotel stays

According to clause 28 of the Rules for the provision of hotel services (approved by Decree of the Government of the Russian Federation of October 9, 2015 No. 1085), the hotel issues a document confirming payment for the stay: a strict reporting form (SRF) or a KKM check.

VAT allocated on a hotel invoice can be deducted without an invoice . This is explained in the letter of the Ministry of Finance dated February 26, 2020 No. 03-07-09/13555.

If an employee brings back from a business trip a hotel bill in which meals are highlighted as a separate line, then these expenses cannot . And the cost of food must be subject to personal income tax and insurance premiums in accordance with subparagraph. 12 clause 1 art. 264 Tax Code of the Russian Federation. The Ministry of Finance takes a similar position (letter dated October 14, 2009 No. 03-04-06-01/263).

The documents provided along with the advance report must contain information not only about the amount of amounts actually paid, but also information that allows you to unambiguously confirm the name of the paid service (letter of the Federal Tax Service of Russia dated November 25, 2011 No. ED-4-3/19756).

When traveling abroad, the hotel also issues documents. And when preparing an expense report, hotel invoices must line by line into Russian. This follows from clause 9 of the Regulations on accounting and financial reporting in the Russian Federation (approved by order of the Ministry of Finance dated July 29, 1998 No. 34n).

When do you need to report to your employer?

Payment for hotel accommodation on a business trip is regulated not only by current legislation, but also by internal regulations. The manager must establish the procedure for sending on a business trip, submitting reports and reimbursement of expenses for the trip in the collective agreement, regulations on business trips and other legal acts.

The employee generates and provides the employer with an advance report within three days upon returning from a business trip. The expense report must also include an invoice (check) from the hotel. The accountant will only accept the form if it is filled out correctly. As a general rule, such reporting forms should include the following information:

- register name;

- a series of documents;

- six-digit number;

- name of the hotel organization;

- registration details - TIN, checkpoint, etc.;

- address;

- seal.

IMPORTANT!

The reporting form must be produced in a printing house or printed through specialized services or automated systems, taking into account all legal requirements (RF RF No. 359 dated 05/06/2008).

It is not allowed to provide a report printed from a regular document without special verification of automated systems.

Reporting documents when ordering services by an employer

In some companies, expenses for accommodation on a business trip are paid by bank transfer directly to the bank account of the hotel or hiring agent. In this case, payment for the hotel on a business trip is not made: upon check-in, the employee only gives the reservation number. When leaving the hotel and handing over the room, the business traveler is given a document issued in the name of the employer.

If the employee paid for additional expenses at the hotel (for example, laundry or breakfast), a separate document is issued for these services.

An employer can also enter into an agreement to rent an apartment for its employees to organize living conditions for them on a business trip. This is especially true for long-term or frequent business trips. The apartment can be rented from both individuals and legal entities. In this case, a lease agreement . And at the end of the lease term (or the period specified in the agreement), the lessor can issue a lease deed. In this case, reporting documents for accommodation will also be issued to the company, and not to the posted worker.

Accommodation for workers sent on a business trip can be arranged in temporary trailers or houses. Sometimes the employer builds entire mobile towns or sites from such pastures and cabins. This is convenient in cases where the construction of a facility is underway and it is more convenient for workers to live immediately on site - to reduce costs and travel time.

As you can understand, the costs of organizing temporary shelters are also borne directly by the employer. Consequently, the employees themselves using such housing do not need any additional documents.

If there is no account

In the absence of supporting documents, payment for hotel accommodation on a business trip is made on the basis of a request to a hotel-type enterprise to confirm the fact of the employee’s residence during the specified period of time and obtain a certificate.

In Moscow, a request is allowed to confirm an employee’s expenses, which is confirmed by Letter of the Federal Tax Service for Moscow and the Moscow Region dated August 26, 2014 No. 16-15/084374. The certificate must contain details of the services provided and confirmation of payment. The company must have other documentation confirming the employee's business trip, in particular, a business trip order, travel documents, etc.

Based on a certificate received upon request, payment for a hotel on a business trip is not always accepted by the tax authorities. Clause 1 Art. 252 of the Tax Code of the Russian Federation allows for indirect confirmation of expenses to be taken into account, so the company has the opportunity to appeal the decision of the tax authorities.

Decree of the Government of the Russian Federation 1085 dated October 09, 2015 approved new Rules for the provision of hotel services. This Decree indicates the obligation to issue a strict reporting form or check.

Also, there are no documents on hotel accommodation if the company rents residential premises to accommodate employees during a business trip. Then payment for the premises is made by the employer himself, so payment of expenses and reporting documents for living in an apartment on a daily basis are not provided.

Determination of daily allowance

The official interpretation of the concept of “daily allowance” is in the ruling of the Supreme Court of the Russian Federation dated April 26, 2005 No. CAS 05-151. Per diem - funds necessary for the performance of work and accommodation of an employee at the place where the official assignment is carried out.

According to the Supreme Court, an employee is entitled to daily allowance when performing a task not at his permanent place of work and when he is forced to live outside his permanent place of residence.

In practice, an employee often receives a daily allowance only if the business trip lasted more than a day and he spent the night away from home. However, the Supreme Court decision No. 4357/12 dated September 11, 2012 states that the amount of time on a business trip is not related to the calculation of daily allowances. The court allowed enterprises to pay funds to an employee if he went on a business trip for less than a day, since this is reimbursement of his expenses, and not a benefit. In addition, according to Regulation No. 749, daily allowances do not depend on the expenses of a posted employee for housing and travel.

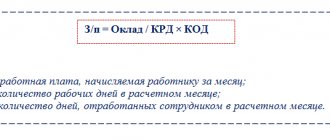

To confirm your daily allowance expenses, prepare your daily allowance calculation using an accounting certificate.

Daily payment rate

What is the daily allowance at an enterprise and does it depend on the form of ownership? No, it doesn't depend. The only thing is that for government institutions the minimum daily allowance for 2021 is set at no less than 100 rubles per day. It is recommended that in privately owned enterprises the daily allowance should not be less than the established minimum for government agencies.

Each enterprise has the right to independently determine the amount of daily payments. But if it exceeds the established maximum, then it will be necessary to withhold personal income tax from the employee’s income.

Currently, the non-taxable maximum travel allowances are as follows:

- Within the state – 700 rubles per day;

- Outside the state – 2500 rubles per day.

An important point: when calculating daily payments, you cannot deduct any deductions from them, in particular, alimony. This situation is due to the fact that according to the Tax Code and Federal Law 229, daily accruals are not recognized as income. And this applies to all amounts of payments, even those that exceed the maximum permissible value of non-taxable daily allowance.

Similar articles

- Calculation of daily allowances for business trips in 2021

- Amount of travel expenses in 2021 (per diem)

- Payment of daily travel expenses in 2021

- Payment of daily travel expenses in 2021

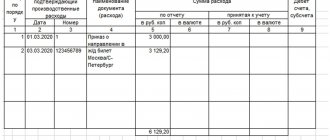

- Travel expenses posting

Per diem in a new way

Keep records in Kontur.Accounting - a convenient online service for calculating salaries, travel allowances, benefits and sending reports to the Federal Tax Service, Pension Fund and Social Insurance Fund. Get free access for 14 days

There is no limit on daily allowance; companies can set any amount, stipulating it in internal documents. Small businesses often limit their daily allowance to 700 rubles, because this amount is not subject to personal income tax (clause 3 of Article 217 of the Tax Code of the Russian Federation). If the daily allowance is more, then personal income tax will have to be withheld from the excess amount. For foreign business trips, the tax-free daily allowance limit is 2,500 rubles.

From 2021, daily allowances above the limits are subject to insurance contributions. But there is no need to pay “injury” contributions from the daily allowance.

Example. The employee was on a business trip for 3 days and received a daily allowance of 1,000 rubles. During the days of his business trip he received 3,000 rubles. Only 3 * 700 = 2,100 rubles are not subject to contributions and personal income tax, and from the difference 3,000 - 2,100 = 900 rubles, you need to withhold personal income tax and pay insurance premiums.