Last modified: February 2021

Within the framework of labor legislation, there is no clarity in the distinction between the terms “allowances” and “additional payments”. Unlike bonuses, they are paid on an ongoing basis not for present and future successes, but for results achieved in the past. Longevity bonus is “milk for the harmfulness received” for years of work associated with increased responsibility or a state of combat readiness and a risk factor not only for health, but also for life.

Regulatory acts

The following list of documents regulates bonuses for length of service in various budget areas: from the central government and the military, to workers in the educational and medical industries.

Labor Code of the Russian Federation (Articles: 21, 135, 143 and others).

Also, this type of incentive bonuses is regulated by many regulations:

- by resolution of the Council of Ministers (No. 638);

- by order of the Ministry of Health of the Russian Federation (No. 377);

- Decree of the Government of the Russian Federation (No. 583);

- by decree of the President of the Russian Federation (No. 1532);

- federal law (No. 73-F3), etc.

What is it and who is it for?

A bonus for length of service or experience is an incentive payment that is awarded to citizens working in the public sector and entitled to such a payment.

It is calculated based on the employee’s official salary, and its size depends on how long he has been working as a particular specialist. Payments are guaranteed by the current legislation of the Russian Federation and are regulated by the following documents:

- Law “On State Civil Service”;

- Labor Code of the Russian Federation, in particular Chapter 21 and Article 317;

- Federal Law No. 306-FZ concerning financial allowances and certain payments to military personnel.

According to regulations, monetary “benefits” are provided for the following categories of citizens:

- persons working in non-profit organizations financed from the state budget;

- civil servants;

- military personnel, employees of the Ministry of Internal Affairs and courts;

- teachers (this category includes teachers, researchers, preschool teachers);

- doctors and nurses;

- persons working in the fire service;

- cultural workers (this category includes theater actors, directors and artists, librarians, museum workers).

What determines the size of the allowance?

It is important to know that in each individual case, the length of service bonus is calculated individually.

Therefore, you should not hope that your colleague’s salary will be the same as yours, because the bonus itself depends on many factors, which will be discussed below.

This premium is always calculated as a percentage and depends on a number of factors, which we list below:

- type of employment (military, Ministry of Internal Affairs, educational and medical institutions, etc.);

- seniority;

- length of service in a specific position;

- the salary you received previously and what you are receiving now;

- regional and district allowances (depending on the specific area);

- allowances depending on the institution (set individually for a particular industry);

- depending on the conditions specified in the labor and collective agreement;

- depending on the specified payments in the regulations on incentives (bonuses) in a particular organization;

- percentage by years of service:

- length of service up to three years – 10% of salary;

- length of service from three to five years – 20% of salary;

- service for more than five years – 30% of salary;

In the military sphere, the percentage of bonuses for years of service differs slightly from the civilian one:

- from two to five years – 10%;

- from five to ten years – 15%;

- from ten to fifteen years – 20%;

- from fifteen to twenty years – 25%;

- from twenty to twenty-five years – 30%;

- from twenty-five years and older – 40%.

The following allowances exist for civil government employees:

- from two to five years – 10%;

- from five to ten years – 15%;

- from ten to fifteen years – 20%;

- from fifteen years and more – 30%.

Also, depending on the position held, you can receive bonuses in the amount of 60% to 200% (maximum).

If a particular employee has access to state secrets , the premium can range from five percent (minimum) to seventy-five percent (maximum).

If a particular official is responsible for protecting state secrets, then he may receive an additional 20 percent bonus.

Calculation rules

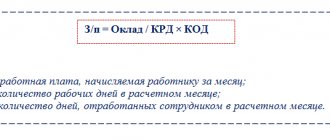

When talking about how to calculate a salary supplement, you need to remember a few points.

First of all, we note that the payment of increases is carried out monthly. And it will be calculated from the salary for the hours or days actually worked. If there is a temporary substitution, then the increase will be accrued depending on the person’s basic rate. If there are grounds for increasing the amount of bonuses for work experience during the year, then the first amount will be accrued for the period that was worked after the right to a percentage bonus. For those people who can qualify for a bonus during the month, then the amount is calculated separately for each period. This principle applies if the salary has changed in a particular month.

Who is entitled to a seniority bonus?

Every public sector employee has the right to receive a seniority bonus.

True, this type of premium is calculated individually based on the factors that we listed above. Such allowances are also available to employees not only of the budget and government sectors, but also of the military, employees of the Ministry of Internal Affairs, as well as those who are officially employed. In the latter case, this type of allowance is usually smaller in percentage terms, because the salaries of employees in private areas are often higher than those of employees in public sectors.

Conditions for assigning pensions

Regardless of what position you hold or perform work, if it is related to a government department, then in any case you are entitled to a certain type of benefit.

However, there are certain professions that are entitled to slightly different benefits due to the fact that their type of activity involves hard work not only in the physical sense, but also in the psychological sense. It is also worth noting that there are certain areas of activity for which benefits are assigned on an individual basis and have types of benefits.

There are two types of these benefits, namely:

- Assignment of pension payments based on a certain amount of length of service.

- Assignment of pension payments upon reaching the established retirement age.

As for other types of civil servants who cannot be classified in the above category of persons, pension payments are assigned to them in the following order:

- Having professional work experience equal to at least 20 years of service in government agencies.

- Having a total work experience of 20 to 25 years. It doesn’t matter where exactly you carried out your work activity and in what structures, in any case it will be counted.

- Leaving the workplace due to reaching retirement age or personal desire.

Examples of calculating allowances

Example 1

An employee teaches Russian in grades five to eleven in a comprehensive school in one of the Russian villages. His normal teaching load is twenty-two hours a week. This teacher is assigned his own class, where he is the class teacher. Twenty-two hours are also spent checking students' notebooks. Previously, before the innovations, this teacher had the tenth category in the ETS. The teacher has worked in the educational field for more than 5 years, but less than eight. The salary for this position of this teacher is 3,278 rubles.

This person also receives a 25% bonus for working in the village: 3278 x 1.25 = 4097.5

We calculate the fee for hours worked: (4097.5x22)/18=5008.1

Additional payment for class management – 20%: 4097.5x0.2=819.5

Additional payment for checking notebooks (22 hours) – 15%: (4097.5x0.15)x22/18=751.2

Based on teaching experience, another 20% of the net salary is accrued, 3,278%20 = 655 rubles. 6,578 + 655 = 7,233 rubles - a full salary.

Example 2

A man works as a mathematics teacher from grades five to eleven in a secondary school-gymnasium in a rural area. His teaching load: fifteen hours a week. This person has the title “Honored Teacher”, and also has the highest qualification category. His responsibilities also include managing the office. It takes five hours a week to check notebooks. The salary based on his position is 3,589 rubles. This man has been working in the educational sector for 7 years (20% bonus).

3589x1.255x1.08x(1+0.25+0.25)=6810.3 rubles

According to this formula, 1.255 is an increasing coefficient for the category of his qualifications. 1.08 – for the title. 0.25 – bonus for working in the village. 0.15 – salary increase coefficient for the specifics of the work.

Based on all of the above, his salary will be equal to 6810.3 rubles. We calculate the bonus based on length of service: 3589%20=717 rubles. 6810+717=7527 rubles.

Example 3

A woman works as a teacher in preschool education. Has an allowance for working in rural areas. This teacher also has the highest qualification category. Her bet is 1.5.

The salary for her position is 3,589 rubles.

Based on the formulas described above, we have the following 3589×1.255×1.25 = 5630 rubles.

1.255 is an increasing coefficient due to the teacher having the highest category. 1.25 – allowance for work in rural areas. We add the profit for the hours actually worked, we have 8,445 rubles - a full salary.

3589%20=717 rubles – long service bonus. 8445+717=9162 rubles, full salary.

How is work experience calculated?

The main document on the basis of which you can receive money for your length of service is a correctly executed and completed work book. A note about the date of entry into position must be made immediately upon hiring. To receive interest payments, if the organization is commercial, you must work in a specific company for a certain period of time (indicated in the local act of the company). The employer will be required to take into account the time of paid vacation, sick leave and business trips as working hours. Any periods for which you were paid a salary are considered to be your length of service.

Also, changing your position in the organization will not affect your work experience. If you were transferred to another department of the same enterprise, then the length of service for calculating the long service bonus will be calculated in total. The exception is if your salary changes within a month. In this case, it is not the length of service that is recalculated, but the amount of the bonus according to a percentage of the salary.

There are cases when employees are transferred to another company during reorganization. That is, the owner remains the same, and the place of work does not change, but the legal entity becomes different. In this case, it is better for the employee to agree in advance so that during the transfer there is no break in the length of service and the cancellation of the long-service bonus.

Another case is when an employee worked for a long time for one employer, and then went to another for a short period of time. Formally, he must again “earn” additional pay for his years of service. But in some cases, when the employee is very valuable and qualified, you can ask the administration to continue paying the bonus. If this is stated in advance and the company is interested in the employee, practice shows that such a request is accepted positively. Don’t be afraid and don’t hesitate to negotiate all the nuances of payment, not just additional pay for experience.

Example 4

The employee is engaged in educational work in a special correctional orphanage. Rate – 1. Previously, this person had rank 10 in the ETS. Worked in the field of educational institutions for 3 years (10%).

Salary based on position – 3,278 rubles.

Rate + specifics of work 3278x(1+0.2+0.2) = 4589 rub.

0.2 – bonus for working in an orphanage. 0.2 – bonus for working in a special institution.

4589%10=458.9 – bonus for teaching experience. 4589+458=5047.9 rubles final salary.

Example 5

A person works as a teacher of his native language in one of the republics of the Russian Federation. He teaches first through fourth grades at a comprehensive boarding school.

His teaching load is 24 hours a week. Qualification: first category. This employee is assigned a class, and accordingly he has a bonus for class management. Twenty-four hours a week are spent checking notebooks. The teacher has 2 years of teaching experience (10%).

Net salary – 3,589 rubles.

Then 3589×1.168×1.15 = 4820.7.

Where 1.168 is an increase in salary for the first category. 1.15 additional payment for the specifics of the work.

We calculate the bonus for the hours actually worked (4820.7×24 hours)/20 hours. = 5784.8.

This person receives 15% for class management (4820.7 × 0.15 = 723.1 rubles).

We calculate the extra charge for checking notebooks (4820.7×0.15)x24h./20h. = 867.7 rub.

3589%10=358.9 rubles – bonus for teaching experience. And that’s 5784.8 + 723.1 + 867.7 + 358.9 = 7734.5 – the final salary with all allowances.

What documents are needed for registration?

Starting from the first working day, the assignment to work is indicated in the work book.

Then, with each working day, the length of service increases. Depending on the number of years worked in the public sector, you receive a corresponding bonus; we wrote above about what percentage and for how many years you can receive.

Based on the above, all the documents necessary for calculating your length of service are already present in the accounting department or at your place of work. This means that all the necessary calculations will be carried out by accountants themselves.

How to calculate average daily earnings - this information will be useful to every employee. When is it profitable to use a bonus payment system? All detailed information on this issue is here.

Do you think you deserve higher pay? Then quickly write a memo to your boss. You will find a sample in this article.

Basic documents establishing payment

According to the above chapter of the Labor Code (labor code), the heads of non-budgetary organizations themselves decide whether to pay them additional amounts to the rate or not. That is, if you work in a commercial company, there is no guarantee that after serving a decent amount of time, you will receive an addition to your salary.

Prizes and all possible cash bonuses must be reflected in the local acts of the commercial organization. It is correct, even when applying for a job, to pay attention to whether there is a clause about material remuneration for the time worked. All allowances and their quantity must be specified in the contract with the employee.

According to Article 135 of the Labor Code of the Russian Federation, incentive payments are optional. But at its discretion, the employer indicates their availability and size. The wishes and recommendations of the workers' representative body are also taken into account. The main document on the basis of which all types of material incentives are based for an employee of a private company will be an employment contract with the employer (a copy of this contract must be kept by the employee).

Documents that reflect the bonus system:

- Employment contract with employee

- Collective agreement

- Regulations on material or moral incentives in the organization (on bonuses)

- Other local acts.

Please note that it is mandatory to indicate the amount and frequency of payment of bonuses for length of service in the employment contract!

According to paragraph 5, part 2, art. 57 of the Labor Code of the Russian Federation, the entire amount of money (including the amount of wages, bonuses and bonuses) is prescribed in the employment contract, or a link is given to the clause of the local act with the specified information. The procedure and conditions for accruing money must also be written down in the employment contract.